- Core (services) remains stubbornly high due to wage growth

- Ignore any noisy jobless claims due to hurricanes and strikes

- Fed to go only 25 (best case) in November

In a perfect world, inflation should be boring.

Boring is good.

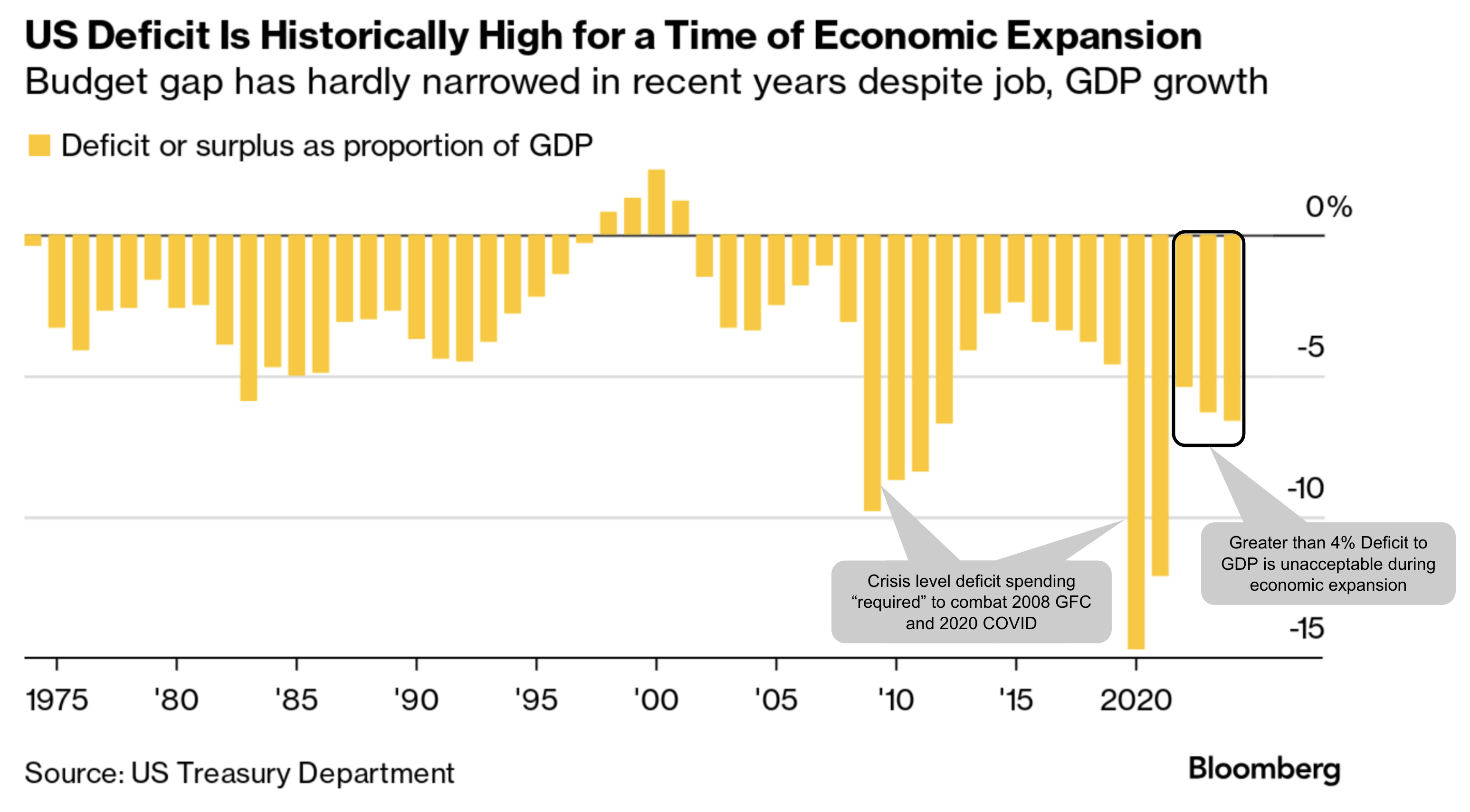

However, when you inject an additional $6+ Trillion into the economy with far fewer goods being produced, inflation becomes a story.

Inflation is defined as excess money chasing too few goods.

No-one wants inflation to be the story.

However, given the emergency fiscal response to COVID-19 (and excessive liquidity over the 3 years to follow) – this drove the price of essentials (e.g., health care, food, rent, energy and insurance) to be a major source of pain for most people.

The good news is the latest data shows inflation stabilizing.

However, ask anyone who visits a grocery store, insures their house or needs health care (which is all of us) – they will tell you these items are 20% to 30% higher than a few short years ago.

In this case, “stabilizing” means these prices are still rising – just more slowly.

