- How to think about fixing inflation

- What’s changed with the Fed’s most recent statement

- S&P 500 likely to fall below 3600

Markets are slowly coming to terms with how far the Fed is willing to go to contain unacceptable levels of high inflation.

The Dow Jones hit a fresh low for the year – closing below 30K for the first time since June.

And much of that is a function of what we see with treasury yields – as the 2-year rips past 4.2%

I only said last week that’s where we are headed… arguably much higher in 2023.

But what all this comes down to is a fear of the Fed doing too much… driving us into a sharp recession.

For example, Wharton Professor Jermey Siegel went on a ‘rant‘ today – believing the Fed has gone “too far”.

“The last two years [are] one of the biggest policy mistakes in the 110-year history of the Fed, by staying so easy when everything was booming.

When we have all commodities going up at rapid rates, Chairman Powell and the Fed said: ‘we don’t see any inflation. We see no need to raise interest rates in 2022.’

Now when all those very same commodities and asset prices are going down, he says: ‘Stubborn inflation that requires the Fed to stay tight all the way through 2023.’

It makes absolutely no sense to me whatsoever, way too tight!”

Siegel is one of the long list of so-called “experts” that believe they know where rates should be.

How anyone is capable of knowing is beyond me… as there are simply too many complex (inter-related) variables to forecast (see this post).

But for every “Siegel” – there are those who think the Fed needs to do more.

Only time will tell.

First, let’s recap on what’s changed with the Fed’s most recent (September) statement.

What’s Changed?

The Fed continues to see modest economic growth (with things like consumption) along with a relatively robust jobs market.

Whilst that’s partially good news for the economy (in the very near-term) – there is also little scope for the Fed to pause.

