- The thing about assumptions…

- The real danger comes from encouraging or inadvertently tolerating rising inflation and its close cousin of extreme speculation and risk taking – Paul Volcker

- Powell could effectively pivot (again) next week

Following Chair Powell’s Dec 14th statement on monetary policy – the market was left doing a double-take.

Barely two weeks prior, Powell told us it would be premature to conclude with confidence that the Fed had achieved a sufficiently restrictive stance; or to speculate on when policy might ease.

In other words, expect rates to be higher for longer.

As it turns out, two weeks is a long time in Fed speak and Powell did an about-face:

- Policy was now “well into restrictive territory”

- Highlighted the Fed would need to start cutting rates “way before” inflation reached its 2% target – where failing to do so could lead to an overshoot and slow activity too much

- Declared the Fed was “very much focused” on the risk of keeping rates too high for too long; and

- Admitted that the FOMC had discussed when they should start cutting rates

Markets loved the new dovish Powell and were given a “green light”.

It’s been risk on for speculators since.

But it had me wondering why the Fed Chair would effectively box himself into a corner?

Next week (March 20th) Powell will share the Fed’s thinking on monetary policy and the state of the economy. And given the inflation (and employment) data we’ve received of late – he could be on the back foot.

For example, hotter-than-expected wholesale inflation today sent market participants scurrying – as they (once again) reevaluate the path of potential Fed rate cuts.

Not long ago markets saw six rate cuts this year. That was subsequently changed to just three cuts a couple of weeks ago – with warm inflation prints.

Could it now be two?

Probabilities for the Fed maintaining the current rate in June went up 5% to ~40% (essentially an even money bet)

Investors are now thinking that rate relief may arrive in July.

