- Economy not falling out of bed (yet)

- Two possibilities which could cause the Fed to cut next year

- ‘Goldilocks’ numbers on durable goods orders and jobs

Stocks continued their impressive run this holiday shortened week.

It’s shaping up to be a ‘November to remember’…

For example, as we wrapped up October the S&P 500 traded 4103.

Fast forward 4 weeks and the Index is ~11% higher

That’s a rip-your-face off rally… which probably saw a lot of short covering.

So what’s going on?

I think stocks are pricing in what can be described as a ‘goldilocks’ scenario:

- Inflation working its way back to the Fed’s 2% objective

- The Fed cutting rates mid next year (more on that shortly)

- Growth slowing but not contracting to recessionary levels; and

- Employment remaining robust

And this morning we had (more) news which supported that narrative.

For example, with respect to inflation we had two helpful data points:

- Durable goods orders declined last month and registered the third drop in the last four months as the corporate investment, passenger aircraft and automobile categories weighed on results; and

- Possible discontent amongst OPEC+ members (as they delayed their scheduled meeting) – which saw 4% declines in oil

With respect to employment – the number of Americans filing new claims for unemployment benefits fell more than expected last week.

This aligns with soft landing narrative stocks are betting on for 2024.

Put another way, with the Index trading close to 4600 (around 19x forward earnings) – it’s not priced for a hard landing.

It sees inflation moderating as growth continues to expand (albeit slower)

But be warned…

As I explained earlier this week – soft landings are rare events given how much the Fed has tightened since March 2022.

I don’t think participants should assume this will be the outcome.

But let’s look at what data we received – and why I think there are two possibilities which could see the Fed cut rates next year.

