- Keep your powder dry…

- Market starting to feel too complacent; and

- Wishing my US readers a Happy Thanksgiving

Wall St has largely powered down its PCs for the week.

Thanksgiving week is traditionally quiet – despite the skew towards bullish seasonality.

And with only ~5 weeks left in the calendar year – most traders are thinking more about positioning for 2023 – versus trying to squeeze an extra “5%” or so before year’s end.

Here’s a funny (useless) stat:

If you’re trading (and I’m not) – over the past 50 years – the two best days (during Thanksgiving week) to be long stocks are Wednesday (today) and Friday.

According to Schaeffer’s Research – Wednesday has returned a net gain 78% of the time, while Friday’s been positive 66% of the time.

I’ve always said you can find “any stat” to suit your narrative (just ask a politician!)

Long-term (and repeating my sentiment from previous missives) – I think we make a new low in 2023.

And to that end, I am leaning towards the first half of next year.

This will mean markets will most likely remain volatile over the next few months.

However, I also believe the market will turn decidedly more bullish as we work our way through 2023.

Why?

Because we will most likely be in the midst of a recession – where markets work ~9 months in advance.

At that point, rate cuts will likely be on the table (as early as H1 2024)

In other words, I think 2024 will see economy’s turn for the better (i.e., where we start to see earnings expand)

However, well before the Fed moves to cut, equity markets will have advanced 15% to 20% (at a guess). It could be a lot more.

But in between now and then – keep some powder dry.

Smart investors know that bear markets are difficult trading environments.

As the old saying goes “bear markets are still tough for bears!”

The idea is not to lose too much money.

Consider someone like Cathie Wood…

She might be right with some of her ‘disruptive thesis’ on names like Tesla, Zoom, Coinbase, Shopify and others.

Time will tell…

And she loves to remind us that her timeframes are at least 3+ years…

That’s all fine and dandy…

But with a bit of rigour opposite valuations and trading discipline – she could have bought these names a lot cheaper than when she did.

Nov 23 2022 – Poor Rigour / Risk Management from ARKK

More on Cathie in my concluding remarks (where I focus on one particular poor example of bad execution)

Above all else, what I have done this year is two things:

- Protect the 15-20% gains I’ve enjoyed the past few years; and

- Only placing trades when the environment was in my favour (e.g. when we saw the S&P 500 pullback to 3600)

