- Outlining the bullish and bearish case

- The average S&P 500 forecast this year is 4768

- Does the upside reward handily offset the downside risk?

Around this time of year – a wrath of ‘experts’ forecast where they believe the S&P 500 will finish the year.

For me it serves little purpose.

For one, most of the time forecasts are typically wrong (and by a wide margin).

Second, as time goes by, more information will come to hand which often changes our view.

From there, forecasts should be updated.

Third, there are almost always random events which reset the game.

What happens to forecasts then?

They are typically tossed out the window.

4 of the 89 books I recommended talk to this phenomenon and the business of forecasting:

- Fooled by Randomness: The Hidden Role of Chance in Life and in the Markets – Nassim Nicholas Taleb

- The Black Swan: The Impact of the Highly Improbable – Nassim Nicholas Taleb

- Antifragile: Things That Gain from Disorder – Nassim Nicholas Taleb; and

- Superforecasting: The Art and Science of Prediction – Philip E. Tetlock, Dan Gardner

Any serious investor should read these books to gain a healthy appreciation of “forecasting”.

With that said, below is the wide range of forecasts market experts offer for the S&P 500 this year:

| Company | S&P 500 2024 F’Cast |

|---|---|

| BCA Research | 3300 |

| Cantor Fitzgerald | 4400 |

| Scotia Bank | 4425 |

| Wells Fargo | 4700 |

| Raymond James | 4650 |

| JP Morgan | 4200 |

| Morgan Stanley | 4500 |

| Stiffel | 4650 |

| Ned Davis | 4900 |

| BoA | 5000 |

| RBC | 5000 |

| Federated Hermes | 5000 |

| Goldman Sachs | 5100 |

| Deutsche Bank | 5100 |

| BMO | 5100 |

| Fundstrat | 5200 |

| Oppenheimer | 5200 |

| Yardeni | 5400 |

The median (or middle value) of these 18 forecasts is 4950

The average value is 4768

With the S&P 500 current trading at 4763 (Jan 9) – the average value suggests there is potentially little upside.

Put another way, very few see the market posting another “20%” year.

However, there are many that see downside.

Ed Yardeni (the most bullish) sees the market adding around 13.2% to 5400.

On the other side of the coin, BCA Research sees the market plunging 31% to finish around 3300.

What does one believe?

From mine, the best path is to use the ‘wisdom of the crowds‘ – a technique developed by James Surowiecki outlined in his 2004 book “The Wisdom of Crowds: Why the Many Are Smarter Than the Few and How Collective Wisdom Shapes Business, Economies, Societies and Nations”.

He argued the aggregation of information in groups, results in decisions that are often better than could have been made by any single member of the group.

Tetlock’s book “Superforecasting: The Art and Science of Prediction” expands on this – where he collectively studied a group of superior forecasters (and specific methods used to gain very accurate results).

The so-called “superforecasters” also used this method.

In this case, a ‘base rate’ would be in the realm of 4768 (essentially where things stand at the time of writing)

Again, this suggests the upside reward does not handily offset the possible downside risks (which I will expand on shortly).

Here’s what the upside vs downside risk looks like in chart form:

Jan 9 2024

But as I said in my preface, one year is a very short timeframe to speculate.

I personally have very little idea where things will finish this year.

My gut feel is 20% chance of finishing in the realm of 5-7% higher; offset by as much as 65% probability of ~10%+ lower.

That said, I would be a buyer of quality stocks (or the Index itself) on any meaningful dip around the 4100 zone (or lower).

At 4100 – the probability of meaningful downside risk is reduced (and the upside large)

With that, let’s spend some time on assessing the primary risks (which auger well for the bears).

From there, provide arguments in favour of Yardeni’s bullish 5400 forecast.

The Bearish Case

1. Monetary Policy Impact

From mine, one of the largest risks to the bullish case is the long and variable lags of tighter monetary policy (i.e. 550 basis points of interest rate rises and over $1T in quantitative tightening).

These lags are said to be anywhere from 18 to 24 months from when the Fed first started to raise rates (which puts us into the first quarter of 2024).

