- Stocks are not done correcting

- Bond market suggests far slower growth

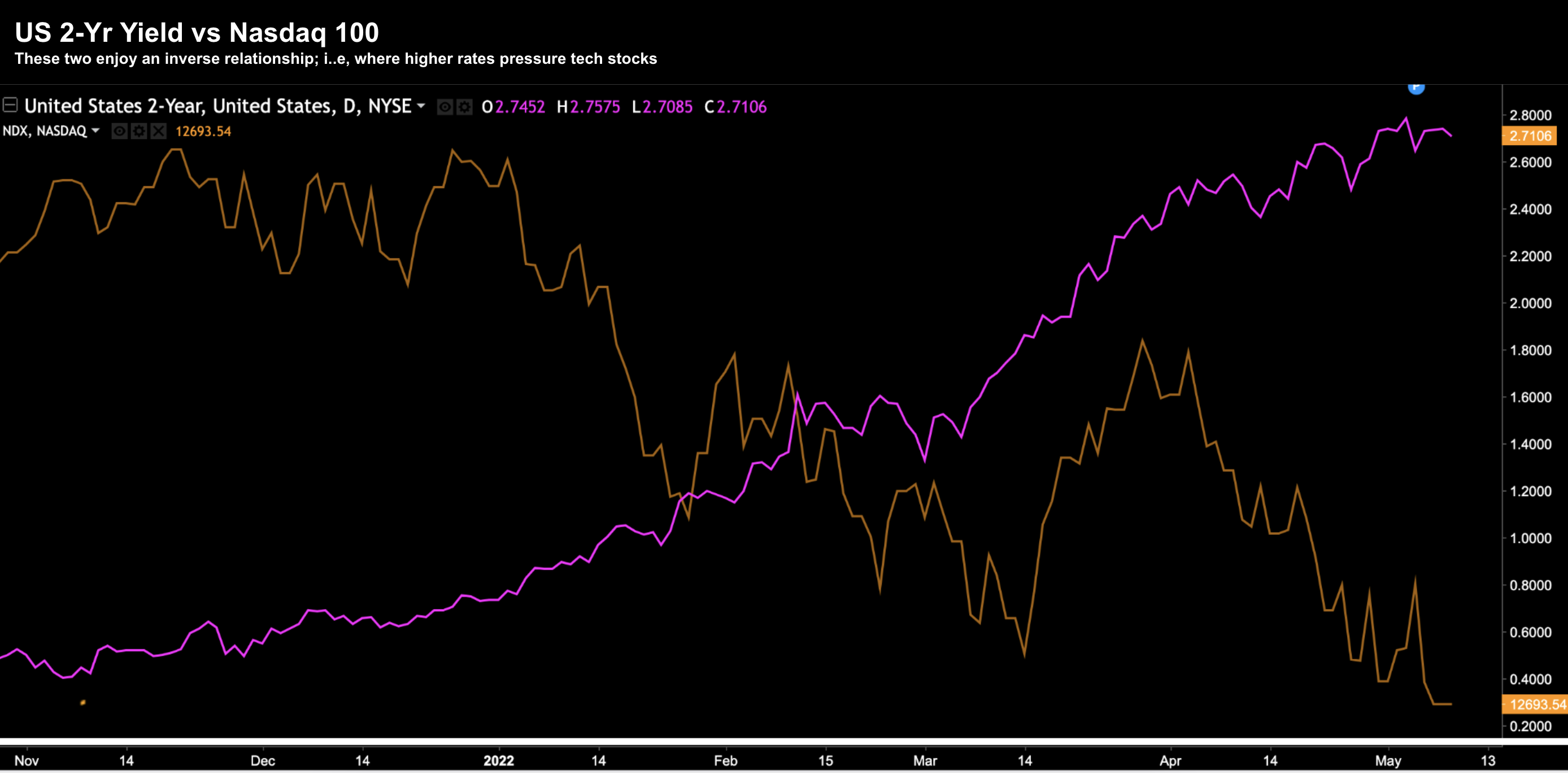

- Tech’s inverse relationship to bond yields

How much more volatile could things get?

Does it get worse? Or have we found bottom?

My best guess:

Expect greater volatility; more pain ahead; and it’s unlikely the selling has finished.

As I was saying last week – what we’re seeing is a market finally starting to realize the Fed may not be able to “land this plane softly”.

In fact, has the Fed ever landed the ‘plane softly’ with this script?

I don’t think so.

For example, the Fed has never brought down inflation from levels they are today – where employment is as low as it is – without causing a recession.

