Words:1,888 Time: 8 Minutes

- Measuring fund manager post-election sentiment

- Are we seeing inflation concerns under Trump 2.0?

- Valuation challenges and investing strategy thoughts

Markets are notoriously fickle.

It made this point here – suggesting traders would be well served to allow the post-election dust to settle.

We saw some of that this week – with the S&P 500 giving back ~2.5%

More on the weekly chart later…

Before diving further into the ‘Trump Trade’ – a word on chasing momentum.

This is a strategy which rarely works over the long-run.

That’s not to say occasionally you will back some winners. You most likely will.

And it was a strategy which worked quite well for me between 1997 and 1999.

But I learned (at a large cost) it relies on the “greater fool” theory…

The theory suggests you can make money by buying overvalued assets, regardless of their underlying value, as long as you can sell them later to someone (a “greater fool”) willing to pay an even higher price.

This trader will mostly ignore traditional valuation metrics like earnings, revenue, or intrinsic value. Their pathway to riches is to ride the wave of hype and speculation.

If an asset is going up, they buy and hope to sell before the bubble bursts.

After paying the price to learn this lesson 25 years ago – this is not how I choose to invest.

But… this is entirely a function of your own investing philosophy.

My strategy will likely differ to yours – as I strive for adequate and sustainable returns over the long-run.

With that, let’s look at what’s driving the Trump Trade… and are investors at risk of tempting fate with the greater fool theory?

🤪 Sentiment Post Trump’s Win

Last week when assessing the surge in markets – I offered examples of how market (sector) dynamics shifted.

Adding to that theme – I was not overly surprised to read how institutional investors are putting money to work.

