- Stretched valuations will cap market gains

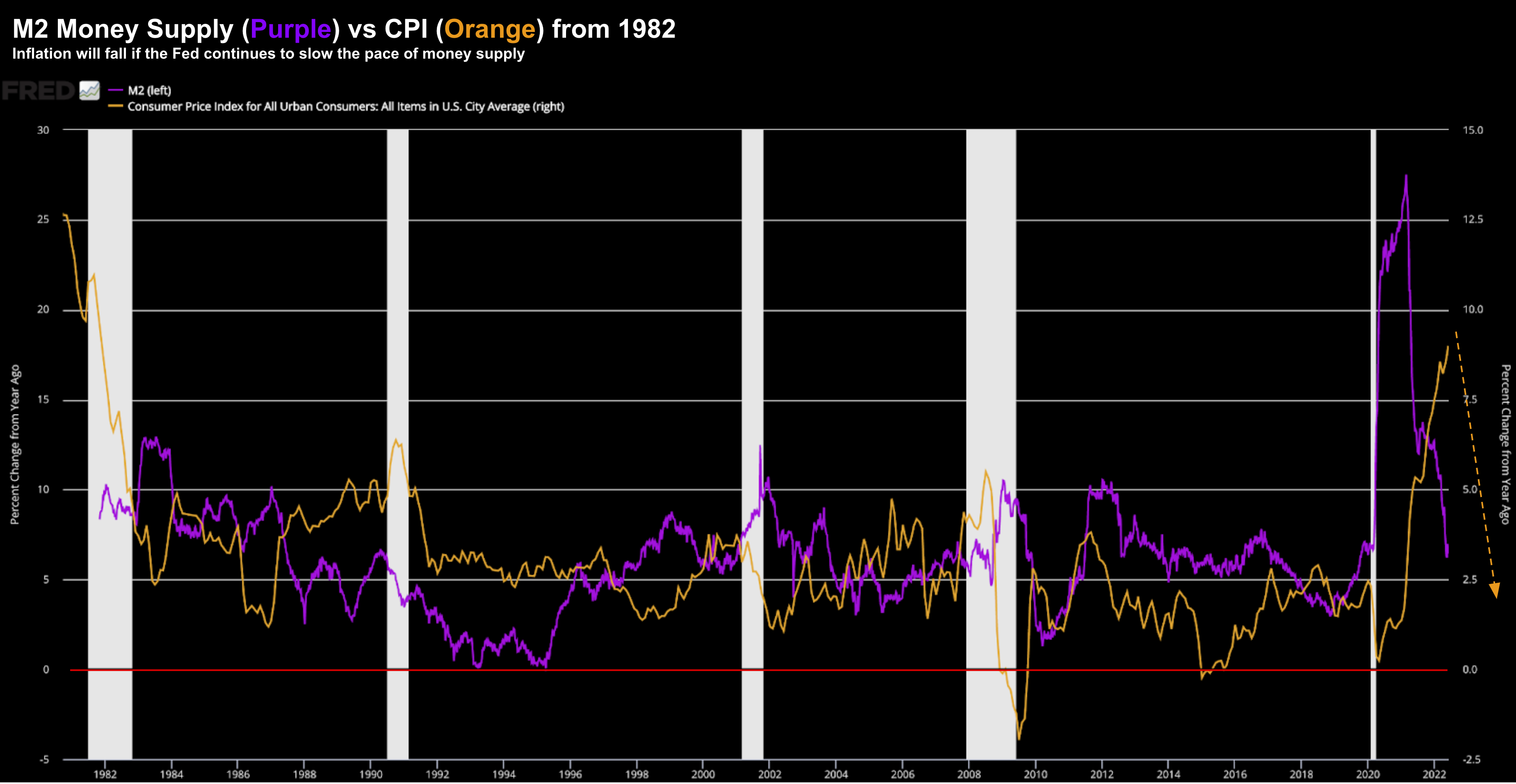

- Pay attention to (slower) money supply growth and liquidity

- Stay patient here…

18% in 8 Weeks!

That’s about as fierce as bear markets get.

What’s more… it’s not unexpected.

2000 and 2008 saw several ‘15% to 20%’ v-shaped rallies as participants wrestled between a ‘bear market bounce’ and the start of a new (multi-year) bull run.

And it’s easy to understand why the bulls are pinning their ears back:

- We’re most likely past peak inflation; and

- This potentially means Fed dovishness

Note: it was ‘beta’ names rallying the most this week – less so higher quality.

