Words: 1,172 Time: 6 Minutes

- Market remains overly dependent on Fed rate cuts

- Services remain sticky – with “supercore” above 4.0% YoY

- Stocks rally for now – but still face resistance

If you needed reminding the market remains closely tethered to monetary policy – we received it this week.

Stock’s surged on the back of two things:

- Consumer price inflation (CPI) coming in slightly better than expectations; and

- The prospect of the Fed having more room to ease rates

Bond yields dropped and stocks jumped.

There’s nothing quite like the sniff of cheaper money to get the animal spirits moving.

Stocks and bonds headed in the same direction (i.e., where bond prices trade inversely to yields)

The good news was the latest CPI print for December offered a very small amount of relief. However, it would be foolish to jump to conclusions.

As I will detail below – the inflation report had many unresolved questions.

For example, not all aspects of inflation are falling. Case in point – the Fed’s preferred measure of “supercore” remains up over 4.0% YoY

Based on this – do you think Powell would be anxious to cut?

Hardly…

But that’s not how stocks read it…

Sticky Services

- Headline consumer price index (CPI) increased a seasonally adjusted 0.4% MoM, putting the YoY inflation rate at 2.9%

- Core CPI annual rate was 3.2% YoY, a notch down from the month before and slightly better than the 3.3% outlook; and

- Shelter prices, which comprise about one-third of the CPI weighting, rose by 0.3% MoM and up 4.6% YoY

Irrespective of how you choose to interpret the data – bonds and equities were quick to celebrate.

Long-term (10-year) yields dropped 20 basis points from their recent highs above 4.80% – trading ~4.60% at the time of writing.

The S&P 500 piled on a whopping 1.8% (I’ll review the chart shortly)

Further to my preface, while inflation figures showed slightly better data – I think it’s premature to assume we can glean clear guidance on the Federal Reserve’s next steps. For example:

- Core CPI was up 3.2% YoY; and

- Shelter prices was up 4.6% YoY

That said, perhaps the most challenging (and persistent) inflation problem for the Fed is in services.