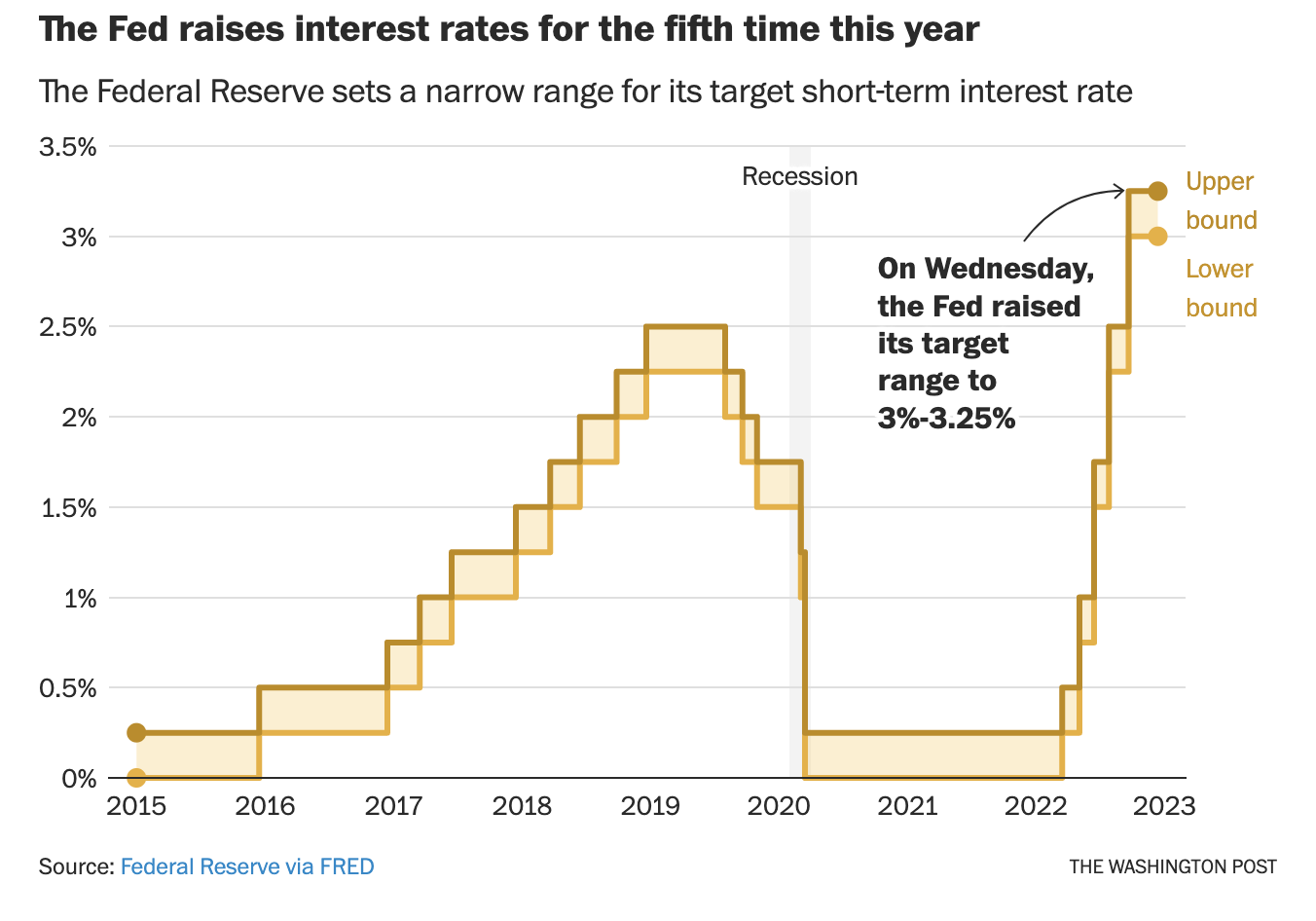

This saw the Fed’s short-term target rate raised to 3.0 to 3.25%

But I think what’s important is what the Fed said (vs their statement):

“We have got to get inflation behind us. I wish there were a painless way to do that. There isn’t.”

Exactly.

Powell added that both consumers and business will ultimately suffer more, and for longer, if the Fed flinches in its commitment to pulling prices back down.

And this is where Siegel is seemingly frustrated…

He thinks the Fed has done enough already (arguably too much) – more than enough to tame inflation.

What’s more, he sees the risks of a 2023 recession, meaningful job losses, higher credit costs; and/or a broader slowdown in demand.

In other words, the Fed are “rear-view mirror” and not looking forward.

On the contrary, Powell is of the view they risk repeating the same stop-go policy errors of the early 1980s (something Siegel obviously feels is no longer a risk).

Is “75” the New “25”?

