- Jobs softened in March… but not enough for the Fed

- Three things the market doesn’t know

- Remaining cautious ahead of inflation data this week.

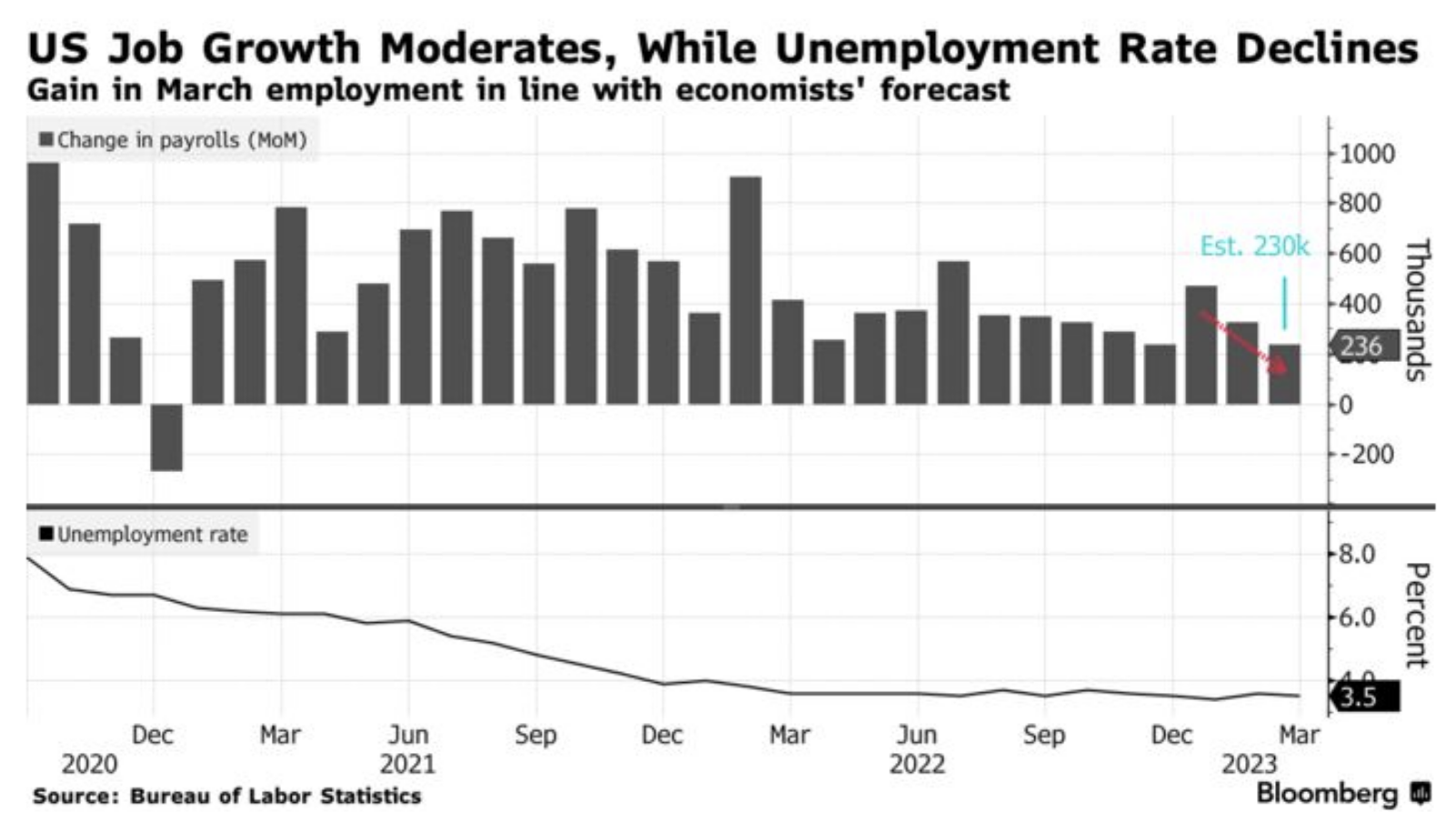

However, the all important monthly jobs report hit the tape as traders cooled their CPUs:

- Non-farm payrolls increased 236K for March;

- Unemployment rate ticked lower to 3.5%; and

- Average hourly earnings rose 0.3%, pushing the 12-month increase to 4.2%

Futures popped on the news – perhaps on hopes that slightly cooler data increased the possibilities of the Fed pausing on rates.

I think that’s optimistic…

Wage growth remains stubbornly high at 4.2% annualized.

Sure, it’s slowed a little… but probably not enough for the Fed.

