- S&P 500 to face resistance in the 4400 to 4500 zone

- Why stocks rallied so sharply this week

- Apple falls 4% after earnings – this should be your watchlist

Did we finally hear a ‘less hawkish’ Jay Powell yesterday?

Maybe.

For the first time in a while the Fed Chair may have slightly lowered his guard.

But barely…

I say that because Powell is far from being a dove.

A dovish Fed is one that is (a) cutting rates; and (b) ending quantitative tightening.

Neither of those things are happening soon.

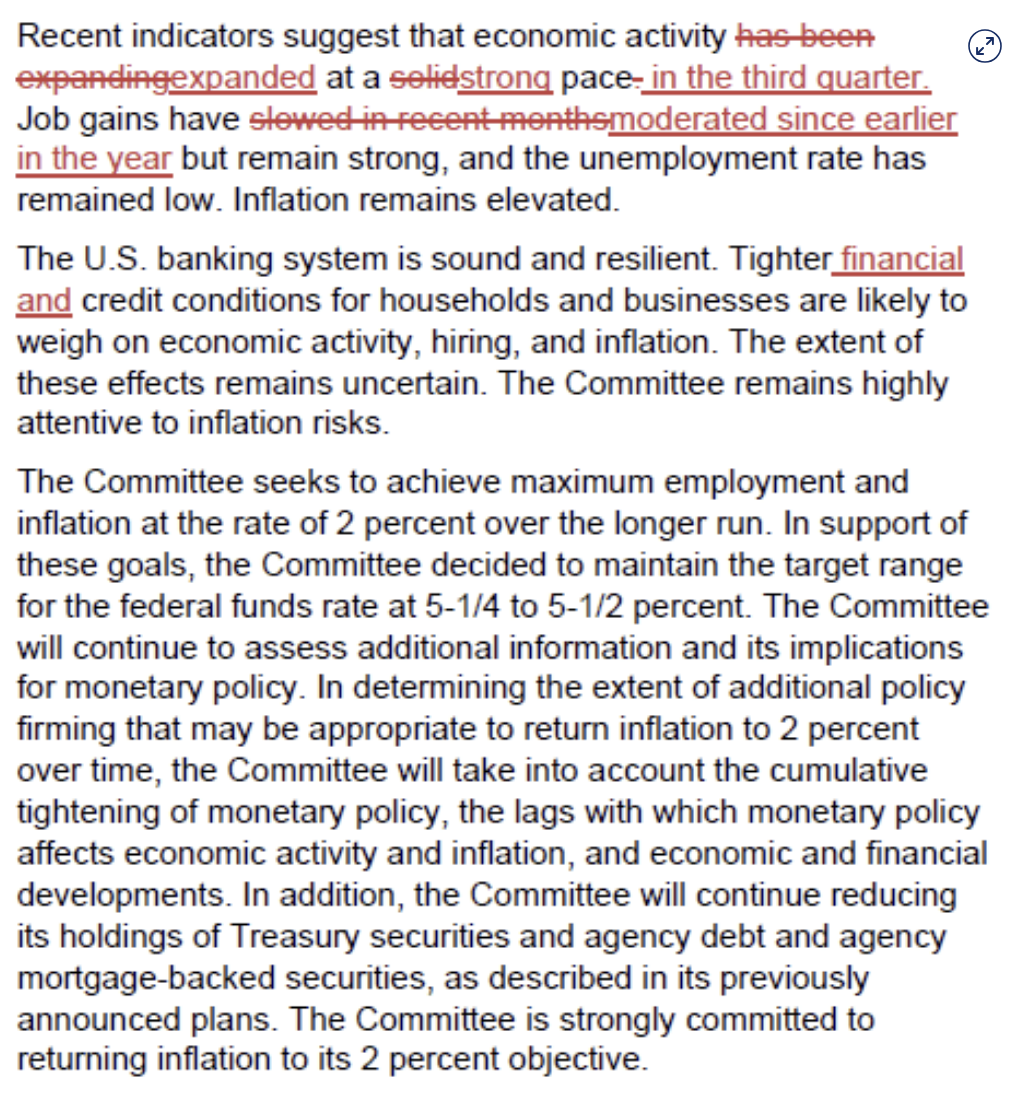

