- Tough choice: financial vs price stability

- Rewarding exceptionally bad bank behaviour / management

- S&P 500: Next leg lower now in play

Something broke.

Not something large (less than 1% of all banking assets) but enough to startle the Fed.

Silicon Valley Bank (SVB) is now a household name.

A week ago no-one had ever heard of it.

The 16th largest bank in the US and lender to ~50% of all US start ups suffered a “bank run” late last Thursday – causing it to be shut down by the government on Friday.

That happened fast!

$42B was withdrawn in just one day – leaving well over $100B of uninsured deposits in limbo.

Well… at least until the government stepped in over the weekend

So how can this happen?

Four things come to mind (not limited to):

- First, exceptionally poor risk management. Clearly SVBs management knew nothing about duration risk or hedging their position(s). Banking 101

- Second, questionable funding base (start ups) – who could not get their money out fast enough (in turn causing the collapse)

- Third point is sheer excess. As the tech sector gorged endlessly on cheap money – SVB was there for the ride; and finally

- Forth, a lack of regulation and oversight – giving the bank enough rope to hang themselves (and they did)

It’s hard to point the finger directly at any one these four things – but overall it’s the resposibility of the bank to manage risks (whatever the environment).

SVB did not have a Chief Risk Officer for over 8 months.

Now since US deposit insurance is capped at $250k (relevant for consumers but irrelevant for 99% of small startup companies), all of these companies were wondering two things heading into Saturday:

- whether they were going to be able to make payroll this week; and

- whether they would even see their own money again?

Sunday evening the FDIC and Fed came to the rescue – announcing all uninsured deposits would be covered (or at least that’s what they told us)

Hip hip hooray – we are all saved (say the collective tech sector)

That’s a big deal.

All uninsured deposits!

Perpetual QE is back in play (because that’s what it is).

All that quantitative tightening we saw the past few months – to help cool inflation – is done.

