- ‘Bond King’ Jeff Gundlach believes we’re already in recession

- However, equities tell us ‘recession is no longer a risk

- Fed cut rates because ‘they can’ vs being ‘forced’ (or did they?)

“I still think the history books will show that September 2024 was the start of the U.S. recession.”

Known to many as the ‘bond king‘ – DoubleLine Capital’s founder and CEO – Jeff Gundlach – is well known for his contrarian calls.

This week on CNBC he made the comment that he feels that we will look back at Sept 2024 and say “this was the start of the 2024/25 recession”.

If Gundlach’s view is correct – the recession has already hit the US economy.

Therefore, this would imply the jumbo sized cut from the Fed this week is already too late – and will do very little to course correct a rapidly slowing economy (especially given the 9-12 month lag effect of monetary policy)

That said, I think it’s fair to say that Gundlach is in the minority.

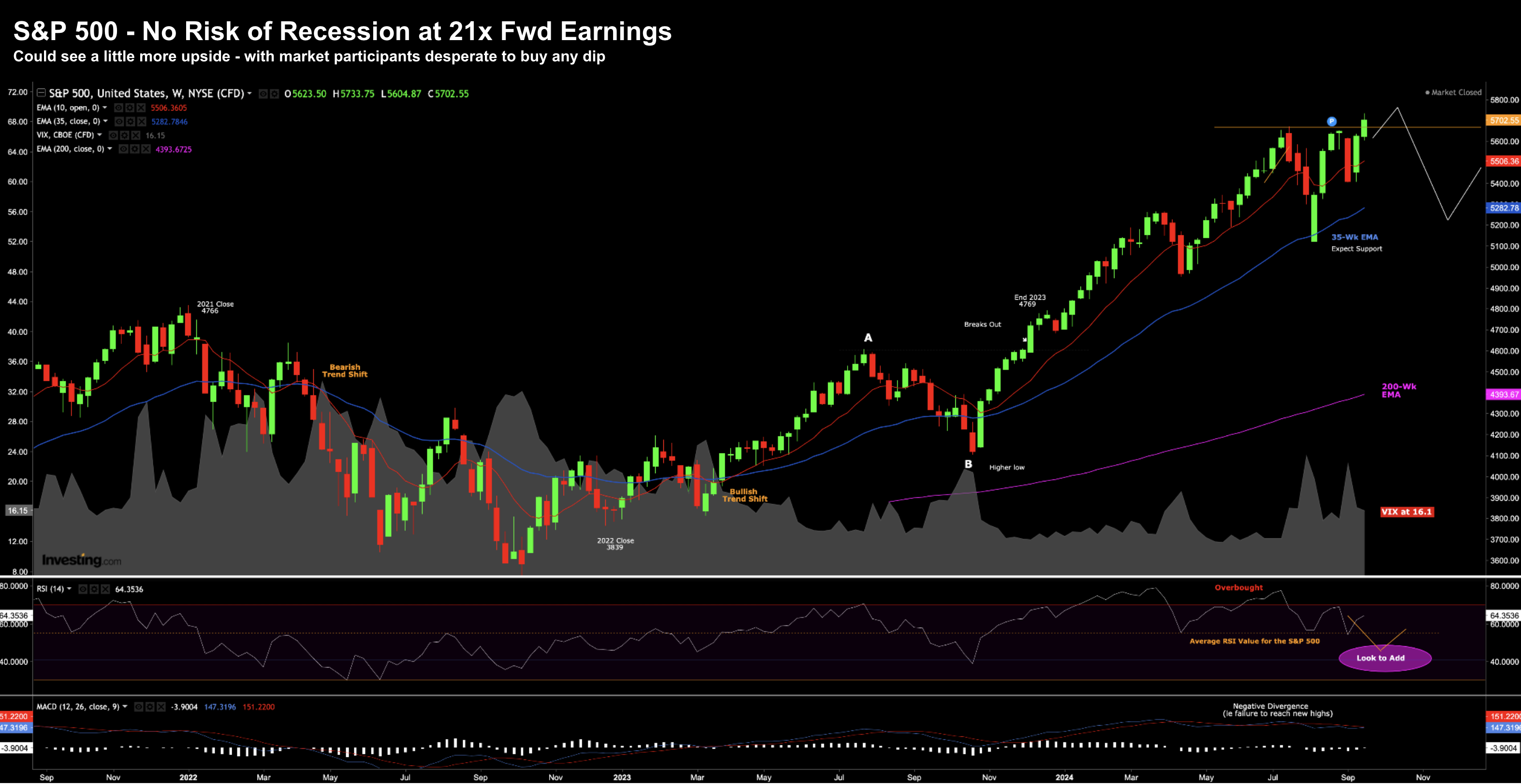

You only need to look at the reaction in stocks… they surged back to all-time highs trading a forward PE of more than 21x earnings.

