- Did Powell just snatch defeat from the jaws of victory?

- Trying to make sense of the Fed’s surprise pivot?

- Looking at the reaction in bonds, the dollar, gold and equities

Only two weeks ago – Fed Chair Jay Powell furnished us with the following language:

“Having come so far so quickly, the [Fed] is moving forward carefully, as the risks of under-and over-tightening are becoming more balanced. It would be premature to conclude with confidence that we have achieved a sufficiently restrictive stance, or to speculate on when policy might ease“

Well it turns out approximately two weeks is a long time in the land of the Federal Reserve.

Forget all that.

This week he pivoted 180-degrees by telling us that “rates are likely at or near their peak during this tightening cycle”

Here’s a snapshot of the Powell Pivot:

- Policy was now “well into restrictive territory‘” (and not simply “restrictive” as he said in November)

- He removed this sentence from the previous minutes: “reducing inflation is likely to require a period of below-potential growth and some softening of labor market conditions”

- Explicitly highlighted the Fed would need to start cutting rates “way before inflation reached its 2% target – where failing to do so could lead to an overshoot and slow activity too much”

- Declared the Fed was “very much focused” on the risk of keeping rates too high for too long

- Admitted that the FOMC had discussed when they should start cutting rates (n.b., ~2-3 weeks ago they were not “even thinking about thinking about” rate cuts); and finally

- When pressed, he declined to comment on the easing in financial conditions from lower yields in bond markets.

I did not see this coming.

None of it.

What happened to tighter financial conditions? Or being too early to conclude with confidence we have achieved a sufficiently restrictive stance?

Strike it all from the record.

Yes, the inflation trend lines of the past few months are encouraging. And it appears we will see 2.x% core inflation next year (all going well).

But is that a foregone conclusion? And what (economic) risks does he see (that we don’t)?

Fed Chair Arthur Burns made that mistake in the late 1970s. Powell reminded us of possible inflation head fakes only a few weeks ago.

Did he just snatch defeat from the jaws of victory?

Let’s try and make sense of what just happened.

Snatching Defeat from the Jaws of Victory

Prior to yesterday’s FOMC meeting – my (incorrect) thinking was given the large drop in bond yields (i.e., easing of financial conditions) – Powell would be uncomfortable sounding dovish.

I expected his usual stoic hawkish tones.

For example, Nov 11 Powell told us that tighter financial conditions could bear on Fed actions if they are persistent – adding “it remains to be seen” if that will be the case.

Given the sharp 80 basis point drop in yields since his last address – my assumption was this could make the Federal Reserve’s job harder.

I was wrong.

Looks like the massive easing in financial conditions turned Powell into a dove!

It was the opposite of what I expected.

Clearly I didn’t understand what Powell was saying only a few weeks ago.