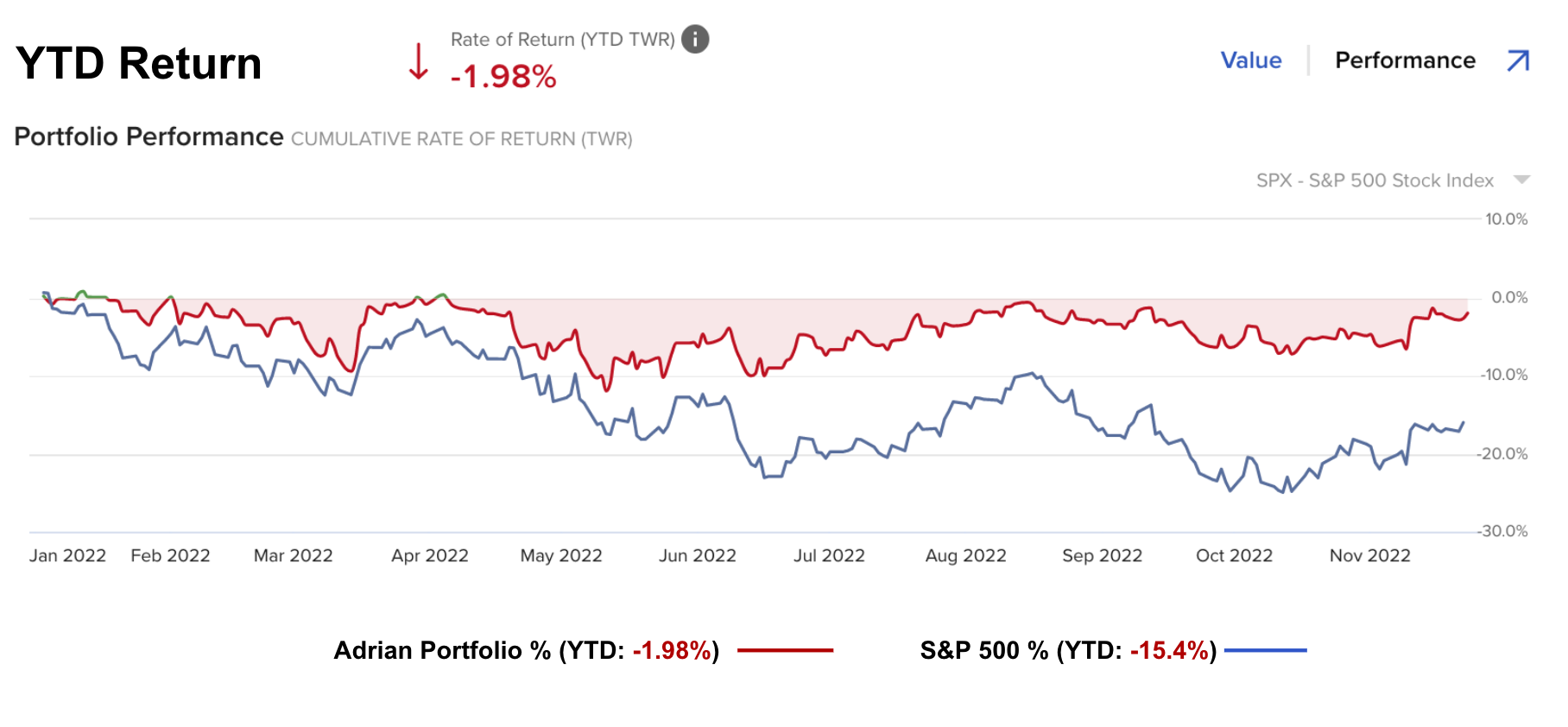

At the time of writing, this has seen me outperform the broader S&P 500 this year by ~14%

Nov 23 2022: Race to the Finish for 2022

It’s good… but not great (great would be positive!)

But that’s also a lot better than the (highly paid / widely followed) Cathie Wood!

Perhaps the most important thing I did right was meaningfully reduce my equity exposure in Q4 of last year (when I warned readers that Q1 was likely to see a major pullback).

For example, I shared my thoughts that it would pullback somewhere in the realm of 10-15%… it turned out to be far more.

With that, this is what I’m watching now as we wrap up an ‘eventful’ year.

