- Stocks bet big on soft-landing in 2024 (with aggressive rate cuts)

- Why I think that’s a lower probability outcome

- Commodities and Leading Economic Indicators suggest otherwise

With the Fed seemingly on pause and bond yields sharply off their highs – markets are optimistic.

Equities have surged the past few weeks – up around 17.6% year-to-date.

The S&P 500 has added 10% in just 3 weeks!

Who knew?!

The narrative (as far as I can tell) is we’re headed for “soft landing”

So what does this mean exactly?

Well it depends who you ask. However, it can be loosely be described as the following:

- no meaningful increase in unemployment (e.g. remaining below 4.50%)

- robust consumer (e.g., spending) with low credit default rates;

- economic growth inline with longer-term trends of ~2.0%;

- immaculate disinflation back to the Fed’s 2.0% objective; and

- double-digit earnings growth.

Sounds terrific…

And if we saw all that – sure – the S&P 500 should be trading well north of 4600.

Now tune into any CNBC or Bloomberg talking head and it’s an echo chamber.

“We expect a soft landing…”

Case in point – here’s Goldman Sachs this week:

US GDP is projected to expand 2.1% in 2024 on a full-year basis, compared with 1% for the consensus of economist forecasts surveyed by Bloomberg. Goldman Sachs Research reaffirms its longstanding view that the probability of a US recession is much lower than commonly appreciated — at just 15% over the next 12 months.

“It was fair to wonder last year whether labor market overheating and an at times unsettling high inflation mindset could be reversed painlessly,” David Mericle, Goldman Sachs Research chief US economist, writes in the team’s report titled 2024 US Economic Outlook: Final Descent. “But these problems now look largely solved, the conditions for inflation to return to target are in place, and the heaviest blows from monetary and fiscal tightening are well behind us.

And this is largely consensus.

But here’s the thing:

It’s rare for economies to actually land “softly”… especially after what we’ve seen with the speed of monetary tightening.

In a recent opinion piece from Bloomberg – John Authers talked about this.

He pointed out that there’s only been one ‘soft landing’ since the 1980’s.

Put another way, it’s a lower probability bet.

However, markets are marching to the tune of what the likes of Goldman Sachs et al. are selling.

I’m not buying it… and I will explain why.

Optimistic on Rate Cuts

Much of the enthusiasm is directly tied to revised rate expectations and the fall in bond yields.

Makes sense… cheaper money is good for stock valuations. Future cash flows are discounted less.

But the question is – are those expectations warranted?