That does not scream recession dead ahead.

It suggests the opposite.

If anything, the enthusiasm for stocks suggests earnings growth next year will handily beat 11-12% (in order to justify the multiple)

So is it time to put the recession narrative to bed?

Has the Fed ‘saved the day’ by starting its (inevitable) easing cycle – with inflation risks now well and truly behind us?

Or will we look back in a year (or less) and ask what Gundlach saw – that very few others did?

Time to Put Recession Narrative to Bed?

If you think there is no risk of recession (or a material slowdown) over the next ~12 months – you should be somewhere between 90% to 100% long equities.

As for me, I remain around 65% long as I think there is some risk.

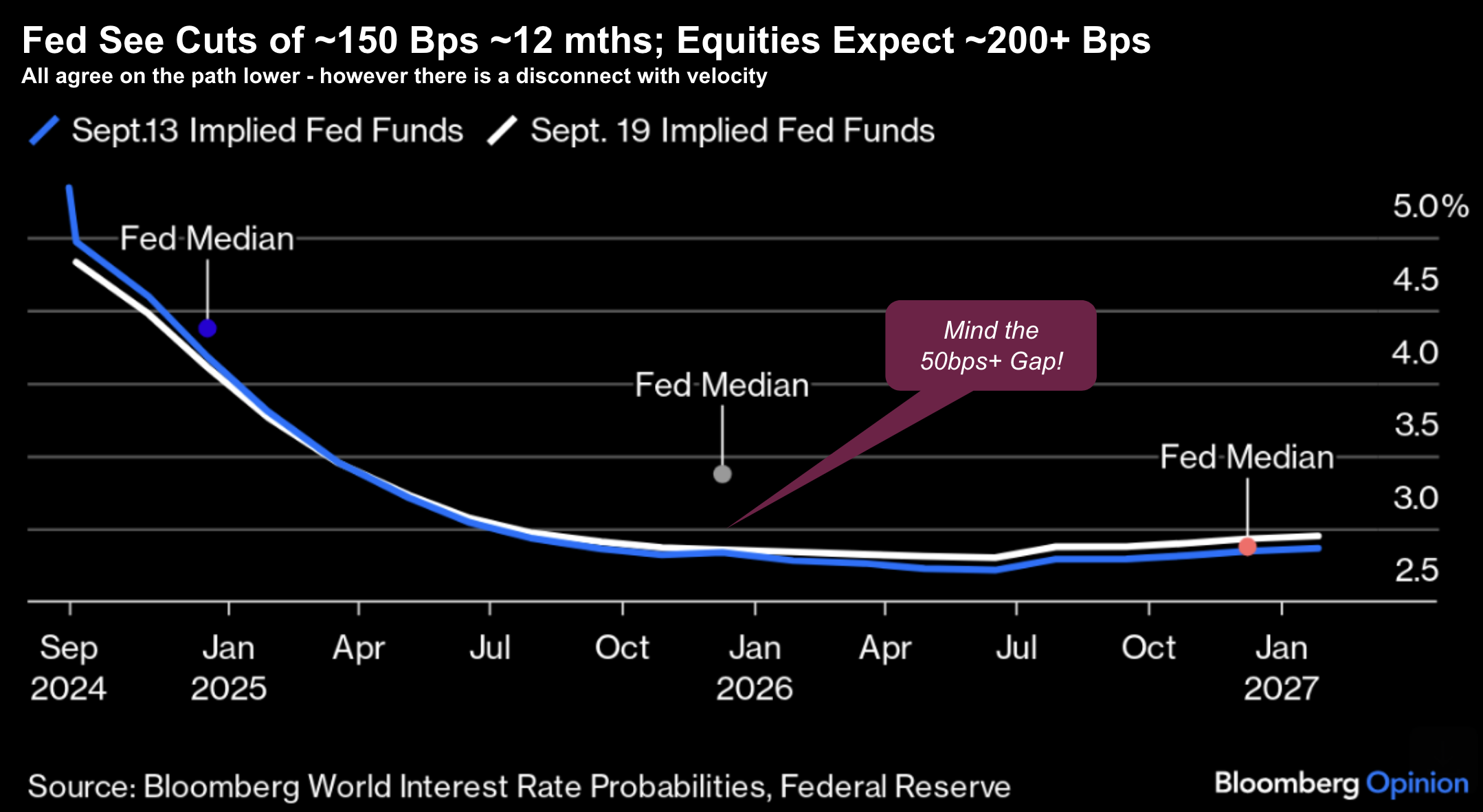

For example, whether we get the 200 bps (as the market expects) or the 150 bps as forecast by the Fed – it’s a highly conducive market for risk assets (assuming no recession).

No recession is the caveat…

If there is a recession – then you should expect stocks to fall in the realm of between 20% to 35% (possibly more)

Gundlach did preface his recession call by reminding us the data today looks fine – however it’s also rear-view mirror.

For example, he reminds us that GDP is ~2.5% (or higher); unemployment remains low at 4.3%; and corporate earnings are growing at a healthy clip (~11%) – with a skew towards tech.

And with the Fed (finally) starting the gradual process of normalizing rates (“recalibrating”) – some suggest it’s time to give up on the idea a recession still lies ahead.

