- Economists expect 250K jobs added over June… is that “good news“?

- Earnings growth for Q2 (so far) ~ 6% YoY (much better than feared); and

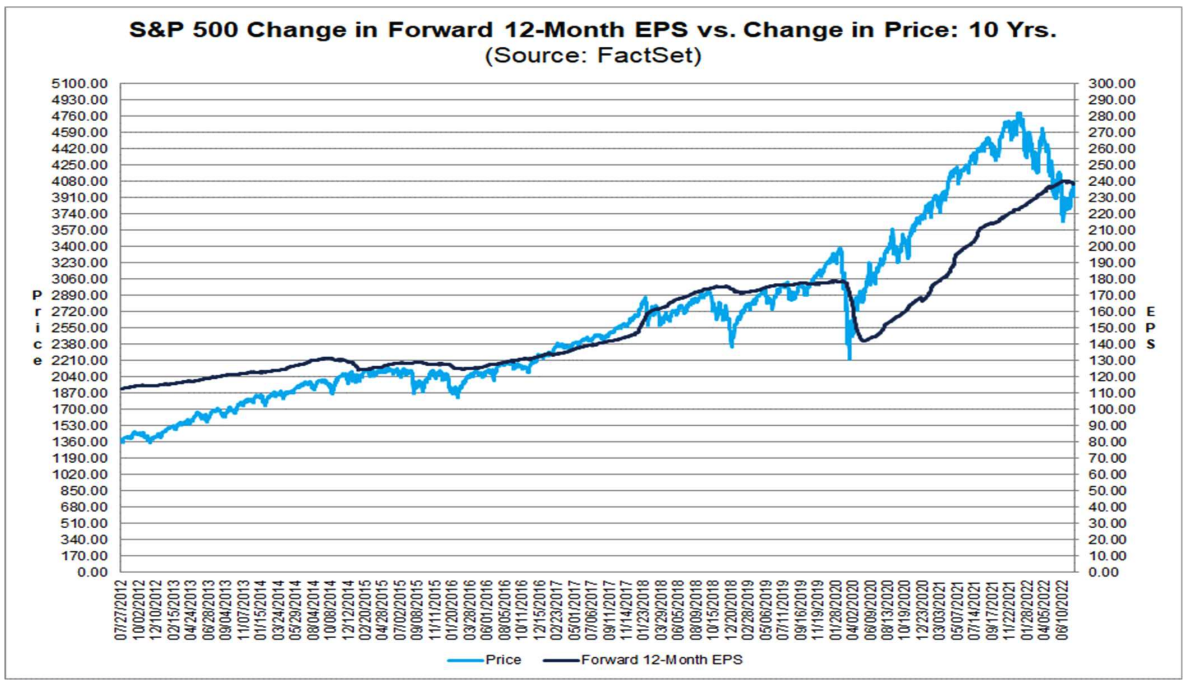

- Market trading around 17.1 forward PE at ~4100

So far – it’s reasonable to suggest that things have fared better than what many feared… with earnings growth coming in around 6% YoY

For example, some feared this could be negative.

Here’s Factset’s Earnings Insight (July 29):

- Earnings Scorecard: For Q2 2022 (with S&P 500 companies reporting actual results), 73% have reported a positive EPS surprise and 66% of S&P 500 companies have reported a positive revenue surprise

- Earnings Growth: For Q2 2022, the blended earnings growth rate for the S&P 500 is 6.0%. If 6.0% is the actual growth rate for the quarter, it will mark the lowest earnings growth rate reported by the index since Q4 2020 (4.0%).

- Earnings Guidance: For Q3 2022, 28 S&P 500 companies have issued negative EPS guidance; and 17 S&P 500 companies has issued positive EPS guidance.

- Valuation: The forward 12-month P/E ratio for the S&P 500 is 17.1. This P/E ratio is below the 5-year average (18.6) but above the 10-year average (17.0).

Forward EPS is in the realm of around $240 per share. Therefore, applying a forward PE of 17.1 puts us at 4104

As I say, even if EPS were to fall 10% next quarter ($216) and applying an average multiple of 15x – that puts us at 3240.

Further to previous missives, I would be a strong buyer at this level (maintaining a minimum 3-year lens).

Will Bad Jobs News be Good News?