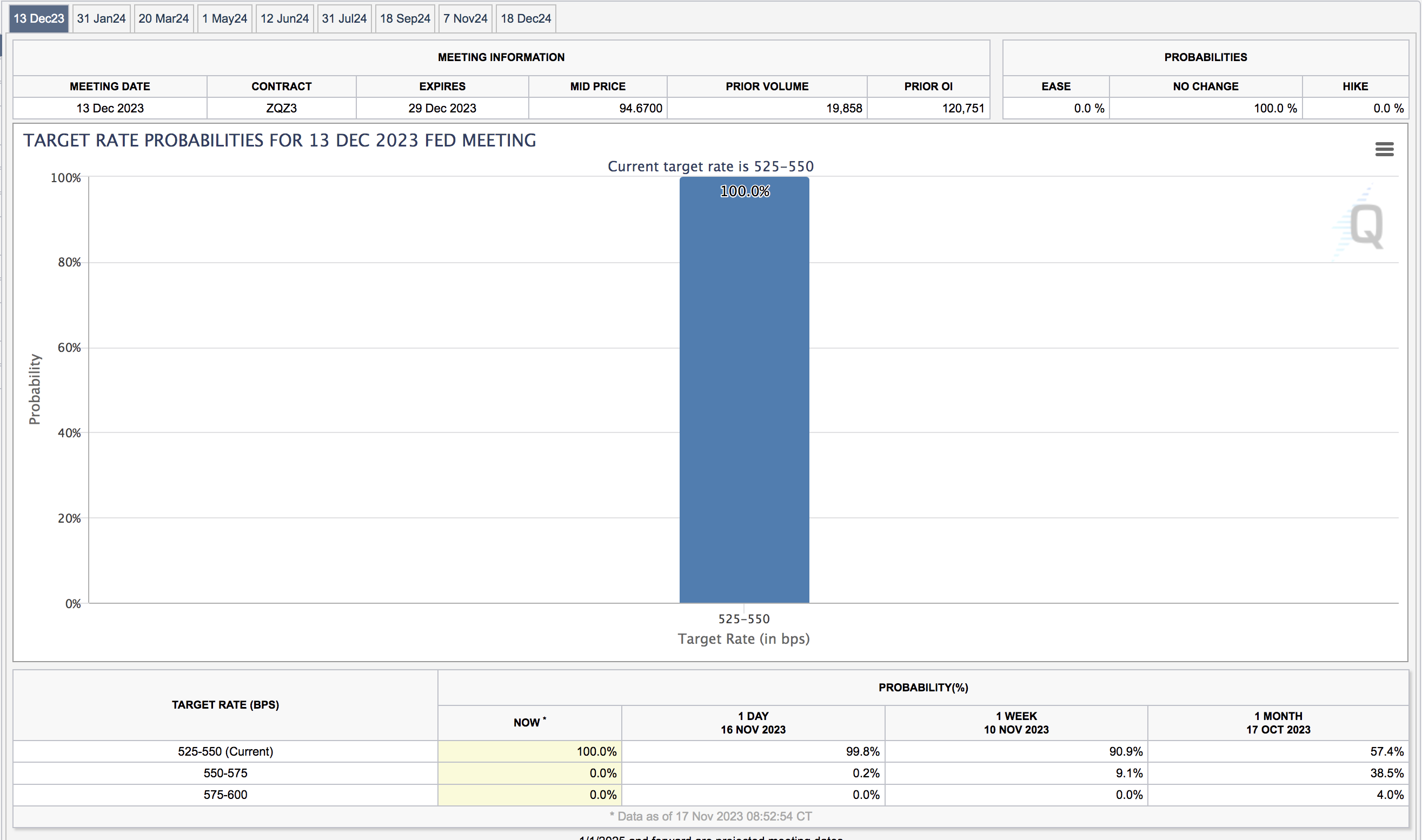

As I noted earlier this week – Fed Funds futures went from a 38.5% chance of a rate hike in December one month ago – to zero today

