- Why I’m watching the real rate of return

- LEI recession indicator flashes red (again)

- Powell’s ‘interesting’ choice of language

“Given the uncertainties and risks, and how far we have come, the committee is proceeding carefully”

“We will make decisions about the extent of additional policy firming and how long policy will remain restrictive based on the totality of the incoming data, the evolving outlook, and the balance of risks.”

As Powell spoke – one reader pinged me and said “Powell sounds dovish”

I said “yes… he does”

Another friend pings me shortly later “Adrian, the Fed Chair sounds hawkish”

I answer “yes… he does”

What do I often say?

People will generally choose to hear what they want to hear.

Powell struck tones which could be taken equally hawkish and dovish.

And I believe that’s intentional…

For example, he said the prevailing data suggests they have more work to do (citing high inflation)

Equally, he acknowledges signs the economy is slowing and increasing risks (including geopolitical).

To that end, Powell is balancing what is rear-view mirror and looking ahead.

That gets tricky – as you are moving forward whilst looking behind.

But on the whole – I still think Powell said it best last month:

“We are navigating by the stars under cloudy skies”

To that end, Powell and the Fed are no more certain about what policy looks like in 6 or 12 months than anyone else!

Powell admitted as much.

Let’s explore both sides of the argument… as this isn’t straight forward.

Recession Indicator Flashes Red (Again)