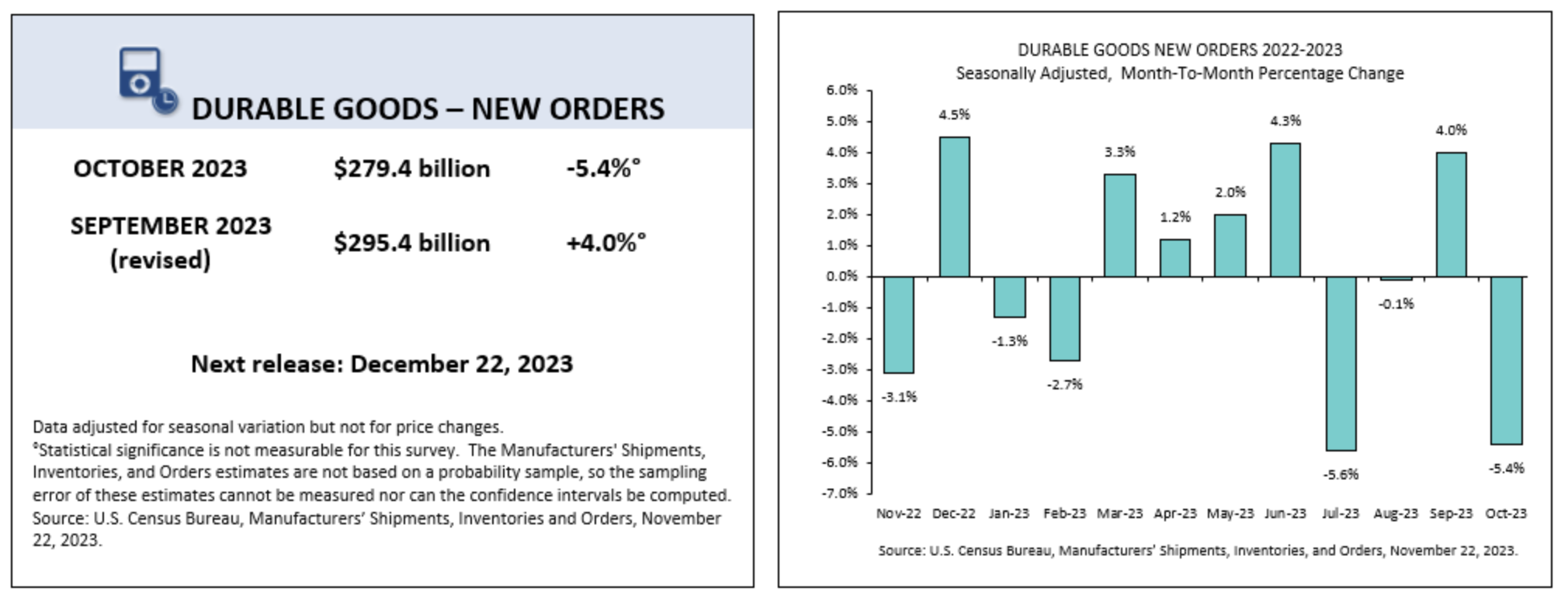

Durable Goods Orders Fall Again…

Further to my preface, durable goods orders declined last month and registered the third drop in the last four months.

From the Fed’s lens – that’s good news. Here’s FX Street’s recap:

Durable Goods Orders in the United States declined by 5.4%, or $16 billion, to $279.4 billion in October, the Census Bureau reported on Wednesday. This reading followed the 4.6% increase recorded in September and came in worse than the market expectation for a contraction of 3.1%.

Excluding transportation, new orders were virtually unchanged,” the press release read. “Excluding defense, new orders decreased 6.7%. Transportation equipment, also down three of the last four months, drove the decrease, $16.0 billion, or 14.8%, to $92.1 billion.”

Two reasons which explain the decline…