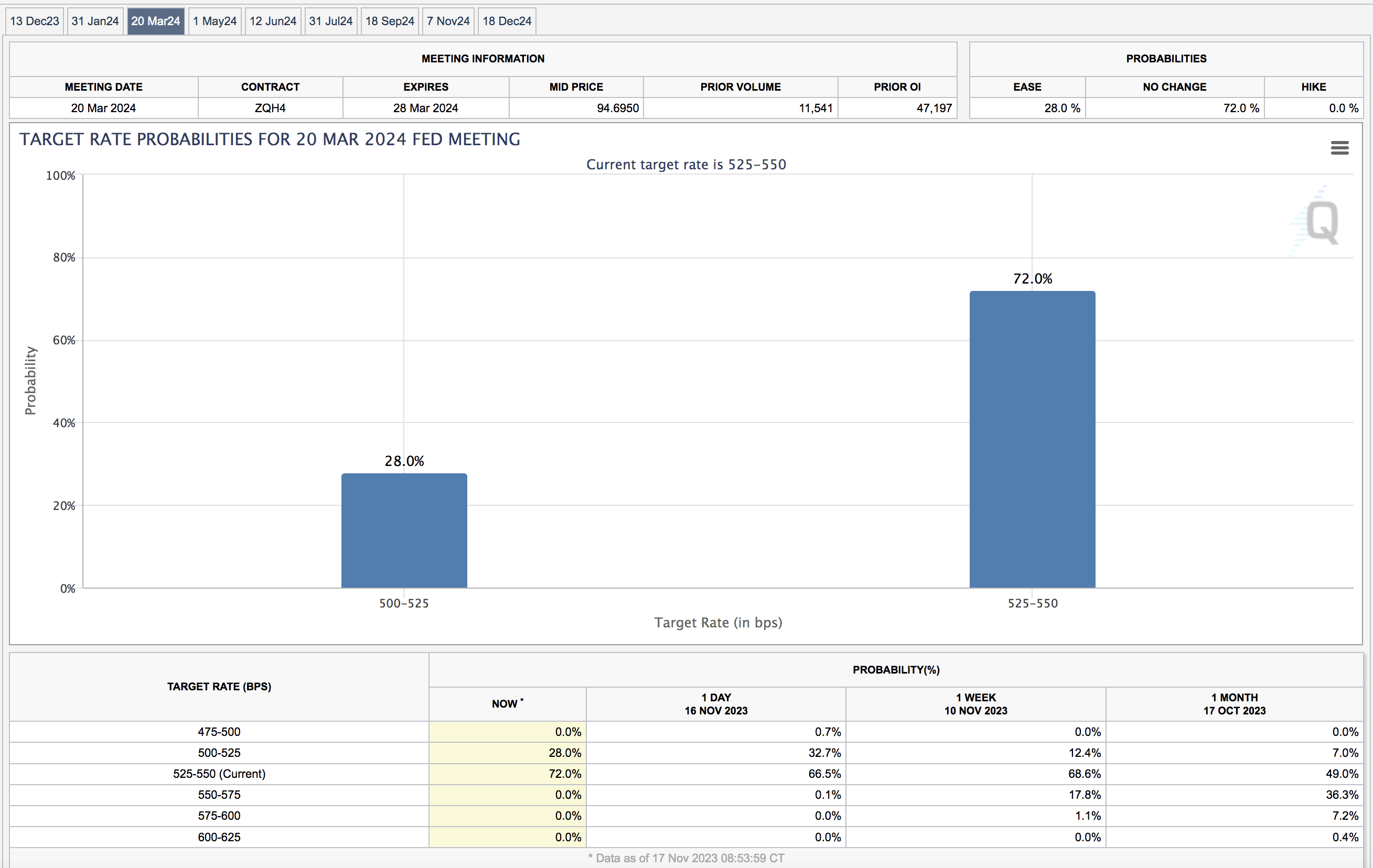

What’s more, the market sees a 28% chance of rate cut as early as March.

And as we look further out – more cuts are expected.

This time next year they see as many as four or five rate cuts.

If you ask me – that’s extremely optimistic.

Three reasons come to mind:

- Unemployment remains below 4.0% (a tight labor market)

- Wage growth is at 4.2% YoY; and

- Core CPI trades north of 4.0% YoY (more than twice the Fed’s objective)

Are we to assume these will all reverse sharply in the next 2-3 months?

I say that because something pretty severe would need to change in the economy for the Fed to consider cutting rates this soon.

With respect to fixed income – 2-year Treasury yields have dropped from 5.22% to 4.89%.

2-year yields are an excellent proxy for what the market thinks is ahead for the Fed.

In other words, they are ‘done’ hiking.

Meanwhile, 10-year yields have plunged from 4.99% to 4.45%.

Nov 17 2023

You might argue that the 10-year is now pricing in (a) lower inflation (b) slower growth; and perhaps (c) Fed cutting the effective funds rate within the next few months

However, yields are not pricing in recession.

If they were – I would suggest they would be much lower.

But there are other macro indicators singing from a different hymn sheet to equities…

Commodities Warn

Commodities are starting to warn of potential downside ahead.

For example, both WTI Crude and copper have been moving lower the past few weeks on demand concerns.

Let’s start with WTI Crude:

Nov 17 2023

The 21% fall in WTI Crude over 7 weeks has been acute.

Not long ago there was a lot of talk of crude shooting north of $100 given the escalating war in the Middle East.

Those concerns have now been offset by far slower economic growth.

That said, I doubt we will see the price fall much below $65.

I will offer two reasons:

First, it’s my expectation that OPEC+ will likely cut production to support a higher price.

And second, $70 to $75 oil should incentivise the US government to consider replenishing its strategic oil reserves (which now sit at historic lows)

OPEC cuts and US government buying could help put a floor in the price of oil.

