- Most forecasters got it wrong mid-year

- Do you buy the dip around 4200 into 2024?

- Why I think Powell continues to lean hawkish

July 24 this year the S&P 500 traded around 4600.

At the time, gains were almost 20% for the year.

The bulls had all the momentum and analysts were ratcheting up their end of year forecasts.

Some felt 20% YTD gains were not enough mid-year – calling for even greater upside

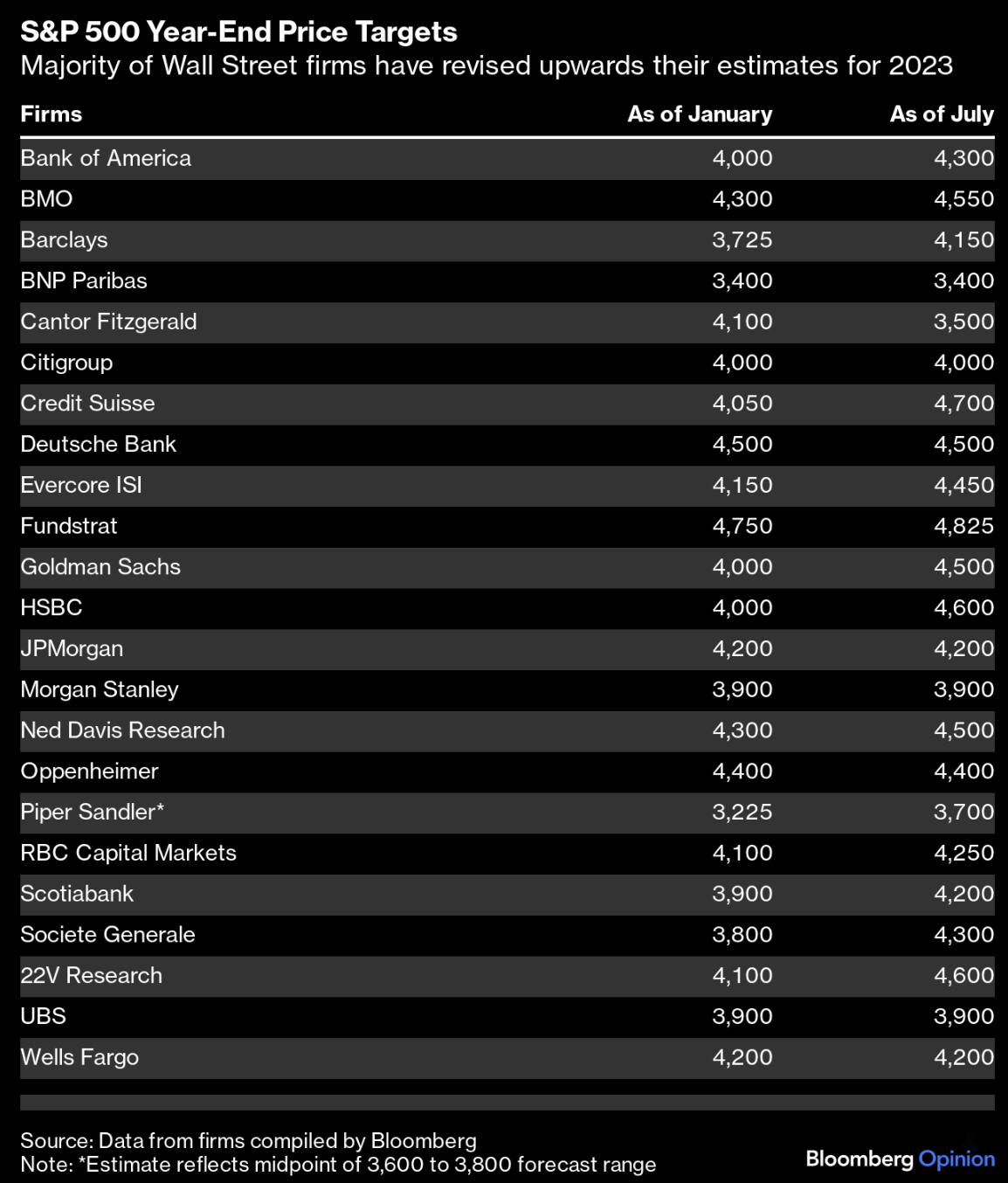

From Bloomberg July 22:

I was struggling to get onboard with numbers north of 4600… I needed more convincing.

