- This is a time not to lose a lot of money

- Market fully prices in 75 basis points tomorrow (and possibly July)

- 20%+ declines are par-for-the-course

When it comes to the game of investing – there are times to:

- make money; and

- not to lose money.

Today’s environment falls into the latter category.

In the near-term – this is not a market which is going to make you rich.

That was the previous 4 years – where total returns averaged ~17% per year (as I will demonstrate shortly).

Rates at zero percent combined with excessive money printing made the game easy.

Outsized returns came for free.

Today’s market is one which is more likely to evaporate your capital rather than reward you (just ask former ‘star’ investor Cathie Wood)

As I’ve been writing the past ~9 months – the investing narrative has changed sharply (not that Ms. Wood noticed).

For example, in November the Fed Chair – Jerome Powell – indirectly admitted the Fed’s poor judgement when it came to inflation.

It was no longer “transitory”.

Since then, the Fed has been scrambling to restore credibility by aggressively hiking rates; with plans to reduce their $9 Trillion balance sheet (‘QT’) to the tune of $95B per month.

This ‘one-two’ punch from the Fed is not conducive to higher asset prices.

But this is intentional from the Fed.

Not only do they want to reduce the supply of money (which helps quell inflation) – they also want to bring down the so-called ‘wealth effect’ from risk assets.

For example, when people see their 401K’s / investment portfolios and house prices plummeting – they’re less likely to borrow and spend – they feel less confident – from there we find inventory levels pile up – where growth and earnings estimates come down.

That’s what I see happening in real-time.

And it’s why this is a time not to lose too much money.

Perspective: Gains are Never Straight Up

Often it’s good to step back and take a broader perspective.

For example, take a look at one of my favourite charts – the S&P 500 using the monthly horizon:

June 15 2022

A couple of things to highlight

- There have been 5 meaningful pullbacks since 2012 (we’re in the fifth); and

- The incredible gains we’ve realized the past decade

Let me dimension the latter…

In June of 2010, the S&P 500 traded at a level of 1030. Fast forward 12 years and we are at 3735.

Expressed as a Compound Annual Growth Rate (CAGR) – that’s 11.33% capital return.

If we then add an average 2% dividend each year – it’s closer to a total return of 13.3% over 12 years.

This is an exceptional performance.

For example, the long-term (100-year) average total return rate for the S&P 500 is closer to 10.5%

But let’s look even closer (as it explains the 22% pullback)…

The CAGR from June 2018 to 2022 is a whopping 15.51% exclusive of dividends (where the S&P 500 traded at 2098 June 2018)

June 15 2022

From mine, total returns of above 17% per year from 2018 were never sustainable.

Put another way – things always return to the mean.

For example, as we entered Q4 last year, I warned readers of an exceptionally extended market.

I said expect a move back towards the 35-month EMA (blue-line) — representing a potential 20% correction.

And that’s what most Index funds (and 401Ks) will be showing…

But coming back to how I framed this missive…

2022 is less about making stellar returns — it’s about not becoming the next “Cathie Wood” (who has seen her ARKK Innovation fund drop from a high of $160 to just $37 at the time of writing).

I hope that’s not you…

From mine, if your portfolio is down less than 20% this year – you are winning.

Very few (long only) funds would be showing positive returns this year (unless you were overweight energy)

Take Warren Buffett’s Berkshire Hathaway (BRK) – it’s down 7.2% year-to-date (vs a long-term 57-year CAGR average of 20.1%)