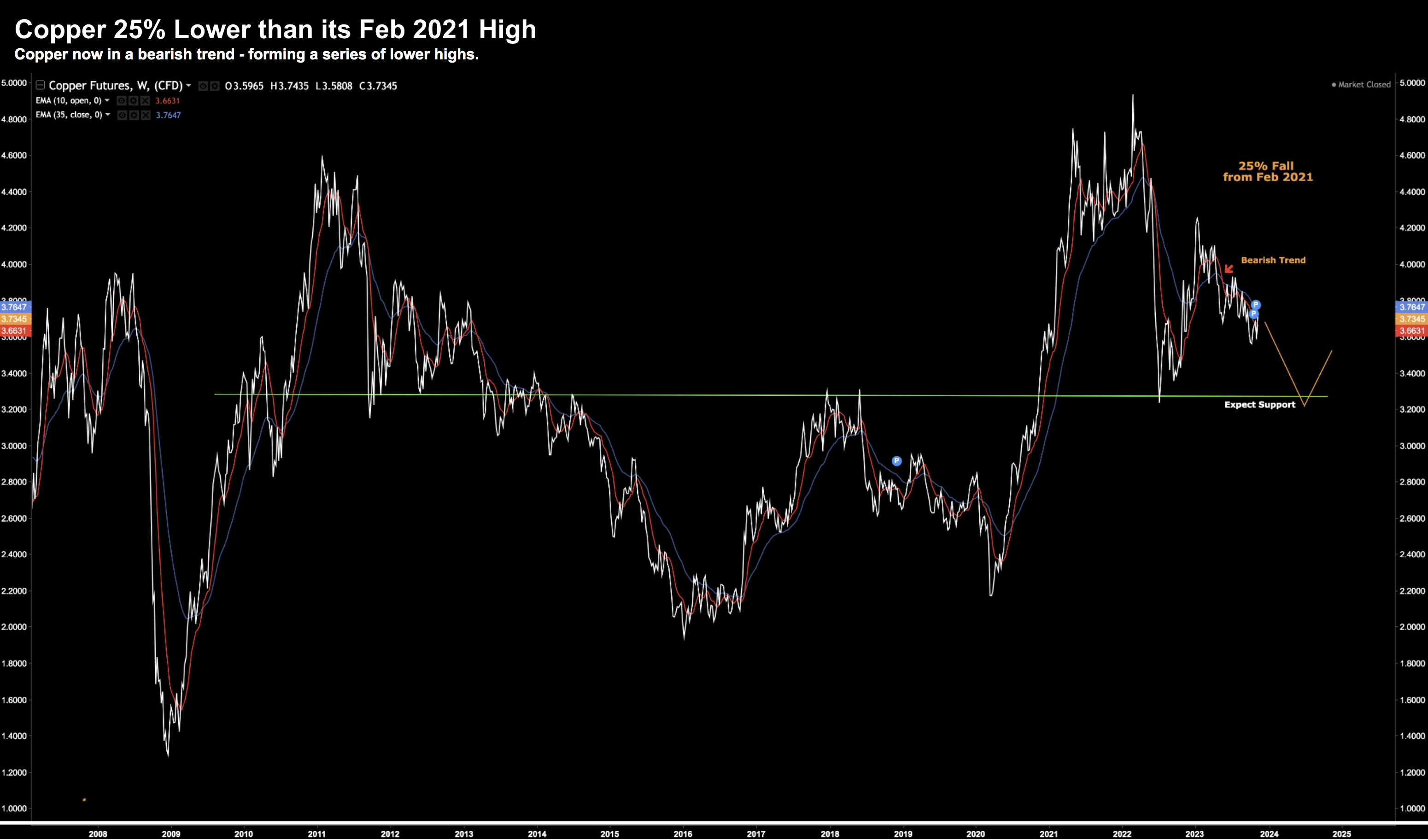

With respect to “Dr. Copper” – it’s often seen as a barometer on the outlook for global economic growth.

It’s now 25% lower than its Feb 2021 high and trending lower:

Nov 17 2023

Question:

Are crude and copper suggesting ‘soft landing’?

Now, a large part of this is arguably tied to China (and its demand for commodities).

The Middle Kingdom accounts for nearly half of global copper consumption.

