Words: 1,938 Time: 8-9 Minutes

- Expanding money supply; lower rates and fiscal stimulus all help stocks

- However, will expanding money pressure inflation?

- And how will growing debts and deficits impact bond yields?

Yesterday’s post outlined why investors should brace for less rate cuts than expected.

In short, supercore inflation – which excludes shelter prices from services inflation – saw an uptick to an annual rate of 4.4%.

Fed Chair Powell has previously stressed the importance of using supercore to predict future core inflation trends.

Furthermore, if also consider:

- resilience in the U.S. economy; and

- stocks trading at new record highs (more on this shorty)

Why do they need to aggressively cut?

But will fewer rate cuts dampen the enthusiasm for stocks? It certainly hasn’t to this point. And could higher bond yields impact stock valuations?

So far the market is not bothered.

These (and other) questions need to be weighed carefully with the S&P 500 trading ~21.5x forward earnings.

And whilst the multiple is heavily skewed by the ‘Mag 7’ – 21.5x is far from cheap.

What’s more, from a historical perspective, paying a multiple above 20x offers investors a very low risk premium (e.g., with the risk free rate above 4.0%).

But hang on…

What’s to say stocks cannot rise further?

For example, what if growth continues to surprise on the upside and we grow into this multiple?

That’s possible however it will depend on a number of factors.

Let’s explore what could help (or hinder) the 2-year bull market extending further.

🚀 5 Forces to Influence Stocks

Despite the stellar rally of the past two years – a multitude of tailwinds could see us make greater highs.

First and foremost are company profits.

Earnings are expected to grow in the realm of 11% year-over-year – with the current quarter expected to come in around 7%.

Banks got things underway on Friday – with JP Morgan and Wells Fargo handily beating estimates (go deeper)

What’s more, both painted a positive outlook for the consumer.

Good news…

But about what the macro variables…

For example, whilst earnings determine the stocks prices – there are various forces which help to influence profits (and/or the overall investor appeal of owning stocks). These include (certainly not limited to):

