- Valuations are best made opposite bond yields and Fed liquidity

- Why there’s a case for approx 16% downside for tech

- Brainard excites the doves – but temper your enthusiasm

And it’s not surprising…

In the very short-term (9-day RSI) it was oversold.

Therefore, a small bounce of 2% was imminent. And if I were to guess – there’s probably a bit more left in it.

But more on that shortly when I look at the chart for the QQQs.

The harder question is not whether tech was likely to bounce in the near-term – it’s whether any rally can be sustained?

That’s more important.

I will attempt to explain why fundamentally and technically there could be downward pressure.

And whilst I am long-term bullish – I believe there are lower prices ahead.

All About Liquidity and Bond Yields

(a) interest rates are set to rise meaningfully (e.g. up to 4.0% nominal); and

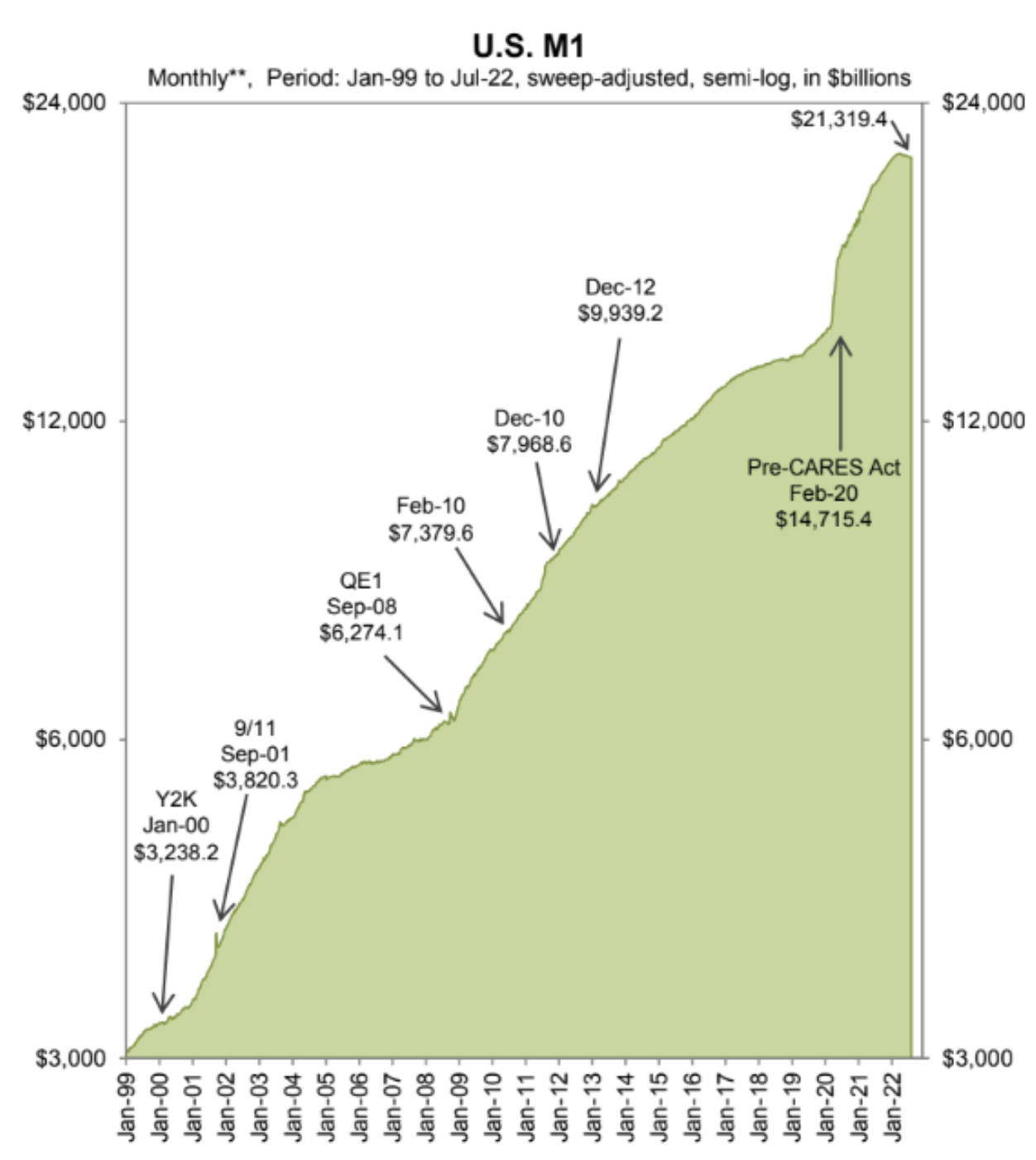

(b) liquidity is being withdrawn (e.g., QT are $95B per month)

Put together it’s a ‘one-two punch’.

Based on that – it means longer-duration assets (like tech) will be discounted.

And they have (to some degree).

For those less familiar, a much higher denominator (interest rates) will mean cash flows will be less.

And at the end of the day, stocks are essentially valued on their ability to generate cash.

With that, let’s start with the most important denominator for valuations – the US 10-year yield.

