- Bear Market Bounces

- Walmart ratchets down earnings for a second time

- So what does this say about the US consumer?

So far we’ve had a nice rally in July… and it could go further.

That’s the good news….

However, I also know that bear market rallies of “10% to 20%” are par for the course.

For example, I showed what happened during 2000 and 2008 here – as markets ‘zig zagged’ their way to a peak-to-trough 50% declines.

2000 saw no less than 7 such rallies…

Now I wonder how many times someone tried calling the bottom?

For example, I bet it looked good after the ~21% rally from Sep 2001 to Jan 2022… but another lower low was ahead (n.b., notice that the weekly bearish trend didn’t change despite the run)

If I look at the market today… none of the ‘turnaround’ signs are there yet.

July 25 2022

And while I don’t see the market shedding “50%” from peak to trough in 2022 (3636 is ~24% lower) – I think the ‘eventual‘ bottom is ahead of us.

And my conviction went a notch higher today after Walmart’s “surprise” announcement

Walmart Slashes Guidance Double Digits

Before I get to Walmart – earnings (so far) for Q2 are mostly coming in as expected.

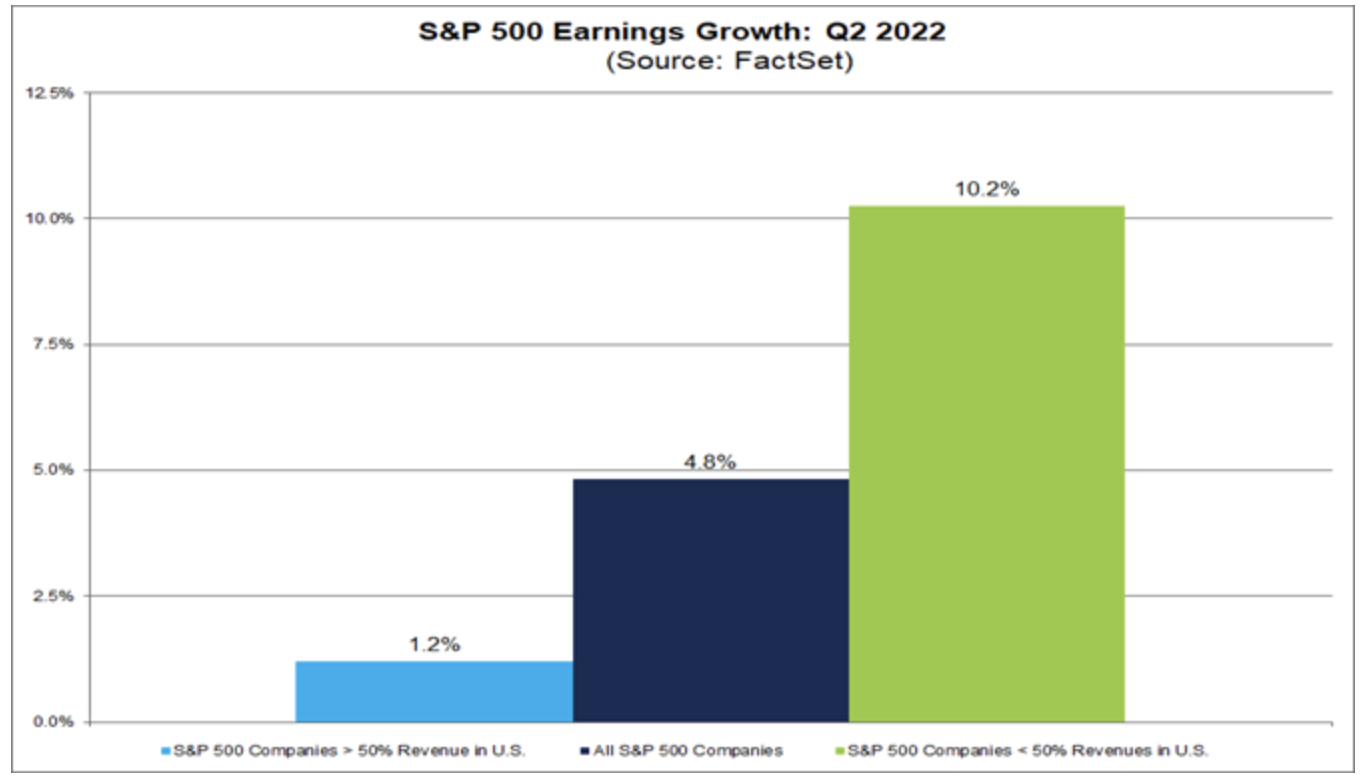

Below is the latest from Factset’s earnings insight:

The blended (combines actual results for companies that have reported and estimated results for companies that have yet to report) earnings growth rate for the S&P 500 for Q2 2022 is 4.8%.

For companies that generate more than 50% of sales inside the U.S., the blended earnings growth rate is 1.2%. For companies that generate more than 50% of sales outside the U.S., the blended earnings growth rate is 10.2%

But this week could move the needle…

For example, we hear from Google, Microsoft, Apple, Amazon and Meta.

