- The popular narrative driving the rally of 2023

- And why that narrative could be on thin ice

- All eyes on retail sales – are consumers spending beyond their means?

Major averages pulled back this week on fears rates could remain higher for longer.

Makes sense to me – with the US 10-year above 4.25% – that’s a reasonable assumption.

But here’s the thing:

Get used to it.

And whilst rates might feel ‘tighter’… rates are still not historically high.

Not even close.

What was not normal was rates being artificially suppressed to near zero for 15 years.

And that might prove to be a difficult adjustment for some people (pending on your level of leverage).

So here’s today’s question:

Where to from here?

The honest answer is none of us know.

What follows are some of the assumptions being made; and perhaps gaps in the market’s thinking.

Again, I don’t pretend to have all the answers.

But what I can do is ask critical questions; examine the data points we have and look at trends.

Assumption #1: The Fed is Done!

Perhaps the most asked question is whether more tightening is needed from the Fed?

My argument is yes… but it’s a contrarian view.

Today, there is a widely-held view (or assumption) that the Fed is mostly done.

And that could be true…

For example, whilst they could raise once more this year (especially if Core PCE trades with 4-handle) – most view 5.75% (or maybe today’s 5.50%) as the terminal rate.

If that’s true – market participants have been buying stocks so they don’t miss the “Fed is done” rally.

Question is whether that’s a good strategy?

To answer that we need to ask a few more questions.

Assumption #2: Earnings Set to Accelerate

The second big assumption being made is with respect to earnings.

For example, coming into Q2 – expectations were set very low.

The market knew earnings were going to be negative year on year – thinking as much as 7% lower

Turns out earnings only showed a decline of 4.1% – far better than feared.

What’s more, 79% of all companies exceeded estimates.

As a result, this led to some analysts increasing their price forecasts for certain stocks (and the Index)

However, the bigger concern from me is the market assumes 2024 will see a whopping 12% growth in earnings.

Ambitious?

I think so…

However, given that’s the assumption, this gave the market another reason to buy stocks.

Assumption #3: No Recession for 2024

The third assumption giving fuel to the rally this year is a recession next year is basically off the table (or at least low probability)

This goes hand-in-hand with 12% earnings growth thesis.

For example, if we are to experience a recession in 2024 – earnings will contract – they won’t expand.