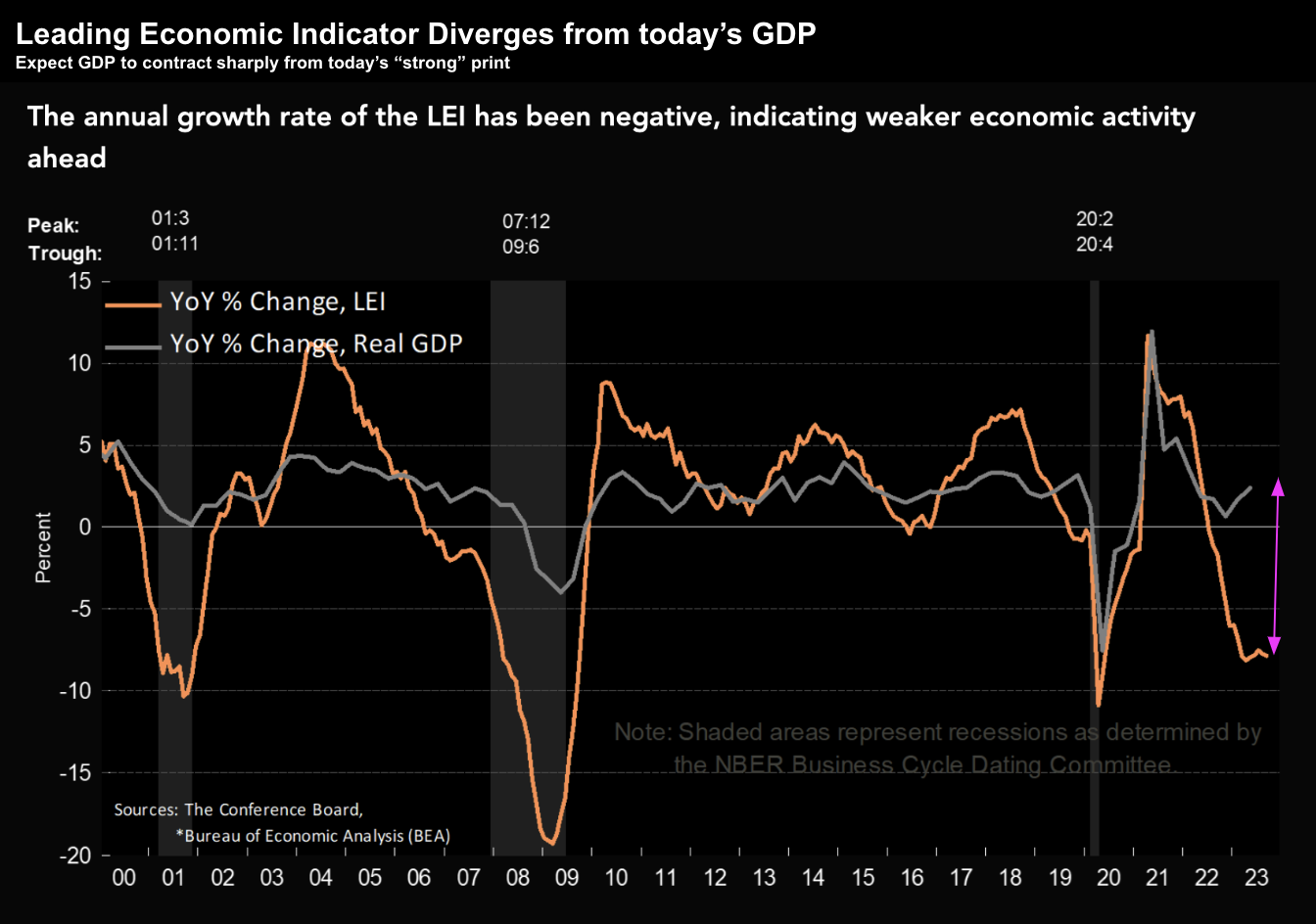

One explanation for Powell saying they are “proceeding carefully” is the latest Leading Economic Indicator Index.

Just like the past few months – it continues to flash red:

For those less familiar – The Leading Economic Index (orange line) provides an early indication of significant turning points in the business cycle and where the economy is heading in the near term.

From their statement:

The Conference Board Leading Economic Index® (LEI) for the U.S. declined by 0.7 percent in September 2023 to 104.6 (2016=100), following a decline of 0.5 percent in August.

The LEI is down 3.4 percent over the six-month period between March and September 2023, an improvement from its 4.6 percent contraction over the previous six months (September 2022 to March 2023).

“The LEI for the US fell again in September, marking a year and a half of consecutive monthly declines since April 2022,” said Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, at The Conference Board.

“In September, negative or flat contributions from nine of the index’s ten components more than offset fewer initial claims for unemployment insurance.

Although the six-month growth rate in the LEI is somewhat less negative, and the recession signal did not sound, it still signals risk of economic weakness ahead. So far, the US economy has shown considerable resilience despite pressures from rising interest rates and high inflation. Nonetheless, The Conference Board forecasts that this trend will not be sustained for much longer, and a shallow recession is likely in the first half of 2024.”

For me, this chart helps explain Powells “hawkish and dovish” language.

For example, on the one hand, the trailing GDP indicator appears robust (for now at least).

In part, this is why the US 10-year yield is rallying.

The other component is the large supply / low demand imbalance for government debt (another topic)

However, the forward LEI indicator is sharply lower – creating the wide divergence.

The rear-looking view looks strong – the forward-looking view looks weak.

So what does Powell do?

Does he base his decisions on trailing indicators like jobs, GDP and retail sales?

They should not be ignored.

Or does he focus more on looking ahead where things are clearly slowing (and sharply in some areas)?

There is no right answer to this question – but plenty of people will share their opinions.

If you ask me:

He needs to apply common sense when seeking the right balance – perhaps leaning more forward than back.

Rear-view mirror is helpful… but we should lean into what’s ahead.

That’s the direction “the car” is headed.

To that end, based on what I heard, it’s more likely the Fed will pause on rates over November and December.

Just to be clear, that will have no bearing on the US 10-year yield.

In fact, I think the Fed could cut short term rates and the 10-year yield might rise.

