- Always think bigger picture

- Why it never (ever) pays to fight the Fed

- Buffett puts $4.2B to work with HPQ

Warren Buffett has put more of his ~$140B cash pile to work.

Today we learned of a $4.2B investment in hardware provider HP.

Interesting move…

My immediate reaction was HP feels more like another IBM… not an Apple.

Yes, they are a solid business that:

- produce consistent cash flows;

- buy back their shares;

- pay a large dividend; and

- trade at a forward PE of just 8x

It’s a very shareholder friendly company – which fits Buffett’s investment profile.

But what’s their moat?

What do HP produce that others can’t?

Their products are ok… but are they ‘Apple like’ quality?

What’s more, what’s the so-called lock-in with HP products and services?

Ink cartridges!

I ask because it’s not hard to switch from say a HP printer or PC to say “Dell, Acer, Lenovo, Samsung or IBM”… and countless others.

But try switching out easily from the Apple ecosystem (e.g. iTunes)?

That’s hard.

Buffett made an astute bet with Apple and why it’s now almost half of his entire portfolio.

But I think HP is more likely to go the same way as IBM.

A $10+ Trillion Question

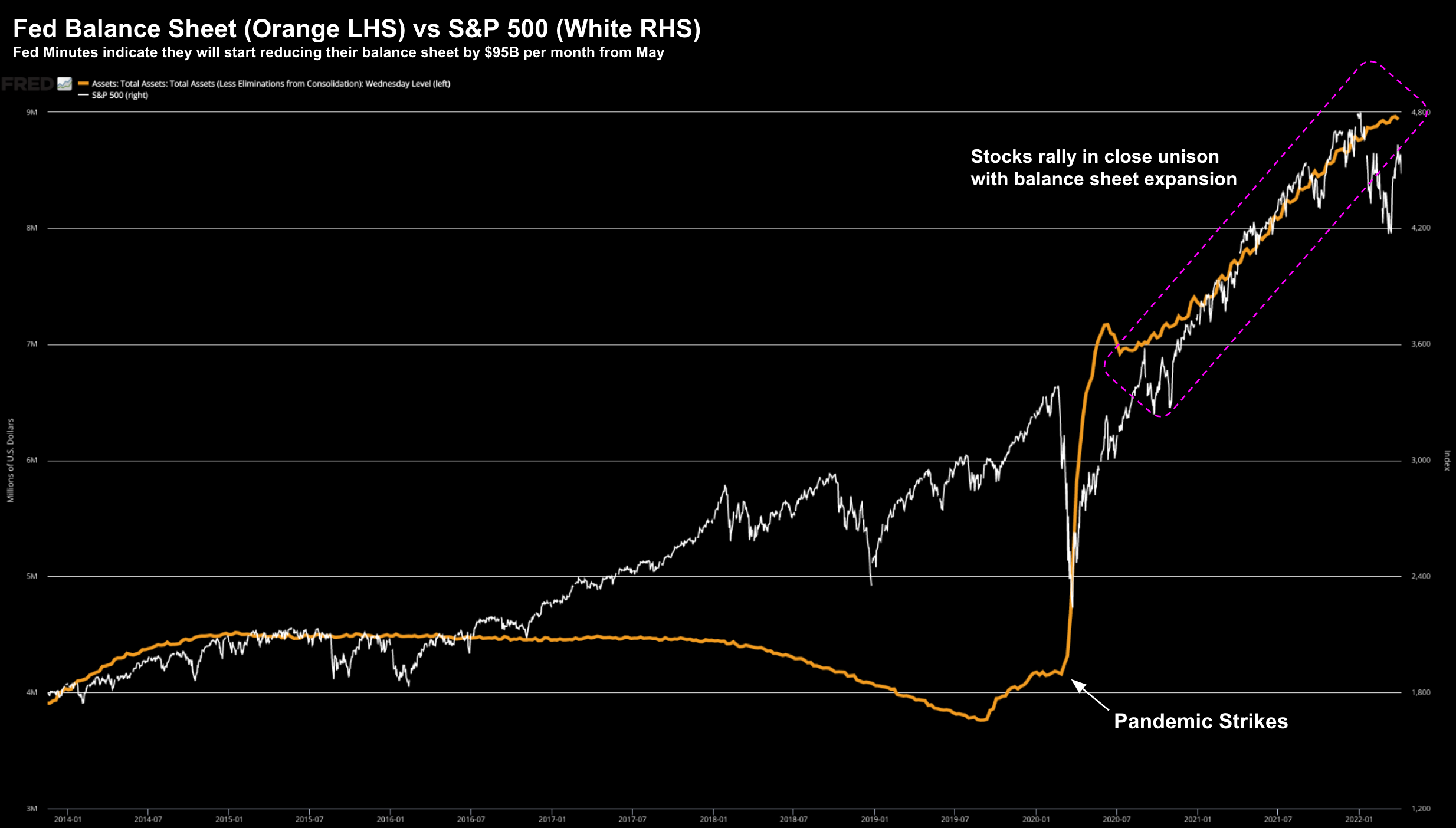

Yesterday I said the biggest thing we’ve learned this week (which investors should pay attention to) is what Vice Chair Lael Brainard had to say on aggressive monetary policy (specifically QT).

