- Stocks starting to recalibrate ‘higher for longer’

- Why 18.3x forward earnings is not a good deal

- Potential for more downside with the S&P 500

- Analysts expect the S&P 500 to earn $235 per share in 2024

- Analysts also expect earnings to grow 12% year on year

- With the S&P 500 at 4320 – that’s a forward PE of 18.3x

So here’s today’s question:

Do you think 18.3x forward earnings is a good risk/reward bet?

For me, the answer is no.

And I say this because investors have a very compelling alternative.

We don’t need to look any further than bond yields.

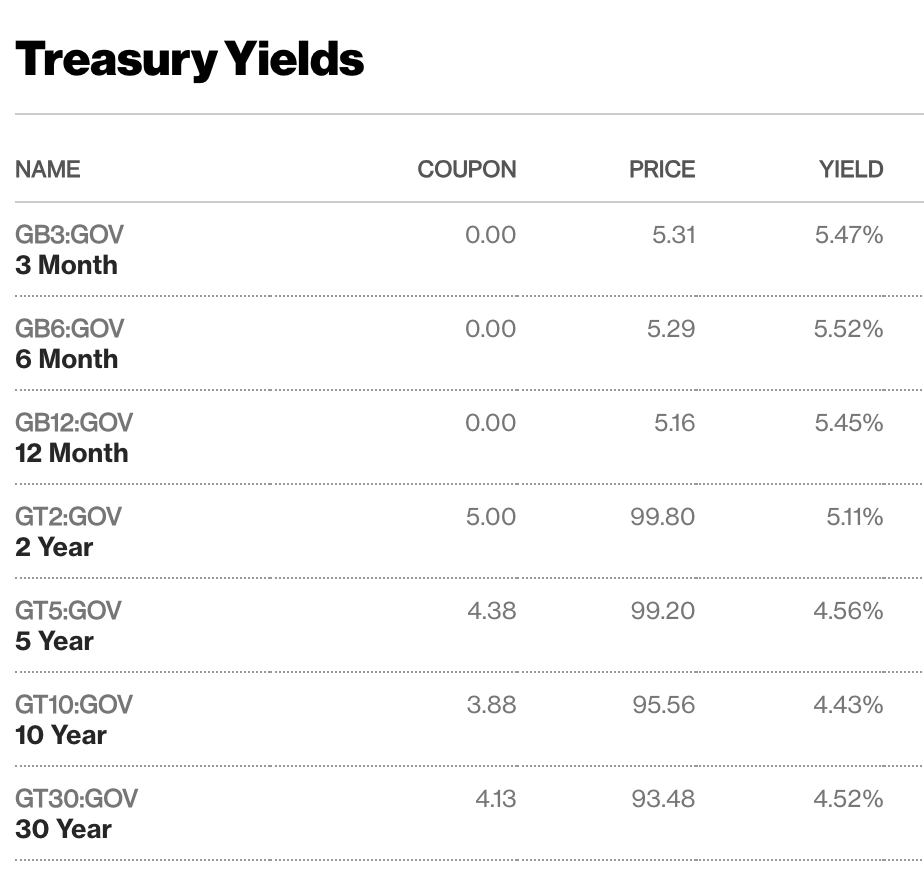

For example, the 12-month US treasury yield offers investors 5.45%

That’s a risk-free 12 month return (if held to maturity)

Sept 22 2023

To get the same 5.45% return from the Index – it would need to trade at 4555

4555 / $235 = 19.4x forward earnings.

Now if you take the inverse of 18.3x – we get a stock earning’s yield of 5.46%

In other words, it’s basically equal to the risk-free 12 month treasury.

Typically when you’re investing in stocks – it involves a high degree of risk.

Therefore, you would expect a premium in compensation for taking that risk.

For example, that premium should be at least in the realm of 100 to 200 bps (some might suggest more)

For example, let’s say the forward PE for the S&P 500 was 16x

The earnings yield would be 6.25% (i.e. 1/16 = 6.25%)

In this case, there is some compensation for taking the risk.

However, $235 per share x 16 = 3760

That’s 13% below this week’s close.