Keep Your Eye on the VIX

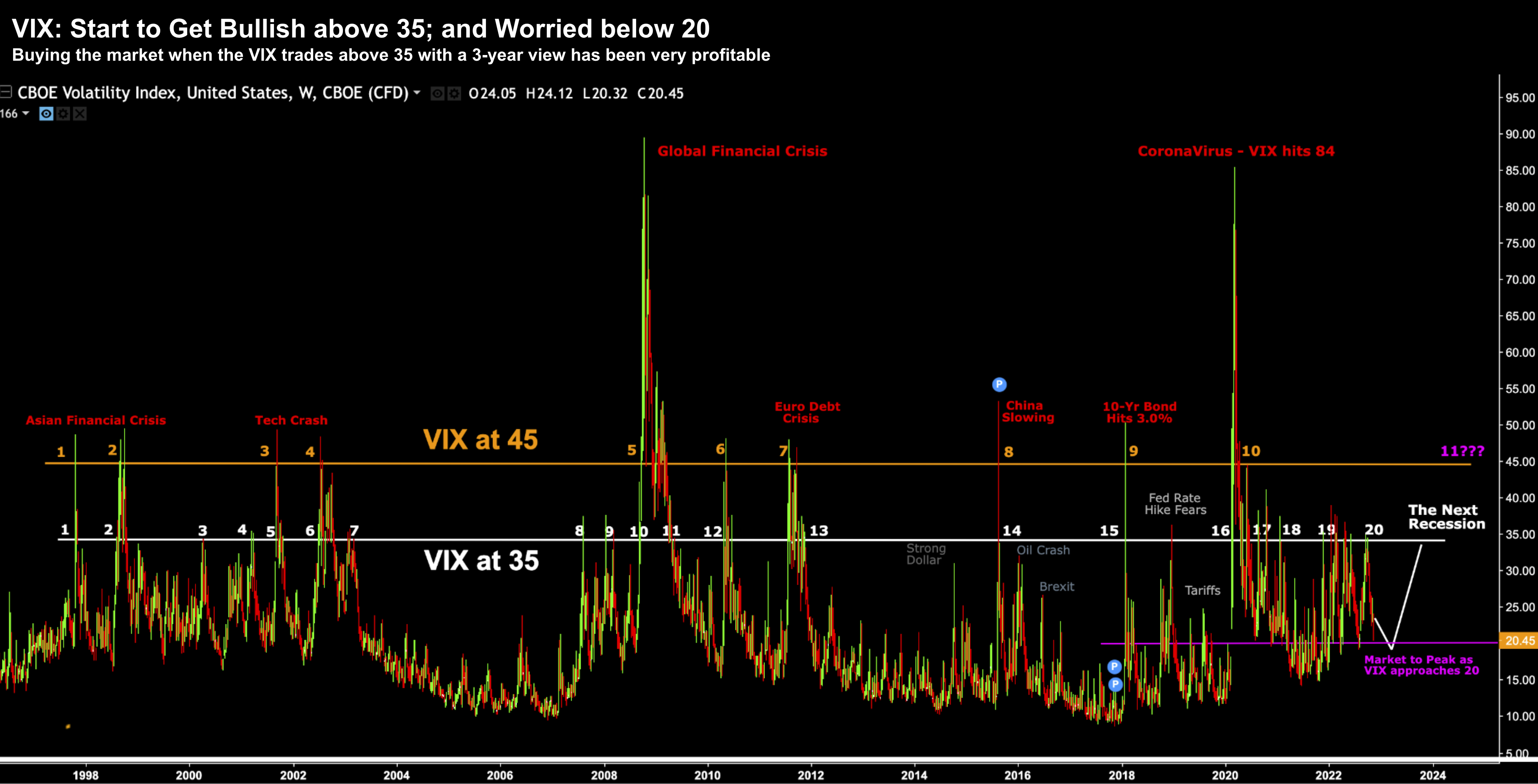

As a preface, one of the better sentiment indicators you can watch is the fear index (i.e. the VIX)

Personally, I think the use of the nickname ‘fear index’ is lazy – as it’s simply a measure of volatility (not simply put options to protect you from downside)

As I’ve shared in many posts over the years – when the VIX moves above 35 – it’s a good indicator there is ‘panic’ in the market.

However, when it moves above 40 – panic is extreme.

That’s the time to get excited!!

Based on historical data – buying the market when the VIX is at 35 or above – has been very profitable if held for 3 years.

And in many cases, it’s proven to be profitable within 12 months.

On the other hand, when the VIX trades below 20, it’s a sign of complacency.

Similarly, if we see levels of 12 or below, complacency is extreme.

Here’s a chart I’ve used several times – which labels the various ‘panic’ events over the past 20+ years (e.g., where the VIX spiked to at least 35)

Nov 23 2022

We can see that investors had 10 opportunities (from 1998) to buy the market at extreme discounts.

Put another way, it’s almost once every 2 years or so.

And my thinking is another occasion will come next year…. where the VIX will trade at least 35 or higher.

