- Market remains vulnerable to a ~10% pullback

- The primary issue which faces ALL banks… but is it ‘systemic’?

- S&P 500 continues to trade ‘per the script’

It’s often said the market always climbs the wall of worry.

Here’s just a handful:

- Worries over the health of the US banking sector;

- Worries over the US debt ceiling;

- Worries of an impending recession;

- Worries about the strength of corporate earnings;

- Worries on trade relations with China;

- Worries with the war in Ukraine;

- Worries concerning how long interest rates will remain high;

- Worries over unacceptably high levels of sticky inflation; and

- <insert your own worry here>

This list isn’t meant to be exhaustive.

From my lens, none of these worries appear to be going away anytime soon. And in some cases, those worries might be escalating (e.g. geopolitical risks – which the market often completely misses)

Perhaps the most pressing concern from the market’s perspective is what we see with the US banking sector and its health. Investors are asking questions like (not limited to):

- How diversified (or solid) is their funding base?

- Do they need additional liquidity to meet fleeing deposits?

- If so, what is their vulnerability to “liquidity mismatches”? and

- How are they hedging (interest rate) risks?

We will find out some of these answers in about 3 weeks when America’s banks start reporting their Q1 2023 earnings (BAC is April 18)

Expect these questions to be addressed in explicit detail (more on this below when I pull apart BAC’s last report)

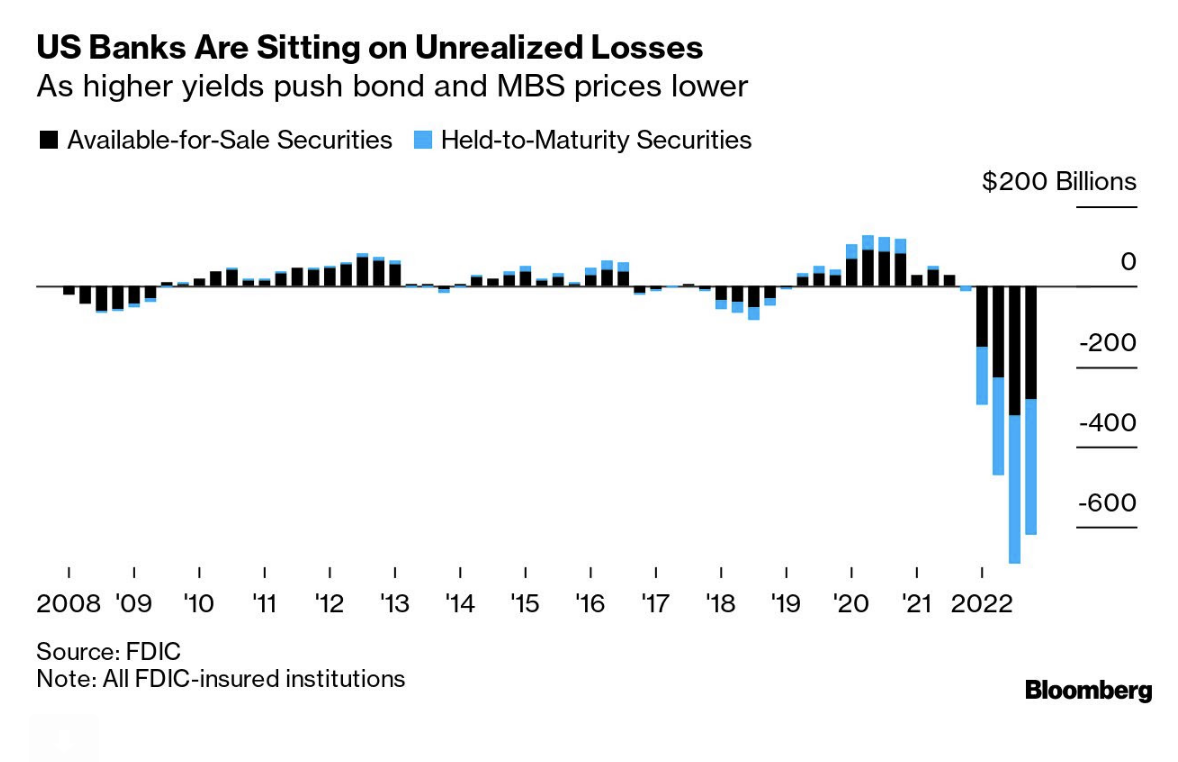

For example, it’s well documented that banks (collectively) sit on ~$600B of bond assets which are underwater. This isn’t new news to anyone who invests in the sector.

Higher bond yields equal lower asset prices.

Bank of America – for example – sits on $114B (19% of the collective industry total) of unrealized losses.

But is this a reason to panic?

Some certainly think so based on the price action the past two weeks.