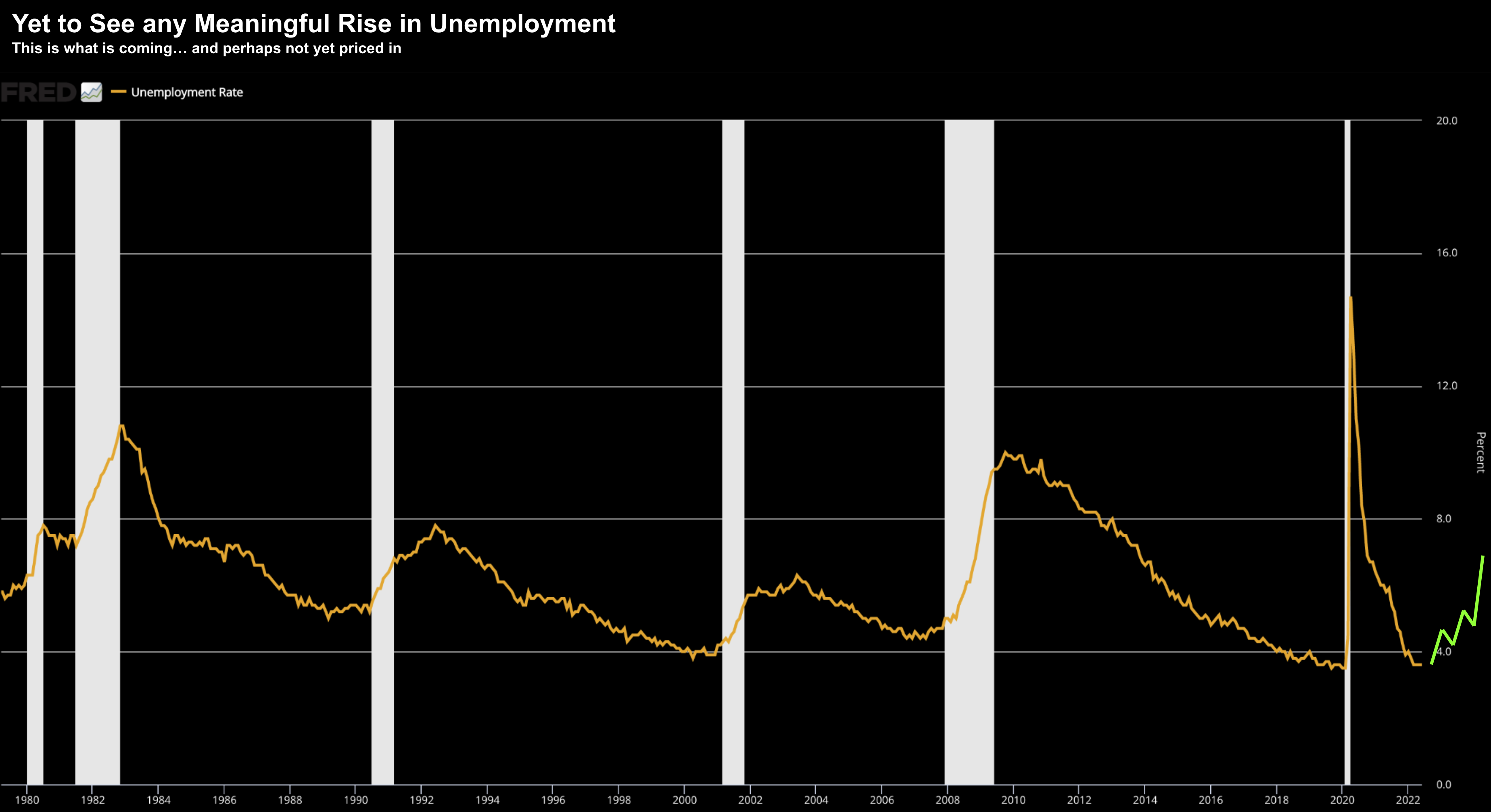

Last week I mentioned we are seeing some very early signs of unemployment ticking higher.

For example over the past few weeks we have heard:

- Google slowing the pace of hiring for the rest of the year, as “sunnier days” come to an end;

- Apple plans to slow hiring in some divisions next year to cope with a potential economic downturn;

- Goldman Sachs to slow hiring as they re-evaluate spending plans;

- Microsoft eliminating many open jobs, including in it Azure cloud business and its security software unit;

- Ford will cut 8,000 jobs;

- Shopify will slash 10% of its workforce (over estimating the sustained growth of eCommerce post pandemic); and

- JP Morgan to eliminate ~1,000 staff in its mortgage lending unit

According a from global outplacement firm Challenger, Gray & Christmas – U.S. based employers announced 32,517 cuts in June, a 58.8% increase from the 20,476 cuts announced in the same month last year.