As we know, the impact of the Fed’s tightening was largely offset last year due to at least three factors:

- $2 Trillion in excess savings (allowing consumer spend to thrive)

- More than 70% of American home owners securing 30-year mortgages below 4% (offsetting any impact from higher rates); and

- Injection of over $500B from the Fed to address the regional banking crisis (a form of QE).

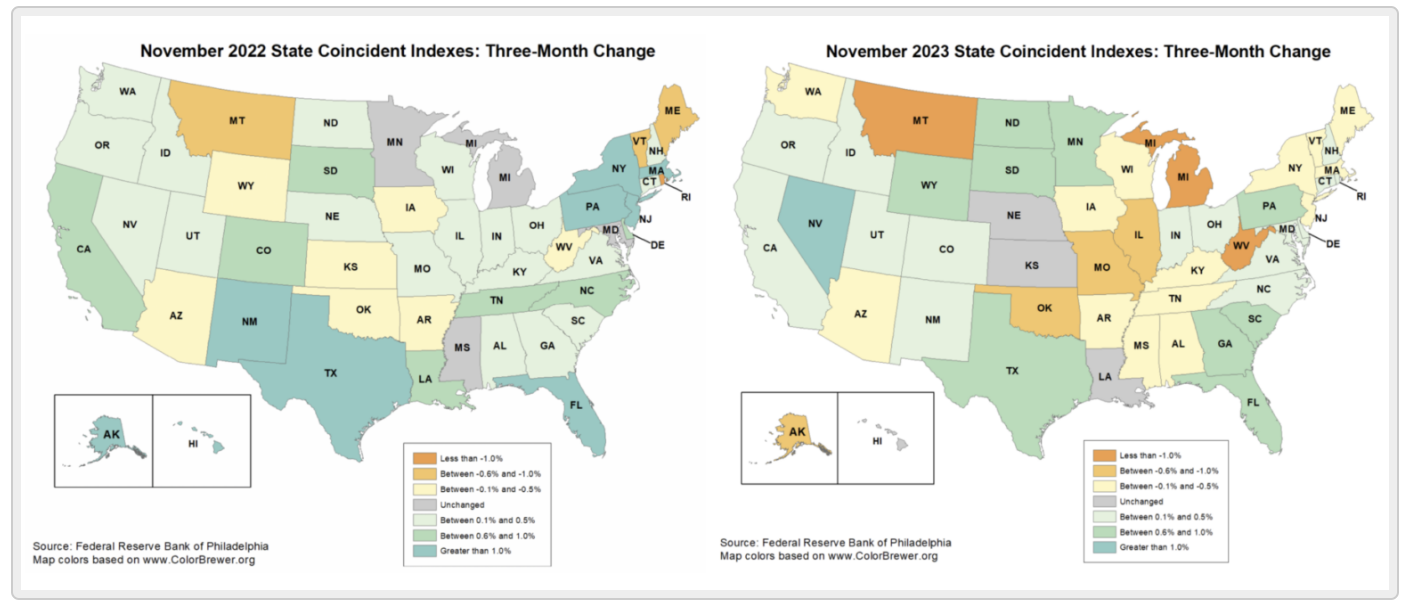

However, things are slowing which is a function of the “long and variable lags” of monetary policy (as I shared in my most recent post with the State Coincident Indicators).

2. Unemployment Moves Higher

Related to the above – another risk to the economy is unemployment increasing.

This will be the trend to watch above all others this year.

For example, recently I explained why the latest jobs report was much weaker than what the headlines suggested.