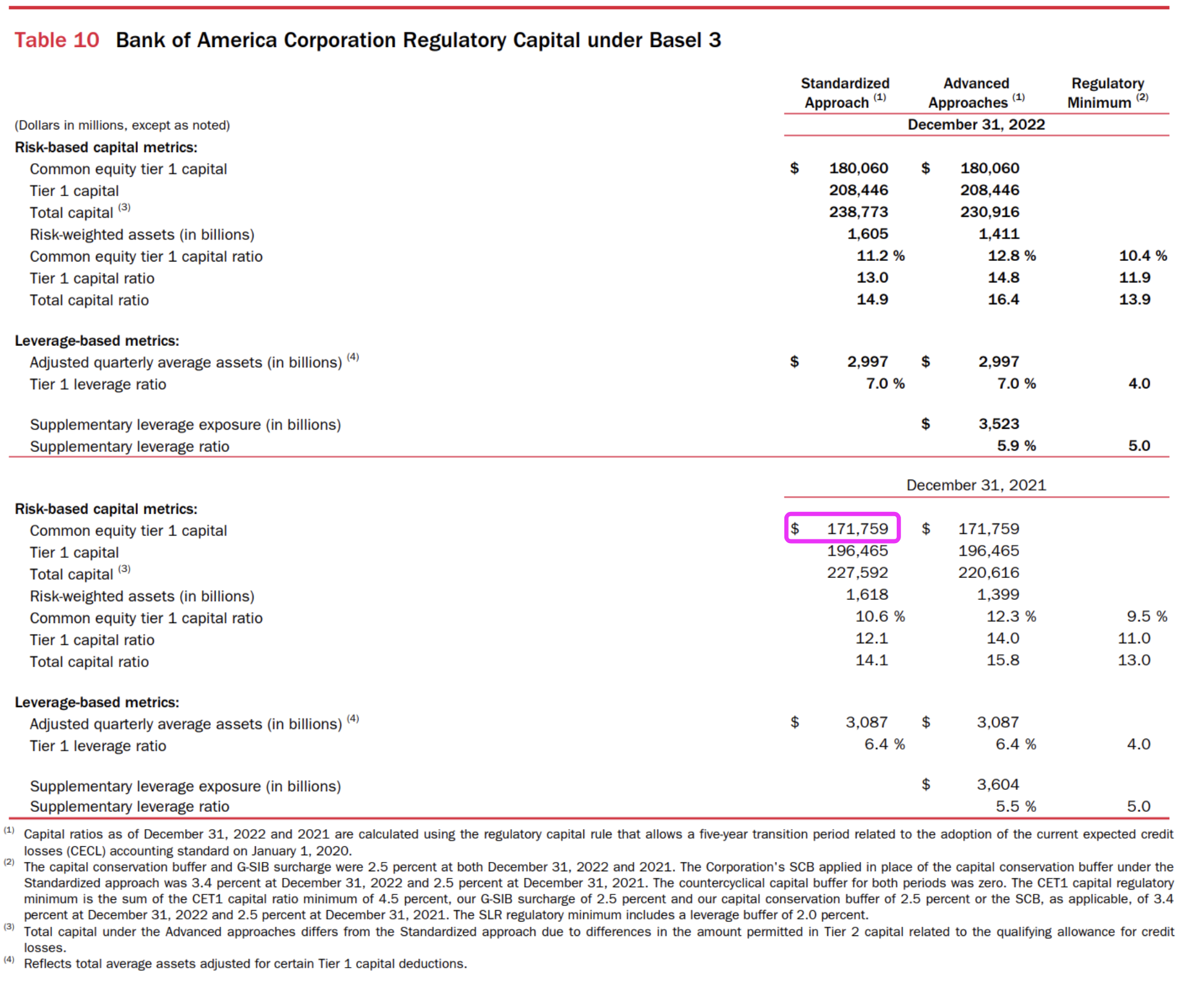

For example, if say BAC was managed like SVB (i.e., were forced to liquidate) – it would reduce its Common Equity Tier-1 ratio from 11.2% to 6% (lower than the 10.4% regulatory minimum).

I will talk to why I took the opportunity to buy Back of America this week (vs sell it) shortly.

Before that, I want to offer investors a simple tip.

Based on the quantity and sentiment of emails I’ve seen the the past two weeks – people are a little uneasy (mostly due to the headlines on the banking sector).

As an aside, when there is ‘fear’ in the market – my blog readership surges. On the other hand, it falls when all is calm.

Did someone once say “fear sells”?

From there, I will offer a quick review of the S&P 500.

In short, my lens hasn’t changed from the past few weeks… we are chopping through a range and likely headed lower.

That’s not a bad thing…

An Investing Tip

The game of asset speculation is not for everyone.

And it’s especially true when it comes to stock speculation. It will test every emotion you have. There is nothing like losing real money.

Most people work hard for it.

And they will stress at any sign of losing it.

Research has shown that most people will do anything to avoid a loss (of any kind). From Nobel Prize winning psychologist Daniel Kahneman:

“The response to losses is stronger than the response to corresponding gains”

Further to my note earlier about the sentiment of emails I’ve received recently – some readers are deeply concerned about the banking sector.

Some don’t agree with my assessment (which is more than fine) – where they think the market is underpricing the risks.

They see it as more systemic risk vs idiosyncratic.

And look, there is every possibility they could be right.

Whilst I don’t necessarily disagree – I think it’s still too early to know.

But here’s the thing – I am not deeply attached to my thesis.

Why?

Because time and experience has taught me that one’s interpretation of events is often wrong.

Not only do we have facts that continue to evolve but we can’t possible see ‘every angle’.

We may think we do (which is a bigger problem) – but typically you will have blindspots.

So here’s my tip:

If you’re deeply concerned that the risks are simply too high (greater than what the market has priced in) – then sell your positions and sit things out (or at least reduce your exposure to where you are comfortable)

I often say that if your trades keep you awake at night… or you’re anxiously checking prices daily… I would recommend removing those positions (unless you are a day trading – which means this blog is not intended for you)

For me personally, I’m fine with my exposure (both to banks and the market as a whole).

However, should my thesis prove wrong (and it would not be the first time) – I will reduce my holdings.

The market could open “10% lower” Monday morning and I will not lose sleep (I hope it does as I will be buying!)

That’s your litmus test.

S&P 500: Trading Per the Script

Perhaps part of the reason I sleep soundly is I think things are trading how I expected them too.

It doesn’t always happen this way but lately that’s been the case.

Call it good fortune.

Whether it’s asset speculation or something else – when things meaningfully miss your expectations – it can cause an emotional reaction.

Let me illustrate:

Let’s say you have a job interview at 9am. You do the drive to the location every day and it takes you ~30 mins. You leave 45 mins early to ensure you are on time. However, on this particular day, there was a massive traffic accident and you are delayed 3 hours.

How will you feel? Stressed. Angry. Upset.

