- Odds improve for ‘only’ a 50 bps in Sept (down from 75)

- However, the Fed is still tightening and QT starts to ramp in September

- Fade this rally – don’t chase it.

Consumer Price Inflation (CPI) did not go up from last month.

Three cheers.

And if you listen to Joe Biden – he said there was no inflation last month.

You can always ‘bend’ facts to fit any narrative… right?

That said, it was widely expected that inflation had peaked at 9.1%.

For example, I explained the 20%+ declines in energy prices and other leading commodities (such as copper, iron ore, lumber etc).

What’s more, we also had:

- the sharp decline in money supply growth (arguably a greater bearing on inflation); and

- 5-year TIPS yields plunging from 3.50% to just 2.50%

But here’s the bad news:

CPI still came at 8.5% YoY – more than 4x higher than the Fed’s objective.

That’s not quite what I would consider “no” inflation.

But let me be clear – it’s very good news inflation is lower from the prior month.

Consumers need relief.

However, going from 9.1% to 8.5% is not the hard part.

Flexible (more discretionary) items like air fares, used cars, apparel etc were all going to come down.

The more difficult fight ahead of us will be getting inflation down from levels of ~5% to the Fed’s objective of 2%.

I say that because stickier inflation remains high.

Wages are up over 5% YoY and rents are up 14% YoY.

And guess what – both of these were up month on month (not down)

And it’s these two inputs that will take at least 12 months to fall… pending what we see with unemployment and house prices.

One Hot Night Never Made a Summer

What did Uber’s CEO say last week…. “70% of new driver sign-ups are their second job!”

That’s people working all day and all night to make ends meet.

But let’s start with energy. For example, since June we have seen:

- Energy down 4.6%

- Gasoline down 7.7%

- Fuel oil down 11%

- Electricity up 1.6%

But when you look at those same segments year over year… it’s shows how far we have to go:

- Energy up 32.9%

- Gasoline up 44%

- Fuel oil up 75.6%

- Electricity up 15.2%

- Food at home up 13%

- Cereal up 16.8%

- Milk up 15.6%

- Coffee up 20%

Zero inflation for July sounds much better.

But let’s take a look at WTI Crude specifically.

This is what needs to come down for inflation to move lower… as it feeds through to the cost of everything we consume (including food!)

Aug 10 2022

And this is largely why we have seen CPI ease to “just” 8.5%.

However, the question is whether oil is likely to go materially lower?

My guess is no.

In fact, on a near-term basis I see WTI Crude rallying back above $100 to $110 a barrel.

And that will spark inflationary fears again.

Supply constraints are still very real.

But if we are to go into a recession (however we choose to define it these days) — then we will see demand destruction and a much lower oil price.