From mine, stocks were both technically and fundamentally stretched.

For example, with 2024 earnings expected to be ~$235 per share (which assumed 12% EPS growth) – that represented a forward PE of ~20x.

That’s not a bargain.

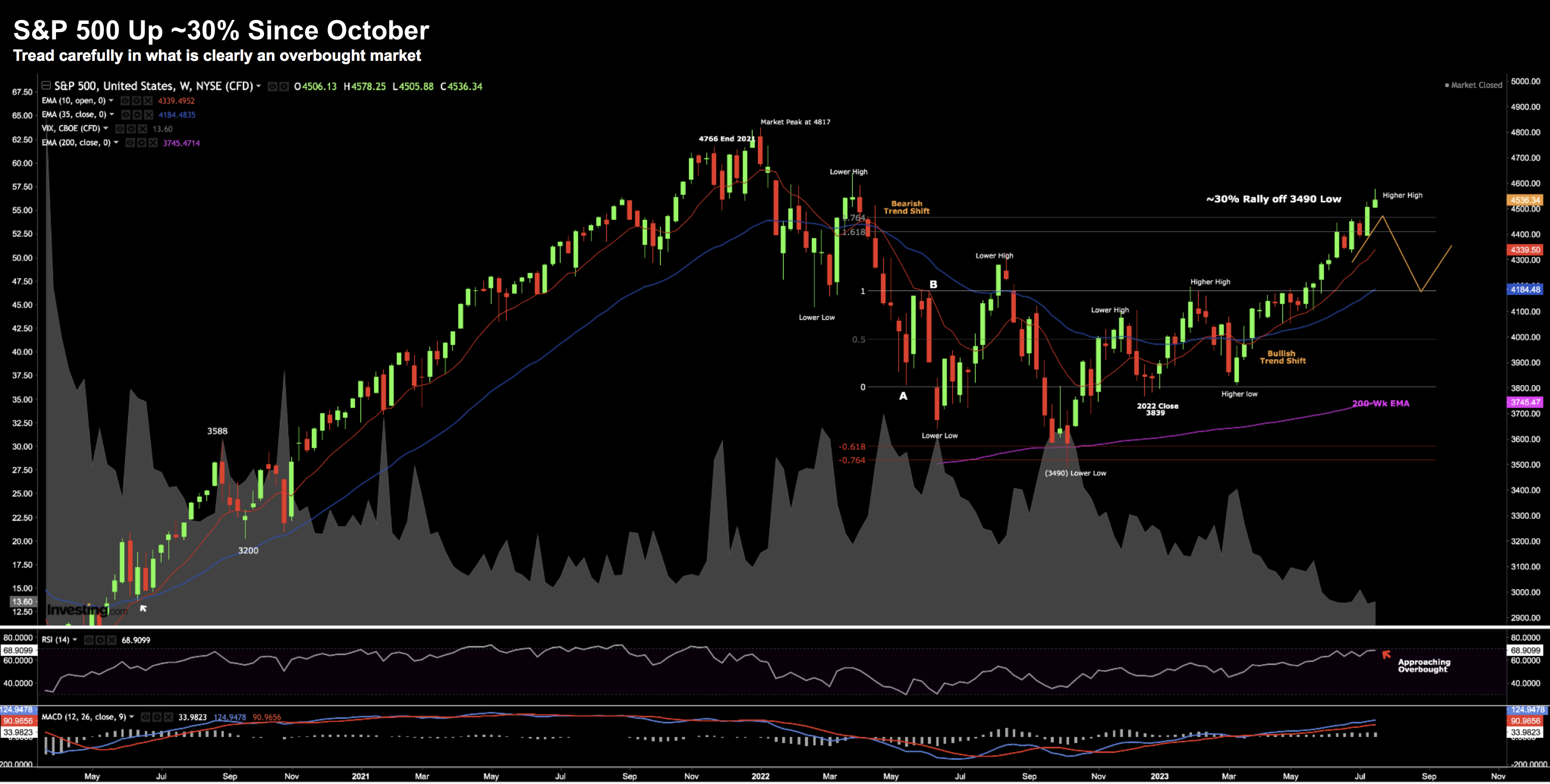

In addition, technically things also looking stretched – where I was looking for 7-10% pullback – offering this chart July 22:

July 22 2023

“Tread carefully” I said – thinking better opportunities could lie ahead.