Now compare that with planning ahead – knowing there would be 2 hour delay on your intended route – how would your emotions differ? You are probably stress free.

Bringing this example back to the market…

If you expected the market to rip higher when it was 4100 – and you increased your exposure – now there’s “accident” – has it impacted your emotions?

Has it caused any stress or worry?

The other side is you felt the market was ripe for a correction at 4100 (i.e. a high probability of an accident) – you are probably feeling pretty calm.

Now I did not forecast any “banking crisis” in January or February.

But I didn’t like how the S&P 500 was trading between 4100 and 4200 (for many of the reasons outlined in my preface).

In short, I felt the risk / reward was not in my favour.

Last week I ran with the chart title “the next leg lower has started” – saying to expect interim support around 3800 but looking for a move to 3600.

This week I saw no need to change the chart’s headline:

Mar 18 2023

Despite the heightened volatility – the VIX touching 30 – the S&P 500 managed to post strong gains.

The reason was the rush back into mega-cap tech.

Stocks such as Apple, Microsoft, Google, Amazon and even Meta – who offer “bulletproof” balance sheets and strong free cash flows – are benefiting from lower bond yields – all attracted inflows.

That said, it’s worth highlighting we don’t often see the VIX higher along with stock prices.

So whilst stocks may have gained – there is a healthy sense of caution.

To that end, I would be surprised if mega-cap tech continued to go meaningfully higher.

As I say, their valuations are exceptionally rich (over 30x forward PE’s in some cases) where we still face a recessionary environment.

Now if you are actively trading them (I’m not) then I would use the strength to sell.

Zooming out – the market remains caught in a range (or a “distribution”). It’s been that way since May last year; i.e. the retracement labelled “A – B”

The bottom of that distribution (“A”) is a level of 3800 (and why I flagged interim support)

However with both the weekly moving average and MACD rolling over – I would not rule out a retest of 3600 (where I will look to increase my exposure)

The Market’s Worry: Unrealized Losses

What follows is a long read.

Maybe make a cup of tea and come back (if you have managed to read this far!)

Warning: things are about to get wonky!

But in this case I think it’s important.

What’s more, you can apply this type of analysis to any banking stock you are investing in (or considering).

What I’m going to explain may help to address some of the reader unease I have received of late (or maybe not)

From my lens, there is a lot of panic regarding the “$600B” in unrealized losses (and whether banks are meeting their capital ratio requirements if forced to sell)

I say this as readers like to point out what these are (maybe assuming I was not aware – not sure?)

Nonetheless, when a reader highlights a number I take the time to check my math.

But outside the math – what this told me was the concept of the banking sector sitting on (large) unrealized losses needs further explanation.

To start, this quote from Tom Michaud, CEO of Keefe, Bruyette & Woods is helpful.

He echoed some of the sentiment I expressed earlier in the week (i.e. the issue is confidence) with this interview with the Financial Times this week:

“These underwater bond positions are going to have to be addressed. That’s what the market has decided it wants to focus on.

Most owners of bonds – whether you’re a bank or not – have a loss in your bond portfolio.

Interest rates are higher, so that shouldn’t be a shocker to anybody … The real issue is confidence in uninsured deposits.”

Exactly.

Maybe I did a poor job of explaining the confidence issue in this post.

For now, I’m calling this a crisis of confidence…. vs say a crisis of bond portfolios being underwater (as some imply).

Let’s start with an example (courtesy of Librarian Capital) and how these losses are accounted for on bank’s balance sheet.

Accounting for Unrealized Losses

Let’s assume we have 3 different banks.

All have $100 of funds – with $5 in equity and $95 in deposits:

- Bank A lends out $100 at 4% in a 5-year loan – with a balloon payment at the end (i.e., a loan)

- Bank B buys $100 of 5-year U.S. Treasury bonds, with a 4% coupon, at $100 with the intent to hold them

- Bank C buys the same $100 of bonds for the purpose of trading.

All three banks will receive $120 over 5 years (i.e. return of their initial $100 plus 4% each year ($4) for each of the 5 years).

However, each of these three banks will report these asset holdings differently on their balance sheet. For example:

- Bank A will report the $100 on its balance sheet as a loan

- Bank B will report it as Debt Securities Held to Maturity (“HtM”)

- Bank C will report it as Debt Securities Available for Sale (“AfS”).

As I will show shortly with excerpts from their most recent quarterly report (10K filing) — BAC is both “Bank A” and “Bank B” (true of most banks).

But here’s where things get interesting…

Let’s say that after the bank buys the $100 worth of bonds – the interest rate environment changes.

The 5-year interest rate jumps from 4% to 5% the next day.

For example, the Fed has said “we need to raise rates 100 bps to fix unwanted excess inflation”

What happens?

We know, when interest rates rise the value of the bond (initially $100) will fall.

In our example, the price of 5-year U.S. Treasury bonds being traded in the market will drop by ~$5 to $95.

Let’s review each banks revised risk profiles:

- Bank A: Nothing changes (apart from potentially paying a little more for customer deposits given rates have risen)

- Bank B: Nothing changes; however Debt Securities HtM will note that “Fair Value” of $95 and an “unrealized loss” of $5.

- Bank C: They are technically insolvent. The Debt Securities AfS line in the balance sheet is marked down “Fair Value” of $95 – realizing a $5 loss that wipes out its equity of $5.

Bank C is regarded as insolvent even before deposits leave.

But let’s talk to Bank A and B…

The “unrealized loss” at Bank B will disappear as you get closer to the bonds’ maturity date (and those times will vary)

Their market prices will also rise to converge on their face value, as they become increasingly certain to be repaid.

However, if Bank B is forced to sell any of the bonds for any reason (e.g. Silicon Valley Bank) – accounting rules require HtM securities to be reclassified as AfS and marked to Fair Value, realizing any losses immediately.