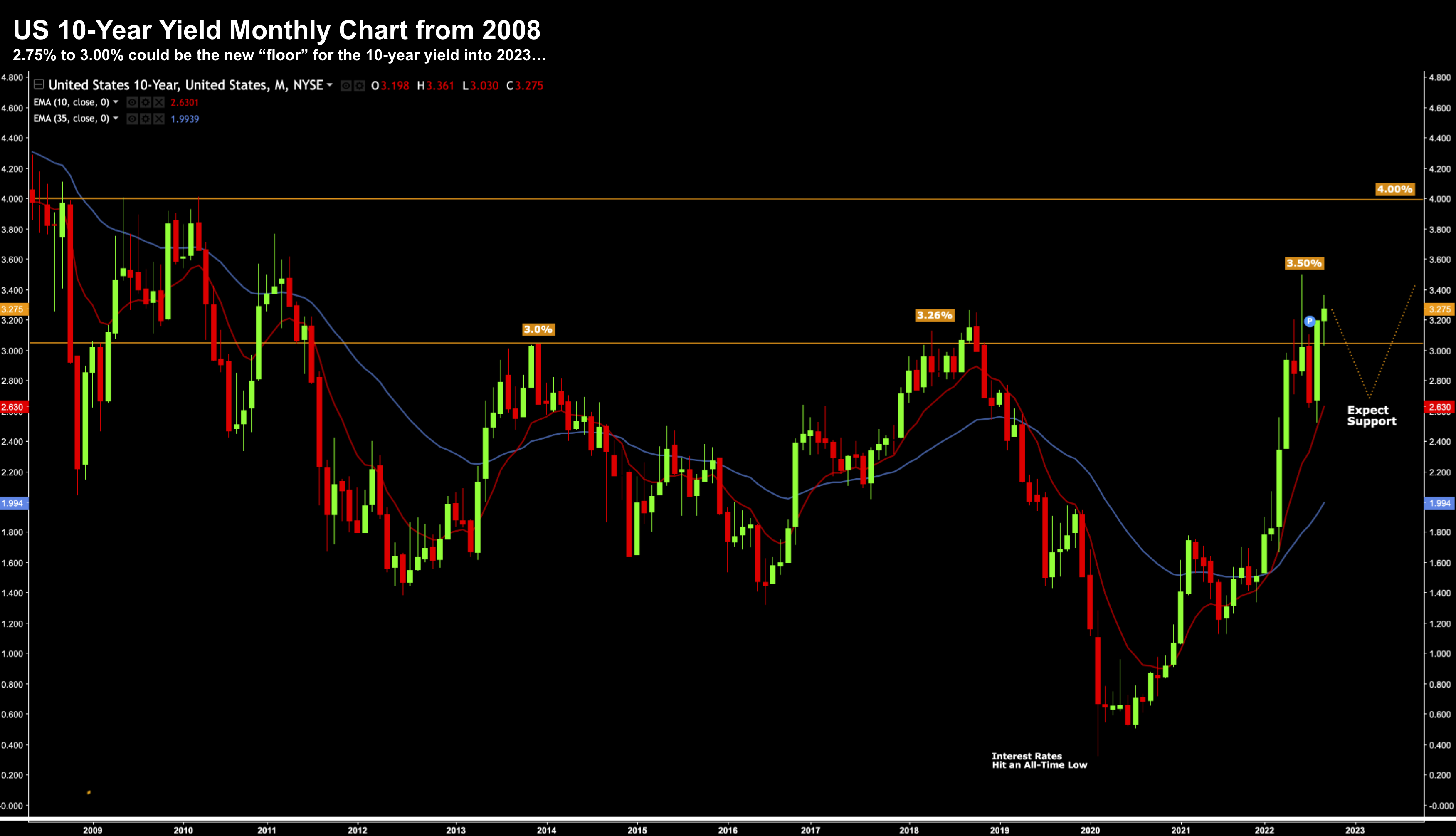

Post Jay Powell’s stern warning at Jackson Hole – US bond yields have soared. Today the US 10-year traded ~3.27% – 17 bps below that of the 2-year yield (giving rise to an “inverted” curve)

Below is the monthly chart from 2008:

Rarely (if ever) have we heard a Fed Chair use words like “expect pain ahead” when describing restrictive monetary policy.

As I explained recently – it’s possible we these yields retreat to ~2.75% (ish) on any news of softer inflation and/or higher unemployment.

For example, the market fully expects CPI to trade closer to a 6-handle by year’s end.

And similarly, it also expects to see the rate of unemployment start to pick up towards the end of the year (as job layoffs start to mount)

Whilst this is bad news for the consumer – the “silver lining” is it could mean the Fed can potentially tap the breaks on its pace of rate hikes.

We will see.

By way of example, here’s Fed Vice Chair Lael Brainard today:

Federal Reserve Vice Chair Lael Brainard vowed Wednesday to press the fight against inflation that she said is hurting lower-income Americans the most.

That will mean more interest rate increases and keeping rates higher for longer, she said in remarks prepared for a speech in New York.

Brainard cushioned the comments with an acknowledgement that policymakers will be data dependent and conscious of overdoing tightening

The market rallied (and bond yields fell) on Brainard’s last point… saying the Fed will be “conscious of overdoing it”

But back to the all-important bond yields.

As part of this post (‘The Case for Retesting the June Lows‘) – I argued why I think the 10-year could find a floor around 3.00% with this chart:

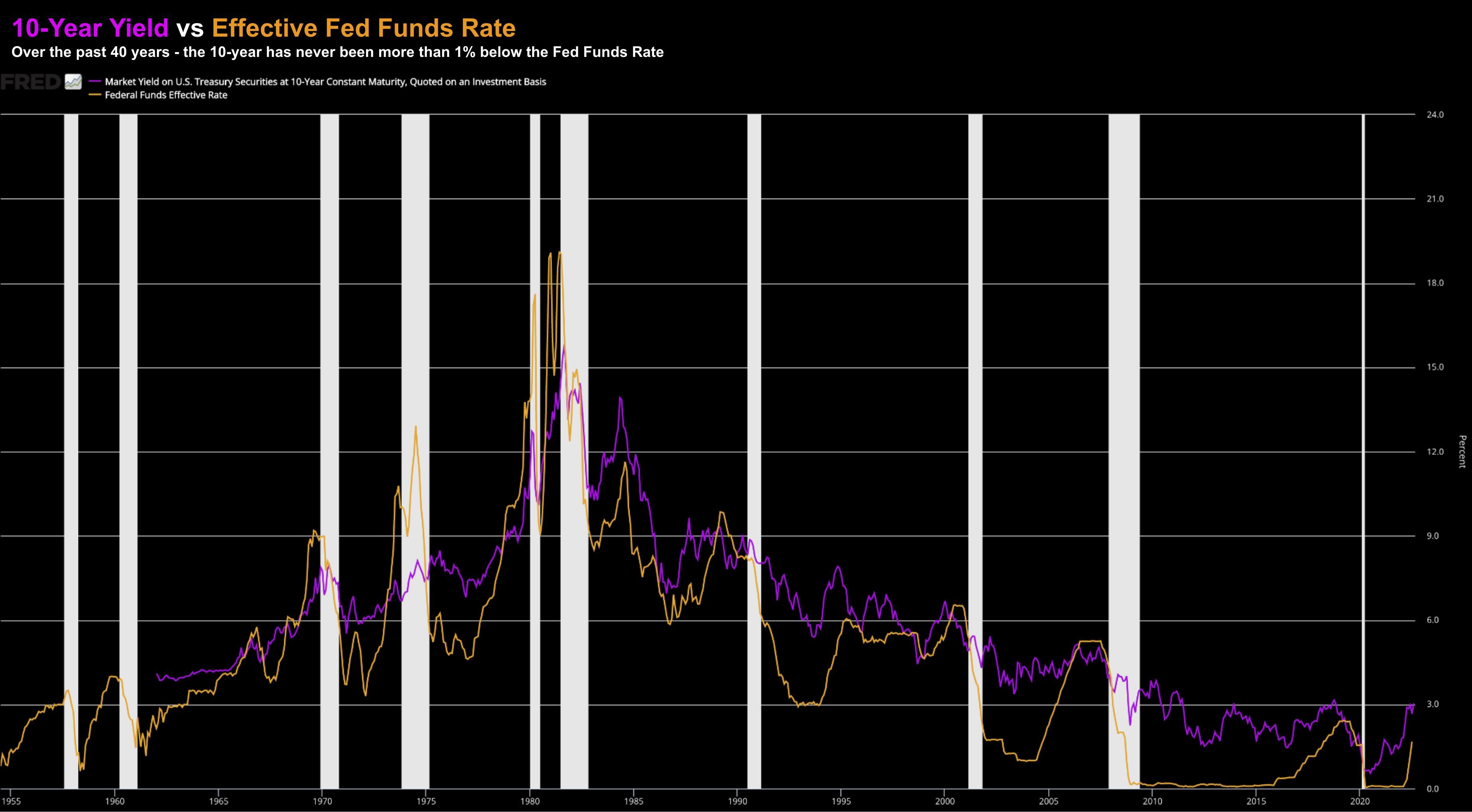

My thesis is that the 10-year has never been more than 1% below that of the Fed funds rate.

The question is (of course) how high do you see the Fed funds rate going?

That’s anyone’s guess…

However I see the Fed hiking to at least 4.00% bearing in mind that inflation will struggle to meaningfully fall below 5% due to sustained pressure with rents and wages.

Again, it pays to listen to what Jay Powell (and his peers) are telling us.

It’s not simply getting to “4.0%” (or whatever rate is deemed “restrictive”) – it’s also about keeping it there.

Think about it…

Assume Fed pivots on their Jackson Hole language sometime in the next ~6 months.

And we hear language about pausing rate hikes and adding liquidity (i.e. a pivot)

If they do this with inflation still high (e.g. where CPI is above 4%) – there is every chance they reignite inflation (especially given the extraordinary amounts of liquidity that is still present in the system)

And whilst Brainard may have given the optimists some hope – Powell also stressed they’re not going to repeat the errors of the past (e.g., 1970’s) with a “stop go” type policy.

I talked about this here – repeating the Fed’s language:

“Restoring price stability will likely require maintaining a restrictive policy stance for some time. The historical record cautions strongly against prematurely against loosening policy”

“Whilst the lower inflation readings for July are welcome, a single months improvement falls far short of what the committee will need to see before we are confident that inflation is moving down”

“So, we are moving our policy stance purposefully to a level that will be sufficiently restrictive to return inflation to 2%”

This is the point Brainard tried to make today…

However, I personally think “this needle” may prove difficult to thread with such a blunt instrument.

The Fed knows the economy will respond to changes in monetary policy with a lag – which makes it difficult to know if they have gone too far.

With that, how will tech stocks (and the market) respond?

Why Tech Valuations Could Come Down

That’s the challenge we have.

Now with respect to the broader S&P 500 – if we assume earnings in the realm of “$230” per share (which I think is ~10% too high) – we’re trading ~17.5x forward.