And with an unemployment rate of 3.5% (full employment) – that only adds pressure on wages.

The good news (from an inflation perspective) is job growth is slowing.

But is it slowing enough?

Wage Growth Still too High

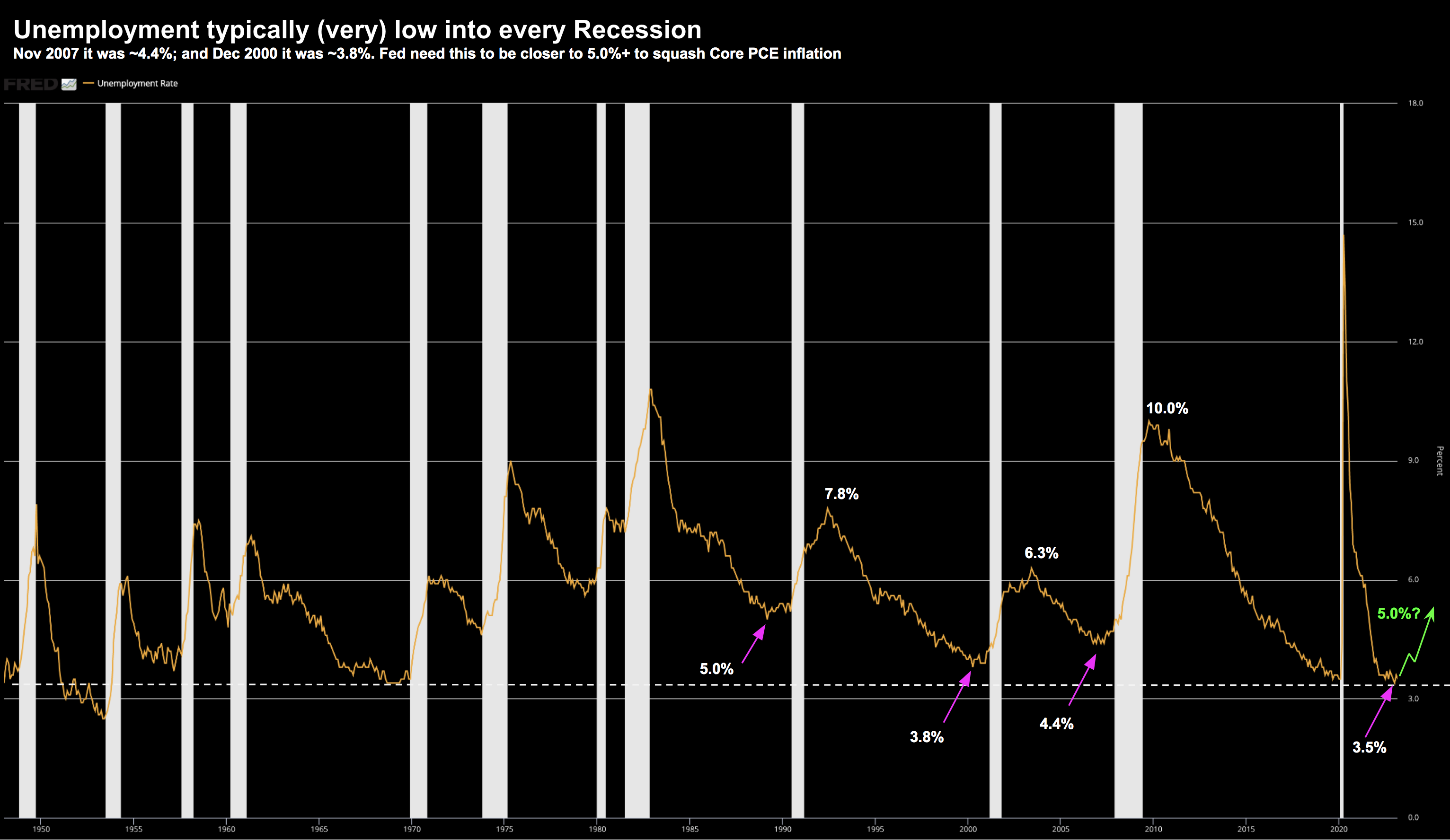

3.5% unemployment is the lowest rate we have seen in 50 years.

And in the absence of unwanted inflation – this number would be celebrated.

Most people have jobs.

April 10 2023

However, the bulk of these job adds were in the service sector (notably smaller businesses) and government.

With respect to services – small businesses struggle to attract and retain workers due to persistent shortages – in turn driving up wages.

From the BLS report:

Leisure and hospitality added 72,000 jobs in March, lower than the average monthly gain of 95,000 over the prior 6 months. Most of the job growth occurred in food services and drinking places, where employment rose by 50,000 in March.

