Words: 1,024 Time: 5 Minutes

- Bond investors demand term premium (and so they should!)

- Volatility in debt markets highly anxiety around fiscal outcomes

- Government has a spending problem (not a revenue problem)

Several weeks ago I suggested investors consider reducing their exposure to 10-year (plus) treasuries.

At the time, the world’s most important debt security was yielding around 3.80%. They would continue to fall to a near-term low of 3.60% (chart below)

October 24 2024

- The market was optimistic pricing in ~200 bps of cuts within ~12 months; and second

- Regardless of who wins the election – fiscal recklessness will likely continue – driving yields higher.

As the chart above shows, the rally in US 10-year treasury yields has been swift. The 10-year has surged some ~60 bps since the Fed cut rates on Sept 18th.

This was not what the market expected…

Two questions:

- Why are 10-year yield rising? and

- Are they likely to keep rising?

The second question is much harder to answer. However, with respect to why — there are several forces at play.

Personally, I think it’s the combination of two things:

- uncertainty around the election (i.e., the fiscal outcome); and

- relative supply and demand bond market dynamics

With respect to the former – markets are increasingly worried about the fiscal outlook. Regardless of who wins, markets realize that it’s unlikely either side will target deficit (and debt) reduction.

For example, both sides talk endlessly about revenues (i.e. tax receipts)

However, they contrast on how revenues will expand.

For example, Trump believes tax cuts will help drive greater business investment – delivering more tax revenue via increased economic growth.

Harris would like to increase taxes on Corporate America and wealthier citizens (on the basis they pay their “fair share”).

Irrespective of what you believe is the better pathway to greater revenue (whether it’s carrot or stick) — tax revenues is not where the problem is.

It’s spending.