Now there’s just one problem…

The Fed is far from done (and I am not just talking about interest rates).

One hot night doesn’t make a summer… let’s explore why.

Bulls Lack Patience

Far from it.

If you ask me, going from 9.1% YoY to say 5.0% will be the easy part.

However, getting CPI from 5.0% to 2.0% opposite stickier wage and rent inflation will take years… not months.

That’s the Fed’s real fight.

To be clear, it’s great we’re finally seeing some (much needed) relief.

But….

We’re still at 8.5% YoY CPI.

Think back to March when CPI hit 8.5%… the market curled up into the fetal position!

Now we are back at that level and some believe it’s reason for the Fed to start thinking about cutting?

This week we had two Fed Presidents (Evans and Kashkari) remind us that nothing has changed in terms of the July CPI print.

Rates are still going up.

What’s more, from September QT will ramp to $95 Billion per month rolling off the Fed’s balance sheet.

How much of that roll-off is being discounted?

That’s hard to know… but it’s in front of us.

But look… I’m very thankful for the ~18% gift.

Given I’m ~65% long – my YTD performance is essentially flat – handily beating the S&P 500 by double-digits.

There’s still a good 5 months to go before I can claim victory… but so far so good.

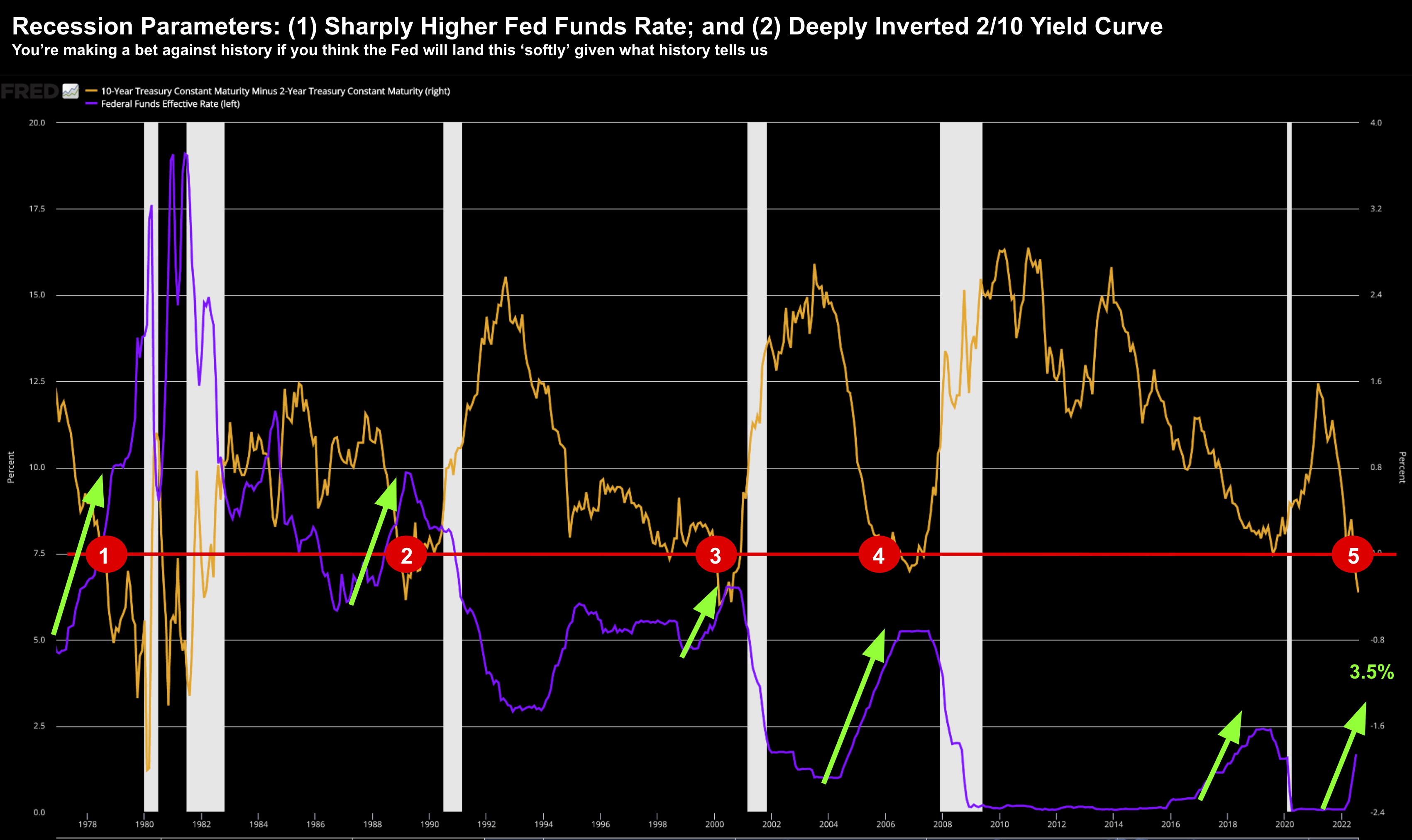

Two Recessionary Signals In Play

- interest rates and bond yields; and

- central bank liquidity (or money supply)

