- Have commodity prices peaked? Too early to know

- WTI Crude, Copper and Wheat well off their highs on growth fears

- At 3,666 – the Bull Bear ‘Sentiment’ Ratio hits Lowest Level since March 2009

Inflation remains the market’s primary focus.

Any hint of lower than expected inflation and stocks will rip higher.

The opposite holds true.

For example, if we continue to experience unwanted (high levels) of inflation – it will:

- hinder consumers confidence and their ability to spend;

- significantly thwart (weakening) economic (GDP) growth;

- typically hurt profit margins (as we saw with NIKE today); and most importantly

- determine how fast (and how long) the Fed continues to hike rates.

A large part of consumer price inflation (CPI) is what we find with commodity prices.

For example, commodities which include (but not limited to) crude oil, coal, iron ore, copper, wheat etc all feed into the resultant price of most goods and services.

To that end, keeping a close eye on commodities might be helpful in terms of what we can expect.

Perhaps the most influential commodity on the price of all goods and service is what we see with WTI Crude.

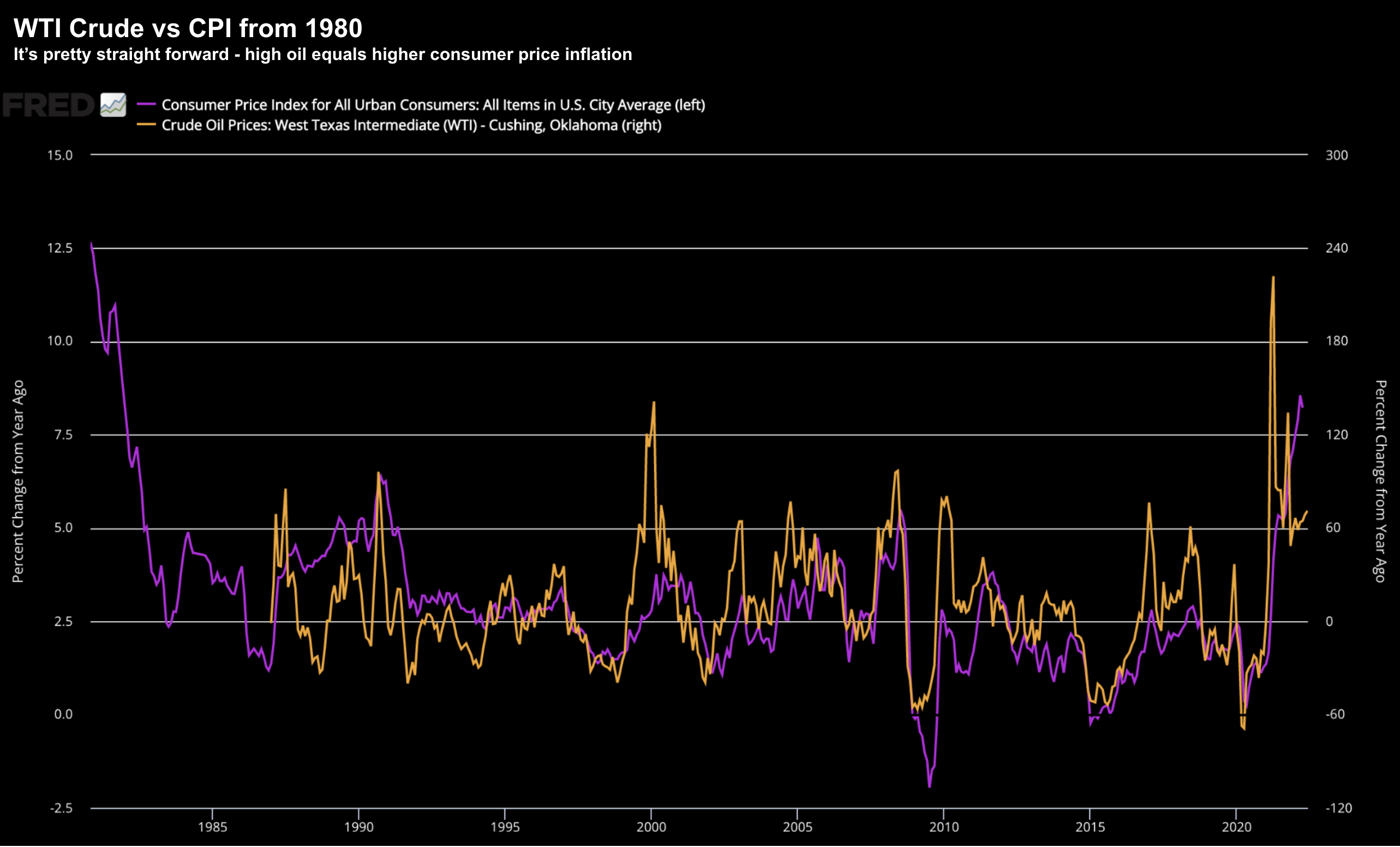

As a preface, below is a chart I shared recently showing its strong correlation with CPI (purple) over the long-term:

As this 40-year old correlation proves – higher oil prices typically means higher CPI.

Let’s take a quick look in terms of what we see with some key inflationary drivers (specifically crude oil, copper and wheat).