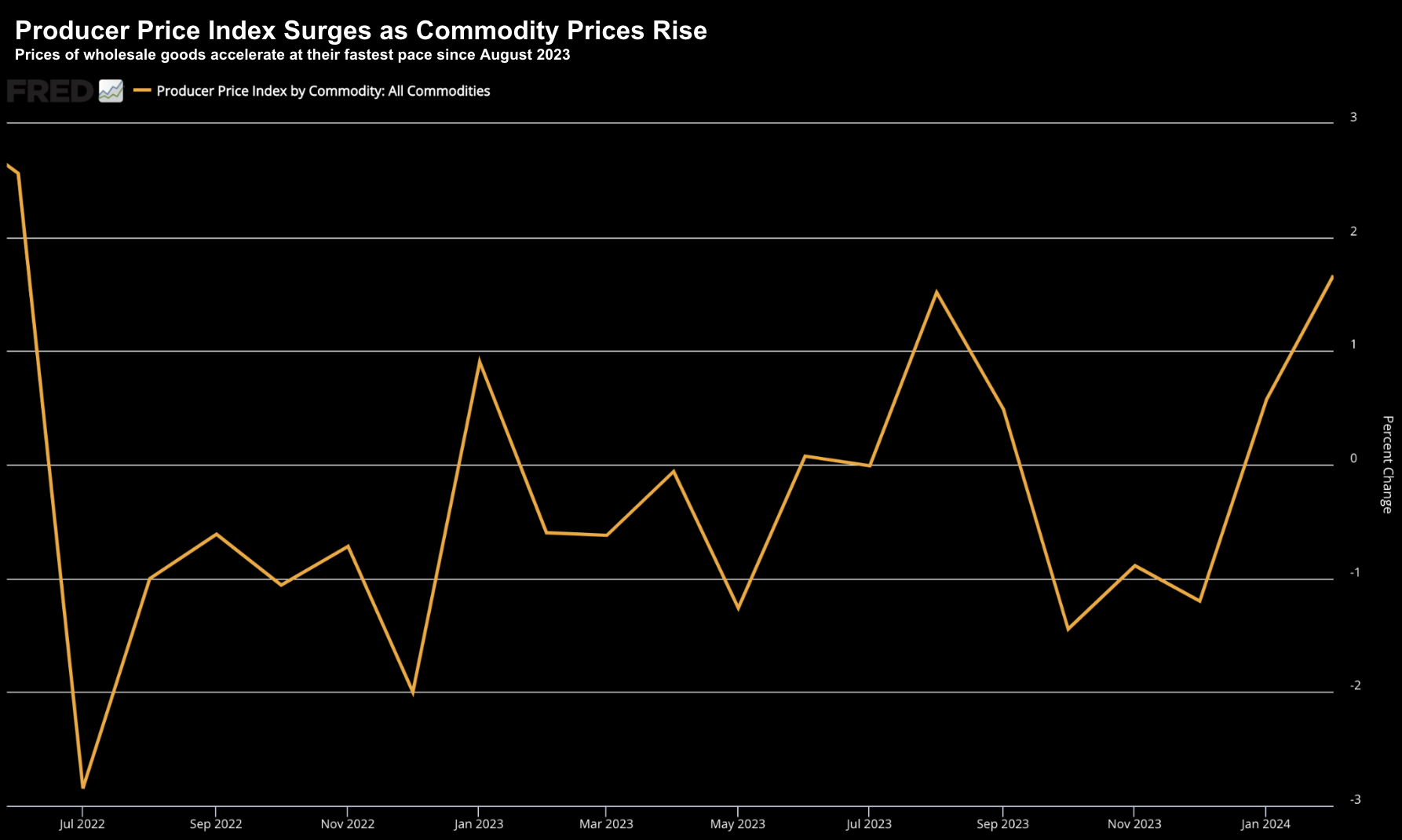

Let’s start with wholesale prices – as they rose sharply for the second consecutive month.

Surging Producer Price Inflation (PPI)

The market was shocked to see PPI come in at double the expected gain in February – as its largest move in ~6 months.

- PPI, which measures pipeline costs for raw, intermediate and finished goods, jumped 0.6% on the month, double the estimate.

- On a year-over-year basis, the headline index increased 1.6%, the biggest move since September 2023.

- Two-thirds of the rise in headline PPI came from a 1.2% surge in goods prices, the biggest increase since August 2023, thanks to a 4.4% jump in energy.

- Retail sales increased 0.6%, less than expected, while weekly jobless claim filings nudged lower to 209,000.

As the data shows, services, goods and commodities all experienced material price gains.

And it’s not surprising – consider what we see with the iShares S&P GSCI Commodity Index Trust (a fund which tracks the results of a fully collateralized investment in futures contracts on an index composed of a diversified group of commodities futures).

March 14 2024

By way of example, below is the surge we have seen in copper…

March 14 2024

With the price of most basic commodities rallying (including oil) – it should not come as a surprise to see PPI up 0.6% MoM vs expectations of just 0.3% MoM – its fastest pace since August.

