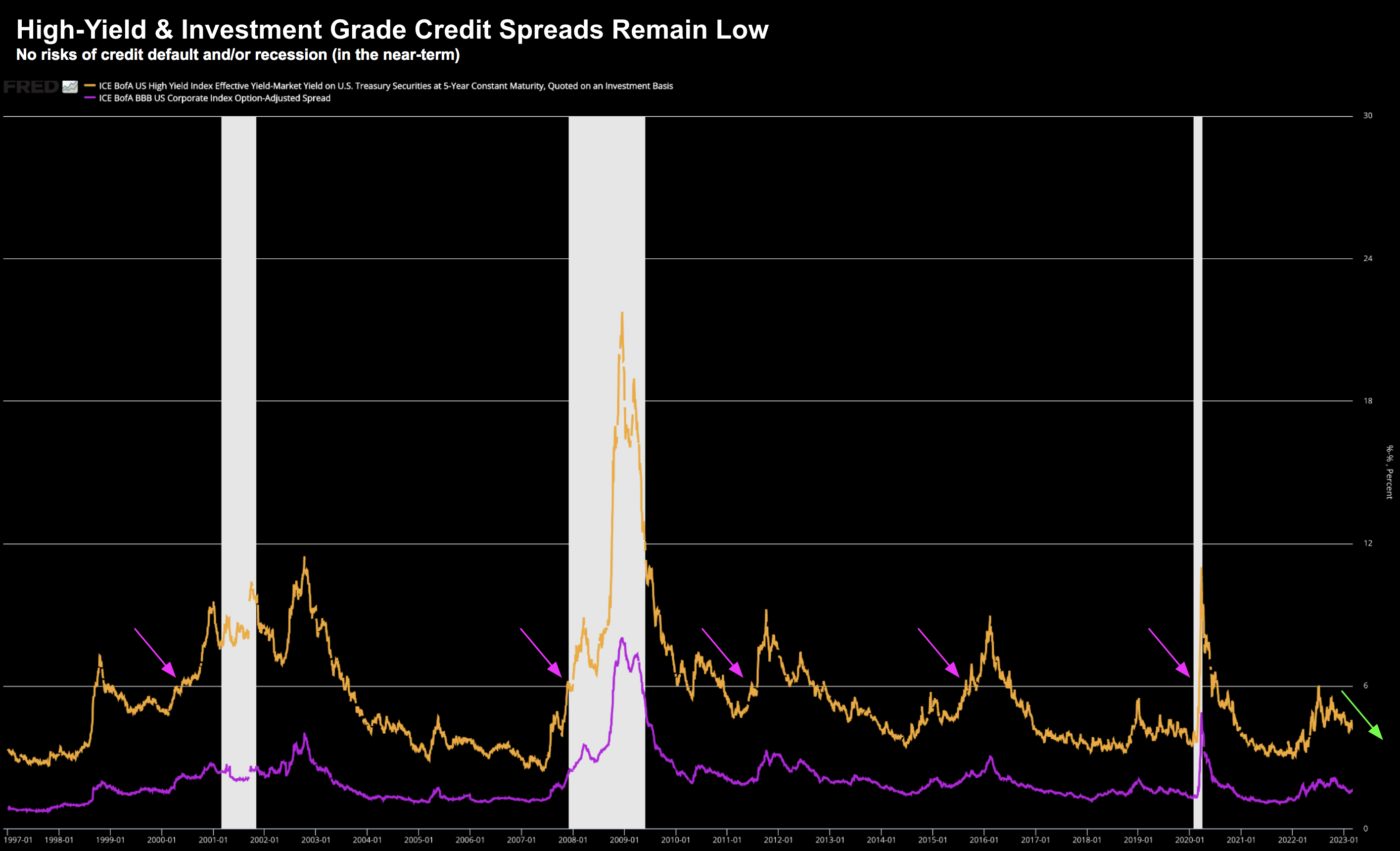

- Credit spreads are not sounding any alarm bells

- Are they complacent? Or is it corporate America in great shape?