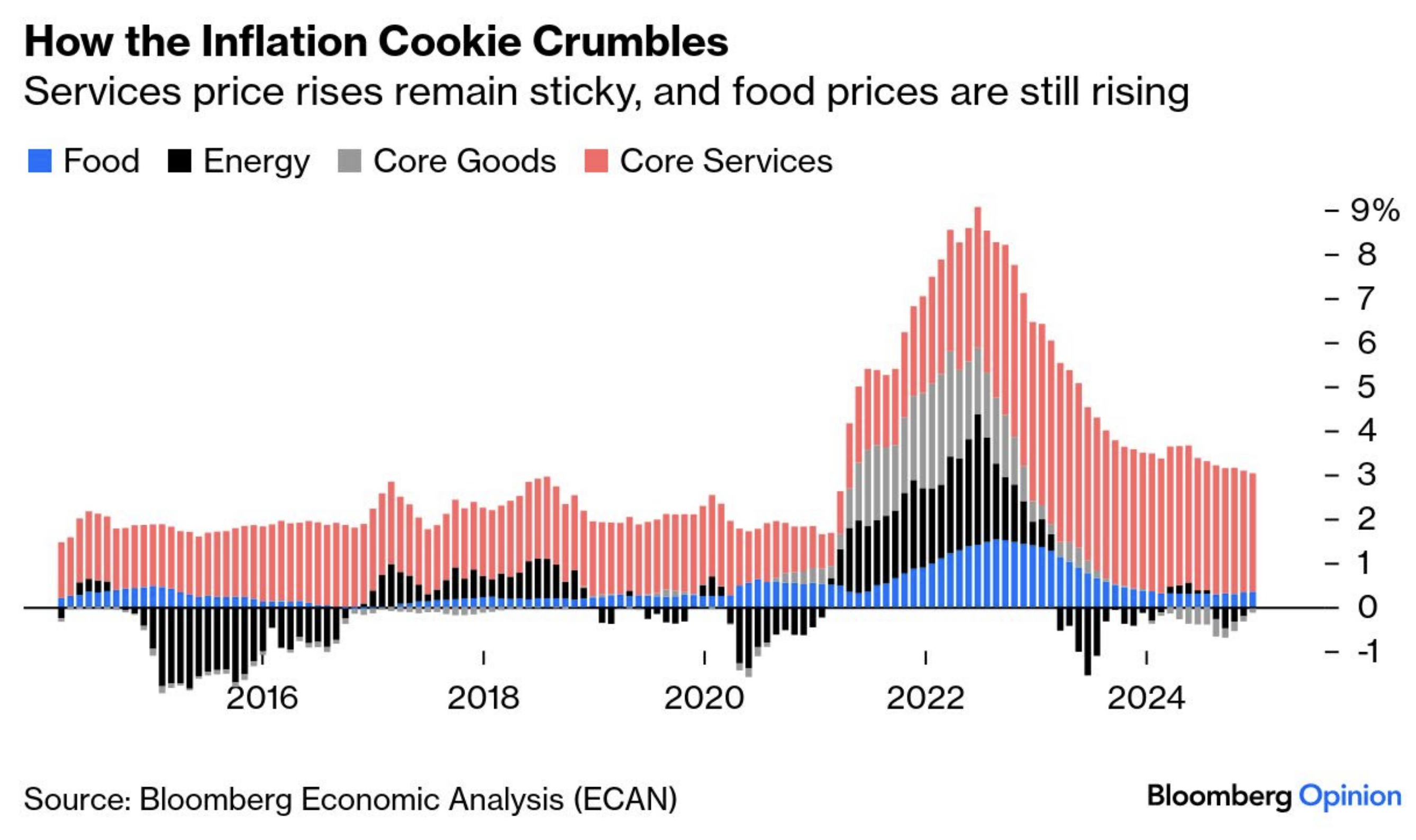

And that’s been the case for ~12 months. Consider this from Bloomberg Opinion:

- Core Services (which includes shelter); and

- Food

On the other hand, energy and goods prices remain stable (if not falling).