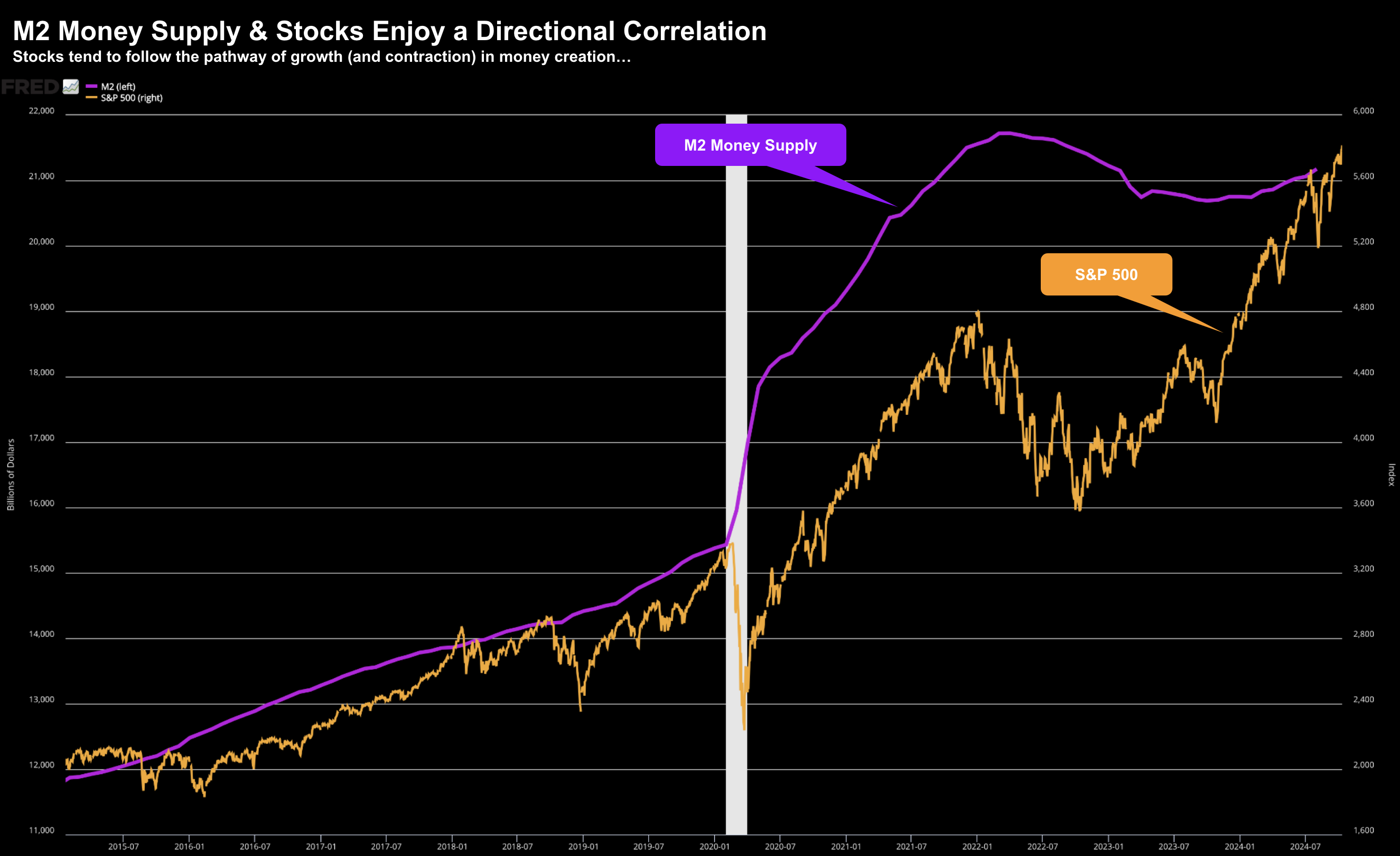

1. Money supply growth: Increasing the amount of money in circulation stimulates economic activity and can boost stock prices. Contracting money growth often sees stocks decline.

2. Short-term interest rates: Lower interest rates make borrowing cheaper for companies, encouraging investment and growth. The opposite holds true.

3. U.S. dollar strength: This makes U.S. exports more competitive, boosting corporate earnings. A stronger US dollar helps lower inflation however hurts international exports

4. Fiscal stimulus: Govt. spending programs and tax cuts can inject money into the economy and support stock prices. This remains a large unknown given the state of U.S. elections. In addition, we have a highly tenuous fiscal situation

5. Long-term bond yields: Lower bond yields make stocks more attractive to investors. However, higher bond yields make fixed income investments more attractive — presenting a more viable risk free return

Let’s examine each to ascertain if there’s room for upside (or potentially what risks to be aware of).

💵 #1. Money Supply Growth

The direction of money supply growth has enjoys a strong correlation with stock prices (and inflation)

When money supply is expanding (the case today) – stocks tend to respond positively. However, the opposite holds true.

What’s important for investors to understand is where things stand today (purple line below):

Oct 12 2024

Approximately 12 months ago – Oct 2023 – money supply started to reaccelerate.

To better illustrate the positive impact this has on equities – we can overlay the year-over-year percentage change:

Oct 12 2024

However, whilst money was being taken out of the economy (to help arrest inflation) – stocks continued to trade lower.

