- Two key macro headwinds are yet to peak

- Bulls ‘want to believe’ a Fed pause or pivot is close…

- Why I think the lows are not yet in for 2022

Monday and Tuesday saw stocks rally sharply off the lows as bond yields eased from their highs.

But it didn’t take long for the 2-day momentum to hit stall speed…

From mine, the sentiment in equities is determined by what we see with:

- Bond yields; and

- the US Dollar Index

That’s it.

When these two macro variables decline, equities catch a bid.

The opposite also holds true.

Now the past two days have seen bond yields move higher – as various Fed officials reinforced their work is not even close to being done.

As I’ve written the past few weeks – I see few reasons why the Fed would pause or pivot (choose your “p”) at this stage (more on this shortly).

Minneapolis Fed President Neel Kashkari said the central bank isn’t even close to stopping its rate hiking.

His comments echoed those by Atlanta Fed President Raphael Bostic, who said Wednesday that the Fed is in the early days of its inflation fight.

Not late. Early.

Now that’s not to say the Fed won’t pause at some point next year (they most likely will) – but for now they are likely to ‘stay the course’.

And from mine, that’s a headwind for stocks.

Tempering Bull’s Enthusiasm

As a preface, over the next three years I think the market will be meaningfully higher than 3600.

History tells me that whenever we see a correction to the tune of 25% or more – if held over 3-years – markets are higher.

I don’t think this will be any exception.

However, that doesn’t mean buying at today’s level of close to 3800 is prudent.

As regular readers will know, I think you can frame the buying opportunity in three ‘phases’:

- Nibble at 3600 (as I’ve been doing)

- Be a little more aggressive around 3400; and

- “Pin your ears back” at anything at or below 3200.

That’s what I am doing… however my view is 3+ years.

The market could fall a further ‘20%’ below 3200 (and that’s fine).

However, at ~3800 my opinion is upside reward is limited to less than 10% with the downside risk as much as 20%

That’s not a trade I like.

I want the upside reward to be at least 2x the downside risk.

Put another way, if earnings are set to decline next year (vs grow), it will be very hard to justify the S&P 500 at 4200 (i.e. 10% upside)

However, it’s easier to make the case for 3200 with earnings around $210 per share (i.e. 15x forward PE with rates at 4.0%+)

Let’s explore…

More Work to Do

To be fair, some of the hard work has been done by the market.

That’s the good news.

For example, with the S&P 500 20% to 25% off its January high – they know that we’re going to have a weak economy next year.

GDP revisions have come down.

And a lot of excessive speculation has been taken out (e.g. the Cathie Wood names)

SPACs are dead and that’s a good thing.

However, as I wrote here, when I look at 2023 earnings estimates, they are yet to come down.

Yes, we’ve seen the PE multiples come down from nosebleed levels of 22x (perhaps ‘justified’ with rates held at zero; or deeply negative in real terms).

They are now close to normalized levels heading into a “likely” recession.

But the “E” in the “PE” is still too high at ~$240 per share (according to Factset).

For example, if we assume $240 with the S&P 500 at ~3800 – that’s a forward PE of 15.8x.

That’s not unreasonable during a recession (i.e., “normalized”)

The problem (of course) is the $240 is optimistic as it assumes ~8% growth on 2022.

Now I say this because a recession always see earnings contract (not expand)

No exceptions.

Therefore, my expectation is earnings will contract somewhere between 5% and 10% (it could be far worse)

But that’s not all..

We also need to consider what we’re seeing with margins.

The trend has been terrible from companies who have reported so far (Nike, Micron, FedEx etc etc)

Margins are being crushed as input costs soar (and revenues fall opposite discounted to clear excess inventory).

However, today the bulls are expecting margin expansion in 2023… something which is hard to believe given what we see.

Put together, there is room for downside from my lens.

CapEx Plans Pulling Back

Related to my thesis is the trend we’re also seeing in capex spending.

Again, none of this is surprising.

Whilst the bulls believe the Fed can “land the plane softly” – withstanding jumbo rate hikes – another key recession indicator is starting to sound the alarm.

That alarm is depressed capital spending.