Houston… We Have a (Spending) Problem

Houston… We Have a (Spending) Problem

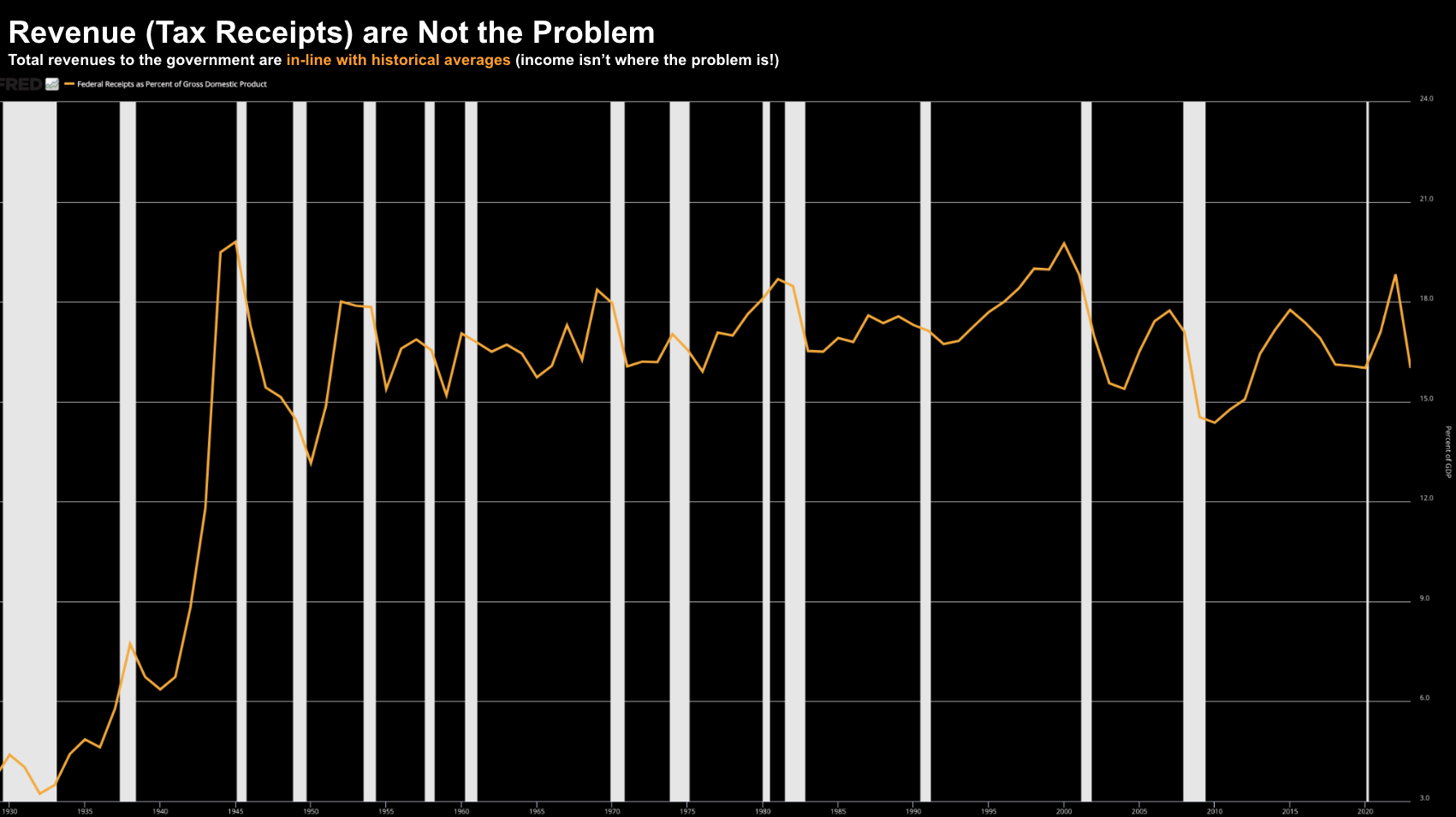

I have two charts to explain why the government’s fiscal problem is on the expense side.

First, below are federal tax receipts as a function of gross domestic product over the past 90+ years.

Post WWII – tax receipts remain mostly inline with historical averages (between 15% and 18%)

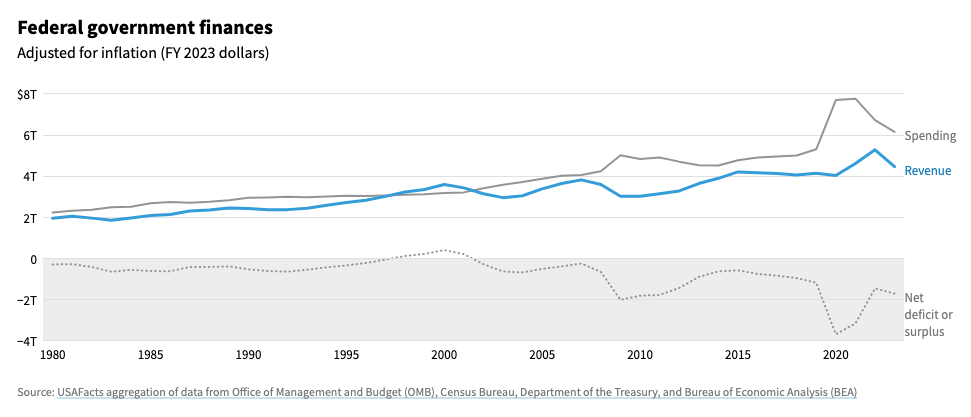

However, it’s the second chart which highlights the source of the problem.

Federal government spending outpaces revenue (and has done for ~25 years)

And that gap is widening… thanks to greater deficits.

For the past 25+ years both sides of the political divide have spent more than they earn (despite tax revenues remaining consistently between 15% to 18% of GDP)

But here’s where the 10-year yield becomes important…

With long-term bond yields now exceeding 4.0% (and likely to rise in my view) – this will take resources away from other (deserving) sectors.

From my lens, that’s fiscally reckless.

Too much debt is like a “backpack full of rocks” when trying to climb Mount Everest.

How do you climb faster? You shed the rocks.

If America wants to reclaim the growth it enjoyed decades ago – they need to focus on the public expense side of the ledger.

Adding more rocks won’t help.

All that does is crowd out the private sector (the sector which generates tax revenue) and from my lens that’s a concern.