First, we’re at the tail-end of the massive fiscal stimulus related to manufacturing.

That gave sectors (like manufacturing and others) a short-term boost which won’t be repeated.

Second are the “long and variable lags” of the Fed’s monetary policy tightening. These typically take somewhere between 18 and 24 months to work their way through the economy.

From the Census Bureau:

Of note, orders for aircraft led the decline, dropping 49.6%. Orders for the automobiles and parts fell 3.8% MoM for October.

Good news for lower (goods) inflation… perhaps bad news for manufacturing growth and jobs.

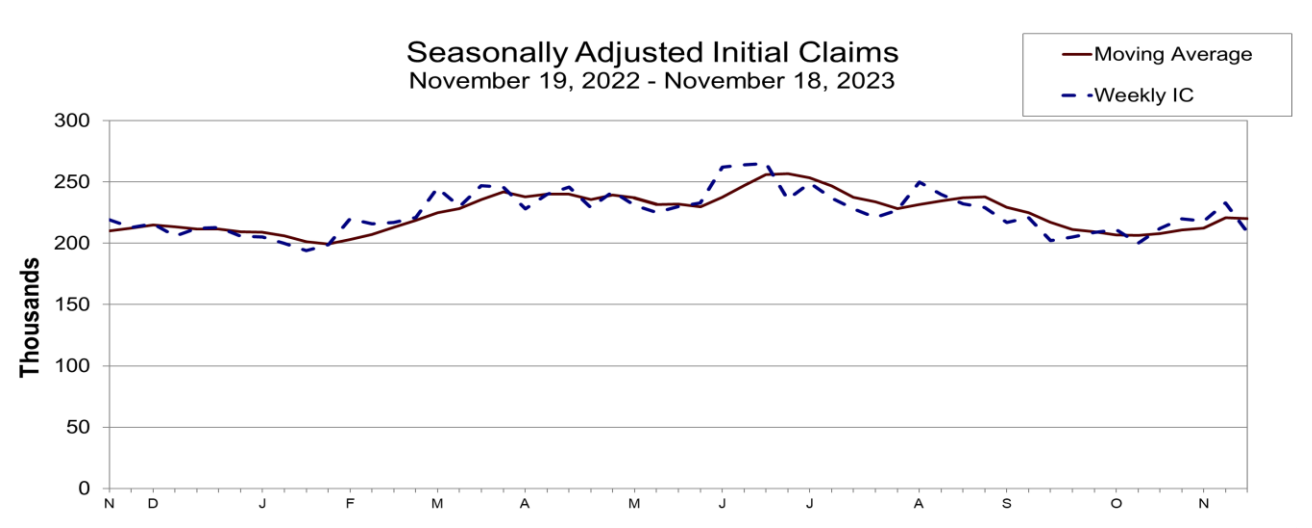

Jobs Resilience…

I think the single biggest key to the soft-landing script is unemployment remaining below 4.50%

If people remain employed – they have income – which means it’s unlikely we will suffer a recession.

