- Lower Q2 earnings revision the next major catalyst

- Macro risks still skew largely to the downside

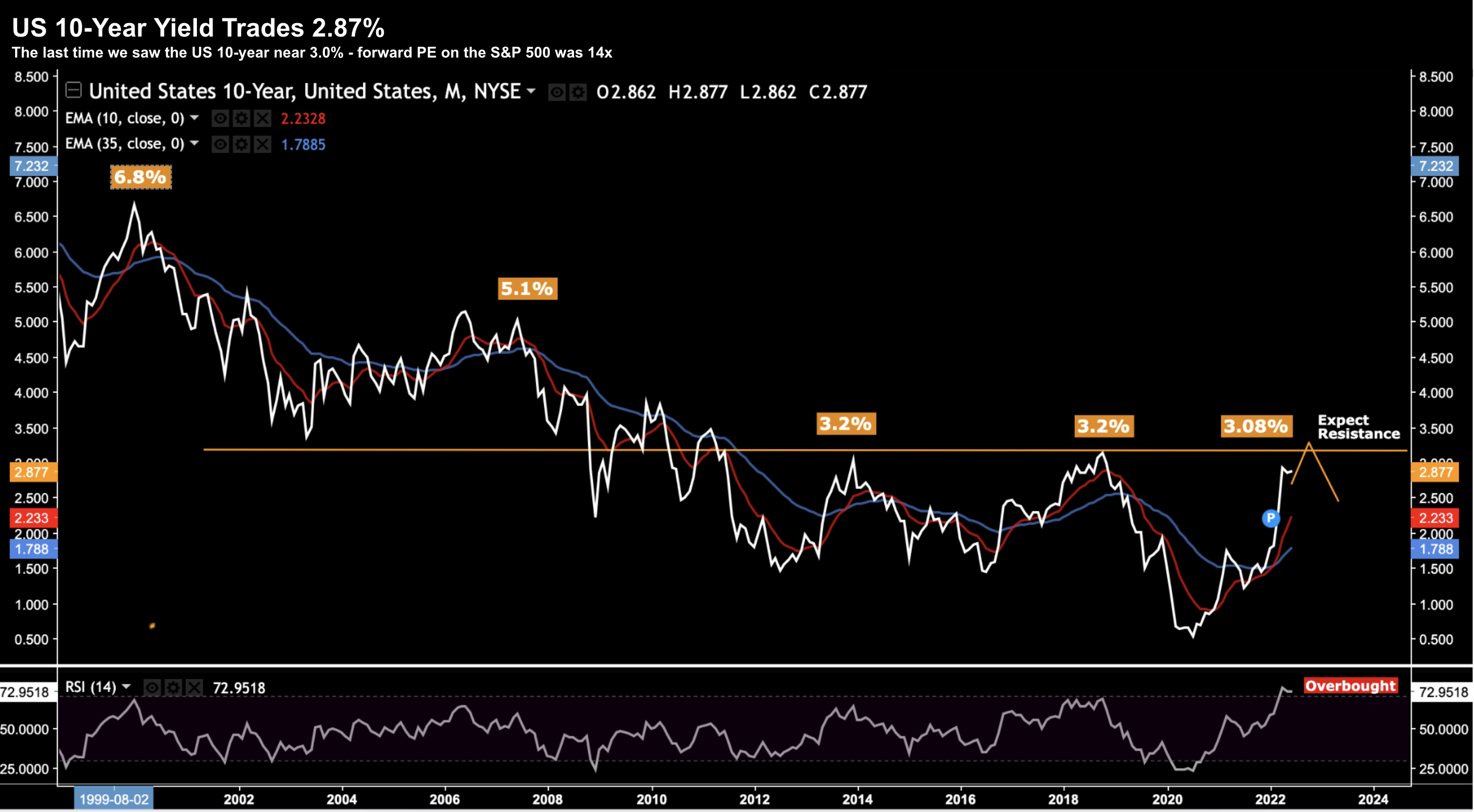

- 10-year yield vs S&P 500 forward multiple

Not even close.

I like to call myself an “armchair economist” – where I try to connect a few of the dots.

Based on what I’ve read – it feels as though we’re in the early stages of a deteriorating macro environment.

For example, things like (not limited to) rising interest rates; higher inflation; oil well above $100; widespread disruptions to supply chains; a slowing Chinese and European economy; and a far stronger US dollar index – are all having an impact on how consumers and corporations will borrow and spend.

Take social media business Snap.

I called it a broader red-flag… not just for the stock.