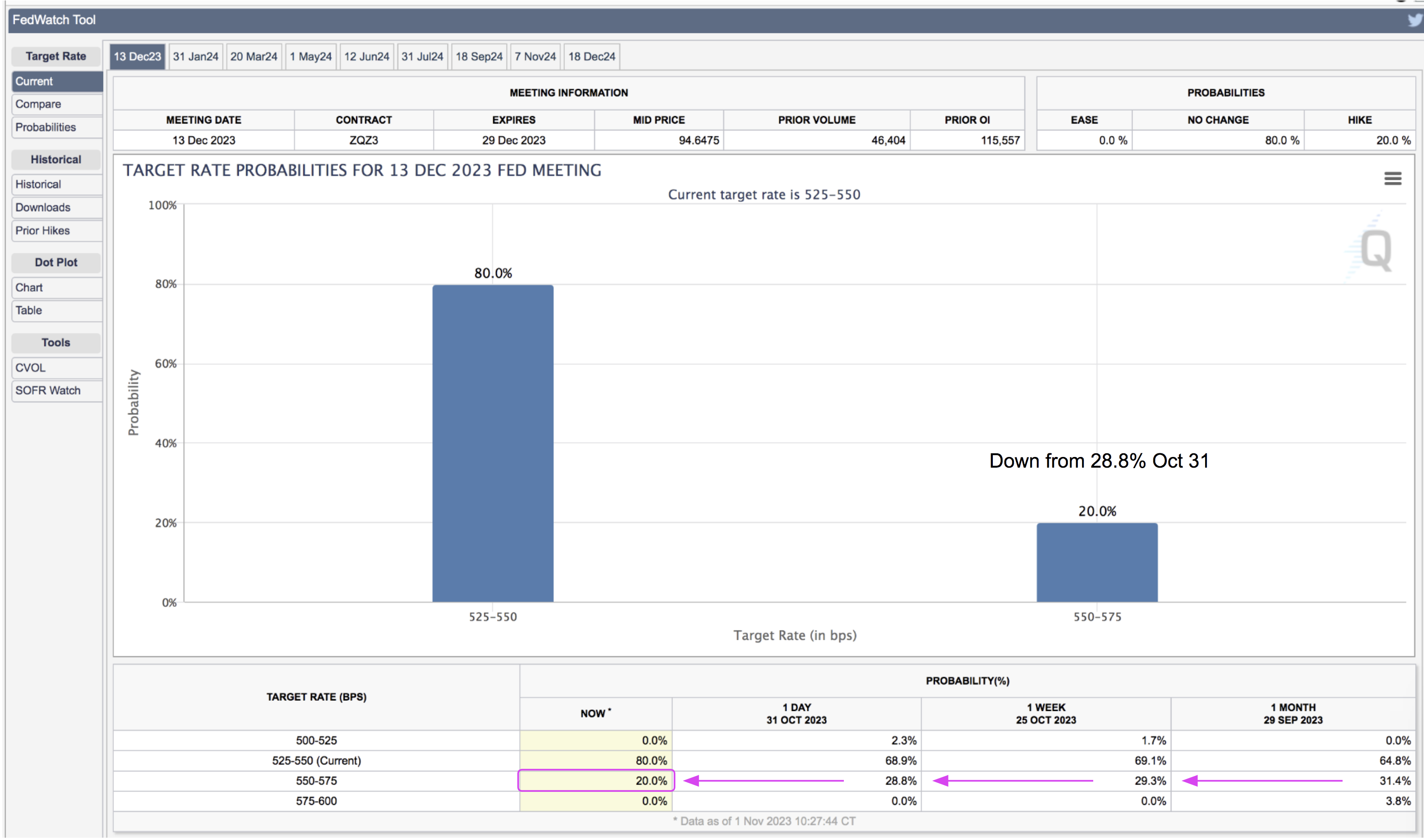

In addition, FOMC policy members still lean towards the option of another rate hike in December.

And Fed Futures price this at 20% (down from 29% before Powell spoke)

However, Powell’s language suggested the Fed is either at (or very close) to their terminal rate.

That sent stocks higher…

But it wasn’t just Powell’s language which fired up the bulls.

Something else happened before the market opened that was equally important.

And that message came from former Fed Chair (now Treasury Secretary) Janet Yellen.