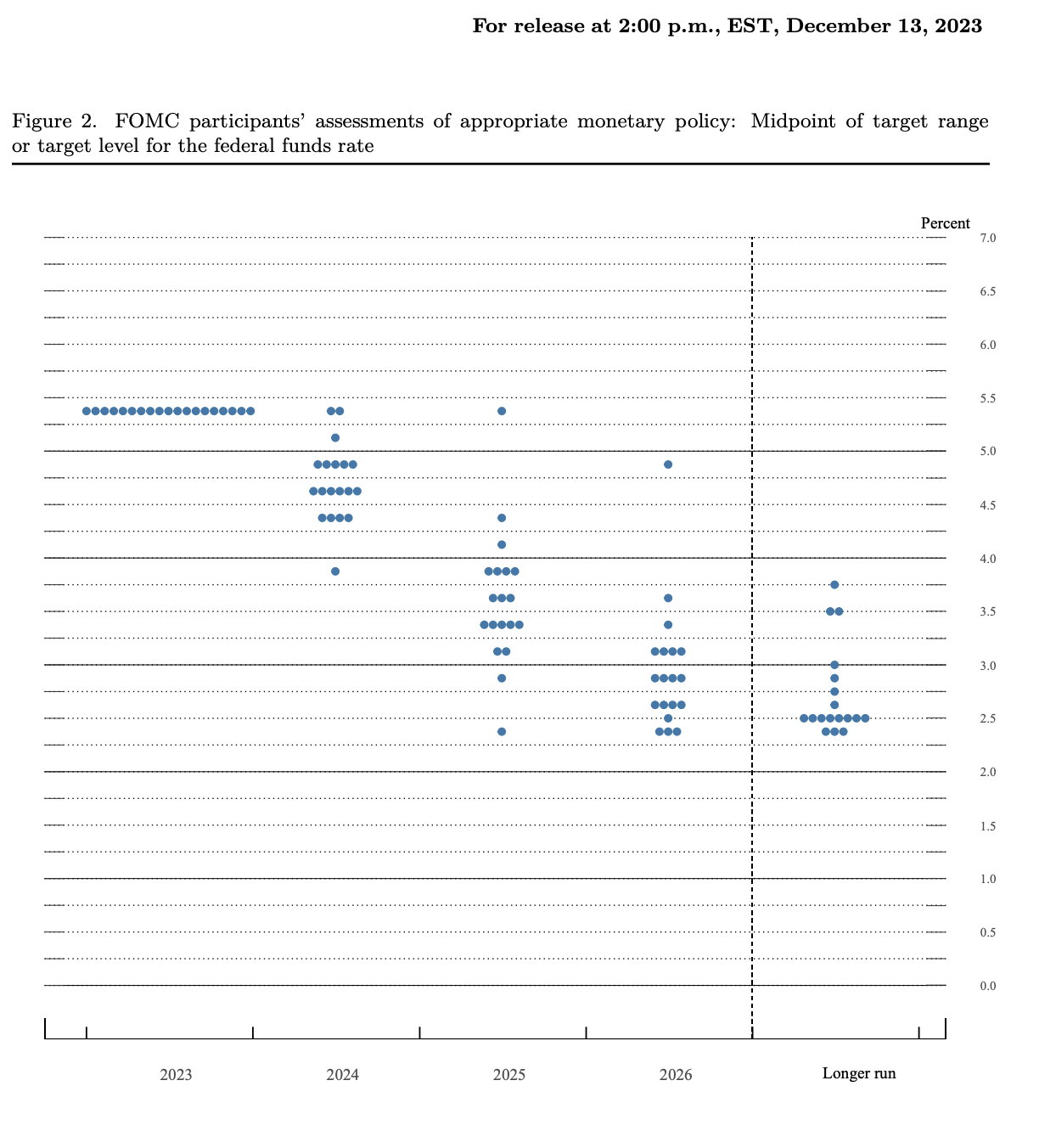

Let’s turn to the so-called Fed “dot plot” – as it shows where members expect rates to be in 1 to 4 years time.

Now, these plots change substantially from month to month.

December was no exception.

FOMC members have projections for rates around 4.50% next year and falling further in 2025 and 2026.

But the shift is startling.

Around three months ago, ten FOMC members thought the fed funds rate would still be above 5% by the end of 2024.

Now only three think that.

The median estimate has dropped by a full 50 basis points, and there is one outlier who thinks that it will drop below 4%.

Here’s my question:

What would cause the Fed to cut rates with asset prices near record highs; and unemployment at just 3.7%?

For example, are they worried about the business cycle? Is economic growth slowing too much for their liking?

Or do they see other risks?

It’s hard to say – but the pivot is remarkable (and perhaps troubling).

Market Reactions

It didn’t take long for currency, bond and equity markets to react.

And the moves were sharp.

Before I take a look at the 2-year treasury – below is a chart I shared November 4th – pencilling in where I saw these yields trading in the months ahead:

November 4 2023

At the time, the US 2-year yield was 4.84% and I said “is likely to head lower”.