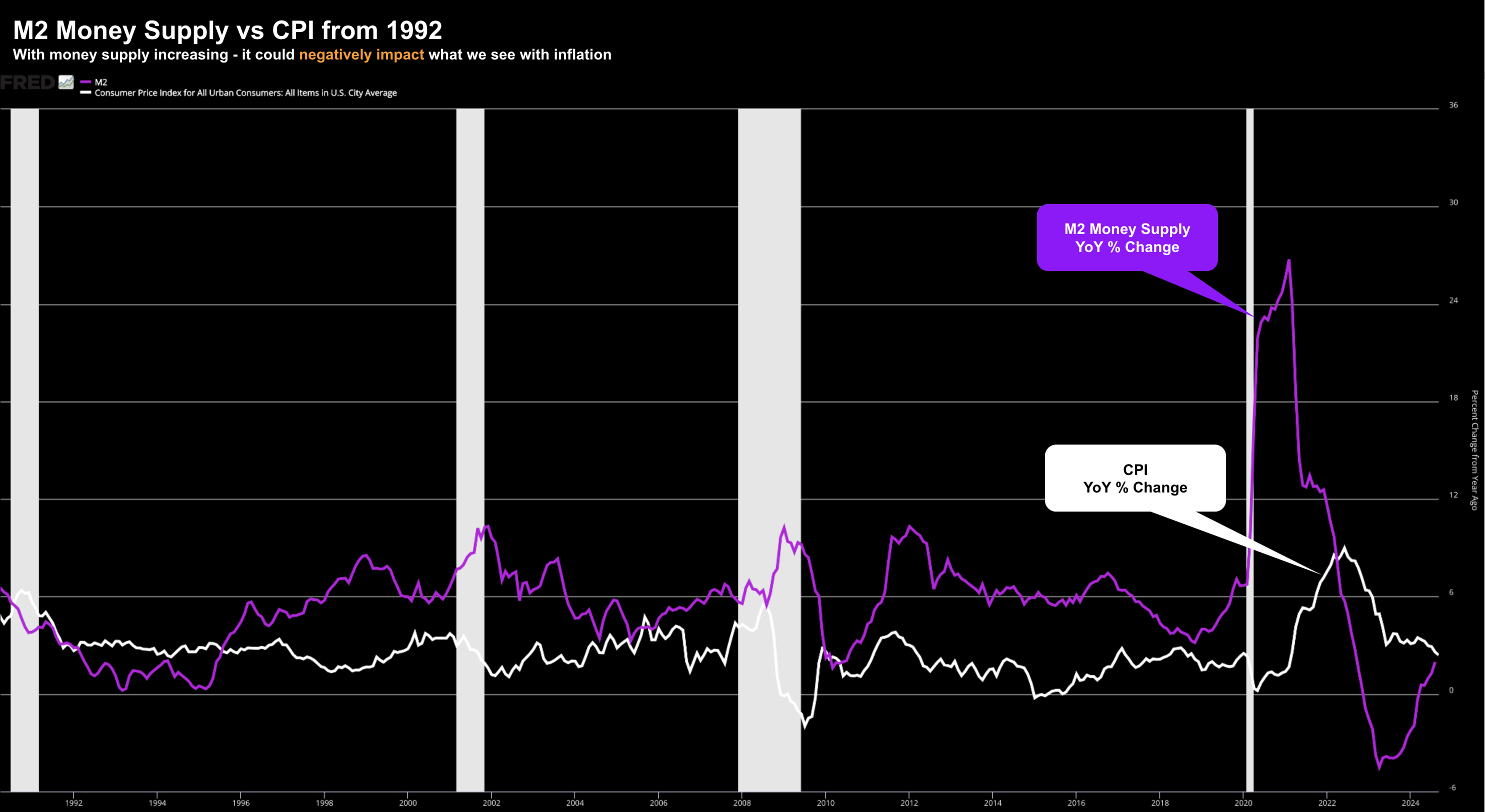

And below we see the close relationship between money supply and inflation:

Oct 12 2024

This overlaps with my post yesterday where I talked to the pressure with services inflation (specifically wage growth at 4.7% YoY)

The Fed will need to be careful as to how much they continue to accelerate money supply. However, should they continue to expand the supply – stocks will likely react favorably.

For now, chalk this up as a tailwind for stocks.

🔢 #2. Lower short-term interest rates

The Fed has made it clear their easing cycle is underway.

However there are two unknowns:

- the velocity of the rate cuts; and

- what the terminal rate will be (i.e., how far they cut)

A few weeks ago the market saw 200 bps of cuts within 12 months.

However, given the strength in jobs and hotter-than-expected inflation print this week – that’s now back to around 150 bps.

And whilst we cannot say how far the Fed will ease (as they are data dependent) – we can say with some certainty that short-term rates will be lower.