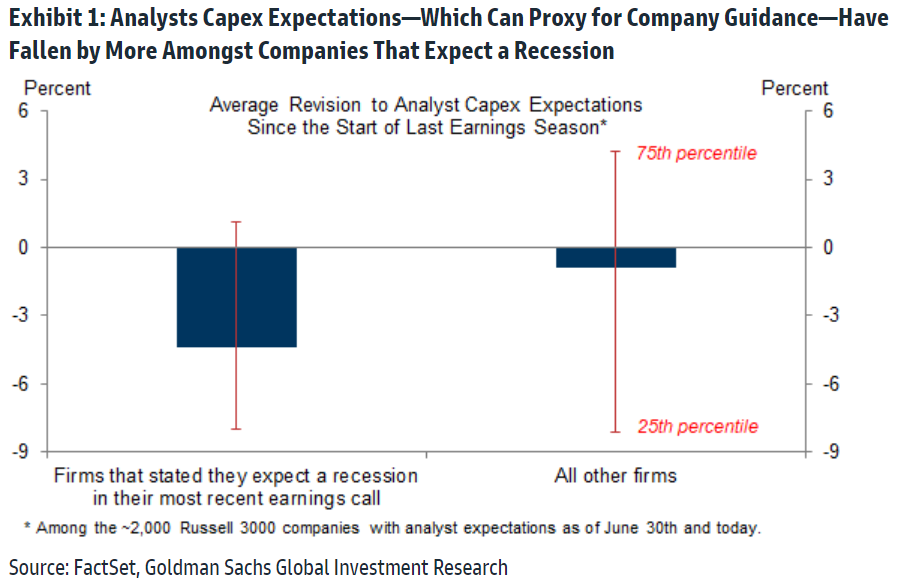

According to Bloomy (via Goldman Sachs research) – high recession-risk perception among company leadership results in a 3-4 percentage-point downgrade to expected capital spending growth.

Goldman produced this study based on a review of earnings transcripts:

And whilst reduction in capex is unlikely to show up in the current round of earnings (perhaps not even Q4) — you will see the impact into 2023.

Growth will slow; margins will decline; and earnings will come down.

Again, from my lens, it’s difficult to see how this won’t be the case.

You may see it differently.

Tape Still Looks Bleak

Oct 06 2022

We’re seeing the expected bounce from a well defined area of support… and that could run a bit further.

Again, if you are trading this, you need the ‘hands of a surgeon’.

You could wake up tomorrow and stocks are “5% lower” – it’s that kind of market.

From mine, the chart does not look healthy.

Beyond the obvious downward trend – two other things which bother me:

- the level of the VIX; and

- where we got to with the weekly RSI

With respect to the former, despite the “sell off” to just below 3600 – the VIX could not get above 35.

What I want to see is the VIX between 35 and 40 – which would indicate more “washout” selling.

That’s a better indicator the lows are closer to being in.

Note: several months ago I posted a study on the strong positive results (over 3 years) if buying the market with the VIX at 35 or above.

With respect to the weekly RSI – this only fell to a level of 35 when the market touched 3600.

Similarly, what I would like to see here a weekly RSI with a 20-handle… indicating that we are closer to being in “oversold” territory.

We are yet to see that.

Finally, if I look beyond the technicals (and further to my preface) – for stocks to rally – they need a tailwind from:

- Far lower bond yields; and

- a much weaker US dollar index

In other words, we need these to peak.

Yes, there was optimism that rates were unlikely to go higher but I think that’s premature.

And whilst there was reason for them to take a pause (and they did earlier this week) – it’s still too early to say with confidence they have peaked.

For example, the 10-year is now back above 3.83% and the dollar index back above $112.

What’s more, inflation “break evens” have been moving higher the past three days.

In short, tread carefully.

Putting it All Together

The sharpest rallies happen in bear markets.

Sometimes traders lose sight of this.

Over the past few days the bulls have been on the front foot… “time to buy” they say.

I’m not convinced.

Not yet.

I think we go lower as the market starts to revise 2023 earnings expectations.

What’s more, the Fed is far from any “pause or pivot” — Kashkari, Bostic and Mester all reminded us of that fact this week (in case you missed the memo)

Yes, there might be some small cracks appearing in credit markets (n.b., I talked to HYG and LQD recently) – but we are far from any real pain.

Note – 25% lower in equities is not pain. 50% maybe.

What’s more, look at the strength we still see in the labor market.

Just on this, tomorrow we get the all-important jobs report for September. According to CNN:

The US economy is forecast to have added 250,000 jobs in September, which would be the lowest monthly jobs gain since December 2020. The unemployment rate is expected to hold steady at 3.7%, according to Refinitiv estimates

If the above forecast proves to be accurate – it only gives the Fed more ammunition to continue on their path of rate hikes.

What the Fed will want to see is the unemployment rate working towards 5% and job losses.

I know that sounds perverse – but that’s what’s needed if we are to see wage inflation fall.

One bit of “good news” this week – the number of open positions fell by 1.1 million, the largest monthly decline outside of the pandemic, according to the Jobs Openings and Labor Turnover Survey released on Tuesday.

Needless to say, the market ripped higher on news of less job openings – on the assumption it might give the Fed scope to ‘tap the brakes’.

I don’t think so… not yet.

There’s more work to do… and we’re yet to experience any form of real ‘pain’.