- Powell sticks to the dovish script

- Tapering of QT coming “fairly soon” is the bigger story

- Equities and bonds reacted very differently… one will be right

Investors were on tenterhooks going into today’s Fed interest rate decision.

Would we see a dovish or hawkish Fed?

Markets had priced in a dove – up sharply the past few weeks – however two consecutive months of hotter-than-expected inflation prints had some thinking twice.

And whilst participants didn’t expect any move in rates this meeting – the Fed’s Summary of Economic Projections (SEP) – aka “the dot plot” – was in focus.

For example, a dovish Fed would potentially turbo charge stocks (not that they needed it).

However, a cautious Fed could see equities give back much of their year-to-date gains – implying rates would be higher for longer.

It turns out Powell remains a committed dove.

However, it wasn’t simply the commitment to three rate cuts which surprised me.

Perhaps what the market didn’t see was the Fed’s plans to slow their balance sheet reduction “fairly soon” (but more on that later).

Not deterred by speculation in stocks; a tight labor market; higher house prices; and/or warm inflation prints – he reiterated December’s (dovish) guidance that we should expect as many as three rate cuts this year.

And whilst equities are happy to know the punchbowl isn’t being taken away – bond investors continue to err on the side of caution.

First, let’s look at the summary of economic projections.

The ‘Dot Plot’

Consistent with its December projection – the Fed remains comfortable with projections for three rate cuts before years’ end.

This was relief for the market as anything less may not have been well received.

Powell reminded investors that the data of the past two months is further proof of inflation’s nonlinear path downwards.

“I think they haven’t really changed the overall story, which is that of inflation moving down gradually on a sometimes bumpy road toward 2%. “We’re not going to overreact to these two months of data, nor are we going to ignore them”