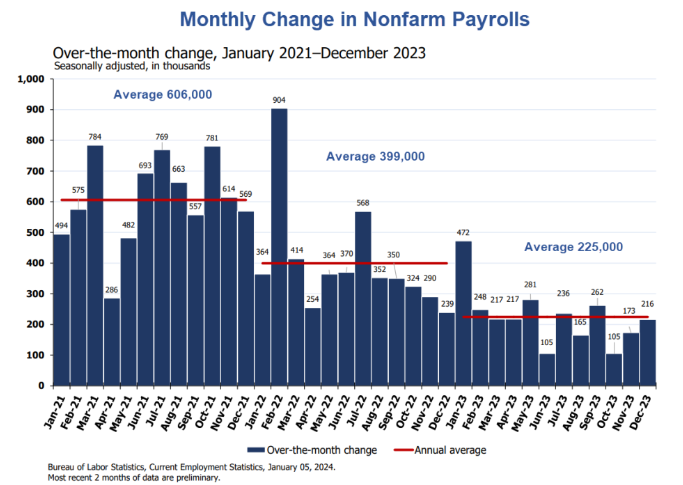

Below we see the declining trend in monthly job additions:

Something like 1.5M full-time jobs have been lost since March last year – with people working fewer hours.

What’s more, the consistent monthly addition of government jobs (to the tune of 50-60K) continues to mask underlying weakness in the private sector.

Should unemployment increase to levels of ~4.5% this year (from 3.8% today) – this will become a concern (perhaps forcing the Fed to cut rates aggressively)

3. Global Slowdown / US Recession

There are ongoing signs that consumers are running out of excess savings and taking on more debt.

Consider US credit card debt…

According to CNBC – credit card balances now total $1.08 trillion, according to the latest quarterly report from the Federal Reserve Bank of New York, a new record.

Over the past two years, Americans’ credit card balances have skyrocketed 40%,” said Ted Rossman, senior industry analyst at Bankrate.

While Americans are managing their credit card debt pretty well, all things considered, we are seeing pockets of trouble at the household level,” Rossman said.

More cardholders are carrying debt from month to month and fewer are able to pay off their balances in full, according to a separate report by Bankrate.com

The market however expects consumers to accelerate their spending next year.

Question is what with?

Beyond the US – Europe has been in a mild slowdown, with “rolling recessions” throughout the continent.

However, China feels like the bigger (global) risk.

Its debt-fueled real estate bubble has officially burst – and there are fresh concerns that their efforts to double-down on manufacturing-led growth will also have unintended consequences (e.g. fueling a new wave of trade tensions).

Arthur Kroeber, head of research at economic consultancy Gavekal Dragonomics, says President Xi Jinping’s vision for China is something akin to a “Leninist Germany,” in which a slower but more stable pace of expansion and a focus on production is preferred to a US-style system.

He expects China’s annual economic growth somewhere between 3% and 4% over the rest of the decade if the current investment and industry-driven policy settings continue.

However, the risks of a Chinese recession are present (especially if trade wars mount)