Question is, are we going to get there?

And that’s where the battle lines are being drawn.

Bulls vs Bears

Markets clearly didn’t like what they heard from the Fed this week.

Chair Powell sang from the same hymn sheet he’s been singing from all year… there was nothing new.

He simply reminded investors the Fed’s work is not done.

Market’s had not priced that in.

For good measure, Powell said not to expect 100 bps of cuts next year… suggesting maybe only two would be appropriate.

Market’s had also not priced that in.

Funny isn’t it…

All year the market has been stubbornly fighting the script of higher for longer.

“The Fed will be cutting by the end of the year” was the Wall St. chorus.

Wrong.

“The Fed will be cutting at least four to five times next year” they said.

Not according to Powell.

All of this has the bulls asking questions:

- Will interest rates now be too high for too long?

- Could $90+ oil spoil the rate cut party? and

- Will corporate earnings come under pressure given a weaker consumer?

These three questions are not meant to be exhaustive – however they play into stock valuations opposite rising yields.

And if earnings are to grow 12% next year (as the market expects) – what will the catalyst be?

You tell me and we will both know.

What is going to drive the surge in corporate profits given the economic backdrop?

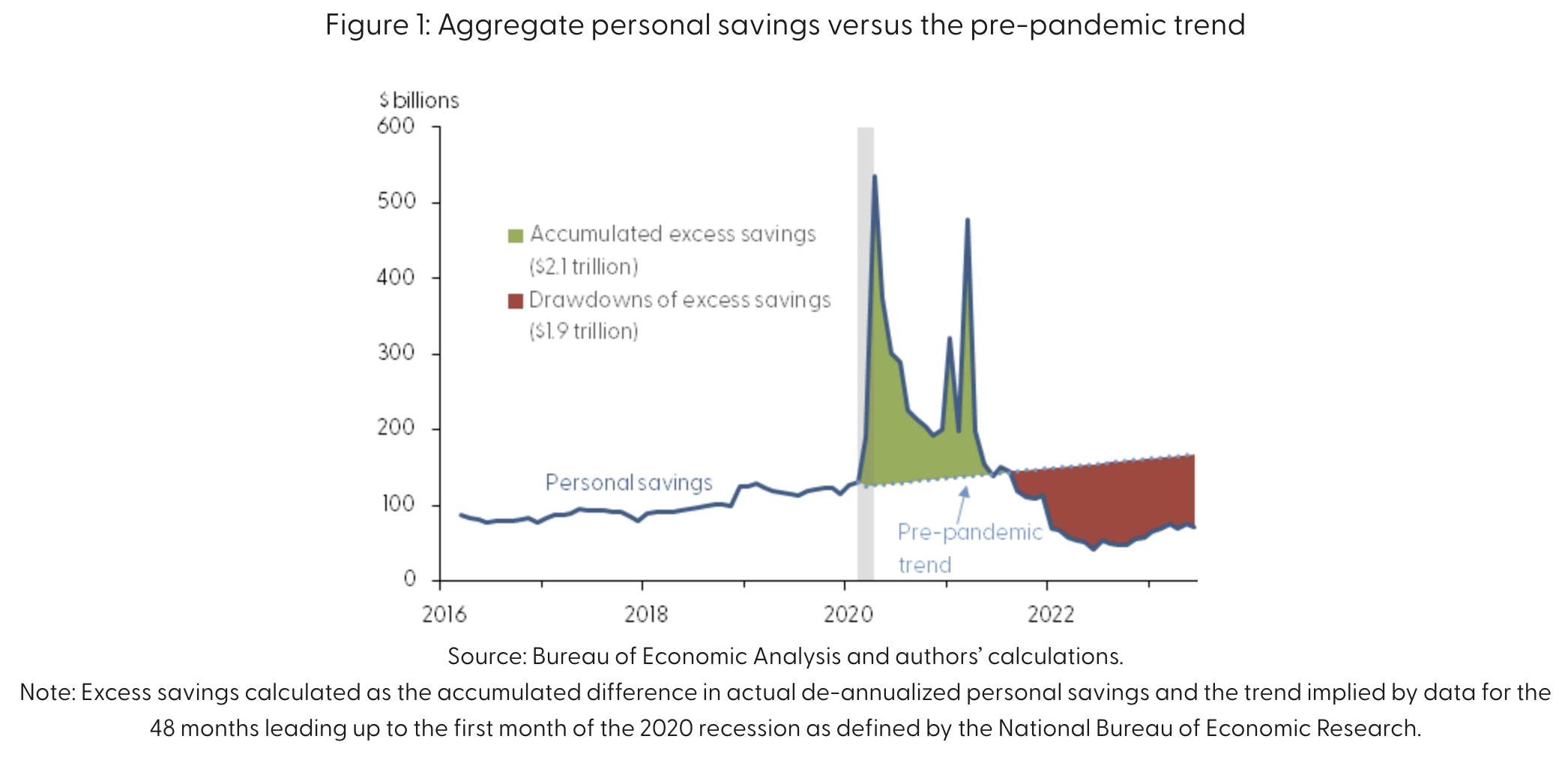

For example, generally earnings growth will come from a cashed up and confident consumer.

Is that the outlook?

According to the latest survey – consumers are lacking confidence and excess savings are almost done…

Admittedly things can change (and often do) – but right now the catalyst isn’t clear.

The Fed is likely to continue with “higher for longer” into a weakening economic backdrop.

And from mine, that only increases the chances of (what I think) is a likely recession next year.

All About Yields

Whilst most people don’t wake up and check the yield on the US 10-year – this is what matters most.

If these yields keep rising (and I expect they will) – this will put a ceiling on how far equities can go.

Again, this comes back to the (historically low) equity risk premium outlined above.

But let’s take a quick look at the US 10-year yield – which topped 4.50% this week.

From mine, this is what put the “fear of god” into equities:

Sept 22 2023

Yields ripped higher after Powell reiterated their hawkish script.

However, I also think equities are still trying to calibrate what this means.

Sure they sold off a little this week – but over the coming weeks it could be more.

And that’s what I think will be the (necessary) adjustment to come.

More Downside Ahead?