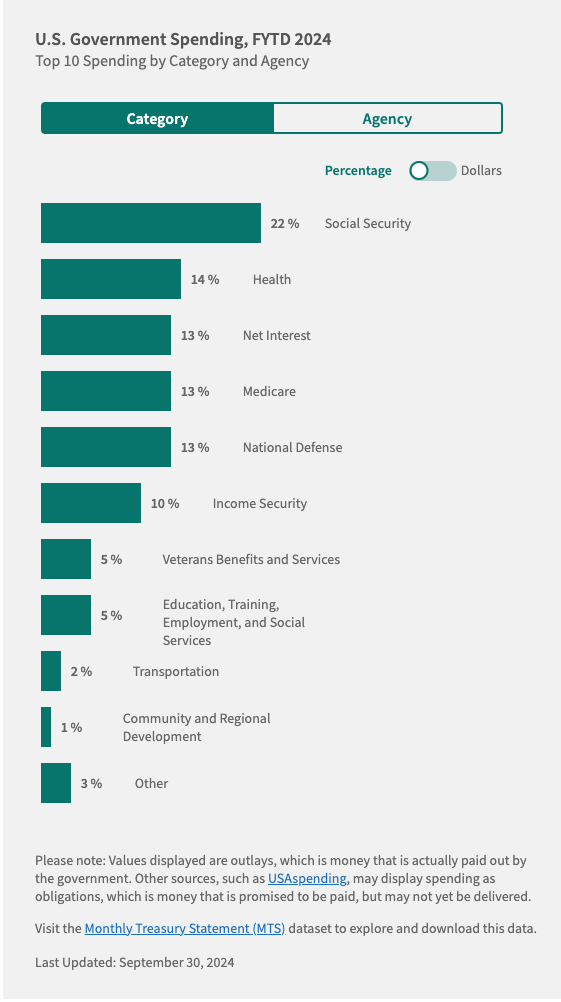

As an example, interest payments alone are now 13% of the total federal budget – surpassing both Medicare and Defense spending this year.

But I digress…

The bond market is concerned by trends with mounting debts and deficits (where debt exceeds 120% to GDP)

Deficits – which exceed 5% of GDP – are highly unusual – rarely experienced during times of economic expansion; and/or non-emergencies (such as today).

Therefore, bonds are concerned about (a) the rate of federal spending; and (b) how sustainable it is?

The chart below is a measure of the relative “anxiety” in the bond market.

It’s rising…

It’s known as the MOVE Index…. the equivalent of the VIX for bonds

Oct 24 2024

We saw a notable spike around October 7 – the largest single-day jump in 4 years.

This indicates the market anticipates significant yield fluctuations reflecting heightened uncertainty.

Bond vigilantes are now making their presence known.

And they are (rightfully) demanding term premium if taking ownership of U.S. federal government debt.

Bond Vigilantes are Back!

Bond Vigilantes are Back!

The bond market serves as a barometer for investor confidence.

For example, as these yields continue to rise, the implications for the government, consumers and business become significant for economic growth.

These will impact everything from government debt, to mortgage rates to corporate financing.

Consider what we saw on mortgage applications last week.

“Application activity decreased to its lowest level since July, as both purchase and refinance applications saw declines”

According to the FT, analysts like Torsten Slok from Apollo and Calvin Tse from BNP Paribas highlight that the increasing bond yield term premium reflects investors’ hesitance to lend to the U.S. government long-term, linking it to fiscal sustainability worries.

For those less familiar, term premium is the expected excess return that investors earn by holding longer-dated U.S. Treasuries versus rolling over (shorter) T-bills.

Joe Lavorgna of SMBC Nikko, suggests as much as ~ 80% of the recent rise in Treasury yields can be attributed to the term premium.

This insight is interesting as it could indicate that the dynamics affecting yields are shifting.

For example, the term premium’s increase reflects higher real interest rates and stronger economic indicators, reducing the urgency for the Federal Reserve to make additional cuts in the near future.

What’s more, we could see the front end of the Treasury curve require repricing.

This is not currently priced in…

Any additional gains in yields will only intensify the scrutiny investors are paying opposite very high stock multiples.

What Matters for Investors

What Matters for Investors

- If long-term treasury yields continue to rise (I expect they will) – investors must remain vigilant – reducing exposure to the long-end

- Higher bond yields will force investors to scrutinize forward PE multiples (which remain very high at 22x)

- The resurgence with ‘bond vigilantes’ and term premium will play a pivotal role where yields go.

If you have exposure to the long-end (via ETF vehicles such as EDV or TLT) – consider reducing them.

I would aim more towards the ‘belly of the curve‘ if owning debt; e.g. 3-5 year bonds.