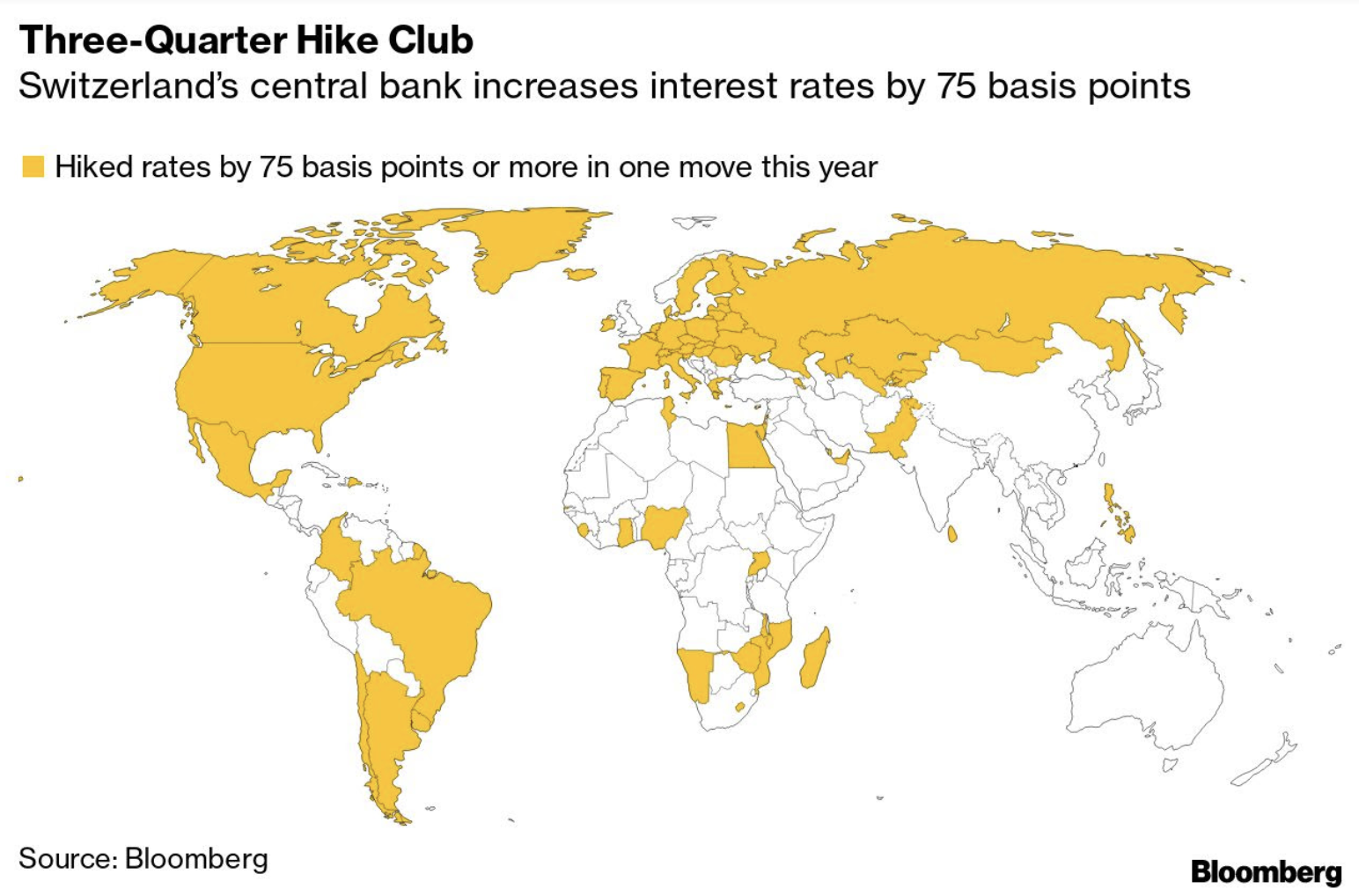

Irrespective of whether central banks are making a (massive) policy mistake – central banks globally are seemingly unified in their quest to bring down inflation at any cost.

Bloomberg reported that borrowing costs worldwide rose a combined 700 basis points over the past month.

Put another way, near-term concerns of recessionary growth are not a priority.

Here’s Citi’s economists post the Fed’s decision:

“Both rhetoric and action of major central banks are demonstrating greater resolve to fighting inflation, increasingly willing to sacrifice growth to achieve this”

- Core PCE inflation running at 3x the Fed’s target;

- Real interest rates at close to their lowest levels we’ve seen in 50+ years;

- More than $9 Trillion that sits on Fed’s balance sheet; and

- Wage and rent inflation still running in the realm of 5% annualized.

What’s more, the Fed funds rate at just 3% – we’re nowhere near the 5% to 6% we traded before the 2008 financial crisis (more on this below when I share the long-term chart for US 10-year yields).

And on that basis (to counter Siegel) – rates potentially still have a long way to go to get back to ‘zero’ – let alone move into “restrictive territory”.

For example, Bank of America and Goldman Sachs are among those predicting a fourth 75 basis-point increase in November.

They also lifted their predictions for when the Fed will stop…

Bloomberg economist Anna Wong warns a 4.5% benchmark would cost about 1.7 million jobs, and rates at 5% nominal rate would mean 2 million fewer jobs.

And that’s exactly what the Fed have in mind IF they are to curb unsustainable (spiralling) 5% wage inflation.

S&P 500: 3600 in Sight

As I’ve been writing for the past 8-10 weeks… my feeling was we were more likely to test the June lows.

I was first looking for a rally towards the 35-week EMA (around 4200) before another pivot lower.

And for the most part – this is what we have seen:

Sep 23 2022

However, for some it probably feels more painful.

None of this should come as a surprise… especially given:

- the strong weekly bearish trend; and

- the series of lower highs / lower lows

Nothing on this chart suggested (to me) we were able to turn bullish.

In other words, I was calling this a “classic bear trap“

It was.

Now I’m hoping that some of you didn’t add to positions around 4200. Instead, you used that opportunity to offload any more speculative ‘Cathie Wood’ type names at a higher price (i.e., sticking to quality)

The question is now what?

My best guess is we are likely to find some support around this zone and could see a relief type rally in the next 1-2 weeks.

But again, that doesn’t mean that lower lows are not ahead.

As I’ve consistently said, I think that around 3600 is an area you can start to add to quality names for the long-term. However, don’t be surprised for us to test 3200 before the year is done.

What We Really Need to See

For example, two of those things include:

- a clear shift in tone from the Fed; and

- S&P 500 earnings revisions to come down.

We will see the latter before we see the former!

However, another critical data point is wither respect to the almighty US dollar index.

It’s surging to new 20-year highs – destroying everything in its path – and that’s a bearish sign for stocks.