However, should unemployment start pushing 4.50%+ – the probabilities of a recession will increase.

It’s my expectation that’s what we will see (as consumers spend less and demand falls)

Note – we also saw consumer confidence fall for the forth straight month.

The Labor Department told us the number of Americans filing new claims for unemployment benefits fell more than expected last week.

But what’s more useful is what we see with the trend.

Weekly claims have been very consistent for the past 12 months – ranging between 200,000 and 250,000 claims per week.

From mine, when (not if) this figure starts averaging north of 300,000 to 350,000 weekly claims – we will see the total unemployment figure rise above 4.0%.

Nancy Vanden Houten, lead U.S. economist at Oxford Economics in New York said “… looking past seasonal noise, we think the claims data are consistent with a job market that is cooling enough to keep rate hikes off the table, but too strong to make rate cuts a consideration any time soon“

The latter is more important.

Why?

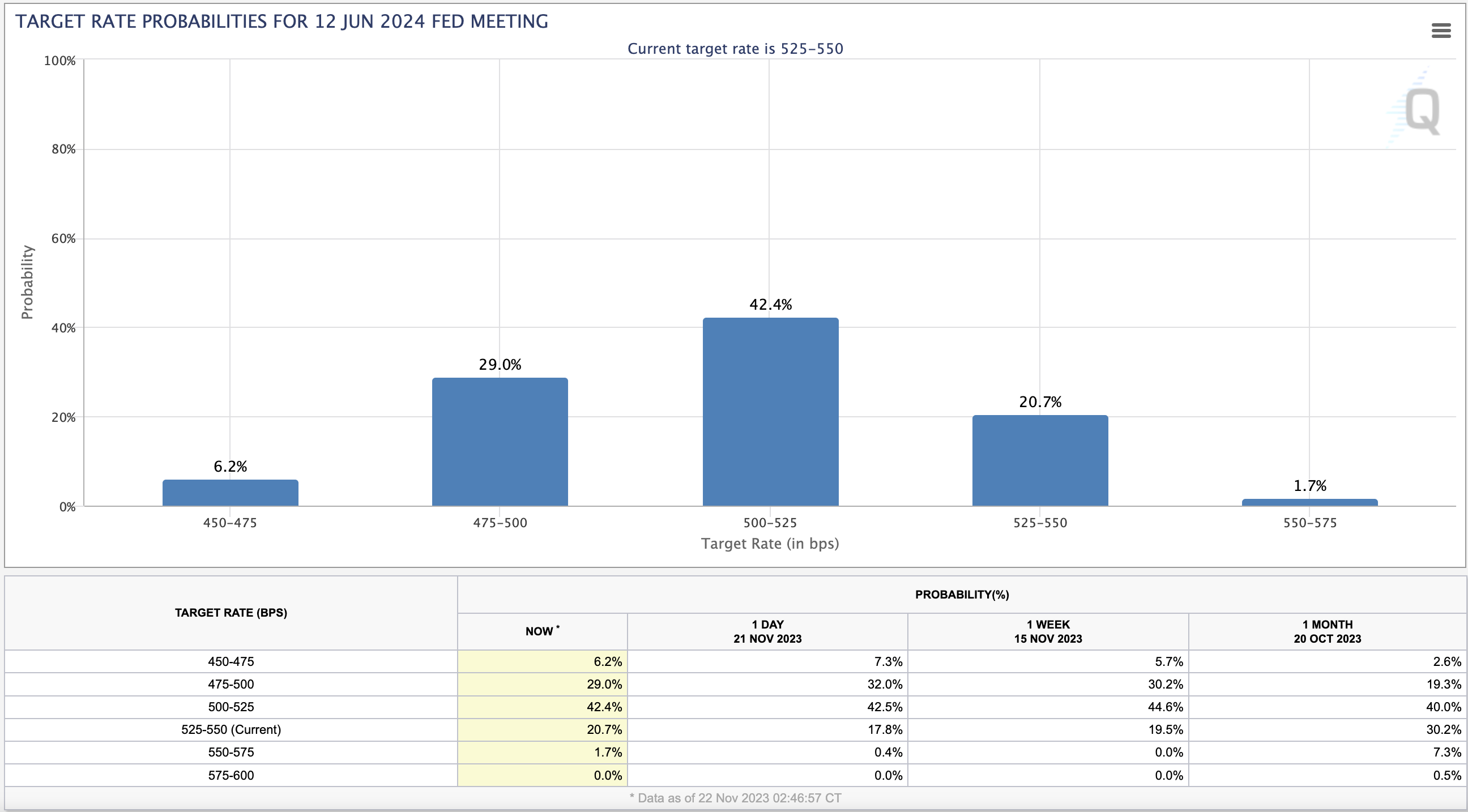

Because the market is pricing in a 42% chance of rate cuts as early as June (see CME FedWatch Tool below).

What’s more, they give a 29% probability of two rate cuts.

So here’s my question:

Why would the Fed be driven to cut rates as early as June?

What Could Cause the Fed to Cut?

I think there are two (perhaps more) outcomes which could cause the Fed to cut in this timeframe.

However, I believe both are unlikely before June:

- Core and Headline Inflation are consistently below 3.0% annualized; and

- There is some kind of credit event and/or recession

With respect to inflation – the reason I’m not saying it needs to be 2.0% (the Fed’s objectives) is what we see with real rates.

For example, with the effective Fed funds rate being 5.50% – and assuming core inflation at 3.0% – this puts real rates at 2.50%

That is very restrictive.

I think with inflation trending lower and real rates still in restrictive territory – they may be able to make the case to cut rates.

