- Looking for the US 10-yr to rally from ~4.10% to 4.50%

- “Goldilocks” job number – not soft enough for the Fed to cut in early 2024

- $7.6 Trillion reasons to give the Government (interest rate) nightmares

Last week the market received what it interpreted as a ‘goldilocks’ jobs number.

Not too hot. Not too cold. But just right.

Non-farm payrolls (NFP) increased by 199,000 in November, according to the BLS.

This was around 19,000 higher than market expectations – however not hot enough for the Fed to raise rates this week.

As an aside, the Government added 49K jobs as part of the 199K (inline with their monthly average)

The unemployment rate, meanwhile, fell to 3.7% from 3.9%, marking the longest stretch of unemployment below 4% since the 1970s.

That’s essentially a full employment picture.

With a number below 4.0% – Jay Powell is likely to reinforce why the Fed are not considering rate cuts.

And nor should they.

For example, when NFP hit the tape, expectations for rate cuts for March dropped.

However, the market is somewhat confident we will see up to two cuts by June.

I don’t agree…

Why Would The Fed Cut?

If you ask me – there are only two reasons the Fed would cut rates next year:

- We fall into recession; and/or

- There is some kind of unexpected (large) credit event

Excluding those two events – it feels unlikely why the Fed would be compelled to start lowering interest rates.

What’s more, as we get closer to a US Presidential Election (November) – the Fed will also be reluctant to interfere.

But consider what we have today…

- Core and headline inflation remains well above the Fed’s 2.0% target (slowly trending lower);

- Unemployment now sits at 3.7% – essentially full employment; and

- Growth continues to muddle along – with expectations for GDP between 1.5% and 1.8% this quarter

How the market can expect a pivot to cutting rates from the most aggressive tightening cycle in decades within the next 3 months is beyond me.

Heck, I’m still struggling to make the case for a cut before June.

That said, there is a case that the Fed will eventually ease at some point in the second half of the year.

However, it will be due to some form of economic dislocation (e.g. a recession or credit event)

Remember – when the Fed starts its rate cutting cycle – generally that is a negative stocks.

It means the economy needs help.

Beyond this, Jay Powell also reminded us that (up until recently) – the bond market was doing a lot of tightening for the Fed.

For example with the 10-year closer to 5.0% – this was helping to tighten conditions.

However, given the massive plunge in 10-year yields to ~4.20% at the time of writing – Powell could now argue this has been undone.

What’s more, if the 10-year was to drop much further (and I don’t think it does) – then Powell may be forced to raise rates.

This scenario is not priced into markets.

Dec 10 2023

Powell will probably cite the dramatic one-month fall in yields – in turn reinforcing the need for the Fed to remain restrictive.

Below is some of his language I expect him to echo this week as the Fed concludes their final meeting for 2023:

“Having come so far so quickly, the [Fed] is moving forward carefully, as the risks of under-and over-tightening are becoming more balanced. It would be premature to conclude with confidence that we have achieved a sufficiently restrictive stance, or to speculate on when policy might ease”

$7.6 Trillion of Debt to Mature Next Year

Something else likely to keep rates elevated is how much public debt matures next year.

A staggering $7.6 Trillion or ~31% of all US debt – will roll over with meaningfully higher rates.

Chief Economist at Apollo – Torsten Sløk– noted that public debt maturing in the near term accounts for more than a quarter of US GDP.

However, this is below its 2020 peak, when it made up a significantly larger share.

That said, during 2020/21 we were fighting what was similar to a ‘world war’….

My question is where is the crisis today?

The note from Sløk also states that US debt coming due next year could keep rising, after the Treasury issued its latest quarterly refunding statement in early November.

Question: how strong will demand for long-term US debt be?

For example, with 10-year yields at ~4.2%, demand could be weak – in turn pushing up yields.

This is what I expect (but is not priced into markets).

S&P 500 – Longest Winning Streak Since 2019

Last week the S&P 500 posted its 6th straight winning week.

The last time we saw this was 2019.

From the low made the week of October 23 – the S&P 500 has rallied some 12.3%

Two reasons for the surge. The market has high hopes of either:

- the Fed aggressively cutting rates; and/or

- much lower bond yields.

Given the conversation above – I clearly think both outcomes are much lower probability.

To be clear, they are possible however it’s not my base case. Therefore, I question the ‘substance’ of the 12%+ rally.

For example, should we see bond yields rise and/or the Fed continue to dampen the prospect of near-term rate cuts – we could see some of the steam come out of stocks.

