- Why higher CPI over January wasn’t a surprise

- Stocks falling 2% is not a pullback

- Yields move sharply higher (i.e, ‘higher for longer’)

Today was “C Day” (vs “D Day”)

C for CPI.

And the news on the latest inflation print was an unwelcome surprise to some…

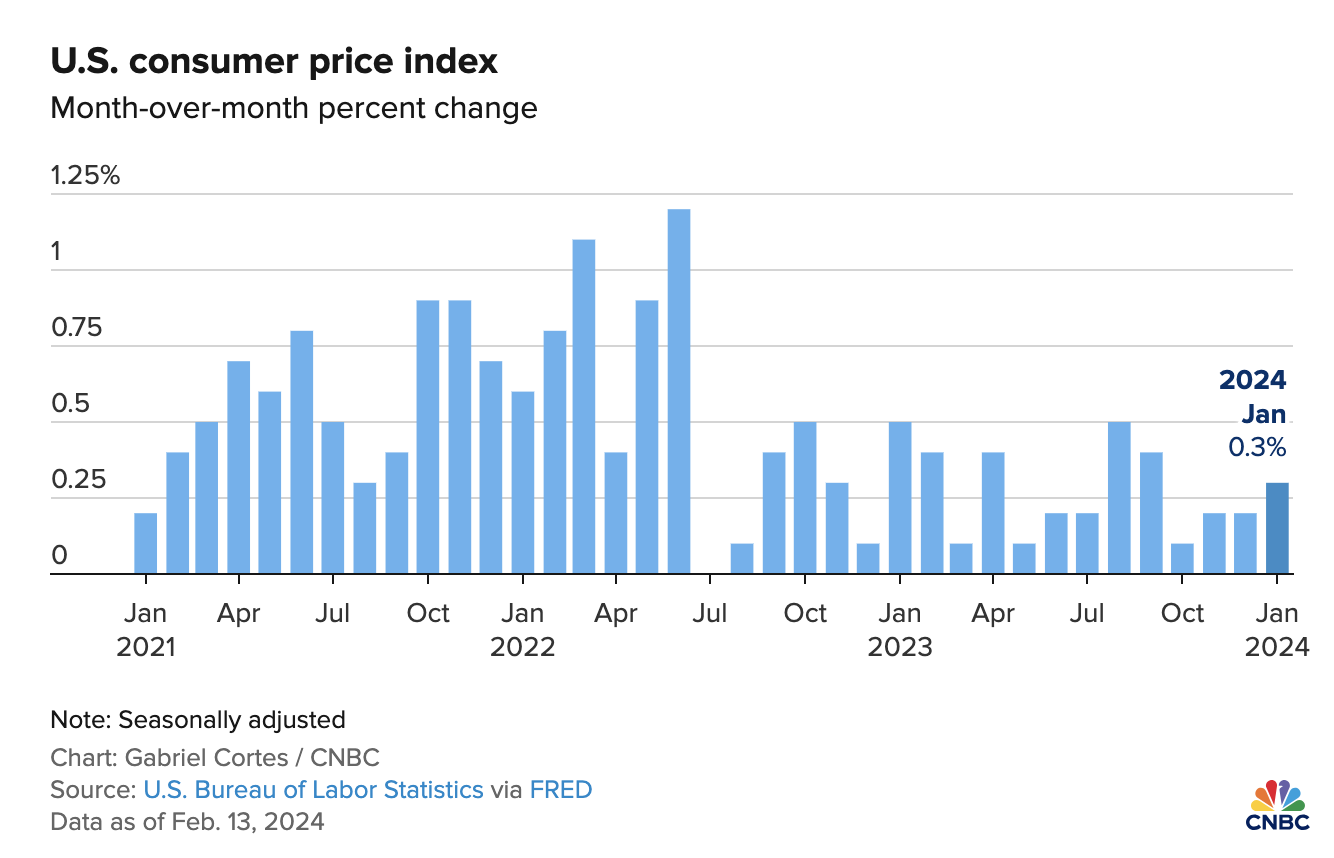

- The consumer price index (CPI) increased 0.3% MoM in January. On a 12-month basis, that came out to 3.1%, down from 3.4% in December.