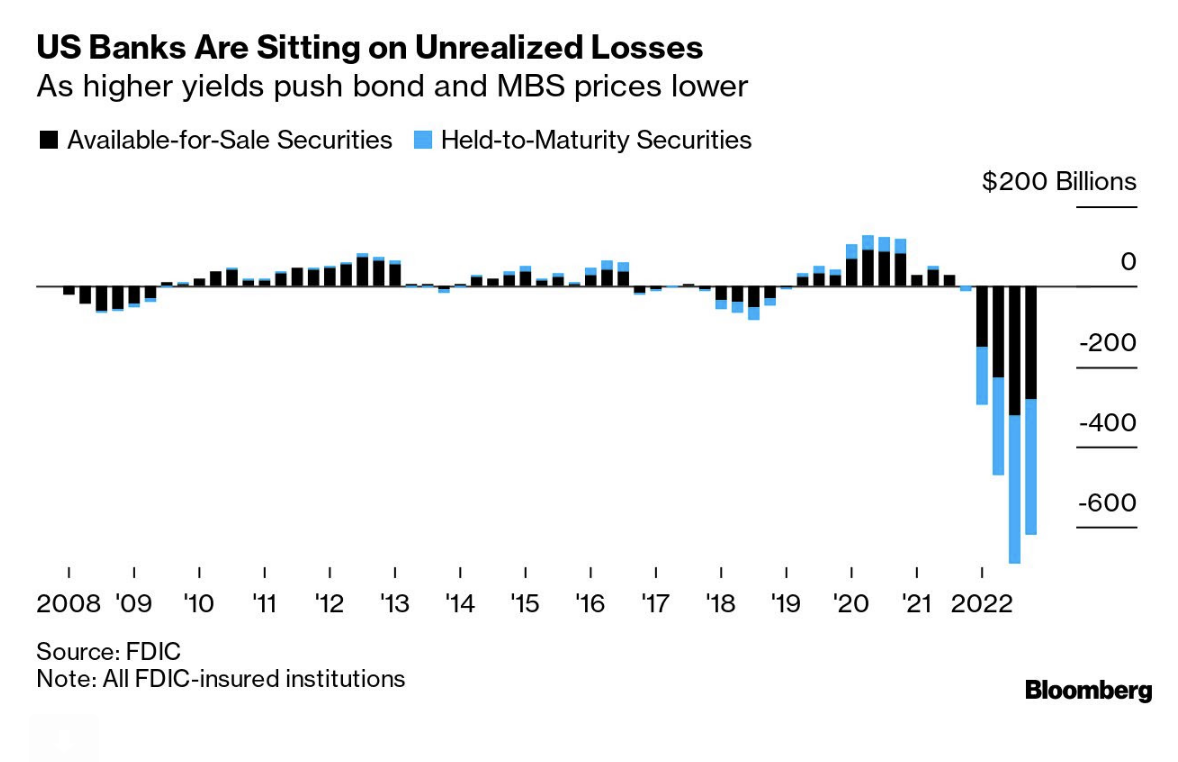

And here’s why… $600B in unrealized losses with banks:

This is the total value of treasury bonds and mortgage backed securities held by banks which are (technically) under water.

Nothing like potentially socializing the losses right?

In other words, the price banks paid for these assets as late as late 2021 are now worth a lot lot less.

Why?

Because rates are a lot higher. Bond prices traded inversely to their yields.

Now as I explained last week, that’s fine if you can hold them to maturity.

Investors are paid back all their principal and the interest at maturity.

But…

If you need to sell these assets before maturity in order to raise cash (in this case return money to depositors) – you lock in your loss.

That was SVB.

But let’s get back to the Fed’s announcement over the weekend…

Whilst markets may have cheered the news in the very short-term (I believe this has a long way to play out) – it raises a lot of questions.

Is This Another Moral Hazard?

Pretend for a moment you are Jay Powell.

You now have to make a choice (neither of them easy):

- stabilizing prices (i.e. taming unwanted inflation); or

- stabilizing the financial system?

… choose wisely.

Tough spot right?

That’s essentially the position the Fed find themselves… with inflation still posing a significant problem.

From Bloomy today:

The Fed has clearly chosen the latter but I would argue at a massive cost.

Let me explain:

The Fed has said that its new program will make it a lender-of-last-resort funding for banks in similar situations in future.

What does that mean?

For example, are we now rewarding (maybe even encouraging) a lack of financial discipline from reckless banks like SVB?

If so… that’s rubbish.

The very last thing we should be doing is rewarding management like what we saw SVB.

Because that is what we could get.

For example, if the Fed is setting precedent as “a lender-of-last-resort funding for banks in similar situations in future” — what are the conditions?

That’s very important.

For example, will it cover such thing as:

- oversight from the Fed;

- regulations on use of capital;

- conditions on their loan book; or

- durations risks with investments?

If not – they should.

Now don’t get me wrong. We need regional banks. They are incredibly important for communities and various ecosystem.

But they should not be run poorly.

For example, if Regional Banks had these types of regulations (as the big banks do) – then we would not be having this discussion.

Now I don’t pretend to have the answers…. not even close.

But we can’t be in a situation where banks like SVB effectively require a bail out for depositors to feel secure.

And from my lens, this feels like we are now rewarding incompetence.

But let me be clear:

The people who had their money in this bank – don’t deserve to lose their money (although I know some people who say they absolutely should – pending their level of sophistication. For example, is a person who has “$1M” in the bank the same sophistication as someone with just $10K? You might argue they are aware of the risks)

SVB’s situation is not what we saw in 2008.

The Fed didn’t bailout the bank, its investors or bond holders.

They are done and deserve to be.

But I have a question with the dangerous precedent the Fed has now set.

Financial Conditions ‘finally’ Tighten

I said this presents a dilemma for the Fed.

For example, they aggressively raised rates (white line) however financial conditions continued to ease.

