- ‘Strong’ jobs drives higher USD and Bond Yields

- Wages accelerate however hours worked fell to lowest level since 2010

- Meta and Amazon shine – less so Google and Apple.

We’re at the midpoint of the Q4 earnings season.

And so far – results have been mostly sub-par. Here’s Factset (Feb 2):

The overall performance of the S&P 500 relative to earnings estimates continues to be subpar. Both the percentage of S&P 500 companies reporting positive earnings surprises and the magnitude of earnings surprises are below average.

However, most of this underperformance compared to estimates is due to the high number of companies in the Financials sector that reported results at the start of the earnings season.

Over the past two weeks, with more companies across all 10 sectors reporting results, the earnings numbers have improved significantly. As a result, the index is reporting higher earnings for the fourth quarter today relative to the end of last week and relative to the end of the quarter. On a year-over-year basis, the index is now reporting earnings growth for the second consecutive quarter.

Overall, 46% of the companies in the S&P 500 have reported actual results for Q4 2023 to date.

Of these companies, 72% have reported actual EPS above estimates, which is below the 5-year average of 77% and below the 10-year average of 74%.

Energy, Health Care, Info Tech, Consumer Staples, Industrials and Consumer Desc. are all above 5-year averages.

Utilities, Materials, Comm Services, Financials and Real-Estate are below (due to interest rates sensitivities).

Last week we heard from the big-cap tech.

Apple, Amazon, Alphabet, Microsoft and Meta represent close to 30% of the total market capitalization.

Coming into earnings – the bar was set very high with the multiple expansion in these names (averaging around 35x forward collectively)

Google, Apple and Microsoft failed to ‘clear the bar’ – with their shares lower post results (however Microsoft staged a solid recovery yesterday)

The two exceptions to the trend were Meta and Amazon.

Meta’s shares surged 20% – handily beating top and bottom line forecasts – also declaring a maiden 50c dividend and a massive $50B buyback.

Incredibly, the stock has rallied ~400% in just over 16 months:

Feb 2 2024 – The Insatiable Appetite for ‘Social Media’

Meta’s revenue jumped 25% in the quarter – marking the fastest rate of growth for any period since mid-2021.

Amazon also gave an optimistic outlook – with first-quarter sales between $138 billion and $143.5 billion, representing growth of 8% to 13%.

Feb 2 2024

Apple however did not impress.

The smartphone giant posted a 13% decline in sales in China, its strongest growth market.

CFO Luca Maestri said they expect iPhone sales in the March quarter would be similar to last year’s $51.33 billion in revenue.

He added (total) revenue would be also similar to last year’s $94.84 billion – where services would grow the same as in the December quarter, which was ~11%.

Put another way – expect very little top-line growth this quarter.

But with Apple trading just below 30x forward earnings – it’s a heavy premium to pay for quality.

I’m happy owning the stock – but I’m not adding to it (not unlike Google, Amazon and Microsoft)

For mine, earnings on the whole has not impressed (with a handful of exceptions)

It’s very hard to justify the high multiples being asked given their projected rates of growth.

To be clear, they each deserve a premium to the market – but the current price is a lot to pay.