The same applies for Bank A.

If deposits flee the bank and have to sell bonds and it could be wiped out.

In summary, the key here is the funding base and whether deposits flee (i.e. the crisis of confidence)

Now let’s drill into what we find with one of the largest deposit banks in the country – Bank of America – who are now seeing record inflows as a result of the crisis.

Is their $114B (19% of the total) of unrealized losses reason to panic?

Not from my lens…

Let’s review their balance sheet, position of liquidity, quality of funding base and whether it’s attractively priced.

All of this information is publicly available from their most recent quarterly 10K filing here.

BAC’s Balance Sheet

Regular readers will know I increased my exposure to Bank of America (BAC) this week.

It now represents 2% of my total portfolio (not 20%… 2%)

Warren Buffett once said “buy when others are fearful and sell when they are greedy”

Well… you could argue that not since 2008 have investors been this fearful about US banks!

There is blood on the streets (hopefully not yours).

That said, I don’t think the media is helping (as I say – fear sells)

Unfortunately I think some readers are feeling some real pain.

We get the next update from BAC April 18th.

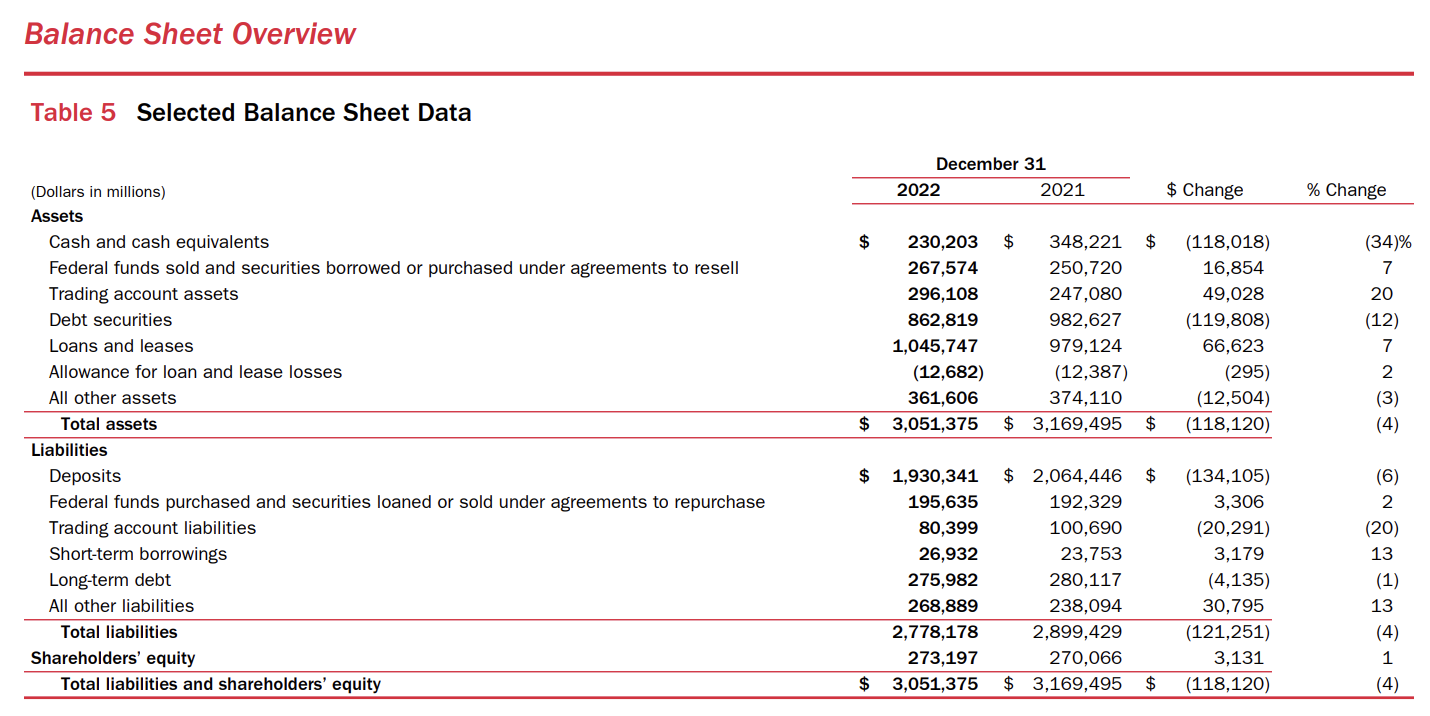

For the purpose of this missive – I will use their most recent (Dec 31 2022) report (10K), the total size of BAC’s balance sheet is $3.1 trillion (10% of all US banking assets) – where Loans and Leases constitute something like $1.05T; with cash and cash equivalents at some $230N – see page 30:

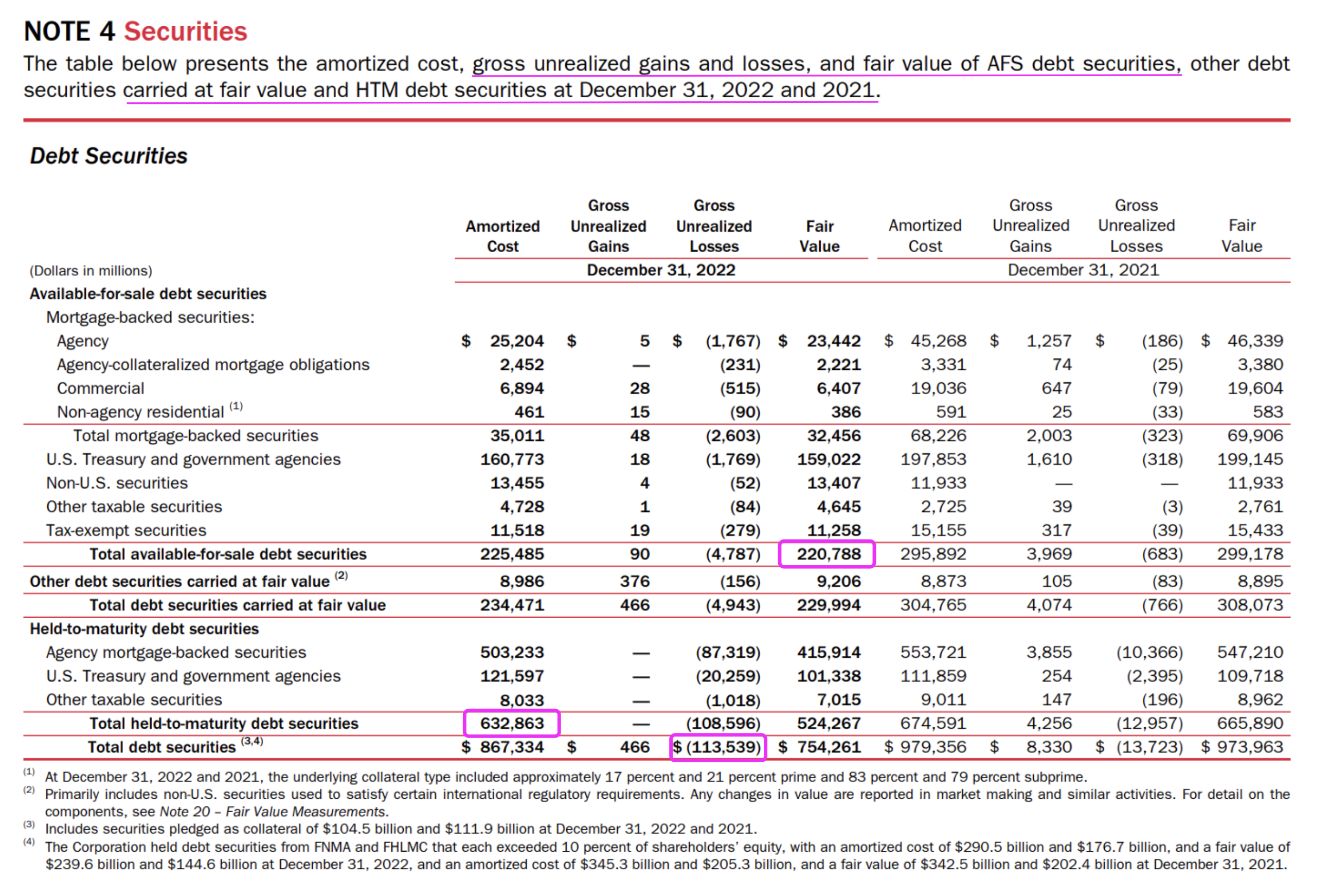

However, the detail we are most interested in is BAC’s Debt Securities portfolio (Page 111):

- $633B Held-to-Maturity Debt Securities are carried at amortized cost; i.e. $109B of “unrealized losses”; and

- Total “Unrealized Losses” $113.5B (i.e., “Gross Unrealized Losses”)

However, what is rattling some investors (recently) is the reported total CET1 capital of $172B (see Page 51).

For example, if BAC were forced to liquidate, it would reduce its Common Equity Tier-1 ratio from 11.2% to 6% (which is lower than the 10.4% regulatory minimum).

But is this reason to sell the stock?

The answer is only if they are forced to sell their underwater bonds (i.e. circling back to our earlier example)

And that’s a function of what liquidity they have; and how much they may need to pay to keep them.

Here we move to BAC’s liquidity position.

BAC’s Liquidity

I think this is where BAC shines.

Much of this is arguably due to their experienced board and CEO Brian Moynihan

As an aside, Warren Buffett is also their largest shareholder – owning $29B of stock which is ~9% of Berkshire’s total portfolio (it’s second largest position after Apple).

Berkshire owns ~12% of all BAC outstanding stock.

The Oracle of Omaha trusts them with $29B of his money – as they have navigated similar interest rate risks in the past.

