- US 10-Year Yield hits lowest level in 7 Months

- Economic data continues to deteriorate

- But it doesn’t mean the Fed are finished with hikes

Bond yields are falling fast.

The US 10-year is now trading at its lowest level in 7 months and the 2-year is not far behind.

Take a look at the weekly chart for the US 10-year:

Apr 6 2023

Just six weeks ago – this bond yielded 4.1%

Today it’s just 3.30% – a huge move in bond markets.

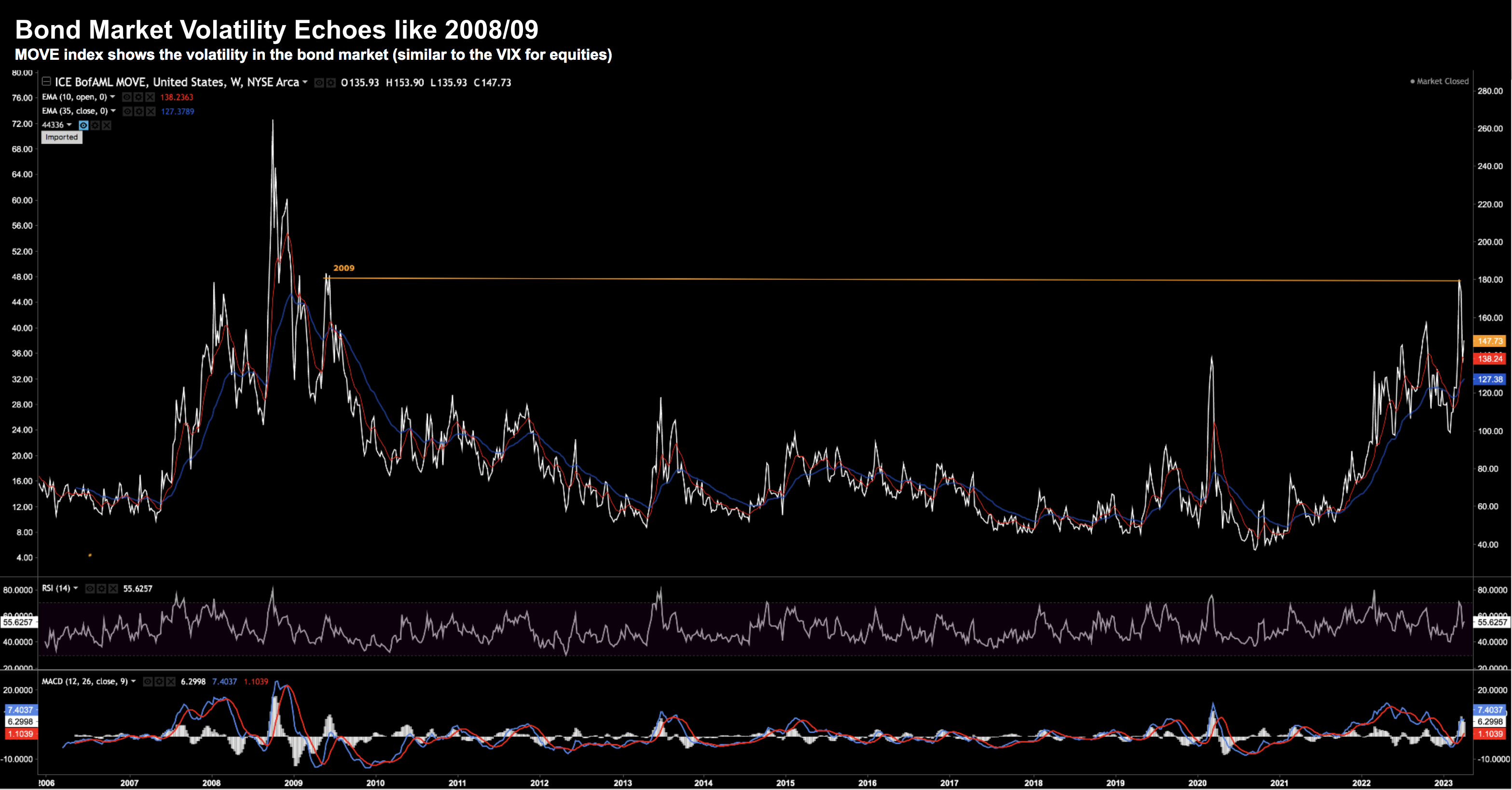

To help demonstrate the bond market’s volatility – we refer to the MOVE Index.