March 14 2024

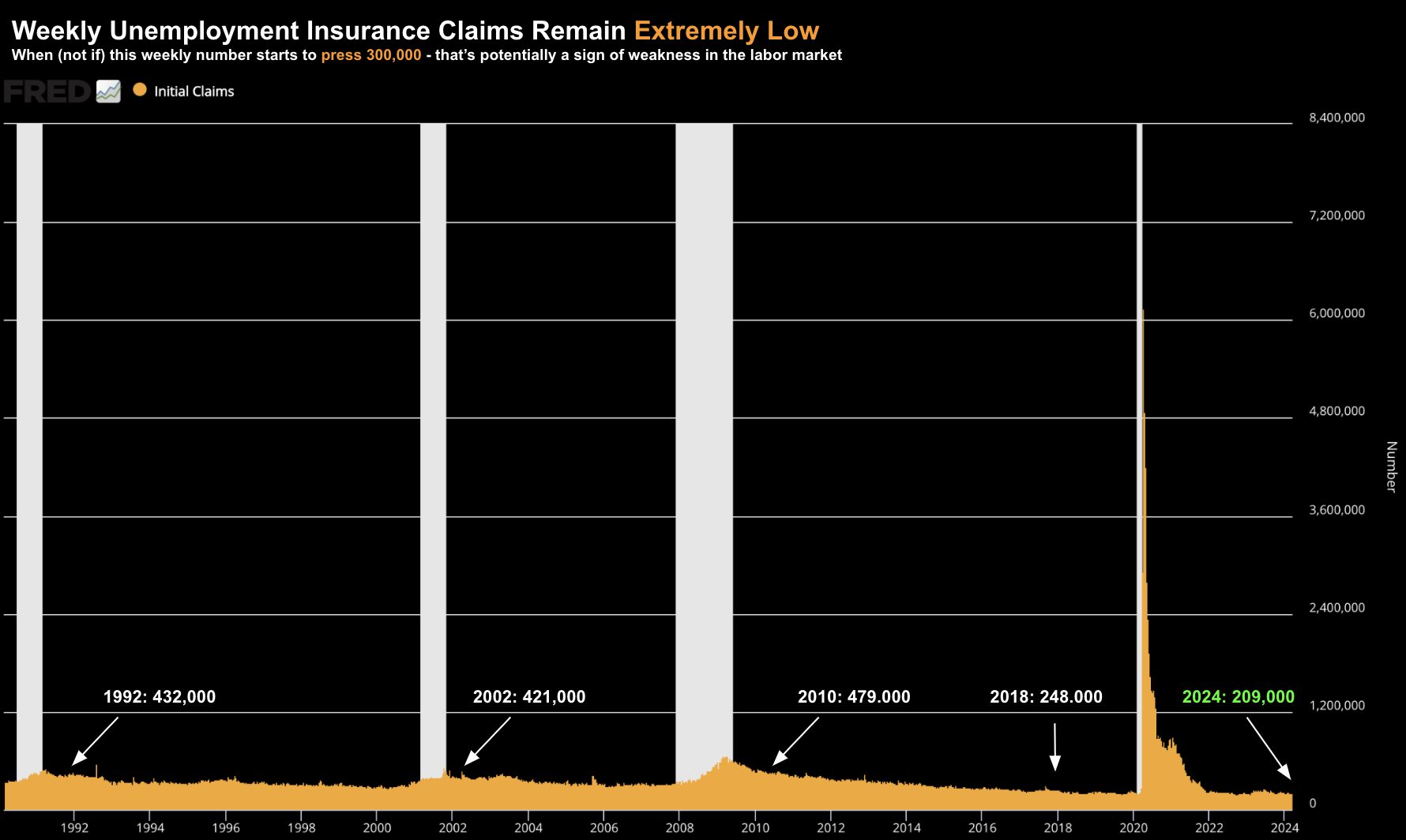

Labor Market Still Tight

The Fed’s worries of unwanted systemic inflation won’t end with higher producer prices – there’s also continued pressure with labor (and why we are seeing higher services inflation)

Before I get to the latest initial weekly unemployment claims – this is one of the most important data points for the Fed.

As background, this number comes out every Thursday for the previous week – where The Bureau of Labor Statistics aggregates the 50 states and publishes a seasonally adjusted numbers.

Today we learned that initial unemployment claims fell to 209,000 for the week ended March 9, below estimates of 218,000 and the previous week’s 210,000.

For context, anything below 300,000 is a very low number.

Consider the average weekly unemployment claims numbers over the past three decades:

For example, in the early 90s this number hovered around 430,000.

In the early 2000s it was similar figure; and prior to the pandemic it ranged between 250,00 and 350,000.

For me, when mainstream commentators freak out if it moves “higher by 30,000” from one week to the next (suggesting weakness) – they miss the bigger point.

When viewed over this time horizon – I think only when weekly claims push into the 300,000 zone – then we’re closer to signs of potential weakness.

Not before.

And this won’t be lost on the Fed.

For now, weekly jobless claims are as low as we’ve seen in decades (not to mention over 9M job openings).