That was not their intent as they sought to cool inflation.

Well that’s changed…

That ‘grinding sound’ you hear outside is the sound of banks tightening:

SVB was a clear shot across the bow.

The shift in short-term interest rate markets Monday was unlike almost anything seen for more than four decades, including even the 2008 financial crisis and the aftermath of the Sept. 11 terror attacks.

The one-day drop in two-year yields was the biggest since the Volcker era in the early 1980s and surpassed the period surrounding the Black Monday stock-market crash of 1987.

We have rarely seen anything like this in bond markets our entire lives.

Below is the move on 2-year yields post SVB:

March 14 2023

At one stage on Monday they hit 3.935% after trading above 5% three weeks ago.

Now swap contracts last week favored a half-point rate increase at next week’s FOMC meeting (I was favouring 25 bps)

Not anymore…

They slashed the odds of any increase from the current range of 4.5%-4.75% — suggesting the peak for this cycle will be a quarter-point higher than where it is now.

In other words, just one more hike and that is it.

Meanwhile, contracts for the rest of 2023 suggest that the Fed could cut rates by almost a full percentage point from the peak in May before the year is out.

I think that is wishful thinking.

Remember:

We still have an inflation problem.

That has not gone away.

But if I put this all together – these actions will see the economy contract.

And that’s what the Fed wanted.

Banks will tighten conditions and money (credit) will be harder to get.

That means less money available chasing more goods.

Prices come down (in theory)

From mine, we can at least increase the probabilities of a recession happening towards the end of the year / maybe early next.

And this is what bond yields suggest…

That’s not a bad thing.

