- Is it a rotation out of tech or something more?

- The reaction to (tech) earnings this week will be important

- And ‘part II’ of the importance of cycles in markets

Yesterday I shared why it’s important we take time to understand the nature of economic cycles.

From there, how we can position ourselves during times of shifting investor sentiment.

Investors can add to their advantage by observing four things:

- The laws of regression toward the mean;

- Longer-term charts over several decades (determining cause-and-effect);

- What’s knowable (fundamentals) vs what’s not; and

- Clear signs of significant excess or aberration (i.e., fear and greed)

This missive continues this theme with a closer look at the (early stage) unwind in large cap tech.

For example, are we working our way through the stage of ‘peak optimism and greed’?

If so, how do we know?

What’s important is these shifts can take time and they’re rarely in a straight line.

Let’s explore…

Tech Drags the S&P 500 Lower

Last week, the broader market gave back some of its stellar recent gains.

But despite the market pulling back – it’s still up an impressive ~15% year-to-date.

However, we are also trading in a zone of resistance where a pullback was likely.

July 21 2024

The price action last week should not come as a surprise.

If anything, I see it as a healthy sign as markets flush any excess.

Recapping my technical observations from the previous week:

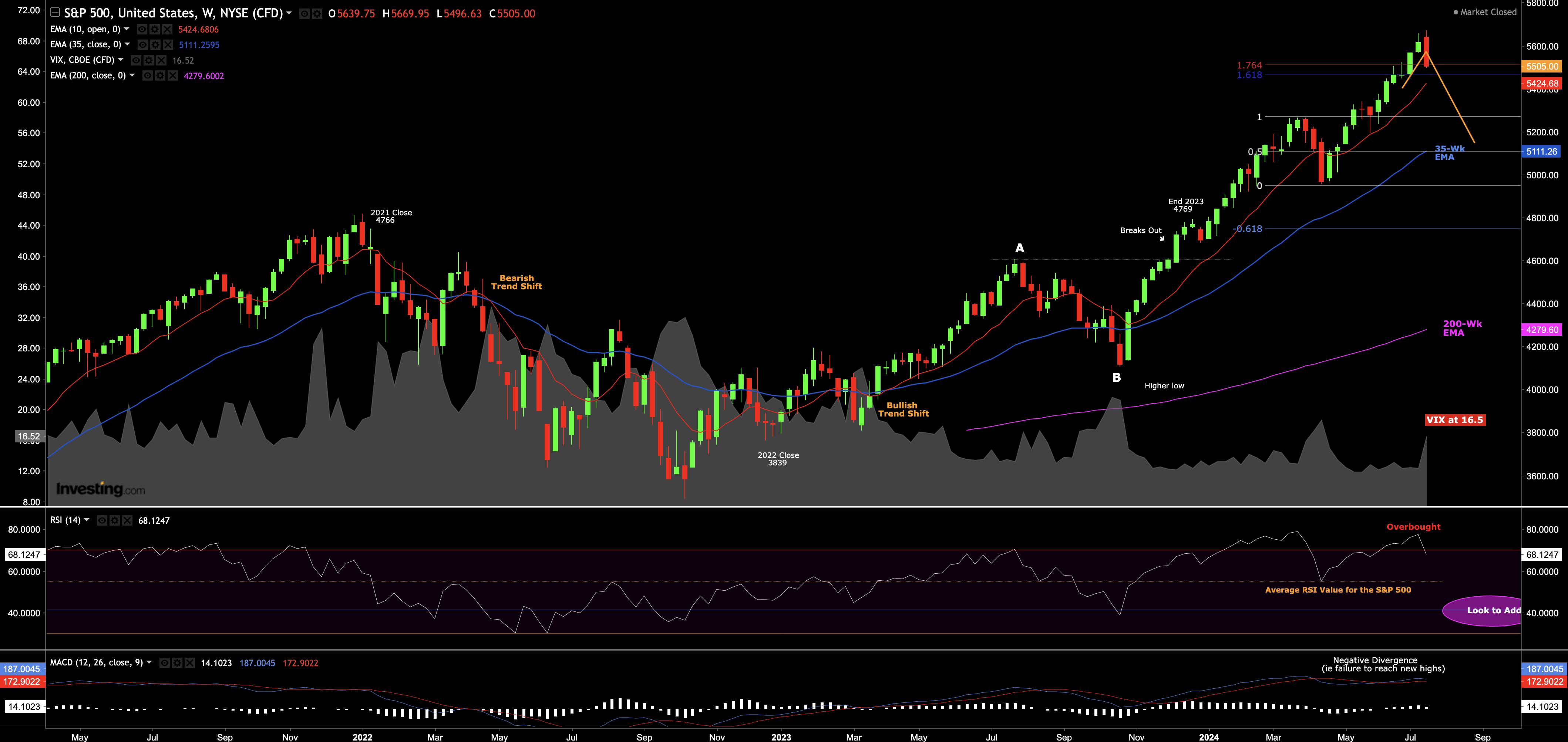

- Our weekly RSI well into overbought territory (hitting almost 78);

- We saw negative divergence on our weekly MACD (lower window); and

- The price action was a long way extended from both the 10-week EMA and 35-week EMA (which over time act as a gravitational pull)

And whilst a pullback was highly probable given each of the above – this remains a bullish market.