Here’s what matters:

When short-term interest rates are lowered, it becomes cheaper for businesses to borrow money for investments and for consumers to borrow for purchases.

For example, the CEO of The Home Depot called this out as a key factor which will determine their profits in the quarters ahead.

This can stimulate economic growth, which in turn can boost corporate earnings and in turn stock prices. From there, asset speculators become more confident.

But there’s a caveat with lower short-term rates:

- If the Fed are easing rates with employment stable (or improving) – stocks tend to outperform; however

- If the Fed are easing where unemployment is rising – stocks underperform

For now, let’s chalk this up as another positive for stocks however we need to mindful of what we see with employment (go deeper)

💵 #3. A Weaker U.S. Dollar

Oct 12 2024

Over the past two years – the dollar index has found strong support around 100.

For example, after a period of weakness from June this year, the past two weeks have seen a strong rebound.

The question for investors is whether this rally continues based on fewer rate cuts; and/or higher bond yields?

For instance, should the US dollar continue to weaken – this could result in:

- Increased exports: When the dollar weakens, US exports become more competitive leading to increased demand for American goods and services – boosting corporate profits; and

- Attract foreign capital: A weaker dollar can make US assets more attractive to offshore money – leading to increased stock prices.

However, the opposite holds true for a stronger dollar.

For now the lower dollars feels like a win for stocks with lower short-term rates. However, the situation appears in the balance