Now by way of example – Fundstrat’s Tom Lee saw things differently.

Following his incorrect bullish call mid-way through 2022 – he tried his luck again with a year-end 2023 target of 4825 for the S&P 500.

Tom is 0 for 2.

Maybe he will be closer next year?

BNP Paribas and Cantor Fitzgerald were less bullish – with estimates of 3400 and 3500 respectively.

My guess was somewhere in between these two extremes.

What’s my point?

The game of forecasting is a fool’s errand.

Sure, occasionally you get one right – but that’s more luck than anything else.

For example, I didn’t know the S&P 500 would pull back to ~4100 from 4600 when I wrote that post in July.

But it felt more probable than say an upside target of “4825”.

However, what I can say with confidence is over the long-run (5+ years) – stocks will rise more often than they fall.

As companies continue to grow earnings and profits – their stocks advance.

Yes, we expect “20%+ bumps” along the way.

That’s part of it.

More often than not – those sorts of price adjustments create opportunity for the astute (and patient) investor.

However, in the near-term the market is bi-polar.

He can be a manic depressive one week; and yet full of optimism the next.

A change of mood can happen without any notable change in the data. It’s nothing more than what side of the bed he gets out of!

That kind of behavior is impossible to predict and time with precision.

As investors, our job is three-fold:

(a) ignore the noise and focus what matters;

(b) invest in quality stocks at the right price; and

(c) maintain a long-term mindset

If you can do these three things – you have a chance at winning.

For example, if you buy the wrong thing too often, you will lose.

Consider this year:

If you didn’t have exposure to the “Magnificent Seven” – odds are you’re underwater.

The equal weighted S&P 500 is negative year-to-date – as this thematic sector (and company) map highlights:

I’m very fortunate, I own each of MSFT, AAPL, GOOG, AMZN and a small position in TSLA.

I was also able to bank some gains from META – buying it when it traded closer to ~$120. I don’t own it now.

But look at the vast majority of this map – it’s red.

Now if you chased momentum and paid too much for large-cap tech in Q1/Q2 (perhaps due to FOMO) – you might also be feeling some pain.

The game of asset speculation requires patience, risk management and discipline.

And for most people – these behaviors are learned.

Stocks are not the Economy

Something else which may have made it difficult for investors is confusing the economy with stocks.

They are very different things.

For example, in the short-run (less than 12 months) – there’s no reason for them to trade in the same direction.

In fact, more often they don’t.

However, over the long-term, a growing (healthy) economy tends to be positive for consumers and company bottom lines.

And as we know, over the long-run, earnings typically map to share prices.

But consider what we’ve seen recently:

Last month we learned US Q3 GDP was 4.9%.

That implies a red-hot economy (assuming the number turns out to be accurate – as there will be several revisions)

But did that translate into stock gains?

No.

The S&P 500 lost ~10% from its mid-year 4600 peak (trading “per the script” – pending your lens!)

What’s happening now is the market is asking the question of whether there will be a recession in 2024?

If that’s true – then it’s unlikely stocks will challenge the 2023 highs.

However, if the market believes the chances of a recession next year remain very low, then investors will continue to “buy the dip”

Which brings me to the question I raised last week:

Do you believe the growth will re-accelerate next year?

If your answer is yes – then buy the dip.

However, if you’re like me and think growth will slow, then proceed with caution.

Maybe the Fed Will Tell Us?

Tomorrow we will hear from the Fed Chair on their outlook for growth and monetary policy.

Whilst the market does not see any hikes for November – Jay Powell’s sentiment will be important.

For example, my view is Powell will lean hawkish.

What’s hawkish you ask?

No near-term signal of rate cuts or changes to QT. Put another way, if Powell decides to keep rates where they are – that’s hawkish.