Sep 23 2022

At the start of the year, I nominated the US Dollar Index as one of my “Top 5” charts to watch for the year.

I said this given I felt the Fed were more than likely to aggressively raise rates.

Today, the dollar is ripping to new highs based on the fed funds futures market now pricing in a peak interest rate of 4.5% to 4.75% for February 2023, with the first interest rate cut coming in November 2023.

Currencies will typically trade on interest rate differentials.

For example, take a look at the destruction we are seeing with both the British Pound and the Euro.

But here’s something else:

As I wrote last week – I don’t believe we can rule out the possibility of the Fed going beyond 5% next year (apologies Mr. Siegel!)

I say that given how persistent core inflation is likely to be (e.g., specifically wages and rents)

Again, I remind readers that rates were routinely around 5% or 6% for decades before the 2009 financial collapse.

Take a look at the US 10-year below:

Sep 23 2022

This chart helps explain why we are in this mess…

From mine, post 2008, speculators become increasingly addicted to a diet of ultra-cheap money.

And this was entirely the Fed’s doing.

Their logic was lower rates for longer (via bond market manipulation) was “healthy” for markets.

Wrong.

Now they are seeing the error of their ways and realize the addiction needs to stop.

And just like giving up any addition – there is typically pain.

Hiking rates back to a more ‘normal level’ of above 4.0% is not unusual.

But it will feel painful for a patient who has been living on a diet of “closer to zero” for almost a decade.

But let’s get back to the Dollar Index…

What we need to see is this bullish trend reverse.

If we see any weakness in the dollar – stocks will most likely catch a bid.

But as long as the Fed remains hawkish – it will support dollar strength.

Therefore, I would not bank on the dollar turning long-term bearish anytime soon. It’s something we could see mid-to-late 2023 – but it’s unlikely before then.

However, in the very short-term, the strength in the greenback appears overdone.

And we could expect a move back towards the 35-week EMA.

(Note: I’m long the US dollar)

Putting it All Together

Inflation is easy to define… but hard to ‘fix’ once it’s out.

It’s like getting toothpaste back into the tube.

It’s a phenomenon where there is simply excess money chasing too few goods.

But therein lies the rub… there are two problems to solve:

- Excess money

- Too few goods

The Fed can only influence (1).

For example, they can increase the demand for money by raising rates (i.e. it becomes more attractive); whilst reducing money supply.

But they cannot influence (2).

With respect to “too few goods” – this is a supply issue.

To be clear, it’s not a demand issue – it can only be solved on the supply side.

For example, if you make more of something, it’s worth less. However, if you make less of something, it’s worth more (Econ 101).

Let me offer three very basic examples…

1. Energy.

We can do a lot more on the supply side here to reduce the price. For example, developing more pipelines for gas or drilling for more oil will reduce prices. In fact, you only need to signal you’re doing it and the market will immediately adjust prices lower (well before any work commences). What’s more, it’s something the US can do domestically (without a need to rely on OPEC).

2. Food.

If you incentivize food production (e.g. tax incentives for farmers or greater subsidies etc) – you will probably get more of it. If you generate more food supply, the price will come down.

3. Housing.

If you implemented a scheme to develop “6,000” more low-cost housing units in a suburb – what do you think will happen to prices? They will most likely fall. Again, make more of something and the prices fall.

Now the Fed can do very little to influence supply of energy, food and shelter.

However, the government can.

What the Fed is doing is attacking inflation with the (blunt) tools they have; i.e., monetary policy.

They’re doing what they can to take the excess money out of the system. They’re also trying to make money more attractive (n.b., it’s not attractive when rates are zero percent!)

But I would argue the government plays an equally important role….

To be clear, this is not a demand problem (as some think).

For example, the solution isn’t about giving people more money to spend (as the UK are doing – with the Pound hitting a ~40-year low); or wiping out student debts. Those kind of measures will only lead to further inflation.

This is very much a supply problem.

In short, we want a situation where there is less money chasing excess goods.

That’s when inflation falls.

Inflation can be fixed. But the Fed will not be able to do it alone.

There needs to be political will to solve this from the supply side – specifically with a focus on where inflation is hurting people most.

In closing, stay patient here folks.

Stocks might catch a near-term bid the next few weeks but we’re not out of the woods. However, if you’re like me with a longer-term view (3+ years) – things start to look a little more attractive as we inch closer to 3200 on the S&P 500.