- Shelter prices accounted for much of the rise, climbing 0.6% on the month; and on a 12-month basis, shelter rose 6%.

A quick note on shelter….

I made the case here that they way the government measure shelter is a lagging indicator (by at least 6 months).

Real-time data (e.g., from the likes of Zillow) suggests that shelter prices are now in decline – not rising.

That said, markets took the news at face value and were quick to react…

Equities moved lower and bond yields spiked.

The US 10-year traded as high as 4.31% – its highest level since November last year.

Feb 13 2024

A higher 10-year yield is not what the market had priced in…

Markets believe rates are likely to fall (not rise).

This presents a potential problem… both in terms of market valuations and risks to consumer spend.

Why Higher Inflation Wasn’t a Surprise

- Shelter +6.0% (which constitutes 1/3 of the total measure)

- Food +2.6%

- Gasoline -6.4%

- Used Vehicles -3.5%

Whilst lower gas and vehicle prices is welcomed news – food and rent is where it hurts.

Economists surveyed by Dow Jones had been looking for a monthly increase of 0.2% and an annual gain of 2.9%.

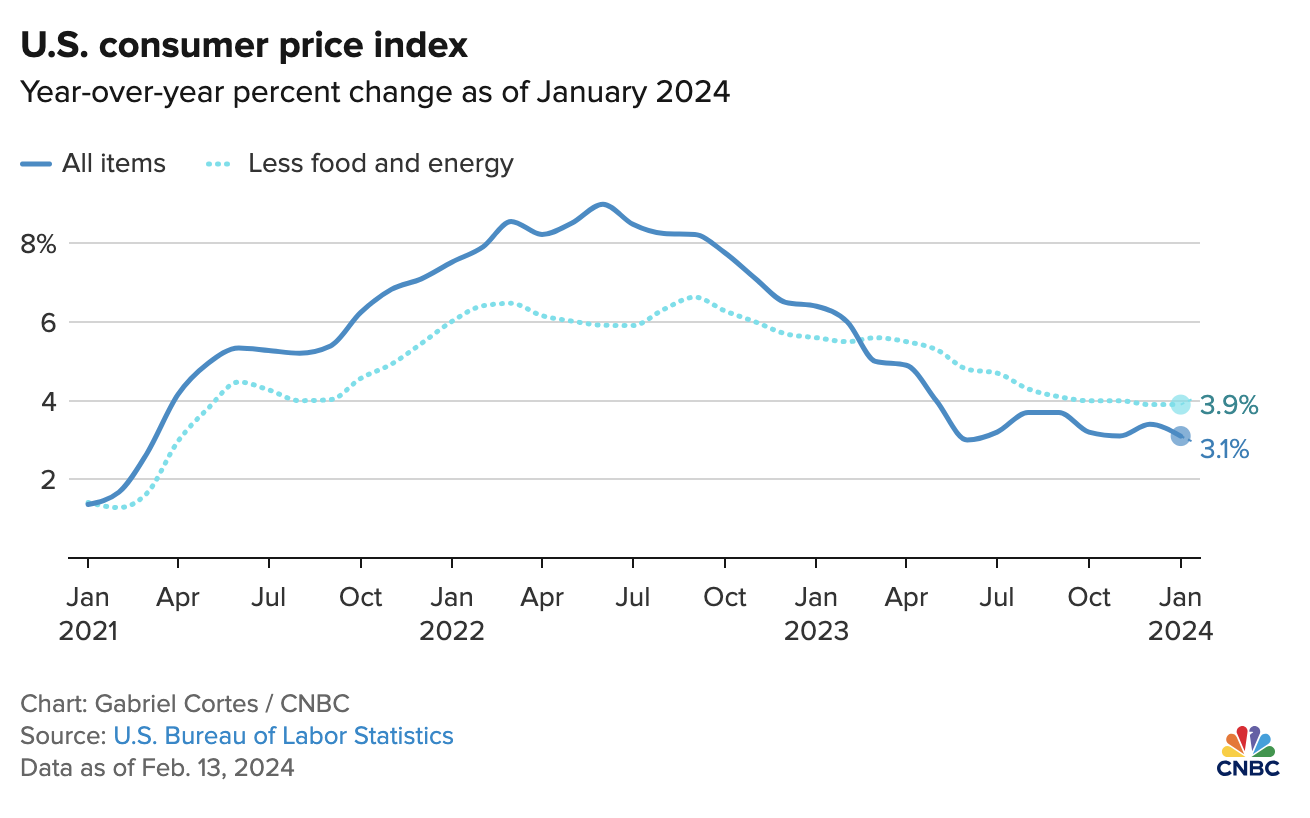

Perhaps, the bigger concern is what we see with Core CPI.

Excluding volatile food and energy prices, Core accelerated 0.4% in January and was up 3.9% from a year ago, unchanged from December.

However, markets were surprised as the forecast had been for 0.3% and 3.7%

The good news from these charts is inflation continues to move in the right direction.

However, this process will take time and is not evenly distributed.

What’s more, consumers are still feeling the pinch of higher prices for the things they buy most often (e.g. food, rent, insurance, health care).

As an aside, take a look at the chart for insurance company Progressive (PGR). Its share price has doubled over the past three years due to higher premiums (e.g. car insurance was up 24% year on year).

In 2023, the average U.S. rate for full auto coverage rose to $2,019 per year, up 24% from $1,633 in 2022 and nearly 29% from 1,567 the prior year, according to insurance comparison shopping site Insurify.

Question: do you think it’s going back to $1,567 (2021 levels)? I doubt it.