WTI Crude: Need a Recession for Prices to Fall

At the start of the year – I nominated WTI Crude as possibly the most critical chart to watch for 2022.

At the time we had no visibility into Russia’s war with Ukraine (they invaded Feb 24th) — however there was supply/demand concerns building opposite Biden’s anti-fossil fuel policy.

After the November 2020 election – the price of oil was quickly on the move higher… almost doubling in a few months.

Fast forward to today and WTI Crude recently traded as high as $130.50 a barrel early March.

Technically, WTI Crude faces near term resistance around the zone of $120 per barrel. For example, we have seen two failed attempts around this zone – only to fall back each time in quick order.

The 35-week EMA (blue line) currently trades ~$98 – which is likely to act as support in the near-term. However, any sell-off on economic growth concerns could see the price fall back to the middle of the longer-term distribution (i.e. between $90 and $95)

However, from mine, for prices to trade back below US$80 (in turn reducing CPI) – we need to see clear signs of an impending recession (resulting in demand destruction)

But in the near-term, oil supplies will remain tight which will support higher prices.

And if we consider China coming back on line (post their massive COVID lock downs) — demand is likely to increase.

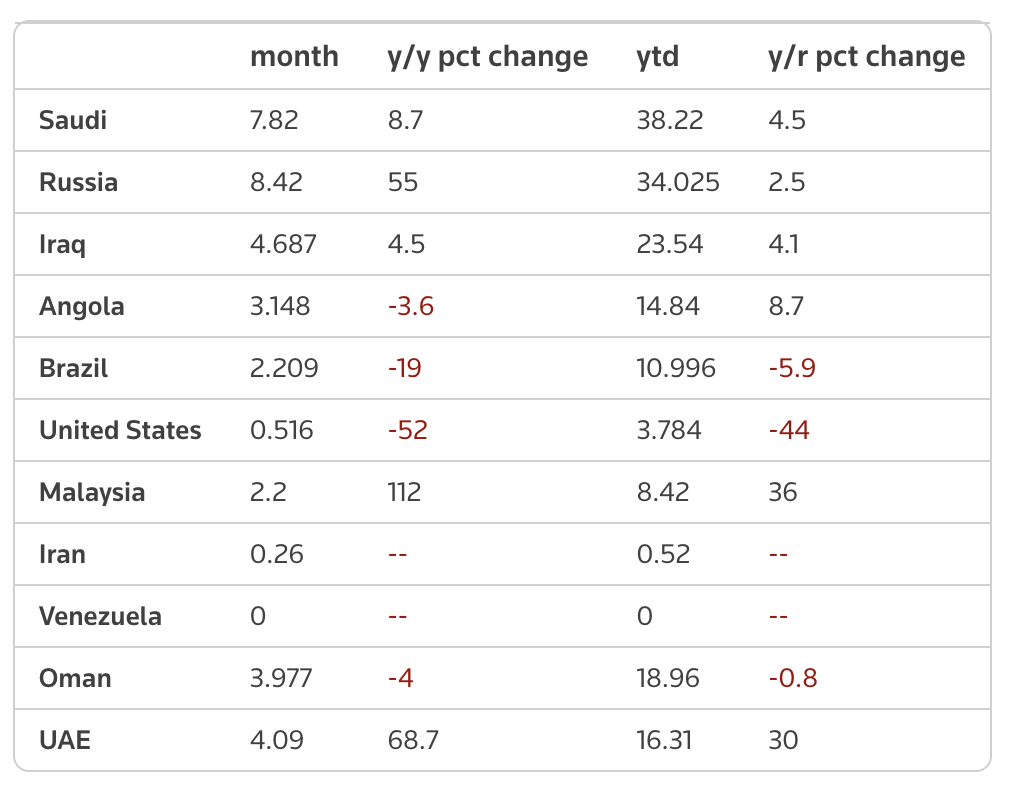

As a complete aside – below is what we find with Chinese oil imports by trading partner (note the 55% increase of Russian oil; and corresponding 52% decline of US oil).