Longer-term yields are going higher for other reasons…

Powell’s Choice of Language

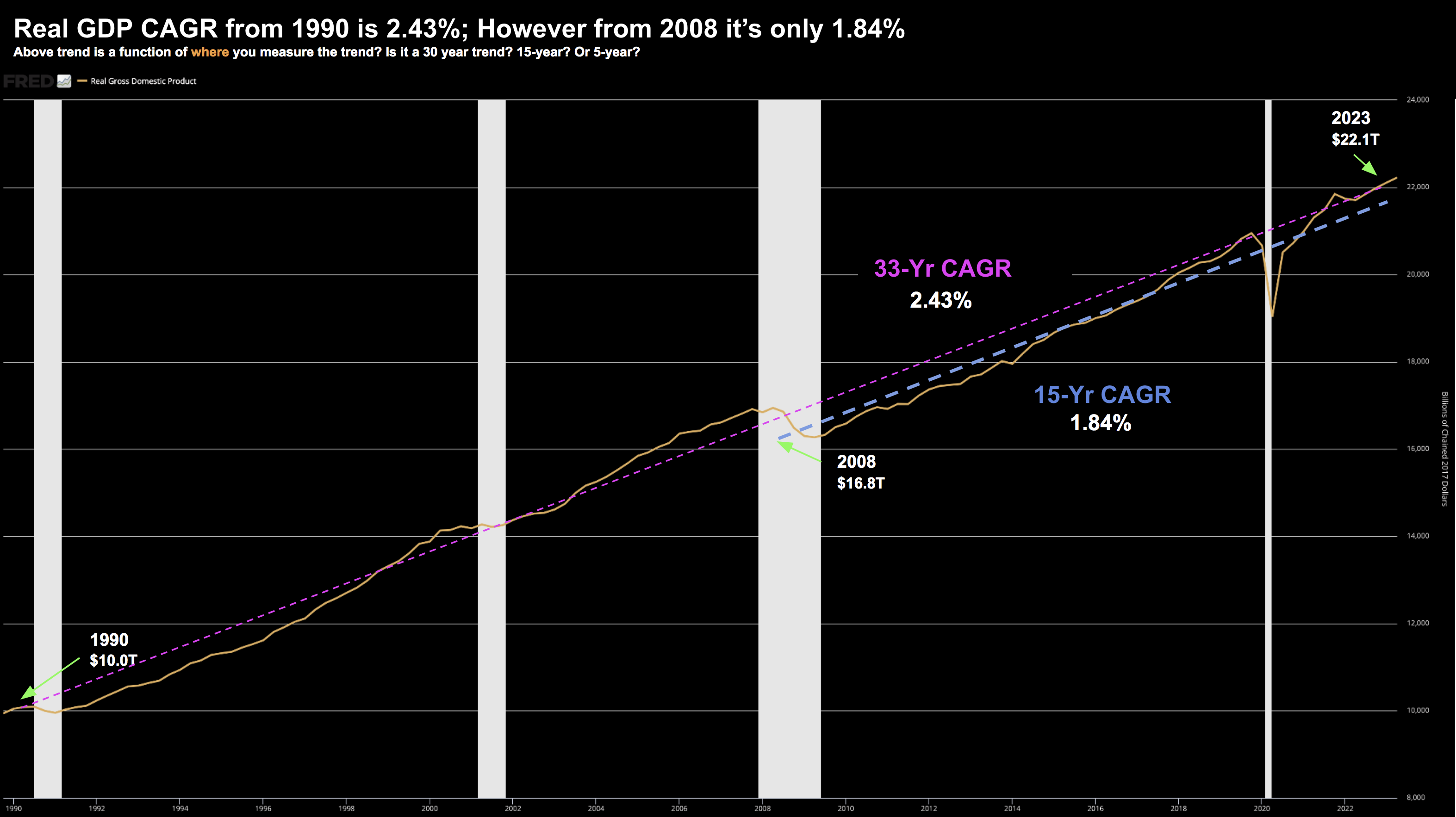

Powell stated today that he sees an economy “...with inflation too high and growth above trend”.

Again, it was an interesting take…

For example, GDP trend for the past two quarters was ~2.0%

Here’s my question – how do we define the trend?

Let me demonstrate:

If we calculate CAGR (Compound Annual Growth Rate) for Real GDP from 1990 ($10.0T) – it’s 2.43%

In that sense – the past two quarters of ~2.0% Real GDP is below trend.

But if we start the clock from 2008 where Real GDP was $16.8T – that growth rate falls to ~1.8%.

So how do define the trend?

Powell also cited “… an overheated jobs market with strong wage inflation“

Now I talked to the so-called ‘hot jobs‘ market here…

Job additions are mostly part-time work and government jobs. And if we look at hours worked – it’s falling year on year

What’s more, full-time jobs (in the sectors that matter) have declined over 600K since June!

Is that overheated?

Again what’s your definition?

And finally, wage growth is now inline with inflation (~4%). However, its velocity is falling (which is a good thing)

I expect a 3-handle on wages before year’s end.

But it’s less about where we’ve been… but more where we are going.

That said, Powell will never admit the fundamental reason why rates need to remain restrictive.