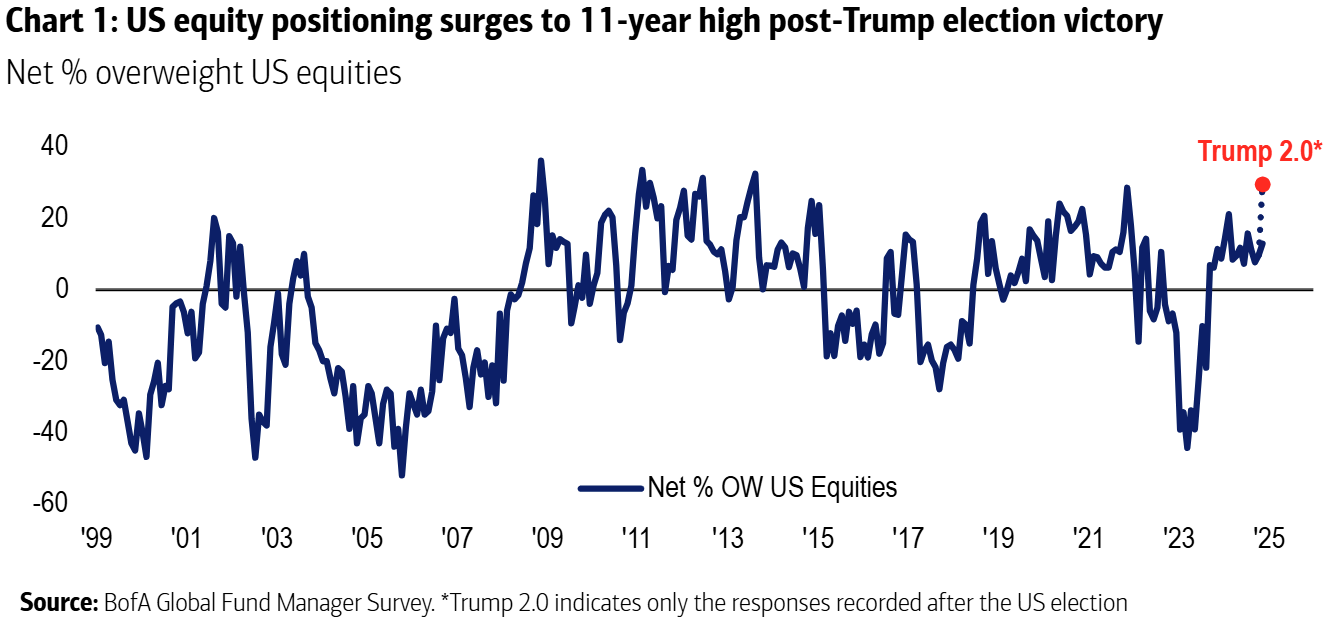

For example, Bank of America Corp.’s monthly survey of global fund managers indicates that Trump’s decisive win is perceived as a potential turning point for investment strategies (for the reasons I explained).

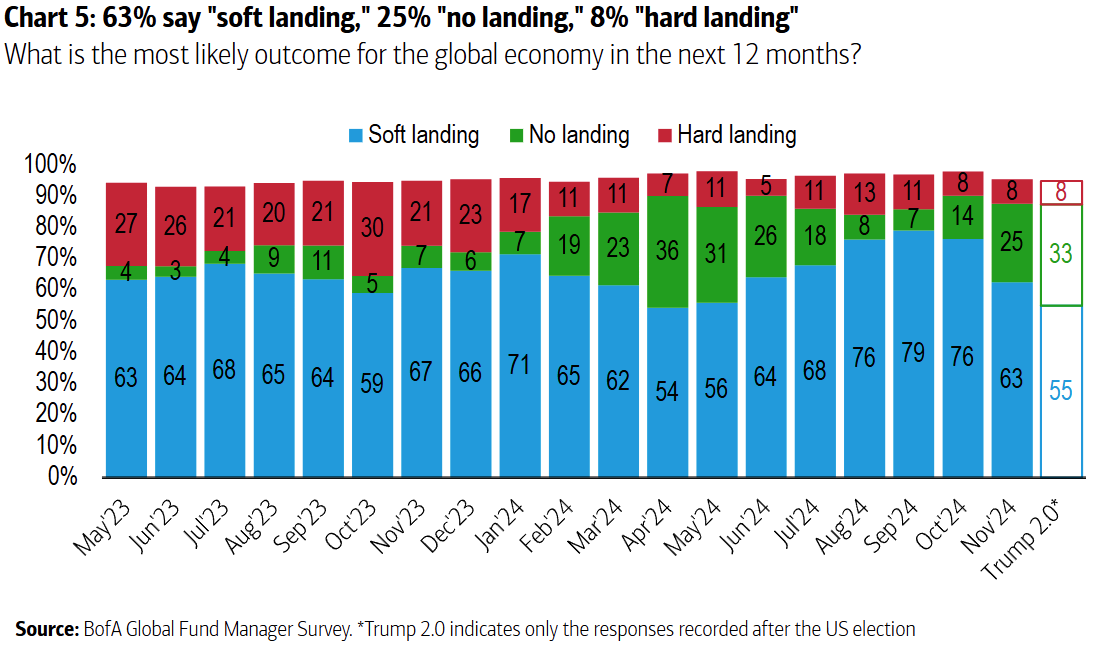

As we see above, prior to the election, many fund managers were opting for a more cautious stance — anticipating no significant economic downturn.

That’s now changed.

Post-election, confidence in a “no landing” scenario — where the economy does not slow down significantly— has increased, rising from a 25% likelihood to 33%.

In short, participants are now less cautious and see the economy accelerating.

This shift has prompted a surge in equity investments, with the percentage of managers indicating an overweight position in equities reaching an 11-year high.

Therefore, it was not surprising to see the S&P hit another record high.

Such bullish sentiment among professionals highlights the profound impact of political developments on financial markets.

The question (as I framed recently) – is whether overweight (equity) positions are wise given the unknown risks?

Does the potential upside handily outweigh the downside risks?

And how do we measure that?

🌶️ Inflationary Implications of Trump 2.0

One of the significant concerns following the election is the potential for rising inflation under a second Trump administration.