Therefore, with labor conditions generally tight (which only increases pressure on wage inflation) – it’s difficult to see why the Fed could make the case to cut rates prematurely.

However, a weekly number between 300K and 400K might give them some scope to cut.

Shades of Volcker

Given what we find with labor markets, wage inflation and the hotter-than-expected inflation prints early this year – all eyes on the Fed’s meeting next week.

Will Powell dial back some of his dovish (Dec) rhetoric?

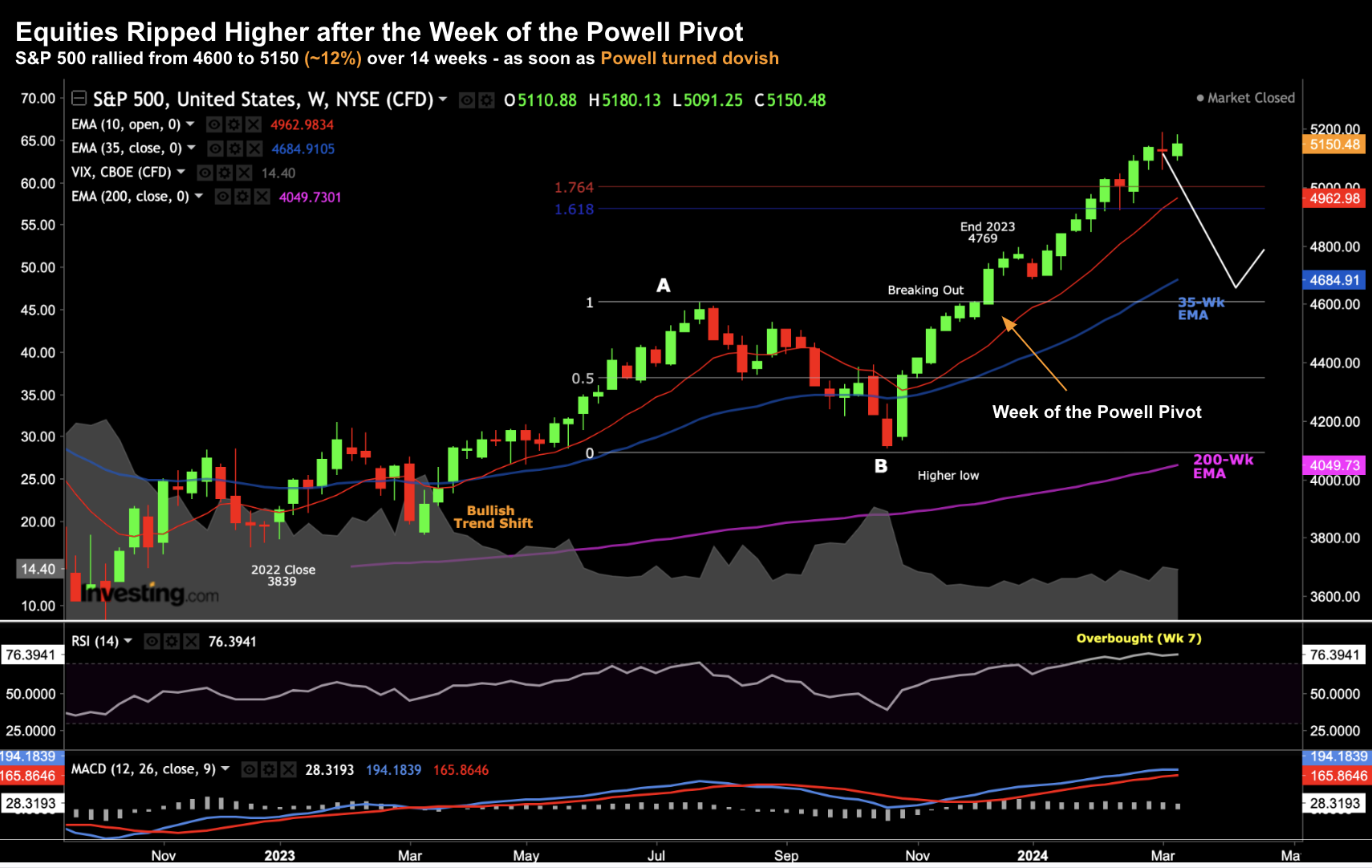

For example, the so-called Powell Pivot (and subsequent easing of financial conditions) is largely responsible for the 12% surge in risk assets the past 14 weeks (in addition to the growing money supply)

March 14 2024

From here, further material gains in the market will need to be supported by a dovish Fed.