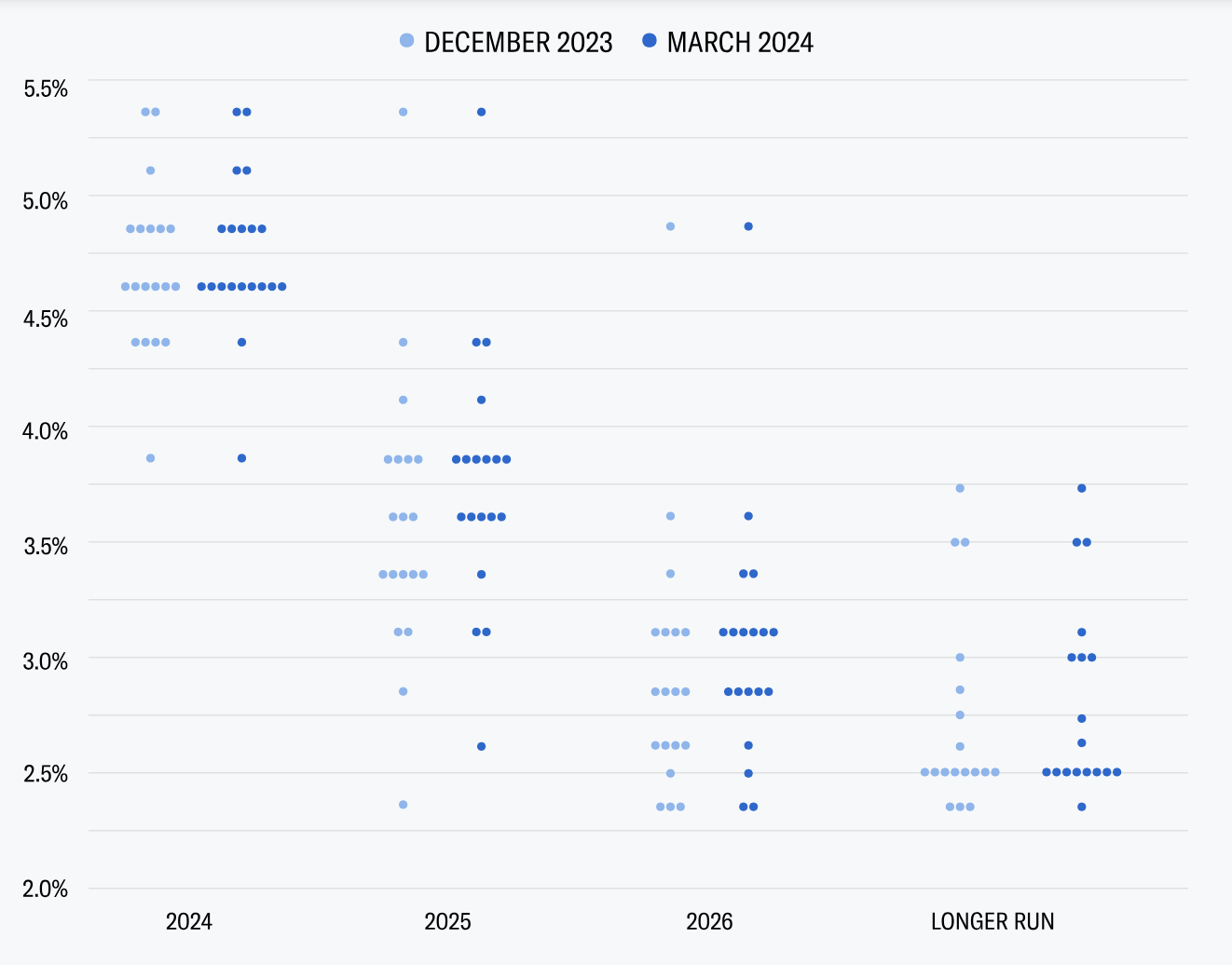

As we can see with the dot plot below (which I think is of very little value) – Fed officials see the fed funds rate peaking at 4.6% in 2024.

That suggests the Fed will cut rates by 0.75% (i.e., three cuts of 25 basis points each).

Fed Dot Plot or “SEP” – March 20 2024

Seventeen officials predict a rate cut this year while just two see no cut.

However, it’s also worth noting that just one official sees the Fed cutting rates by more than 0.75% (down to 4.25%) this year.

For example, the dark blue dots show that in December – that was five officials.

Given the revised plot – the CME’s FedWatch Tool now sees a ~60% chance the Fed will begin to cut rates at its June meeting, up from 55% the day prior.

The SEP also indicated the Fed sees core inflation peaking at 2.6% this year — higher than December’s projection of 2.4% — before cooling to 2.2% in 2025 and 2.0% in 2026.

Officials see unemployment rising to 4.0% in 2024, lower than the previous forecast of 4.1% (i.e., essentially full employment and where we are today).

They also raised its forecast for US economic growth, with the economy now expected to grow 2.1% this year — up from December’s 1.4% projection — before ticking down slightly to 2.0% in 2025 and remaining at that level through 2026.

This is telling the market they don’t see a recession anytime over the next two years (i.e. “soft landing” ahead)

And whilst I give very little weight to long-range forecasts (or dot plots) from anyone (especially the Fed) – if true – this obviously bodes well for corporate profits and earnings.

Bond Market Reaction

Equities celebrated whilst bonds remained muted – barely moving a few basis points (as the daily chart for the 10-year shows).

March 20 2024

I found the reaction curious as I would have expected yields to move sharply lower (given the commitment to rate cuts)

Not so.

The question is why? What do bonds see that equities don’t?

For example, maybe the bond market remains less convinced of the Fed’s current dovish rhetoric – and still only sees two rate cuts before year’s end.

To that end, perhaps they see another month or two of hotter-than-expected inflation prints (e.g. with services) – which would make the Fed reconsider their dovish stance?

All of the above are quite possible.

It’s difficult to say – but for now – but yields remain relatively high (i.e., above 4.0%) until convinced otherwise.