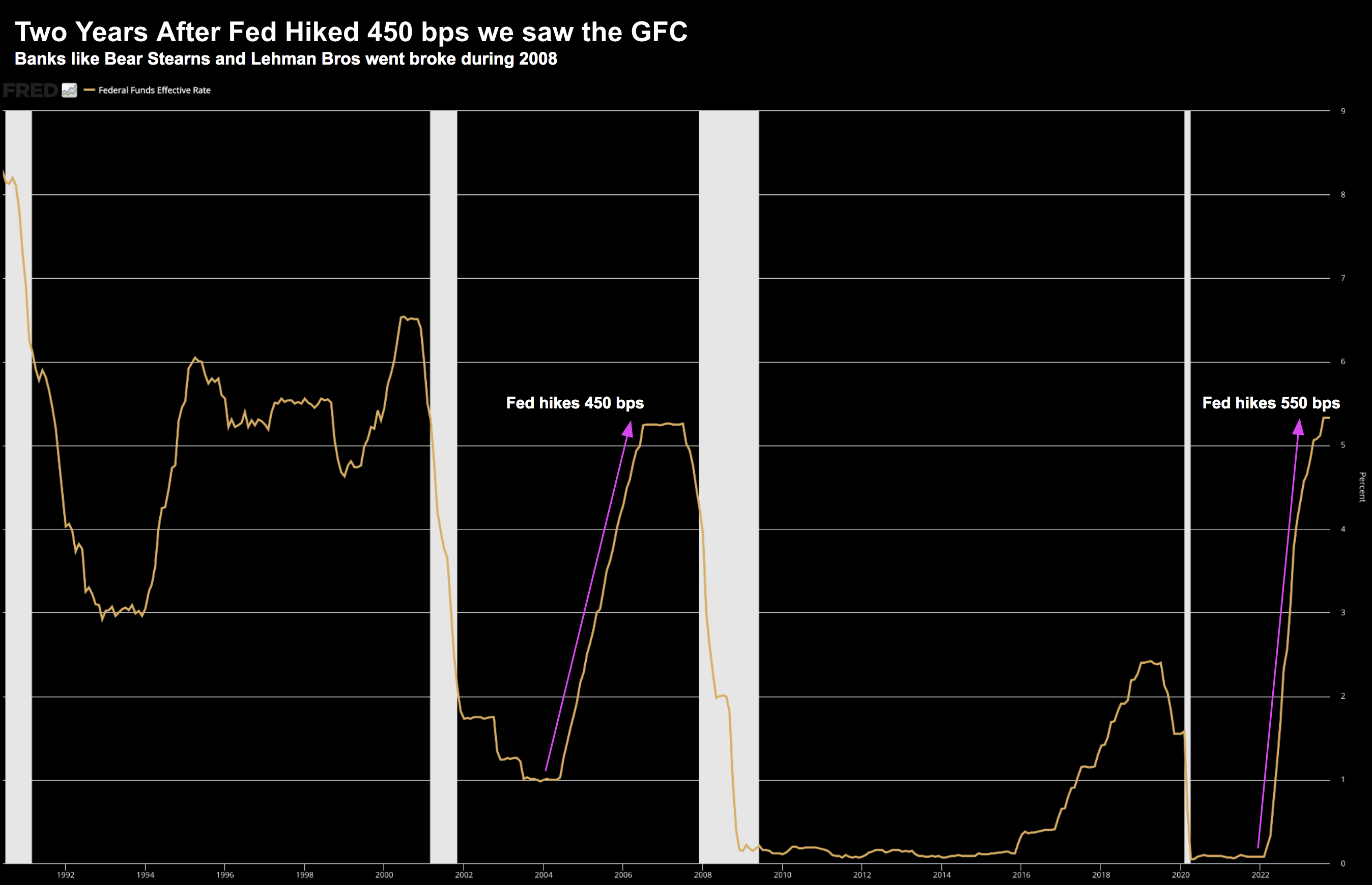

The second possible catalyst is some kind of credit event and/or recession.

For example, it wasn’t until two years after the Fed paused on hiking rates 450 basis points (from Jun 2004 to Jul 2006) before we saw banks like Bear Stearns and Lehman Brothers vanish.

That’s how long it took before the financial stress in the system became evident.

For clarity, I’m not saying we will see a repeat of 2008 (probabilities are we will not)

My point is these things can take longer than expected.

The Fed started hiking rates March 2022… which means we’re ~20 months in.

From here, it’s likely the central banks are about to hold for the foreseeable future (not unlike we saw over 2006/07)

Therefore, I think it’s far too early to predict (with a high degree of certainty) we have achieved ‘escape velocity’ from the Fed’s 550 bps of hikes.

But for whatever reason – the market assumes we’re ‘all clear’.

That feels like a mistake of judgement to me.

