- Bond yields ease sending stocks higher

- Why I’m not tempted by a ‘5-10%’ rally

- Earnings assumptions for 2023 are far too high

Last week I said “Forget Stocks – It’s All About Bond Yields”

The thesis being:

- Higher bond yields < > Lower stocks

- Lower bond yields < > Higher stocks

On the flip-side, if yields were to fall, stocks would most likely catch a bid.

Today yields plunged and stocks popped.

Bond Yields Ease…

Oct 03 2022

As we can see in the lower window (RSI) – the chart suggested things looked extremely overbought.

Often when this indicator moves above 80 – we are on the lookout for a corrective move lower.

You can see how this happened in the past.

From here, it’s possible these yields continue to ease as markets price in the possibility of the Fed being less aggressive.

If that were to happen, it could result in a sizable equity rally.

We saw similar price action in 10-year yields – pulling back from levels of over 4.0%

Oct 03 2022

The 10-year is closely watched – is this yield determines your mortgage, car loan, student loan etc.

When these yields pushed 4.0% last week – US 30-year fixed rates challenged 7.0%

And this is precisely the Fed’s intent… to reduce excessive speculative demand.

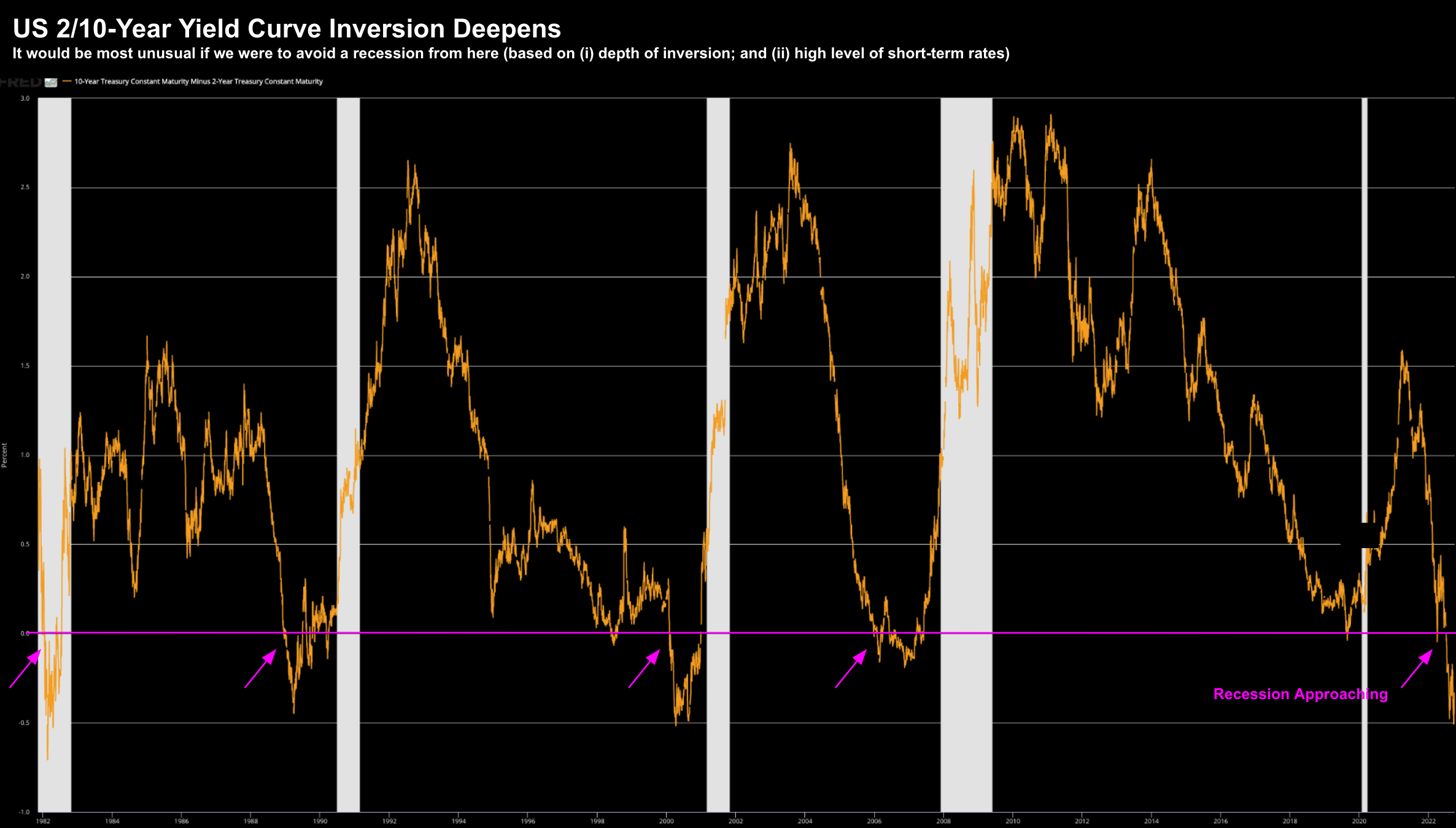

Finally, look at how these two work together using the 2/10 yield curve (i.e., the 2-year less the 10-year yield):

Oct 03 2022

When this falls below zero (pink line) — a recession typically follows within 12-18 months.

And whilst not a great ‘timing’ indicator – it’s reliable in terms of what’s to come.

From mine, I think it’s unlikely we escape a recession in 2023 based on:

(a) the depth of the inversion with the 2/10 curve; and

(b) Fed funds rate above 4.0% into next year (and held there for some time)

And if that’s the case – expect earnings to decline (something I will talk to more in a moment).

Nothing to Get Excited About

With yields easing – the Dow Jones added 900 points at its highest level during the day before paring some of those gains – its best day in a couple of months. And it was the best day since July 27 for the S&P 500 (adding over 2%).

But…

As I like to remind readers – the sharpest rallies will always occur in bear markets.

Expect them.

However, also expect the following “days and weeks” to potentially give back similar amounts at a moment’s notice.

Last week, I felt the market faced a “binary” event from the zone of 3600.

Based on the chart below – it was equally probable we could see the market either:

(a) rally 5-10% in quick time; or

(b) the market breaking down completely.

Here’s the chart with annotations (updated for today’s bounce):

Oct 03 2022

We could be in for a small rally… but it’s not one I am tempted to trade.