This is similar to the VIX – however it tracks volatility for bonds.

Apr 6 2023

We haven’t seen volatility like this since the financial crisis of 2008/09.

But it raises the question:

What signals are bond markets sending? And are equities listening?

Bond Market Signals

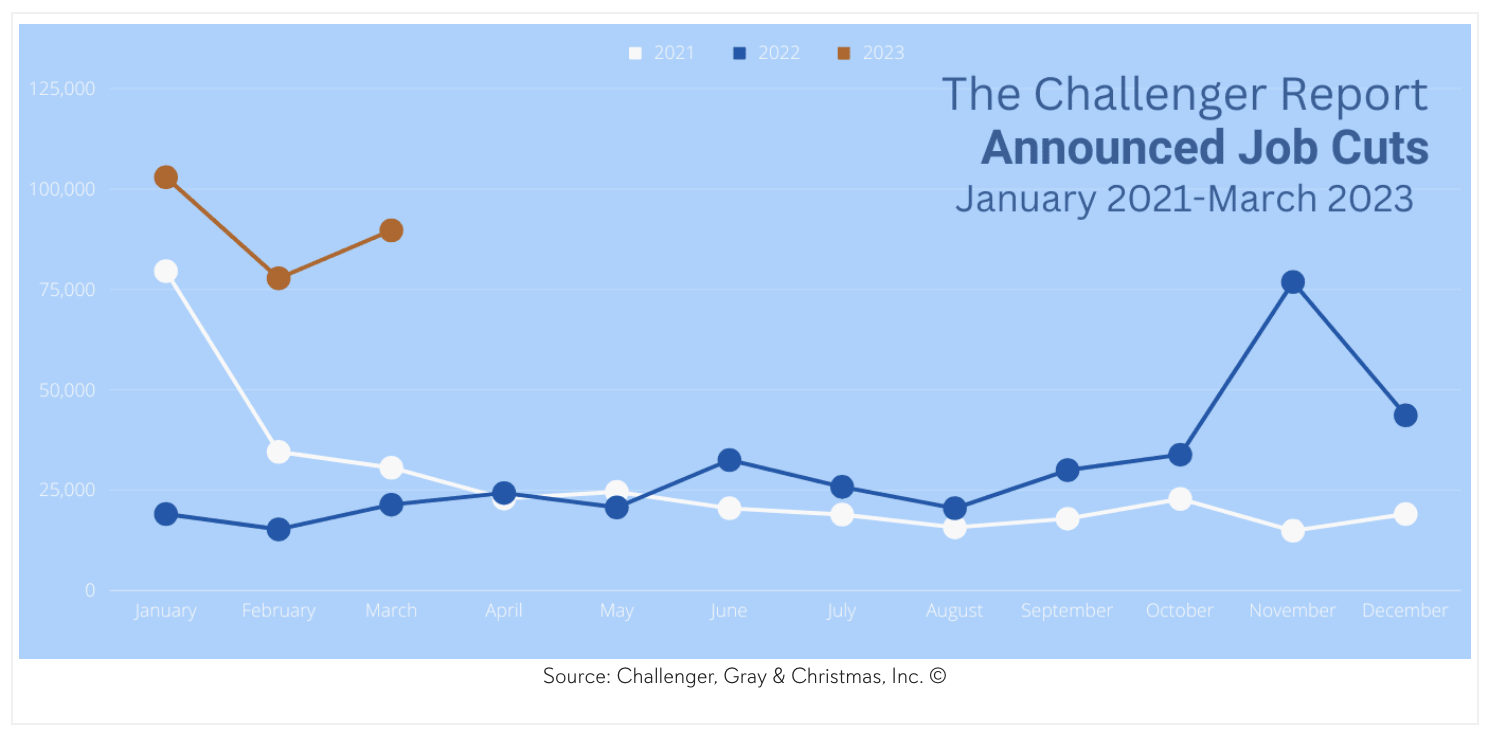

- Monday: ISM Manufacturer data showing further contraction – hitting a new 3-year low