Again, what would give Powell leverage to sound overly dovish?

I can’t see it.

Let’s cast our minds back to Jackson Hole 2022 – where Powell delivered one of the more blunt messages. At the time, the market had experienced:

- a sharp rally in commodity prices

- a few hotter-than-expected inflation reports; and

- equity markets were ripping to new highs – around 4325

“Restoring price stability will likely require maintaining a restrictive policy stance for some time. The historical record cautions strongly against prematurely against loosening policy”

“Whilst the lower inflation readings for July are welcome, a single months improvement falls far short of what the committee will need to see before we are confident that inflation is moving down”

“So, we’re moving our policy stance purposefully to a level that will be sufficiently restrictive to return inflation to 2%”

In the space of 9 weeks the S&P 500 dropped from 4325 to around 3490 – a plunge of ~20%

Now I’m not suggesting Powell repeats this performance with language like “there will be economic pain ahead” as he did two years ago.

We’ve made a lot of progress (on inflation) since then. However, that was also the lower hanging fruit.

As I said at the time, it’s far easier to get inflation from “9% to 4%” than it is say “4% to 2%” (which is mostly driven by housing costs and wages)

But I very much doubt we will hear “the same dove” as we did in December.

And this brings me back to the former Fed Chair of 1979….

Volcker’s poignant words from his book “Keeping At It, The Quest for Sound Money and Good Government” may be sitting in the back of Powell’s mind.

He offers this advice when taming unwanted inflation:

The real danger comes from encouraging or inadvertently tolerating rising inflation and its close cousin of extreme speculation and risk taking, in effect standing by while bubbles and excesses threaten financial markets.

Ironically, the “easy money,” striving for a “little inflation” as a means of forestalling deflation, could, in the end, be what brings it about.

That is the basic lesson for monetary policy. It demands emphasis on price stability and prudent oversight of the financial system.

Both of those requirements inexorably lead to the responsibilities of a central bank.