And given their rapidly slowing economy (and growing debt concerns) – it’s little wonder we see the outlook for demand weaken.

And Leading Economic Indicators?

Finally, it’s also worth noting what we see with the Conference Board’s ‘Leading Economic Indicators’

As part of their most recent update – the Conference Board states:

“The LEI for the US fell again in September, marking a year and a half of consecutive monthly declines since April 2022”

The blue-line is now near historic lows.

This has been a reliable predictor of recessions since 1950.

I see no reason to challenge why it won’t be accurate for 2024.

S&P 500… What Risks?

Which brings me to the price action in the stock market.

It’s fair to say a 10% rally in 3 weeks doesn’t scream ‘recession ahead’ (let alone a slowdown).

For example, earnings are expected to grow as much as 10% to 12% next year to $235 per share.

At this week’s close of around 4500 – that’s a forward PE ratio of 19.1x (or an earnings yield of 5.2%)

That’s exactly what you can get risk-free with 12-month T-bills at 5.23% (at the time of writing – Nov 17th)

In other words, you are getting zero risk premium for betting on equities.

Is that a good bet?

You tell me.

One would expect that premium to be at least 200 bps in compensation (given the risks with equities)

You could also frame it this way:

Does the upside reward meaningfully outweigh the downside risks?

Nov 17 2023

The surge in equities this month has been surprising.

My best guess (as I said last week) is we will see resistance in the 4400 to 4500 zone (i.e. where we are now)

Again, I think there has been a lot of short covering.

But this is why it always pays to have some long exposure… even when things look scary.

It’s impossible to predict these moves from week to week.

You can’t.

My YTD gains are ~15.0% (slightly below the S&P 500 return) – as I didn’t make any meaningful changes when stocks plunged to levels of 4100

I was very close to buying a couple of stocks – however refrained from pulling the trigger.

That said, I’m not looking to sell anything at these levels.

I did trim some tech positions slightly – simply to maintain my preferred market weights.

Now equities could easily rally a further 5-10% from here (at a guess) – as it’s a seasonally strong time of year.

However I’m not willing to chase the market.

I will let it come to me.

My approach will be to wait for a better risk/reward entry point…. which may not come until next year.

And that’s fine…

Three or four months isn’t long to wait in this game – not based on the timeframes I choose to trade.

What’s more, I am not complaining with the year-to-date gains.

Putting it All Together

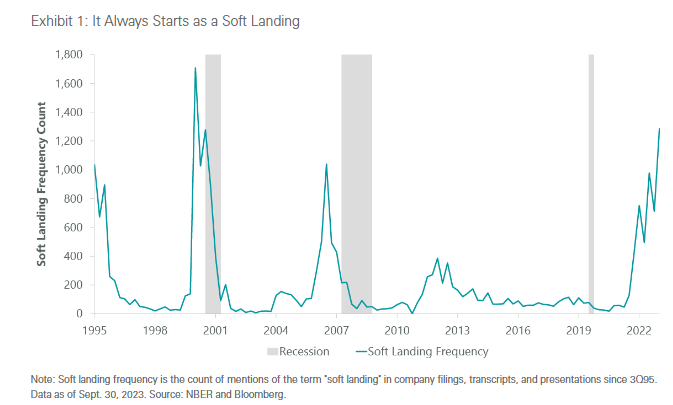

Before I close, Bloomberg’s Authers offered this:

We published this chart from Jeff Schulze of ClearBridge Capital, showing that recessions generally follow a spike in interest in soft landings.

In terms of the analogy, as the aircraft begins its flight path down toward the runway, it will look consistent with a soft landing. It’s one of the phases through which a hard landing must pass:

Authers is correct – it always starts with a “soft landing”

For example, mid-2007 the Fed was calling for 2.0% economic growth in 2008.

What’s more, at the end of Q4 2007, we had experienced three consecutive quarters of 2.0%+ GDP growth.

Unemployment was also around 4.0%

No-one was calling for a hard-landing.

Authers says that past experience does mean that we should tend to regard a “hard landing as the default (most likely) outcome”

And absent other evidence, when the Fed hikes this much (and especially this fast) – we should expect one.