Because that’s where we are headed in 2023.

The only parallel we have seen is perhaps the late 1970s…

Some might say we saw something in 1994 but that’s not true… inflation was nothing like today.

Now what Powell outlined last week changes nothing about the script.

Powell could have said 50, 75 or 100 basis point rises are coming… I think it’s largely moot.

The Fed are going to tighten aggressively.

However the overall narrative hasn’t changed; i.e.,

- inflation is far too high

- the Fed are meaningfully reducing monetary support; and

- economic growth is slowing (i.e. negative last quarter)

However, what’s changed is companies are now starting to feel the impacts of inflation and tightening measures to come.

We’re seeing this in terms of earnings and forward guidance (as consumers start to feel the pinch)

But let’s start with the weekly chart for the S&P 500.

We’re likely headed lower; e.g., where the market starts with a “3-handle”.

S&P 500: Expect a 3-Handle Soon

5 weeks ago I said to readers they should think carefully about fading the rally…

As context:

We had bounced off the March / April lows – piling on 10% in just a few weeks – but something felt off.

Meme stocks were rallying; Cathie Wood’s ARKK ETF was in favour; and call option buying was seeing levels not since 2021.

This wasn’t a rally to be trusted.

Fast forward a few weeks and those 10% gains were erased in a heartbeat.

Let’s take a look:

May 9 2022

The S&P 500 put in its fifth straight losing week ending May 7.

From mine, the current level of support is likely to give way soon.

And that could see the “flush” I’m hoping for.

For example, my best guess is we see the S&P 500 trade somewhere in the realm of 3800 to 3900.

If we consider earnings are likely to come in around $230… and we apply a 17x multiple… that puts us in the realm of 3910.

Question is whether 17x is too high?

Maybe.

Hard to know. For example, that number could be as low as 16x.

But I can say with ‘some’ confidence that a lot of the (necessary) price adjustment will have been made if we see a forward multiple between 16x and 17x.

And I would to be a long-term buyer around these levels – not a seller.

Bond Yields Up = Tech Down

The carnage in stocks last week has mostly been opposite growth stocks.

For example, those where revenue growth matters (less so earnings).

But the massive pivot from value to growth has been playing out since November last year (i.e. when the Fed admitted their mistake).

This chart shows the pivot we have seen in respective sectors so far in 2022:

May 9 2022

Case in point:

Take a look at utility based stocks – they rallied last week.

But the theme is a simple one:

As rates rise – you want to focus on stocks that are:

- shareholder friendly (dividends; buybacks etc);

- turn a good (consistent) profit;

- have robust free cash flow

- fortress balance sheets;

- pricing power; and

- do not trade at excessive multiples

Companies who do not exhibit each of the above have been slammed.

Regardless of their so-called growth “potential” – they have been re-priced.

Even the very best of companies – Google, Microsoft and Apple – have felt pain (mostly due to their higher multiples)

And here’s why:

May 9 2022

It all comes down to bond yields / interest rates.

The US 2-Year Yield has rallied from close to zero last October to a level of 2.71% today (pink line)

That’s an incredible move in a very short space of time.

The 2-Year is a great proxy of where short-term rates are headed (with the bond market already doing a lot of the Fed’s work)

However, look at the (inverse) reaction we have seen in the Nasdaq 100.

Higher rates are not conducive to growth stocks – not at the multiples we’ve seen.

The good news is prices are now a lot more attractive.

And to that end, we’re a lot closer to a “fairer” price for many of these stocks (i.e., where I say stocks – I am only talking to those that tick the boxes above)

But I think the adjustment we needed to see still has a little further to go.

Putting it All Together

This is the most aggressive we’ve seen the Fed since 1994.

And it’s overdue.

They are still a long way behind the curve… and will be playing catch up for a while.

Credibility has been lost.

For example, I shared where we are with M2 Money Supply as part of my last post.

This has to come down if they are to pull back inflation.

There’s no other way.

Now mainstream have been (or are?) caught up on whether the Fed hikes “50 or 75 or 100″ basis points the past few months… but it doesn’t matter.

The monetary vice is being squeezed.

And consumers and companies alike are going to feel it.

That’s their intent.

The Fed want to take money out of people’s pockets and they want to pull asset prices down.

Now the bond market has been telling us what’s going on for the past few months… equities were just slow to react.

That’s usually what happens.

Note: we get CPI this week. It’s a big print… as a lower than expected number could see bond yields pause – setting up for a rally. However, the opposite also holds true.