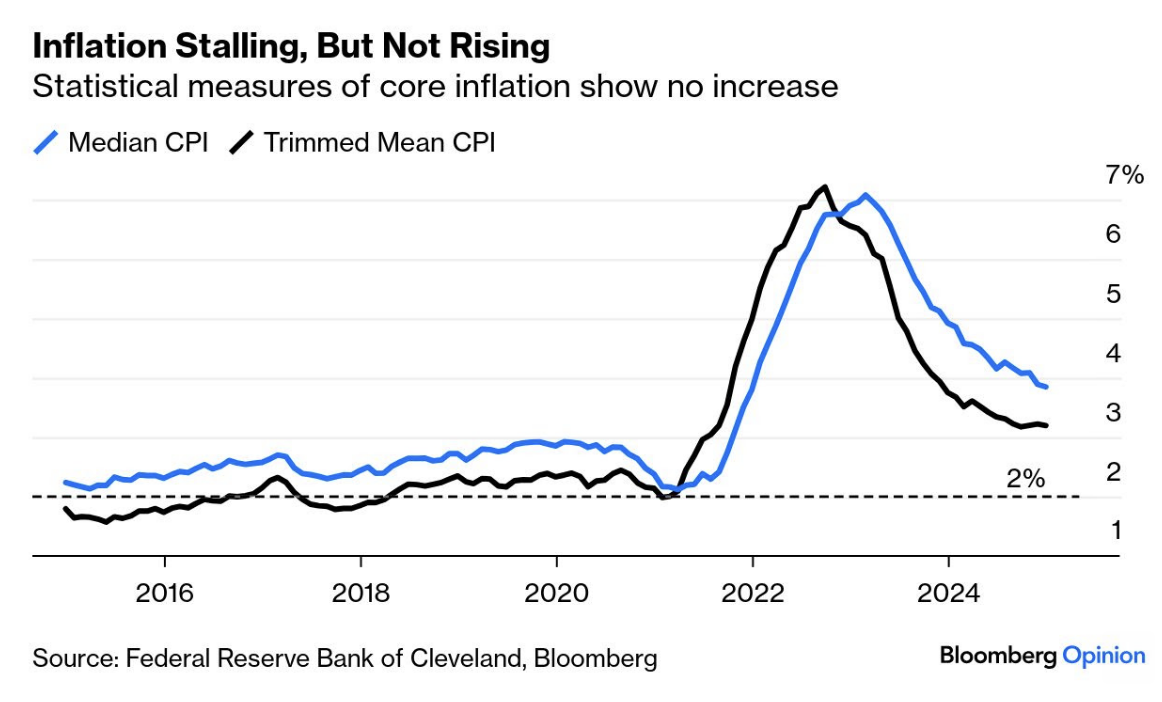

More refined statistical measures, such as the Cleveland Fed’s trimmed mean and median inflation indices, show a gradual decline but still indicate that inflation is far from the Federal Reserve’s 2% target.

Encouragingly, the Atlanta Fed’s sticky price index, which measures prices that are slow to change, displayed a sharper decline over the past three months, though it remains uncomfortably high.

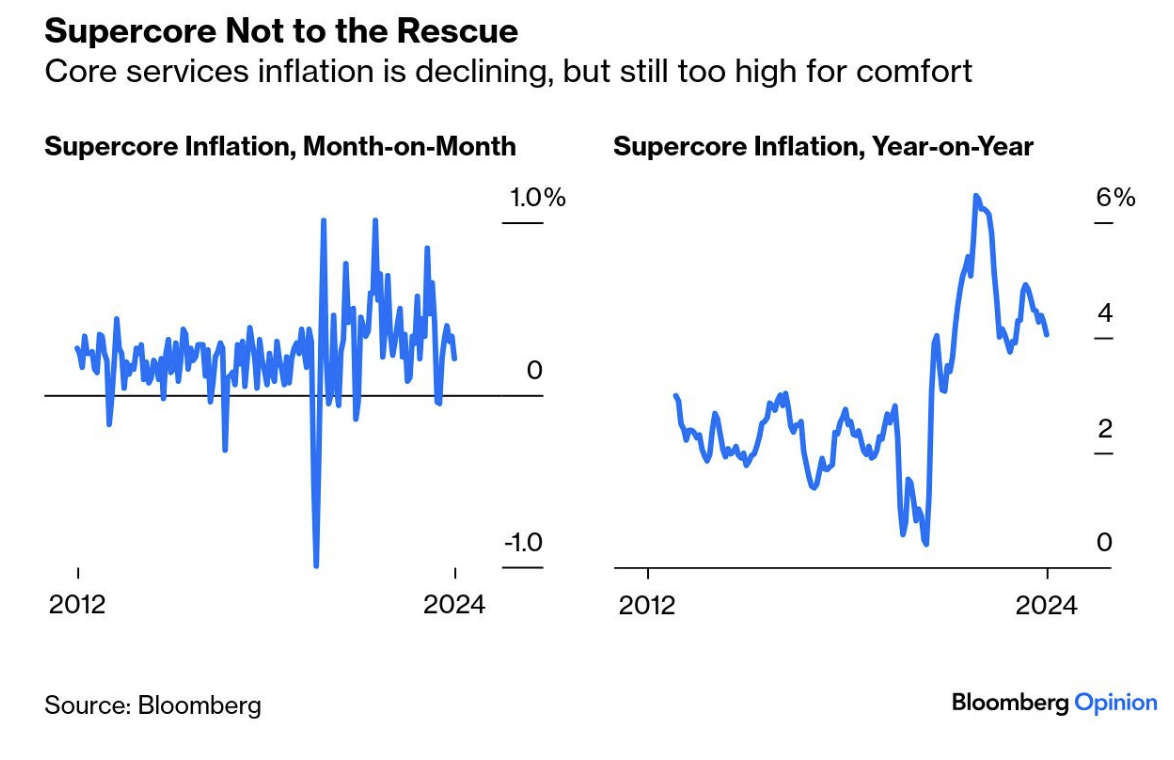

Now something Jay Powell often likes to call out is “supercore” inflation.