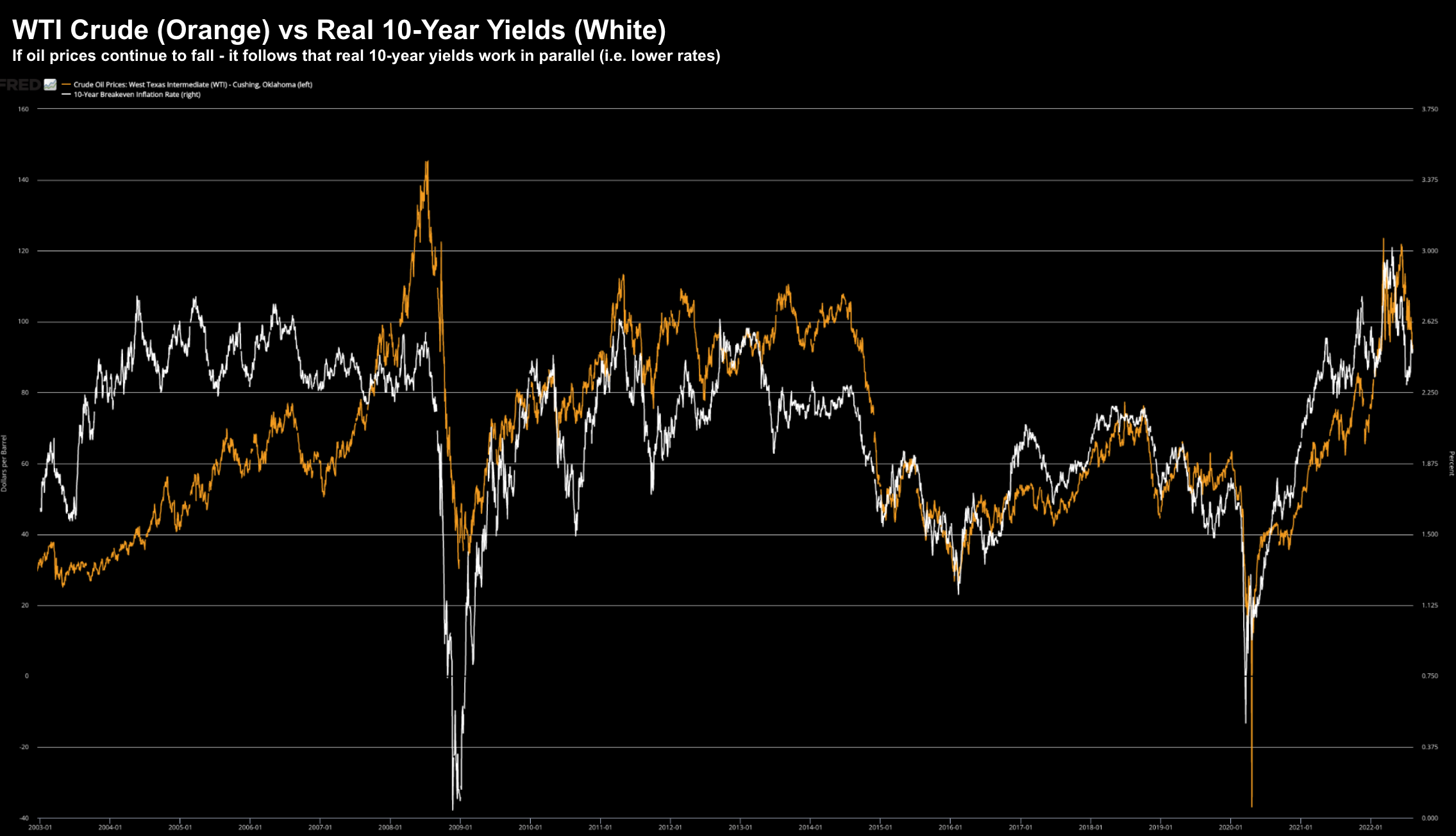

One last chart with WTI Crude…

Take a look at the relationship with real 10-year yields (i.e. interest rates):

Aug 10 2022

With oil plummeting – so too have real yields – which has been great news for stocks (specifically tech)

Again, I think we will see a floor in these yields soon (more on why below); and a bounce in crude prices.

No Reason for the Fed to Stop

I don’t think so… not materially.

And what I mean by that is they may now lean slightly to 50 basis points in September – and not 75.

Remember:

8.5% is a whopping 4x more than their objective.

Now immediately following the 8.5% CPI release – Fed President Charles Evans said:

“I expect that we will be increasing rates the rest of this year and into next year to make sure inflation gets back to our 2% objective. While inflation did slow a bit, the pace remains at an “unacceptable high”

What’s more, Minneapolis Fed President Neel Kashkari is more hawkish.

He expects the Fed funds rate to rise to nearly 4% by the end of 2022 and almost 4.5% by the close of 2023.

Kashkari has sharply pivoted from one of the uber doves at the Fed to one of the biggest hawks.

As for the notion of the Fed trimming rates in early 2023, Kashkari called that idea “unrealistic” until the Fed is convinced inflation is “well on its way” back down to the 2% target.

Spot on.

But today the market was not buying anything that Evans or Kashkari was selling… equities were “fighting the fed”

Let’s add some much needed perspective:

First thing is the Fed has only just begun to tighten.

They started to raise rates in March (~12 months late in my view)

Now there’s a long way to go in this cycle before we think about possible pivots (echoing Kashkari’s sentiment)