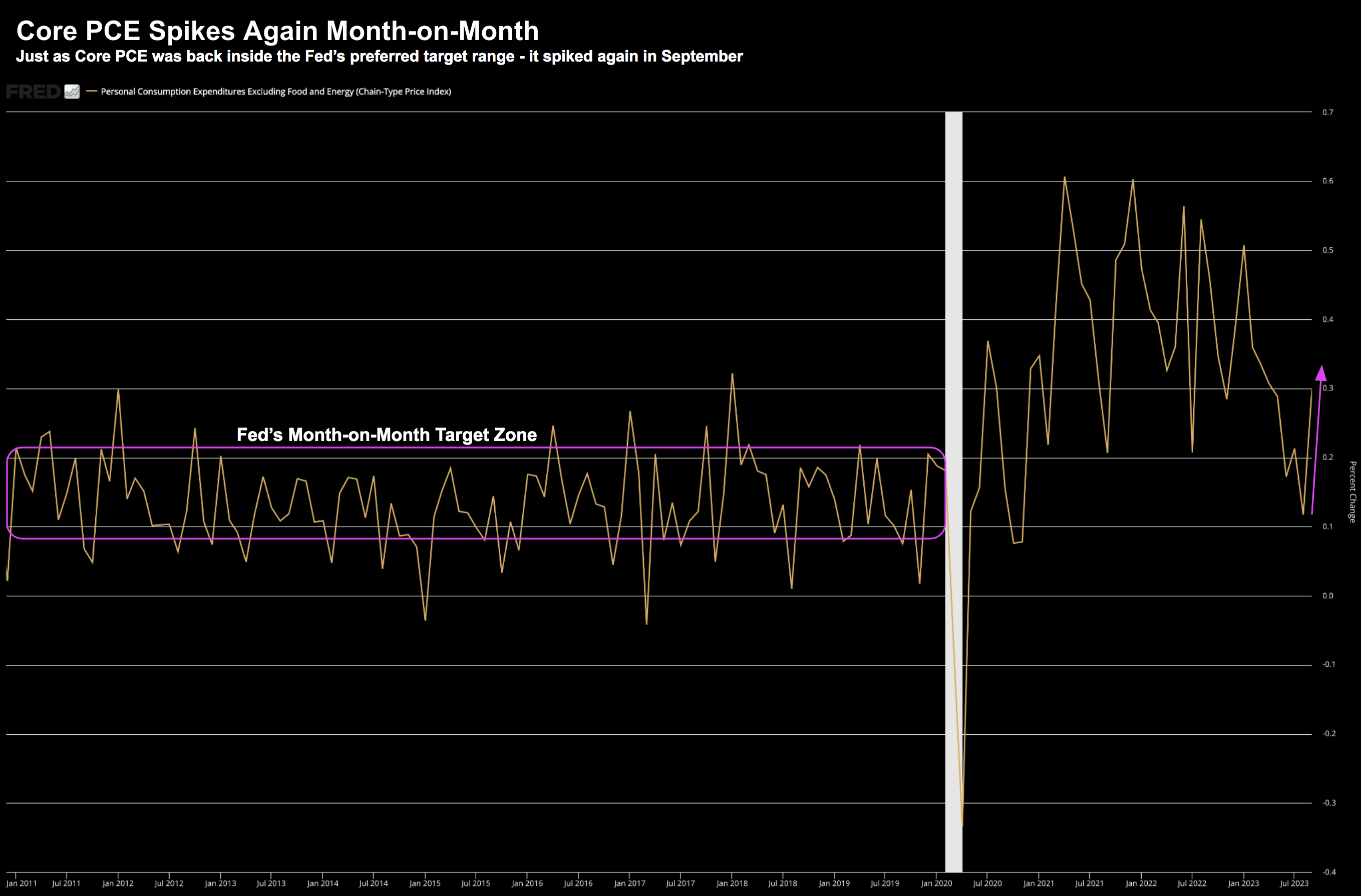

There are very few advantages for him to sound dovish – especially given the most recent Core PCE inflation print and jobs data.

I shared this chart last week showing the jump in MoM Core PCE:

Today Core Inflation (both MoM and YoY) remain above the Fed’s comfort zone.

Yes, YoY is trending lower but it’s still well above their 2.0% target.

Given this – don’t expect the Fed Chair to claim victory just yet.

There’s more work to do.

However, Powell might suggest that tightening financial conditions (e.g. the rise in yields) may be helping the Fed’s cause.