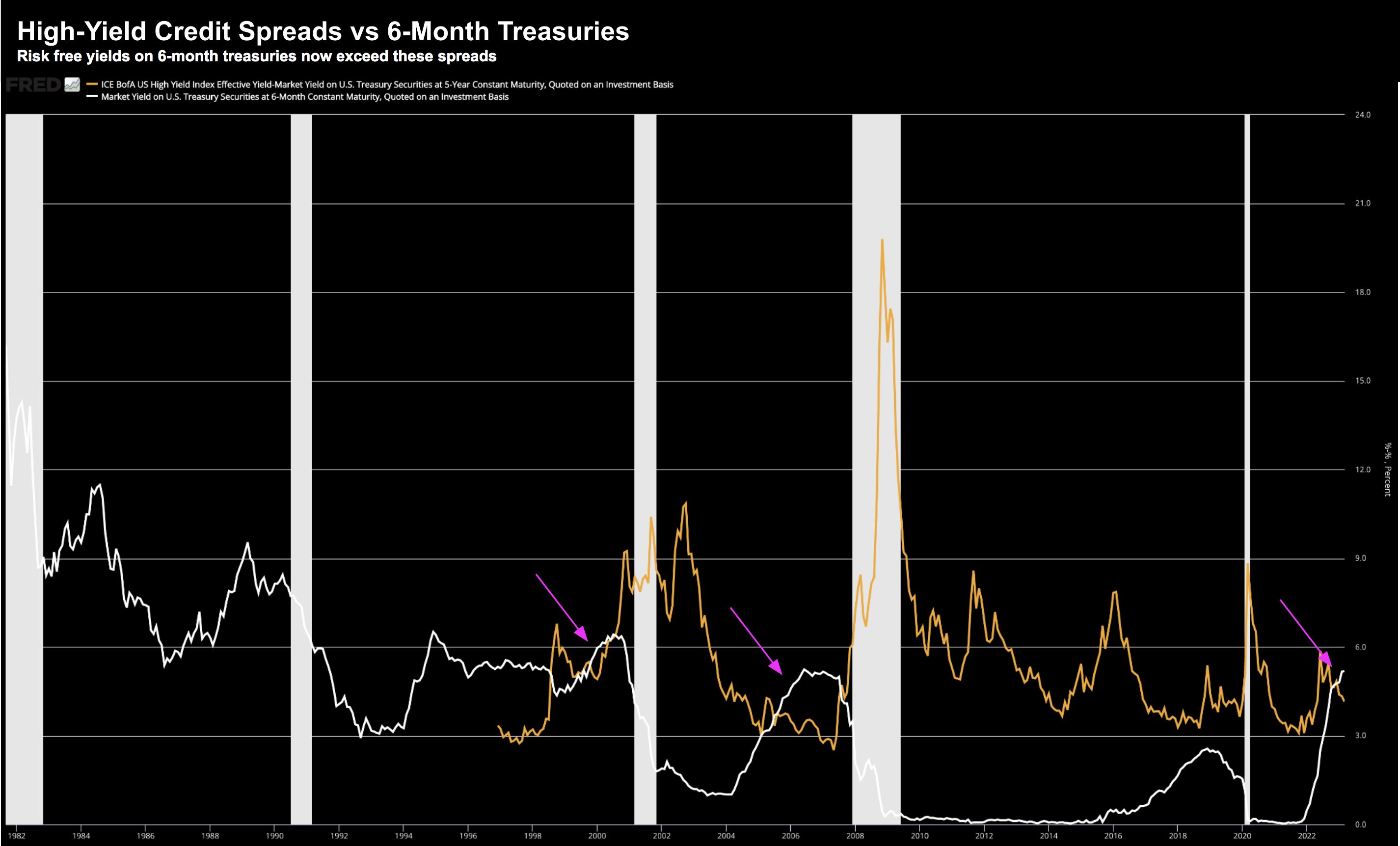

- Risk free rate now above that of high-yield spreads

- those which are lagging (e.g. inflation, employment, GDP); and

- those which are real-time and forward looking (e.g., yields, credit spreads)

Real-time indicators are less cited by the financial media… but are immensely more useful.

Consider bond yields…

Over the past few weeks, not only are they telling us rates likely to be higher for longer – they also suggest the Fed will most likely over-tighten into a recession.