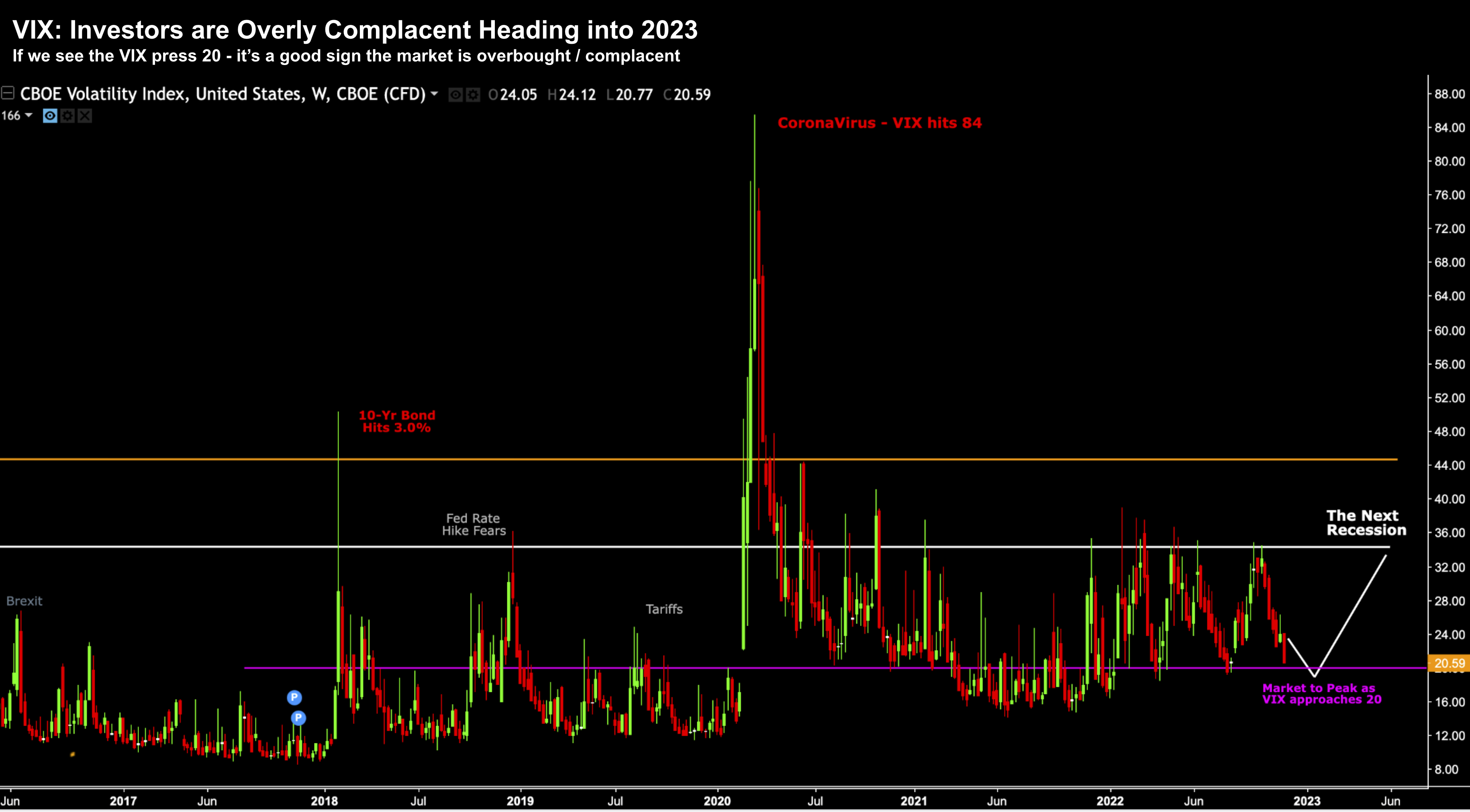

But let’s look up close…

What I see today is the VIX making its way back to 20…

Nov 23 2022

This is widespread complacency… that’s dangerous.

It’s how you lose money quickly.

This also tells me that the market is getting closer to making another near-term high (i.e. around the 4100 zone as I’ve highlighted)

So far this year, the VIX has pulled back to around 20 on 4 separate occasions – found support – and then spiked.

I think we could see something similar again.

To be clear, the VIX could very well trade down to say 17 to 19 given the strong seasonality of the market.

This is often a bullish time of year (especially in a mid-term election year)

But if we were to see that, it would only reinforce (to me) the near-term highs are close.

I could be wrong, but I think we see the VIX remain complacent for 2-3 weeks before ripping higher.

And if that’s correct – be prepared for the next leg down.

Market Higher into the Holidays

It’s not unusual for the market to trade higher this week.

