- Another indicator we are closer to (not at) the bottom

- What the past 9 recessions have in common with rates

- Three key zones to watch on the S&P 500

Stocks are on track for their worst first half of the year since 1970.

What a difference 6 months makes!

Sentiment could not have been more positive when the ‘free money spigots‘ were flowing… not so much when they are closed.

It’s rare we see sentiment so negative…

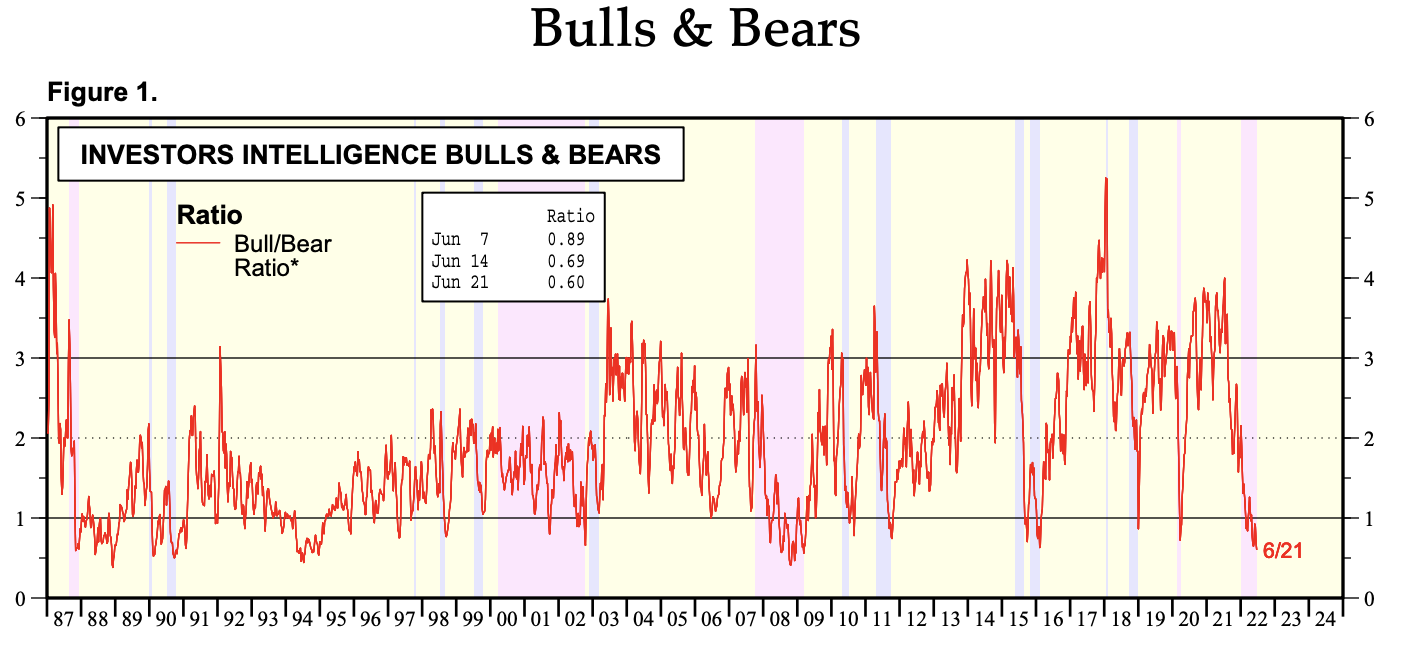

For example, Ed Yardini said earlier this week that investor sentiment hasn’t been this bad since the depths of the 2008/09 crisis – citing the Bull Bear Ratio:

Yardini feels this indicator suggests we could be close to a “near-term” bottom. However he cautions it’s not yet clear whether this is “the” bottom.