But I’m not yet in the “all clear” camp…

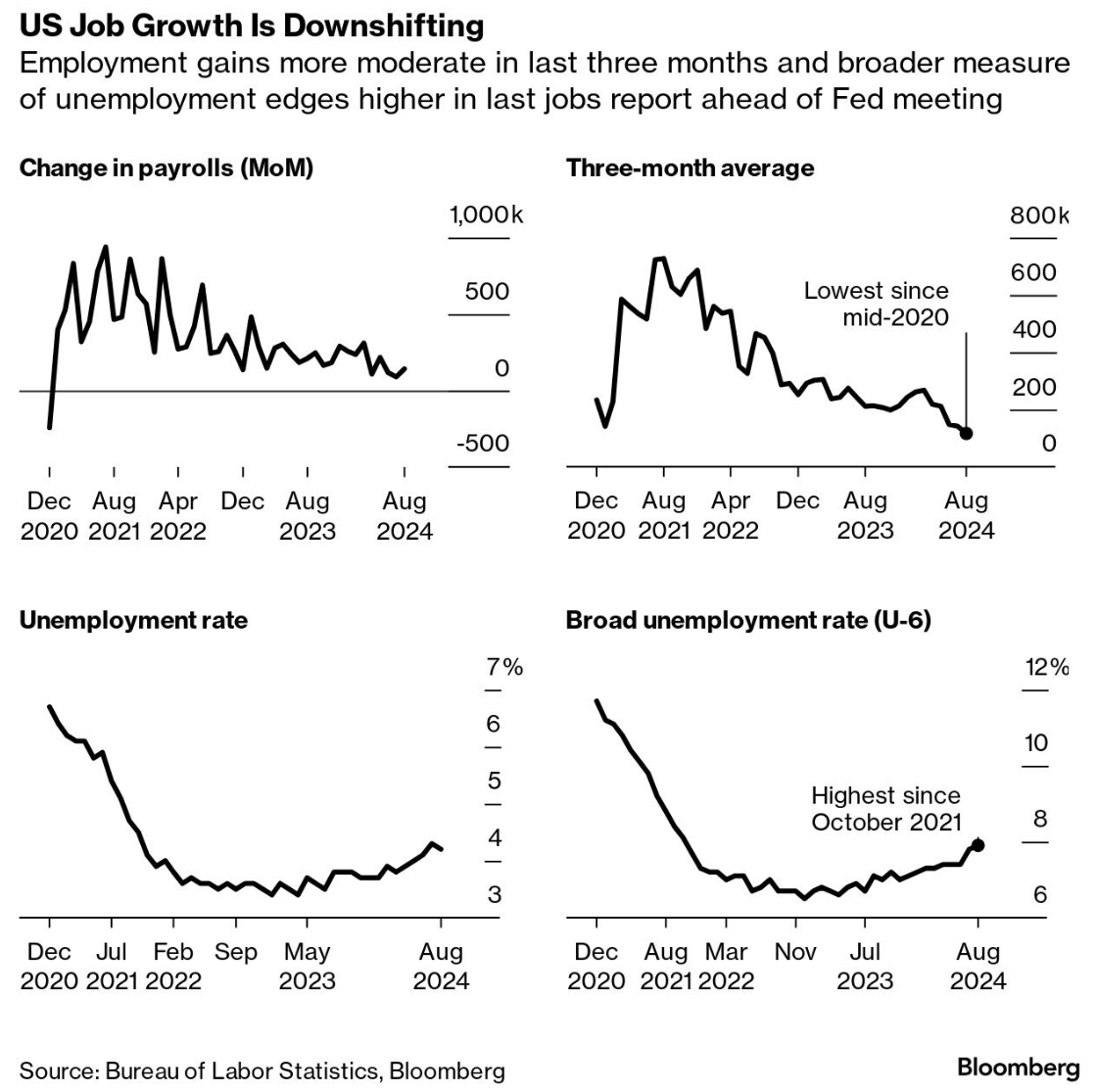

For example, I think we will see a weaker labor market.

And whilst the last monthly print as around 140K jobs (most of which were government job additions) – I think the next few months will show a weaker trend – where the unemployment will tick above 4.5% by the end of the year.

If that’s correct (and it may not be) – you can dial in another 50 bps cut for November.

Market’s don’t want to see a panicky Fed with back-to-back 50 bps cuts.

As Powell will have a very difficult time saying ‘everything is just fine‘

Did Powell “Downplay” Weakness

When summarizing Powell’s address during the week – I felt he fumbled his way through.

It was not the typical concise and forthright Powell we’re used to.

His message came across as mixed and at times contradictory (for me).

Thinking more about this, what does Powell see that has him concerned – but does not want to spark potential fear?

For me that is the trend he sees in unemployment.

For example, once we start to see large scale layoffs (which we are yet to see) show up in the data – it’s already too late.

And I think this is Gundlach’s point… the ‘recession train’ has left the station.