For now, let’s talk about what we see with rates (drawing some lessons from history)

History tells us that 85% of the time, sharp tightening cycles (like the one we have today) have led to a recession.

If you refer to the chart below – this is highlighted by the purple line with green arrows.

Second, 100% of the time when we get an inverted yield curve (e.g., 2/10s) — we have had a recession with 12-18 months (noted by the 4 red circles – where the 2/10 feel below zero (red-line)

Here’s the chart with these two monetary conditions highlighted:

Aug 11 2022

For example, I believe the short-term Fed funds rate will be in the realm of 3.50% by year’s end.

What’s more, I don’t think 3 or 4 consecutive meaningfully lower ‘CPI prints’ will change this figure.

From mine, best case scenario is we see CPI trade with a 5-handle by year’s end (and that assumes that oil trades well below US$70/b)

If that assumption is accurate – a short-term Fed funds rate of 3.50% will still be well below CPI.

That’s inflationary.

By way of example, Fed President Neel Kashkari expects the Fed funds rate to rise to nearly 4% by the end of 2022; and almost 4.5% by the close of 2023.

As for the notion of the Fed trimming rates early next year opposite falling inflation – he said that’s “unrealistic”.

My take is the Fed will need to see at least four to five months of similar Core PCE and CPI declines before we talk about cuts.