Their CEO – Evan Spiegel – issued a profit warning last week saying that the macro environment was hitting it harder and faster than expected.

Much like Salesforce (who announced strong revenue and earnings) – it’s planning to slow hiring and look for additional budget cuts.

My expectation is this will be a continuing theme throughout 2022/23 – all a function of how the corporate and consumer spending behaviors are rapidly changing.

Brace for Q2 Revisions

Two weeks ago I said expect the S&P 500 to rally from ~3800 to the zone of 4200 to 4300.

This appears to be playing out… with the market adding more than 6% last week.

However, the fundamental backdrop has not changed a great deal. For example, consider the follow macro view:

- Input costs for companies continue to rise (a consistent theme across all sectors);

- Energy prices (notably oil) continuing to hold above US$100 a barrel;

- Inventories are rising as consumer spend slows (per Target and Walmart);

- Sales are now starting to slow YoY – given the impacts of higher rates and inflation;

- Supply chains are improving (which helps lower inflation) however this adds to inventory overheads (i.e. we will see more goods to clear which means its more difficult to raise pricing); and

- As consumer confidence (and spend) slows – enterprise spend will also slow.

And as these conditions cascade through the broader economy – this will undoubtedly impact Q2 earnings.

From that lens, July has the potential to be a big moment for the market (or potentially late June if we hear of revisions)

Because if (not when) earnings turn lower – so will the market.

June 1 2022

That’s approx 3-4% higher than today’s close.

However, if we assume 4300 with earnings of ~$225 – that places the S&P 500 at 19x forward.

But that’s a “full” multiple in this environment…

For example, it’s fairly priced (perhaps low) if we assume zero nominal rates with QE.

But today we have a 10-year yield trading over 2.87%

June 1 2022

We have gone from around 50 basis points (bps) on the 10-year to 285 bps in rapid time.

This has seen the earnings multiple for the S&P 500 contract from around 22x to ~17.5x today.

And whilst that’s better – the last time the 10-year was 285 bps – the S&P 500 traded at ~14.5x

Again, if we assume S&P 500 earnings of $225, that puts us closer to 3250

Further to recent missives – we cannot rule out an S&P 500 forward multiple in the realm of 15x the next few months.

Therefore, you must ask yourself does the upside gain here (e.g. 4300 in the near term at 19x) significantly outweigh the downside risk(s) (e.g. 3400 at 15x)

I don’t think so.

Put another way – the upside gains don’t meaningfully outweigh the downside risks. However, this equation starts to look better around 15x forward.

Does Salesforce Suggest Upside?

The most watched earnings update today was Salesforce (CRM).

In full disclosure – this is a stock I own (from ~$160) with an overall ~2% weighting.

Further to my preface, the leading cloud (and CRM) provider beat on both the top and bottom lines. And for many – this report was important from an enterprise spend perspective.

Yes and no…

Enterprise strength is still there but they are slowing hiring.

However, my take is don’t read too much into move in the stock (higher by ~9% after hours).

Now CRM trades ~5.8x sales – not outrageous given its market position and 24% top line growth. It’s also 34x forward earnings (on the expensive side).

That said, it is still ~30% lower than its peak a few months ago (underperforming the market but a good margin)