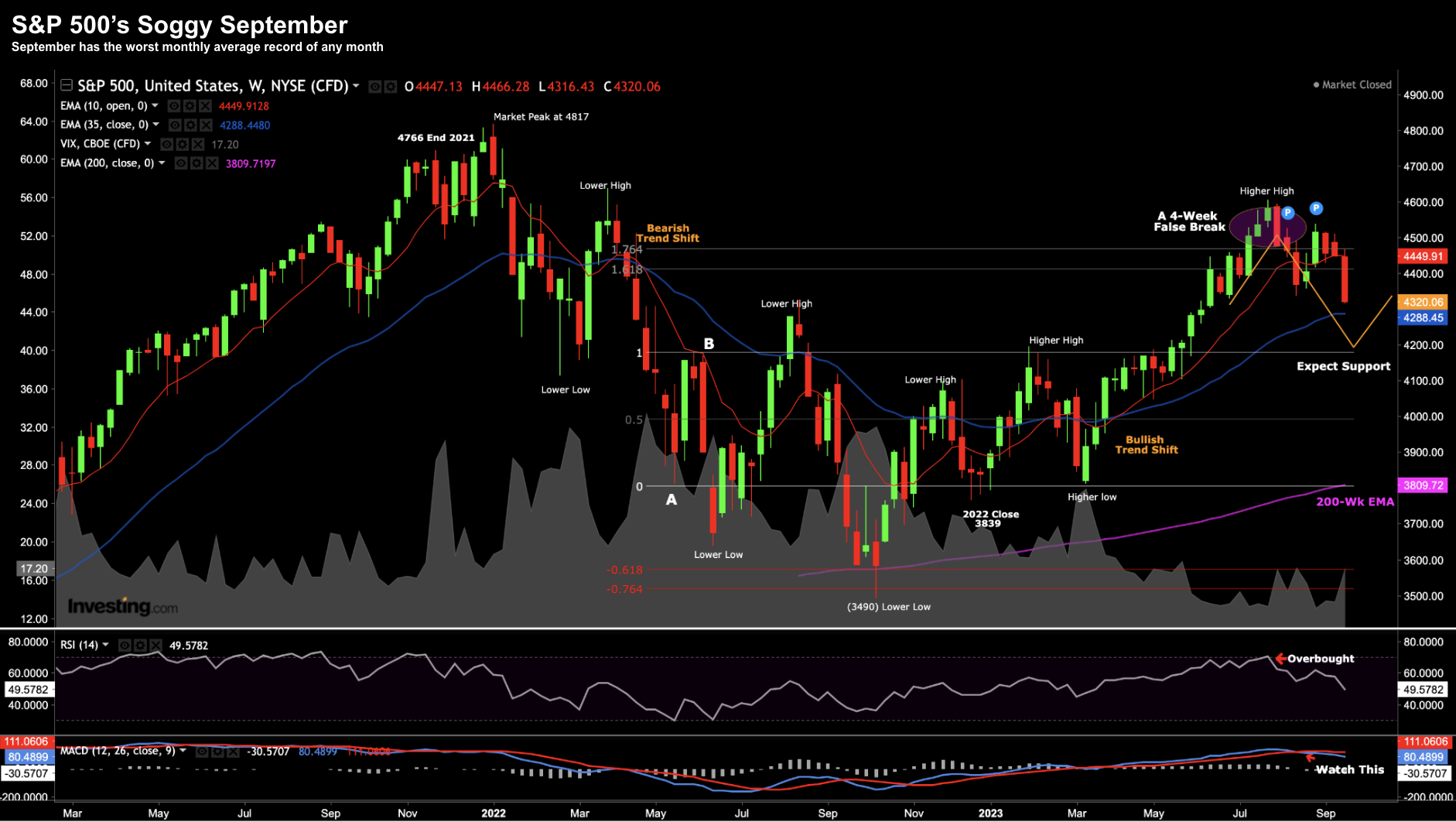

So far, September is living up to its reputation as the worst (average) calendar month for stock returns.

We have seen three consecutive negative weeks… with the S&P 500 trading at the same level as we saw in late June.

In fact, this week was the worst since March.

But again, it wasn’t that bad with markets not that far below their recent 4600 highs.

Let’s start with the weekly chart:

Sept 22 2023

For me, things are “trading per the script” (per the orange lines I sketched in)

Regular readers will know I’ve been patiently waiting for a move back to the 35-week EMA zone (blue line)

We are now within 1% of that moving average.

And whilst buying here is certainly better than 4600 – it’s still not attractive.

Again, you’re being asked to pay 18.3x forward earnings vs risk-free 12 month yields near 5.50%

What’s more, 18.3x assumes no recession in 2024.

My best guess is the market could easily revisit the previous resistance zone of 4200.

Previous resistance often becomes new support.

To be clear, that is not say the market will find strong support around 4200.

It may not.

For example, if the 10-year yield continues to surge closer to 5.0% (or more) – the market could tank.

However, if we were lucky enough to see the Index trade in the zone of 3800 to 4000 – I would be happy buying quality stocks with a 3-year lens.