As I say… ‘good news’

That said, there are still pockets of inflation which remain uncomfortably high.

Specifically, services.

This is because services have a high wage component.

Unfortunately for the Fed, curbing services inflation is a direct function of wage growth.

Mixed Signals

Mixed Signals

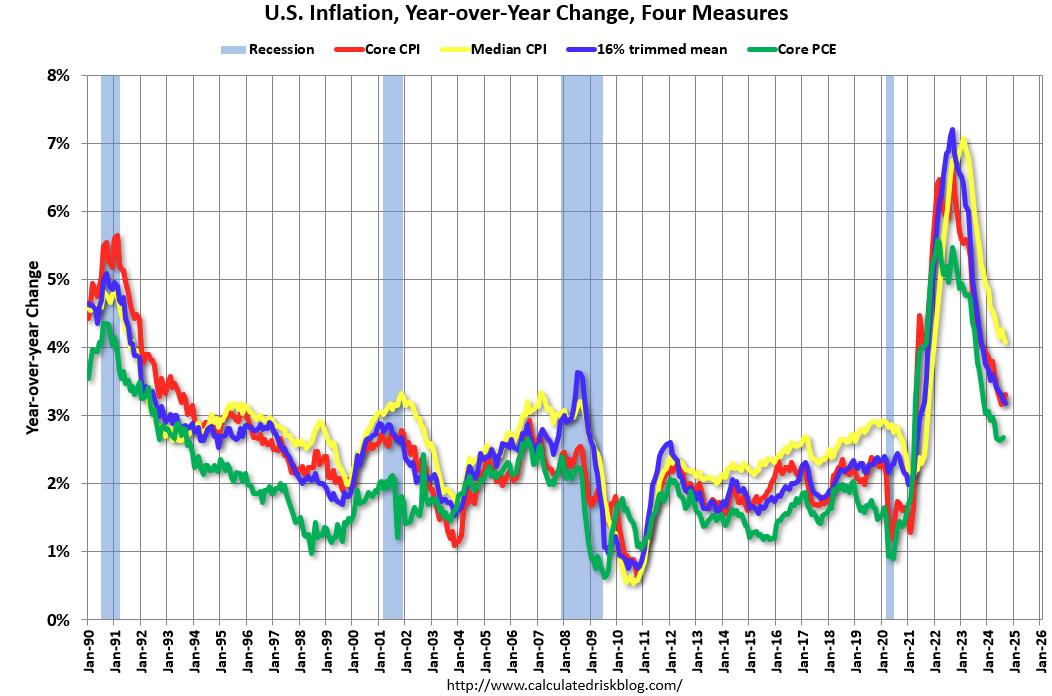

Whilst the Fed would not be unhappy with the latest September CPI inflation print – they would not be thrilled either.

By the numbers:

- CPI up 0.2% for the month, putting the annual inflation rate at 2.4% – 0.1% above forecast.

- Exc. food and energy, core prices rose 0.3% on the month, putting the annual rate at 3.3% – 0.1% above forecast.

The Fed are less interested in the headline 2.4% – instead choose to focus on what they call “supercore inflation”

Supercore is said to exclude shelter prices from services inflation – which saw an uptick to an annual rate of 4.4%.

For example, late 2022, Fed Chair Powell stressed the importance of supercore inflation in predicting future core inflation trends.

Therefore, you can imagine Powell’s angst to see it still clocking in at 4.4% YoY just after slashing rats by 50 bps.

Two additional insights:

- Transportation services – a significant driver of services inflation – rose from 7.9% to 8.5% YoY in September.

- Auto insurance – an essential item for most households – surged 16.3% YoY

- Geopolitical risks are likely to drive oil prices higher (a key input to headline inflation); and

- A weaker US dollar – due to the expectation of rate cuts in 2025

… both could drive headline inflation higher as we close the year.

Such forces are likely to dampen the Fed’s ability to be overly aggressive with rate cuts.

This is why the market is now leaning towards 25 bps in November – and not ruling out the chance of no rate cut.

On the flip side, the positive is the Cleveland Fed’s trimmed mean (go deeper), which removes outliers and averages the remaining components, shows a declining trend. From calculatedriskblog.com

The period of rapid decline is now well behind us – but that was always lower-hanging fruit.

However, the pathway getting core services from 4% to 2% is going to be a grind.

For this to happen – keep your eye on wage growth.

But try telling that to the specific States who keep raising the minimum wage; or unions striking for higher wages (go deeper).

Those forces help fuel inflation.