- Tuesday: JOLTS – falling below 10M – worst levels since May 2021

- Tuesday: Dallas Fed reports credit crunch is already underway

- Wednesday: Prices paid for service sector – lowest level in three years.

- Thursday: US employers shed ~90,000 jobs in March.

The last point is particularly telling – ahead of the all important monthly jobs report tomorrow (where economists expect around 250K jobs to be added).

And whilst all of this is “great news” in the fight against inflation (but not great if you are looking for a job) – it suggests we’re in for a sharp slowdown.

In other words, a recession is on the way.

It might be late 2023 or early 2024.

I don’t pretend to know.

It might already be here?!

However, that’s what’s showing up in bond yields….

Again, consider the 2-year yield – the reasonable proxy of where the Fed is likely to be in the months ahead:

Apr 6 2023

I shared this chart the other week – suggesting that if we see the US 2-year trading closer to 3.0% – we are likely to see a 10%+ decline in equities.

Why?

Because it tells me that things are in bad shape economically.

Growth is falling fast.

But what’s interesting here is the 2’s and 10’s are moving together.

Apr 6 2023

From mine, the inversion on this curve (along with the 3-month / 10-year) has been flashing red for sometime.

And yet – equities are happy to ignore it?

The S&P 500 is trading in the realm of 4100 or ~19x forward earnings (based on earnings of $215 per share) – and a VIX at ~18x.

Let’s take a look.