For example, I’ve highlighted one of the more consequential impacts post the election… the sharp rise in long-term bond yields.

Below is the dramatic move we have seen with the US 10-year treasury:

Nov 15th 2024

Prior to the election – there was optimism regarding declining inflation rates.

However, Trump’s win and his (inwardly focused) ‘America First’ policies have caused a notable shift in expectations.

A majority of fund managers now anticipate that inflation will rise during 2025.

Perhaps aware of these policy risks – Fed Chair Jay Powell say yesterday that he is “no hurry to reduce interest rates”. I quote:

“The economy is not sending any signals that we need to be in a hurry to lower rates. The strength we’re currently seeing in the economy gives us the ability to approach our decisions carefully.”

His (more hawkish) comment sent yields immediately higher.

And new inflationary risks pose a potential challenge for both the Federal Reserve and the incoming administration.

For example, core to Trump winning was his promise to lower the prices of essential goods for all Americans.

However, if prices were to rise, it gives the Fed less wiggle room (hence Powell’s remarks).

Now I believe this is risk not being priced into equities – as they see as much as 175 basis points in cuts coming next year.

The market will need to navigate economic policies that could either exacerbate or mitigate inflationary pressures in the coming months.

Powell is acutely aware… investors perhaps less so.

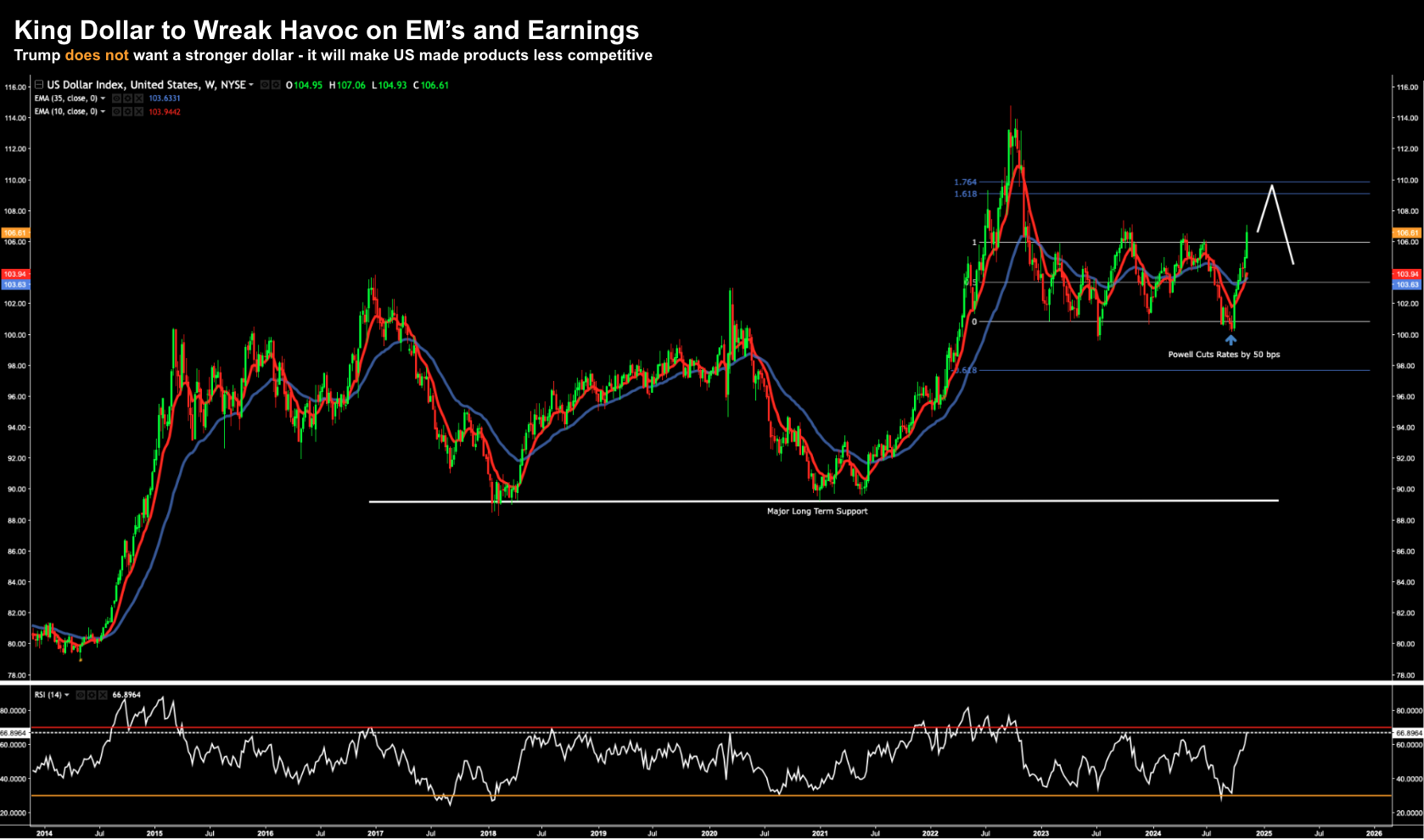

👀 Keep an Eye on Currencies

Whilst the moves in bond yields should have your attention – so should the strong move in “King Dollar”

The greenback’s surge is remarkable… especially given Powell has cumulatively lowered short-term rates by 75 bps:

Nov 15th 2024

The dollar’s move echoes what we see with long-term US bond yields…

Now, prior to November 5th, investors were optimistic about a weaker US dollar (and what Trump expects).

However, they’ve been wrong footed.

Sentiment has flipped which has seen major implications for major currency pairs (such as the Yen, Euro, Yuan and Aussie Dollar)

Investors are now more bullish on the U.S. dollar – while optimism for the Euro, Chinese Yuan and Aussie Dollar has declined.

This shift reflects a broader change in geographic investment strategies, with a renewed focus on U.S. assets.

For example, if I look at how global markets have performed post Trump’s win, they have not seen any follow-through (vs the S&P 500).

However, prior to the election, global stocks were expected to outperform U.S. stocks. That trade has reversed.

Fund managers are now increasingly favoring U.S. equities, a trend that suggests a confidence in the American market amidst changing global dynamics.

But as I will explore – that could be premature…

Let’s start with valuations (and establishing our ‘baseline’).