💎 #4. Greater Fiscal Stimulus

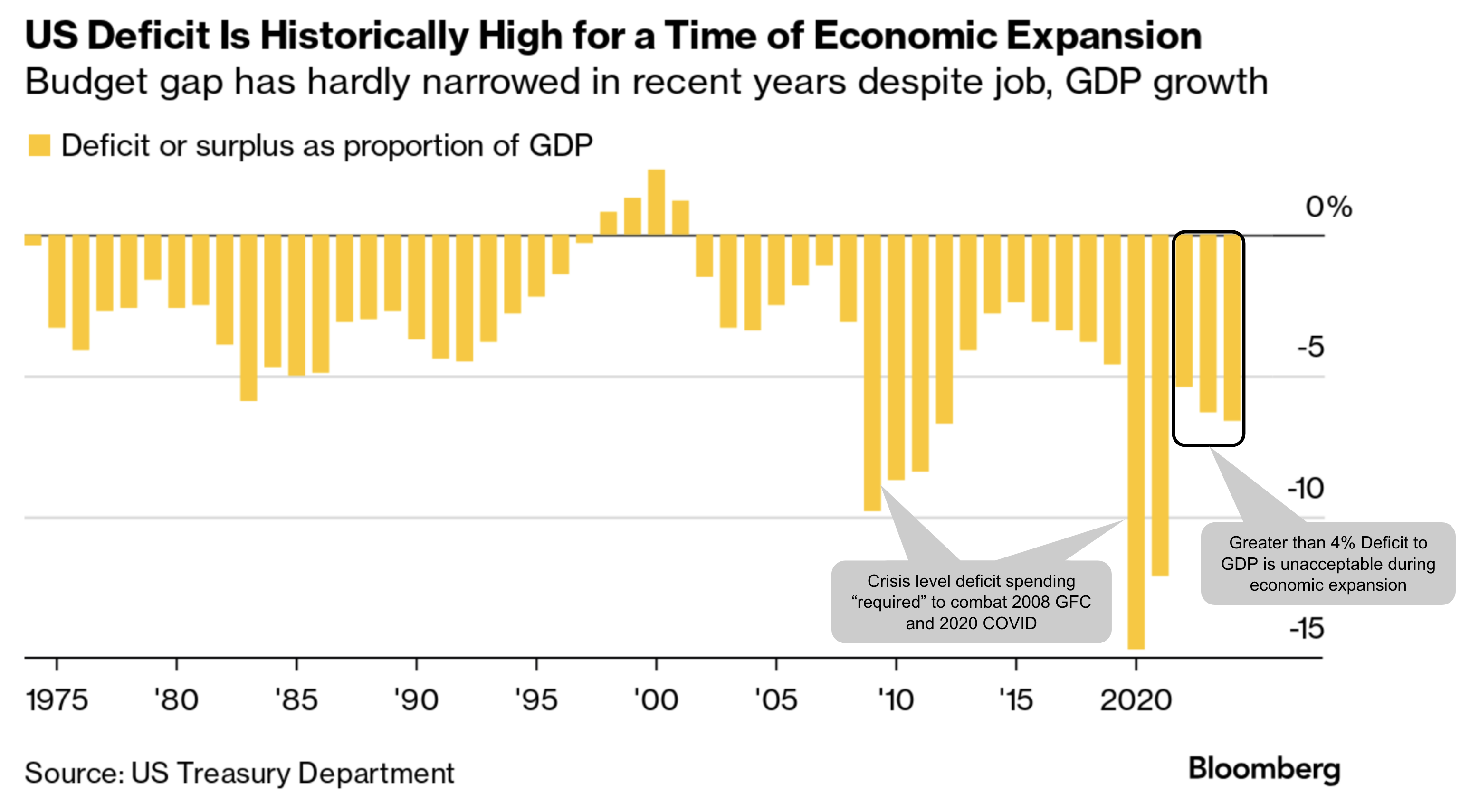

The amount of stimulus from Federal spending programs (as a function of GDP) is unprecedented in the modern era.

The last time we saw deficits of this magnitude were during WWII.

However, during peacetime (and especially during economic expansions), rarely does deficit spending exceed 4% of GDP.

The current administration has kept this above 5% each year after the COVID emergency ended.

I can hazard a guess as to why (but then we get into a political discussion!)

The point for investors is stocks (and inflation) tend to accelerate during times of massive government spending.

The open question is what will the incoming administration do?

My best guess is both parties will look to continue spending well beyond their means. This is one area which appears to be bipartisan support.

Let’s also chalk this one as another win for stocks.

