- Howard Marks’ Latest Memo Worth Reading

- Why rates are not going back to 2.0%

- Market clinging to the hope of 2023 rate cuts… that’s dangerous

Over the past month – the market has traded on tenterhooks in anticipation of the November CPI report.

The bulls were praying it would come in lower than 7.5%… the bears hoping for something higher.

Turns out it was 7.1% (thanks to energy prices falling).

Yes, the monthly inflation print is important.

Higher levels of inflation suggest the Fed stays higher for longer.

But are investors asking the right questions?

We’ve seen peak inflation.

That was June at around 9.1%.

And it’s trending lower. Expect a 6-handle next month.

But we should start thinking about the broader shift which is taking place.

The investing “rules” have fundamentally changed… and it’s a tectonic move.

For example, what impact will this have on economic growth? Company earnings? Consumer spend? Debt levels? Valuations?

It’s a long list.

That’s what you should be thinking about… not whether the monthly inflation print is going to be “7.3% or 7.1%”.

Higher inflation is now rear-view mirror.

Market Giddy at 7.1% CPI

When news of today’s November CPI hit the tape – the market initially surged by around 3%.

At one point, the tech heavy Nasdaq was up 4%.

That partially makes sense… especially if you think the Fed are about to cut rates next year (more on that shortly)

But the rally lasted about “5 minutes”… CPI still has 7-handle… largely a function of (temporary) lower energy prices (see this post).

Here’s Yahoo!Finance:

The Consumer Price Index (CPI) for November showed a 7.1% increase in prices over last year and a 0.1% increase over the prior month, the Bureau of Labor Statistics said Tuesday.

Economists had expected prices to rise at a 7.3% clip over last year and 0.3% month-over-month, per Bloomberg data.

On a “core” basis, which strips out the volatile food and energy components of the report, prices climbed 6.0% year-over-year and 0.2% over the prior month. Consensus estimates called for a 6.1% annual increase and 0.3% monthly rise in the core CPI reading”

From mine, the bulls got excited when they say that Core CPI only rose 0.2% over the prior month.

What’s more, my guess is the “algos” kicked into gear as soon as the number broke.

Programs would have been written along the lines of “if inflation < 7.3% -> buy xyz and/or cover short positions on abc etc”

What today’s print means is the Fed will likely only raise rates by 50 bps tomorrow.

However, that was already priced in.

What’s more, the market has more confidence that the Fed will only rise 25 bps in February.

Put together, that will put the Fed funds rate at ~4.50%.

All going well… that is getting closer to the end (perhaps within 50 bps). As I said recently, the rate hike cycle is maturing.

But the precise timing of these things is impossible to forecast and it’s pointless trying.

However, there is one thing I am certain of:

Rates are going higher for longer.

What’s more, they are not going back to a range of 0% to 2.0% anytime over the next few years (barring some deep recession)

As I said recently, the Fed are not going to repeat past mistakes.

Not this time.

And that’s the shift I want to talk to tonight (and what you should be focused on).

A Tectonic Shift

- Inflation is falling fast where a recession is likely next year;

- Fed will pause hiking rates soon; and look to cut rates H2 2023;

- That’s positive for earnings, economic growth and stock valuations

Or something like that.

From mine, that script is largely helping to support stock prices.

But it’s lazy thinking.

In short, I don’t see rates going back to being ultra-accommodative for a long time (e.g. at least 2 years — excluding a bad recession).

As a result, you need to shift how you think about investing in stocks and bonds.

What worked for you the past decade – is not going to work for you the next decade.

And this is why…

The 40-Year Shift in One Chart

All of this comes down to how risk is priced.

For example, look no further than the all-important US 10-year treasury note.

This 40-year chart tells a telling story:

Dec 13 2022

My thesis (and I’m happy to be wrong) is that the multi-decade trend of lower and lower bond yields (in turn lower interest rates) is over.

And if correct, that will have a massive bearing on your expected returns (and also what to invest in)

Put another way, there are now alternatives to stocks.

On the flip-side, if you’ve been fortunate enough to have been vested from the early 1980s…. you were lucky enough to enjoy some of the best financial conditions we’ve seen at any time in our history.

That’s luck (assuming you took advantage).

Thanks to a combination of exceptionally lower and lower rates (held at zero for almost a decade) — combined with trillions in free money — this resulted in the S&P returning an average of 10.3% per year from 1982.

It does not get any better than that.

But that period is now finished.

The “free money” is over… where investors should not simply expect “10.3% in perpetuity”.

