- Things are starting to moderate

- Bad news will now become bad news (a change from the past 12 months)

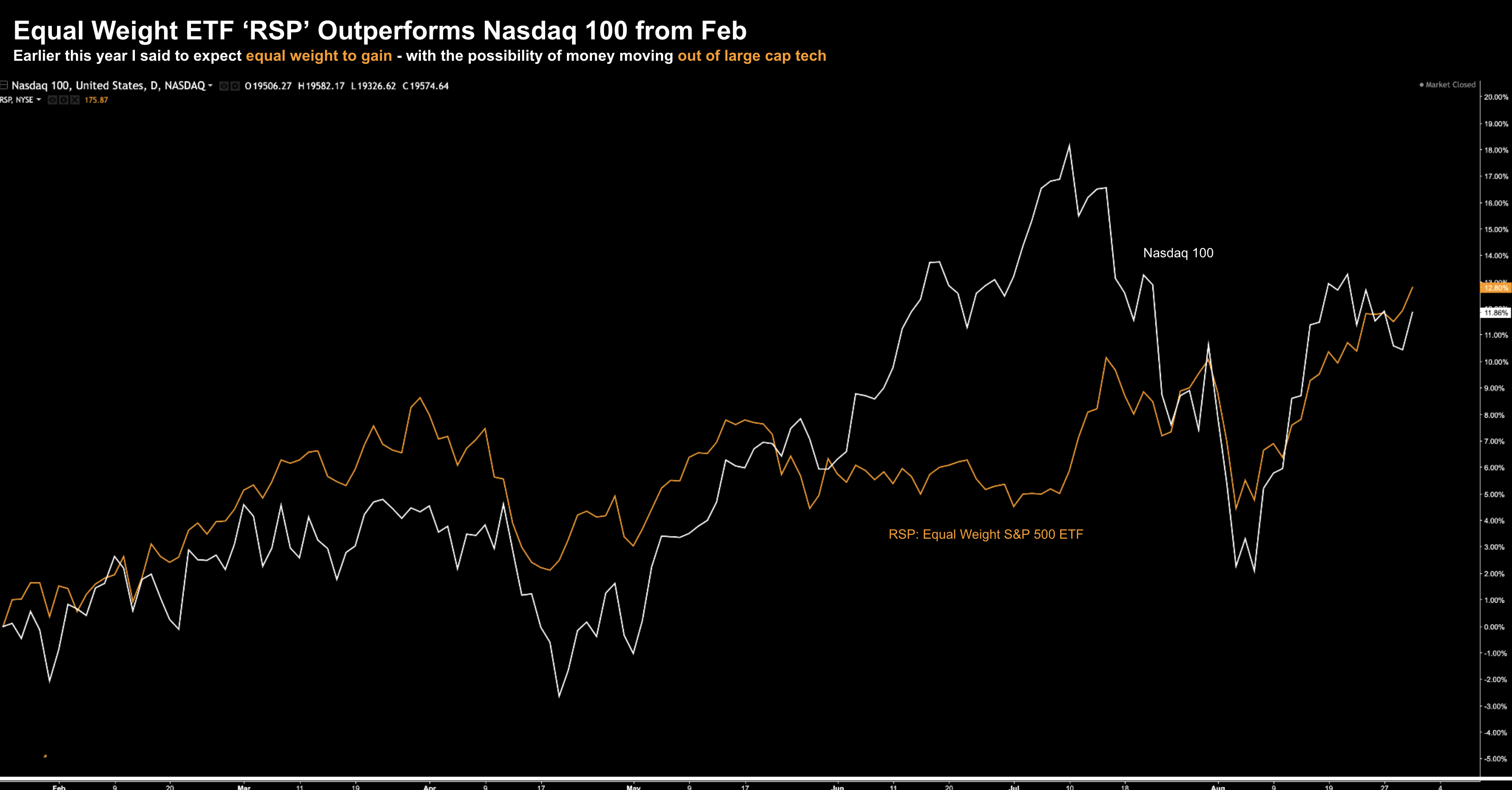

- Why equal weight exposure is a safer bet than the broader S&P 500

Markets are closed Monday for the labor day long-weekend.

I thought I would use the opportunity to pen a few thoughts on how I’m thinking about the rest of the year.

