- Tech has become cheaper – but it’s still at a premium to the market

- Healthcare, energy, financials and industrials likely to lead

- Keep your powder dry – market lows still not in

Yesterday stocks ripped higher – with most major indices up over 2%.

Traders had a skip in their step… hoping for a Santa Claus rally.

Fast forward 24 hours and those gains are gone.

Speculators rushed for the exits today – concerned about the threat of a recession and how long interest rates would remain elevated (e.g., above 4.00%).

A stronger than expected jobs number suggested the Fed has more to do…

As I wrote earlier this week – the market is going to take its cue from the labor market going forward.

That will be the Fed’s sole focus when it comes to the pace (and duration) of rate hikes.

Adding to the negative sentiment – widely followed billionaire hedge fund manager – David Tepper – said he is “leaning towards the short side“

From his lens, the upside reward does not handily outweigh the downside risks (something I’ve been saying all year)

Tepper always keeps things simple.

He adds risk during easing cycles and he’s cautious when central banks are tightening.

I talked about this here.

Whilst not the focus of this missive – the past two days is why I don’t attempt day trading.

It’s a coin flip as to what the market do day-to-day (or even week -to-week for that matter)

You’re just as likely to win betting “red or black” at the casino.

Experience has taught me if you lengthen your timeframes – the higher your probability of investing success.

(Note – the opposite holds true in a casino; i.e., the longer you stay – the more likely the house wins!)

The shortest possible timeframe I use is a weekly chart (and I consider that very short-term)

Now this year I’ve been lucky forecasting not only the broader market decline – but also the timing (and extent) of the bear market rallies.

Below highlights what I’ve sketched in along the way (orange and white lines)

Dec 22 2022

But let me repeat… this isn’t skill… it’s fortuitous.

I typically share my hypothesis on what I think could happen (drawing on facts) – but it’s only a hypothesis.

For example, a month ago (Nov 23rd) – I shared this post “Watching the VIX for a Market Reversal”

My thesis was as follows:

- Probabilities suggested a near-term top if the VIX traded at (or below) 20

- If correct, it paid to keep some “powder dry” for better prices; and

- The market felt overly complacent given the headwinds.

Turns out I was lucky… as the market could have equally made me look foolish (as it usually does)

In this case, the market reversed at the 35-week EMA zone (where I flagged likely resistance); and has since drifted lower by ~7%

Now if we go back a little further to October 18 – similarly my thesis was “Short-Term Rip… Then a Bigger Dip”

In other words, it felt like another bear market rally.

Below is the chart from the time (the white dotted line my forecast):

October 18 2022

Again, things traded as expected.

Going forward (and at the risk of looking foolish again) – my thinking is we’re likely to break the October lows (outlined here Nov 27th)

That said, I welcome lower prices (“Excited About the Opportunity Ahead“)

That’s when you want to go shopping…

For example, take a look at this monthly chart (as it provides perspective):

Dec 22 2022

First it shows how hyper-extended stocks were this time last year (and why I suggested reducing long exposure into Q1)

And whilst we’ve shed some of the rampant (excess) speculation of the past two years – it feels like there’s more to go.

I see the market trading down into the lower half of this long-term trend channel; e.g. the zone of 3200

Sure, we could easily trade below that level and I don’t pretend to call the bottom.

But that’s an area I would be happy meaningfully increasing my exposure.

If correct – it also implies heavier weighted stocks are likely to lead us lower.

Which is a nice segue to big-cap tech… do you buy it here?

Tech to Remain Under Pressure

- Rates are likely to remain higher for longer (i.e. Fed Funds rate above 4.00%)

- Earnings are likely to fall as much as 10% (maybe up to 20%); and

- The economy is likely to fall into recession (i.e., lower earnings and multiples)

Now I could be wrong on all three counts… but that’s what makes a market!

Assuming my hypothesis is reasonable – it will have meaningful implications for what sectors will likely perform (vs those which may struggle).

First I want to consider big-cap tech…

It was the sector which led us higher the past decade – mostly due to a very low cost of capital.

But the game has changed (see this post)…

Technology comprises ~30% of the total Index – with the largest four stocks ~20% of total market cap.

That’s a staggering number…

In recent weeks, almost $400B of market cap was lost across these four names.

Below is their performance relative to the S&P 500 from November 1st (where Apple shed 13% or ~$200B; and Amazon ~15%)

Dec 22 2022

The good news is sky-high valuations have come down – however I would argue they’re still not cheap.

And we are yet to see any kind of capitulation selling.

For those less familiar (and as a general rule of thumb) – a low Price to Earnings (P/E) multiple implies investors are expecting lower earnings growth in the future relative to companies with a higher P/E.

For example, anything above 20x forward P/E is considered high and anything below 10x very low.

On average, the forward P/E for tech has come down to somewhere in the realm of 22x forward (I will share some averages shortly).

Cheaper, yes.

But not yet cheap.

This suggests to me that investors are now much less confident about earnings growth (and certainty) for this sector than they were with rates anchored at zero.

And none of this is a surprise.

We often call tech stocks “longer duration” assets

In other words, they’re a bet on growing their earnings substantially well into the future.

However, when rates rise, the sum of their future cash flows is discounted.

The higher the rate – the bigger the discount.

Put another way, if we have higher rates expect tech stocks to fare worse than the broader market.

From there, if we also consider the likelihood of recession (which also implies slower growth); and it’s a double-whammy.

But let’s get back to valuations… as this is where the (potential) problem is.

Bloomberg expects full-year 2022 earnings per share (EPS) for the companies in the S&P 500 Index to come in at $223.6 and rise to $229.7 in 2023 (a rise of 2.9%) based on a research note published December 2.