For example, the market could easily shed at least 10% (e.g. to the 35-week EMA) and still look bullish.

From here, let’s look at some of the internals – specifically, the rotation out of large-cap tech.

To start, let’s dimension what we saw with the Mag 7 last week (vs the S&P 500 and Equal Weight Index)

July 21 2024

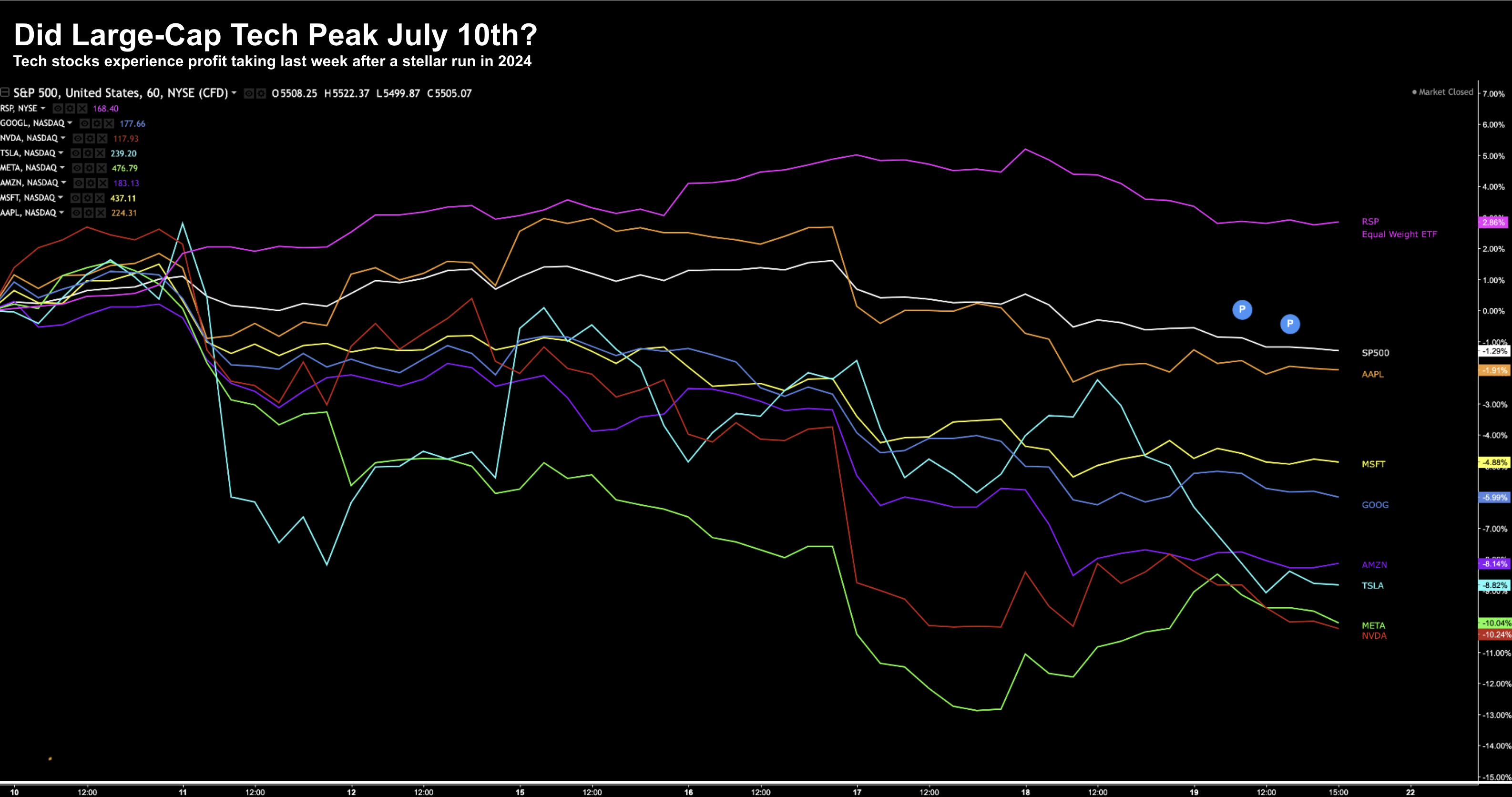

The Equal Weight Index added ~3.0% – perhaps the beneficiary from the outflow of money from tech.