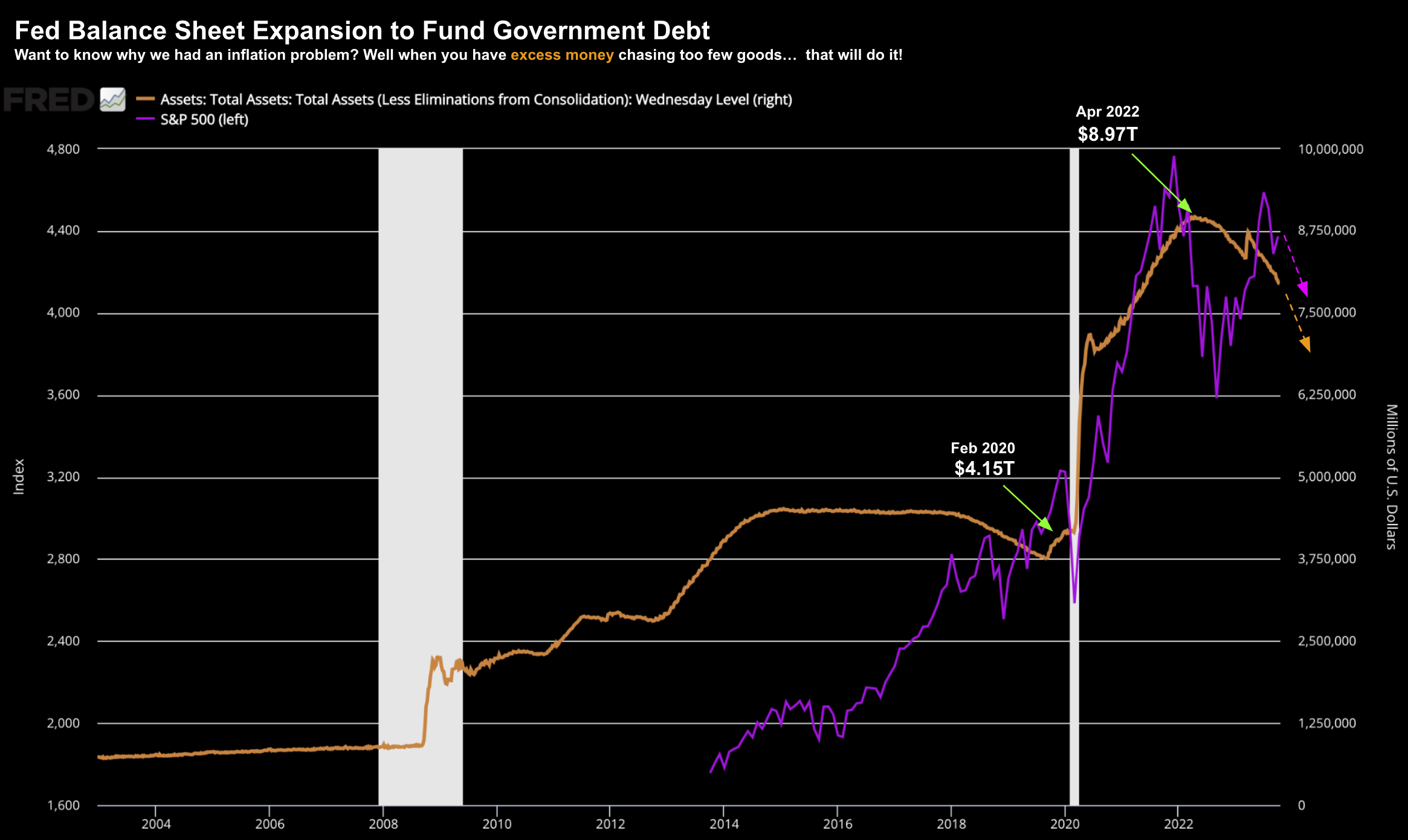

And it’s all in this chart:

For 22 years (from Jan 1998) – M2 money growth saw a CAGR of ~4.2%

Through two major recessions (2001 and 2008) – the Fed added $3.4T to the money supply.

Again, that was over 22 years.

But in just two years – during and after the pandemic – the Fed went parabolic adding ~$2.0T.

Batshit crazy.

Now we were able to hold the “beach ball under water” for a period – as the world went to ground.

But at some point, not only was that ball going to surface – it was going to surge!