Yellen Soothes the Bond Market

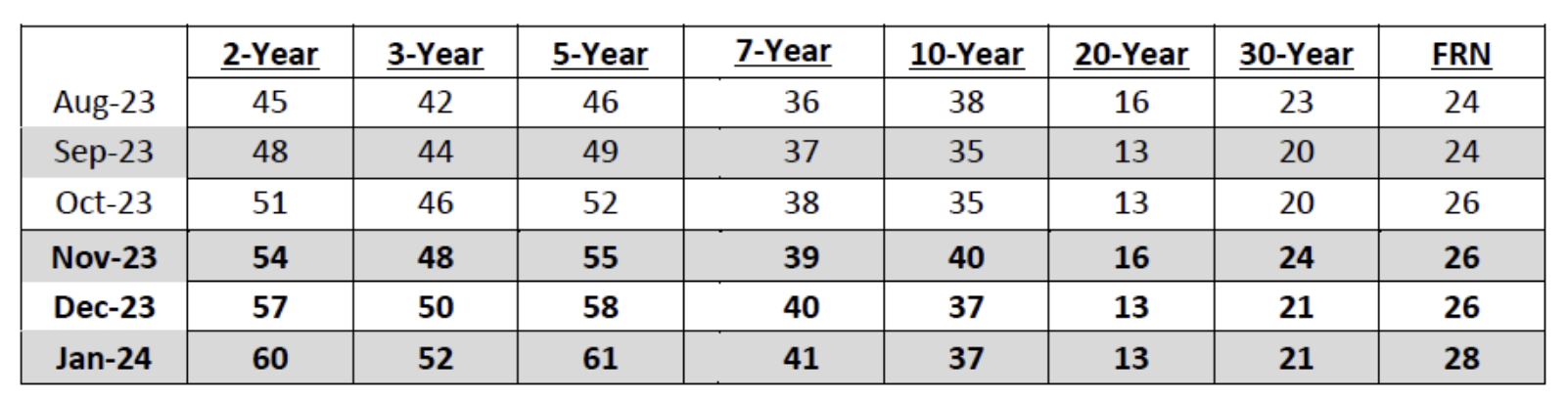

Before the Fed were due to speak at 2pm EST – fixed income eyes were on the Treasury’s quarterly refunding announcement.

The U.S. Department of the Treasury is offering $112 billion of Treasury securities to refund approximately $102.2 billion of privately-held Treasury notes maturing on November 15, 2023.

Now to be clear, that’s a ‘boat load’ of new debt. The government sees no limit to its spending ambitions.

However, what piqued the market’s interest was the duration (or composition) of that debt.

For example, was it going to be more short-term bills or longer-term bonds?

Below is what we saw:

- A 3-year note for $48 billion, maturing November 15, 2026;

- A 10-year note for $40 billion, maturing November 15, 2033; and

- A 30-year bond for $24 billion, maturing November 15, 2053.

Naturally, the market’s focus on bonds (those with a 10 or 30-year duration)

This is what the private sector has to soak up.

And as we know, the past 6 months has seen a “buyers strike” for long-term – sending their yields sharply higher.

For this quarter, the bond issuance was being kept the same.

To be clear, it’s extremely high. However, for next quarter, Treasury “only” plans to increase the bond issuance by $10B.

To put that into perspective, three months ago they increased bond supply for the current quarter by $160B.

This is a significant decline in the rate of change.

Naturally, with less supply than expected, the bond market reacted by sending yields lower (and bond prices higher)

And as the old saying goes “where bond prices go – so go equities”.

And sure enough…

Reaction in 10-Year Yields

The 1-hour chart below shows what we’ve seen in the 10-year during the months of September and October

Nov 2 2023

10-Year yields peaked just over 5.0% – the same day when Bill Ackman covered his (well publicised) short position.

Yields climbed not long after Ackman covered – finding resistance at a similar level.

However, you can see the two sharp legs down after we heard from both Yellen and Powell.

They dropped from around 4.93% to 4.62% today.

That’s a massive move.

From an trading perspective – expect a tactical bounce higher – however if we see softer economic data the next few prints (e.g., soft monthly payrolls at the end of the week) – these yields could find themselves back to levels of ~4.50%

I expect a strong bid in that zone given the massive amount of supply the private market is expected to buy.