4. Relying on “The Mag 7”

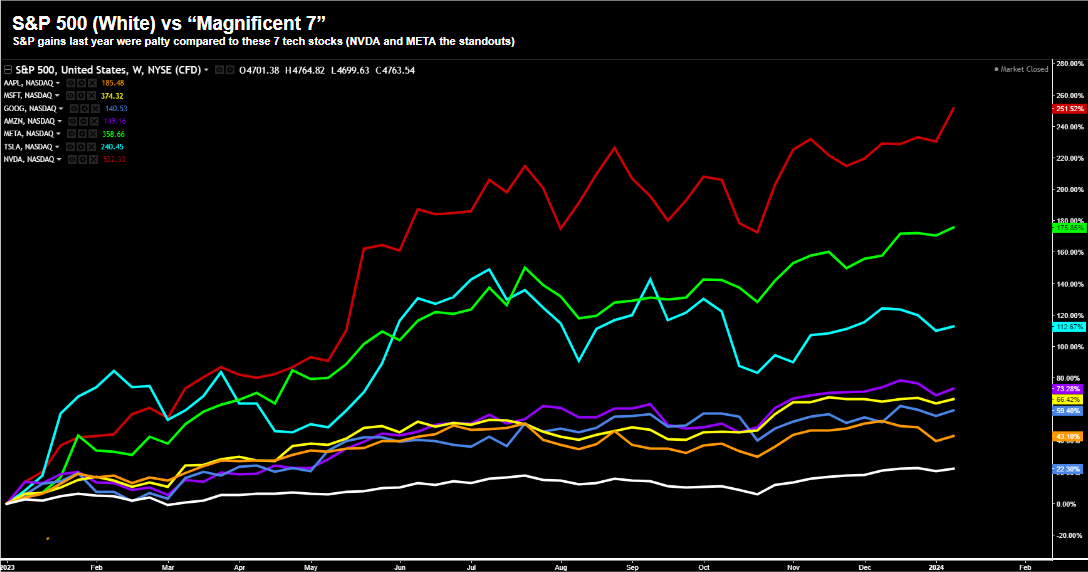

The 24.2% 2023 gains in the S&P 500 mostly came from the so-called “magnificent seven stocks”

For those less familiar, they are (1) Apple; (2) Microsoft; (3) Google; (4) Amazon; (5) Meta; (6) Tesla; and (7) NVIDIA

Below is the performance of each over last year – with the S&P 500 in white.

If you failed to have exposure to these 7 names – it would have been very difficult to match (or exceed) the market’s 24% returns.

The question I have is whether these seven stocks can continue to carry the market (which already trade at very high multiples).

And if they don’t (my expectation) – how will this bode for “10%+”upside in the S&P 500 in 2024 (as Yardeni predicts)?

Best case is weakness in the “Mag 7” broadens out to include more large, mid, and small-cap stocks.

And I hope that’s the case…

However, reality is if 25%+ of the total S&P 500 market weight begins to fail – it’s likely to take the market down with it (or at least minimize any outsized gains).

Note: Apple is already starting to show early signs of weakness on concerns over iPhone sales.

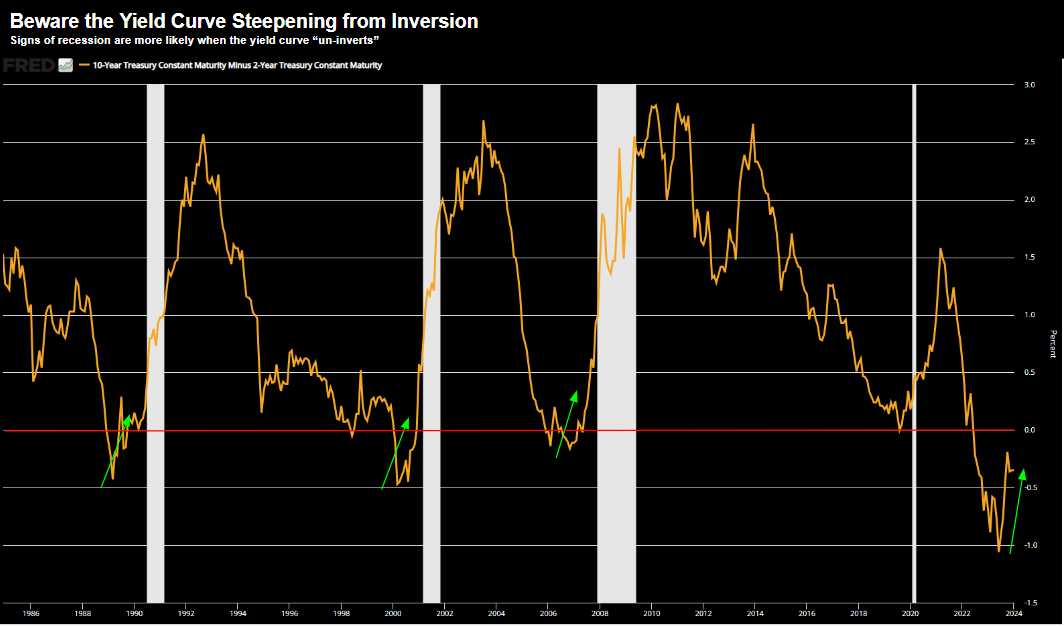

5. Yield Curve Un-Inversion

The yield curve has been inverted since mid-2022.

By itself I don’t think that is a harbinger of imminent recession.

In fact, on most previous occasions, the market has continued to rally whilst the yield curve remains inverted.

However, when the yield curve starts to un-invert, then the market should worry.

For those less familiar, this is when the delta between the 10-year yield and 2-year yield starts to close.