For example, the Mag 7 stock price index shed ~8.4% from its July 10 peak.

Such as META and NVDA saw double-digit declines over the week.

That said, they are also higher than any other Mag 7 stock year-to-date.

This had many saying the correction in tech is here… and “buy the dip”

I think that’s premature.

So far, we haven’t seen any correction.

According to data from Bloomberg, the Mag 7 comprised 28.7% of the total capitalization of the S&P 500 Index at the end of last year.

By July 10 – the proportion of the S&P 500 comprised by the Mag 7 surged to 34.4%

We had not seen concentration (or valuations) like this since 1999/2000.

The good news is concentration fell to ~32%.

Put another way, the market broadened slightly however is still more concentrated than what it was at end of last year.

The bad news is valuations are still at ‘lofty’ levels (in some cases).

Which brings me to my question:

Can the market let the air out of the bubble without consequence?

The answer relates to what I explained yesterday…

That is, panics and busts only occur after booms and bubbles.

But what a minute Adrian – are you saying this is a bubble?

My answer to that is look at where we are in relation to the long-term mean.

That’s your litmus test.

For example, if we simply take the S&P 500 – it trades at ~22x forward earnings (on the assumption earnings growth this year is ~12%)

The 10-year average forward PE for the S&P 500 is ~18x (mostly as a function of long-term yields trading near zero).

And the 100-year forward PE average is closer to 15.5x

At approx 22x – we are a long way from the mean.

But if I was to dig a little deeper – consider the valuations (both price-to-sales and price-to-earnings) for the Mag 7:

| Company | Price-to-Sales | Fwd Price-to-Earnings |

|---|---|---|

| Nvidia (NVDA) | 37x | 45x |

| Meta (META) | 9x | 24x |

| Alphabet (GOOG) | 7x | 24x |

| Apple (AAPL) | 9x | 30x |

| Amazon (AMZN) | 3x | 39x |

| Tesla (TSLA) | 9x | 96x |

| Microsoft (MSFT) | 14x | 33x |

Source: Yahoo! Finance July 21 2024

One could argue Google and Meta are not exceptionally excessive here (especially when you ‘back out’ their cash-on-hand)

This lowers the ratio of what you’re paying.

They trade ~24x forward earnings; where both deserve a premium to the market given the strength of their business / cash flow / balance sheets etc.

That said, with the balance of names, I would not be willing to pay:

- 37x sales revenue for Nvidia (that’s a sales multiple!)

- 96x earnings for Tesla;

- 30x earnings for Apple;

- 39x earnings for Amazon; and

- 33x earnings for Microsoft

As a very rough rule of thumb – I start to bristle at 10x sales when I’m pitched investing in startups!

Irrespective, the multiples above suggests (to me) there is plenty of “air” in the bubble (despite all the promise)

Rotation or Something More?

For now, the rotation out of tech has been orderly.

From mine, it’s (smarter) investors removing some exposure into earnings.

We’ve seen what happens to companies if they don’t meet growth expectations (and guide lower).

But so far this year, it’s been tech stocks and not much else.

What I will be watching for is if the selling continues post earnings.

That will be a better indication as to whether there is more to the selling.