However, there’s also a caveat…

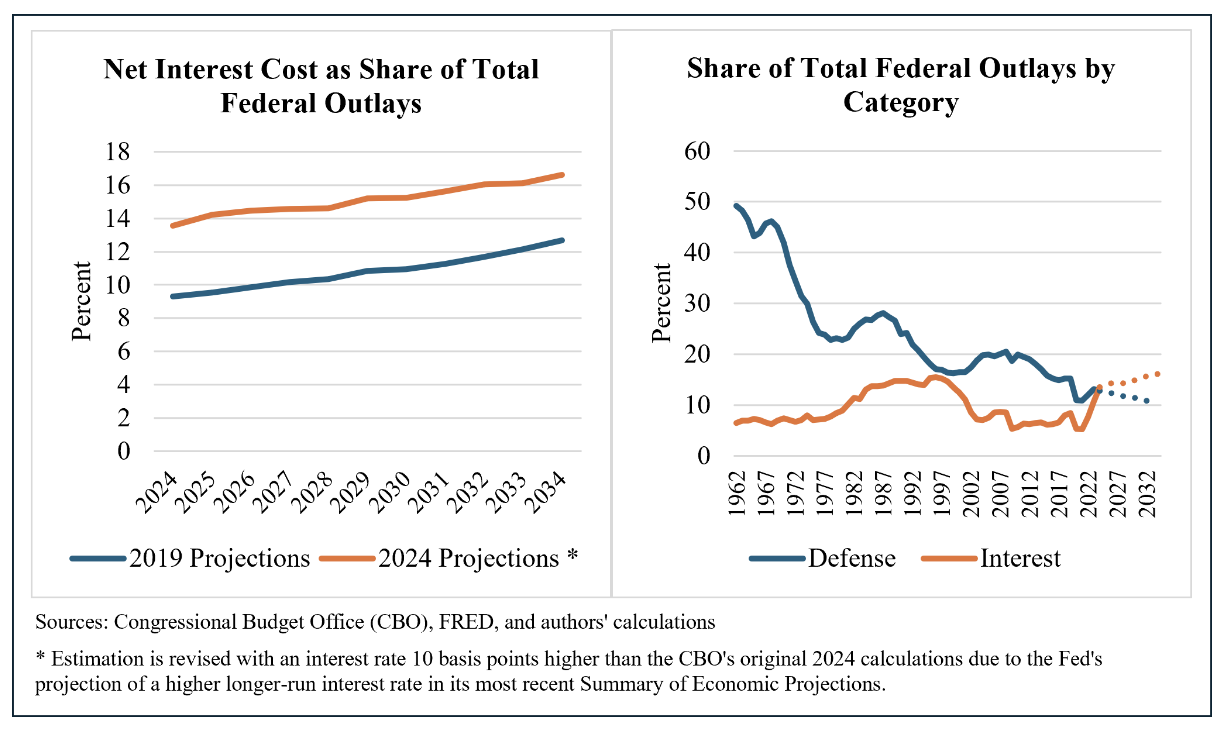

With greater fiscal spending (and borrowing) comes higher long-term bond yields.

💵 #5. Long-Term Bond Yields

- The direction for longer durations yields (e.g., over the next 2+ years)? and

- What impact they will have on equity valuations (e.g., lack of equity risk premium)

With respect to the first point, this week I shared how Stan Druckenmiller sees bond prices falling.

Put another way, long duration bond yields are going higher.

Druckenmiller – whose 30-year investment record rivals Warren Buffett – has a high conviction on this trade – allocating 15% to 20% of his portfolio.

However, Druck (wisely) doesn’t pretend to know the timing. He doesn’t know if the trade will be profitable in “6 months or 6 years”

And that’s the smart way to think about it…

However, he is confident (like me) there will be further reckless spending regardless of who wins.

And I think that’s a safe bet.

Let me offer a long-term chart for the 10-year yield to glean any insights:

Oct 12 2024

Here we see the bullish yield trend shift which occurred in early 2022.

Throughout 2022 this caused a lot of angst for equities – seeing the S&P 500 giving back more than 20%

However, over the past two years, equities managed strong gains despite higher long-term yields.

This caught a lot of investors off guard.

The question is at what point will the 10-year yield become a head wind?

4.5%? 5.0%? Higher?

It’s difficult to know as there are many factors to consider (including those above).

However, if we’re to experience further fiscal recklessness by the incoming US administration (a good bet) – it’s difficult to explain why yields would fall sharply.

To be clear, we could easily see the 10-year at 3.50% within the next 12 months (that’s possible); however longer-term the trend for yields looks higher.

From mine, this is a major concern not only for proposed fiscal stimulus programs (where today the interest cost on the outstanding Federal debt exceeds defense spending – see graphic on right hand side – go deeper) – but also stocks

📈 S&P 500: Pushes Higher

Oct 12 2024

Two things stand out with the weekly chart (both of which I mentioned previously):

- Negative divergence with the weekly MACD (lower window); and

- A rising VIX despite equity gains (i.e., expect greater volatility)

The S&P 500 has risen for 5 straight weeks… and has maintained a level above the previous high of 5670

This could signal the next leg of the major breakout… however it’s still early.

What concerns me is what we see with the weekly MACD.

It has failed to make new highs in parallel with new price highs. That does not confirm the rally.

In addition, the VIX continues to rise. Generally the VIX rallies in a falling market – not one which is rising.

This tells me that traders see greater volatility ahead.

Therefore, be prepared for a 7% to 10% sell-off (which will be another buying opportunity)

💥 What Matters for Investors

- strong fiscal support

- lower-short term rates with stable employment; and

- expanding money supply

… stocks generally do very well.

On the flip side, stock returns diminish with fewer supportive policies.

The open questions I have are with respect to the US dollar and longer-term bond yields.

For example, further fiscal support is likely to result in widening debts and deficits.

That’s not conducive for lower bond yields.

My best guess is these yields rise over the next few years (but not necessarily in the very near term; i.e., next 12 months).

But for now, most of the “fiscal winds” appear to be in stock’s favor.