- S&P 500 losing 9.3% is Sept is a good thing

- But I think there’s still more downside to come

- Understanding the “real” Fed pivot of the past 15 years

If you’re tuning into mainstream media – the headlines will read something like:

A “Brutal September“; or “A Run Away Bear Market” etc

Sure… they make for great headlines.

And fear always sells.

Yes, major indices gave back some ground this month.

Mweh…

That’s not a bad thing.

In fact, it’s a reason to start feeling more optimistic.

If your lens is like mine, you are now starting to sharpen your pencil.

Put it this way:

When I see stocks screaming higher – trading at “21x forward earnings” – or perhaps excess of “10x sales revenue” – I get worried.

That’s when I start to sweat.

But when we see stocks give back 10% in a month… I’m not sweating.

I’m exactly the opposite.

Your best money is buying quality during bear markets.

The goal is to buy well (not just buying quality assets).

I’ve never been a fan of buying at tops (or especially when investors are overly complacent).

I get excited when there is blood on the streets.

Even if that means it’s your own blood!

The question is of course – when is the right time to buy?

I will offer a framework for that shortly…

But the good news is we are slowly but surely inching our way towards a once-in-ten-year opportunity.

Fed Reiterates Rate Warning

From Reuters:

Mester, who holds a voting role on the rate setting Federal Open Market Committee, said she still sees inflation as the paramount problem facing the economy, which means the central bank needs to press forward with rate rises, lifting a federal funds target rate range now at between 3.00%-3.25% to over 4%

Mester said she does not see a case for slowing down on rate rises right now. She noted that at last week’s FOMC meeting officials penciled in a path for the federal funds target rate that will get it to 4.6% next year and said she expects the central bank will likely have to go further than that.

“I probably am a little bit above that median path because I see more persistence in the inflation process,” Mester said.

“Getting above a 4% fed funds rate is important to helping to lower inflation, she said.

Exactly my sentiment.

In addition to Mester, Fed Vice Chair Lael Brainard in a speech Friday morning cautioned against pulling back “prematurely,” saying rates will remain higher “for some time” until inflation is brought under control.

My thesis (and it could be wrong) is the Fed will not stop until real rates are positive.

For those less familiar with monetary policy – real rates are those adjusted for the rate of inflation.

For example, if the Fed Funds rate is 4.50% and inflation is running at 5.0% – real rates are said to be negative 0.5%

And I think this is why Mester is leaning towards a path closer to 5.0% for the nominal rate next year.

Today we were given ample reason why this could be the case:

- Core inflation rose 4.9% from a year ago in August and 0.6% on a monthly basis, according to a measure the Federal Reserve watches closely.

- Personal income rose 0.3%, the same as July and in line with the estimate.

- Spending rose 0.4% after declining 0.2% the month before.

- Headline inflation, including food and energy, also accelerated, despite a sharp drop in gasoline prices.

Now I’m sorry Mr. Siegel (who thinks the Fed has done too much) – but there was nothing in August’s report which suggests to me (and probably not the FOMC) they should not stay the course.

CNBC add:

The Fed generally favors core PCE as the broadest indicator of where prices are heading as it adjusts for consumer behavior. In the case of either core or headline, the data Friday from the Commerce Department shows inflation running well above the central bank’s 2% long-run target. Outside the inflation data, the numbers showed that income and spending continues to grow.

The Real 15-Year ‘Pivot’

As the market continues to push for new lows (perhaps worried about a sharp recession) — I don’t think any of this should be unexpected.

For example, I’ve been bearish on the market for most of this year.

And this is perhaps why my own portfolio is only down ~5%.

I was positioned for it.

And week to week – month to month – things continue to “trade per the tape”

September was no exception.

Now whilst prices have come down a good margin (just over ~25%) – it’s still not yet time to get too aggressive.

Let me spell it out:

- The monetary landscape is changing from expansionary to contractionary.