And once we see the 10-year yield back above the 2-year – we have a positively sloped curve (which is normal).

Yield curves are known to un-invert at the start of recessions.

Below is what we find today looking the popular 10/2 yield curve:

The green arrows show the un-inversion of the yield curve prior to every other recession.

Question is whether this un-inverts in 2024?

6. Geopolitical Risks and US Election

From mine, there are a lot of geopolitical risks going into this year.

However, none are being discounted by the market (not yet)

But that’s typically what happens with geopolitical risks… markets will react very late.

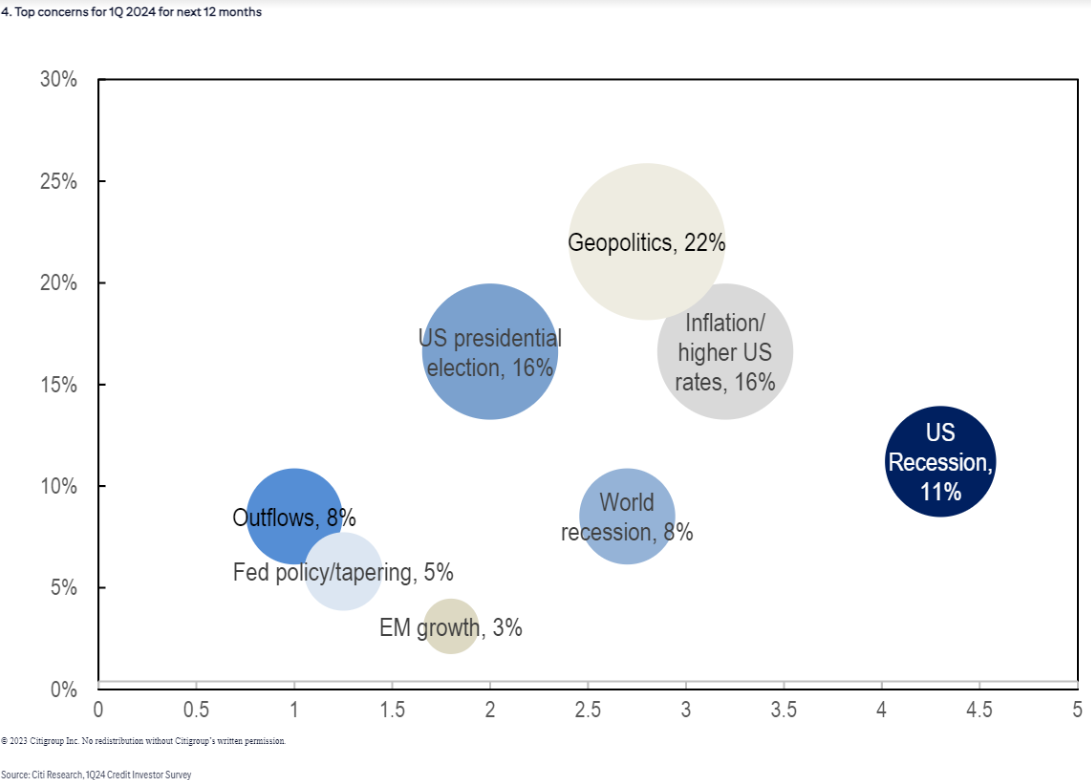

According to Bloomberg, the emerging markets team at Citi polled clients on what they perceived as the top concerns for the year ahead.

Summarized below, the results showed that geopolitics in general and the US election in particular came out ahead of all the more conventional concerns about inflation, growth and monetary policy:

And whilst geopolitical events are very hard to predict – a risk weighting should be applied.

From mine, they are some (not all) of the primary bearish arguments I’ve heard or read.

If one or more of these risks do happen to materialize – it’s very hard to justify a 20x forward multiple for the S&P 500

What’s more, we would need to discount the 12% EPS growth the market currently assumes.

Let’s now turn the page and look at why folks such as Tom Lee at Fundstrat and Ed Yardeni see as much as 13% further upside for the market next year.

I’m sure these guys recognize the risks above – however they lean towards the bullish case.