As I say, you really need the “hands of a surgeon”!

That’s not me.

Now our 10-week EMA (red) trades around 3900 at the time of writing.

With today’s close at 3678 – that represents something in the realm of a further 6% (adding to today’s 2%).

However, from there I will be looking for a lower high followed by a move to the downside.

Why?

It’s all about earnings going into 2023…

The Deterioration in Earnings to Come

For example, over the weekend I read this from Factset.

Cuts to Q3 were long overdue (analysts are always late) — however we’re yet to see the material revisions to 2023.

I think we will get a feel for this as we hear from major companies over the coming weeks – especially as they took the dollar headwinds.

For example, we got a peak into just how strong those headwinds are from NIKE last week.

The share price saw its steepest drop in over 20 years.

As I’ve written in previous posts – the market still assumes something in the realm of 7-8% earnings growth next year (or around $240 EPS)

That’s far too aggressive.

For example, if we’re to suffer a recession next year (and bonds suggest this will be the case) – we should expect those earnings to decline.

Personally, I’ve pegged earnings in the realm of $200 to $210 per share… vs $240 current estimates.

To be honest, no-one really knows what the “E” will be, but I doubt it’s going to be anywhere near $240.

Now if we use the higher end of my range at $210 – with the S&P 500 around 3700 – that’s a forward multiple of almost 18x

That’s high given rates will likely be north of 4.0%

And if we can rally to say 3900 (again assuming $210 earnings) – that moves to 18.5x

That’s why I offer caution on any rally.

Putting it All Together

In the near-term, don’t be surprised to see the market add a few points.

And we might see 3900 on the S&P 500.

We will often see some sharp bear market rallies as we make our way lower.

But don’t be fooled…

Earnings assumptions for 2023 are optimistic.

They will come down.

For now, I am not buying the bull’s thesis either technically or fundamentally.

For example, we heard the resolve from various Fed officials just last week (notably Mester) — reminding us of the long fight on their hands.

We also heard from Stan Druckenmiller – suggesting a recession could be worse than what many assume.

Here’s a copy of the full interview with CNBC (a must watch)

To that end, I think the market is underestimating just how long the Fed might be willing to hold rates above 4.0%

For example, most talk we hear is where short-term rates might peak…

That’s only half of the equation as it doesn’t weigh how long they may need to keep them there (i.e. pending what we see with stickier forms of inflation)

And that could be well into 2023….