That’s what a deeply inverted yield curve indicates.

We will see if that forecast comes true over the next 9-12 months.

My quick take is that a recession will be the unavoidable consequence (or cost) to kill unwanted inflation.

Did you think $4 Trillion in fresh liquidity at zero rate of interest was completely free?

Some did.

Tonight I’m going to look into credit spreads.

There are few better real-time measures of corporate America’s ‘health’ than credit spreads.

Let’s take a look…

Credit Spreads are Low… Too Complacent?

Over the past four weeks – yields on the US 2-year treasury are up ~100 basis points.

I’ve never seen that kind of increase in my 25+ year investment career.

Then again, nor I have ever traded through a period where CPI was above 9% (at its peak)

Very few people below the age of 65 have….

Given this, it’s worth checking if the higher cost of debt is spilling over into credit markets.

For those less familiar, corporate credit spreads refer to the interest rate premium investors demand to hold corporate debt over safer U.S. Treasury bonds.

Typically you will see spreads narrow as bond yields fall; i.e., a sign of more money going into these securities.

To frame this missive (and analysis) – below is long-term chart summarising:

- ICE BofA US High Yield Debt less the US 5-Year Treasury (i.e., creating the spread); and

- Investment Grade spreads (in purple)

March 6th 2022 (chart this here)

The orange line represents higher yielding spreads.

For example, after a sharp rise last year (where riskier spreads doubled to 600 basis points) – today the equivalent five-year government bonds have calmed down (i.e., absent of any real fear).

Not surprisingly, we see a similar pattern in higher quality investment-grade credit (i.e., purple line)

But for me, here’s where it gets interesting…

If we compare the above to the risk free 6-month treasury (white line) – we find something we have not seen since 2006/07:

March 6th 2022

This raises two questions:

- should alarm bells be ringing? and if not

- is it possible markets are mis-pricing risk on corporate debt?

Maybe credit markets know something I don’t (more on this below) — but this ‘inflection point’ has my attention.

For example, we saw alarm bells sounding at this juncture the last two recessions… is this time different?

Andrew Lapthorne, chief quantitative strategist at Societe Generale SA offered this:

With interest rates much higher and profits falling, you’d think investors would be more concerned about credit risk.

While updating our models, we reached a familiar conclusion: markets seem to be largely ignoring the consequences of much higher interest rates and apparently rapidly evaporating excess profitability.

Sounds logical. And he’s not alone.

For example, I listened to David Rosenberg outline a similar concern to CNBC recently. He feels we’re yet to see the full extent of the “rate shock”… expressing his concern over the trillions in debt which will need to be refinanced at far higher rates.

But John Authers who writes for Bloomberg suggests an alternative take (citing Chris Harvey from Wells Fargo):

The critical one is that consumers’ balance sheets are in much better shape, in part thanks to learning the lessons of the GFC, and in part because households received so much government largesse to tide them through the pandemic.

Chris Harvey, equity strategist at Wells Fargo Inc., suggests that we should trust the credit market as saying that the underlying economy is “muddling along,” rather than in any kind of crisis”

That’s true too – the government was very generous handing out all kinds of money which wasn’t theirs.