And they have a number of good reasons to…

The Bullish Case

1. Trade the Tape

Let’s start with my blog’s namesake…

As we start this year – the weekly (and monthly) trend remains bullish.

In other words, that’s where momentum is today.

With a bullish tape – we should lean more towards to the potential for upside.

But there’s more…

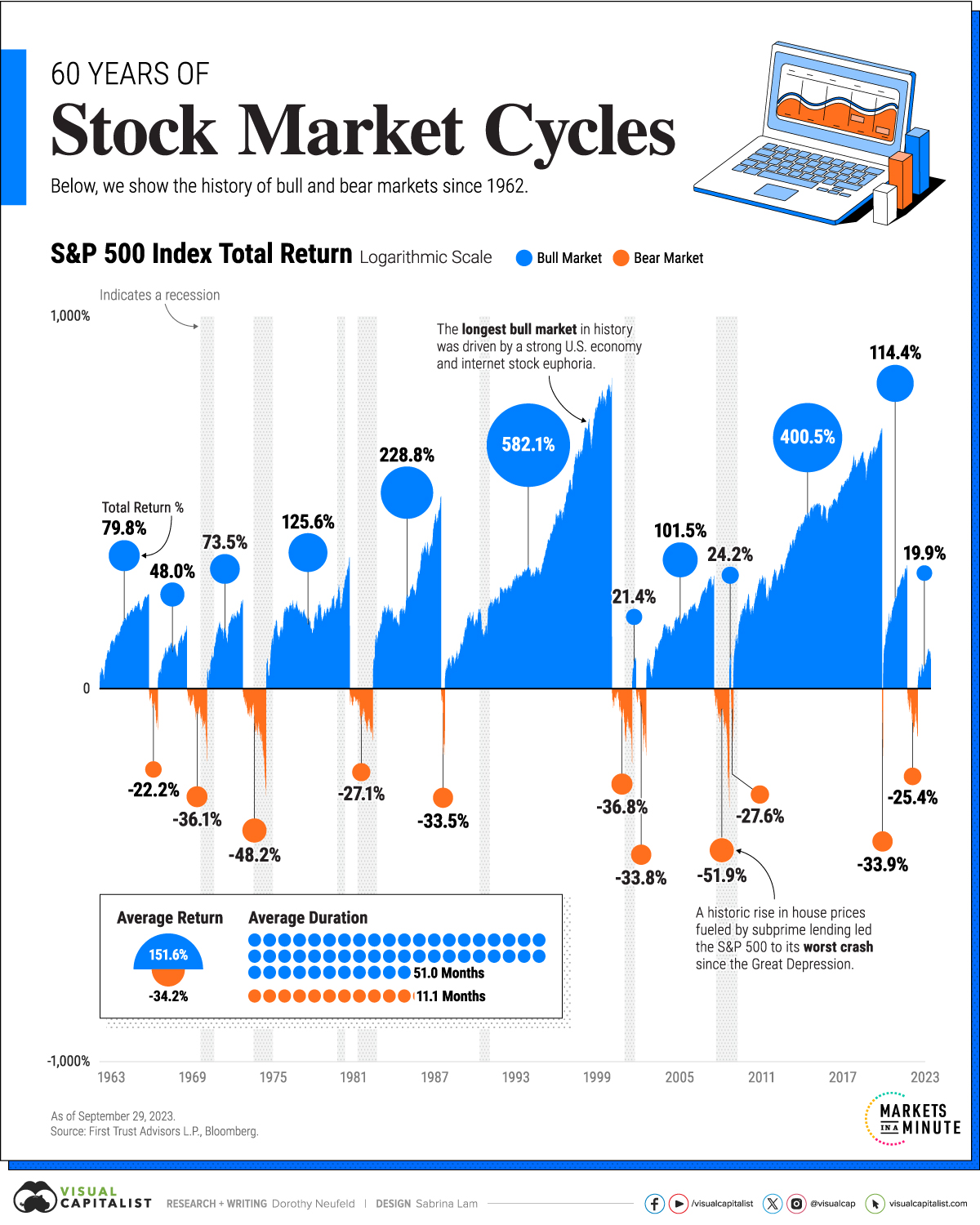

Since 1928, years with gains of over 20% were followed by an average gain of 5.9%.