This is 57% higher than the 20,712 cuts announced in May

However, the positive news is the U.S. economy has proven resilient – overall gaining 372,000 jobs last month.

This week we will learn how many jobs were added for July… expected to be ~250,000 jobs.

On the surface, a tight labor market is good news (as employees are able to negotiate higher wages)

That said, these kind of pressures will do little to help bring down inflation.

For example, consider this chart from Bloomy:

From mine, this will be last form of inflation to fall (after rents – which typically trail house prices by around 18 months)

My thinking is a strong labor report for July will only bolster the Fed’s resolve to continue with another sizable rate hike in September (e.g., 50+ bps).

However, slower hiring will likely help see wage inflation fall.

Now according to Evercore ISI, we are seeing stronger wage inflation as more people swap jobs.

Krishna Guha, a vice chairman at Evercore ISI wrote:

“Elevated pay awards for newly hired workers may create disparities within firms that in time require employers to increase the wages of their longstanding employees by more”

Guha added that even if the job market cools, wage pressures could remain for “a time”.

And that’s problematic for the central bank…

Threading the Needle

All of this presents a delicate balancing act for Central Banks… not only the Fed.

For example, how do they architect slowing the economy “just enough” so they can bring down wage inflation – but not too much that it causes serious dislocation?

Citigroup – for example – does not think it’s possible (and I tend to agree).

In a note last week – on their economists wrote:

“We expect inflation to stay stubbornly elevated, forcing policy rates to move higher and stay at those levels longer.”

Again, much of that will depend on what we find with key determinants such as oil, wage and rent inflation.

How quickly are these likely to come down?

The Bloomberg Economics team, led by Anna Wong – sees the Fed’s target range running as high as 5% next year.

She writes:

“The Fed can’t afford to pause prematurely next year if it hopes to get inflation back down to the 2% target by the end of 2024″

Wong predicated her projections in part on suggestions from Powell that the unemployment rate needed to tame inflation is likely higher than usual.

And today – at just 3.6% unemployment – this still has a long way to go.

Don’t Underestimate the Fed

Last week, many interpreted the Fed’s language last week as dovish.

It was a big part of the reason why the market surged – coupled with ‘less bad’ earnings from big-cap tech.

For example, post the Fed’s latest decision, Goldman Sachs saw five reasons for slower than expected hikes:

- Getting to 3.4% this year is consistent with smaller increases

- Powell called 75 basis point shifts “unusually large”

- Powell said the full effect of tighter policy has yet to be felt

- The Fed will react to data rather than inflation alone, Powell said

- He reiterated officials aim to rebalance supply and demand through softer growth, not a recession

That all makes sense. And Powell indirectly admitted they could be closer to “neutral” (where that is now believed to be closer to 2.50% vs 3.50%)

Just on this – this is the Fed following the 2-year yield – not the other way around!

But make no mistake – the Fed is not done

And what’s more, inflation will need to show meaningful (consistent) signs of slowing for the above to come true.

Bill Dudley, a former central banker, says folks like Goldman Sachs (not limited to) are underestimating just how far the Fed will go to tame inflation.

He noted Powell repeatedly pointed to the Fed’s June projections that showed officials expected to raise rates to about 3.4% this year and 3.8% in 2023.

He said:

“That suggests to me that the Fed thinks they’re going to do quite a bit more than what’s priced into the markets”

And to that extent, if we do happen to see either 50 or 75 bps in September, markets may not react with as much enthusiasm.

Putting it All Together…

Markets now have two solid months before the Fed meets again.

As I said last week, the economy needs time to truly see the impact(s) of the cumulative 225 basis points of hikes since March.

This will take time to work through the economy… but we are starting to see early signs of traction.

Fewer job additions is an example.

But as I noted last week – the latest Core PCE monthly number at 4.8% YoY – tells us we still have a way to go in terms of getting back to the Fed’s objective rate (2%)

Markets have reacted well so far… and remain optimistic the Fed has their back.

For now, let’s see how 20% of the S&P 500 reports this week and what guidance they offer.

And with respect to the monthly jobs data for July…

If we see another 250,000 jobs added over June… it will only give the Fed more ammunition for at least 50 bps in September.

Put another way “bad jobs news may actually be good news”