The call for lower yields was correct (and why I was recommending increased exposure to bonds at the time) – however the velocity was surprising.

Let’s update the daily chart (which highlights the impact of the Fed’s announcement) – leaving the orange lines pencilled in from 5 weeks ago:

December 14 2023

I was expecting lower rates towards the second half of 2024… not at the end of 2023.

But here we are…

Let’s turn to the all-important US 10-year yield (using the weekly chart this time)

December 14 2023

I’ve been saying “expect a 3-handle on the 10-year in the second half of next year”.

We now have the 3-handle… ~6 months faster than I expected.

Hat tip to Chair Powell!

As an aside, for those who added exposure to vehicles such as (and not limited to) EDV, AGG, TLT, HYG etc – you will have seen double digit gains in a very short space of time.

EDV for example (which I was adding to when yields climbed to ~5.0%) rallied from levels of ~$63 to trade above $82 in a few weeks (good enough for ~30%)

(Note: I’ve taken partial profits as I think the move is overdone).

It’s the 10-year which is worth paying close attention to.

As I’ve written previously, this is the critical benchmark used for almost all financial transactions across the world.

Your mortgage, car loan, student loan, credit card rate are all determined by this yield.

And it’s an interest rate which is set by the market – not by the Fed.

What I take from the weekly chart is we’ve now seen the peak in yields for this cycle.

For example, that doesn’t mean the 10-year may not trade “above 6.0%” (or higher) in years to come… it could easily.

But in the very near-term (next 12-24 months) – it feels like we have seen peak yields.

Over the next few weeks – I would be surprised if the 10-year was to trade much lower.

My best guess (and it could be wrong) is we stabilize around the mid-point of the distribution (i.e. ~3.90%) – and rally back to levels of around ~4.30%

For example, there are two strong supply forces which the market seems to have forgotten all about:

- Trillions in long-term government debt still to be auctioned; and

- $7.6 Trillion of US public debt which matures next year.

Both of these forces are likely to help push yields higher.

The counterforce to that is obviously a recession.

For example, if economic growth stumbles (or contracts) – then it’s difficult to see a 10-year yield trading above 4.0%

US Dollar Tumbles

With the Fed forecasting lower interest rates – and the downward pressure in yields – the US dollar plunged.

Naturally, this saw risk currencies – such as the Aussie and Euro – surge.

December 14 2023

A lower dollar will be welcomed by larger S&P 500 companies – which will act as a tailwind for earnings.

Dollars which are earned off-shore are now worth more.

From a technical lens – I think the DXY could fall a little further – maybe to the bottom of the distribution (e.g., around 101.00)

However, I expect it to find support in that zone before catching a bid.

Remember:

Whilst the US may see lower rates next year – you could also argue the relative strength of its economy is far better than most of its peers.

A stronger economy will typically attract further investment (i.e. dollars)

Then There’s Gold…

It was not surprising to see the yellow metal catch a small bid on dollar weakness:

December 14 2023

From 2020, gold has muddled between $1,600 and $2,100 – failing at the upper band on four occasions.

The question is whether it can break higher?

A lower dollar and lower yields will help its cause.

However, I think the real catalyst for gold will be the prospect of recession in 2024.

Generally gold shines when there is greater economic uncertainty and/or contraction.

That said, if we’re to avoid a recession next year (as many believe) – then it’s hard to see gold moving materially higher.

You are better in risk assets.

As an aside, a 17-year CAGR of 7.3% isn’t terrible.

To that end, I would rather own the precious metal closer to that long-term trend line.