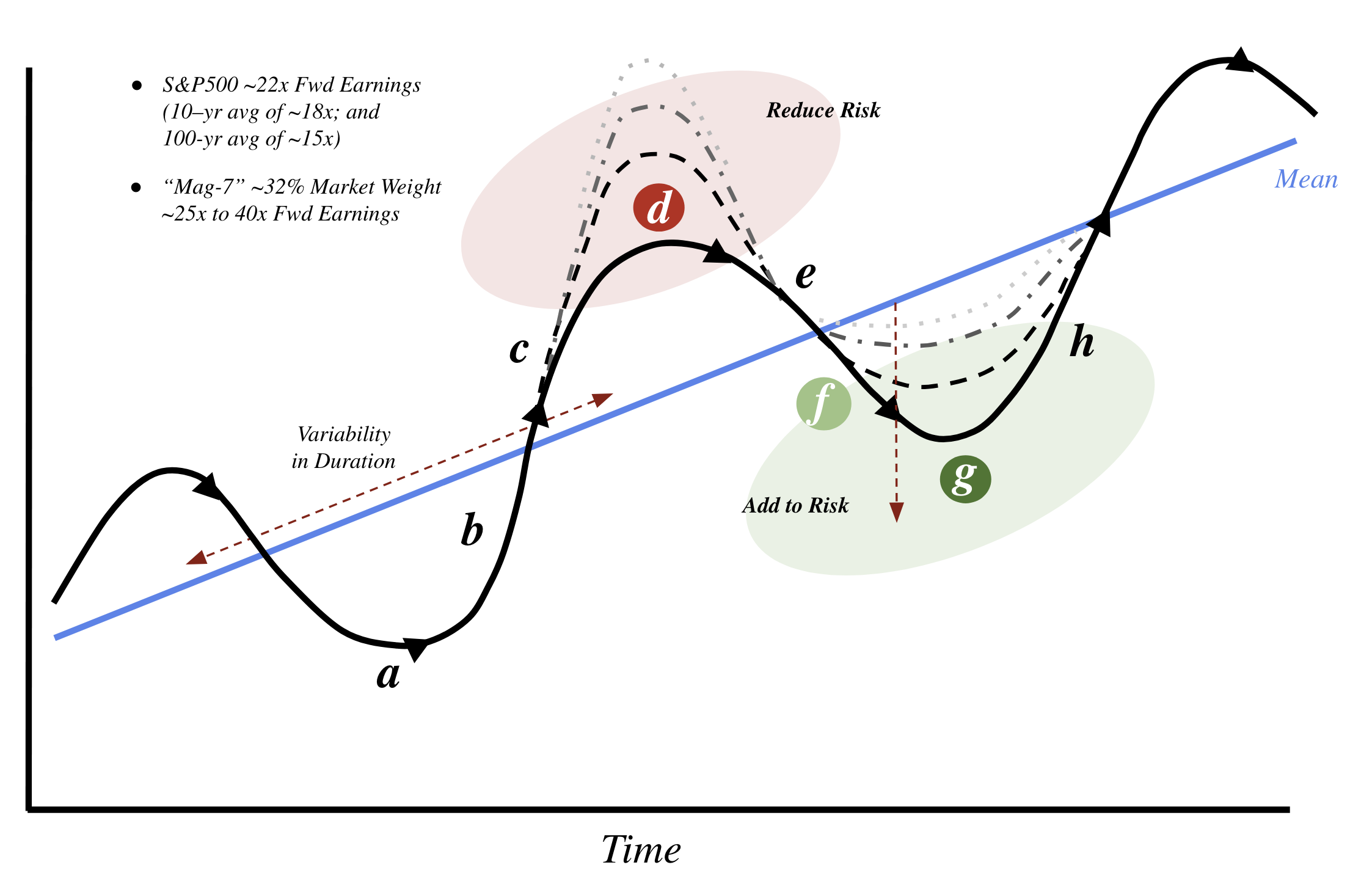

If that happens – it will increase my conviction we could be moving to the next stage in our cycle below.

Once again referencing Howard Marks’ model – we could move from “d” to “e”

It’s at stage “f” where we begin to sharpen our pencils.

However when (not if) stage “g” presents – this is where we take full advantage of quality assets trading at steep discounts.

Again, we are a long way from that.

Quality tech stocks – like the Mag 7 – have not corrected yet.

Putting it All Together

Last week the bears managed to pull stocks down a tick or two.

However, it was not as vicious as the media reported.

This week the optimist could easily prevail again as securities are bid higher.

And the following week – some stocks may disappoint with earnings or guidance – as the pessimists gain sway.

This is greed and fear in motion.

When everyone simply wants to buy (and no-one wants to sell) – where few people cannot think of reasons why stocks should rise – greed will dominate.

We saw that in 1999/2000.

And we’ve seen it rhyme over the past 12 months.

For example, I drew various comparisons between Cisco (in 1999) and Nvidia on both fundamental and technical levels.

They are notably similar.

And if you are not participating in the rally – you can feel pretty stupid.

Here’s the battlecry:

“AI is a new paradigm. Get on board with this new shift or you will miss it. And the price I’m paying is right as markets are efficient”

But eventually something will change.

For example, if you have time, take a read of this piece from Sequoia.

It’s called “AI’s $600B Question”

Goldman Sachs issued something similar.

In short, businesses (large and small) have invested a massive $600B on AI chips (to NVDA’s benefit) with virtually no line-of-sight to either meaningful revenue growth and/or the much heralded productivity gains.

This has been my question for months (as I’ve stressed on the blog).

However, the author correctly notes that AI will be transformative.

It will be.

But the road is a long one.

And whilst I can’t tell you is what use-cases will transform what we do – or how it will be monetized – but I can promise one thing:

At some point a stumbling block will materialize; and/or some prominent large-cap firm will report a significant problem.

And at that point, investor psychology will turn.

For example, what do you think burst the bubble of 2000?

Was it excessive valuations? A lack of revenue? A lack of product market fit? Unproven business models?

Or were we just too early?

For example, I would argue that almost every business idea around e-commerce in 1999 would probably work very well today.

But it didn’t then.

It’s difficult to pinpoint but greed turned to fear.

The narrative went from “you can’t afford not to be in this trade” to “better sell it before it goes to zero”

Irrational exuberance is replaced by excessive caution.

Again, we are long way from excessive caution today.

However, at some point the cycle repeats.