As context, Brainard has widely been considered one of the more dovish Fed voices.

She is largely in favour of ultra-low rates and money printing…. and was Senator Warren’s pick for Powell’s role.

However, now Brainard has conceded we have a problem.

Specifically, she said inflation is just as bad as not having a job!

Not sure about that… some income is better than no income?

But granted – it certainly makes the lives of average income earners much harder.

It’s yet another tax…

Brainard joins the growing chorus of officials who collectively agree on a more aggressive (inflation fighting) stance.

But as I asked yesterday – how much have stocks priced in?

Not enough in my view.

Let me offer some numbers:

From a monetary perspective – the Fed added $4.8 Trillion since the start of the pandemic (more than doubling their balance sheet)

In addition, from a fiscal perspective, the government spent ~$5.5 Trillion (mostly on welfare handouts).

Put together we have over $10 Trillion in combined stimulus… thrown at an economy which is not much more than $23 Trillion in size.

And where did the money go?

You got it.. risk assets.

Stocks and houses exploded to the upside.

Therefore the question you should be asking yourself is whether the same thing will apply on the way back down?

The answer is yes – to some extent (e.g., 20% or so)

Therefore, I personally feel the potential upside here does not easily outweigh the downside risks.

Again, I will use this chart to demonstrate my thinking.

April 7 2022

This illustrates the kind of downside we might see over the next 12 months or so.

Again, the monthly MACD warns of downside.

And if we were to see a zone around 3700 to 3800 on the S&P 500 – where earnings are expected to be between $220 and $240 – that’s a forward PE between 16 and 17x.

Not unreasonable.

At that point, I would be a big long-term buyer.

But It’s Not ‘Only’ the $10T Drop

Whilst US fiscal and monetary declines will have a significant impact on asset prices – there are other factors at play which should not be ignored.

Consider Europe…

Credit spreads are blowing out to 2015 levels – which tells me liquidity is becoming a concern.

From mine, Europe is at a much greater risk of imminent recession and this will impact global markets (as Janet Yellen warned this week).

Note also that Jamie Dimon called this out as one the three top risks for 2022.

And sadly, I don’t think Putin’s invasion of Ukraine will end soon. For example, experts are saying this could take months or years… leading to a long, dark chapter in Europe’s history.

From there, we also should be mindful of how this is impacting the EUR and stronger US Dollar Index.

April 7 2022

Along with much higher rates and oil prices — I called a stronger DXY as one of the Top 5 charts to watch as we started the year.

As the weekly chart shows, the US dollar index remains in a strong bullish trend.

Therefore, what (potentially negative) impact will a strong dollar have on US company earnings?

Look for this to emerge as a theme when we hear companies report on Q1 in the coming weeks.

Note – the EUR is the largest currency in the dollar index basket – making up 57.6%. The weights of the rest of the currencies in the index are JPY (13.6%), GBP (11.9%), CAD (9.1%), SEK (4.2%), and CHF (3.6%)

Outside Europe we have the Chinese economy slowing – not to mention their economy in partial COVID lockdown.

Which raises another question – what impact will this have on things like supply chains, manufacturing and overally Chinese growth?

Again, what’s priced in?

When you string all these things together – with the S&P 500 a mere ~6.25% off its all-time high – do you think the potential downside has been priced in?

The tape suggests this isn’t the case.

Putting it All Together

Over two years markets were injected with ~$10 Trillion in stimulus – monetary and fiscal.

That is now in reverse.

I am reminded of the legendary Marty Zweig who coined the phrase ‘don’t fight the Fed’

That should always be your focus.

For me, this chart (which I have shared often the past few years) – highlights Zweig’s point:

This will be one of the sharpest pivots in monetary history.

For example, we could see somewhere between $3 Trillion and $4 Trillion removed from their balance sheet.

What will that do?

Yes, stocks could easily rally 5-10% in the near-term. I am not ruling that out.

But a 20% type correction is certainly plausible given the above.

If nothing else, expect a bumpy ride as this ‘orange line’ turns south.