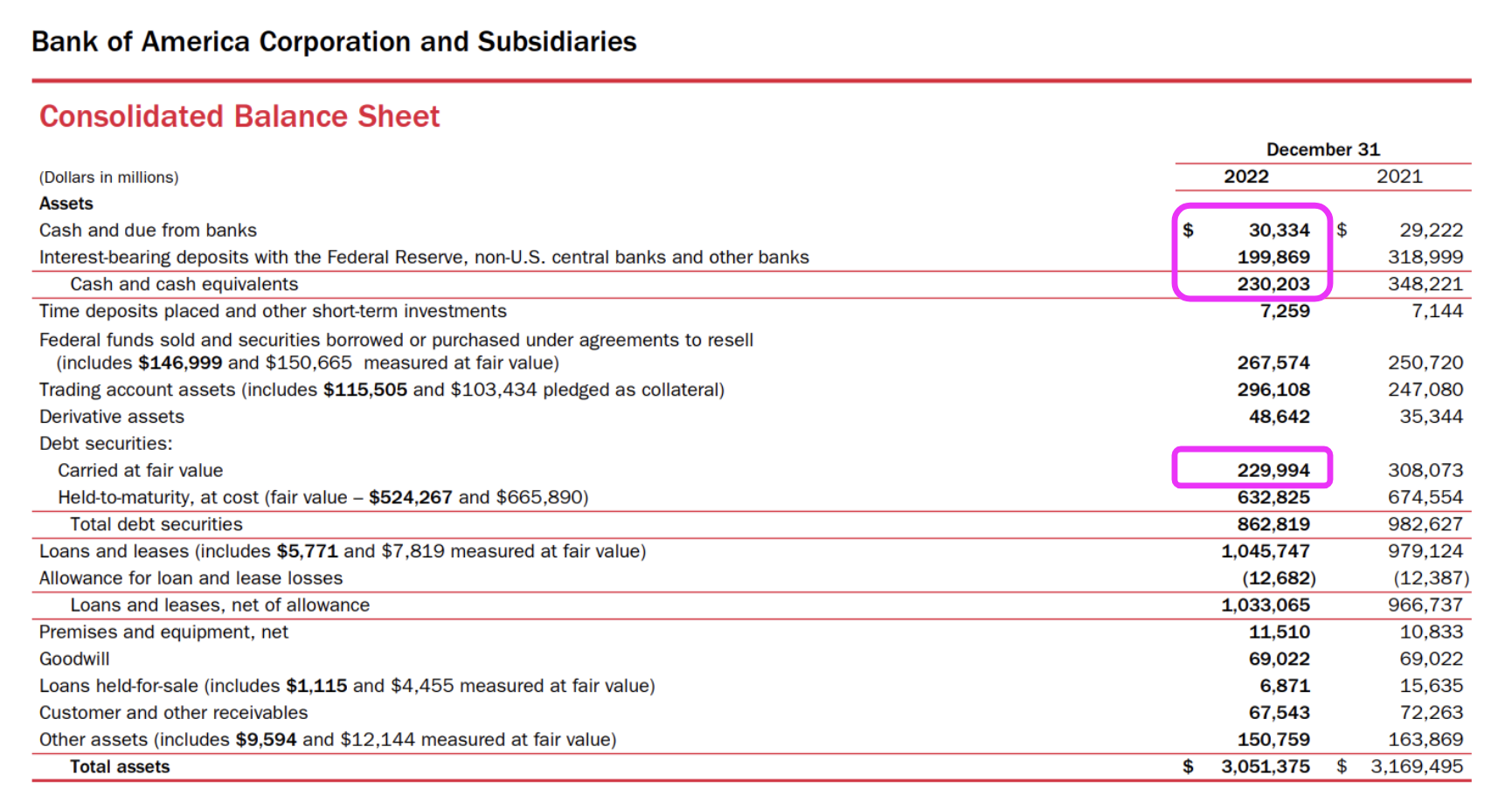

With that, let’s start with their position of liquidity (see Page 91)

- $30B cash and due from banks

- $200B deposits at the Fed and other central banks

- $230B debt securities Available for Sale, already marked at Fair Value

That’s a total of $460B or about 24% of BAC’s total deposit base.

From mine (and this is subject to your interpretation) – this puts BAC in an incredibly strong position.

As an aside, it’s may help explain why there were able to advance their competitor – First Republic Bank – $5B this week.

But here is something else:

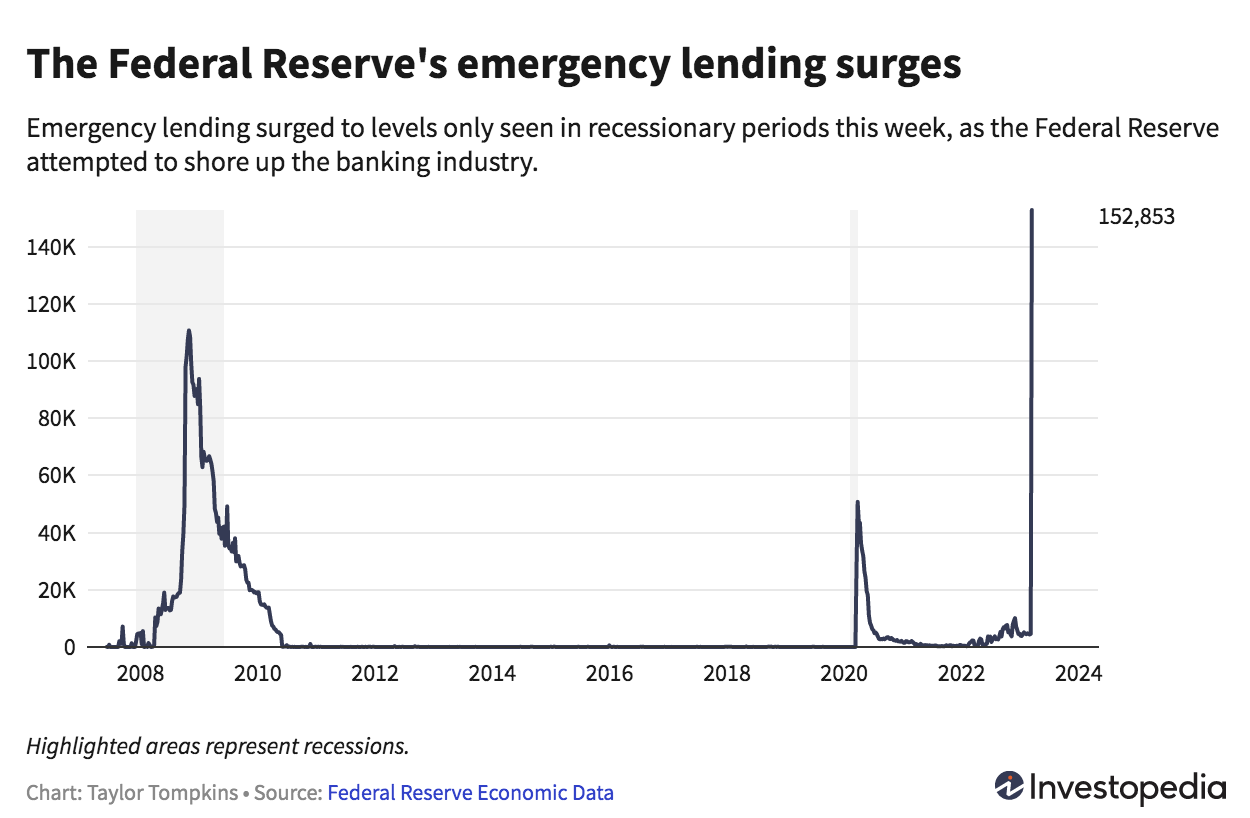

Whilst already in a position of strength – the Federal Reserve added to it this week.

