- GDP contracts for the second consecutive quarter… is that a recession?

- Why these 4 ‘tech pillars’ should form a part of your core long-term holdings

- Amazon and Apple’s exceptional management rises to the top

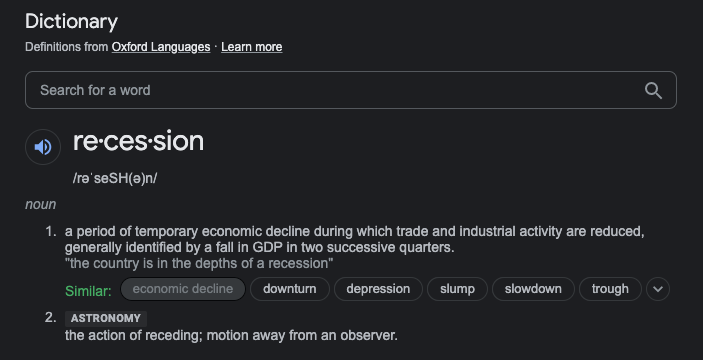

What’s the definition of a recession?

If you ask Google (who cites Oxford) – this is what you will find:

Well… turns out it’s no longer two consecutive quarters of economic contraction – according to the White House.

Today we learned GDP contracted again for Q2.

But the White House is telling us that’s all semantics… hmm mmm.

Recession or no recession – what cannot be debated is growth has slowed sharply from the 4%+ we saw prior to the pandemic.

Hopefully we can agree on that?

But despite all the doom and gloom – I’ve been selectively adding to my Top 4 Core Holdings where I felt the risk/reward (and valuation) was more attractive.

What are my Core Top 4?

- Microsoft

- Apple; and

- Amazon

These are among some of the highest quality companies on the Index.

There is just one catch – most of the time they are expensive!

Like almost everything in life – you pay for the highest quality. And in the case of these stocks – typically its an above market multiple.

Whilst your view may differ – I think there are few other companies that match each of these companies in terms of (but not limited to):

- The relative strength of their competitive positions (defensible moats)

- How important they are to our daily lives (and relentless demand for their products)

- The strength of their balance sheets and free cash flows; and

- Quality of their management

This week we heard from each of these companies.

And I’ll be honest, I was braced for the worst.

Some of the reports we had earlier from the likes of Best Buy, General Motors, Walmart, Target, Meta and others had me asking some questions.

That said, part of me hoped at least one were smacked down to the tune of at least 15% – as I would have been in there buying.

That didn’t happen.

All four delivered ‘solid’ quarters during a period where signs of weakness (and mismanagement) has seen shares sent to the woodshed.

Today Apple and Amazon told us how they navigated a difficult Q2.

And whilst growth slowed – and meaningful cost pressures remain – the results handily beat the most fearful expectations.

Core Positions vs Trades

Several years ago I found myself trading in and out of these names with varying degrees of success.

For example sometimes I was ‘too cute’ in trying to time a bottom; or I thought I was selling at top.

Sometimes this worked (and I patted myself of the back) – but analysis showed me I was simply better off owning these stocks at an attractive valuation (i.e. not overpaying) and watching them move consistently “up and to the right”.

Over time – high quality stocks like these (i.e., that produce lots of free cash flow) rarely offer attractive pullbacks (e.g. 20%+)

But when they do… you take them.

These positions are now what I consider my core holdings.

And when I find them trading at a discount (which was recently for all of them) – you buy some more.

Make no mistake – 2022 hasn’t been kind to these stocks.

As I shared last week – my portfolio is down ~2% year to date as a result. This is the result of:

(a) lowering my exposure;