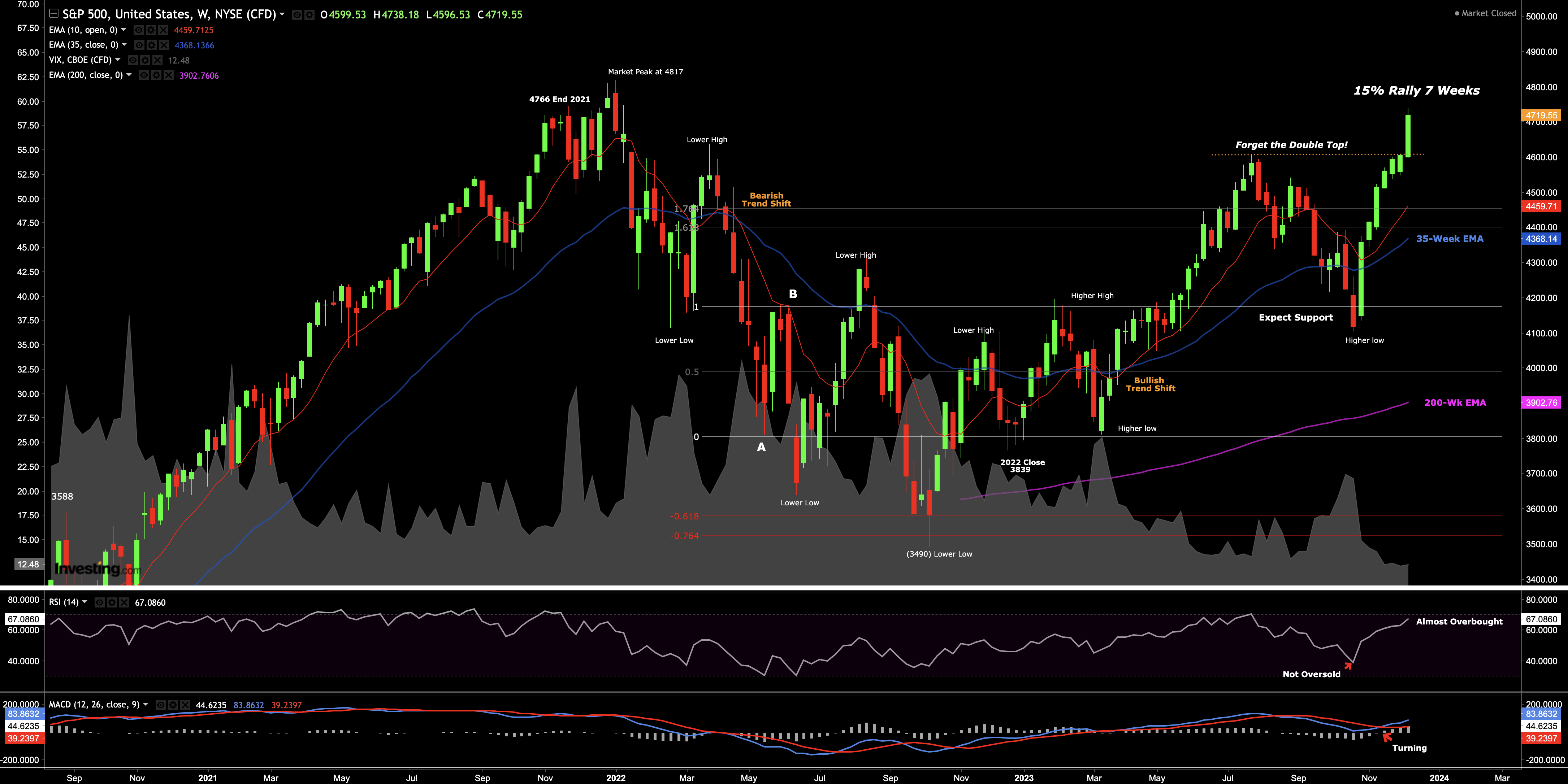

Finally Equities

Last but not least we have equities…

With equities addicted to “cheap money” – it was not surprising to see (some) stocks rip to the upside.

It’s largely Pavlov’s Dog – a conditioned response (but some may argue rational)

If you ring the bell – they will come.

December 14 2023

Now, if you owned rate-sensitive or higher-risk stocks – congrats!