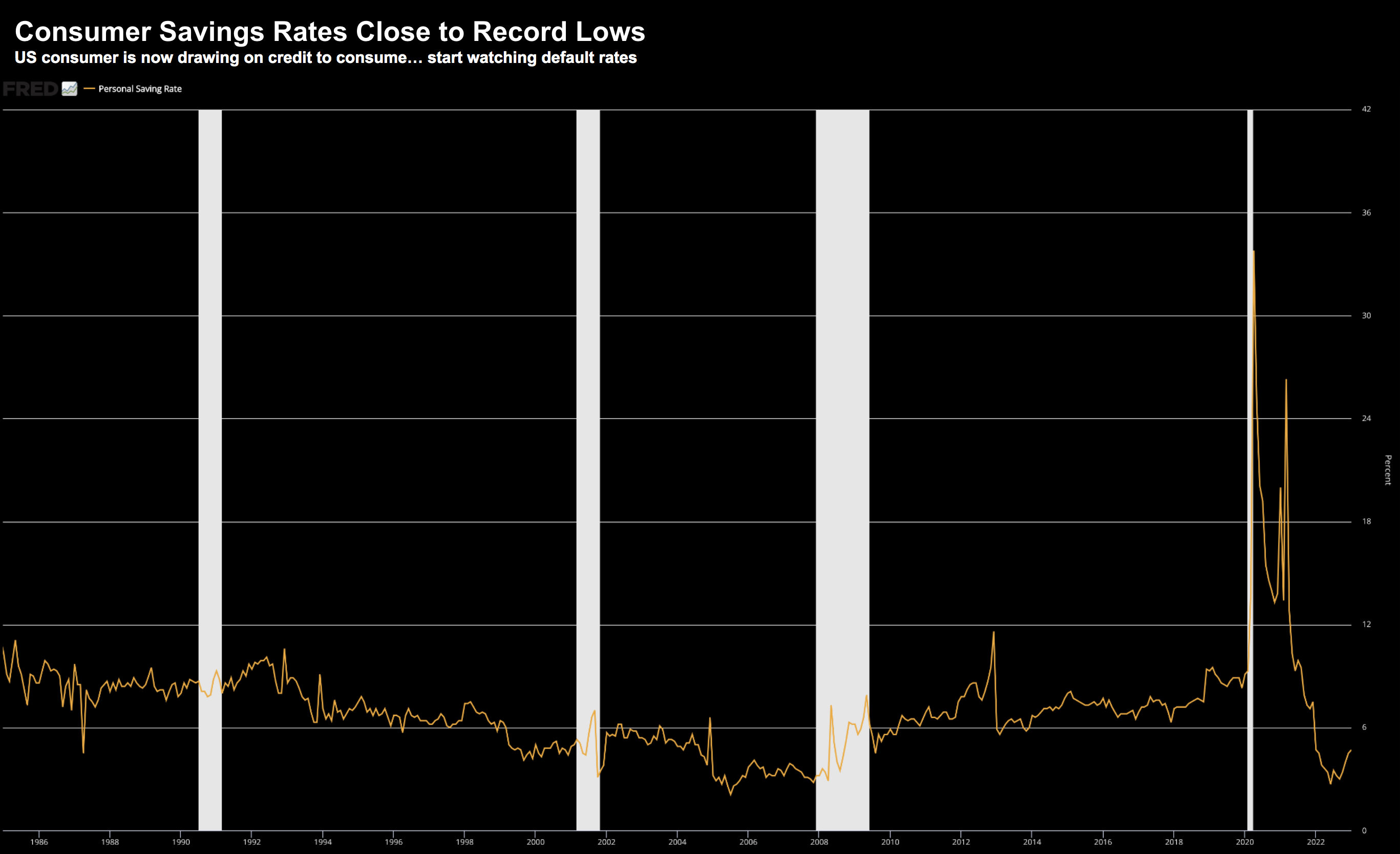

But how much have consumers chewed through those free handouts?

For example, perhaps one measure is the trend (or level) of US consumer savings rates post COVID:

March 6th 2022

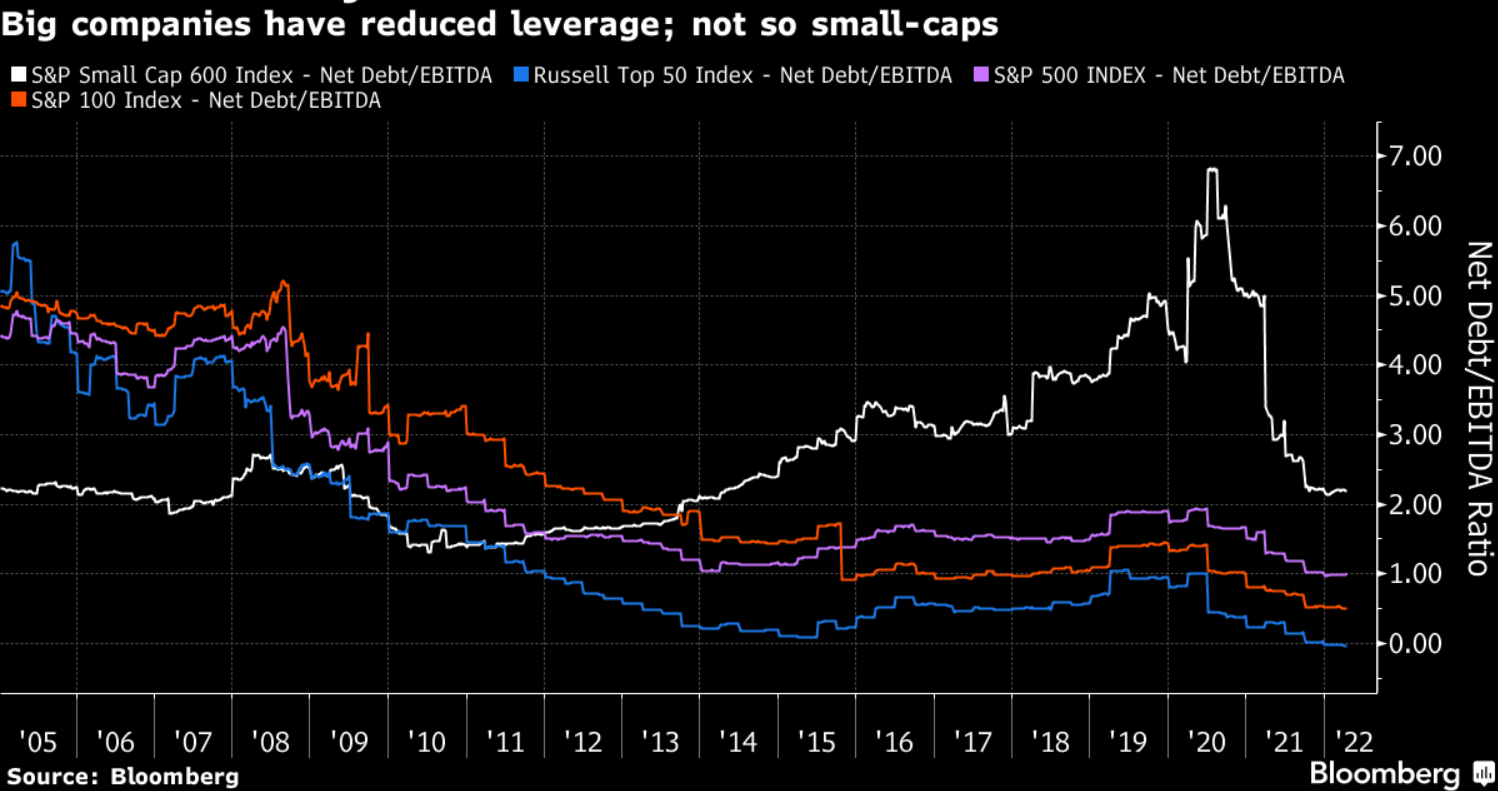

Company Balance Sheets Remain Strong

It’s curious to see credit spreads remain low (in a historical context) despite the rapid rise in rates.

Perhaps part is not just the apparent health of consumers – corporate balance sheets also remains in pretty good shape (for now).

For example, heading into 2008, most companies carried excessive amounts of leverage.

Excluding smaller cap stocks (always risky in a recessionary environment) – this isn’t the case in 2023

Below is what we saw during 2022:

In summary, companies in the S&P 100 have strengthened their balance sheets over a decade later.

You learn from the scars.

If nothing else, this might explain why credit investors are less concerned – despite far higher rates.

Putting it All Together

Credit spreads are a very liquid and reliable measure of the market’s confidence in the future health of corporate profits.

Today, spreads indicate that the debt market thinks the economy is okay in the near-term.

What’s more, they see profits ahead.

That doesn’t mean that equity valuations are justified… however their balance sheets can withstand higher rates.

Continue to keep an eye on this.

For now, there doesn’t appear to be any real pain in spreads.

Not yet…

However, what will that look like with the effective Fed funds rate at say 5.50%? Or 6.0%?

Will alarm bells sound then?

Possibly.

If they do… it will be time to cue the exits.