(b) avoiding low-to-no earnings companies; and

(c) buying quality at attractive risk/reward valuations

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

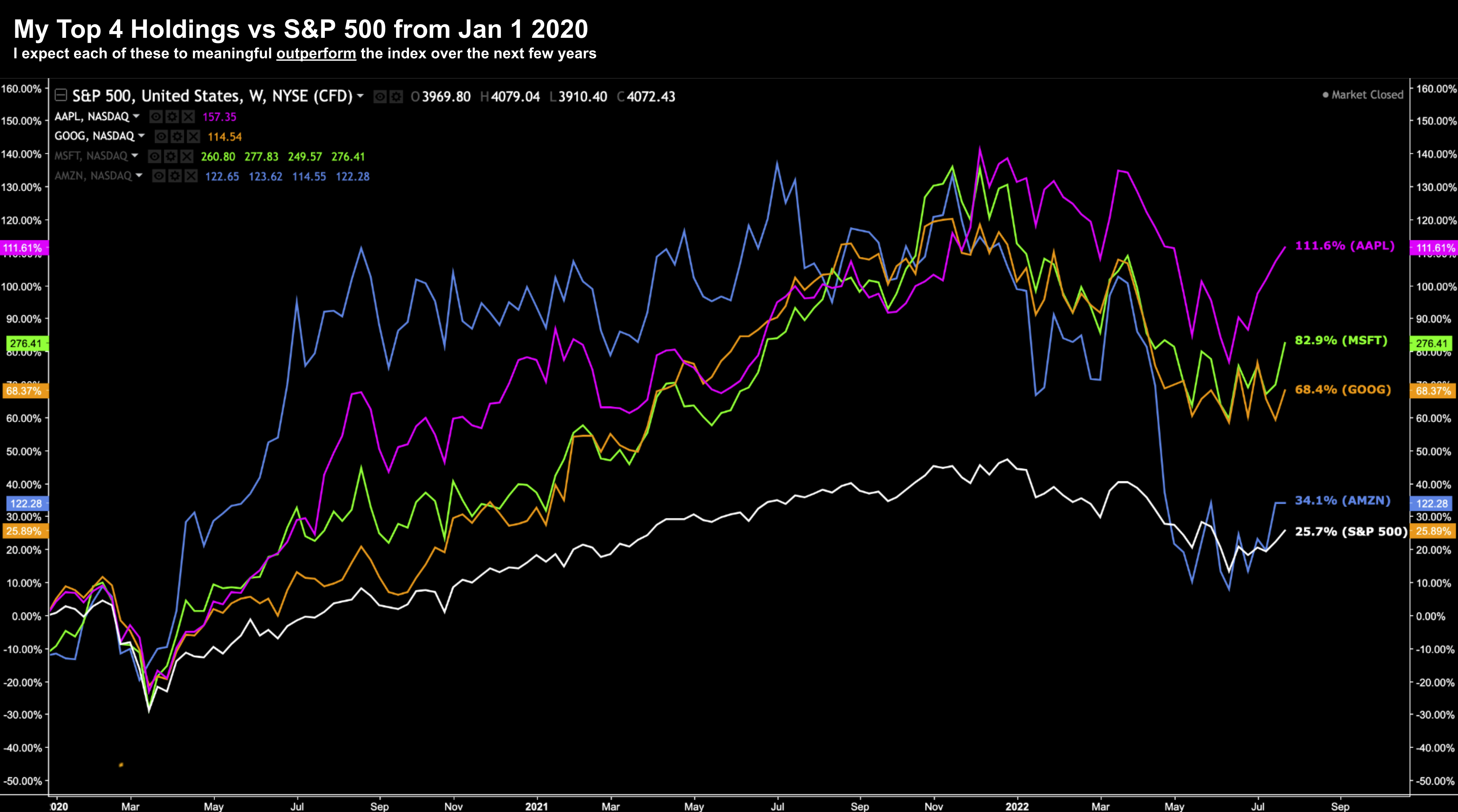

Before I give you my take on the results for both Apple and Amazon – take a look at their performance from Jan 1 2020 vs the S&P 500 (white)

July 28 2022

Apple has delivered some 112% in gains over the past 2.5 years. Microsoft ranks second with gains of ~83%.

But 2.5 years is a short time horizon (in my world!)

Here are the returns over the past 5.5 years (inclusive of the large pullbacks this year)

July 28 2022

And the longer you go – the more impressive it looks.

Now 2022 has seen all four drop considerably from their (previously over-extended) highs.

For example, we can see how in recent months we find them ‘basing’ (and where I was adding to positions)

With that – let’s review the latest results from Apple and Amazon (and the charts for each)

Amazon: Exceptional Management

First, let’s recap of the headline metrics followed by some general comments:

- EPS: Loss of 20 cents (which includes a $3.9B write-down on Rivian);

- Revenue: $121.23 billion vs. $119.09 billion expected (top line growth of 7%)

- Amazon Web Services (Cloud): $19.7 billion vs. $19.56 billion expected;

- Advertising: $8.76 billion vs. $8.65 billion expected

- Q3 Guide: Revenue b/w $125B – $130B – growth of 13% to 17% (vs $126B expected)

Much like its peers – Amazon faced headwinds in the form of inflation (fuel, energy and labor), supply chain snarls; and slowing consumer demand.

And yet – the company delivers top-line growth of 7% inclusive of the ~$4B write-down on its Rivian stake

From mine, the two highlights were:

- 18% growth in Advertising; and

- 33% growth in Cloud Service (AWS)

Amazon’s ad business is one area that investors should pay attention to.

Revenue growth of 18% was closer to 21% if measured on a constant currency basis – and massive 48% 3-Year CAGR

Now ~50% of all product related searches on the web are made on Amazon’s property. And I think that is a testament to their breadth of choice, price competitiveness and above all else – exceptional service levels.

For me personally, it’s the service level which is why I shop on Amazon for every-day needs.

It’s a no-brainer. The products show up (magically) on my door within 2-days – meaning I don’t have the cost, time and effort associated with going to a store.