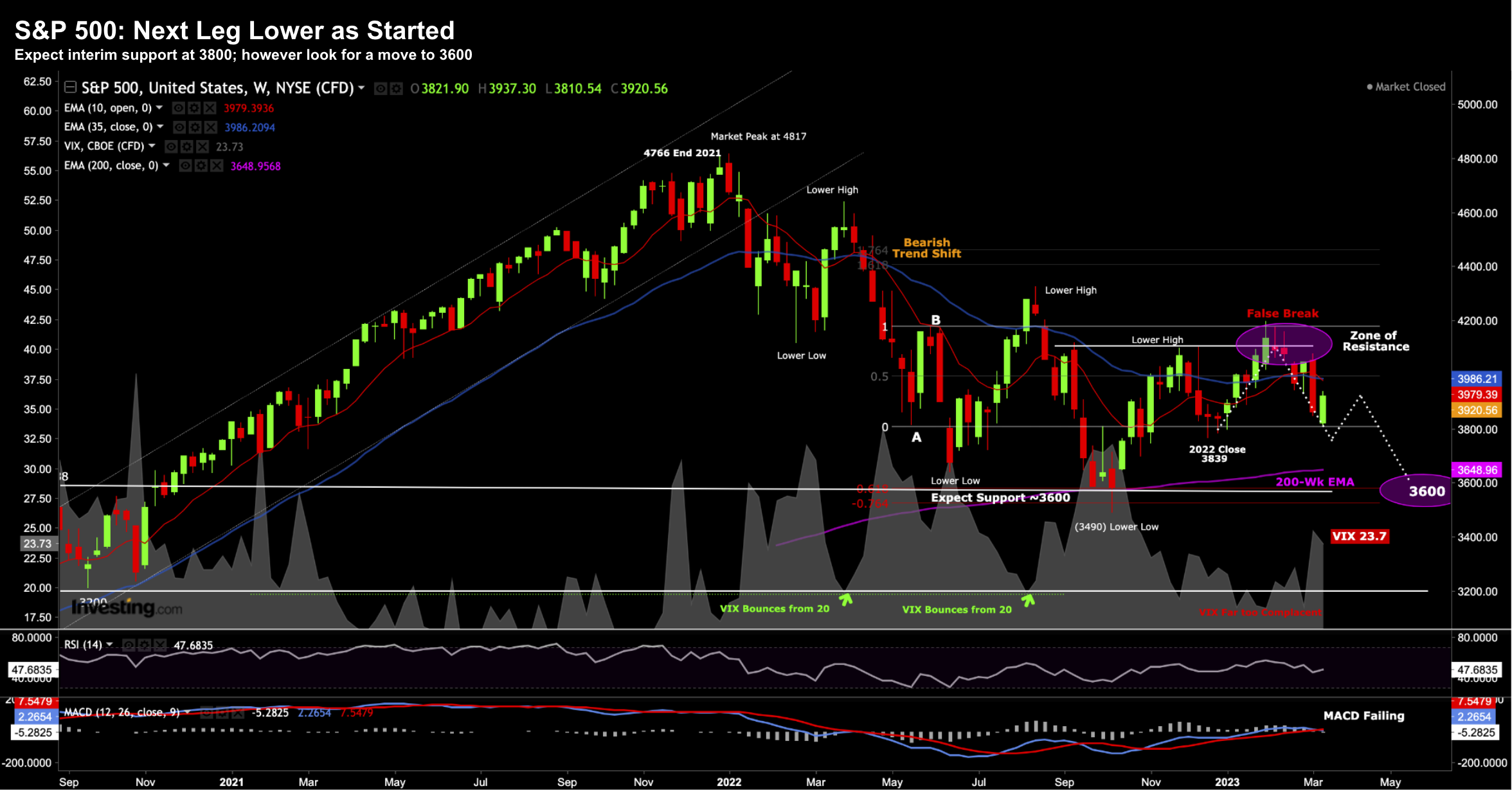

Next Leg Lower Started

It’s been an exceptionally volatile few days.

And look no further than the bond market (as I outlined earlier).

And until we see stability in bonds, we can forget about stability with equities.

Markets caught a small bid today however it feels like the next leg lower has started.

Nothing rises or falls in a straight line.

For example, regular readers will know I’ve been looking for an interim move to the 3800 zone where I thought we would see support.

This week we touched 3810 before we recovering to 3920

March 14 2023

However, I would be a seller on strength.

This market is now on tenterhooks.

You only need to see the price action in banks.

They are rolling over and given the actions from the Fed this week – you’re going to see banks cost of funding increase; margins decrease and lending tighten.

As I say, I don’t think that’s necessarily a bad thing… but it will materially slow a credit dependent economy.

And a slower economy will mean lower earnings.

One final thing – pay attention to the weekly MACD – it’s rolling over.

The past few times we have seen this – equities made a move down.

Putting it All Together

Some readers have asked me what I think the Fed will do next week given the collapse of SVB.

My view is they will stick with an increase of 25 bps.

Could they pause?

Yes.

But I don’t think they will.

The more important question is how long they persist with higher rates.

I still don’t see cuts this year… not yet.

However, what will potentially force the Fed’s hand is either:

- A recession; and/or

- A financial crisis

Careful what you wish for with rate cuts.

The flip side to cutting rates is they still face a long-term battle with price stability (as today’s CPI showed).

- Consumer Price Index increases 0.4% in February

- CPI rises 6.0% on year-on-year basis

- Core CPI climbs 0.5%; up 5.5% year-on-year

Jamie Cox, at Harris Financial Group in Richmond, Virginia put it this way:

“The Fed is going to have to pick its poison, tolerate some inflation for a bit to see if its current series of rate hikes takes hold and pause or keep hiking and deal with the financial instability caused by their own policy decisions”

Cox is right but I take a slight issue with his last comment.

Yes, aggressive rate hikes caused bond prices to fall… no question.

The weather turned ugly.

But could you argue that known risks can be managed (or at least hedged)?

For example, if you know it’s going to rain – do you take an umbrella?

The Fed told us very bad weather was ahead.

Month after month.

Some listened.

Others either chose not to; or just simply didn’t know what they were doing.