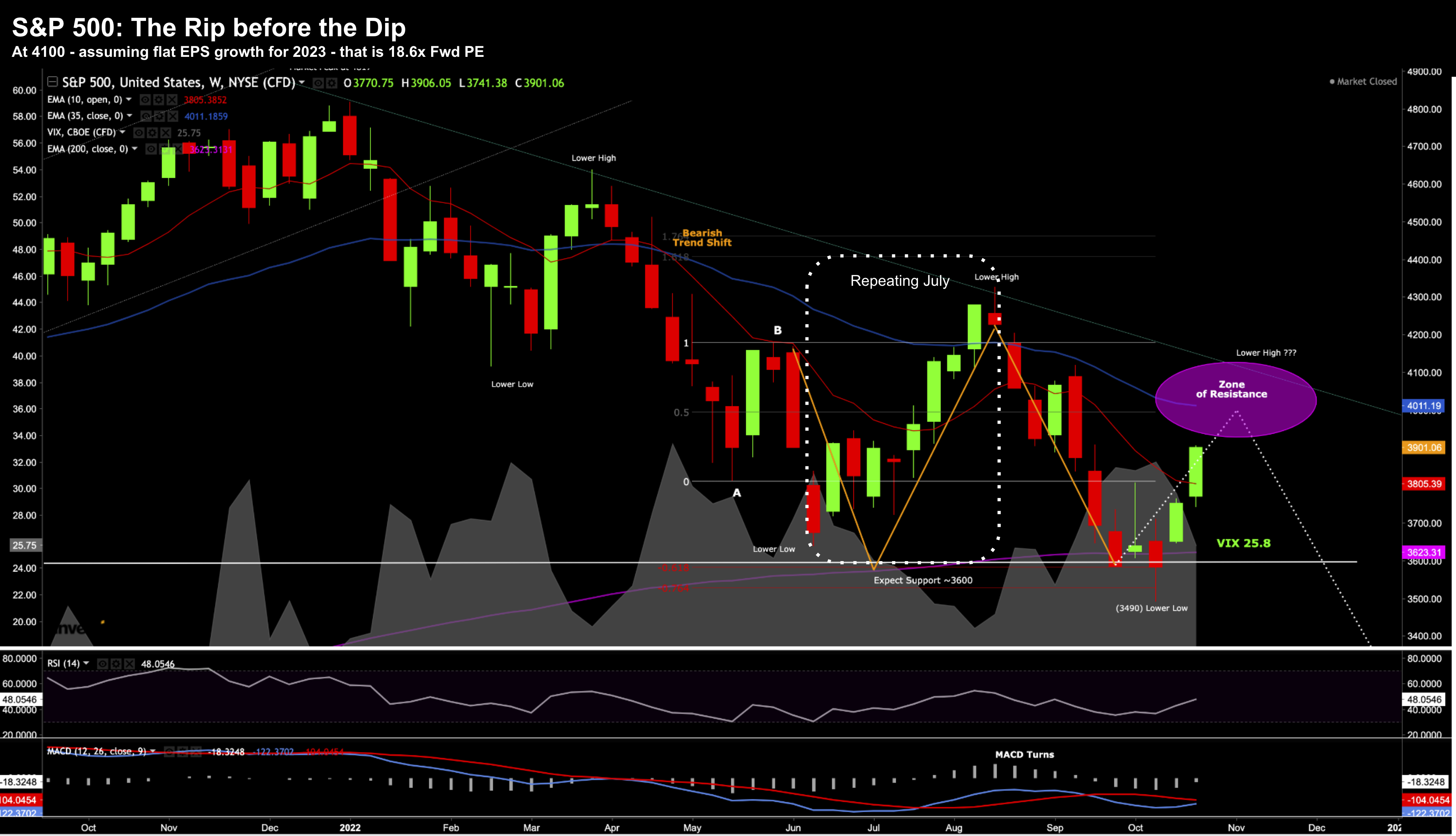

- Bear market rally can go a little further…

- Apple the only big-tech winner with earnings inline and guidance weak

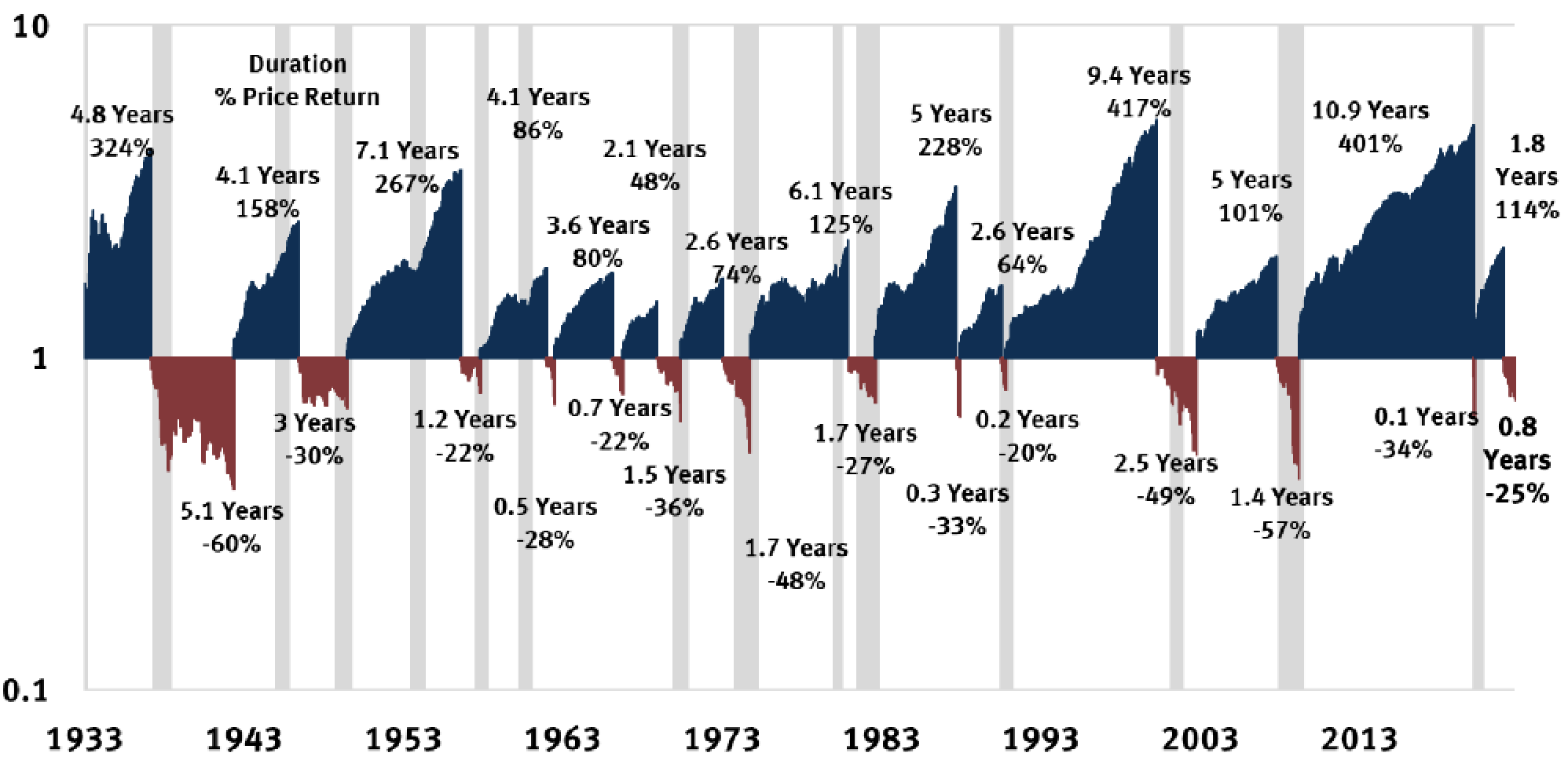

- On average, recessions last around 14 months

It was an entertaining week…

Facebook’s ‘Metacurse’ dropped 30%… Google fell ~10%… Amazon fell ~10%… and yet all three major indexes posted strong gains.

Good fun all round.

But it was the Dow Jones Industrial Average that stole the show.

It was the fourth positive week in a row for the DJIA – adding 5.7% – its best performance since May.

What’s more, it’s up ~15% in just 3 weeks and on track for its best October since the 1970s.

The only other 10% October gains for the Dow came in 1982 and 2002, both breaking bear markets.

The S&P 500 and the Nasdaq Composite ended up 3.9% and 2.2% respectively – held back by weak guidance from big tech.

Earnings reports from the likes of Meta, Google, Amazon and Microsoft did not offer investors much confidence about the year ahead — as revenue, earnings and margins all took a hit.