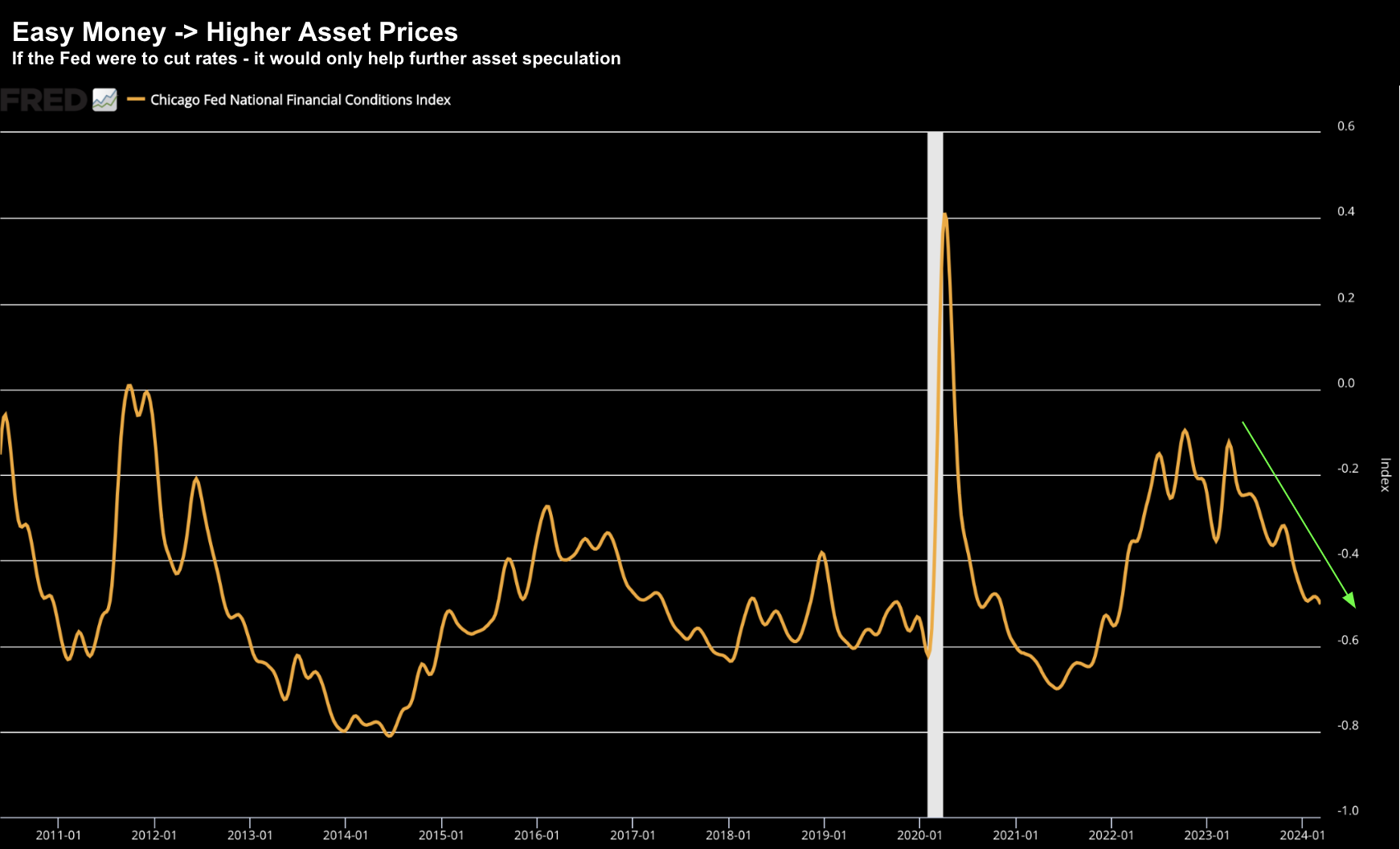

Today’s market is not void of its share of rampant asset speculation and risk taking – as the S&P 500 climbs to all time highs – where some stocks have more than doubled in value in a short space of time.

And whilst CPI (headline) has retreated from its “9% high” – it’s still much higher than where the Fed wants it to be (especially services surging 0.6% MoM)

At the same time, we have easing financial conditions (enabling the speculation).

March 14 2024

With this in mind – what will be Powell’s course of action?

For example, does he:

(a) continue to let financial conditions ease (talking to rate cuts) – pouring fuel on stock speculation? or

(b) commit to a laser focus on price stability and measures to curb excessive speculation?

Personally, I’d like to see more of the latter. But that’s not what markets are pricing in.

Putting it All Together

Powell has put himself in a difficult spot.

But he didn’t need to.

For example, on the one hand he doesn’t want to signal panic by suggesting rate cuts will be needed (as was the case in 2001, 2008 and 2020).

But on the other hand, he doesn’t want to fan the flames of rampant asset speculation.

Clearly the market thinks we’re on a glide path to a soft landing (as Powell has communicated).

And maybe we are…

However, he will be conscious of:

- the rapid acceleration in risk assets;

- hotter-than-expected inflation prints (especially PPI and Core Services)

- rising commodities; and

- general tightness in the labor market.

Therefore, does cutting rates in June (or July) seem prudent?

Perhaps Powell would be wise to heed the advice of someone who has been there:

“… the real danger comes from encouraging or inadvertently tolerating rising inflation and its close cousin of extreme speculation and risk taking, in effect standing by while bubbles and excesses threaten financial markets”