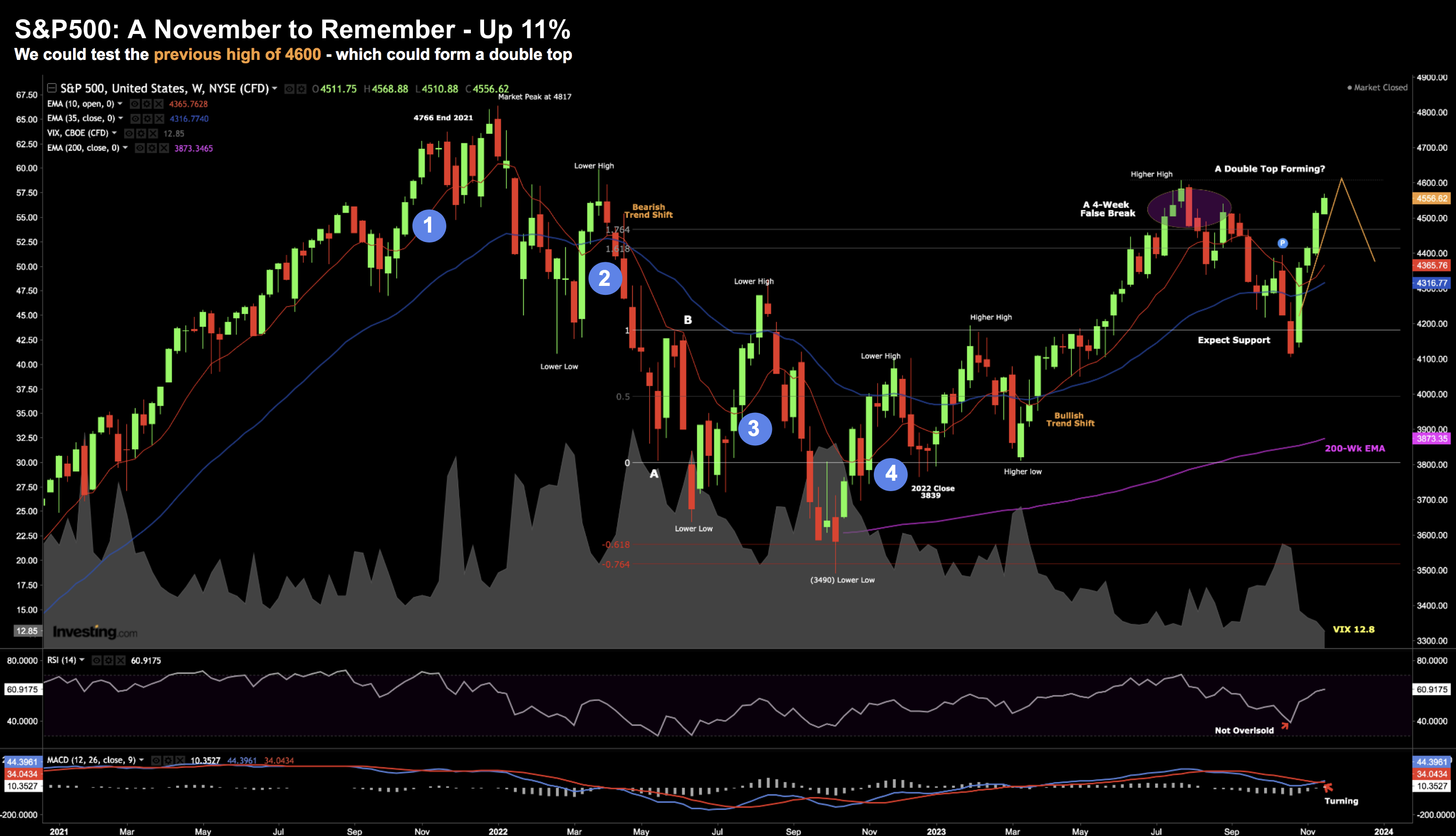

S&P 500: A November to Remember

Goldilocks macro data in combination with falling bond yields have sent stocks sharply higher.

The question is how much more upside is there?

Nov 22 2023

Short answer who knows?

That said, I’m reminded of the four similar 11%+ rallies we’ve seen the past two years (labelled 1 to 4)

All four happened in a similar timeframes – only to pivot sharply.

My best guess is we see resistance around this zone (which I originally called for between 4400 and 4500).

If we do – the market could be forming what technicians call a “double top”

Now, we might blast straight through the previous high of 4600 and shoot higher… it’s possible.

This is a seasonally strong time of year.

And if we continue to get soft economic data (e.g. on inflation and jobs) – it’s like the market will continue rally.

Soft data equals less Fed.

This is why it pays to have a reasonable amount of long exposure (I’m 65% long)

What’s more, it’s also a brave person who is short this market (I also don’t have any short positions and/or puts).

In closing, what I will be watching from here is how the market behaves around 4600.

Bulls will want to see it bust meaningfully higher and hold that level through the end of the year (as a minimum)

Bears on the other hand will be looking for the double-top.

As for me, I’m not married to either view.

Putting it All Together

As we head into the US Thanksgiving holiday – traders should be very thankful for much lower bond yields.

The US 10-year for example traded as low as 4.40% today.

That’s a massive 60 bps lower than where traders like Bill Ackman covered his short bet on bonds (i.e. he was saying 10-year yields were more likely to fall after touching 5.0%).

You might say he “top ticked the tape”

It’s the lowest yield on the 10-year in over 2 months and I think is likely to test the zone of 4.20%

Now, if you added to your bond portfolio the past few weeks – you would be enjoying some attractive capital gains.

For example, a few weeks ago I added to the ETF EDV (among others) – which has enjoyed a ~15% gain over the past 5 weeks:

Nov 22 2023

I think this has further to go… perhaps challenging the 35-week EMA zone (~$77) before facing resistance.

This would likely coincide with the 10-year falling to ~4.20% (where I think it finds support)

If we were to see the 10-year drop another 20 bps – it will also bode well for equities.

In closing, to my US readers – Happy Thanksgiving tomorrow.

Have a great long weekend ahead.