Putting it All Together

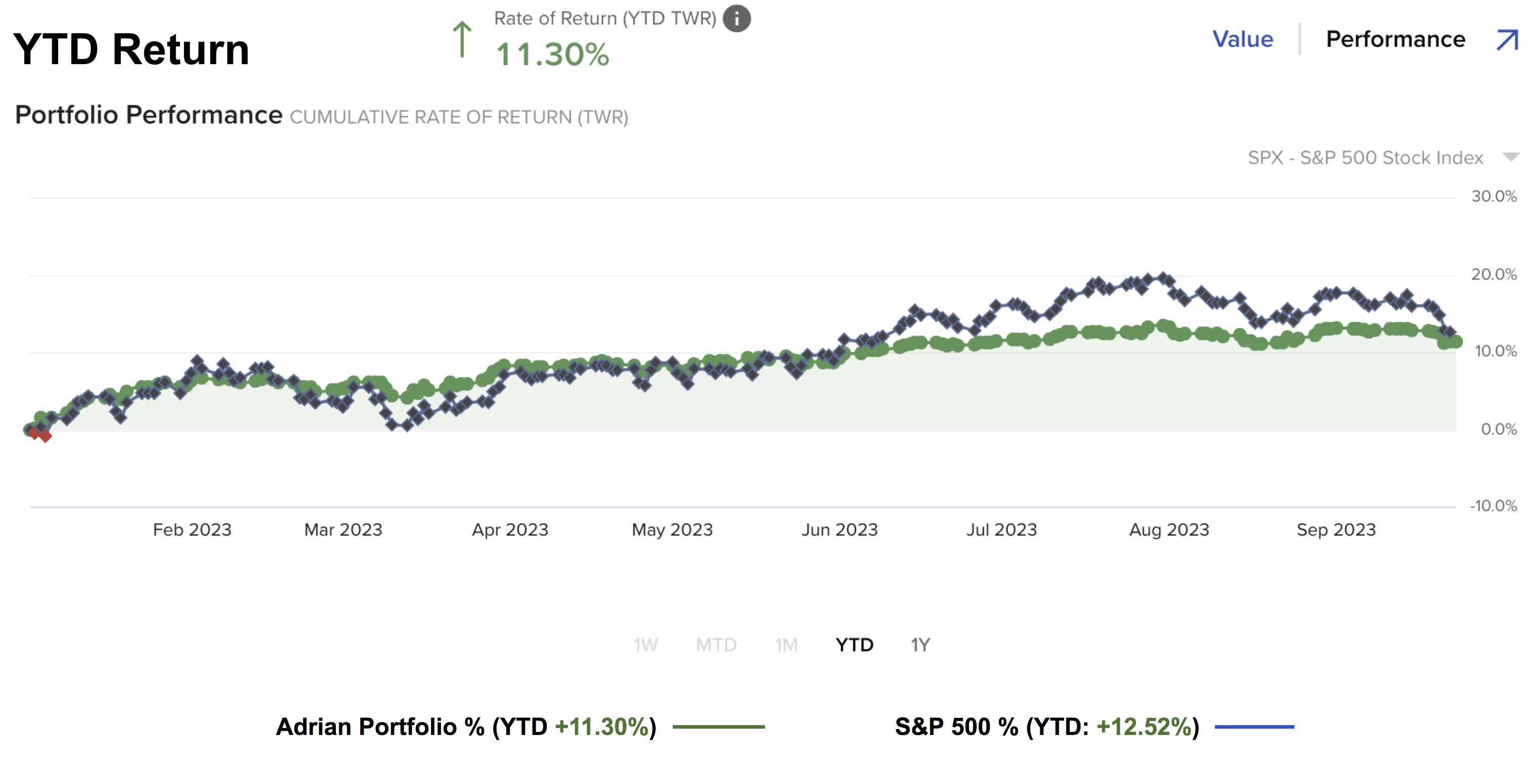

The S&P 500 is now only up 12.5% for the year.

In August, it was up ~20% (as the blue line shows below).

My personal YTD return is 11.3% – which is only 1.2% below that of the Index.

Now a few months ago – I trailed the S&P 500 by ~6% – as I refused to pay the excessive multiples.

In other words, I was not willing to take the risk. That proved to be a good move.

Perhaps what I’m most happy with is achieving close to Index performance with only 65% of my capital.

In other words, I didn’t take much risk.

However, my goal is always to put more cash to work.

For me, a 5-6% annual return is unacceptable.

If that was my goal – I would put the whole lot in short-term bonds and hold to maturity.

There’s your 5-6%.

To get outsized returns you need to take calculated risk.

For example, I’m not willing to put cash to work if the asking price is too high.

You will often hear me say it’s not just what we buy – it’s more so how much we pay.

Put another way, you can buy the world’s best businesses (“Apple, Google, Microsoft and Amazon” etc) – and still lose if you pay too much.

Don’t over pay.

My guess is we will get a better opportunity to put cash to work over the next few weeks.

The market will begin to recalibrate Powell’s commitment to ‘higher for longer’.

Up until recently – they refused to believe the Fed Chair.

Maybe not now.