This measure excludes shelter costs from services inflation.

While this metric showed a slight improvement last month, the annual increase is still above 4%, underscoring the stubborn nature of inflationary pressures.

Why is ‘supercore’ so stubbornly high?

Look no further than what we find with wages.

Wage Growth and Its Implications

The “good news” (pending your lens) from the Atlanta Fed is a slowdown in wage inflation based on census data.

Wage increases for lower-income workers, who typically spend more of their earnings, dropped below those for higher earners for the first time in a decade.

And whilst this development will help ease the pressure on inflation – it does raise fresh concerns about economic inequality.

Market Reaction

In response to the slightly softer inflation print (and cooling wages for lower income workers) – markets feel more confident of at least one rate cut this year.

With respect to a second cut – those odds went from 24% before the CPI release to over 50%.

However, if the labor market continues to remain strong (which is a function of how you choose to measure it!) – this could offset the chance of rate cuts.

Here’s the key takeaway:

The market is behaving like an “addict” when it comes to what the Fed will potentially hand out.

The mere fact that CPI was every so slightly below expectations saw markets surge across the board on the premise cheap money is on the way.

For example, consumer discretionary stocks (very dependent on rates) significantly outperformed staples (which tend to perform in any market)

If nothing else, this suggests a risk-on attitude.

Which is a good segue to the S&P 500 and how things finished the week.

S&P 500 Optimism Rises on Rate Cut Hopes

It was the market’s best week since the outcome of the election…

Prior to this week – the gains over the past three months had been completely erased.

January 17 2025

- We find strong overhead resistance in the zone of around 6100

- There is negative divergence with both the MACD and RSI indicators; and where

- The 35-week EMA is likely to be the first zone of support.

The next hurdle to clear will be Q4 earnings and especially forward guidance.

For example, the banks started things well (as expected) – with most enjoying stellar net income margins. No surprises there.

As an aside, Citi appears reasonably priced (trading below book value). However, J.P. Morgan is significantly over-valued at more than 2x book (but remains the highest quality)

All eyes will quickly turn to the last week in January / first week in Feb when large-cap tech reports.

And whilst I think we can confidently assume at least 18% earnings growth from the Mag 7 for Q4 (excluding any foreign exchange headwinds) – the market will keen to see any measurable return from AI.

Hundreds of billions in capex (over half a trillion) has already been spent on AI chips (GPUs) with only a marginal line of sight to revenue growth.

And whilst the market is hopeful strong returns on capital (ROIC) will come over time – large cap tech will need to demonstrate strong progress.

I’m personally not overly enthusiastic about this market either fundamentally or technically.

For example, I mentioned three weeks ago when I sold the last of my Apple shares for $254 – explaining why I could not justify a forward multiple of 32x.

It’s always really hard to sell super high quality companies – but everything has its price (even Apple)

Since then, Apple traded as low as $228 per share (or ~29x forward earnings).

However a forward PE of 29x (or ~10% lower) is nowhere near enough for me to consider buying it back.

I think it falls much lower.

For what it’s worth – a price of ~$180 starts to get a little more interesting for me (e.g. a forward PE of around 22x).

But even at that price – it’s a fair price – not a bargain.

Putting it All Together

The market’s reaction to the inflation print felt overdone.

Yes, the numbers offered slight relief – however it left broader uncertainties unresolved.

Supercore remains above 4.0% – more than double the Fed’s target. That’s Powell’s focus.

Personally, I don’t think anyone can forecast the Fed’s next move with any certainty.

However, the market will always attempt to front-run the Fed’s next move.

With respect to earnings, so far about 9% of all S&P 500 companies have reported earnings from Q4.

Of the 9% – they’re showing an average 12.5% earnings growth rate for the quarter.

That’s very strong…

If 12.5% is the final result for all 500 companies – it will mark the sixth consecutive quarter of year-over-year earnings growth for the index (and why prices are rising).

But here’s my question:

Does it warrant a forward multiple of 22x with a 10-year yield north of 4.60%?

Not from my lens. But that’s what makes a market.