A ‘Less Hawkish’ Powell

Two things of note:

- The outlook for growth being stronger; and

- Financial and credit conditions tightening.

Now when Powell was pressed for an additional 25 bps hike in December, Powell said there may not be a need.

Fed funds futures reacted immediately – where probabilities for a Dec hike fell from 28.8% yesterday to 20%

As I said in my preface – the market is almost of the view that the Fed is done.

Powell helped give investors ‘comfort’ by saying the risks of “doing too much” vs “doing too little” are now more evenly balanced.

He offered this:

“It’s fair to say that is the question we are asking – should we hike more? That is the question. In September we wrote down one additional rate hike – and we will write down another forecast in December”

As I suggested yesterday – Powell said the “rise in yields was a reason the Fed could afford to pause – however those gains in yields needed to be persistent”

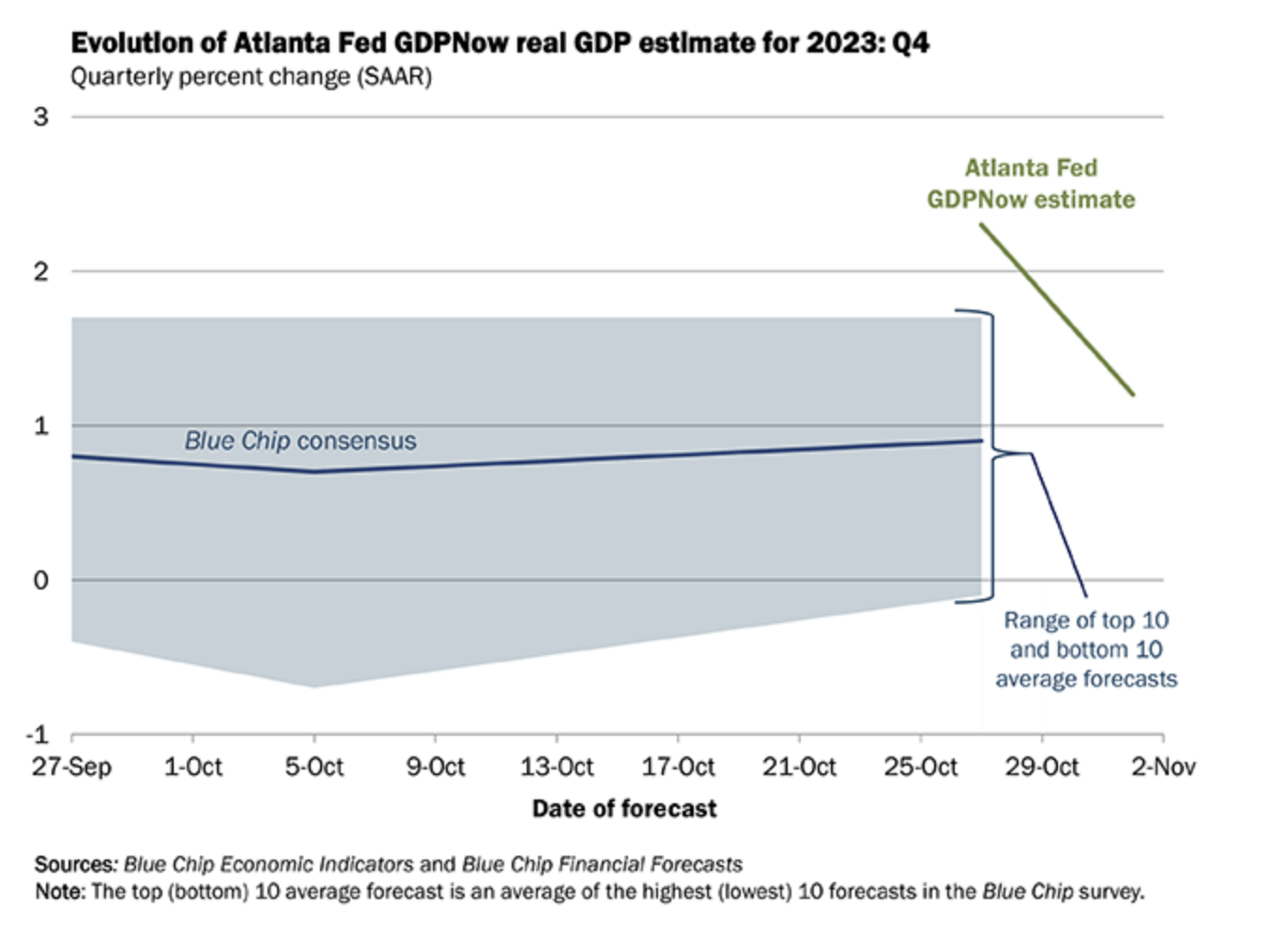

In summary, to me it feels as though the Fed could be on hold if:

