- Bankruptcies surging at an alarming rate

- Credit conditions starting to crack (but it’s early)

- Keep an eye on the ETF HYG

Love it or hate it – the US is a credit driven economy.

Period.

If credit dries up – it’s goodnight nurse.

Some interesting snippets:

- The US consumer now owes close to $1Trillion on their credit card

- That’s a 17% jump from a year ago and a record high

- More than 33% U.S. adults have more credit card debt than emergency savings

- The average credit card interest rate is 20.92%, higher than at any point since the Fed began tracking rates since 1994

- $1.5 trillion in auto loans;

- $1.6 trillion in student debt; and

- $12 trillion in home loans

Put that all together and you are pushing some $17 Trillion in debt.

Mind blowing…

One should never under-estimate the US consumer’s desire to spend (even if they don’t have the money)

Given this, it pays to keep a close eye on credit conditions.

From my lens, there are some surface cracks appearing.

To be clear, there is no need for panic.

That comes later.

For example, typically it will take somewhere between 6-12 months before the cracks really start to widen.

And I will show you where to spot it…

Let’s take a look at the “oxygen” for the US economy…

Credit Starts to Crack

Whilst equity markets may be celebrating the possibility of no recession and/or the Fed cutting rates — credit markets tell a different story.

For example, small private companies are defaulting at an alarming rate.