To that end, not much has changed from the commentary / forecast I’ve been sharing the past 8 weeks or so…

Nov 23 2022

The VIX is highlighted in dark grey – where:

(a) it bounced from ~20 (green arrows); and

(b) corresponding peaks in the bear-market rallies

I could be wrong – but this feels like it will be something similar (not unlike what we saw in June).

At the time of writing, the S&P 500 is trading around 4028, up around 15% off the October lows.

If it were to get to 4200 – that’s ~4% of upside – which would also imply a VIX below 20.

What’s more, 4200 represents a forward PE of 20x (based on $210 EPS next year; i.e., 5% decline on 2022)

For my money, that’s not attractive.

If anything, the market looks equally as expensive as it did in Q4 2021 — where the forward PE for the S&P 500 was ~21x.

All that’s changed is earnings expectations have come down a little (e.g. from 8% YoY growth to about 4% for 2023).

But I think they will contract by at least 5% next year (and not expand by 4%)

Where:

$210 EPS x 15.5 Fwd PE = 3255

That’s ~20% below where we trade today….

There’s your risk reward equation: 4% upside vs 20% downside risk.

I’m not taking that bet.

Putting it All Together

Don’t get me wrong – this game is hard.

It takes discipline.

Even some of the best fund managers are posting double-digit negative returns this year.

How did your fund manager do? How did your 401K or Super Fund do?

Was it positive?

If my fund manager posted a loss of 15% or more – I would probably sack them.

Good thing I don’t have one.

Now for perspective, about one year ago, when the S&P 500 was trading around 4,700 — Goldman Sachs thought a 2022 year-end target of around 5,100 seemed reasonable.

And they were not alone.

Fast forward 12 months and Goldman is saying that 4,000 seems like a good target for year-end 2023.

That’s 12 months from now.

I can understand how they came to that conclusion. For example, if we assume:

- we finish 2023 at $210 per share (i.e., 5% contraction on 2022’s ~$220); and

- 8% EPS growth into 2024 (i.e., where 4,000 offers a fwd PE of 17.6x)

Sounds reasonable with rates around 4.50% or so (that will be key)

But the business of forecasting is a fool’s errand.

What is far more important is you stay consistent and disciplined in your execution.

That’s what I have done throughout the course of writing this blog for 11 years.

Hopefully some of that discipline has rubbed off on you.

Before I close, a couple of words on Cathie Wood…

She has had a terrible time of things the past 12 months (all of it self-inflicted).

Again, she might be correct that the companies she invests in are creating the future.

Time will tell.

But her ‘good work’ is undone due to her lack of investing discipline.

What Cathie does is she continues to double-down on many losing bets.

Typically that doesn’t end well.

Take Coinbase (and it’s not the only example)

After buying hundreds of thousands of shares of COIN from $234 all the way down to the low-$50s — Cathie turned around and sold 1.133 million shares on July 26, 2022, around $54.

Ouch!

She then purchased more than 207,000 shares on November 9, 2022, in the mid-to-high-$40s and another 255,000 shares on November 18, in the mid-$40s.

Why?

Put another way, why not just wait until the market has given you a better indication it might be closer to forming a bottom? And until then, continue to watch it drop like a rock (as it’s doing).

Heck, the stock may be “$20” in a few weeks for all I know? Does she simply buy more? How about when it hits say $5… do you keep buying?

Again, Coinbase may have an exceptionally bright future in the world of crypto exchanges.

I honestly don’t know as it’s not a space I’m particularly interested in (fortunately!).

Blockchain yes. Bitcoin less so.

Here’s the bottom line:

With her fund down 78% from its highs – her approach needs ‘tweaking’ to say the least (especially in an environment where stocks that lose money are crushed opposite tighter monetary policy)

Put it this way… if my fund’s performance was down 78% this year (vs being down just 1%) — I would probably stop writing this blog (advising people to do the opposite of what I was doing!) Right?

In closing, stay patient folks.

Keep a little powder dry… even if it’s as little as 20% of your portfolio.

My best guess (and it’s only a guess) is we are getting closer to a near-term top.

To my US readers – have a wonderful Thanksgiving ahead.

And I am very thankful for all your feedback and words of support… I really appreciate it.

I read every email I receive….