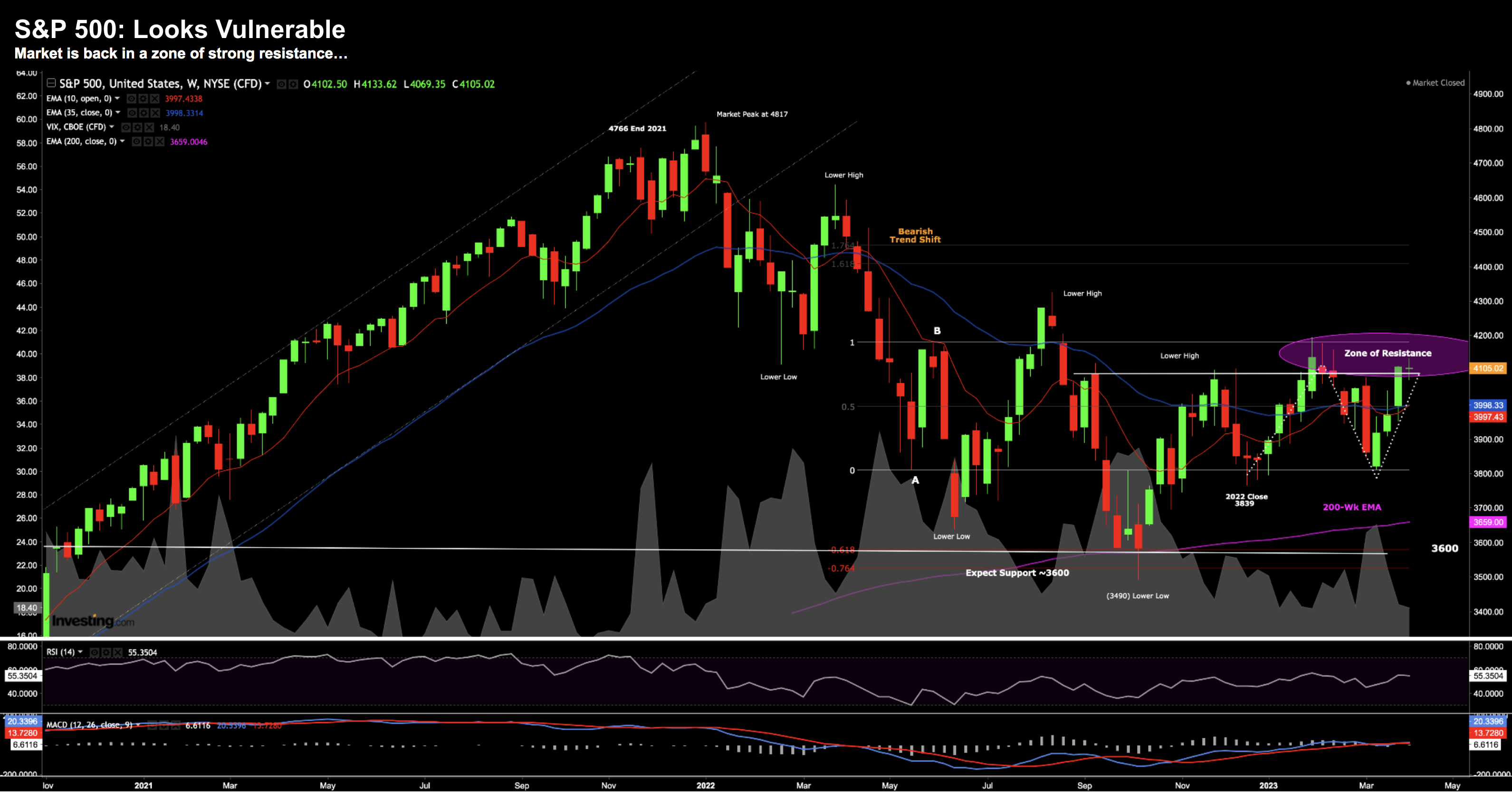

S&P 500 Feels Vulnerable

Below is how the S&P 500 finished the week:

Apr 6 2023

There isn’t a lot to add here from last weekend…

We have rallied straight back to a zone of resistance – where the market has stalled.

But as I’ve been saying – there are a surface cracks appearing.

Perhaps none more than what we see with poor market breadth.