📜 Historical Context on ‘America First’ Policy

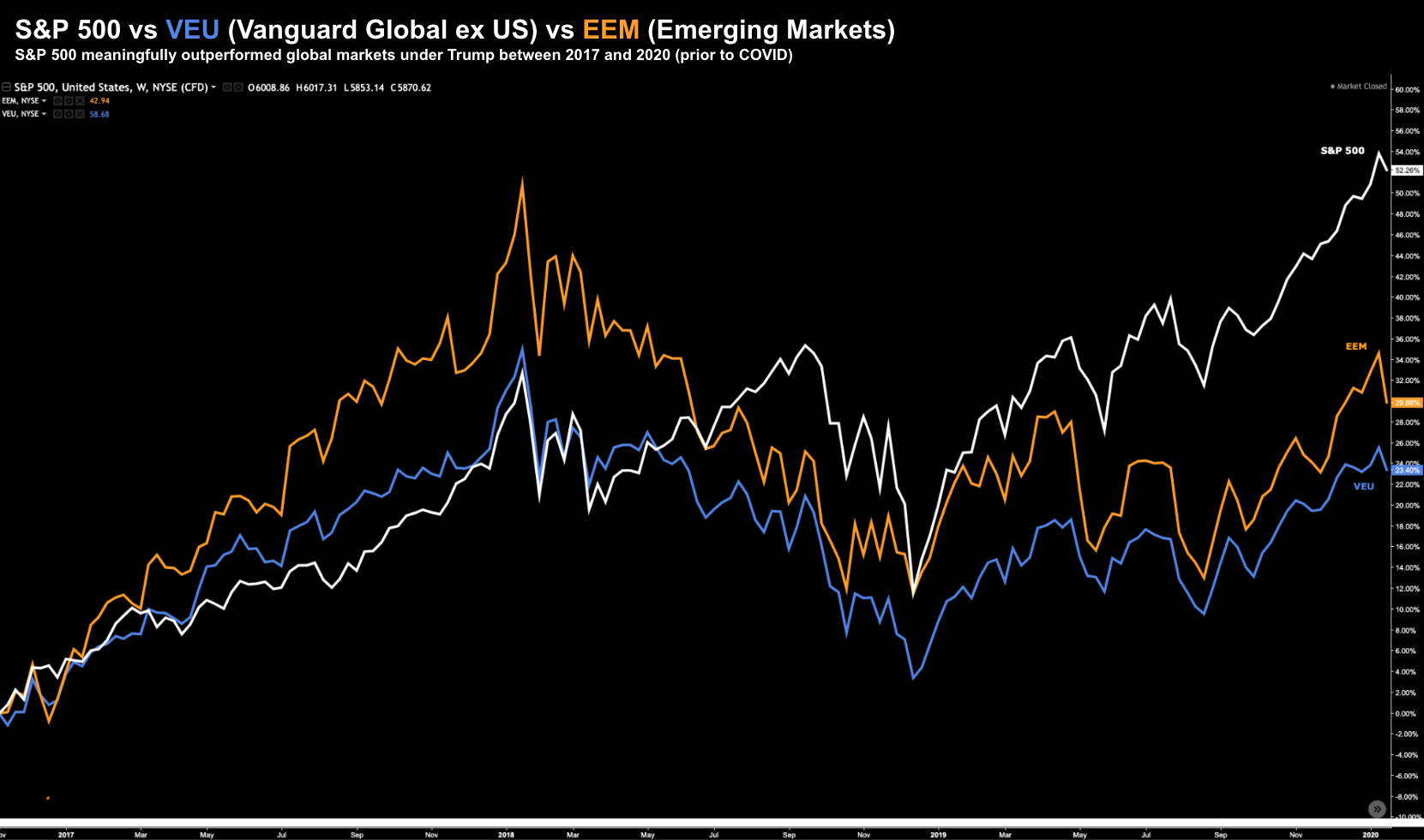

If we turn back the clock to try and gauge how Trump’s policies may influence stocks – we can look towards the period from 2017 to 2020 (up until COVID).

Historical data shows that U.S. stocks outperformed other markets from his election win in Nov 2016.

The initial year of Trump’s presidency was characterized by a synchronized global recovery, but this changed with the implementation of tax cuts and tariffs.

Nicholas Colas from DataTrek International underscores that global asset allocators are keenly aware of these trends as they consider their investment strategies for the next four years.

The prevailing sentiment is that a powerful country (such as the US) – with nationalistic policies – may yield better returns than other options (despite the risks)

By way of example only – the S&P 500 averaged a CAGR 14.1% between Nov 2016 through to Feb 2020 (prior to COVID)

However, I think it’s unlikely that will repeat for reasons I’ll explain.

Below we see the S&P 500’s performance during Trump’s first term through to Feb 2020 against two other global indices:

- VUE (Vanguard FTSE All World ex US ETF); and

- EEM (Emerging Markets ETF)

November 2016 to February 2020

Investors are betting we might see something similar….

However, I will argue the set up coming into 2025 is not the same as it was in November 2016.

Remember the golden rule:

It’s how much we pay that determines future returns (i.e., not simply favorably economic policy in vaccum).

Therefore, is the asking price today heavily in our favor?

🗺️ Navigating the Terrain

Despite the (uber) bullish outlook on U.S. equities, I remain cautious on current market valuations.