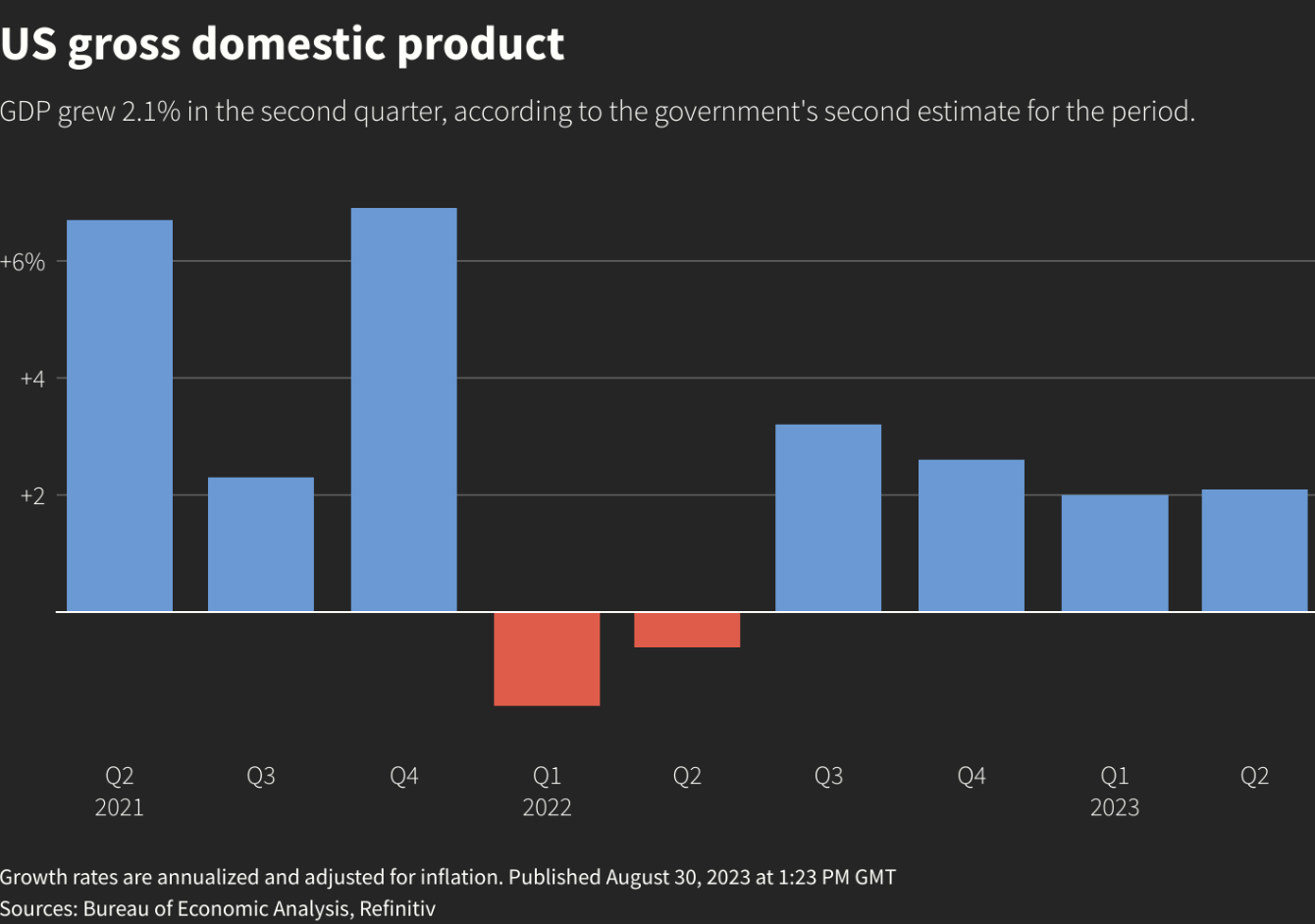

Now Q3 is expected to show at least 2.1% GDP growth – consistent with the previous two quarters.

As an aside, at the end of 2007, we had three straight quarters of 2.0%+ GDP growth with unemployment around 4.0%

No-one was calling for a recession in 2008 either… not even the Fed.

So far this year, economic growth has mostly been lifted by:

(a) strong consumer spending (from excess savings and credit cards – more on this later); and

(b) record stimulus from the government.

Reuters reported that the momentum has picked up early this quarter — as a tight labor market underpins consumer spending.

Given this, it’s understandable why some analysts see earnings expansion next year.

But let’s now explore counter logic to some of these widely-held assumptions.

As I say, this is the narrative driving the market higher.

However, how sound is that logic?

Counter #1: Yield Curve Disagrees

All of the above explains why market participants have bid stocks higher this year.

Things are not falling off a cliff – despite 550 bps of rate rises.

But…

These assumptions (and more) are worth challenging.

To start, consider the US 10-year note trading around 4.26%.

This not only hurts stock valuations – it will also have a material impact on the economy.

In short, leverage costs a lot more.

Individuals, businesses and government agencies are going to be rolling over their debt at far higher rates. This is only just starting to take effect.

In addition, with the 2-year yielding around 5.00% – we are inverted to the tune of around 74 basis points.

That is, 4.26% – 5.00% = -0.74%

Since January 2022, we’ve seen the 2-year yield appreciate a lot faster than the 10-year:

A deeply inverted curve signals economic contraction ahead.

But that’s not what the market assumes.

What’s more, it’s the bond market suggesting the Fed is going to have to cut rates.

So how did we get here?

In simple terms – the massive money supply increase (to fund excessive government spending) led to a rise in inflation (e.g., excess money chasing too few goods) – which then forced the Fed to raise short-term rates to 5.50%.

However, the longer end of the curve, the 10-year, didn’t rise as fast because longer term economic growth and/or inflation wasn’t expected to rise as strongly.

Put together, this tells me the economy is not comfortable with the Fed’s tightening – and a recession seems likely.

Again, if that’s true, then the “12% earnings growth thesis” will prove false.