I am probably not alone which means there are a lot of ‘eyeballs’ they can monetize via ads looking at everyday products.

But from mine, the jewel (and cash machine) in Amazon’s crowd is AWS (or cloud).

Cloud grew 33% from a year earlier to $19.74 billion, above the $19.56 billion projected.

This business provides the cash flow and profit margins underpinning their other businesses. AWS generated $5.72 billion in operating income, up 36% year over year.

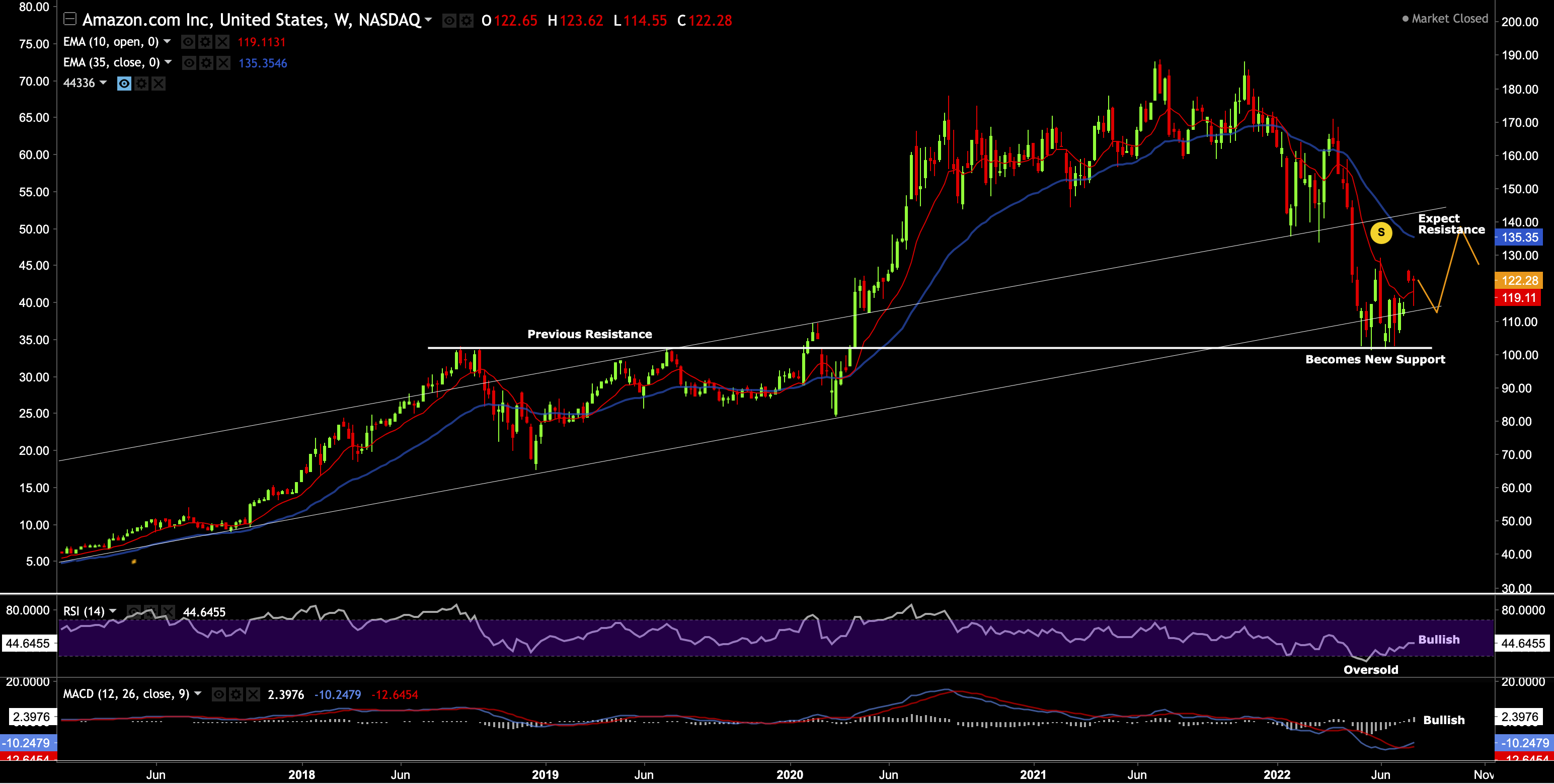

Let’s look at the weekly chart:

July 28 2022

What strikes me most with this 5 year chart is how previous resistance (through 2018 and 2020) has become new support (i.e., $100)

Now last quarter I warned that we could see AMZN fall all the way to this zone – but it was an area to accumulate.

This is where I was adding to my position.