Good years tend to cluster together.

For example, take a look at this chart from Visual Capitalist:

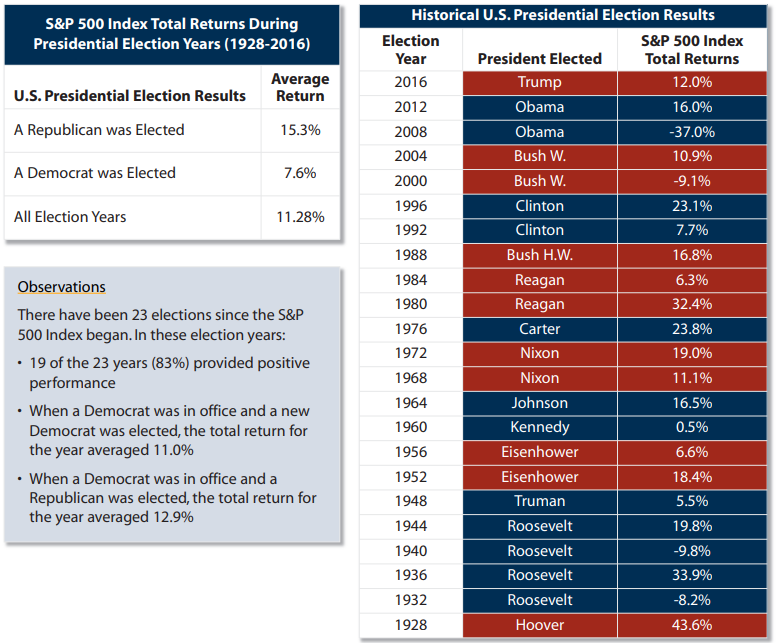

2. Election Years are Typically Good for Stocks

Somewhat related to the above chart – election years are typically positive for stocks.

They are said to be positive 83% of the time

On average, the market returns over 11.3% during an election year.

Below is some compelling research from the team at Morgan Stanley:

3. We Avoid Recession

This is arguably the single largest reason to maintain a bullish lens.

For example, Ed Yardeni and Tom Lee (Fundstrat) both believe we will avoid a recession in 2024.

And we might…

For example, if we exclude recession years, after a strong (double-digit) year, subsequent year gains averaged 9.7%.

However, during recession years losses averaged 10.1%

In summary, negative return years are far more likely with recessions.

I would guess that every analyst who forecast the S&P 500 would decline this year is also expecting a recession.

Since 1928, markets have fallen in non-recessionary years only 16 times (note – 2022 was one of those exceptions).

In other words, it’s a rare event to see market’s decline if we avoid a recession.

My base case for 2024 is we will not avoid one.

4. Inflation is Done

You might have wondered why you didn’t see “inflation” under the list of bearish reasons.

In short, I don’t think it’s a meaningful market risk.

Inflation has likely peaked.

And whilst it could easily remain stubborn (above the Fed’s 2.0% target) – anything below 3.0% core will not pose a major threat to markets.

Yardeni correctly pointed out last year:

“Inflation tends to be a symmetrical phenomenon. It tends to come down as quickly or as slowly as it went up when measured on a y/y basis. We can see this consistent pattern in the CPI inflation rate for the US since 1921”

n addition, Jay Powell essentially declared victory over inflation at his last FOMC address with the comment “we see up to three rate cuts next year”

Powell would not have uttered those words if he saw inflation as a major threat.

And whilst there could be an inflation head-fake in 2024 – I think that remains a lower probability event.