Government employment increased by 47,000 in March, the same as the average monthly gain over the prior 6 months. Overall, employment in government is below its February 2020 level by 314,000, or 1.4 percent.

There’s 50% of the job additions in those two sectors alone (n.b., we could do without the extra (tax) overhead of more public workers)

Here’s Bloomy’s quick take:

“The slow pace of deceleration flags the risk that the unemployment rate will undershoot the median FOMC participant’s end-year forecast of 4.5% — in which case, the Fed will have to hike a couple more times after May”

That echoes my thinking.

As an aside, I think the Fed wants unemployment closer to 5.0% (vs 4.5%)

However, they would never publicly state this.

But there are some things “we know”:

- Inflation is slowly coming down;

- Wage growth is slowly falling (but still high);

- Economic growth is slowing; and

- The Fed has done the bulk of its heavy lifting with respect to rates (i.e. they are closer to the end)

Markets have priced most of this in.

So what don’t markets know? Or what are they potentially missing?

What We Haven’t Seen

- Unemployment

- Earnings

- Yields

1. Fed Needs 5.0%+ Unemployment

With the unemployment rate falling to just 3.5% – it’s hard to be overly bearish.

Whilst people continue to have jobs – they will continue to spend.

However, this report from Lendingclub.com suggests 60% of all Americans live paycheck to paycheck — but they remain optimistic on the outlook.

As of January 2023, 60% of United States adults, including more than four in 10 high-income consumers, live paycheck to paycheck, down 4 percentage points from January 2022. This decrease suggests that spending cutbacks in the previous year have effectively improved some consumers’ financial situations.

Moreover, consumers appear to be settling into the current financial environment. For example, the share of consumers expecting their financial situation to worsen has also decreased, and more people are optimistic about 2023

“Consumers living paycheck to paycheck dropped for the first month of 2023. While it’s too early to indicate a trend, consumers have accepted that inflation is part of their everyday lives and they are actively making behavior changes, especially during the 2022 holiday shopping season, to adjust their spending and better manage their cash flow,” said Anuj Nayar, financial health officer at LendingClub.

Perhaps this is why so much of the commentary leans towards a so-called “soft landing”

But I’m not buying it – as employment is always backward looking.

My personal take is the Fed wants this higher…

But how much higher we don’t know?

That said, there has never been a overly fearful news cycle which starts with a labor rate at 3.5%

Question is:

Has the market priced in 5.0% to 6.0% unemployment?

Not yet.