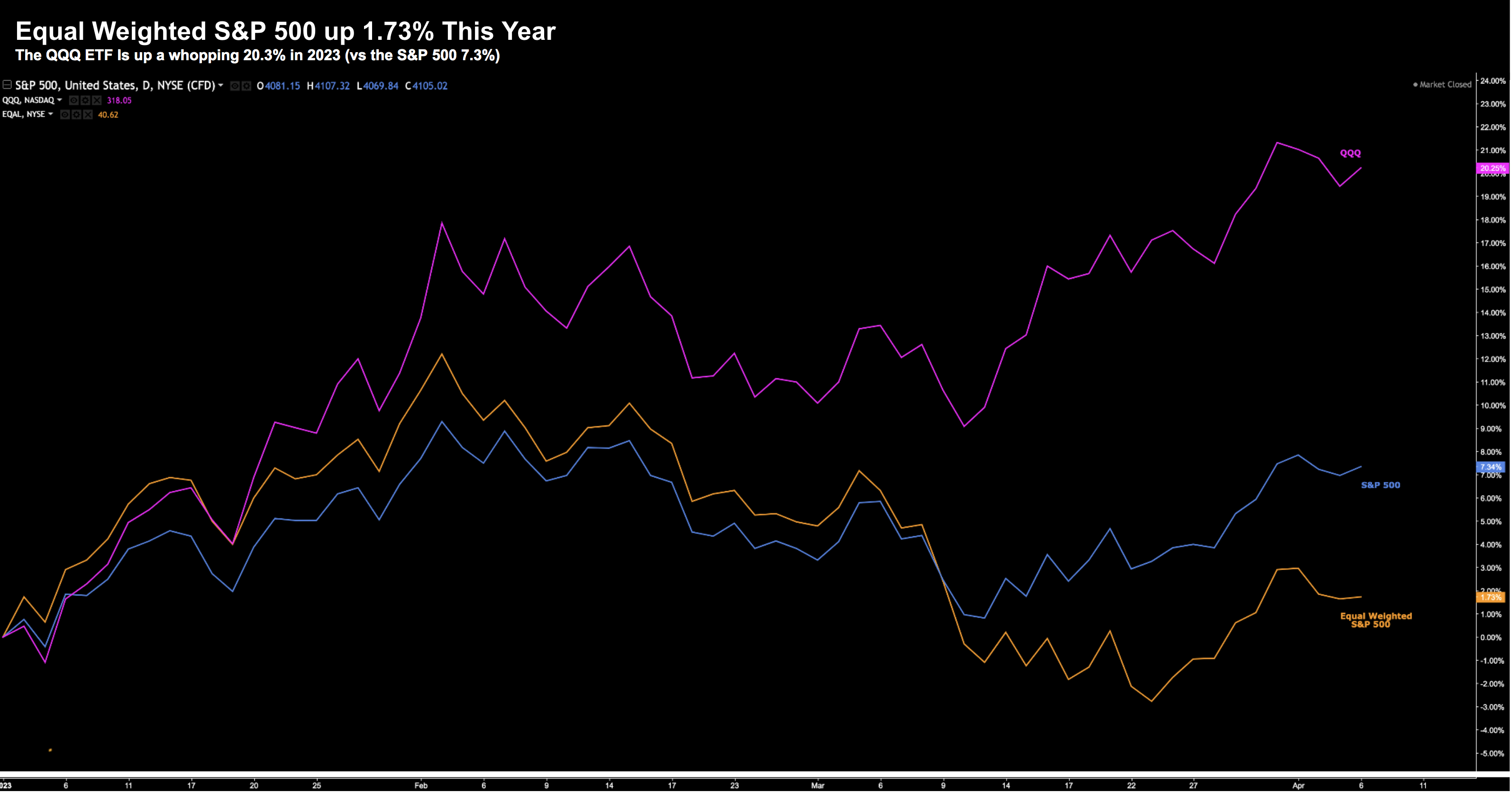

For example, big tech the only sector lifting the market.

The QQQ ETF is up 20% so far this year.

However, by comparison the equal weighted S&P 500 is essentially flat for the year (up 1.7%)

Apr 6 2023

That’s a very narrow market.

Now when you consider it’s only been multiple expansion (versus stronger earnings) that’s taking these stocks higher – that’s not healthy.

For example:

Apple is trading 27x forward earnings with single digit sales growth and earnings. Microsoft is now trading at a crazy 27x forward earnings.

Now I own these stocks (good news I guess?) – but what a great time to be selling covered calls against them.

Why?

Because investors are seeking shelter in names like Apple, Microsoft and Google for their balance sheets and cash flows.

And I get that.

However, they are paying through the nose to own them at “27x forward”

My tip:

If you are over-exposed to big tech – it’s a good time to take a little off the table.

To be clear, I own each of these names and maintain an aggregate 20% market weight across the Top 4 names (AAPL, MSFT, GOOG, AMZN).

And I feel that is ‘heavy’.

But they are good stocks to own.

However, I’m hedging my risk by selling covered calls with their multiples so stretched.

Putting it All Together

The market is convinced the Fed is done with its tightening cycle.

What’s more, they also see the liquidity spigots coming straight back.

This is what we see with bond yields.

But I’m not buying it…

Yes the Fed is certainly closer to the end.

But I don’t think the Fed is done despite the “wave” of bad economic news hitting the tape (e.g., ISM, credit, employment etc).

Put another way, whilst the Fed will be ‘happy” to see these things, it will want to see the whites of the eyes of inflation before they pause.

We haven’t seen that yet.

I think they go with another 25 bps hike in May (which is only partially priced in)… and maybe then… they might consider a pause (pending what we see with inflation and Core PCE).

Right now Core PCE is still more than 2x the Fed’s objective.

Now if the Fed hikes in May – equities will likely push lower.

But I think it’s bold to think the Fed has finished hiking… especially given last month’s inflation print.