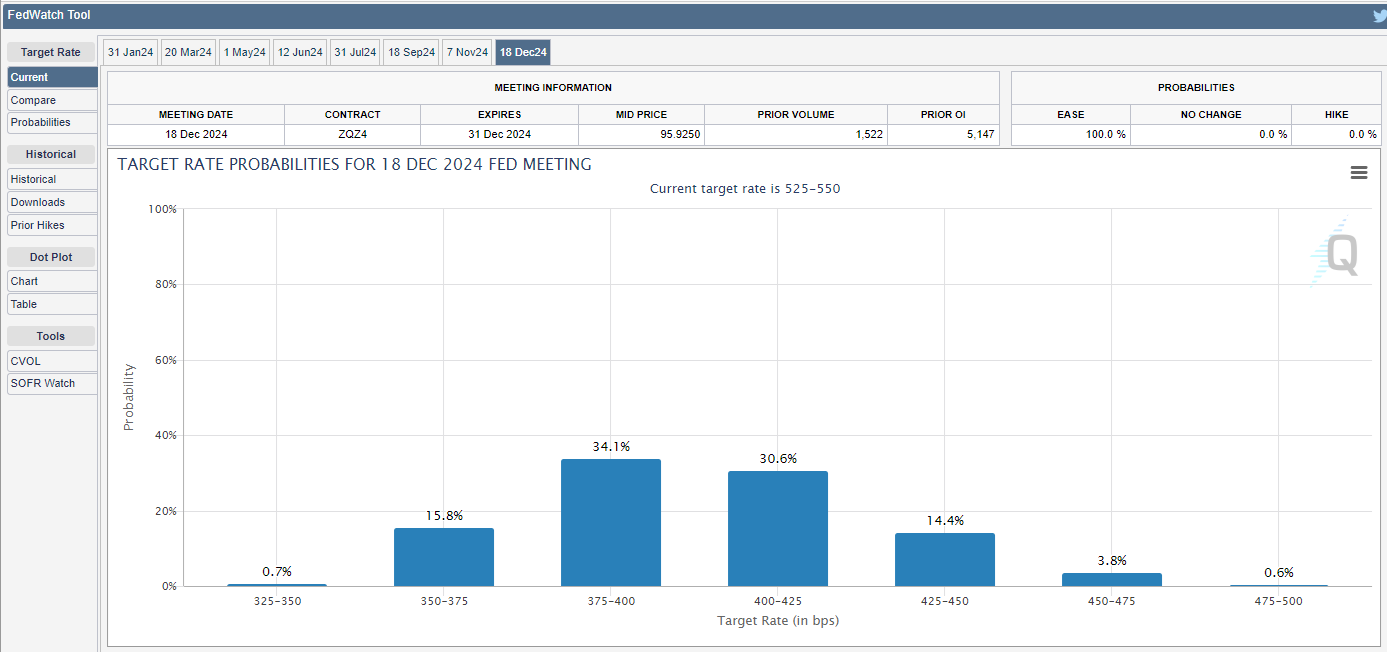

5. Rates Have (Finally) Peaked

And the Fed is done… finally!

Following Powell’s most recent address – the market is pricing in somewhere between 5 and 6 rate cuts next year.

Below is the CME’s Fed Watch Tool:

If so – many believe this will be bullish for equities.

Maybe…

For example, the counter argument is the start of the Fed easing cycle is often bearish for equities (as it implies an economy in need of assistance)

Nonetheless – for now equities are excited that the Fed is largely out of the picture and rates have peaked.

Put another way – if the market felt the Fed had not hit its terminal rate – that would be bearish.

Putting it All Together

Forecasting is a very hard business.

I strongly recommend you read the books I suggested above (they will help)

The world is a very random place.

And where there are unknowns – there will always be uncertainty.

Those who think they know where the S&P 500 will finish next year are kidding themselves.

No-one knows.

Besides, one year is an incredibly short period of time to make a forecast.

For example, if you asked me where the S&P 500 was likely to finish in 10-years time, my guess would be in the realm of 10,700

How did I get that?

I applied a CAGR of 8.5% over 10 years from a starting value of 4750.

Not only do we need this timeframe for longer-term secular trends to play out – but it also allows for various random events to normalize.

There will be random events this year that no-one is talking about.

And we should expect it.

The “unknown unknown” events will potentially derail the market and people’s 12-month forecasts.

But it’s those type of events which potentially create opportunity over the long-term.