Wage Growth a Problem

Wage Growth a Problem

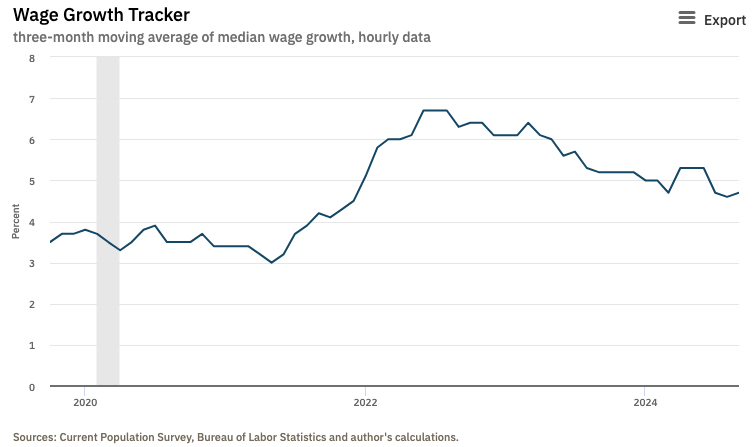

Wage growth has the potential to be thorn in the side of the Fed.

A recent surge in jobless claims, most influenced by Hurricane Helene, did raise questions about the health of the labor market.

But the market will be very quick to look beyond that.

The impact of such devastating (unwanted) events are almost always temporary.

However, what won’t escape the eye on the market is Atlanta Fed’s wage tracker (go deeper)

Whilst wage growth is down from its peak of almost 7% in early 2022 – there has been little progress the past 12 months:

The latest data points to an uptick in wage growth to 4.7%.

The Fed’s (unspoken) objective for wage growth is closer to ~3.0% (or 1.0% above inflation)

That’s a healthy number…

3.0% wage growth is enough to keep wage earners above the intended inflation rate … but not too high that embeds unwanted inflation.

For example, a number closer to 5.0% brings about a dreaded inflationary spiral.

The Atlanta Fed’s chart suggests price pressures stemming from wage increases have persistent for ~3 years (from late 2021)

Therefore, until we see this trending solidly back towards 3.0% (or less) – it would be premature to declare the services inflation battle is firmly won.

That said, there are some positive signs…

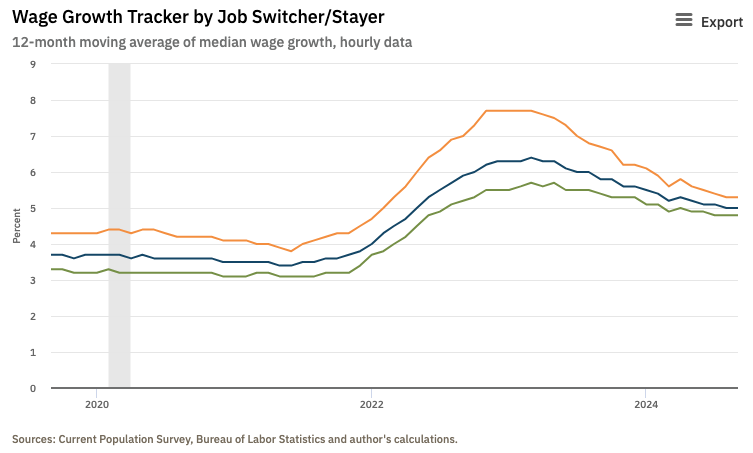

For example, their data also tells us that the wage premium for job switchers is subsiding.

Employers are getting back the upper hand when it comes to people trying to force a pay rise by swapping jobs.

What Matters for Investors

What Matters for Investors

Services inflation remains sticky.

That was always going to be the case.

The low hanging fruit was goods prices falling as soon as supply chain snarls eased.

However, lowering wages is a far more difficult affair (as people struggle with non-discretionary costs)

Despite some positive signs, inflation remains stubbornly above the Fed’s desired core 2.0% level, driven primarily by services inflation and wage growth.

My Top 3 takeaways for investors:

1. Labor dynamics are crucial: wage growth remains a key factor. Market’s will ignore noisy labor data from weather related events and union strikes. However, the Fed will want to see wage growth closer to 3.0% before claiming victory over core inflation.

2. Markets recalibrating for fewer cuts: The recent move higher in bond yields tells me the market is waking up to the fact there will be fewer cuts next year. However, I’m cautious on equities – who appear less concerned. That said, I maintain a ~65% long exposure to equities (despite the rich 21.5x forward multiple) — more on this in tomorrow’s post.

3. Complexities increase: Given what we find with geopolitical risks (where JP Morgan’s CEO Jamie Dimon warns are treacherous and increasing) and the nuanced picture of the economic environment – there are clear challenges and complexities faced by policymakers. The Fed may have less wiggle room than previously anticipated.

I will be back tomorrow with a look at how the S&P 500 finished the week (we made another record high); and the key tailwinds for stocks