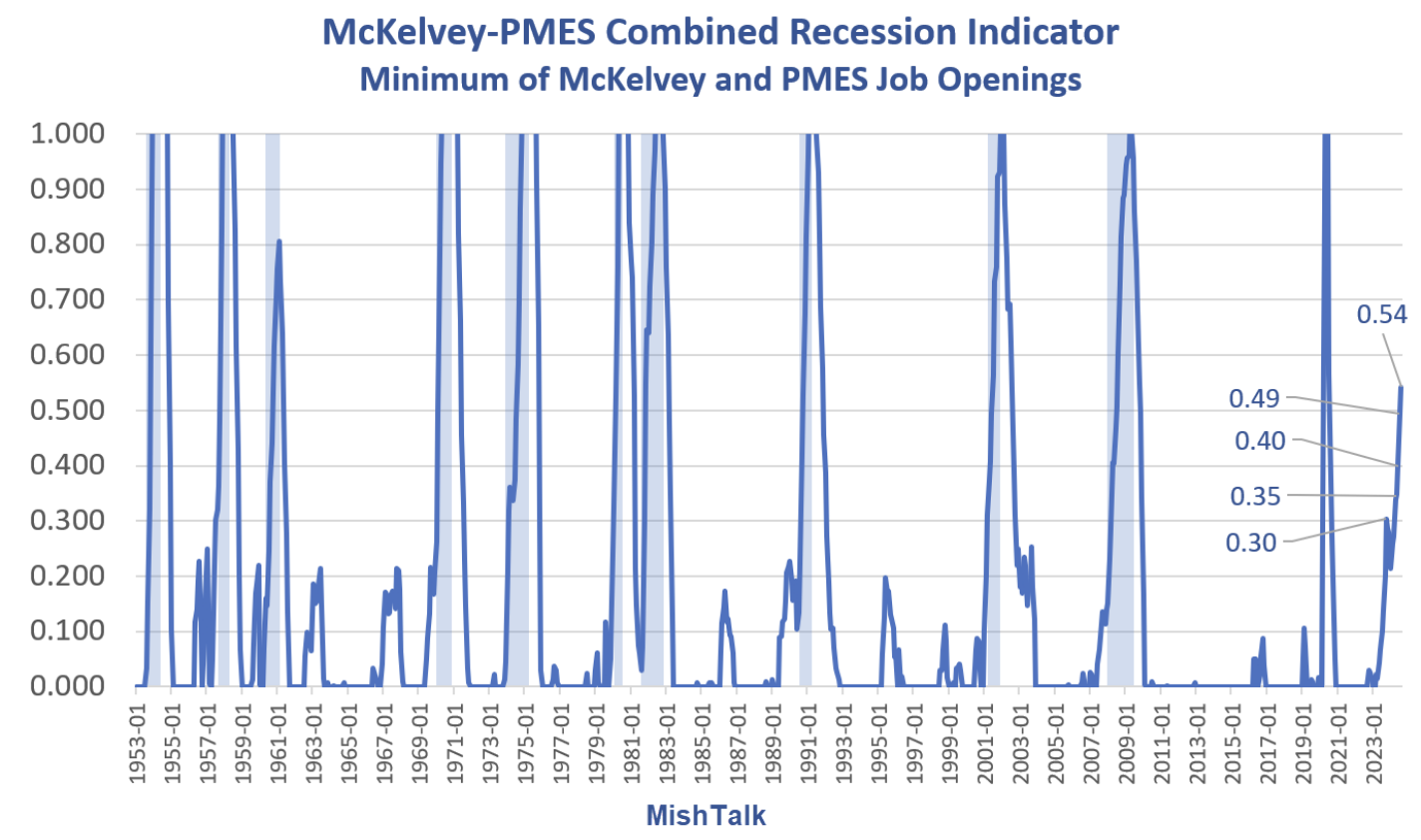

Here I want to circle back to the work of Mike “Mish” Shedlock and his recession indicator.

If Mish’s indicator is correct – he supports Gundlach’s call that we are already in recession (which triggers at 0.40)

As explained here, Mish’s trigger is a combination of several indicators and integrates what we see with job openings (JOLTS)

And as Bloomberg told us last week (prior to the Fed’s decision) – U.S. job growth is downshifting.

Consensus is Soft Landing

It’s fair to say that the majority of people are in either the “soft” or “no” landing camp.

Again, this is reflected in equity markets at all-time highs.

Very few (excluding Mish or Gundlach) remain in the “hard” landing camp.

And that crowd seems to grow thinner by the day.

For me it remains at least a 30% to 40% risk (hence my reduced equity exposure)

Put another way, only a fool would say the risk is close to zero.