Technically I observe that:

- It was oversold on the weekly RSI ~$100 (RSI falling below the value of 30)

- Recently bullish divergence on the weekly MACD – ie momentum is turning positive; and

- Could be about to enter its long-term (upward) trend channel formed by the higher lows

From here, look for Amazon to challenge the 35-week EMA (~$136) where it may meet selling pressure.

And whilst that’s a positive development – what I want to see is the formation of a new higher low (sketched in)

I like the way this stock is setting up and the earnings call today was better than I expected.

And coupled with a strong guide for Q3 – continue to add to this name on weakness.

It will come again – be ready to act.

Apple: Masters of Supply Chain & Demand

As an Apple shareholder – I sleep well at night knowing Tim Cook is CEO.

If anyone wins the award for “CEO of the Year” – it might just be Cook!

Cook had massive shoes to fill when he took on the role – but he offered something Jobs didn’t.

He was never going to come up with next “smartphone” or “iPod” — but he was the “king of supply chain”

And this quarter he demonstrated why he earned this reputation.

Apple delivered a solid quarter – especially given the ongoing difficulties in China, component shortages and inflation.

But here’s the thing:

A rule I have is you always want to own companies that produce products which people desperately want.

Put another way, they have products where there is no true viable alternative.

I might sound like an “Apple fan boy” here… but in terms of the quality of their products… they are exceptional. And there are ~1B other people who seem to agree.

Let’s review the numbers and then some commentary:

- EPS: $1.20 vs. $1.16 estimated, down 8% YoY

- Revenue: $83 billion vs. $82.81 billion estimated, up 2% YoY

- iPhone revenue: $40.67 billion vs. $38.33 billion estimated, up 3% YoY

- Services revenue: $19.60 billion vs. $19.70 billion estimated, up 12% YoY

- Other Products revenue: $8.08 billion vs. $8.86 billion estimated, down 8% YoY

- Mac revenue: $7.38 billion vs. $8.70 billion estimated, down 10% YoY

- iPad revenue: $7.22 billion vs. $6.94 billion estimated, down 2% YoY

- Gross margin: 43.26% vs. 42.61% estimated

- $28 billion on buybacks and dividends during the quarter.

Looking ahead – Cook said to expect revenue to accelerate in the September quarter despite seeing some pockets of softness.

You might say it’s a mixed bag…

For example, Apple only delivered revenue growth of just 2%

Now that is a very small amount of growth when it trades in excess of 26x forward earnings (which I will talk to shortly)

But there were four standouts (for me):

- iPhone revenue up 3% in a seasonally soft quarter (i.e. with the iPhone 14 out in September)

- Services revenue up 12% at ~$20B (remember it was $0 only five years ago);

- Gross margins of 43.26% (which demonstrates their pricing power); and finally

- Greater China, which includes Taiwan and Hong Kong, declined just 1% on an annual basis to $14.6 billion

Cook added that major Covid restrictions hurt demand in China… so look for that to improve in the quarters ahead.

The only negative thing you can say is the premium the stock commands.

Again, there is a price to pay for quality.

As I mentioned, the stock trades at ~26x forward at ~$163 (where revenue growth is only around 2%)

But the best way to value Apple (in my opinion) is on its free cash flow.

For example, at $163 it boasts a 4% cash flow yield… which is attractive.

But I would not be a buyer at the current level – however offers a more attractive risk/reward at $138 (where I was adding to the stock)

To the weekly chart:

July 28 2022

Not unlike what we saw for Amazon – previous resistance levels became new support.

A quick technical tip:

Sometimes you will see “false breaks” of support and resistance. For example, the price can move above resistance (briefly) and fall straight back below (and the same in reverse). I ignore brief breaks. Support and resistance zones are rarely “to the penny”

Obviously I didn’t “time” Apple’s bottom (at $129) with my entry.

However, based on both my fundamental and technical analysis – I felt the zone of ~$138 would catch a bid.

From here, what I want to see is the formation of higher low on the next pullback.

Similarly, what I don’t want to see (technically) is a new lower low (e.g. below $129). If that happens – and I am not ruling it out – we are headed lower

From there, the next support level is ~$120 which would be an exceptional long-term risk/reward entry.

Putting it All Together…

Tomorrow night I will discuss the other ‘big-tech’ Q2 report – Meta

I own the stock but it is not considered a core holding.

For example, I would place a stock like Ely Lilly or Visa as closer to a core holding than say Meta.

Meta is a speculative play (less than 4% of my portfolio) which has the potential to go very right; or very wrong!

And I will be honest – it could be either way.

Tomorrow I will talk about the company’s first ever revenue decline since listing in 2012 – missing on both the top and bottom lines.

And whilst MAUs and DAUs (Monthly and Daily Active Users) held up – significant headwinds remains.

That said, the company looks cheap fundamentally.

The question I have “is it just a value trap?”

Put another way, most of the time “cheap can always get cheaper”

But more on that tomorrow…