And from there, stock valuation multiples (where the S&P 500 trades around 19x forward earnings) will come down.

Counter #2: ‘Almost Done’ Means What Exactly?

The inversion of the yield curve suggests that Fed is close to the end of their tightening cycle.

But we need to define what is meant by “done”.

For example, if “done” means don’t expect more than say “50 bps” of rate rises… that’s plausible.

But it says nothing about rates staying at 5.50% to 5.75% for many months (e.g. up to 12 months or more) into the future.

That depends on Core PCE and employment.

This is where I see a disconnect with the market.

For example, markets believe we will see 125 basis points of rate cuts next year – starting from mid-year.

I think that’s an aggressive assumption.

And whilst I agree the Fed might be almost done raising rates – that does not necessarily equal cuts.

Now over the past few weeks (where markets have eased) – some might be questioning the following bullish narrative:

- The Fed is done;

- Inflation is coming down;

- Earnings are better than feared / growing at 12% YoY next year; and

- It’s most unlikely there will be a recession

Again, I think the US 10-year above 4.25% is not only going to be a hurdle for stock valuations (e.g., resulting in an historically low equity risk premium) – it also presents a headwind for the economy at large.

Remember:

The yield on the 10-year impacts every debt instrument in the market (mortgages, car loans, credit cards, student debt etc)

And at some point, this is going to pinch consumers (more on this in a moment when I look at savings rates)

Counter #3: Fed Aggressively Shrinks their Balance Sheet

Whilst higher for longer is a form of monetary tightening – the Fed are simultaneously reducing their balance sheet (QT).

Sep 8 2023

From mine, QT carries just as much weight as rate increases (perhaps more?)

This is the Fed’s effort to constrain money supply.

What’s notable here is we are roughly $238 billion less than the level that coincided with regional bank stress in March.

This tells me two things:

- The Fed are comfortable with the “lack of stress” in the (regional) banking system (following an emergency $400B injection); and

- They are happy to continue sucking money out of the economy – to help bring down unwanted inflatio

This is important as the contraction in money supply enjoys a close relationship with equities.

And whilst that relationship can be ‘loose’ in the near-term – over the long-term it’s proven to be consistent.

In short, stocks perform well during periods of QE (i.e., balance sheet expansion); however they rarely perform well during (money supply) contraction.

From mine, expect the Fed to continue to attempt to remove at least $1 Trillion from the money supply over the next 12 months (where $95B per month equals ~$1.1 Trillion over one year)

Whilst it’s very hard to dimension – $1.1 Trillion in QT over 12 months could equate to up to “50 bps of rate hikes”.

Counter #4: Can Consumers Still Spend?

Along with the all-important read on CPI next week – we get one of the more anticipatedreports: retail sales.

My feeling is this will be largely positive – as consumers continue to spend beyond their means (evidenced by the trend with credit card debt)

But excess savings are rapidly being eroded…

Consider this report from the San Francisco Federal Reserve:

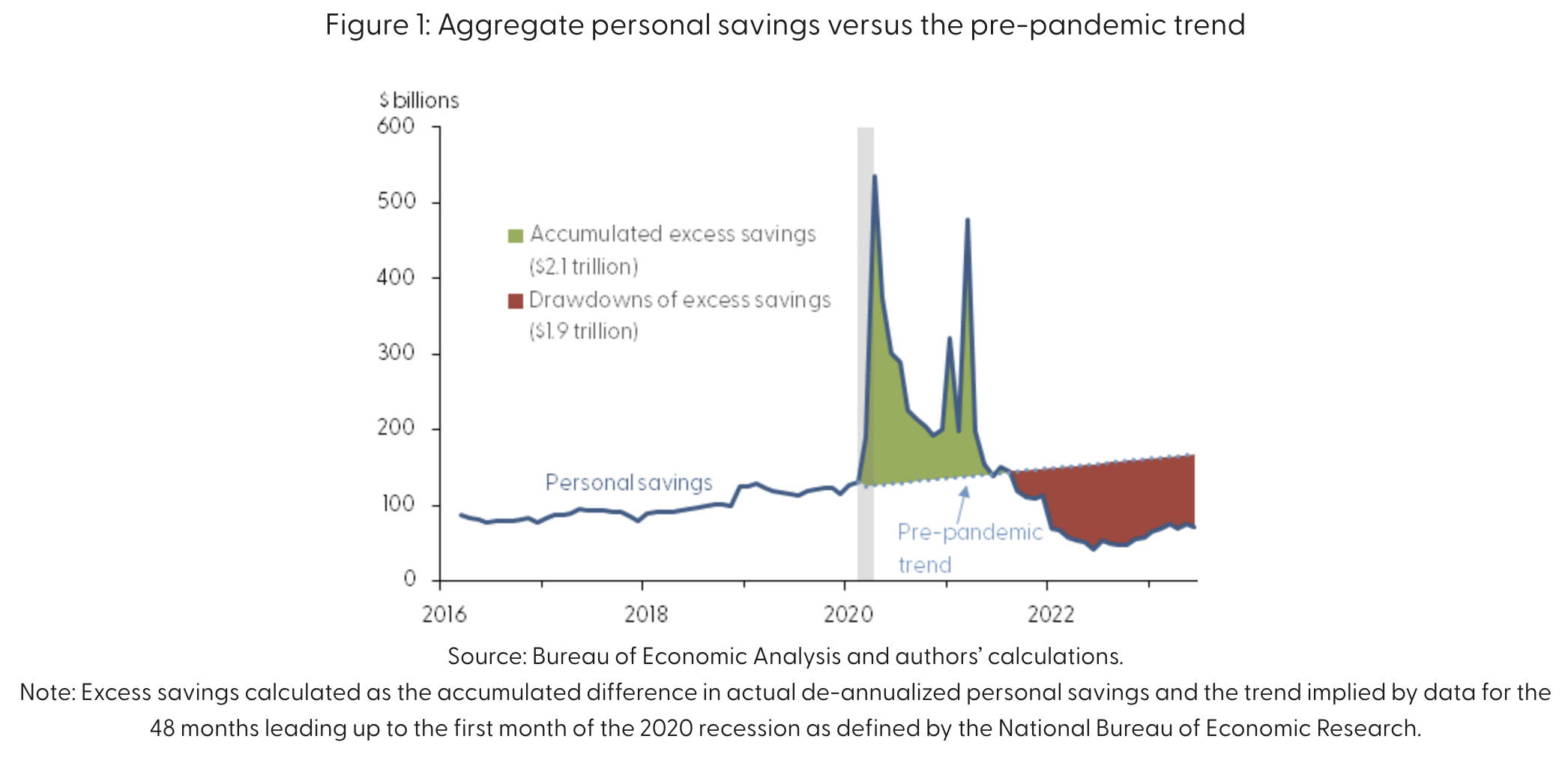

“Our analysis suggested that some $500 billion of the $2.1 trillion in total accumulated excess savings remained in the aggregate economy by March 2023.

Since then, data revisions show noticeable changes in household disposable income and consumption, while new data releases indicate that consumer spending picked up in the second quarter.

Our updated estimates suggest that households held less than $190 billion of aggregate excess savings by June.

There is considerable uncertainty in the outlook, but we estimate that these excess savings are likely to be depleted during the third quarter of 2023″

… and it’s gone! (watch the video – it’s hilarious)

This chart shows that the drawdown on household savings was initially slow — but started to accelerate in 2022 and has remained around $100 billion per month on average

By itself – this drawdown in a concern. However, we should also consider:

- APR’s on credit cards average over 20%; and

- Student loan repayments will start coming due in September

American’s owe something in the realm of $1.8 Trillion in student debt across almost 46M borrowers.

And with rates higher – I don’t see how this will be an economic “tailwind” for further consumption. It’s less disposable income – not more.

Putting it All Together

- the Fed is done (i.e., don’t miss the rally);

- inflation is coming down;

- earnings are better than feared / expected to grow at 12% in 2024; and

- there is no 2024 recession

… deserves closer scrutiny.

But this is the ‘broad’ narrative which has sent stocks higher so far this year.

What’s more – there’s nothing to say it can’t continue.

However, I’m not buying it.

With an asking price of almost 19x forward earnings on the S&P 500 – against 12-month risk free rates of 5.50% – it’s hard to understand how this is really compelling?