Strong Jobs

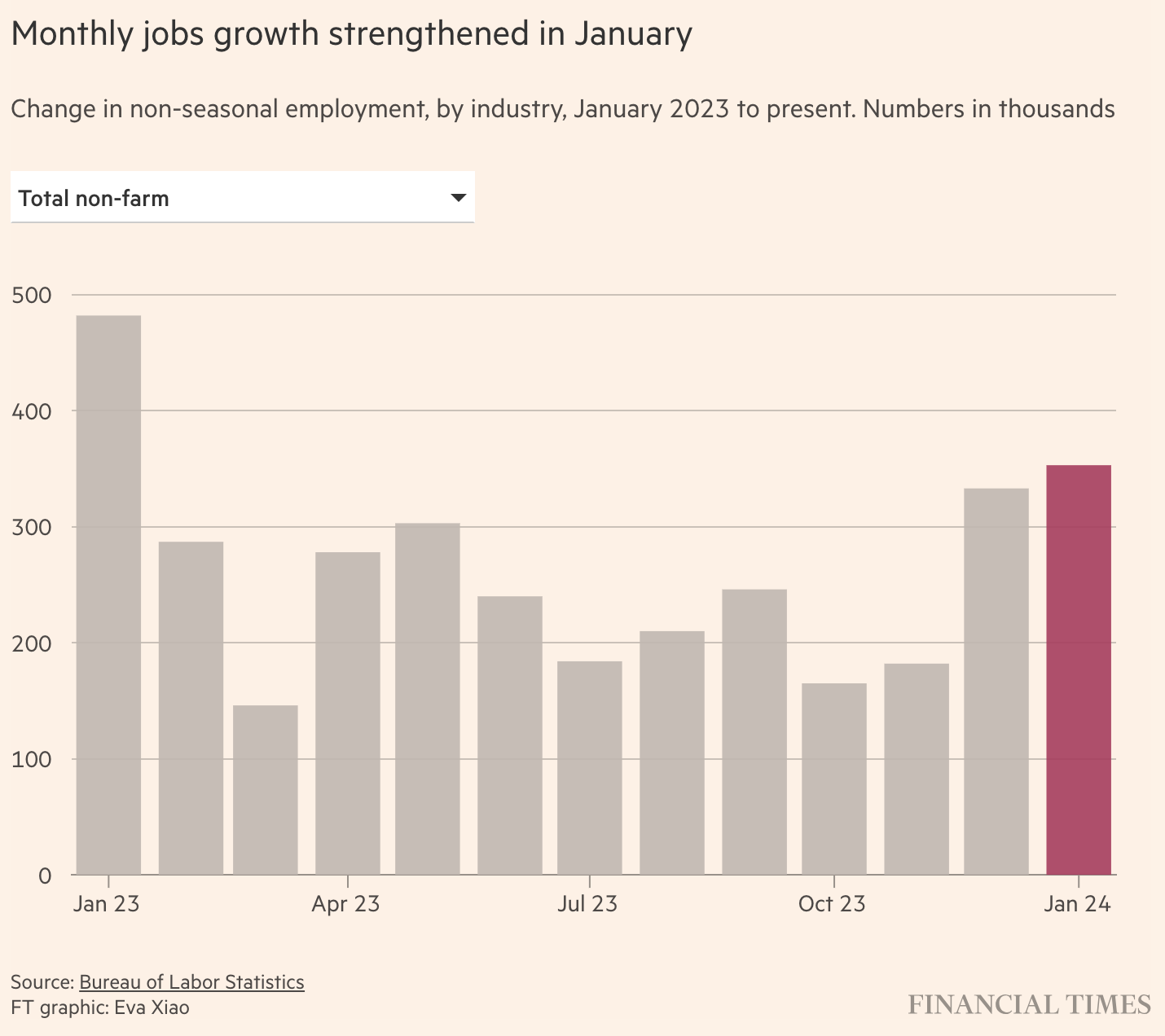

Perhaps overshadowing earnings was the (perceived) strong jobs report.

The headline was said to show the strongest employment growth in 12 months alongside the fastest wage growth in 22 months.

Given the strength in employment – it means the Fed has less of a need to start cutting rates in the near-term.

That could obviously change in the second half – however I think a rate cut for March is off the table (with probabilities at 38%)

Naturally, news of stronger-than-expected jobs sent yields higher across the curve .

Below is what we see with the all-important 10-year – finding strong support around the 4.0% zone

Feb 2 2024

But the jobs print begs an important question:

Why would the Fed consider cutting rates as early as March given what we see with the labor market?

From mine they wouldn’t.

Post the jobs report – odds for a March rate cut are 38%. A week earlier this was 46%; and one month ago 65%.

The US Bureau of Labor Statistics told us that employers added 353,000 jobs in January – the fastest rate in 12 months.

The following categories led job gains:

- Private education and health services – 112,000

- Professional and business services – 74,000

- Retail trade – 45,200

- Government – 36,000

- Manufacturing – 23,000

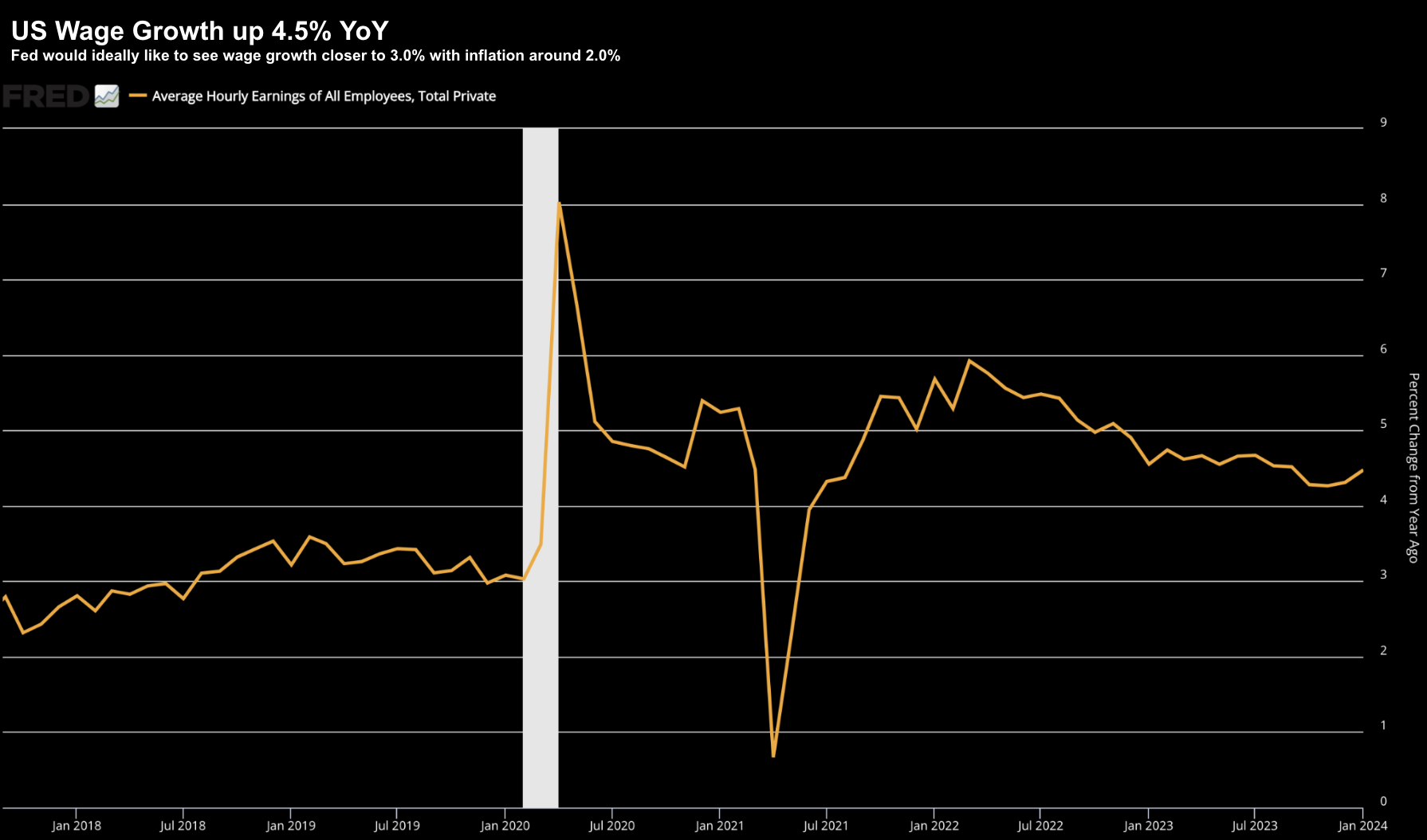

Wage Growth Remains High

Of more concern to the Fed was strength in wage growth.

It was said to accelerate at its fastest pace since March 2022 and surpassed analyst’s expectations.

Average hourly earnings rose a sharp 0.6% MoM even as paycheck gains were expected to slow to 0.3% from 0.4% in December.

On a year-over-year (YoY) basis, wages grew 4.5%, beating the forecast of 4.1% and accelerating from the previous month’s 4.4%.

The Fed has stated they prefer to see wage growth closer to 3.0% (with a 2.0% inflation target). In other words, real wages increasing ~1.0% YoY.

Feb 2 2024

But There was Weakness…

Despite the headline employment numbers appearing strong – it’s worth noting the employees continue to work less hours (where full time work is being replaced with part-time work)

The average hourly work week fell to 34.1 as employers cut hours to maintain margins.

This is the lowest level we’ve seen since the pandemic trough. In addition, it’s the weakest work week since 2010.

In summary, it would appear more jobs are being created – however people are now working less. Part-time jobs are taking the place of some full-time work. Fewer hours worked is being partially offset by higher wages.

On the whole – there is very little in January’s job report which would hasten the need for the Fed to cut rates.

Putting it All Together

Following large-cap tech earnings – the “great divergence” in the market continues to expand.

Investors rushed back to tech (notably Meta and Amazon) and steered clear of other asset classes more sensitive to higher rates.

For example, the cyclically tilted Russell 2000 lost 0.6% on Friday.

This tells me that market breadth remains poor – as rate sensitive sectors such as real estate, utilities and materials all lost ground.

These sectors typically do well when rates are low.

Finally, if we look at the greenback – it too received an expected boost against all major currencies from lighter Fed easing projections.

Overall, I maintain a ‘cautious but invested’ stance on the market – as things appear extended.

That said, I’m also mindful the stock market can remain overbought for several weeks.

The sharp gains in Meta and Amazon only adds to my caution.