To set the scene, the good news is the broader economic data has been better than expected.

Good news is now good news.

Let’s start with economic output (or GDP)…

Q2 GDP was revised higher this week based on solid consumer spending data.

The economy grew at a 1.4% pace in the first quarter. Economists polled by Reuters had forecast GDP would be unrevised at a 2.8% pace.

Consumer spending, which accounts for more than two-thirds of the economy, increased at an upwardly revised 2.9% rate. It was previously reported to have grown at a 2.3% pace. That offset downgrades in business investment, exports and private inventory investment.

And whilst GDP growth has cooled considerably the past 12 months – it hasn’t slowed too much.

Now supporting the ‘robust’ consumer thesis – July’s PCE told us spending continues to grow year-over-year despite a notable fall in savings.

Here’s the BEA on Real PCE:

The 0.4 percent increase in real PCE in July reflected an increase of 0.7 percent in spending on goods and an increase of 0.2 percent in spending on services.

Within goods, the largest contributor to the increase was motor vehicles and parts. Within services, the largest contributor to the increase was health care.

Finally, we also learned the Fed’s favoured inflation indicator – Core PCE – continues to slow (albeit very slowly). From the BEA:

The PCE price index increased 0.2 percent MoM. Excluding food and energy (i.e. Core PCE), the PCE price index increased 0.2 percent MoM. Real DPI increased 0.1 percent in July and real PCE increased 0.4 percent; goods increased 0.7 percent and services increased 0.2 percent

Given the above, a data-dependent Fed confirmed at Jackson Hole they now have the scope to begin their easing cycle. Here’s Powell:

“The time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks”

The ‘balance of risks’ the Fed refers to are what we see with jobs.

The unemployment rate continues to tick higher (now 4.3% – good news for lower inflation) – however they don’t welcome the rate going too much higher.

Given all the above – the market has responded in kind.

The S&P 500 is up 18.5% year-to-date (excluding dividends).

However, those gains are not evenly distributed.

For example, approx half of this year’s Index gains stem from just 7 stocks – the ‘Magnificent Seven”

The ‘Mag 7’ have added over 37% year-to-date.

That said, the landscape is starting to shift…

Sectors such as real-estate, utilities, financials and health-care have all caught strong bids.

Which brings us to today and what I’m thinking about for the balance of the year…

Starting to Moderate

Over the past year or so – one of the key investment themes has been “bad news is good news”

Bad news implied the Fed was more likely to cut rates.

For example, after the market incorrectly assumed we would see 6 or 7 rate cuts at the start of the year – the Fed have finally come to the table.

In other words, the economic risks (to growth) are sufficient enough for the Fed to act.

This is important.

What happens during this transition is “bad news is no longer good news”

For example, Powell told us:

“It seems unlikely that the labor market will be a source of elevated inflationary pressures anytime soon. We do not seek or welcome further cooling in labor market conditions”.

In turn, the reaction from the market will also change should economic data disappoint.

Put another way, what we don’t want are rate cuts where the economic landscape is deteriorating.

History shows us when this happens during an easing cycle – stocks perform poorly.

Therefore, the market’s primary concern now is whether the Fed has waited too long?

Now we know that economic data and earnings are start to soften.

Analysts have been busy reducing their earnings forecasts.

And whilst consumers are ‘hanging in there’ – not all cohorts are doing well – as discount retailer Dollar General told us during the week:

“It appears to us very strongly that … this lower end consumer continues to be very much financially strapped especially as it relates to her ability to feed our families and support her families,” Vasos said. “[T]his is a cash strapped consumer right now, even more so than what we saw in Q1″

But it’s not just Dollar General – we’ve heard a similar sentiment from ULTA Beauty, The Home Depot, Starbucks, Lululemon, NIKE and a host of others.

From Yahoo!Finance on ULTA’s disappointing revenue and earnings miss:

“We think beauty demand may come under pressure in 2024 as consumer budgets remain stressed after two years of elevated rates”

From mine, when I listen to overall sentiment with earnings guidance – one must question whether the Fed has waited too long?

Possibly.

We won’t know for another few months.

Remember: employment is a lagging indicator.

If the answer is the damage is already done – then rate cuts are not going to make a lot of difference to what we see over the next two to three quarters.