Chinese Oil Imports by Partner

n summary, I don’t see the price of WTI Crude falling substantially in the near-term.

Prices are likely to remain high (above $90 per barrel) which will add to (already high) inflationary pressure.

However, the caveat here will are recessionary risks.

And for that, we turn to Dr. Copper…

Copper: Growth Slowing

Perhaps the counter to the above is what we see with copper.

Prices continue to thunder down on increased recession fears (or materially slower growth). And if true, it follows we are likely to also see lower oil prices.

As context, copper’s ability to predict turning points in economic cycles and gauge the overall health of the global economy has earned it the nickname of “Dr. Copper”

For example, falling copper prices are often viewed as a leading indicator of an impending economic downturn owing to the metals’ wide variety of use cases in electrical, industrial, housing and transportation applications.

As the weekly chart shows below, from May this year, copper has been sounding alarm bells — with the weekly trend decidedly bearish.

June 27 2022

From mine, with crashing through $4 per pound – down over 24% from the highs and down to a 16-month low tells me a recession is all but priced in.

What’s more, recession risks are now quite possibly “trumping” inflationary risks.

For example, UBS believes rising demand from the clean energy transition (a strong use case for copper) will not be enough to keep copper prices elevated amid falling global economic growth.

They argue copper will move even lower in the second half of this year and into 2023 as growth slows.

Here’s UBS’ metals analysts:

“As a result we expect [copper] demand growth to moderate, but not collapse. We expect copper prices to trade between $2.75 and $3 per pound over the coming year”

Technically this aligns with the weekly chart – where previous recessions saw copper trade back below $3 per pound.

Wheat: Prices Still 70% Above Average

The other commodity which has screamed to record highs opposite the Russia / Ukraine war has been wheat.

Last year, Ukraine produced about 33M tonnes of wheat, of which it exported about 20M tonnes, making it the sixth-largest exporter globally.

June 27 2022

According to the Guardian, Ukraine has already moved to ban exports of grain and many other food products, in an effort to preserve its own food supplies.

Transport is also difficult, with Russia blockading the country’s Black Sea coast.

From the Guardian:

While wheat prices have since slipped back slightly from record highs, analysts at Rabobank predict they could rise again due to the war in Ukraine, where it is predicting production could fall by slightly more than 20%, as well as sanctions on Russia and dry and hot conditions in other wheat-producing nations including the US and India.

Carlos Mera, an analyst at Rabobank, said prices would remain high as it was unlikely leading global producers would be able to increase production significantly, because of high fertiliser prices and pressure to grow other crops where prices were also rising

Looking at the chart, the long-term rising channel for wheat prices would typically indicate a price of around $550 (or $600 at the higher end).

However, despite the recent pullback from $1,283 — the commodity is still trading around 70% above its longer-term average.

Further to the comments from Rabobank analysts — it’s unlikely we will see prices back inside this trend channel for many months to come — suggesting higher food prices ahead.

In summary, I continue to watch commodity prices as possible leading indicators of inflation (especially WTI Crude).

I think the pullback we’ve seen of late across commodities such as crude, copper, wheat and iron ore (and more) – has provided some of the ‘juice‘ behind the current relief rally.

The key work being ‘relief’ (see this post).

However, I expect commodities to remain highly volatile.

‘Bull Bear’ Sentiment Ratio Tanks

The other thing worth noting with respect to the current relief rally is sentiment.

Last week – when the S&P 500 traded 3,666 – sentiment was as bearish as we have seen since March 2009 – during the depths of the global financial crisis.