Feb 13 2024

What’s more, I was digesting a few of the fast-food chain’s earnings last week.

McDonald’s shares were hit hard as higher input costs (i.e., inflation) was a key part of their earnings story.

It was the Golden Arches first sales miss in four years.

Why?

Because that’s where a lot of everyday Americans eat. For example, it’s the consumer who earns less than $100K per year and also works at say a “McDonalds” or “Walmart”

How can they afford an additional 6% YoY in rent; or 20% more for car insurance?

The essential products and services that people need might be rising more slowly (which investors are quick to cheer); however they have not gone back to the levels they were prior to 2020.

And that’s a point which is often missed.

Layer in the overall spend increase we saw last month (mostly from consumers using credit) – in addition to robust jobs – it’s little wonder we are seeing further inflationary pressures.

What to Watch

As I say, the market is quick to cheer a “3-handle” with respect to headline inflation late last year.

“The fight has been won” was the sentiment.

And maybe it has if you assume rent prices are likely to drop sharply in the next 6-12 months (given the 6 months lag with government data reports)

But inflation is not evenly distributed.

And it would be wise to pay very close attention to what this really means for everyday consumers.

For example, what do we see with the use of credit and specifically credit quality.

Are delinquencies rising or falling?

According to AP – more and more Americans are falling behind on their payments.

“Experts worry that members of these groups — mostly lower- and middle-income Americans, who tend to be renters — are falling behind on their debts and could face further deterioration of their financial health in the year ahead, particularly those who have recently resumed paying off student loans.

“The U.S. economy is currently performing better than most forecasters expected a year ago, thanks in large part to a resilient consumer,” wrote Shernette McLoud, an economist with TD Economics, in a report issued Wednesday.

“However, more recently that spending is increasingly being financed by credit cards.”