Sure enough…

I bring this important chart to your attention as we’re still working through Milton Friedman’s famous “long and variable lags”

That’s going to take time…

But the point is it’s not so much ‘hot jobs and wage growth’ causing the inflationary pressure Powell talks to.

The culprit is the (unprecedented) injection of ~$2.0T in the space of just 2 years.

Where is that nugget in Powell’s presser?

You won’t hear it.

It grew by a whopping 40% – versus a 22-year CAGR of ~4.3%

Now part of the Fed’s effort to cool inflation is to take money out of the system.

And so far, they’ve been able to remove about $1.0T

But let’s bring this back to the LEI chart I shared earlier…

With the Fed raising rates by 500 basis points and taking ~$1 Trillion out of the money supply – this is having the intended effect.

Things are moving in the right direction.

Inflation is cooling and wage growth is falling.

That’s where our ‘car’ is headed…. not where it’s been.

Watch the Real Rate of Interest

Yesterday I commented how the 10-year was set to exceed 5.0%

Today we got there…

By the time you read this – it will likely be well above 5.0%

And whilst that is having a major impact on asset prices (for reasons I’ve previously explained) – it’s equally important to track what is happening with the real rate of interest.

Again, the 5.0% is a nominal rate. That needs to be adjusted for inflation.

Now in 2013, Eugene Fama won the Nobel Prize for his work on empirical analysis of asset prices

And in 1988 – he produced this paper. Below is the preface:

The one-year expected inflation rate and the expected real return on one-year bonds move opposite one another.

The result is that the term structure shows little power to forecast near-term changes in the one-year interest rate, even though it shows power to forecast its components.

When the forecast horizon is extended, interest-rate predictions improve because they primarily reflect changes in expected inflation that arc less strongly offset by changes in the expected real return.

The information is the term structure about interest rates, inflation, and real returns is related to the business cycle

In plain english – Fama discovered that the real rate of interest is generally very stable.

The nominal rate is a different story…

And over time – when the Fed are not being “interventionists” – it tends to be about 1% per year.

In other words, that is the interest rate you earn on Treasuries (~5.0%) less the inflation rate (~3.0% today)

Again, this assumes the Fed is not influencing Treasuries (which they have done the past few years with QE)

For example, QE saw the Fed’s balance sheet expand from $4.1T before COVID to ~$9T.

I shared this chart yesterday:

October 19 2023

This massive purchase of government debt (QE) forced rates lower to a negative real rate of return.

Since then they’ve allowed bonds to roll off their balance sheet (vs selling them) – which has seen their balance sheet decline by over $1 Trillion

This is important as it has the same effect as raising the short-term interest rate.

Put together, this is the reason the real rate of return turned from negative to being positive.

In fact, it’s now around 2.5%

For example, the 5-Year, 5-Year Forward inflation expectation is now 2.50% (see below)

October 19 2023

With the 10-year rate at 5.00% – that gives a real rate of 2.50%

Coming back to Fama’s research that the real rate of interest is generally very stable at 1.0% (over the long-run with no central bank intervention) – the current rate is very high.

And this has big implications for stock valuations – where this rate is used to discount future cash flows.

Put another way, when the 10-year yield falls, stocks are likely to catch a bid (as the stable rate gets closer to 1.0%).

Putting it All Together

I said a few weeks ago the 10-year yield could easily challenge 5.00% and possibly get to 5.25%

Given the new supply / demand dynamic – it’s not surprising.

There’s a ton of supply coming (well done Washington DC) and very few willing buyers.

The Fed’s not interested… neither are the Japanese (as they sell US debt to manage their currency).

However, given the above, I find it difficult to imagine it goes appreciably higher than 5.25% in the near-term

Again, if economic growth is to slow in 2024 and inflation pressures continue to ease, then we will see the 10-year yield fall.

That’s my view over the next 6-12 months.

However, longer-term (e.g., 5+ years), we could easily see a 10-year yield trading north of 7% given the gross fiscal recklessness from Washington.

Now I could be horribly wrong on my thesis for slower growth in 2024.

Right now – this is a contrarian view. The market expects a soft landing and no recession.

And if I am wrong – then will take a decent loss on my long bond positions (which I’ve steadily been building).

This position also includes buying investment-grade and non-investment grade corporate debt over the past two weeks.

Let’s see how things go…