Berkshire Hathaway – June 14 2022

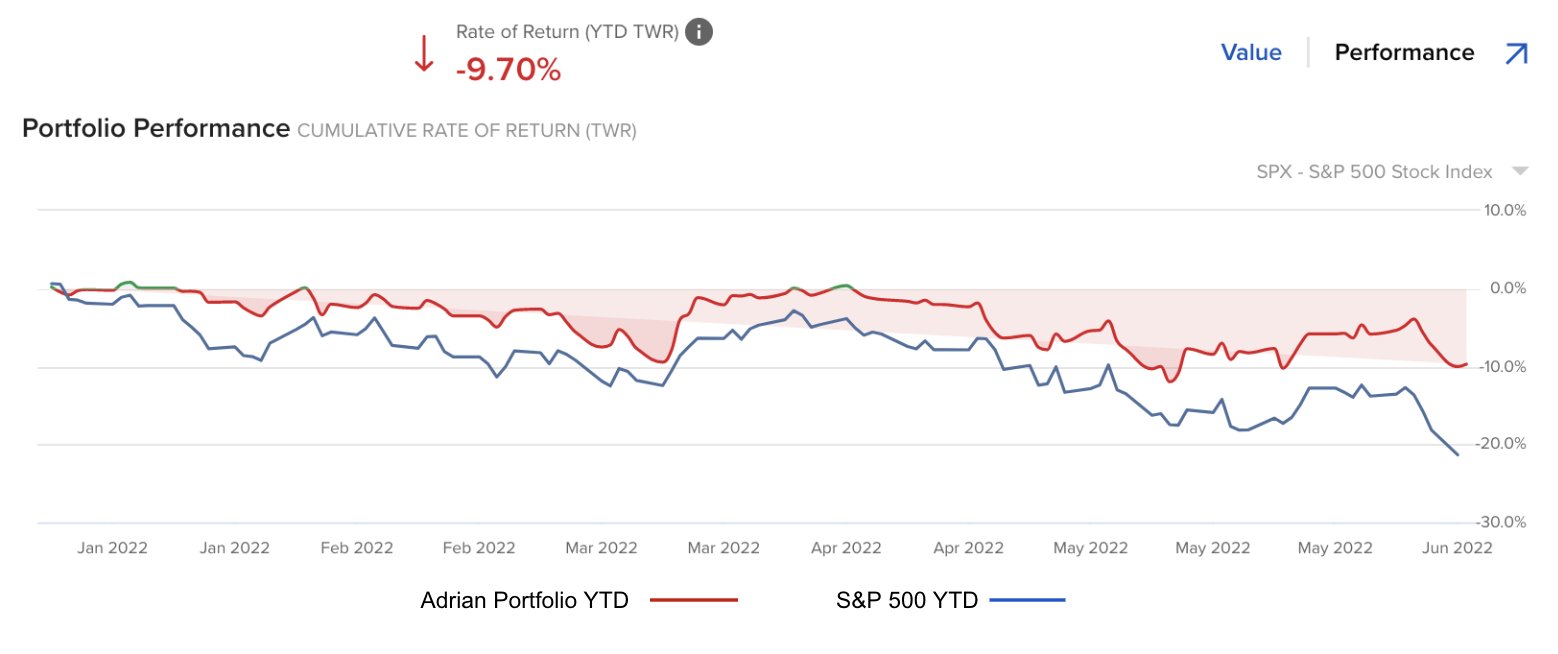

For me personally, my portfolio is down 9.7% YTD, where I’m ~65% long.

My top four holdings are Google, Microsoft, Apple and Amazon (none of which have performed well).

However, more important I avoided (portfolio damaging) exceptionally high multiple / little-to-no earnings (Cathie Wood) names; whilst also reducing my exposure going into Q1 of 2022.

Below is my YTD performance (red line) at June 14th vs that of the broader S&P 500 Index (down ~22%)

As I say, it’s been tough going so far this year.

If Warren Buffett has seen the value of his fund fall over 7% – you know it’s tough!

However, we must take the good (i.e. the past decade) with the bad.

My view is 20-30%+ corrections are ‘par for the course’. And they should be expected given the outsized (above average) returns of the past few years.

That was the time we made money (i.e. zero rates combing with excess money printing).

Put simply – our job is two-fold:

(a) limit how much we lose (on paper) in this unforgiving climate; and

(b) step-up and buy quality companies which are attractive from a long-term lens.