- the economy continues to slow; and

- bond yields remain high

With respect to the former – if we look at the Atlanta Fed’s GDP Now forecast for next quarter – they see real Q4 GDP slowing to just 1.2% – which is down from 2.3% on October 27

But with respect to the latter – the Fed will need the market to keep yields high.

For example, if yields continue to fall (e.g., a 10-year back to 4.0%) – then I think it gives the Fed less scope to pause and this might bring a rate hike back in play.

The market was happy the Fed might be done – however that needs to be balanced about how fast the economy is slowing.

Is This Week’s Rally for Real?

Let’s check in with the S&P 500 – is this week’s rally the real deal?

Nov 2 2023

In short, it’s too hard to say.

The post-Fed bounce this week has erased almost all of the losses of the past two weeks.

However, I would suggest the bounce was expected.

For example, last week I mentioned expect the market to catch a bid around the 4100 zone.

Repeating some of my language below:

“We’re coming into a very seasonally strong time of year… so don’t be surprised to see markets catch a bid. For example, if we’re to receive weaker-than-expected payrolls numbers next week – that could auger well for stock prices”

And given the massive decline in yields – markets should be on the ‘front foot’.

However, looking at the weekly tape, I think the S&P 500 may start to face headwinds around the 4400 to 4500 zone.

Put another way, I think it’s likely to put in a lower high.

And if that’s true (it may not be) – then it could auger for another leg lower.

But that represents an opportunity….

An important lesson here is not to panic when we see ~10% type sell-offs.

Instead what we should be doing is looking for attractive things to buy.

Now I would not be surprised if there were some traders (not investors) who sold last week – in fear or anticipation we go much lower.

My approach was to maintain my 65% long position and look for companies which represented value.

However, I take a much longer time horizon versus typical traders (and perhaps many readers?)