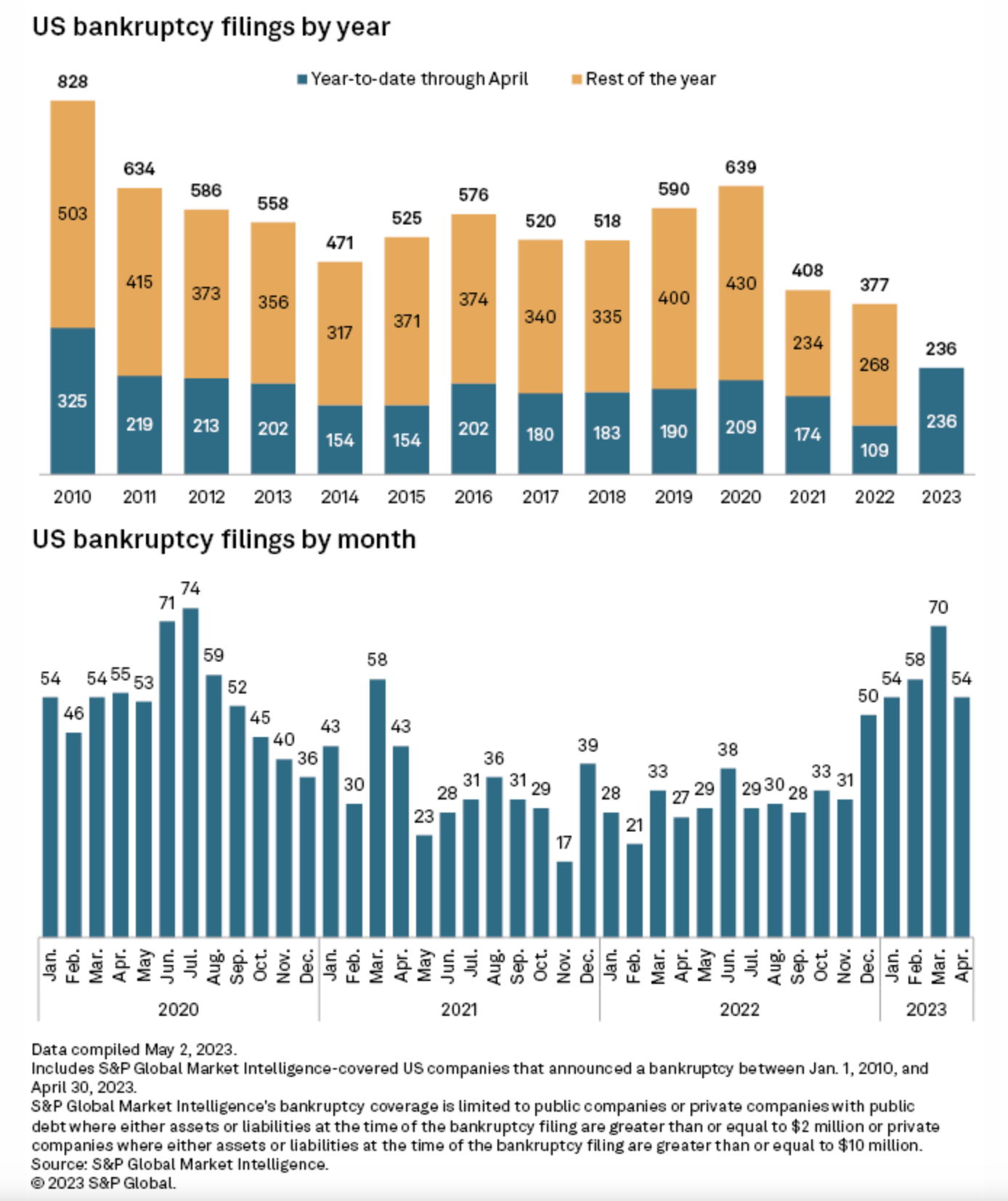

The most recent S&P data show 2023 corporate bankruptcies rising at an alarming clip. Data show 236 bankruptcies were recorded through the end of April 2023 (109 had been recorded over the same time period last year). UBS also found in a recent study that bankruptcies worth $10 million or more had a rolling average of about 8 per week

Don’t you find it alarming we have seen 236 bankruptcies by the end of April – which exceeds every year (YTD) since 2011.

Will this exceed “878 businesses” by year’s end (i.e. matching what we saw in 2010)?

So what’s going on?

In short, credit conditions are tightening.

Researcher and economist Peter St Onge said this:

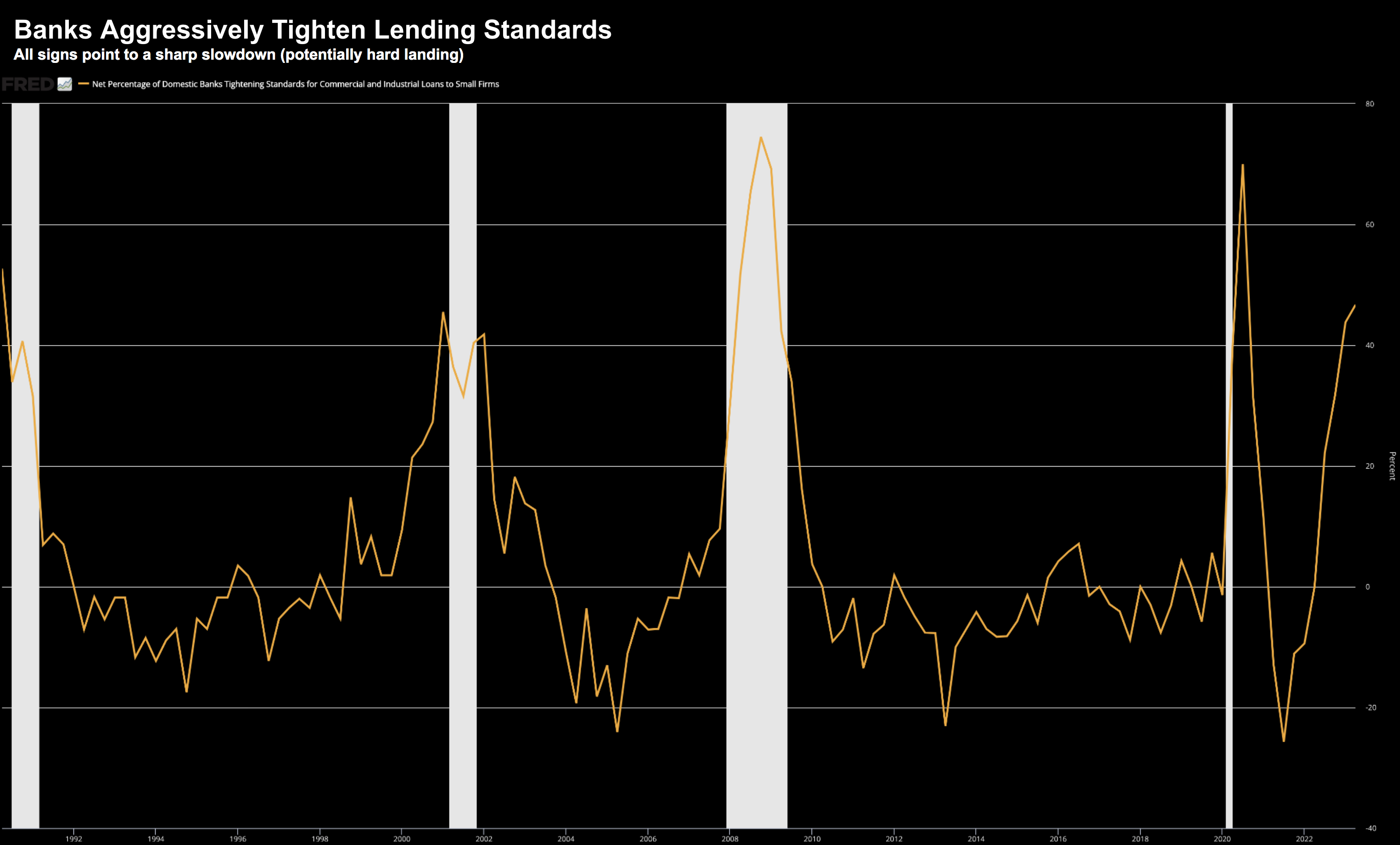

“Banks are battening down the hatches, hogging their bailout money instead of lending it out” adding small business surveys reveal the biggest deterioration in lending since the 2008 crisis.

That credit crunch means not only do we get bankruptcies like in any recession, on top of that we get a lending wall that cuts off even the healthy businesses. Of course their jobs go down with them. Major banks are now setting aside loss reserves. So Citi double theirs, Morgan Stanley quadrupled the money they set aside to cover failed loans.”

This is exactly what I talked about last week; i.e. the market is under-appreciating the impact of credit tightening.

The chart below (from the Fed Reserve) shows how lending standards are as tight has they have been at any time since 2008 (excluding COVID)

May 17 2023

From mine, the market is paying almost no attention to what we see with financial conditions.

Either that or they don’t think this will have any material impact.

I think that’s a foolish assumption.

Now as we know, this is why the Fed raised rates 500 basis points the past 12 months.

This was supposed to tighten lending conditions.

With less money available – in theory – this helps bring down inflation.

As lending conditions tighten -> credit spreads widen -> capex starts to slow -> which leads to bankruptcies.

But further to my preface, we only seeing smaller companies go into default at this stage.

We saw seven failures just this week!

Typically they have very poor balance sheets (i.e. leverage too much debt) – and they break first.

The weakest links in the chain are always first to go.

Companies with no debt on the other hand (i.e., strong balance sheets) cannot go broke.

They may not make as much money – but they won’t go broke.

Investing Tip:

If you are compelled to invest in smaller companies (I’m not) – limit your selection to those with no debt on their balance sheet.

Keep an Eye on this (Credit) Chart

One of my favourite proxies for tracking (deteriorating) credit spreads is the ETF HYG:

May 17 2023

In short, if credit quality is deteriorating the HYG will trend lower.

The HYG ETF has been relatively ‘stable’ the past few weeks after thundering lower late 2022.

However, more recently it appears to be moving lower.

From mine, if this starts to break down, it’s a good indication that cracks are starting to widen.

I expect to see this much lower (below 70) by the end of the year.

If so, this will be a negative for the market.

Putting it All Together

Credit cracks will always start with the weakest links.

The 236+ bankruptcies we have seen already this year is a frightening number.

However, the market is paying almost no attention.

My thinking is these cracks will only get wider from here as:

(a) the Fed keeps rates higher for longer; and

(b) banks continue to shore up their own balance sheets (tightening lending)

With respect to the former, the Fed may not need to raise rates further.

And I stress ‘may not’.

All they need to do is maintain rates around the current level and the vice will tighten.

For example, should Core PCE inflation continue to stay above 4% – I see no reason why the Fed would entertain cuts.

In addition, with unemployment now at a 70-year low – around 3.5% – again why the need to cut rates?

But that’s not what equities are pricing in.

Keep an eye on credit.