‘Slowing’ of QT

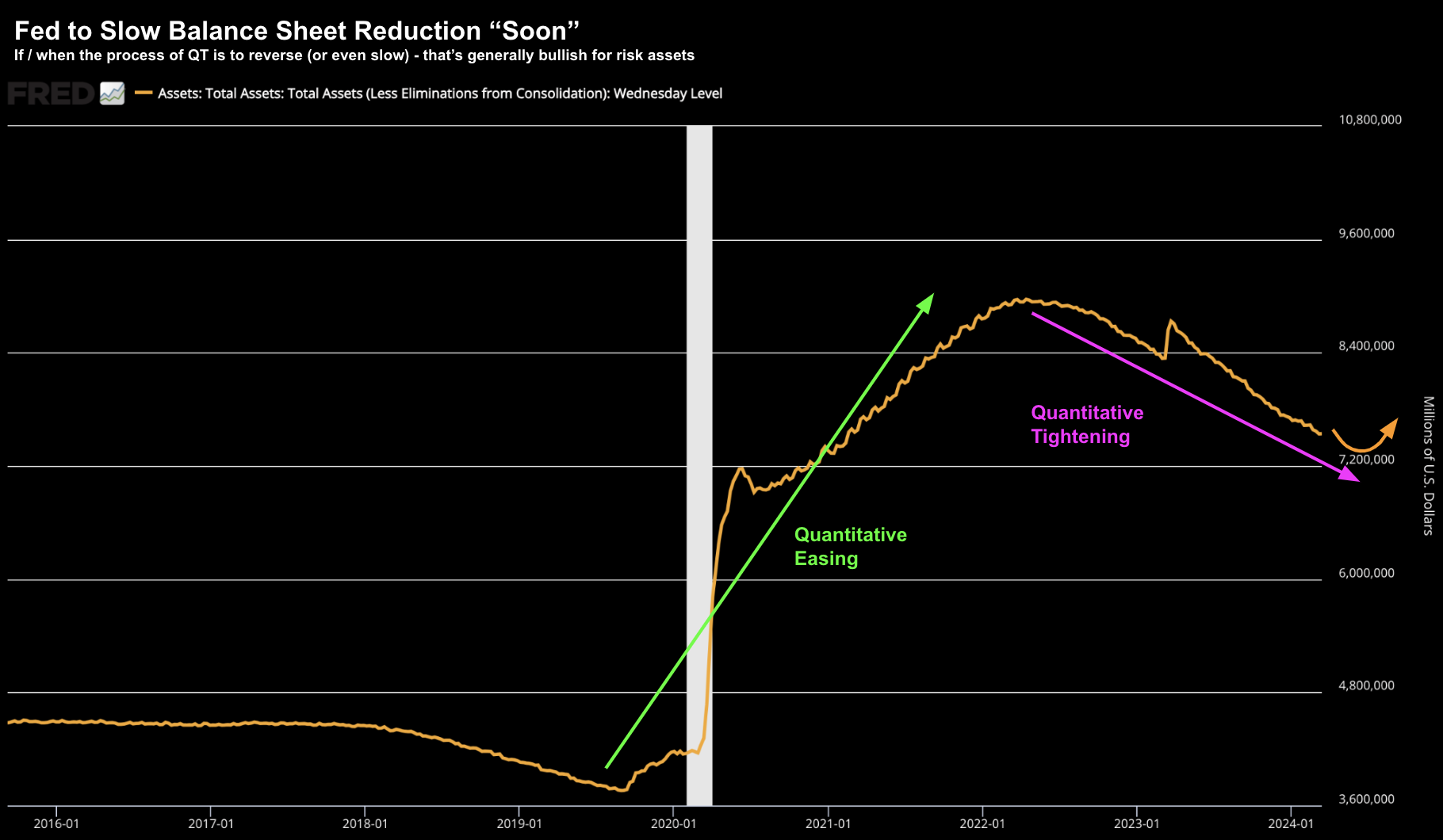

Whilst mainstream focused mostly on the dot plot (where changes month to month are common and widely varied) – the surprise (for me) was with respect to the Fed’s balance sheet.

As context, the expansion of the Fed’s balance sheet (“QE“) is often a massive tailwind for stocks (for the reason it adds liquidity).

However, when Powell sought to reduce their asset holdings in a bid to tame inflation (i.e., letting assets roll-off their balance sheet) – many were concerned this would negatively impact equities.

Not so.

From mine, this is what gave the bulls more juice.

It was arguably the most explicit Powell has been on QT – which has seen about $1.4 trillion of bonds roll off the Fed’s balance sheet – in turn driving up yields.

Whilst not offering a specific timeline as to when this would start – Powell said “… it will be appropriate to slow the pace of run-off fairly soon”

And this is why I say it’s a dovish Fed.

The green arrow on my chart above shows how the process of QE started around March of 2020 – where the Fed bought Treasury and mortgage bonds in unprecedented numbers to stabilize financial markets during COVID and provide stimulus.

QE topped out around $9 trillion by the mid 2022 – well after the pandemic had finished.

This was highly inflationary (especially for risk assets).

We had excess money in the system chasing too few goods.

The Fed began to shrink the size of its holdings (“QT”) later that year – hoping to bring inflation back to 2% by taking money out of the system.

However, now Powell is saying the pace of reduction is set to slow “fairly soon”, which means the Fed are not worried about the easing of financial conditions (and any inflationary impact that could have).

Again, will this change with one or two more ‘uncomfortably’ high inflation prints?

We will see…

Putting it All Together

Apart from what Powell said with respect to QT – the Fed’s narrative largely feels unchanged from December.

On the surface, this is bullish for stocks.

There are no plans to take away the punchbowl.

And whilst some of the inflation numbers for January and February remain above expectations – Powell is not reading too much into two months of data.

Question:

What will a third or forth consecutive hotter-than-expected inflation print do to Powell’s mindset (especially with respect to core services and housing). Will that see an equally dovish Fed in June?

I doubt it.

Therefore, I think the next two months inflation prints (especially housing and services) will be key (as will the employment picture)

For now at least, Powell still needs more data to have confidence that inflation is returning to target before they cut (which is inline with what he told Congress only two weeks ago)

That said, equities heard all they wanted to hear (i.e., three rate cuts and a slowing of QT). And that’s more fuel for stocks.

However, the ‘smart money‘ (i.e., fixed income) was not buying all the Chairmen was trying to sell. Not just yet.

And from mine, that’s quite telling.