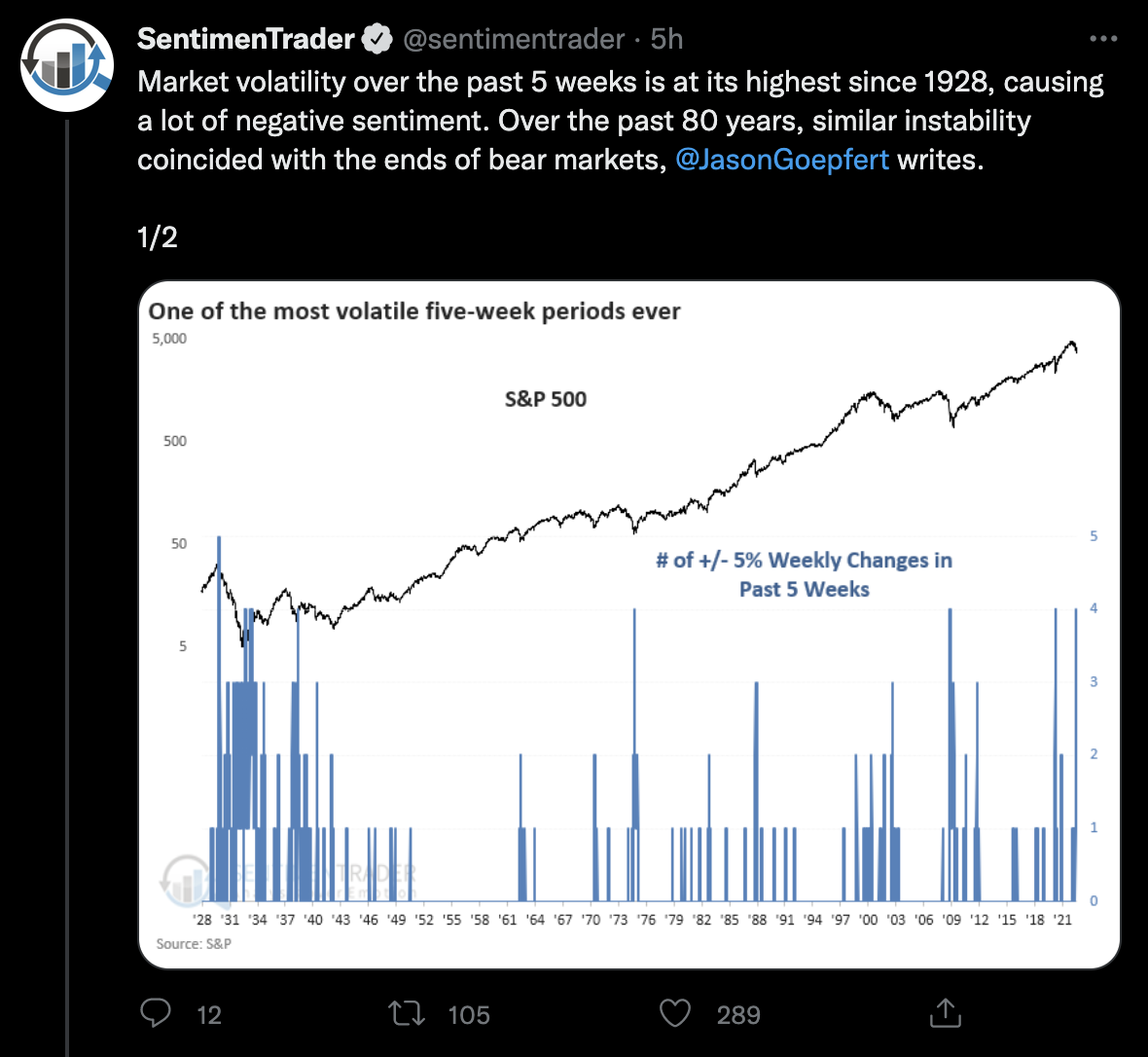

Echoing his sentiment – SentimenTrader shared this on Twitter today:

Jason Goepfert is measuring the number of 5% changes over the past 5 weeks.

We have not seen these kind of swings in almost 100 years (1928)

However, 5% swings in both directions tell us there is still a lot of indecision.

And Jason’s thesis: we only see this kind of indecision towards the end of a bear market.

Let’s see…

But I think it’s easy to understand the indecision. For example, how does one easily calibrate a combination of:

- unusually high levels of (persistent) inflation;

- sharply higher bond yields;

- subsequent Fed policy (to combat unwanted inflation)

- impact on the US dollar as a result of monetary policy

- impacts of currency, inflation and supply chain disruptions on earnings and margins;

- negative consumer confidence;

- soaring commodity prices;

- the war in Ukraine; and

- various global economic growth scares?

You can’t. Not easily.

For example, when I dialed into NIKE’s earnings call yesterday, it was a complex story. You generally don’t hear that kind of narrative from them.

But that in itself is what’s happening… why do you calibrate all the moving parts?

Above all else, what’s front of mind for traders and investors today is what we see in terms of monetary policy.

For example, how are the Fed going to shrink a $9 Trillion balance sheet – hike rates above 3.0% – and land this plane softly?

You tell me.

Now it’s wise to “run with the bull” when the Fed are jacking up asset prices. That’s what we saw the past few years.

But be very careful betting against them when they reverse course.

Here’s Research Affiliates take:

“Inflation is a simple consequence of a supply/demand imbalance. If demand exceeds supply, prices rise until balance is restored.

The current surge in inflation has been caused mainly by blowout spending, supply chain disruptions—some related to Covid lockdowns and some to geopolitics—the Russia-Ukraine war, and working from home, which leaves people with more money to spend, even as many produce less goods and services.

Which of these can the Fed influence? None? Is the Fed powerless to rein in inflation? Not at all.

Central bankers can decrease demand, albeit with serious lags, even if the problem is on the supply side”

As I often say, inflation is excess money chasing the same (or fewer) goods.