How I’m Approaching It

As readers will know, I’m currently underweight the market (with ~65% long exposure)

I call it ‘cautiously invested’.

I’ve been underweight since the first quarter — where I reduced a solid portion of my large-cap tech holdings (which was too early in hindsight!)

This has seen me underperform the broader S&P 500 by ~10% year-to-date… effectively the cost of taking some insurance.

Now with the market ripping back to its previous highs – I’m not thinking about adding exposure.

Repeating a portion of my last post:

Investors are willing to pay higher multiples for stocks as rates come down (see this post for an explanation on the inverse relationship stock valuations enjoy with rates).

And whilst lower rates typically demand higher PE ratios – we are now pushing close to 22x forward earnings.

22x is far from ‘fair value’…. it’s risky. For context, over the past 10 years, the S&P 500 has averaged a forward PE of around 18x. That’s potentially 4-turns too high…

Now as I said in my preface – multiple expansion has largely been driven by the Mag 7.

And sure – they have been doing exceptionally well from an earnings standpoint (as we heard from Nvidia during the week)

However, if you look outside the Mag 7 to the “493” – year-over-year earnings have been flat (or negative in real terms)

But this could also be the opportunity looking ahead….

For example, I don’t think expectations for the “493” are high (based on their valuations) – however in contract – the Mag 7 continue to be priced for perfection.

And whilst I don’t expect the market to knock it out of the park – there will be (strong) pockets of opportunity outside tech.

For example, take a look at what we see with the equal weight S&P 500 ETF (RSP) vs the Nasdaq 100:

Aug 31 2024

- Money could start to come out of large-cap tech (given the excessively high valuations); and

- Seek greater risk / reward with non-tech sectors (e.g., utilities, health, real-estate, finance etc)

With respect to the first point – consider some of the themes we saw with several Q2 13F filings.

In this post I explained how certain hedge funds were reducing their exposure to tech – seeking value elsewhere.

And whilst I didn’t know it at the time (as we get 13F filings 45 days after the quarter is finished) – it appears they were taking a similar course of action (e.g., from Buffett to Ackman to Tepper… and others)

Now if you’re not particularly skilled at identifying stocks (and don’t have the time or inclination to pore over balance sheets) — one way of playing this is via the ETF ‘RSP’ – structured to give every stock in the S&P 500 an equal weight.

In this ETF – a stock like “Nvidia” or “Apple” is given the same weight as say “Johnson & Johnson” or “American Express”

This is a better approach than simply buying the S&P 500 – as this is over indexed to tech (i.e., where valuations are arguably stretched)

On the other hand, if you have the ability to identify quality names outside tech (i.e., where they show strong free cash flows, low debt, strong moats) – then that’s my preference.

Not all stocks in this ETF are created ‘equal’ (pun intended!)

They may have equal weight – however the respective quality of their businesses (e.g., cash flow, operating margins, debt levels etc) vary considerably.

For example, I’ve shared several non-tech names I’ve added to this year (many moving in the right direction – e.g., MCD, SBUX, NKE, BMY, ABBV, GILD, ACN among others)

Putting it All Together

My guess is the market will not maintain the current pace of gains through the end of the year.

For example, if it’s to close ‘flat’ between now and Dec 31 (e.g., finishing with ~18% gains) – you would take it.

That would be an exceptional year by any measure.

And whilst I think risks remain to the downside – I also don’t see stocks collapsing.

My red flag will be raised when we start to see the year-over-year change in quarterly Real PCE start to decline sharply (e.g., more than 2.0%)

That’s when I know the consumer is in trouble… the rest will flow from there (i.e., lower investment, less production, lower earnings and higher unemployment)

That said, I would recommend playing greater defense vs offense (despite rate cuts).

For example, looking at quality defensive names trading at more reasonable multiples – which are less prone to weaker consumer spend.

And if you want to maintain some exposure to large-cap tech (which is certainly warranted) – the ETF RSP is a conservative approach.

That’s the investing logic I’m applying…

Whether I’m right or not is a different thing!

If nothing else – hopefully I’ve been able to offer you another lens when thinking about risk into the end of the year.

And to all my U.S. friends – enjoy the long weekend.