However, in terms of tech, the premium jumps to nearly 24x forward earnings.

What has some investors excited is this is down from ~27x forward last year (around August)

As I said in the preface, some of the ‘work’ has been done.

However, it’s still very high given this specific climate.

I say that because the multiple needs to be balanced opposite what we see with rates and liquidity.

For example, if the Fed were slashing rates to zero and maintaining aggressive rates of QE (i.e., expanding the money supply) – we could make a case for 27x forward.

But not when we find the opposite.

For example, with 10-year nominal yields trading at ~3.30% (and potentially headed higher) – that’s consistent with growth stocks trading closer to 20x forward (not 24x)

Put another way, this implies we need to see further multiple contraction in the realm of say 16%

Which brings us to earnings…

The Focus Shifts to Earnings

In short, I think expectations for $240 EPS are far too high.

Consider the following:

- $240 forward earnings implies ~8% growth year on year (vs avg growth of closer to 10%)

- Past tightening cycles will typically see earnings growth fall (not grow)

- For example, when the Fed tightened in 2015 we saw earnings growth fall 2%

For example, if we are conservative and apply just a 2% fall (vs current expectations of 8% growth) — we’re closer to the $215 earnings per share (EPS)

If they fall say 5% (which is plausible) – we are at $210 EPS

Now you can plug in your own assumptions and rates of decline – the point is valuations are driven by liquidity and Fed policy.

And if the Fed’s not increasing liquidity – then it will be hard for valuations to stay where they are today (in my view)

The Chart for the QQQs

Let’s now move away from the fundamental equation and see what the chart offers us.

Given we are talking tech – I will use the weekly chart for the ETF QQQ’s (as a proxy)

But before I do – let’s take a look at the forecast I made for expected price action from July 22nd (“Forget SNAP – There’s a Much Bigger Picture“)

I was looking for a move to 35-week EMA zone – to find resistance – followed by a sharp leg lower (below is the chart)

Sept 07 2022

The weekly bearish trend remains very much intact (also forming a series of “lower highs”).

In the very short-term – it’s likely tech will enjoy a bounce from what are technically oversold levels (e.g., a daily timeframe)

Extremely active traders (not me!) might try and catch this.

But good luck – you will need the hands of a surgeon.

From a weekly lens – I see the Qs rallying back to test the 35-week EMA zone and facing another litmus test.

And I think that test fails.

For example, if I try and marry the fundamentals – apply a ‘16%’ discount to the PE multiple – this augers for a price of ~$250 (or at least in that zone)

As a point of reference, the Qs say strong technical resistance at ~$240 in 2020 – which could become new support.

But here’s what’s important:

I don’t pretend to know how low the Qs (or Nasdaq) could trade.

It could be much much lower.

However, I’m happy to start adding to quality positions in the zone of $250 to $265 for the Qs (which is what I did in June).

From mine, the longer-term (3+ year) horizon looks like a good risk/reward at this valuation.

20x forward is more reasonable in this climate than today’s ask of 24x.

And from what I can tell – the technicals suggest this could be possible

Note:

I didn’t sell any quality tech positions in the surge to the 35-week EMA zone.

However, I was actively selling covered calls in this zone on the expectation the stocks were overvalued and would likely pull back. It appears I will most likely keep these premiums based on the pullback the past 3 weeks. I will repeat the exercise should we see another run higher.

Putting it All Together

Today stocks caught a small bid.

And there’s every chance things rally a bit more.

Not only were things over-sold in the very near-term – we also saw oil move ~5% lower and bond yields drop on Brainard’s comments.

If you look at this recent post – you will find the close correlation we see between the US 10-year yield and equities.

But remember – this is a long game.

The bearish trend remains intact and nothing has changed from the Fed’s lens.

Markets will occasionally react to a small sound bite from someone like Brainard… but I would curb any enthusiasm.

They will not make the same “stop-go” policy error of the 1970s.

From mine, with nominal rates likely to challenge 4.0% next year and liquidity being withdrawn – valuations will come likely down.

And for tech – that implies a forward PE closer to 20x (not 24x)

That’s when you want to start adding for the long-term.