Since the onset of the pandemic – the market experienced a torrent of money (see this post from May 6) whilst producing far fewer goods.

Naturally the price of everything went up.

Stocks. Houses. Energy. Wages. Food. Rent. Bitcoin… you name it.

Rob Arnott’s article cites MIT economist Rudi Dornbusch – who observed this in 1998:

“… none of the post-war expansions died of natural causes, they were all murdered by the Fed.”

He says the Fed’s attempt to slow the economy by ending its era of negative real interest rates will cause a severe economic downturn”

By ignoring inflation too long the Fed now faces triggering a deep recession.

“Being late to the game increases the probability that the Fed overreacts, because it didn’t act soon enough,” says Arnott.

“This increases uncertainty and elevates the probability of a hard landing, which is what everybody wants to avoid.

Hard landing means we go into a serious recession, like the one associated with the global financial crisis.

It remains to be seen if we go into a recession similar to that of 2008… I don’t think we will.

My feeling at this stage is will be more like a “weaker consumer recession” (which can also be deep) vs banking crisis of liquidity.

For example, today banks are exceptionally well capitalized and have been more stringent on loans.

Nonetheless, whilst the banks ‘should’ be fine… it’s hard to say how consumers will come out the other side given what we find with the cost of living.

Fed Mistakes: ‘Rinse and Repeat’

For all that is unknown (which is driving the uncertainty) – we do have a list of what I believe are “knowns”.

Don’t fight the Fed is a known.

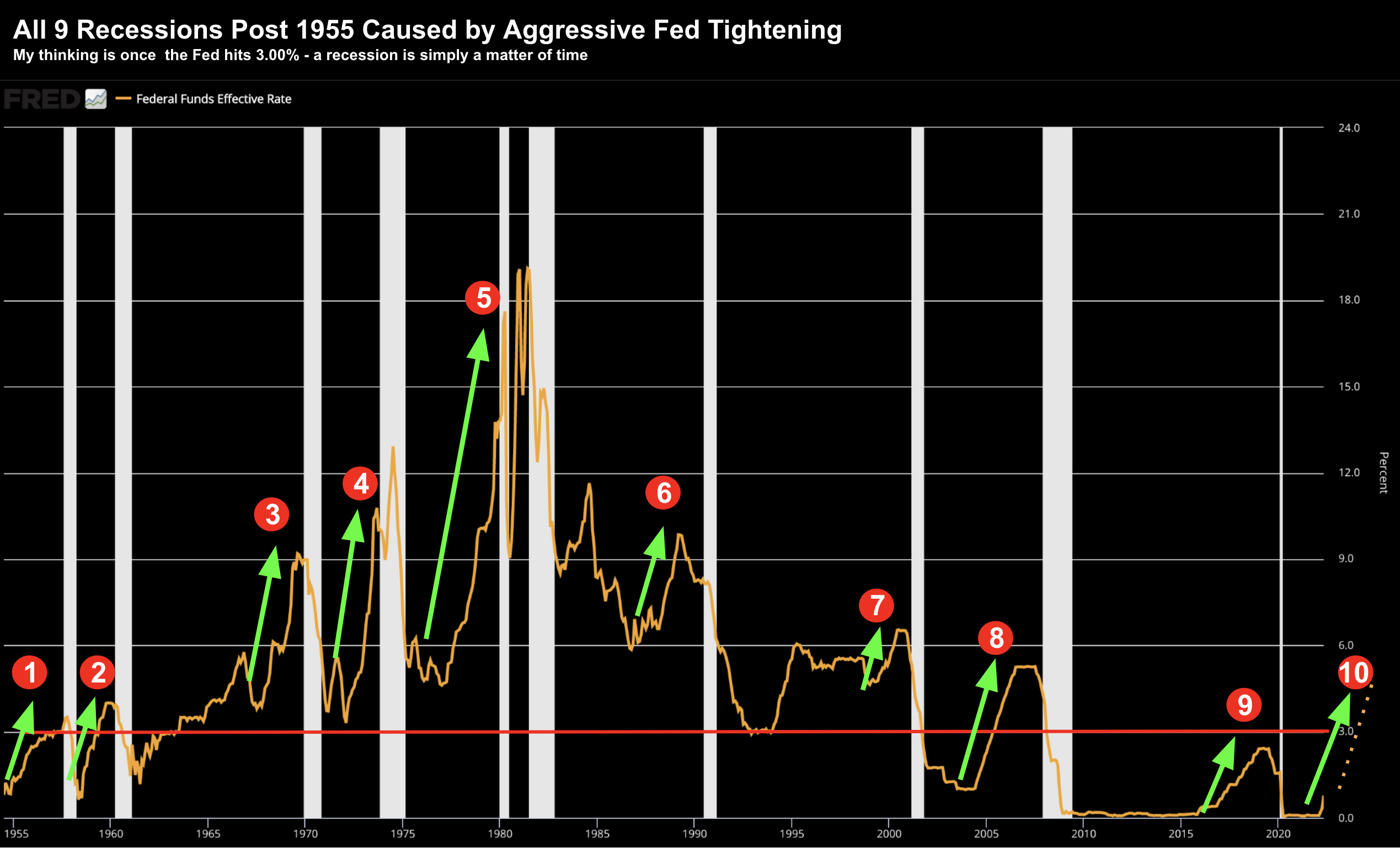

For example, we know that every recession after 1955 (9 in total) was caused by aggressive Fed tightening.