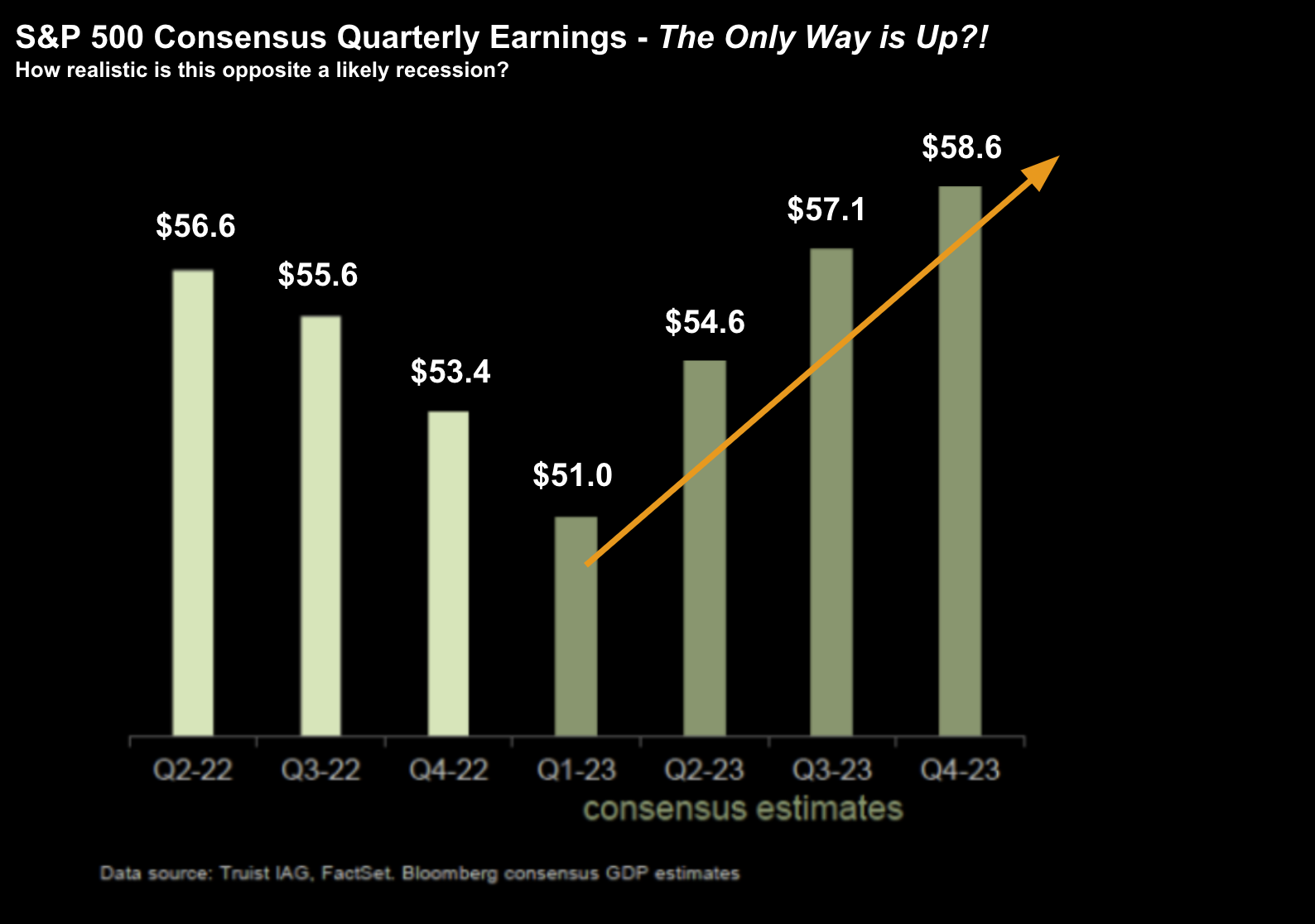

2. Earnings to Contract Further

The second thing the market may not be fully pricing in is persistent weakness in earnings.

For example, we know that Q4 was down year on year.

We also come to the acceptance that Q1 will be down as much 7% YoY

We are now in an earnings recession.

Recently I shared this graphic showing earnings expectations for the full year ahead:

In aggregate – these four quarters equate to $221.30 of earnings.

But what do we see starting Q2 – an emerging strong uptrend.

They see earning expanding.

What’s the catalyst?

My quick take is the assumption of $221 earnings could be as much as 10% too high for this year.

For example, with a market at around 4100 – at $221 earnings – that’s a multiple of 18.6x

However, if we plug in a EPS number of closer to $200 (my likely scenario) – that multiple becomes closer to 20.5x

Regardless, whether your EPS number is $221 or $200 — anything north of 4100 is a poor risk reward.

As an aside – my bear case for earnings is somewhere between $180 and $190.

If we were to see that – we can dial in a number of closer to 3400 for the S&P 500.

3. Yields Post the Debt Ceiling Raise

It’s widely accepted Congress will inevitably raise the debt ceiling.

Failure to do this will see the US Federal Government run out of cash by around mid-August.

And whilst we will see politics played by both sides between now and then (never let a good crisis go to waste) – the retractable roof will be opened.

Why call it a ceiling?

From mine the issue is not whether a deal will be reached – it’s the reaction we see in bond markets.

I say that because every debt ceiling raise is new level of fiscal irresponsibility (and why gold is above $2,000)

The government continues to draw down on the general account – which will ultimately do two things:

- Raise taxes on people over time (adding more debt is not free); and

- Make it more difficult to achieve growth

For example, the U.S. government spent a record US$213 billion on interest payments on its debt in the fourth quarter, up $63 billion from a year earlier.

Indeed, a jump of almost $30 billion on the previous quarter represents the biggest quarterly jump on record.

But I’m not here to explain why raising the debt ceiling is a reckless act (that’s low hanging fruit) – it’s the market’s reaction I am interested in.

My guess is yields could rise as a ‘penalty’ opposite the US Administration’s woeful fiscal mismanagement.

We’ll see… but for now the market is paying zero attention to this risk.

Putting it All Together

Last year when the market traded around 3600 – I was adding to positions.

This led to outperformance.

But I’m not bullish at anything above 4000… especially not given the unseen risks above.

The strongest of these risks are what we see with earnings (especially profits and margins).

However, when we combine the forces of tighter monetary policy with lower profits — it’s not a good recipe for stock prices.

This week we get the latest read of CPI and PPI.

Needless to say the market will be on tenterhooks.

Both are expect to show further signs of easing… but enough for the Fed to tap the breaks?

Probably not.