The only winner from the pack was Apple.

It produced another earnings beat (doesn’t it always?) – with the stock gaining 7.5%.

“Sometimes in-line results are most exciting” wrote JPMorgan analyst Samik Chatterjee in a note Friday.

Hmm mmm.

But given what we heard this week – I would have expected the Nasdaq to lose ‘10%’.

So what gives?

Two things:

(a) it shows how negative sentiment was coming into earnings; and

(b) how much cash was sitting on the sidelines.

Next week get more earnings (expect more volatility) but also the November Fed meeting.

Fed Whisperer – Nick Timiraos – told us earlier this week that 75 basis points is set in stone for November.

However, market’s are now hoping for a less hawkish Fed (e.g., a smaller rate hike for December)

But from mine, whether it’s “75 or 50 bps” in December is arbitrary.

What matters is how long the Fed will hold rates at or above 4.50% next year?

For example, I don’t think it’s a question of how we get there… point is we’re going there.

And rates are likely to stay at elevated levels for some time.

Set to Repeat June / July?

The S&P 500 is up ~11.8% from the recent low.

But this is not the first bear market rally we have seen this year… and it won’t be the last before the recession is done (more on that in a moment)

From mine, it would not be surprising to see us repeat what we saw over June and July (irrespective of what the Fed does or says next week)

October 28 2022

My previous missive highlighted what I felt could be potential resistance in the near-term.

The ‘upper limit’ of that zone is around 4100 (or slightly above our 35-week EMA)

That’s another ~5% from this week’s close – implying a possible peak-to-trough rally of 17.5%

By way of comparison – the rally over June and July was ~16%.

It’s not uncommon for bear market rallies to realize 15% to 25% gain over a few weeks.

For example, we saw numerous 20%+ rallies through the bear markets of 2001 and 2008… as the market continued to make lower lows.

I think that’s what we are working through now.

This is not a rally I’m willing to buy – not with less than 5-10% upside from here.

However, I continue to maintain a 65% exposure, where I was adding some (quality) exposure around 3600.

A Race to the Finish – Who Will Win?

So What’s Changed?

I believe this rally is more ‘technical’ than it is fundamental.

And I say that because the fundamental picture has not changed.

If anything – based on the forward guidance – it’s arguably worse.

For example, how many companies have you heard raise guidance?

Not many.

Now Q3 earnings have largely met expectations (Meta’s obscene cash furnace excluded) – but guidance remains weak (for those willing to offer it).

Personally, I think it’s hard to make the case for earnings expanding next year.

Consider the S&P 500 rallying to 4100 – what will that mean in terms of valuations?

For example, if we assume: 0% earnings growth for 2023 (i.e. where 2022 will finish around $220) — that represents a 18.6x forward PE going into a recession.

18.6x is not cheap.

And it’s especially not cheap if rates are to trade anywhere at or above 4.50%

However, if we assume earnings will contract next year (typically the case during a recession) — the forward PE is higher again.

For example, if earnings contract 5-10% next year – it puts them closer to $210 per share.

At 4100, the forward PE jumps to 19.5x

A multiple above 19x resembles what valuations were closer to January!!

For me, you want to buy closer to 15x (or 16x at the high end) in the climate.

Now if rates were closer to 2% – I would argue for a higher multiple.

But not with rates set to climb into a slowing economy.

And from there, you want to focus on quality (i.e., strong free cash flow, balance sheets, operating margins, competitive moat) – and hold that as both earnings and multiples expand.

Remember:

When the Fed signals to pause rates towards mid-to-late 2023 (maybe early 2024) – we will see a massive pivot into equities.

But not before.

Recessions Typically Last 14 Months

I told him I would find a way to weave this into a blog – so here goes.

A couple of things when I look at this chart:

First it’s important to know that – on average – recessions last around 14 months.

Therefore, if you’re investing with a timeframe shorter than this, your probabilities of success will be much lower.

Good luck!

Second, the average market decline in any recession is in the realm of 30%

However, we also know that when markets suffer a 20% decline — 80% of the time they are positive in 12 months time.

If you extend that to 24 months – markets are positive over 90% of the time.

Therefore, what you want to do is look at quality companies that you want to own for at least two years (ideally longer).

I’ve said this in the past but it deserves repeating…

You need to lengthen your timeframes in this market.

This remains a very difficult environment where you need to be selective.

What worked 12 months ago (i.e. throwing darts at a dartboard) no longer works.