What’s more, each recession (excluding the pandemic) saw the effective Fed funds rate move beyond 3.00% (see red line below) – typically forcing an inversion of the yield curve (e.g. 2/10).

If we are to fall into recession (deep or otherwise) – this will make the 10th recession in 67 years.

That’s about right… 1 recession every ~7 years.

At the time of writing – fed fund futures indicate a nominal rate of ~3.50% by year’s end.

And with inflation likely to be well above 5% at the end of the year – the Fed will need to be at least at this level (if not higher).

Therefore, it follows we are on a ‘collision course’ with a recession in 2023

But here’s what else we know…

Aggressive tightening over a short time period typically results in the following unfavorable conditions:

- Higher unemployment rates;

- Lower consumer spend (which I touched on yesterday opposite NIKE)

- Lower earnings / margins (as a function of the above); and

- Lower GDP (given ~70% of GDP is tied directly to consumer spend)

With the S&P 500 trading ~3900 – the question is whether all of the above if fully priced in?

My answer is not yet – not all of it.

Recently I said my best guess is we have priced in maybe 70% of the downside (with the market 24% off its highs at 3666).

However, I still feel the market is hopeful we will avoid recession.

But is that how consumers are feeling?

From mine, at levels of around 3900 on the S&P 500 – we are still pricing in much higher earnings than what’s to come.

Again, companies such as (not limited to) Snap, Microsoft, Adobe, Nike and Salesforce have all guided lower.

And before long – we will hear from giants like Amazon and Apple.

All of this is likely to come down…

What Else Do We Know?

The other thing we know is we are trading through a very well defined bear market.

A bear market means two things:

- ‘Lower highs and lower lows” until proven otherwise; and

- Strength is usually sold.

As such, we can expect lower prices.

Now if we zoom out and look at the monthly timeframe – it also suggests there is more ahead.

As we make our way lower – three distinct zones deserve watching:

1. Area of 3800 (35-Month EMA)

This is where we trade today and an expected zone of support. For example, if you scroll back over the past 10 years (to 2012) you can see each meaningful dip has found buying support around this zone (even with intra-month dropping below the moving average line)

2. Area of 3200

This is my preferred area to add meaningful exposure for the long-term (e.g. minimum of 3 years). From a fundamental stand point – this will be roughly 15.6x forward earnings if we see an earnings decline of around 10% year-on-year (e.g., $205 EPS vs $235 currently expected).

What’s more, the free cash flow yield for the market (estimated at around $1.5T) will be above 5.0%. That’s getting more attractive — however shy of the 5.9% free cash flow yield we saw at the depths of the financial crisis in 2008.

3. Area of 3000

In the event of any panic selling (still probable) – we could see a move to 3,000. This would represent a decline of ~38% from the peak; and a forward PE of 14.6x (assuming an earnings decline of 10% YoY to $205)

Technically this level is also the bottom of a well-defined 10-year trend channel (with 3500 the upper end).

Putting it All Together

The soft earnings guidance from NIKE yesterday added to my conviction there’s more to come.

For example, we also heard from RH today – they expect a fiscal-2022 revenue decline of between 2% and 5%.

The leading furniture and home goods retailer in June called for revenue growth between flat and up 2% — itself a lowered expectation — and already sounded worried, seeing “softening demand” amid economic uncertainty.

Now just 27 days after reporting Q1 earnings – they are now saying Q2 revenue will decline between 1% and 3%

RH were not alone – we also heard from homewares company Williams Sonoma also revising guidance lower citing weaker demand.

Put together, recession is now our base case.

And that means volatility is far from over.

Start dialing recession in when the Fed inches towards 3.0% in a few months time.

What’s more, I just don’t see how shrinking a $9 Trillion balance whilst hiking rates above 3.0% “lands softly”

Companies like Target, Walmart, Nike and RH are telling us to ‘buckle up’.

Bear markets don’t end in a ‘perfect’ text-book fashion. And it’s impossible to pick the bottom.

If we could – we would all buy at the some point!

However, if you lengthen your timelines and starting adding to quality positions (or even the Index itself) in the zones outlined above, the 3-year risk/reward looks very attractive.