For example, he’s like to say he sees growth slowing (back to its longer-term trend)

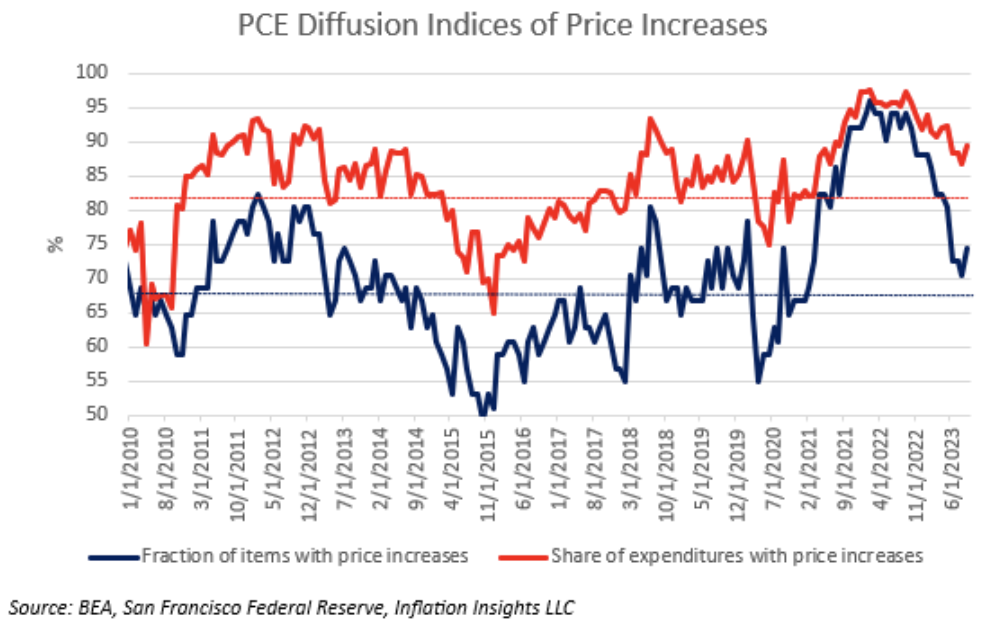

Talking more to Core PCE for a moment – Bloomberg’s John Authers cited an interesting chart from Omair Sharif at Inflation Insights.

Sharif said the “distribution of products and services that are still seeing the highest inflation is likely to make consumers unhappy”

He added that “… the proportion of PCE components showing an increase (in blue, and more-or-less back to normal), and the proportion of the expenditures that consumers are currently making where prices are rising, which is right at the top of the historical range”

None of this is good news for the consumer. It hits their hip pocket. And that will hurt growth.

However, as we saw the most recent ‘robust’ retail sales report, higher inflation has not stopped them from spending.

Again, how does this give scope for Powell to offer dovish language?

It’s hard to see.

Putting it All Together

Tomorrow Powell is going to try and strike a balance between both forward and backward-looking data points.

For example, we know the FOMC remains “data dependent” when it comes to monetary policy.

Question is what data?

We’re furnished with a plethora of backwards-looking data – which give all the impressions of a thriving consumer.

But when we try to marry that against forward-looking indicators – the picture changes.

For example, take a read of this Goldman Sachs’ interview with PayPal’s CEO.

“The consumer has been pretty resilient — I think everyone’s seen that,” Schulman said in an interview with Goldman Sachs Chairman and CEO David Solomon at the Communacopia + Technology Conference in San Francisco. “But I do think the consumer is somewhat fragile right now.”

Schulman points to household savings that are “coming down quite meaningfully” as pandemic-era government benefits are exhausted and spending on so-called “revenge travel” peaks. Schulman also cites data showing that consumer credit is reaching record levels.

“You’re beginning to see credit defaults tick up a little bit,” he says. “As you look out to the fourth quarter and into next year, I think you’ll probably start to see travel, entertainment, ticketing, start to slow a little bit,” he says.

Somewhat ‘fragile’!

I don’t know if Schulman is right – however his company has a solid lens into the purchasing habits of over 430M consumers.

Again, do you believe the consumer is accelerating spend into 2024 or decelerating?

If it’s the latter (which is my bet) – then growth will slow (given they are almost two-thirds of GDP)

In either case, today speculators are essentially making a bet between:

- the consumer, and hence the economy, will outperform expectations of a slow-down next year; or

- the still-robust economy is bound to slow down opposite (lengthy) restrictive monetary policies and a tapped-out consumer.

If you lean towards the former – there are many stocks which are trading at very attractive levels.

For example, if you refer back to the thematic performance map I shared – sectors such as financials, energy, health care, utilities, consumer staples, consumer discretionary and transport are negative for the year.

But remember – cheap often becomes cheaper.

On the other hand, if you think the consumer will not have the means to accelerate their spending from here, then many of these names could easily be value traps.

I think it’s a bold investor who can confidently say next year will see both a robust consumer and economy.

But I’m always happy to be wrong.