You now need to sharpen your blade.

Where Tailwinds Become Headwinds

According to Howard Marks’ latest investment memo – whilst there have been many reasons for the impressive gains of the past four decades – he feels ultra-low rates have played the greatest role.

Yes, we can argue how cheaper capital spurred economic growth; allowed technology to develop; and the “benefits” of globalization (and cheap labor).

But ultimately, it was low rates in combination and money printing which amplified investor returns.

Again, go back to the chart for the 10-year treasury yield.

During the 1980s – you were borrowing money anywhere between 7% (at the low) and 20% (at the high)

Imagine taking a home loan at 20% today?

My parents did!

My first home loan was ~8.5% in the mid 90s (and I thought that was a bargain!)

But if mortgage rates hit “10%” today – you would probably break the bank.

Now from 2008 through to 2022, that rate was barely above 3%

What was the result?

According to Marks:

- Consumers resorted to buying in credit;

- Lower cost of of finance for borrowers (at the expense of lenders and savers);

- Companies borrowed to invest in facilities, equipment, and inventory (lower their cost of capital);

- This increased the “fair value” of assets;

- Valuations parameters for stocks went higher (as future cash flows were discounted at a lower rate);

- With asset prices higher (stocks and houses) – people felt wealthier – more willing to spend; and finally

- When our “asset base” is higher – we take on more leverage

Property. Stocks. Bonds. You name it.

And whilst we saw that occur over the past 40 years… that cycle went exponential during the pandemic.

The danger (of course) is leverage.

When rates stay ultra-low – it works well. But when rates move the other way – it’s lethal.

Marks’ described it this way:

- Investors analyze a company, concludes that he/she can make 10% a year (eg average S&P 500 index return) and decides to buy it.

- Then they ask what it would cost to borrow 75% of the money.

- They are told the cost is 8%, and it’s “full speed ahead”

- For example, earning 10% on three-quarters of the capital that’s borrowed at 8% would lever up the return on the other one-quarter (his equity) to 16%.

- Banks compete to make the loan, and the result is an interest rate of 7% instead of 8%, making the investment even more profitable (a 19% levered return).

- The interest cost on his floating-rate debt declines over time, and when his fixed-rate debt matures, he finds he can roll it over at 5%.

- Now the deal is a “home run” — a 25% levered return all else being equal.

It’s little wonder leveraged funds enjoyed outstanding returns the past decade – with a declining (near zero) rate environment.

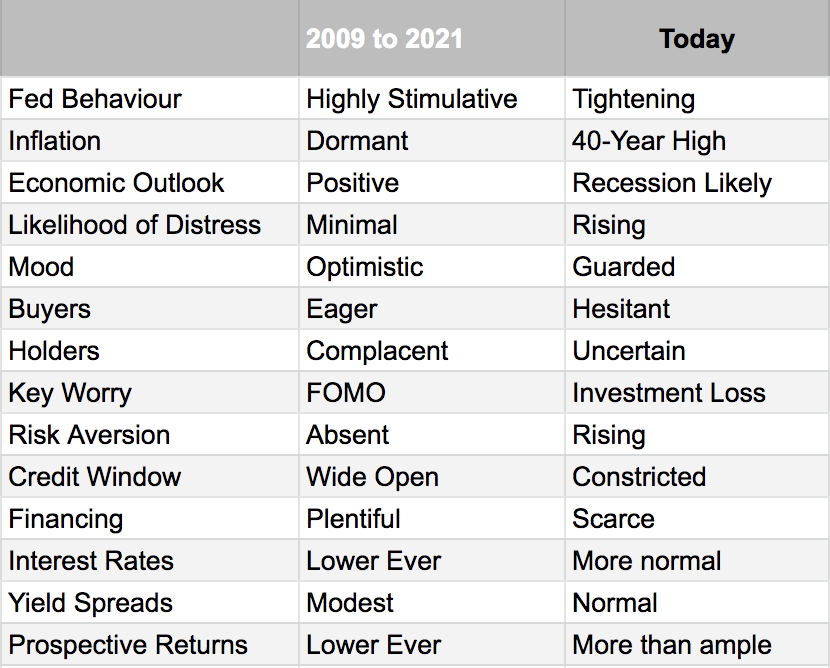

Here’s how Marks described the investment climate of the past decade:

Marks adds:

…”these were golden times for corporations and asset owners thanks to good economic growth, cheap and easily accessible capital, and freedom from distress. This was an asset owner’s market and a borrower’s market.