- Rates are going higher and liquidity is being withdrawn

- This means we shift from focusing on a return of capital (not a return on capital)

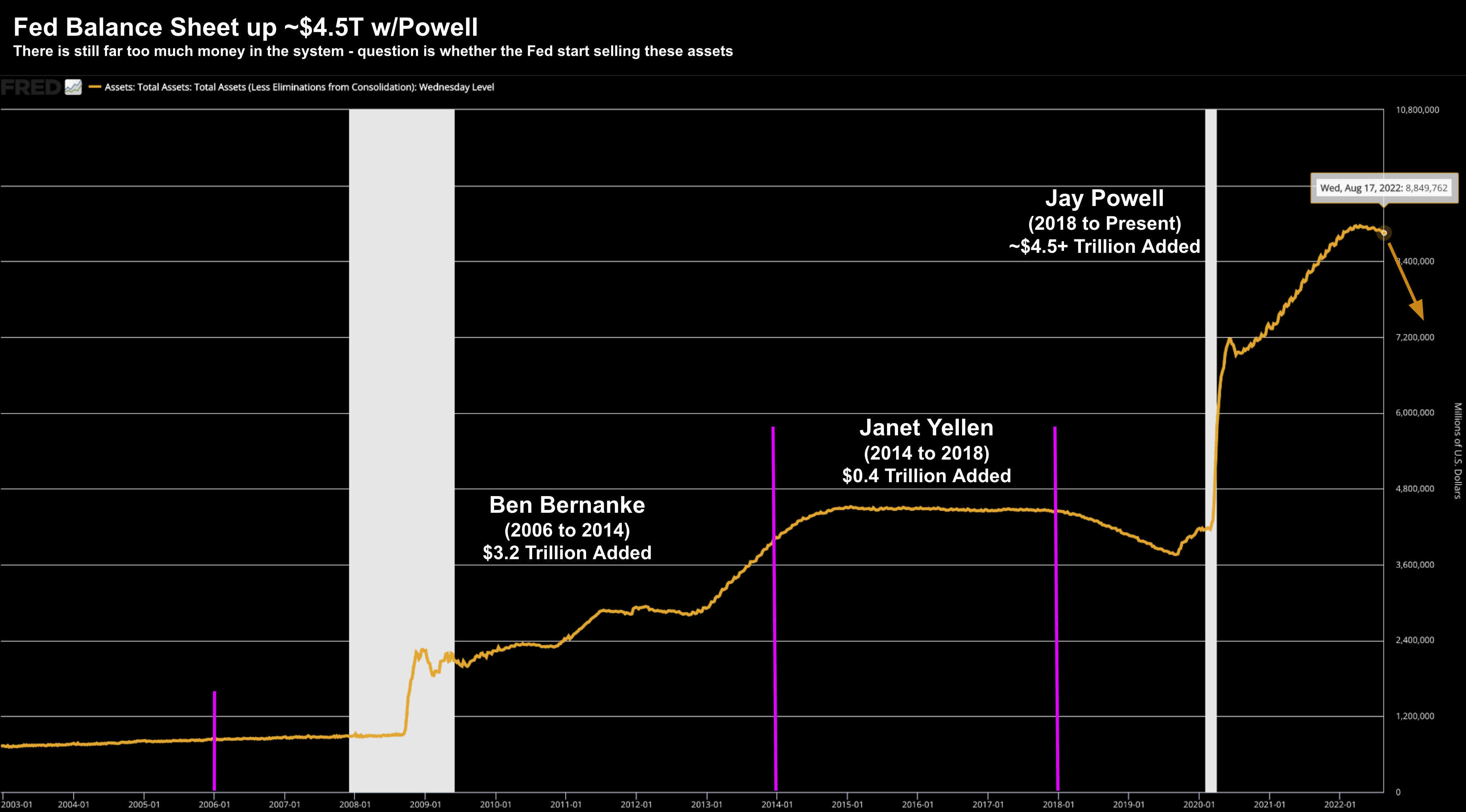

We have seen approx 15 years (from 2008) where the central banks globally have flooded the market with liquidity and ultra-low rates.

I’ve offered this chart several times in the past:

Put together, low rates with QE has been nothing short of rocket fuel for all risk assets (stocks, houses and bonds)

These charts are now shifting.

Liquidity is being taken out and the Fed is no longer intervening in the bond market.

This is critically important and grossly underestimated by investors.

Interest rates are what determines where risk assets go.

They control the traffic.

Now when they are held at zero (or close to) — it’s been a “green light” to speculators.

Central banks were signaling to the market to “take more risk” — leading to a lot of leverage in both stocks and houses.