Let’s now switch gears to the Fed… is it 75 basis points tomorrow? Or will it be 100?

Fed Has No Option Here

I have made no secret about what the Fed needs to do.

My criticism was not how the Fed responded to the pandemic between March and September of 2020 (i.e. ensuring there was not a crisis of liquidity) – it was what they did the 18 months after the emergency had cleared.

The money spigots were left open for far too long.

With rates negative in real terms and M2 money supply growing in excess of 20% – there was little doubt there was going to be a price to pay.

Today we are paying that price…

CPI in the form of 8.6% YoY; and risks assets adjusting in the realm of 20-30%

And ultimately this results in a recession (which I expect in 2023)

That point of view is now generally accepted (as its rear-view mirror). But at the time – it was a less popular view.

Tomorrow the Fed is widely expected to raise rates by 75 basis points (something they have not done since Bill Clinton was President!)

And that’s what the market has fully priced in (or close to)…

For example, when I look at Fed Fund Futures for the end of the year – we are already at 375 basis points.

That means 75 basis points tomorrow; 75 the following meeting and perhaps 75 thereafter.

Forget 50, 50 and then maybe 50…

This is quite extraordinary given only a few weeks ago that 75 basis was completely off the table!

But as I said yesterday – the leaked the 75 bps rise via the Wall Street Journal (it’s what they do)

As an aside, did you see this tweet from Bill Ackman today – who manages the ~$10.5B Pershing Square Fund:

He is correct that ‘some’ of the credibility in the Fed would be restored with 75 basis points (as it shows they are reacting to the data).

And yes, 100bps and the next 2 meetings are needed.

But that’s not what we will get.

Powell will want to show he is nimble… but not reckless.

For what it’s worth – Goldman Sachs economists have pencilled in another 75 basis points for the July meeting.

With 75 quickly emerging as the consensus, “one might wonder whether the true surprise would actually be hiking 100,” JPMorgan Chase’s Michael Feroli said. That’s something he views as a “non-trivial risk.”

As I say, Fed Futures sees a July 75 bps rise at 80%.

However, 100 bps would be a surprise and my guess is it won’t be well received.

But 75 is locked in; and we’re almost there for July.

And what we’ve seen in bond and equity markets deserves special attention.

For example:

- US govt. bond yields climbed the most over two days since the early 1980s

- So far, this is the worst year in bond market history (in terms of losses)

- S&P 500 lost ~7% in 2 days – something we’ve not seen since the 2007-09 crisis.

As an aside, at one point Monday, every single stock in the index was lower— the broadest selloff since 2011

With respect to the incredible velocity with the US 10-year yield – I shared this yesterday:

And whilst I think markets have maybe priced in ~75% of the downside risk (it’s hard to guess) — there’s potentially more to go.

Putting it All Together…

For what it’s worth – on the basis we see 75 bps from the Fed tomorrow – I think the market behaves positively.

75 bps was fully priced in Monday – when the WSJ leaked the news (perhaps nudged by the Fed).

For example, fed fund futures now see 375 bps by year’s end.

And the ‘good’ news is markets are now pricing in more of the downside risk(s).

However, I maintain we are still yet to see Q2 earnings revisions.

That’s the next leg lower and your opportunity to position yourself for the long-term.

Again, anything in the realm of 3500 on the S&P 500 with a minimum 3-year view will prove to be a good risk/reward entry point.

For example, consider some back-of-the-envelope math:

- 12% CAGR (exc. 2% dividends) from 3500 over 3 years puts us at 4900 (vs this year’s high of 4817)

- Assuming $230 p/share at a conservative 8% growth – offers an EPS of ~$290 in 3 years.

- At a 17.5x forward multiple – we could see the S&P 500 at 5075 in 3 years (i.e., 13.3% CAGR plus dividends)

From mine, those numbers are conservative.

Irrespective, the 3-year risk / reward at ~3500 on the S&P 500 looks attractive

And I think that view looks even better for large cap tech… but we will see.