But it will be one which rewards a patient investor.

Putting it All Together

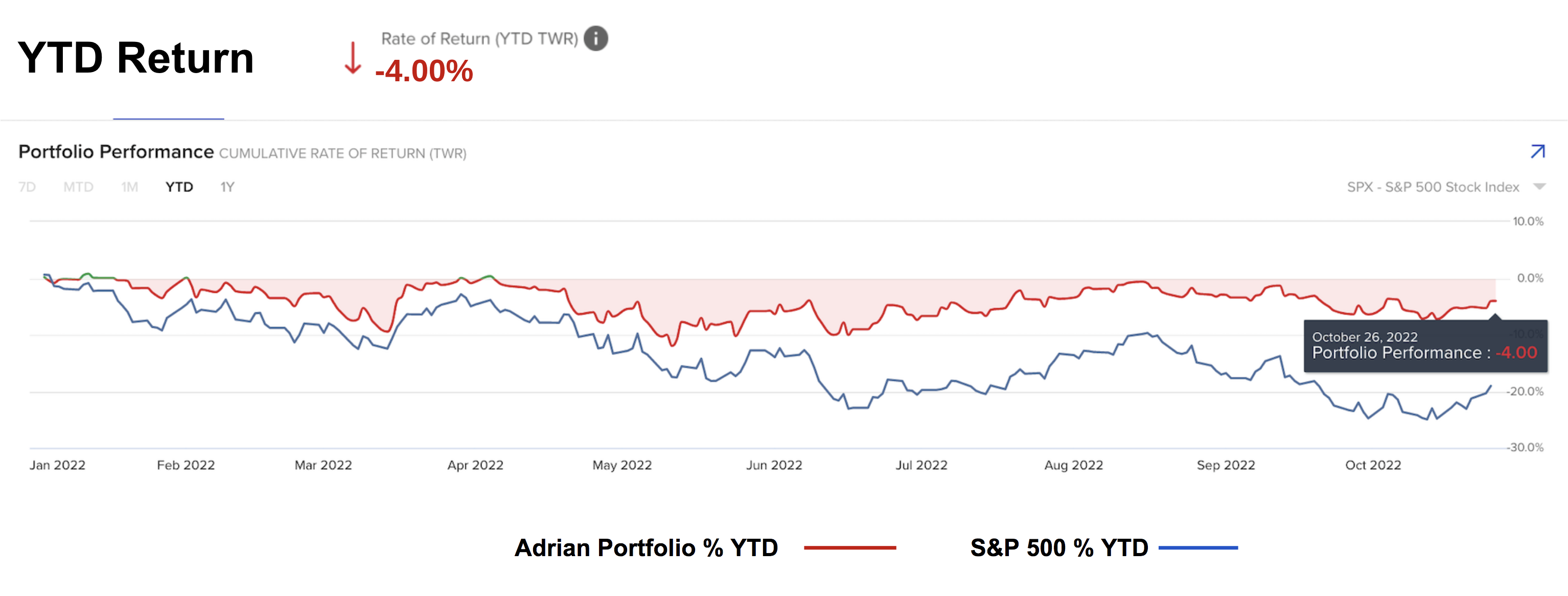

For me personally, it’s been a difficult year to navigate.

I’ve been sharing my thoughts (and strategies) week to week… including portfolio performance relative to the S&P 500

My own portfolio is down ~4.0% – my worst performance in almost a decade.

The last few years it really has been “shooting fish in a barrel” – for which we were all thankful.

It was hard not to make money.

Free money even made Cathie Wood look like a genius (ouch!)

And whilst I knew the returns were outsized — it was not difficult to see valuations were extremely stretched.

As a rough rule of thumb: be very careful if paying 10x sales for ANY company (I don’t care how fast they are said to be growing)

I warned of this in Q4 2021 where I started to take risk off the table.

The good news is multiples have come down.

They had to.

But the “E” in PE is yet to come down.

However, week by week we get more revisions lower.

For example, JP Morgan’s top equity analyst – Marko Kolanovic – cut his EPS forecast next year to flat.

JP Morgan are now at $220 EPS for the S&P 500 – however were previously at $240 (which assumed 8% YoY growth).

In summary, I would use any rally to around 4000 to 4100 to rebalance your portfolio.

Recessions are said to last about 14 months on average — where earnings will contract.

And that is still in front of us.

Remember:

It’s not just what we buy… it’s equally important to buy well.