These 5 stocks represent just under ~22% of the entire S&P 500 market cap; and almost 40% of the Nasdaq.

I expect they will mostly meet earnings targets for Q2 – however the guidance is what the market will be looking for.

But back to Walmart…

They are scheduled to report earnings August 16 – about 3 weeks from now.

But today they let us know they will join the growing list of companies who missed guidance.

If you recall – we also heard from Walmart May 17th.

Two months ago they advised earnings were going to be lower than expected… where they had inventory problems. And not long after – Target followed suit.

Fast forward two months and it appears the problems are worse than feared.

Inventory is not clearing.

For the first time in approximately a decade – Walmart slashed guidance by double-digits mid-quarter.

That’s how bad they got it wrong.

The largest physical retailer by size cut its quarterly and full-year profit guidance, saying inflation was changing how its customers spend.

No kidding!

And you are figuring this out now?

The retailer said it now expects same-store sales to rise by about 6% (entirely due to inflation) in Q2

They added consumers are buying more groceries instead of higher margin discretionary items (like apparel and home wares)

As an aside, ~50% of all Walmart’s business are groceries.

The problem is whilst groceries will keep customers coming back (as they need them!) – they are lower-margin goods.

But how is any of this surprising?

For example, weekly ago Walmart said they have “20% of inventory they would love to make disappear”

Turns out it’s still on shelves… and discounts are not working.

These are Big Hits

I was of the opinion Walmart was a sophisticated retailer that was likely ahead of such headwinds.

Wrong…

For example, Walmart (and others) failed to see that 2020 and 2021 was simply a lot of demand pulled forward.

People were forced to stay at home whilst being gifted “stimulus” cheques which exceeded their salaries…

And where did most of it go?

Discretionary goods!

Inflation remained low; interest rates were anchored at zero… and the money from the government was burning a hole in their pocket.

Big box retail never had it better.

Now with stimulus checks gone – monetary conditions far tighter – consumers are spending a lot less.

What’s more – with inflation exceeding wage growth – their salaries are going backwards.

It would appear that very few retailers saw this shift coming (especially on the inventory front).

Walmart is guiding that the second quarter will be down 12-14%; and the full year down between 11-13% in operating income.

That’s not insignificant for a company of its size and scale.

Most of this will be a hit in Q2 with (necessary) inventory markdowns (great news for the consumer if they have discretionary income – but bad news for Walmart shareholders!)

The stock is down close to 10% on the “surprise” news….

What’s more – expect a decent knock-on effect across all of retail (e.g., names like Target, Amazon, Macys, Kohls and others)

But the move lower was already telegraphed on the chart (if you knew what to look for):

July 25 2022

Let’s run through my basic technical check-list:

- the stock remains in a weekly bearish trend (i.e., expect strength to the sold)

- it had broken its previous major low (i.e., expect lower lows)

- has not yet made a new higher high (i.e., lower trend intact); and

- rallied to the 35-week EMA – where you would expect to see resistance.

The only positive I can see is it touched a seven year upward sloping trend-line…

But nothing here screams buy.

And the Fundamentals?

WMT at $132 trades near 21x forward earnings (or ~$6.30 per share)

Now let’s say that EPS full year is set to fall 10% – which would see earnings closer to $5.70 per share.

If assume a price-to-earnings multiple of 17x (generous for the stock but inline with the market) – that’s puts the share price at $96.90

Now technically – this lines up with the March 2020 pandemic low.

Call it a “round trip”

So fundamentally and technically – I might get interested in nibbling at the stock around $100.

Fortunately I don’t own the stock (or Target) today… and nor would I recommend it.

Nonetheless – expect analysts to put a sword to WMT’s estimates in the days ahead.

For what it’s worth – 17 analysts slashed their ratings for SNAP after their earnings last week – but with only one analyst saying “sell”.

Hmmm….

What’s WMT say about the US Consumer?

Last week I touched on the news from AT&T that consumers were taking a lot longer to pay their mobile and internet bills.

I made the argument that missing this bill is like missing your water and electricity!

This caused the company to dial back its operational cash flow by $2 billion… possibly putting its dividend at risk.

When I heard this – it reinforced (to me) that consumers are feeling the pain more than what the market could be pricing in.

Walmart put this beyond doubt.