Personally I think that’s still optimistic (as earnings typically decline during recessions) – but let’s take it for what it is.

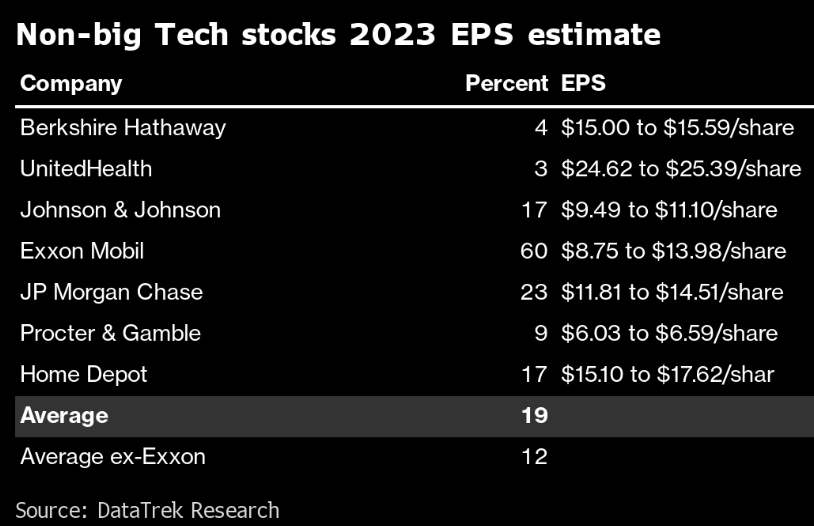

However, with respect to tech, a note by DataTrek Research last week showed EPS uncertainty is 6x to 8x higher than for the major non-tech companies in the S&P 500.

Below are DataTrek’s expectations for big tech next year:

If we then apply these EPS estimates as a forward PE ratio range – we get:

Dec 22 2022

If we exclude Amazon (as they’re undertaking a very large capex cycle) – the higher end of the forward P/E range is 28x.

The best case (i.e., these stocks are able to generate the higher end of earnings) is a P/E of ~18x

This is still expensive given:

- significantly slower growth (and likely recession); and

- higher rates for far longer.

Now at the end of September – I made the case the sector was still too expensive.

At the time (by way of proxy) the tech-heavy ETF QQQs was trading for ~$302

However, I warned of the likely downside ahead.

Today the Q’s are ~12% lower or around $266:

Dec 22 2022

I’m expecting this ETF to trade lower – as names like Apple and Microsoft (both with very high multiples) to grind lower.

In particular, Apple could be higher risk given what we find with China (and demand for $1,000+ phones during a recession).

As a target, look for something in the realm of $225 to $235 for the QQQ ETF.

For example, I would not be surprised to see Apple trade ~$110 (from ~$133 today); and Microsoft ~$200 (from ~$240)

- Apple at $110 represents a fwd P/E b/w 15x to 18x.

- Microsoft at $200 represents a fwd P/E b/w 16x to 19x

And if these two market ‘generals’ are to fall… they will drag the entire index lower with it.

They are both ‘best in class’ – and these stocks are typically the very last names to be sold.

Defensive Alternatives

So that’s tech… tread carefully.

Let’s now compare the former market darlings with those names which have been mostly forgotten the past decade.

For example, stocks which make anything from baby powder to bathroom fittings.

These stocks are not going to grow “30%” per year… but they’re not going away.

What’s more, you need them arguably more than you need your iPhone and Google Search (although I know ‘one or two people’ who may beg to differ!)

The thing is… they’re far less volatile and arguably less prone to prevailing interest rate headwinds.

Below are the seven largest non-tech names in the benchmark gauge:

And in terms of forward P/E multiple ranges we find:

Dec 22 2022

Interestingly the best case forward PE is similar to big-cap tech around 18x.

However, the bear case for earnings next year is closer to 20x (vs 28x for big-cap tech)

That’s a large delta…

One way of reading this is traders have a higher conviction that non-tech companies will meet their earnings estimates.

That said, these specific names are not exactly cheap.

And for good reason.

They boast exceptionally strong moats and balance sheets, enormous positive cash flows and earnings reliability; and they can exercise pricing power to defend margins.

Put together, they are likely to hold up better in a recession.

But the same argument cannot be made for tech.

For example, I own UNH, J&J, JPM, PG and MCD (McDonalds) heading into 2023.

What I will likely do is increase my weighting towards these names and reduce my tech weighting.

But let me be clear:

I am not looking to sell my long-term core holdings in quality names such as AAPL, MSFT, GOOG and AMZN.

These four stocks should have a place in any portfolio.

However, I would challenge whether they should constitute “market weight” (or ~25%)

From mine, look to reduce tech to no more than perhaps 15% to 20% (assuming entry at fair multiple).

Putting it All Together

Over the past decade, being overweight tech has been the right call.

A period of money printing with ultra-low rates allowed these companies to expand at a low cost of capital.

That’s unlikely to repeat in this climate – where you can no longer pay any price for growth.

Looking ahead, more defensive names (including bonds) warrant a place in your portfolio.

And given we’re likely to head into a recession – you could equally make the case gold will rally (not unlike bonds).

Gold outperforms during recessions (as it’s essentially a bet against the economy doing well).

In closing, if you do not have exposure to high quality large cap tech – aim to add these names below a 20x multiple.

That’s where they ‘should’ trade as rates move higher.

Apple, Microsoft, Amazon and Google are terrific businesses – with exceptionally strong moats, balance sheets and free cash flows.

And whilst they are not going away… also understand you can pay too much.

So keep some powder dry…

And echoing David Tepper – I believe there will be better opportunities ahead in 2023.