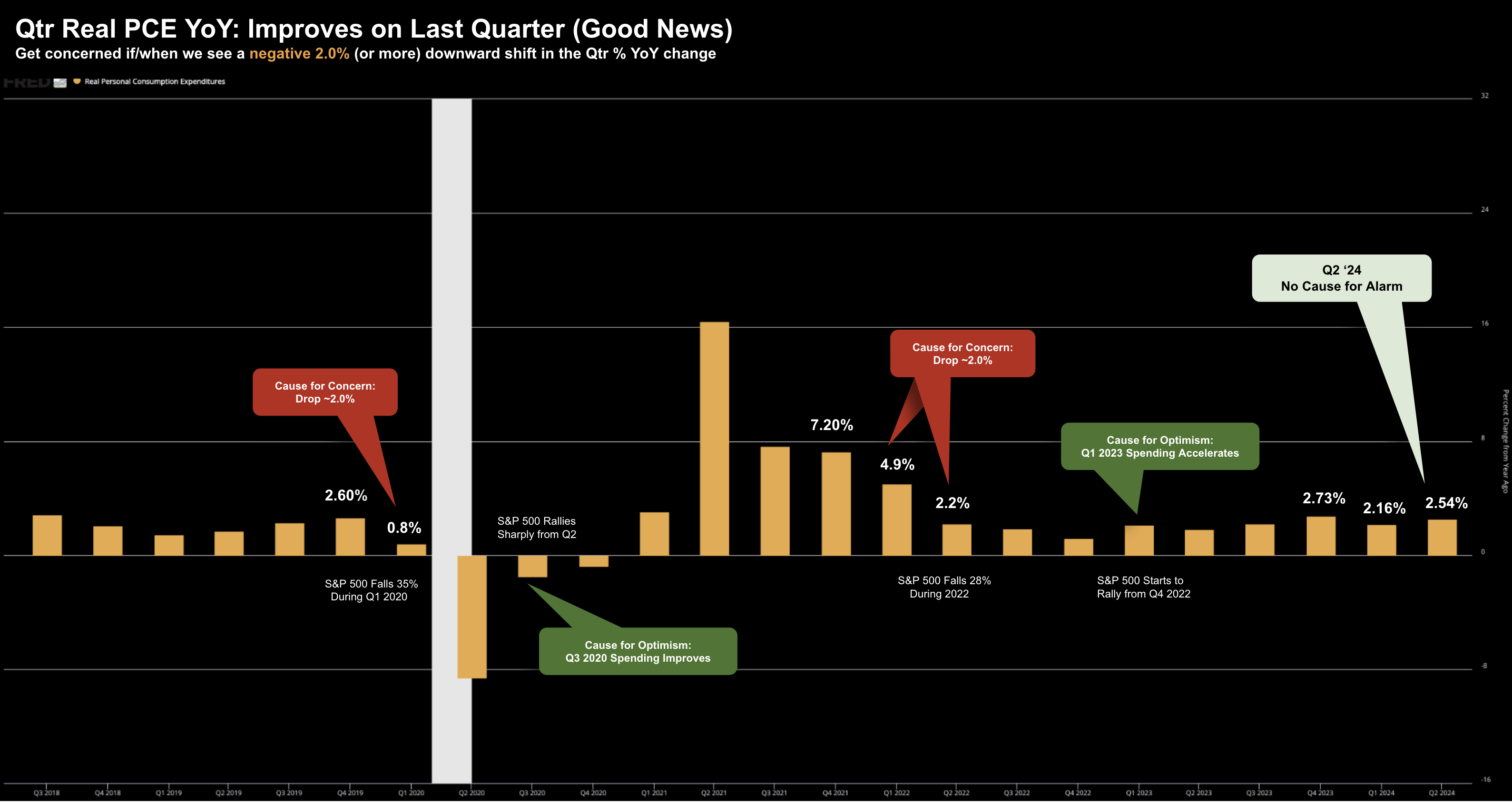

As regular readers will know, my alarm bells will trigger only when I see YoY quarterly Real PCE (consumer spending) start to decline at least 2%.

That’s 70% of all GDP.

We get the next monthly (August) Real PCE report on Sept 27th.

And as we know, the first month of Q3 (July) was solid – where Real PCE showed little change year-over-year.

Concensus is this (spending) trend is set to continue – with the economy arguably less interest rate sensitive than it was pre-pandemic.

For example, the vast majority (more than 70%) of homeowners locked in their 30-year home loans below 4.0% – allowing them to spend during a period of higher rates.

What’s more, with house prices soaring, this has seen their net-wealth and balance sheets improve.

And finally, with their wages now growing faster than inflation – this potentially sets them up well to keep spending (especially if inflation is to settle in well below 3.0%)

That’s your soft-landing script…

But what’s not in the script is widespread job layoffs.

S&P 500: 39th Record High

When Powell announced the 50 bps cut on Wednesday – market’s closed the day lower – staging a massive intra-day reversal.

However, on Thursday the market had a re-think and took off to the upside – recording its 39th record high close for the year.

Friday was basically flat.

In any case, the bulls remain in control – where weakness continues to be bought:

Sept 21 2024

Technically the Index has nudged its nose above the previous high.

I think it’s too early to call this a breakout to the upside… we will need to see a few more weeks like this one to make that call.

What the bulls will not want to see is another close below the previous 5669 high.