Now it’s the reverse.

And as this turns – the dynamic of valuation also changes.

For example, now a stock which was priced at “10x sales revenue” without earnings is no longer enough.

Or a stock trading at a forward “PE of 30x” plus only growing at say “15%” is considered excessive.

This wasn’t the case the past few years – it was simply ‘growth’ at any price.

Valuations once again matter.

This is Healthy

Now what makes me happy about months like September is this is what we need to see.

The speculation needs to come out.

What we experienced last year (and the year before) was not healthy.

Sure stocks surged more than 20% and I took full advantage.

But it was based on bullshit.

Cheap money. Mispriced risk.

The moment we saw this shift coming – where the “lights turned yellow” – it was time to take some chips off the table.

That’s what I did.

However, we’re slowly but surely making our way down to levels which are more attractive.

But there’s more work to do.

And I say that because expectations for earnings are going to go a lot lower.

To be more specific, each of the following will come down:

- Sales

- Earnings; and

- Margins

Just look at what we have seen just in the past few weeks (e.g., Nike, FedEx and Adobe – all hammered)

Think it through:

Sales were elevated because of the inflation push that went through to the consumer.

That’s now done.

Margins are getting smashed because of inflationary pressures and meaningfully higher labor costs.

And lastly, multiples will always come down in a higher rate environment.

For example, over the past couple of months I’ve said 2023 earnings will likely be in the realm of $200 to $210 per share.

The might be slightly higher or lower but that’s about the range.

Apply a 15x multiple to say EPS of $210 and we are at 3150

Speaking of levels – let’s now turn to the tape – as it’s been right all year.