Americans held more than $1.05 trillion on their credit cards in the third quarter of 2023, a record, and a figure certain to grow once the fourth-quarter data is released by Federal Deposit Insurance Corp. next month.

A recent report from the credit rating company Moody’s showed that credit card delinquency rates and charge-off rates, or the percent of loans that a bank believes will never be repaid, are now well above their 2019 levels and are expected to keep climbing.

To dimension the massive growth in overall debt – here’s the New York Fed and their latest quarterly report on Household Debt and Credit (Q4 2023):

- Total household debt rose by $212 billion (QoQ) to reach $17.5 trillion;

- Credit card balances increased by $50 billion (QoQ)to $1.13 trillion;

- Mortgage balances rose by $112 billion (QoQ)to $12.25 trillion; and

- Auto loan balances rose by $12 billion (QoQ) to $1.61 trillion

They add that delinquency transition rates increased for all debt types except for student loans.

Adding to the above – this from ratings agency Moody’s:

“You have these noticeable pockets of consumers — mostly middle- and lower-income renters who have not benefited from the wealth effect of higher housing prices and stock prices — who are feeling financial stress and that’s driving up these delinquency levels.

They’ve been hit very hard by inflation,” said Warren Kornfeld, a senior vice president at Moody’s, in an interview.

The average interest rate consumers are paying on their credit card debt is over 27%.

Loan sharks would give you a more competitive rate.

So yes…

We can cheer slower rates of inflationary growth. Sure. And we can cheer the higher consumer spend from the past month.

But middle-and-lower income Americans are stretching their (affordability) limits by leveraging the use of credit card at an interest rate north of 27%

Is that money they can handily afford?

Put together – I think we see a weaker consumer through the balance of the year.

As an aside, Shopify told us as much today with their earnings report (a stock that I own).

S&P 500 Yet to Pullback

Today the S&P 500 gave back a very small amount of ground…

However, the headlines will read something like “huge market sell-off” (designed to lure eyeballs) – however we’re simply back at levels we were last week.

In other words, nothing has changed. Nothing.

Feb 13 2024

- We continue to trade in what I think will be a zone of resistance (around 5,000).

- The weekly RSI remains in overbought territory

- The VIX is starting to stir – still very low at just 15.8

My expectations are for the market to come back to around the 35-week EMA zone over the next few weeks.

Today that level is 4568 – which would represent a pullback in the realm of 8%

This is a zone where you could slowly increase exposure. And I say slowly – as there is every chance we go lower.

Putting it All Together

Bonds and equities are telling us two very different stories.

Both can’t be right.

If I were to bet – I’ll back the smart money (i.e., bonds)

My feeling (as it’s been over January) is that equities are too frothy.

It’s been too much too fast (also supported by the overbought weekly RSI)

Therefore, I paired my exposure (mostly opposite tech names with excessive multiples)

As an aside, I laughed when I saw Jeff Bezos sold $2B of Amazon stock this week. I lowered my Amazon exposure last week. I hope to buy it back cheaper in the coming weeks (or months)

With respect to inflation…

Yes, it’s showing slower year-on-year increases. Good news. However, we are nowhere near the levels prior to the pandemic.

When will average car insurance premiums of $2,019 drop back to the 2021 level of $1,567?

Maybe never? Progressive hopes so.

That will require meaningful deflation.

This means middle-to-lower income earnings are feeling it where it hurts most (and why I think this year’s US Presidential election could be about ‘hip-pocket’ issues)

They have chewed through their ~$2 Trillion in savings and are now financing their gym memberships, Netflix subscriptions, and monthly phone bills with money they clearly don’t have (i.e., credit)

Delinquency rates are starting to rise – which should not be surprising with the average interest rate above 27%.

Question: how will consumers continue to accelerate their spend over the next few quarters?

I ask because that’s what markets are pricing in with ~11% YoY earnings growth.

Stay patient. Allow prices to come to you.

FOMO has no place in the game of asset speculation.