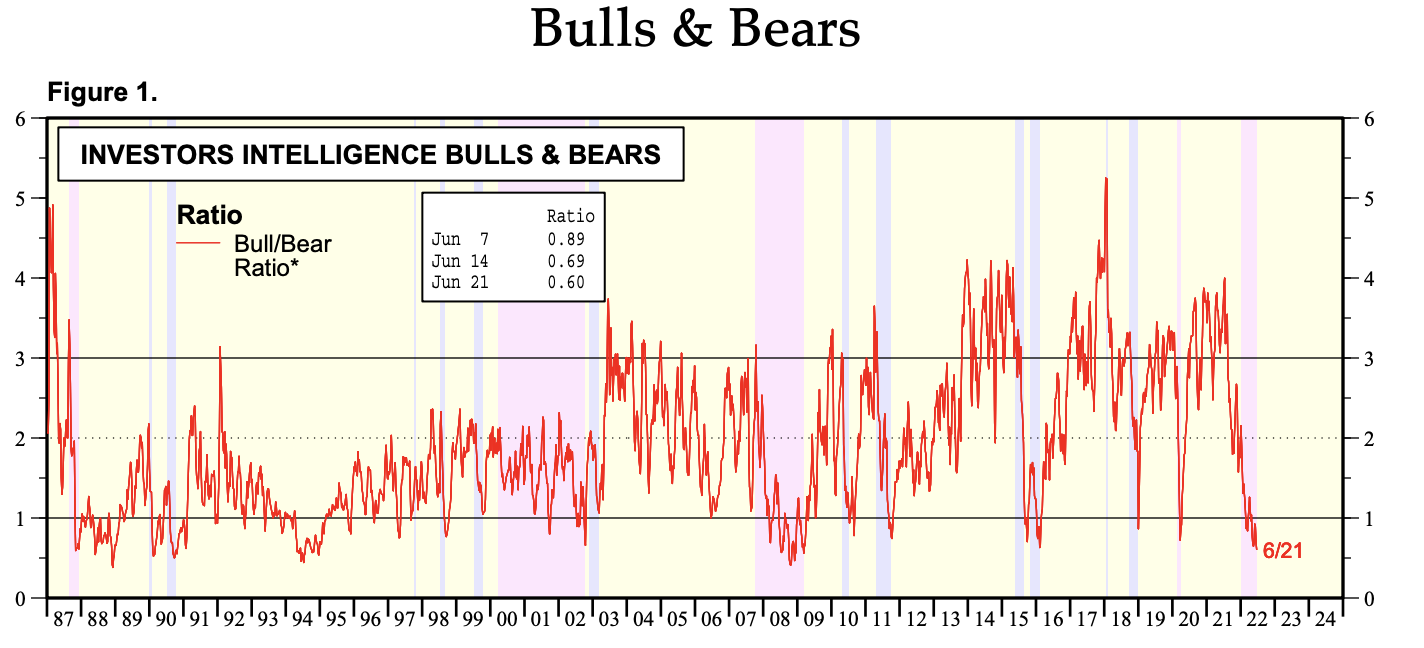

For example, according to the Bull Bear Ratio – put together by Ed Yardini – we can see how far low this fell:

A couple of things here:

- The fundamentals today are significantly better than what we saw during the depths of the global financial crisis in 2009

- The market ave up ~50% of its value during 2008/09 (see this post) when sentiment was this negative. We have ‘only’ given up 24% in 2022 for this Bull Bear Ratio to match a similar level.

Put together, this tells us we may have made “a” bottom at 3,666.

For example, it’s rare we see this ratio as low as 0.60

At 0.60 – this has often been a good long-term buy signal; and where I added a little to long-term positions – including the Index itself.

However, it’s still premature to call it “the” bottom.

Forward PE’s dropped to around 15.5x at 3,666 (boldly assuming an “E” of $235 per share) – however we have since recovered to 16.6x (with the S&P 500 at 3,900)

Further to recent missives – I think it’s most unlikely we will get back to a forward PE of 19x or above.

And more likely we make “new lows”.

Putting it All Together

For now, this market is all about inflation.

For example, if inflation is able to fall quickly (e.g., via meaningfully lower commodity prices) — the Fed and their peers may be able to pump some of the brakes.

However, if inflation persists (which still feels like for the balance of this year) – central banks will remain ‘pedal to the metal’ on rates.

That said, the open question is what happens if we tumble into recession (which feels likely)

For example, will central banks pivot?

As we know, CPI for May indicated that rates have to rise much further – with end of year expectations now close to 3.50% for the effective fed funds rate.

Question is will June give us any material relief on CPI (e.g. below 8.0% CPI)?

Unlikely.