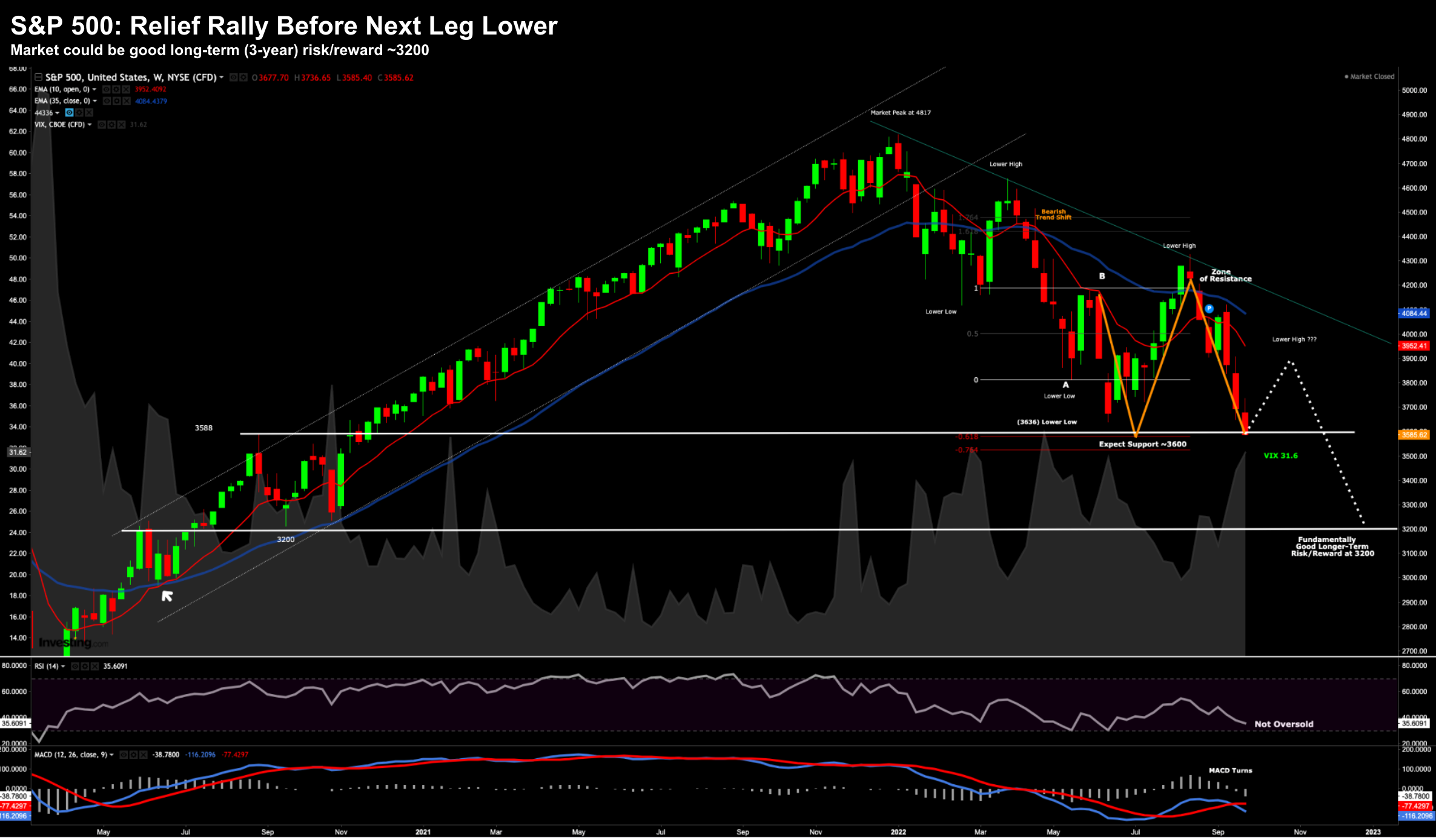

S&P 500: Dial in 3200

Last week I nominated 3600 as a key battleground between the bulls and the bears

My best guess was we could see a short term rally – however I felt it was going to break.

Put another way, I was not tempted to join any rally.

Let’s update the weekly chart:

Sept 30 2022

For regular readers – nothing has changed using this lens.

This is why the past couple of weeks (for me) hasn’t been that eventful – as the chart still looks much the same.

But again, I am sure it might be painful for some.

At the end of September, we sit around 3600 (3585 to be precise)

This is the battleground being fought.

For example, it would not surprise me to see stocks catch a bid next week (e.g., rallying more than 2-3%).

Equally, it would not surprise me to see this give away and plunge 5% or more.

It’s that kind of market.

I am hoping for the latter (naturally) – but I think patience will prevail.

As I’ve said recently, if your view is at least 2-3 years, you can starting nibbling at quality names here (big tech looks very attractive)

I would be more aggressive around 3400…

And I would buy with high conviction at (or below) 3200.

Now I nominate each of these levels because I have no idea where stocks will bottom.

For example, “3585” might the bottom for the next 5 years? We might be there already?

Equally it could be “2700”.

I have no idea.

However, I have a healthy degree of confidence the market will be a lot higher than 3200 in 3 years time.

For example, it’s my view that:

- Inflation will be behind us;

- Unemployment will be higher (leading to softer wage growth)

- House prices will have dropped meaningfully (taking the sting out of rents)

- Speculators will be been taken out; and most importantly

- The Fed’s monetary traffic lights will have changed from “red” back to “green”

I say that because I think there’s a strong probability 2023 will produce a recession (especially given what I see with the negative yield curve)

As an aside, Stan Druckenmiller not only sees a recession – he thinks it will be deeper than most expect.

If that thesis holds true – there is a high probability that rates will move down in this climate – not up.

Furthermore, if the Fed can get rates north of 4.5% (as Mester suggests) – it gives them more scope to cut rates.

And that’s your ‘green light’.

Putting it All Together

At one point this quarter, the S&P 500 was up as much as 14.3%

I called it a bear trap and suggested investors take advantage of the relief rally to get rid of more speculative companies.

From there, the market gave back some 20%, closing the quarter down 5.3%

In summary, September may have been bruising for some of you.

The Dow gave back 8.8%, the Nasdaq lost 10.5% and S&P lost 9.3%

But zoom out a little…

If we go back just 4 short years to September 2017 – the S&P 500 traded 2519

At this week’s close of 3585 – we are 42% higher.

Perspective is sometimes helpful.

In closing, I’m starting to like what we see. But I still think we need to see more.

Employment is still strong; consumers are still spending; wages are rising; and inflation is still high.

We have not seen pain yet.

And I don’t think I’m being “too cute” when I say we could test 3200… I think it’s realistic.

So far, the tape has served us extremely well in 2022…

Let’s see if that continues to be the case.