But here’s what bothers me looking ahead…

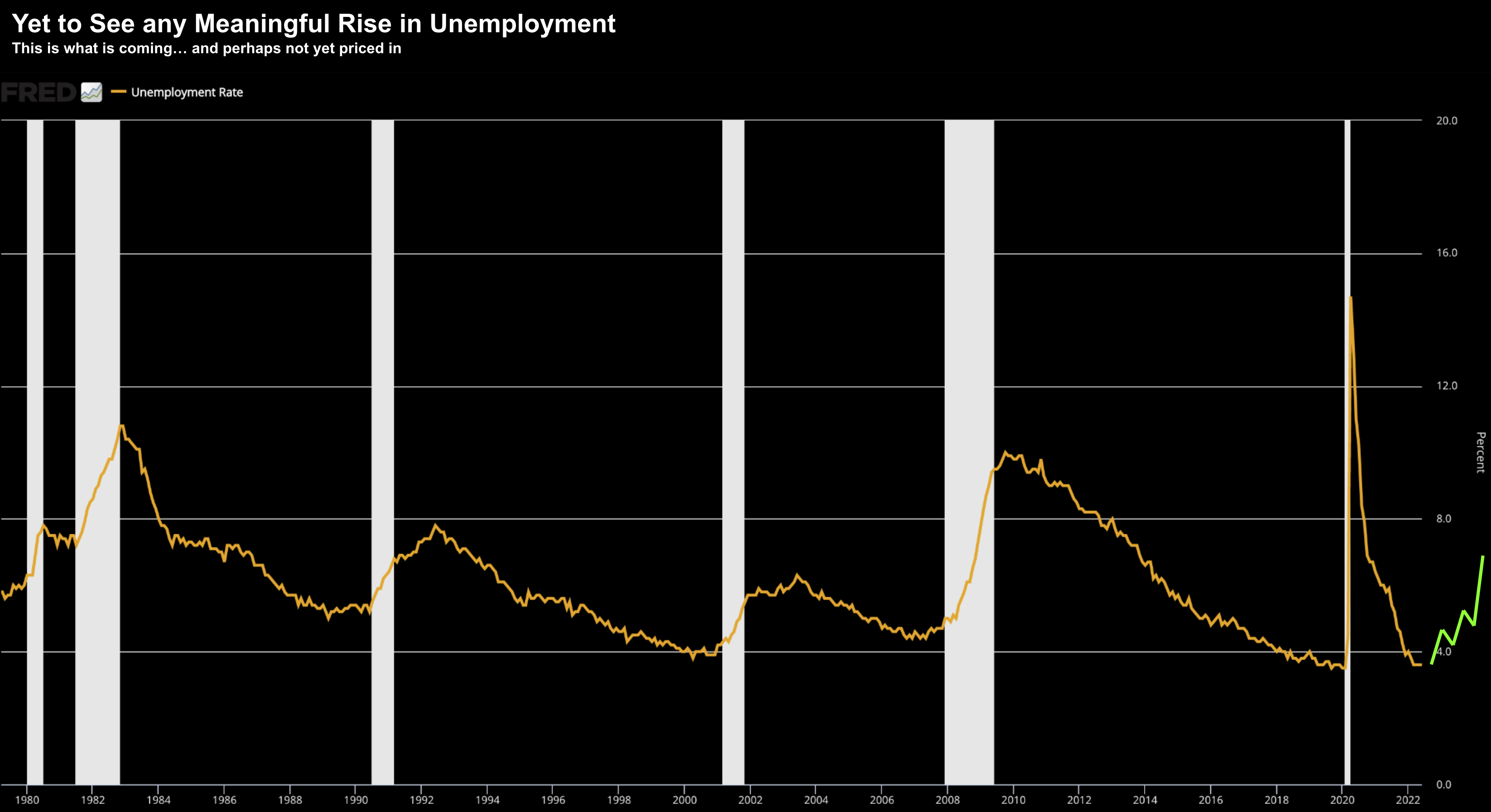

Financial conditions are only just starting to tighten (as the Fed raises rates); and we’re yet to see any meaningful pick up in unemployment.

So what happens when this ticks higher?

July 25 2022 – Unemployment is Going to Move Higher

Now I think if retailers start slashing prices — this won’t fix a demand problem.

Consumers discretionary income has been consumed opposite rising rent, gas and food prices.

And if anything – it’s really gas prices which are probably hurting the (lower income) Walmart consumer.

None of this bodes well for the ‘Walmart consumer’.

Yes, the Fed are going to do what they can to tame inflation with higher rates (we will hear more about that this week)… but that is going to hurt the very consumers Walmart depends on.

Putting it All Together

All of this is all part of the necessary ‘bottoming process’.

Unfortunately it takes time…

And analysts will take a sword to the outlook (which we are only starting to see).

For example, with respect to Walmart, there are 32 buys, 8 holds and no sells.

Wrong.

I find this extraordinary when you consider the stock was trading at a whopping 21x forward in this climate?

In closing, I don’t think this is limited to a “Walmart or Target” problem

The “E” is likely to come down across the entire market…. and that’s a good thing.

It means we are a step closer to the bottom… but there’s more to go.

As an aside, look out for an insider trading case in Walmart on the back of this news. For example, take a look at the July 29th expiry puts in Walmart and specifically the $130 strikes (with the stock trading at $132)

Here we see a staggering 13,268 contracts were traded today… with open interest of just 348.

For those less familiar with options: 1 option contract controls 100 units of stock.

Therefore, that is the market value of some $172.4M effectively betting Walmart is likely to tank within 4 days.

And these contracts went through in the last hour of the day.

So… do you think someone was tipped off?

Again, Walmart has not made an intra-quarter revision down by this magnitude in a decade. It’s highly unusual.

Some people are just not terribly bright… better lawyer up!