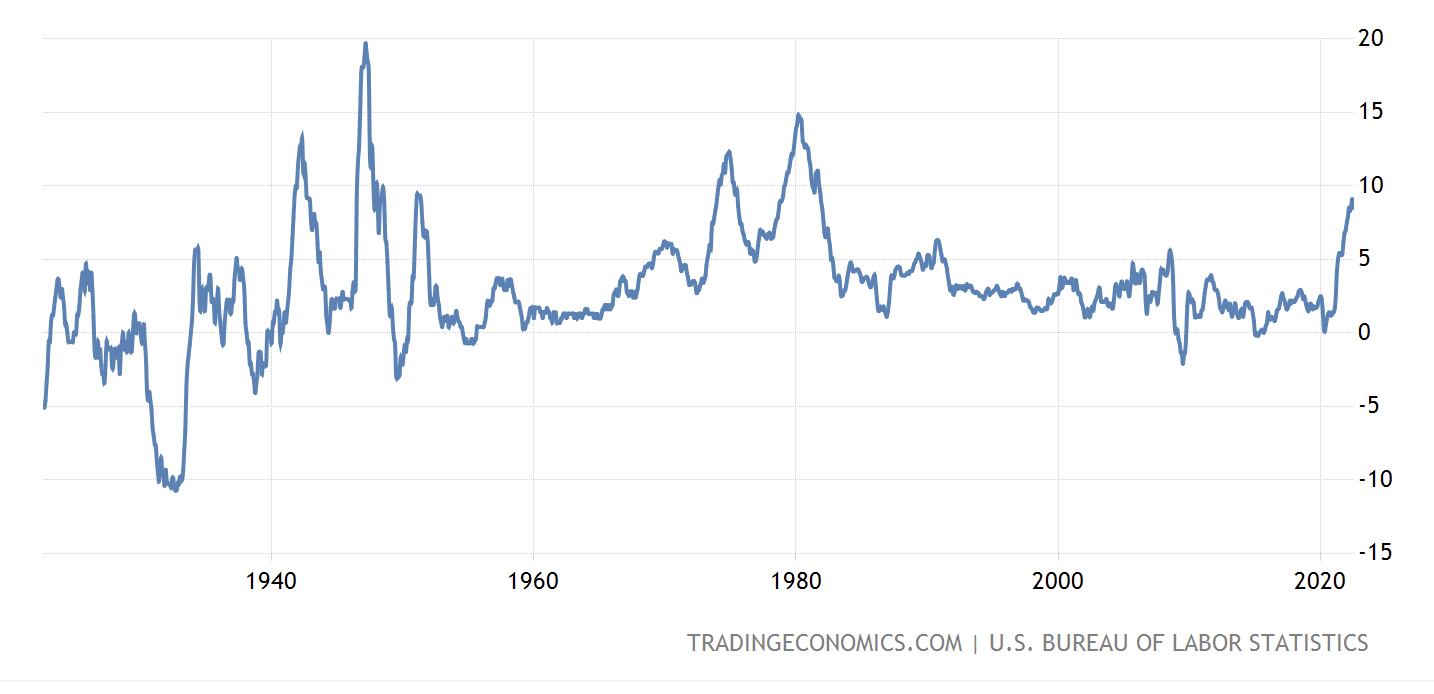

One other data point from history:

In 1980 inflation had also peaked…

Fed Chair Volcker raised short terms rates above the rate of CPI and inflation started to come down (shown in the chart below from tradingeconomics.com)

But here’s the thing…

The market didn’t bottom until 1982.

And in between 1981 and 1982 — the S&P 500 saw two rallies exceed 14%

Stay Patient…

And for me, that answer is no.

Sure, the market could extend to around 4,400 (as I’ve suggested in recent missives).

That’s another 4-5% or so from here.

But if we assume earnings are to come in around $237 per share (and don’t go down) – that’s a forward PE in the realm of 18.5x plus.

Aug 12 2022

In favour of the bulls — momentum and breadth are on their side.

Now breadth is important — as it means with more segments of the market participating in the rally – it potentially bodes well for a higher low on any pullback.

Regular readers will know this is a very important technical signal that I’m looking for…

Now something else in favour of the bulls is we’re seeing good performance out of cyclical risk-on sectors.

For example, small caps have been handily outperforming the S&P 500 for a couple of months.

Good news… sentiment is improving.

But from here, we run into the valuation argument I previously outlined.

For example, what risk premium are investors willing to pay into a recessionary and tighter monetary environment?

More than 19x forward? 20x?

Good luck with that.

For example, 19x was close to peak valuation in 2018 and early 2020 (i.e., before the Fed went a rampage with an extra ~$4 Trillion in QE (with zero rates) – pushing valuations to 21x)

And fundamentally, that’s why I ‘draw the line’ in the ‘zone’ of 4200 to 4400.

Parallels to 20% Correction of 2018?

For ease of reference, I’ve included the chart below for the S&P 500:

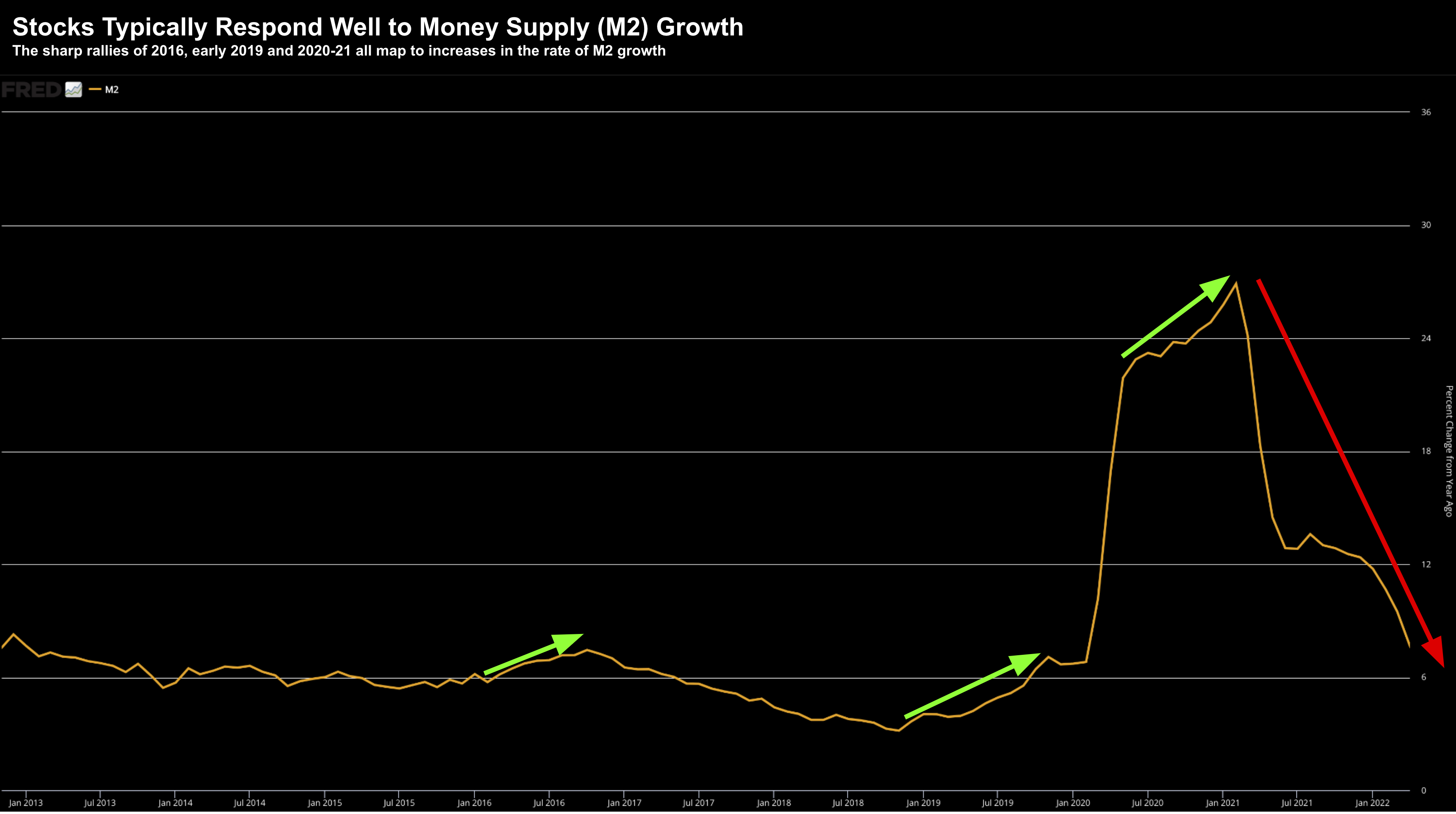

However, the most important difference between 2018 (in addition to the sharp rallies in 2016 and 2020) is Fed policy (and specifically the pivots)

Not only were the Fed embarking on a path of easing short term rates – liquidity during these times was becoming far more abundant (i.e. QE)

For example, take a look at the percentage change in M2 growth when we experienced these rallies:

My logic was it had to come down if the Fed was going to be successful in pulling down inflation.

And if my hypothesis was correct – the S&P 500 would follow suit.

Here’s the chart I shared earlier this year:

The lesson here is when the Fed is expanding their balance sheet (and printing money) – it supports valuations for higher PEs (e.g., 20x forward)

However, when the Fed is forced to take money out of the system (by slowing the rate of M2 growth) – it pulls valuations lower.

What’s more, the Fed are telling us this!

So let me ask you this:

Why would you choose to put more risk capital to work at a forward valuation of 18.5x plus – with the Fed withdrawing liquidity – as they combat CPI ~8.5% YoY?

That’s not math I get excited about.

Putting it All Together…

Not yet.

Yes, I can see the case for inflation peaking.

So what.

I made that case a couple of months back when I mapped CPI to the change in (M2) money supply.

Here’s the chart for those who missed it (well before we get the July 8.5% CPI print)

Why inflation will fall

We knew inflation was likely to come down.

And in theory (given lower oil prices) – it should come down again next month.

Good news.

But given the Fed wants to see financial conditions tighten – and money being withdrawn from the system – it’s hard to support the bullish case beyond 4200 to 4400.

What’s more, they want to see real yields move higher.

Further to recent missive, I cited the US 10-year dropping to ~2.50% being a big part of the equity rally (especially tech).

I called the post “It’s All About Bond Yields”

However, I made the case it’s unlikely we will see yields fall much lower and if anything, look for them to start accelerating back towards 3.0%.

Right on cue… that’s what we have seen with the 10-year now trading at ~2.90%.

Again, this is what the Fed wants to see.

But as we know, higher yields are not conducive to higher asset prices (e.g. stocks or houses)

Right now the bond market is screaming recession (evidenced by the deeply inverted curve)… however equities simply don’t want to hear it.

Not yet. But they will.