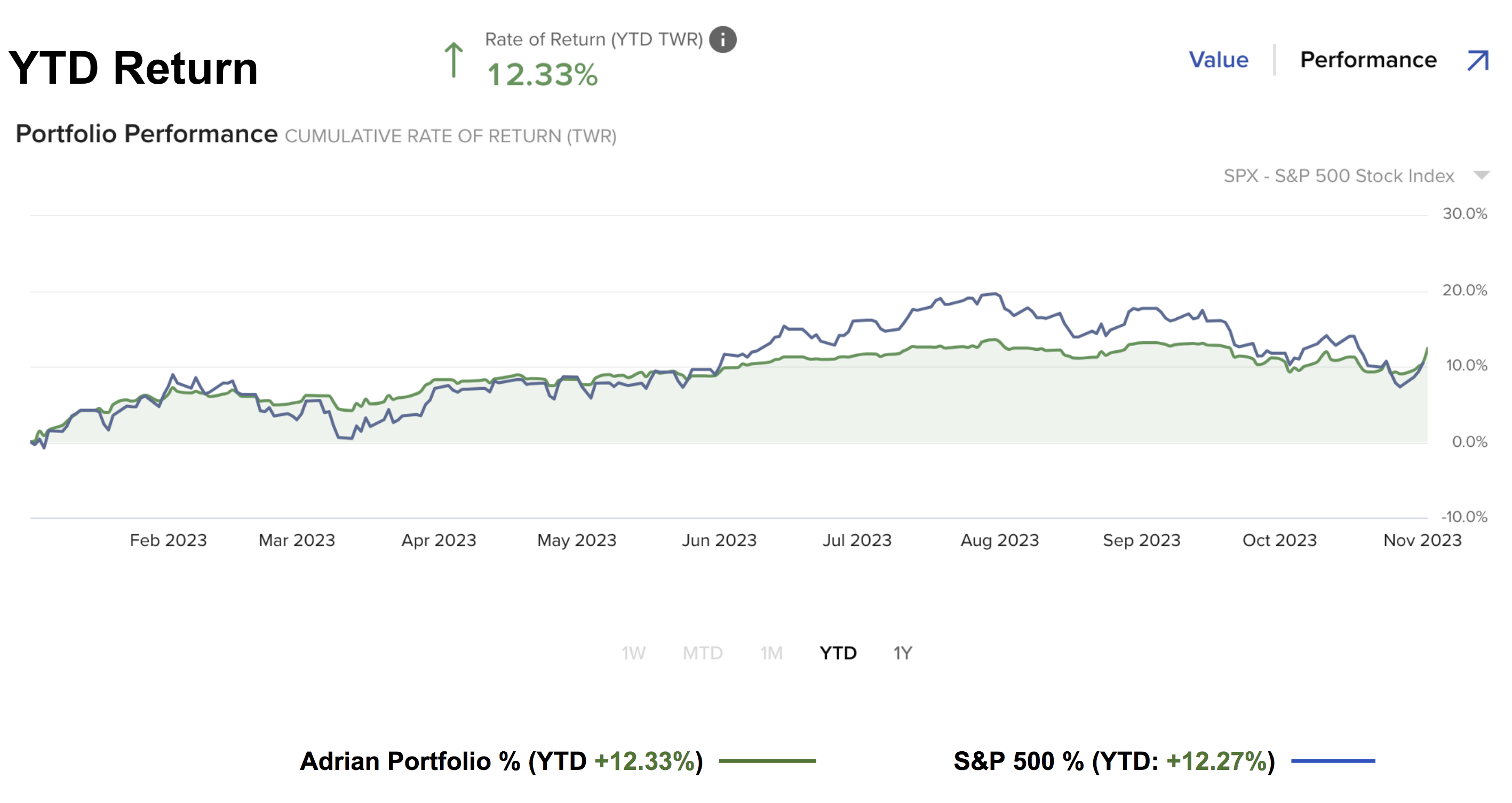

This saw my portfolio bounce largely in-line with the market (now up 12.33% YTD)

Nov 2 2023

To that end, let’s revisit the longer-term horizon.

I do this at the end of every month – as you should always maintain a some exposure to risk assets – despite the constant “wall of worry”

In addition, you should never be too perturbed by 10% to 20% corrections. They are par for the course in this game.

Below is the monthly chart for the S&P 500 back to 2007:

Nov 2 2023

What’s notable (for me) is the long-running trend channel – which translates into a CAGR of ~8.5%

Add dividends and you are closer to your 100-year S&P 500 average of ~10.5%

Now the mid-point of this channel is ~3600.

It’s possible we realize that zone (vs level) if we see a recession next year (not priced in by markets)

The top end of that channel is around 4000 – which I think is a good area to start adding to quality.

Finally, if you assess the current market “sell-off” (if that’s even the right word?) – it’s trivial using this timeframe.

TL;DR

If we see the market trading in the range of 3600 to 4000 over the next 6 months or so – use that as an opportunity to increase your (quality) risk asset exposure for the long-run.

Putting it All Together

Talking about quality stocks – this afternoon Apple reported their latest results.

This is a stock you want to target on any dip.

The iPhone maker posted its 4th straight quarterly revenue decline – which they flagged last quarter.

But there were two bright spots in the report:

- Their install base continues to grow; and

- Services revenue grew at 16% – which is the future of the business.

What I don’t like about Apple is not the business itself. It’s arguably one of the best on the planet.

My issue with Apple is its multiple (and that’s not Apple’s fault)

You have a company barely growing at single digits trading at a forward 27x multiple (based on full year EPS of $6.30)

That’s too high.

To be clear, it deserves a premium multiple to the market. But for me it’s not 27x.

Ideally you get it closer to the mid-20s.

As a refresher – in this post “Apple: An Incredible Business – But Don’t Overpay” – the stock was trading around $182.

I said to exercise patience and wait for a price of around $159 to $165 (at ~26x fwd)

At the time of writing, the stock is trading $171 after earnings.

Put this on your watchlist of stocks to add to if it continues to fall.