With the risk-free rate at zero, fear of loss absent, and people eager to make risky investments, it was a frustrating period for lenders and bargain hunters”

But that was then. And this now.

Here he adds a third column – reflecting what we see today:

Referring to the table above, here’s how Marks describes the impact to risk assets:

“How has this change manifested itself in investment options? Here’s one example: In the low-return world of just one year ago, high yield bonds offered yields of 4-5%.

A lot of issuance was at yields in the 3’s, and at least one new bond came to the market with a “handle” of 2.

The usefulness of these bonds for institutions needing returns of 6% or 7% was quite limited. Today these securities yield roughly 8% meaning even after allowing for some defaults, they’re likely to deliver equity-like returns, sourced from contractual cash flows on public securities.

Credit instruments of all kinds are potentially poised to deliver performance that can help investors accomplish their goals”

Not now.

Shift Your Lens

The game has changed.

And this is something I’ve been saying all year.

What worked the past decade isn’t going to work with higher interest rates.

From mine, far too many investors are thinking that inflation will plunge; the Fed will cut rates; and away we go.

In other words, what we saw between 2009 and 2021 will simply repeat.

That’s highly presumptuous.

And I certainly would not be investing with that mindset.

Yes inflation will likely continue to fall (on the basis energy prices remain low) – however I also see the rate stalling around 5.0% (thanks to higher wages and rents)

And yes – the Fed will likely pause on rate hikes around 4.75% to 5.00% (at a guess)

But as I outlined in this post – expect them to remain well above 4.0% for an extended period.

According to Marks (famous for not giving macro outlooks) – he believes the base interest rate over the next several years is more likely to average 2-4% (i.e., not far from where it is now) rather than 0-2%.

He adds:

“… the bottom line is that highly stimulative rates are likely not in the cards for the next several years, barring a serious recession from which we need rescuing (and that would have ramifications of its own)”

As an aside, I had a chuckle when he said that “people who came into the business world after 2008 – or veteran investors with short memories – might think of today’s interest rates as “elevated”. But they’re not in the longer sweep of history, meaning there’s no obvious reason why they should be lower”

For example, there are perhaps some investors out there (~40 years of age) who may have never traded through a recession and/or where rates were above 4.0%

This is not an environment they are familiar with… they have no experience.

And in that context… yes… rates may seem “elevated”.

They are not. Not yet.

Fed Speak Tomorrow… Expect Hawks

Tomorrow the Fed Reserve are likely to raise rates another 50 bps.

This will take the effective Fed Funds rate to 425 bps.

However, with CPI at 710 bps – it implies a negative real rate of -285 bps

My view is the Fed will remain hawkish and will continue to raise rates (albeit at a slower pace) until real rates are positive.

That would result in the short-term rate exceeding 5.0% in the months ahead (pending inflation)

And from there, they are likely to hold rates at this level should inflation continue to fall.

That said, I think the conversion should move away from all things inflation and the Fed.

What we should be focusing on is earnings and economic growth (or the lack of!)

Q4 is quickly coming to an end… and in ~6 weeks time we will start to hear how corporate America navigated the quarter.

What’s more, we will get guidance (in some cases).

My expectation is earnings are likely to contract next year.

However, that is not consistent with the market’s expectation for 4% earnings growth.

If we are to see contraction, then the S&P 500 looks expensive around 4100 on a forward earnings basis.

Putting it All Together

If you get a chance to read Marks’ latest memo – it’s worth the 10 minute read.

He does a great job of explaining the crack-up boom and the dangers of artificially low rates for extended periods.

I call it mis-pricing of risk – giving false price signals to investors – leading to a large misallocations of capital.

Result: boom and bust.

Marks is saying something similar and concludes with (bold emphasis my own):

We’ve gone from the low-return world of 2009-21 to a full-return world, and it may become more so in the near term. Investors can now potentially get solid returns from credit instruments, meaning they no longer have to rely as heavily on riskier investments to achieve their overall return targets.

Lenders and bargain hunters face much better prospects in this changed environment than they did in 2009-21.

And importantly, if you grant that the environment is and may continue to be very different from what it was over the last 13 years – and most of the last 40 years – it should follow that the investment strategies that worked best over those periods may not be the ones that outperform in the years ahead.

Marks echoes my final remarks from this post last week: “Sorting the Wheat from the Chaff”

Here I finished with the words “…what worked well the last decade (with zero rates) – won’t work as well the next decade”