Please collect $200 as you pass ‘go’.

What’s more, many of the lower quality stocks surged (i.e. those that make little or no money – which depend on cheaper credit)

A good proxy is Cathie Wood’s “ARK Innovation ETF” (remember that?) – it too managed to catch a bid.

That’s when you really know it’s risk on.

My previous thesis of a potential double-top was wrong… that’s gone.

That said, I wasn’t wedded to my thesis and was happy maintaining my 65% long exposure.

What’s more, I made a point I was not short and nor did I own puts.

The weekly trend was bullish which suggests it’s more likely we will see higher prices.

Now, the last time the market ripped higher like this was March / April of 2020 – where it added ~25% in the same timeframe.

However, that was on the back of the Fed injecting trillions and slashing rates to zero.

Today interest rates are 5.50% with the potential to come down next year (not certain) and we still have quantitative tightening.

In any case, the chart is the chart.

Given I was not willing to chase the market higher before the Fed decision – I’m not willing to chase it here.

The weekly RSI (middle window) suggests we’re getting closer to being overbought in the near term.

I think once we see this exceed 70 – there is a high probability to expect a reversal.

That said, the weekly RSI can remain above 70 for several weeks. It’s not an indicator you should trade in isolation.

From a valuation perspective – I consider the market expensive.

I don’t think it offers a compelling risk/reward.

For example, let’s assume earnings are to grow ~12% next year to say roughly $240 per share.

4700 / $240 = 19.6x forward earnings

That’s a very high multiple to pay for stocks with rates above 4.0% (let alone today’s 5.0%).

My preference is to buy the market somewhere closer to 17x to 18x forward.

But if we put multiples aside – I don’t subscribe to the view we will see earnings in the realm of $240 per share.

My view is growth will slow sharply and earnings will expand single digit (best case).

I think the more likely case is they will contract.

If you assume a number closer to $230 and a multiple of 18x – we get 4140.

That’s where I think you have a better shot at upside (with lower downside).

But for now, the market doesn’t agree and is willing to pay “any price” for stocks. Have at it.

Remember:

In this game of asset speculation – it’s not just what we buy that matters – it’s equally how much we pay.

Putting it All Together

I’m still wrapping my head around Powell’s pivot.

Why box yourself into a corner? Why remove optionality? Why declare victory?

It doesn’t make sense to me.

Jay Powell is not Paul Volcker.

He may end up being more Burns… who would have thought?

After all, if you’re seeking easier financial conditions to accommodate the business cycle (which now appears to be the case) – the bond market is doing that for you.

I guess all of this comes down to the future course of inflation and employment (more so the latter)

That’s all that matters.

Yes, the trend lines for inflation are good. It’s headed in the right direction.

But there are stubborn pockets (e.g., 4.2% wage inflation)

Sure, we’re seeing signs of the labor market loosening but we have full employment (at 3.7%).

Now, I can understand the Fed choosing to pause on rates with things heading in the right direction.

That makes sense.

So why not just hold them there – and maintain your position to see how things go?

There’s no harm in that – unless you think you are too restrictive?

In the end, maybe we do see inflation fall below 2.0% next year (both core and headline) and it was transitory after all?

That’s possible. It just took a longer than expected (given the excess liquidity in the system).

In that case, maybe their surprise pivot is now more towards the business cycle (and less about inflation)?

For example, Powell said the Fed would need to start cutting rates “way before inflation reached its 2% target – where failing to do so could lead to an overshoot and slow activity too much”.

I read that as specifically targeting the business cycle.

Let me conclude with this…

If Powell does manage to “land the plane softly” (and I know he desperately wants to) – given the extreme measures taken with monetary policy – it will be one for the history books.

We wish him well.

For now, I’m happy maintaining my balanced long exposure through to the end of the year. Stocks are likely to end on a high note.

It appears the fat guy in the red suit came early.

Ho ho ho!