If we see that, it could be a “false break” of the high – which suggests another test of the 35-week EMA zone.

But as we know, in a bullish trend – that’s the zone which attracts buyers.

If I were to guess, we could push a little higher heading into Q3 earnings season.

However, earnings (and guidance) need to continue to show strong growth (11-12% YoY) to sustain the rally.

And they could… especially tech.

But that’s your next catalyst to justify a 21x forward multiple.

Putting it All Together

Whether the Fed went with 50 or 25 bps was neither here nor there for me.

Over time, they will work their way back to “neutral” rate – given inflation risks are behind us (which they seem to be)

Now the neutral rate could be “2.00% or 3.00%” – we don’t know (and Powell won’t suggest one).

But we can say it’s a lot lower than what it is today.

The only question is how quickly we get there?

That’s the expectation ‘gap’ in the market (as I demonstrated earlier).

Irrespective…

The single biggest key for stocks and monetary policy will be what we see with spending and employment trends.

Will we see large scale job lay-offs?

If we do, then you could argue it’s already too late to cut rates as the train has left the station (echoing Jeff Gundlach)

Popular opinion is the economy is “doing just fine” and things will only get better with rate cuts (i.e., it’s time to add risk)

That could be true.

Contrary opinion is the weakening employment trend remains a headwind – which was downplayed by Powell.

And perhaps this is what the gold market is telling us?

From mine, I don’t think we can confidently rule these risks out (as equities appear to be doing)