The Fed’s new support facility, the Bank Term Funding Program (BTFP) will lend money to banks for up to one year in return for collateral — where US Treasury Bonds and Mortgage-Backed Securities are both eligible as collateral and will be valued at par.

What does this mean?

Banks can raise cash without selling any of its Held-to-Maturity Debt Securities. This effectively navigates issues of “unrealized losses” in their portfolios.

The Fed saw Banks borrow some $11.9 billion under new Fed program

You can read more about how banks leverage this facility here.

Now we don’t know the par values of BAC’s Held-to-Maturity Debt Securities.

However, my assumption is most long-dated bonds will be trading below par (as much as 15%)

But let’s make some conservative assumptions:

- BAC can only borrow an amount equal to the Fair Value of the bonds (from their 10K)

- That unlocks a potential $524B

- If fully utilized – it would bring BACs total liquidity to $984B ( ~50% of its deposit base)

Therefore, with up to say $984B in total liquidity – do you see forced selling of bonds?

I think it’s unlikely.

Remember:

The only reason BAC would be forced to sell is if they had insufficient liquidity.

Outside of the potential $984B in total liquidity – BAC have been attracting an even greater amount of deposit income since this crisis began.

Yes, they may need to pay a little more to keep those deposits – which will impact margins.

So let’s explore what that might be.

BAC’s Funding Base

A risk to all banks (not just BAC) is their cost of funding will rise.

This means net interest income (NII) will likely to be reduced.

I also believe this will hit regional banks harder than major banks… however the concern is widespread.

That said, this is not a new issue.

BAC’s CFO Alastair Borthwick stated last quarter that Net Interest Income will fall by about 3% sequentially in Q1 2023

However, what’s important is to look at how BAC is likely to manage this chage.

BAC have a long record of retaining large amounts of zero-interest deposits and paying below market when rates rise.

How can they do this?

Because customers will forgo this for peace of mind (i.e., confidence) knowing their money is safe.

That’s worth something.

You might suggest this echoes Kahneman’s thesis that “… the response to losses is stronger than the response to corresponding gains”

Let’s take a look:

- 2019 – with rates at 2.40% – BAC finished the year with an average balance of $409B in zero-interest deposits (29% of total). On interest-paying deposits it paid an average 0.61%

- 2007 – with rates at 5.25% – BAC had an average balance of $174B in zero-interest deposits (24% of total). On interest-paying deposits it paid an average 3.33%

- Q4 2022, with rates at 4.0% – BAC had an average balance of $680B in zero-interest deposits (35% of total). On interest-paying deposits it paid an average 0.96%.

So yes, there may be some impact to NII as their CFO warned.

However, I expect this to be minimal.

Finally, here’s the Financial Times on how BAC is attracting strong inflows as a result of the current crisis:

“Large U.S. banks are being inundated with requests from customers trying to transfer funds from smaller lenders … in what executives say is the biggest movement of deposits in more than a decade …

Despite the Silicon Valley Bank bailout depositors are still attempting to move balances into larger banks such as JPMorgan (JPM), Citi (C) and Bank of America, as well as money market funds”

My assumption is that flow is likely to continue (rather than reverse)

BAC: Long-Term Discount

Earlier this week I said BAC is trading roughly at book value of just over 1.1x.

That’s cheap for a bank of this quality.

Poor quality banks – like Citi – are likely to trade at book value closer to 0.5x

My view is BAC is trading a discount due to fear over unrealized losses / forced losses.

Again, this is what many readers love to point out (but there might be other reasons).

Hopefully what I have outlined above gives some perspective on whether these $140B in unrealized losses are a risk to the bank.

I don’t think they are.

If you agree the risk is low – let’s try and put a number on the stock.

From a technical perspective – I would not be surprised to see BAC trade as low as $25 amidst this panic – at least 10% lower than its last close.

I offered the chart the other day and forecast during the week:

March 18 2023

$25.00 is approx 61.8% outside the current distribution – consistent with where it has found support in the past (at much lower earnings / higher multiple)

Which brings me to the fundamentals – starting with expected 2024 earnings:

The average estimate for 2024 earnings is $3.68 per share.

At a current price of $27.82 – that is a 2024 forward PE of 7.6x (less than half the current market multiple)

Relative to history, BAC shares are 8.0x 2019 EPS and 9.0x 2022 EPS (adjusted for subsequent buybacks).

What’s more, the BACs dividend yield is currently 3.1% and growing.

Based on their cash position – I don’t expect to see the dividend at risk.

I also think BAC will deliver an around 8% EPS CAGR going forward (taking into consideration further buybacks)

Therefore, if we assume:

- PE Multiple expansion back to 11x (conservative)

- 2025 earnings at ~$3.97 (i.e., 8% CAGR)

- Estimate price of ~$44 in 2025

Based on the current price of $27.82 – that’s ~58%+ capital return plus 9% in expected dividends.

Obviously if we see multiple expansion to 12x or 13x – it’s a lot better (closer to $50 per share)

In summary, for me this represents:

- ~15% downside risk in the near-term; vs

- Upside of 60% the next 2-3 years

I am comfortable taking that risk with 2% of my total capital.

And if I see the stock at $25… I will likely increase my position to 3%.

Putting it All Together

This post was unusually long.

Congrats if you made it all the way.

I felt it necessary to explain why I don’t see excessive risk with BAC (or other major banks like JPM or WFC)

If this methodology makes sense to you – feel free to apply to banks you are invested in (or are considering)

For example, I can’t say that most Regional Banks exhibit this kind of quality.

And I fear more will collapse.

It all depends on the quality of their funding base and their position of liquidity.