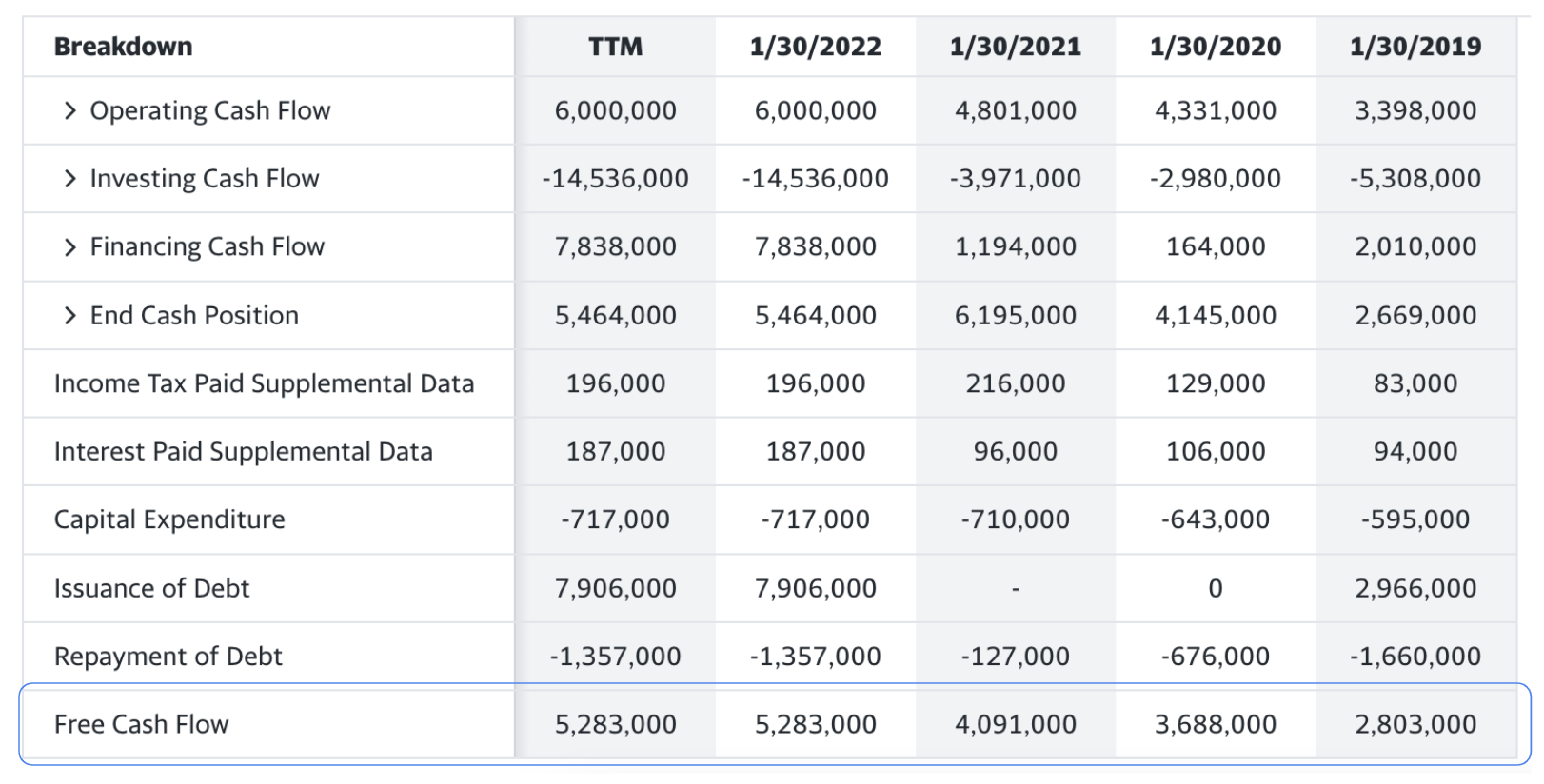

But I think the metric to focus on is its ~4x free cash flow yield.

That’s very much inline with free cash flow yields with Microsoft and others. For example, look at the (impressive) bottom line in this table (yet to be updated for Q1 earnings):

For example, leading tech stocks (like CRM) have already discounted most of the negativity. As a result, I’m not surprised to see the stock up 9% after this report.

But don’t confuse CRM with unprofitable; or low-to-no free cash flow tech stocks.

That’s a very different story.

They are not the stocks you want to own.

For example, as these stocks fall and credit markets begin to dry-up, these stocks will suffer. Note – we are already see far lower liquidity.

Put another way, when QE and free money spigots were wide-open, cash flow negative stocks were able to raise money on the back of (strong) revenue growth.

However, now the free money spigots are closed – the ride gets rougher.

Remember:

A company which has fallen “80%” from its highs can easily still lose another 80%.

In fact, it’s likely.

Putting it All Together

There are two “green shoots” I can offer when I look at the market:

- Fed rates hike expectations are now close to fully priced in; and

- Inflation looks like it is starting to improve (albeit slowly)

- The impact of the Fed’s $1 Trillion (plus) balance sheet run-off; and

- We are still yet to price in expected Q2 earnings revisions (i.e. multiples are still too high)

And if we read through the Fed tea-leaves – they are deliberating looking to induce demand destruction (in part via lower asset prices) to dampen inflationary risks.

From an equity perspective – the correlation between the Fed’s asset sheet expansion (or contraction) and the performance of the S&P 500 enjoy a very close relationship.

Put simply – during QE prices generally rally. The opposite holds true during QT.

With respect to earnings revisions — once we see these start to come from mid-to-late June — expect the market to re-price. Multiples will contract.

And from mine, that’s your catalyst for the next leg lower (after an expected technical rally).