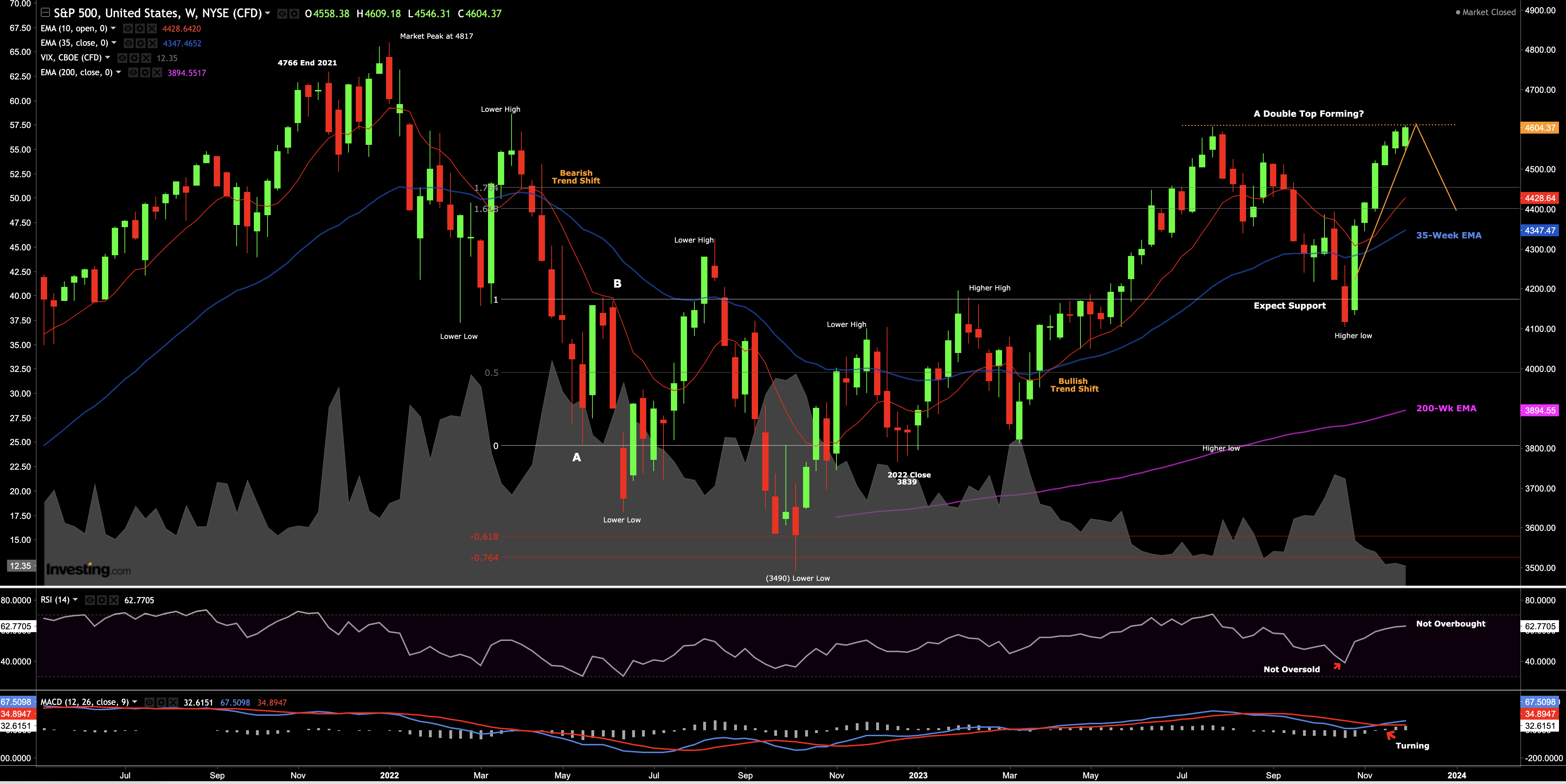

Let’s take a look at the weekly chart:

Dec 10 2023

Very little has changed from my previous technical update.

Stocks remain in a strong bullish trend (with the 10-week EMA above the 35-week EMA) – however they are getting closer to being over-extended.

For example, here I will watch the RSI (middle window).

Once I see this weekly measure top a value of 70 – the market will be considered over-bought.

We saw something similar in July. But we are not there yet.

For now, I’m watching how stocks behave around the 4600 zone (the high made in July this year)

For example, if we reverse from this zone, the double-top scenario might come into play.

This is the outcome I’m leaning towards.

That said, I’m neither adding to positions or selling stock.

Put another way, I’m not wedded to either outcome and would not be unhappy if the rally continued.

You should always have some long exposure to quality names.

So far it’s been a reasonably solid year… but who knows what can happen in the next 2-3 weeks.

And if the market is to reverse back towards 4000 to 4200, I would be happy to put more money to work.

Putting it All Together

With respect to the drop in bond yields – I expect to see them rally from here.

The caveat to that is any surprise language from the Fed.

From mine, 4.10% to 4.20% is at the lower end of my expectations for the US 10-year treasury.

In other words, the bond buying has been overly aggressive.

For example, looking at the 10-year chart, I nominated “the zone of 4.10% to 4.20% as likely support”

So far this has been the case…

I’m also a little wary when I see real 10-year yields around 2.0% (which is similar to 5-year breakevens)

This is also too low for me.

Now, if last month’s FOMC meeting was all about “...the bond market is doing the work for us” – what will December’s theme be?

Bond yields have completely reversed the past 30-days.

Powell said whilst he is happy watching bond markets tighten financial conditions – he stressed they needed to be persistent.

Dropping from ~5.00% to 4.10% in ~30 days is anything but persistent.

From mine, rates feel about 30-50 basis points ahead of themselves.

If you’re trading bonds – it would be wise to lighten exposure to treasuries here (i.e. take some well earned profits)

Let’s see what Jay Powell & Co. has to say this week…

I would be very surprised if he was dovish – given the sharp moves we have seen in risk assets / sentiment.

That said, the market will typically choose to hear what it wants to.