Will depositors stay?

For example, First Republic may have received $30B in emergency funding from their competitors ($5B from BAC) – but they will still need to see customer money coming back.

They may not.

The San Francisco crowd are a pretty ‘flighty’ bunch at best!

My expectation is there will less bankers by years end – as we see further rationalization.

It would be a shame to see Regional Banks disappear (communities depend on them) – however it bodes well for the larger banks.

It’s pretty simple:

If you want your community bank to stay – then leave your money in there. Don’t do what Peter Thiel did and tweet “everyone get your money out now”... that’s irresponsible.

In closing, it was a rough week for my own portfolio.

My exposure to banks and energy pulled it lower (as recession risks grow)

Not only did my holdings in BAC and WFC see downside, so did my holdings in OXY (energy play)

The good news – some of that was offset by big-cap tech.

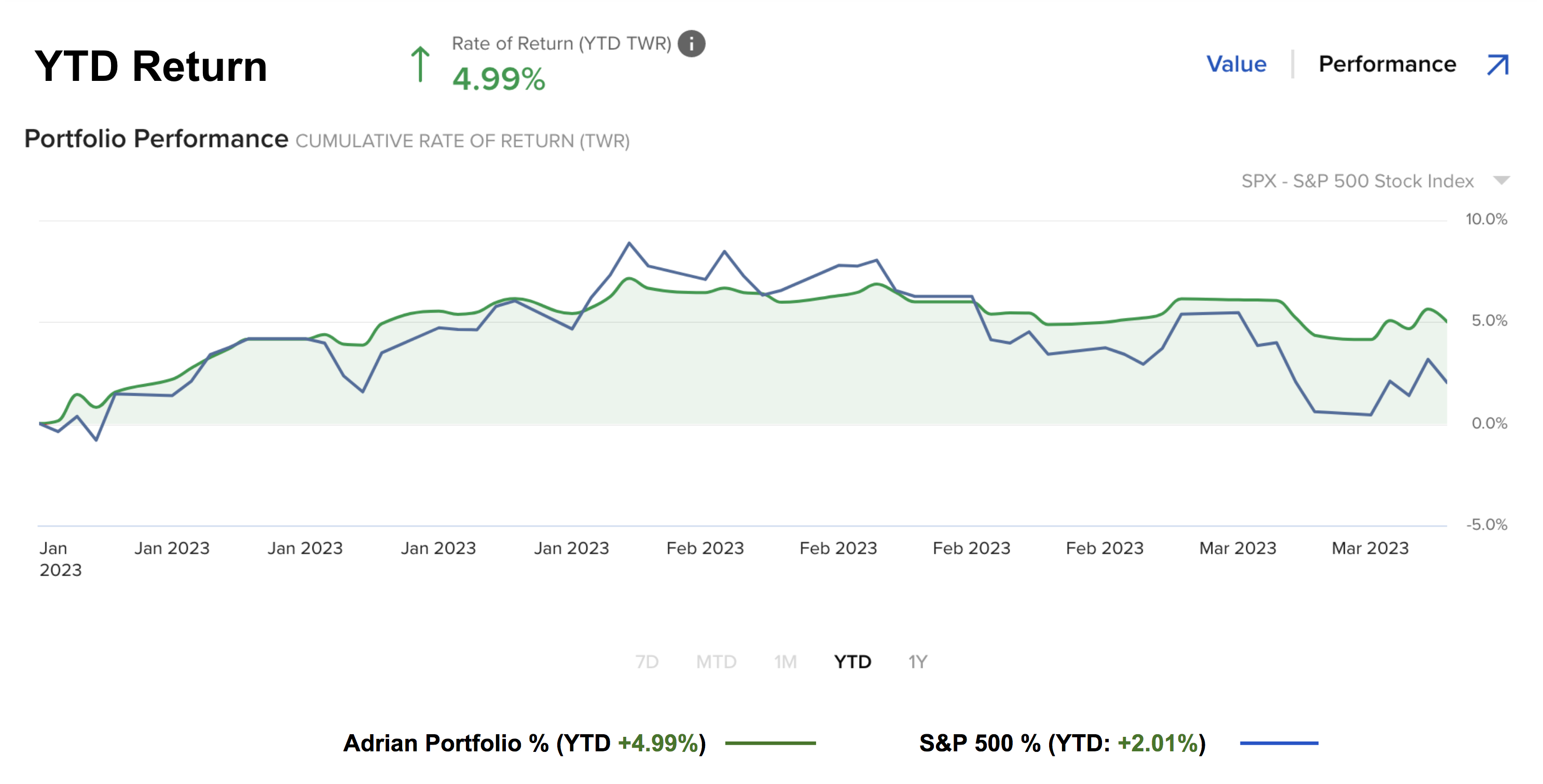

Year-to-date – my portfolio is up 4.99% vs the S&P 500 up 2.01%

March 18 2023

Over the past 15 months – my returns are ~22% ahead of the benchmark (I can’t complain)

You can track my week-to-week performance here.

As I said recently, if I’m offering you my thesis on what I think could happen (or reasons why I’m taking positions) – it’s only fair I share my performance (every newsletter service should – paid or otherwise)

On the other hand, there are many ‘experts‘ who have no shortage of opinions (which is fine); or offer weekly tips on stock trading – but do not publicly share how their own portfolio’s are performing.

There is only one measure in this game.

It’s not whether you’re right or wrong on an particular issue… or your ideological lens… or whether you got your last trade right.

It’s how you perform against the benchmark S&P 500 over the long term

That’s the only thing which matters.

I’ve always felt that if you can’t do that consistently – year in year out – it might be best to simply buy the Index.

Again, there is nothing wrong with average returns of 10% compounded over a long-period of time (for doing very little work).

I hope this email was helpful.

Stay patient. Better opportunities are ahead.