With the S&P 500 trading close to 22x forward earnings – that’s not a discount.

It’s my view (which could be wrong) that U.S. stocks are starting from a position of high valuations.

This is important we are looking ahead to see what returns we could see with Trump 2.0.

For example, in November 2016, the forward PE ratio for the S&P 500 was 17.2 (source)

Now the 10-year average forward PE for the S&P is 18.0x. Therefore, we could say it was trading at a slight discount (with respect to modern history)

(Note: the 100-year average forward PE is 15.5x)

A forward PE of 17.2x is around 5-handles lower than today’s starting point.

5 x $275 EPS = 1,375 S&P 500 points.

5,870 less 1,375 = 4,495 (or ~23% lower than this week’s close)

Therefore, when assessing Trump 1.0’s ~14.1% 3-year CAGR (Nov 2016 to Feb 2020) – it stared from a far more attractive valuation.

Put another way, I think the odds for investors were more in their favour.

And whilst Trump’s policies like lower corporate taxes and deregulation will likely free up the private sector to invest and expand (that are some of the positives) – my concerns are valuations.

As an aside, investors should equally weigh the positives and negatives of Trump’s proposed policies (if they came to fruition) – and not simply lean into only the positives (which it appears to be doing).

Regardless, US fund managers don’t seem overly bothered – as they increase their exposure to equities at a 22x forward valuation.

Note:

Warren Buffett is the exception – sitting in more than 30% cash (~$325B) – a record for the 94-year investor who averages a ~20% CAGR for 58 years.

Let me close with some questions:

- Are institutional (perhaps retail) investors ignoring possible valuation and policy risks?

- Why is the prevailing mood of the market overwhelming bullish (are they simply looking at the nominal performance from Trump 1.0 from Nov 2017 to Feb 2020)?

- Are investors simply taking the positives from Trump’s proposed policies (and failing to weigh the negatives)? and

- In terms of measuring the performance from 2016 to 2020 – are we comparing apples for apples – given the relative starting point of valuations (where the S&P 500 traded at 17.2x Nov 2016)?

The interplay between market sentiment and economic fundamentals will be critical in shaping strategies moving forward.

✋ Trump Rally Hits Pause

Market’s allowed for some of the election dust to settle this week – as they process the implications of higher inflation, rates and Trump’s proposed policies.

However, we still remain very close to record highs.

My thinking is if US 10-year continues its march towards 5.0% (as I believe it will – based on the fiscal challenges facing the incoming government) – this may challenge equity valuations.

Investors today are receiving zero risk premium for buying stocks – which traditionally has been a poor bet over the long-run (see here).

With that, let’s take a look at how the S&P 500 finished the week:

Nov 15th 2024

There was very little movement this week; however we did see resistance in the zone I nominated.

Repeating my three (technical) points from last week:

- 61.8% to 76.4% Fibonacci zone outside the August pullback (often an area of resistance);

- Weekly RSI and MACD indicators do not confirm the rally (showing negative divergence); and

- Price action very extended from the 35-week EMA

I continue to remain ~65% long – sitting in ~35% cash or cash equivalents (short term bills and money market)

And whilst I understand the positives of lower taxes and deregulation – there will also be unseen effects we need to balance (i.e., the negatives).

For now, I fail to see how stocks are a bargain. And that might be the case for a few months yet.

Typically this game is a case of (a) near-term sacrifice; for (b) greater longer-term gain.

Note: for those who enjoy the ancient Chinese game “Go” will appreciate the reference.

💥 What Matters for Investors

The aftermath of the recent elections has prompted a substantial recalibration of investment strategies among major fund managers.

But I think this is largely premature…

Trump’s policies will likely have notable implications for equities, inflation expectations, currency trends, and emerging markets.

As the landscape evolves, the challenge will be to balance optimism with caution, particularly in the context of excessive market valuations and potential economic shifts.

For now, I continue to exercise patience.