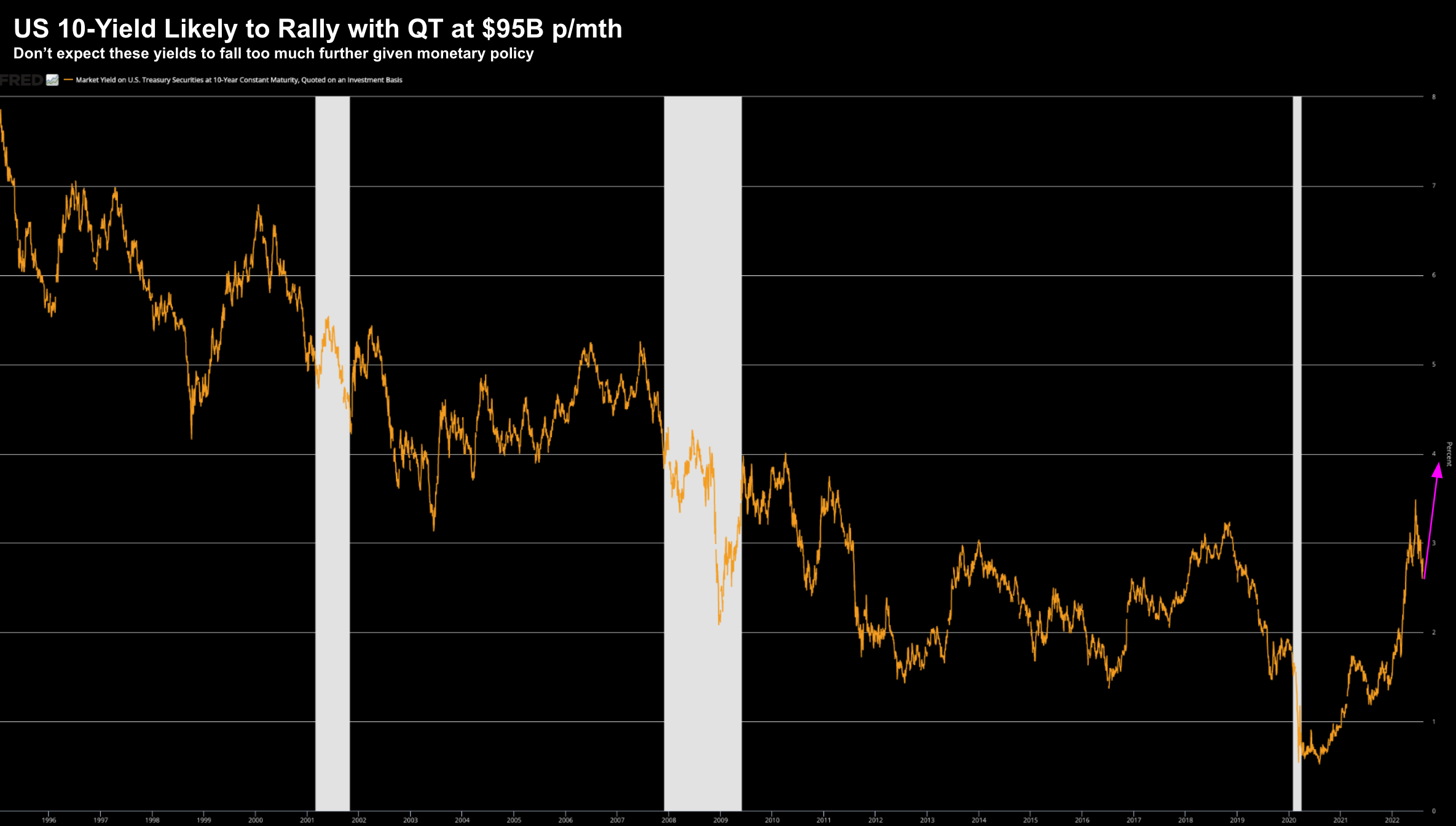

But perhaps what is under-appreciated (mostly from an equity perspective) is the coming transition to quantitative tightening (QT).

This started in June and is not yet at the intended $95B per month.

This will start to pick up in September.

QT is equivalent to a partial rate rise – and will have the effect of putting a floor in bond yields; i.e. yields are likely to go higher.

This will translate into meaningful structural changes in the economy which will keep supply constrained.

And this is by design.

Looking at today’s burst of enthusiasm at the (lower) 8.5% CPI YoY print – the market is now very much “fighting the Fed”

They see possible easing… not hikes.

I see the Fed in tightening mode.

They are looking to contract the monetary base… not expand it.

And until we see a CPI number starting with a 5-handle (best case) – maybe we can start talking about a pivot.

That won’t be in 2022…

Especially not given what I see with wages and rents.

S&P 500 Chooses to ‘Fight the Fed’

Regular readers will know this is the zone I targeted some two months ago.

From the lows of June (3636) we have piled on almost 16% in 8 weeks.

That’s a “v-shaped” rally!

What’s more, it’s a market which sees a much ‘friendlier’ Fed…

Aug 10 2022

And if accurate with S&P 500 earnings per share estimated at $237 – that puts us close to 18.5x forward earnings.

That’s at the ‘higher end’ of the range…. certainly no discount.

Again, this assumes that forward earnings estimates are accurate and will not come down.

I think they do.

Given the tightening measures to come and expected structural slow-down – this will only pressure earnings.

In closing, with my portfolio ~65% long, it’s been nice to see the rally.

But more importantly, I’m not putting new capital to work here. That time was closer to 3600.

Not here.

Happy to wait patiently for the next pullback.

We look a little over-cooked here.