- The survey I’m watching most closely

- The US banking system is sound – but bank failures will hurt stocks

- How to think more like an engineer

It was a negative week for markets – despite the small bump it received Friday.

Apple’s Q2 result lifted sentiment – as they were better than feared.

And that seems to be consensus with Q1 earnings…. better than feared.

However, don’t think results have been ‘great’.

Most barely showed revenue growth (Google and Apple showed consecutive quarterly declines); and those who did expand revenue were only at single digits).

The bar was set exceptionally low.

On the whole – the market continues to hit a wall in the zone of 4200.

And there is good reason for that…

Investors are being asked to pay a large risk premium to own stocks.

And by my calculation – the forward PE is in the realm of 19x.

That’s far too high with interest rates at 5.00%; inflation more than twice the Fed’s objective; and a real risk of recession.

Today I will take a look at the weekly chart for the S&P 500 and why caution is warranted.

I will also spend a minute on the so-called “banking crisis”.

I prefer to call it a crisis of confidence – as the US banking system is sound.

However, we should expect many more regional bank failures – and that will lead to greater credit tightening.

There are real financial losses which are hitting someone!

And whilst I don’t mind seeing some of the 4200+ banks in the US fail (i.e., the economy will function better with far fewer high-risk taking bankers) – this will have implications for credit.

If credit tightens (and it will) – this will see economic growth slow.

My personal view is the full extent of the tightening – across all its channels – is not fully appreciated by the market.

The Coming Tightening of Credit

Access to money is starting to become more difficult.

This is good news for the Fed in its fight with inflation – but bad news for the economy.

For example:

- Interest rates are likely to stay higher for longer (despite what some think);

- Banks are tightening credit to shore up balance sheets; and we have

- Ongoing quantitative tightening (Fed reducing its balance sheet)

Now I’ve expanded on the first point recently.

My best guess is the market could be caught offside by a good margin.

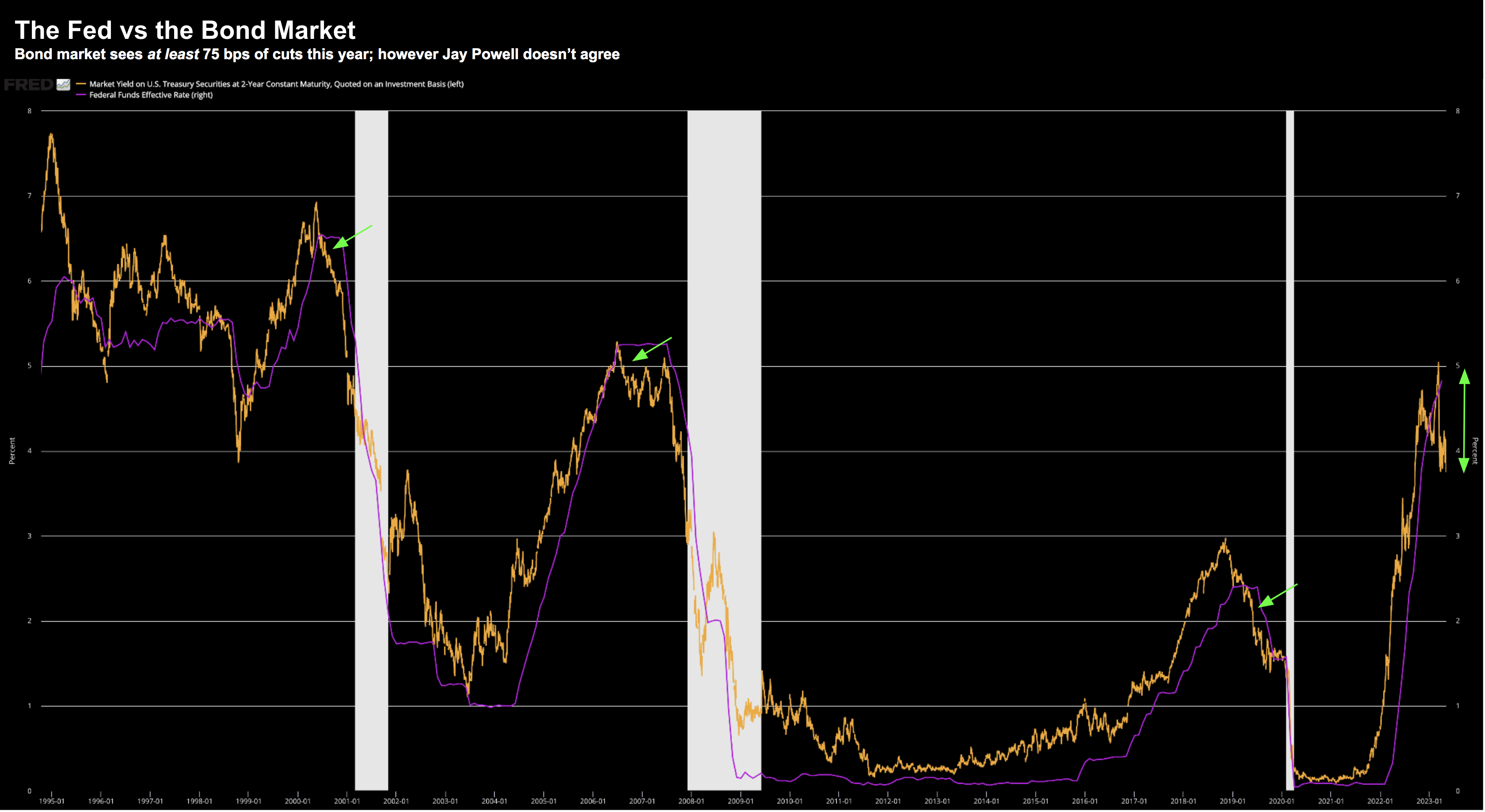

For example, consider the widening divergence between the yield on the US 2-year treasury and the effective Fed funds rate (now at 5.00%):

May 6 2023

At the time of writing (May 6) – the yield on the 2-year is 3.91%

That is some 109 basis points below the Fed’s fund rate of 5.00%

In other words, the bond market sees rate cuts coming.

And that’s a given.

Rate cuts will always come – however the timing is important.

For example, based on the chart above, it’s generally at least 6 months before the Fed moves to cut after the 2-year moves below the funds rate.

However, in these instances, there was no inflation problem.

For that, you need to go all the way back to 1980.

Apart from the events of circa 1980 – there is no other period over the past four decades that deserves a like-for-like comparison.

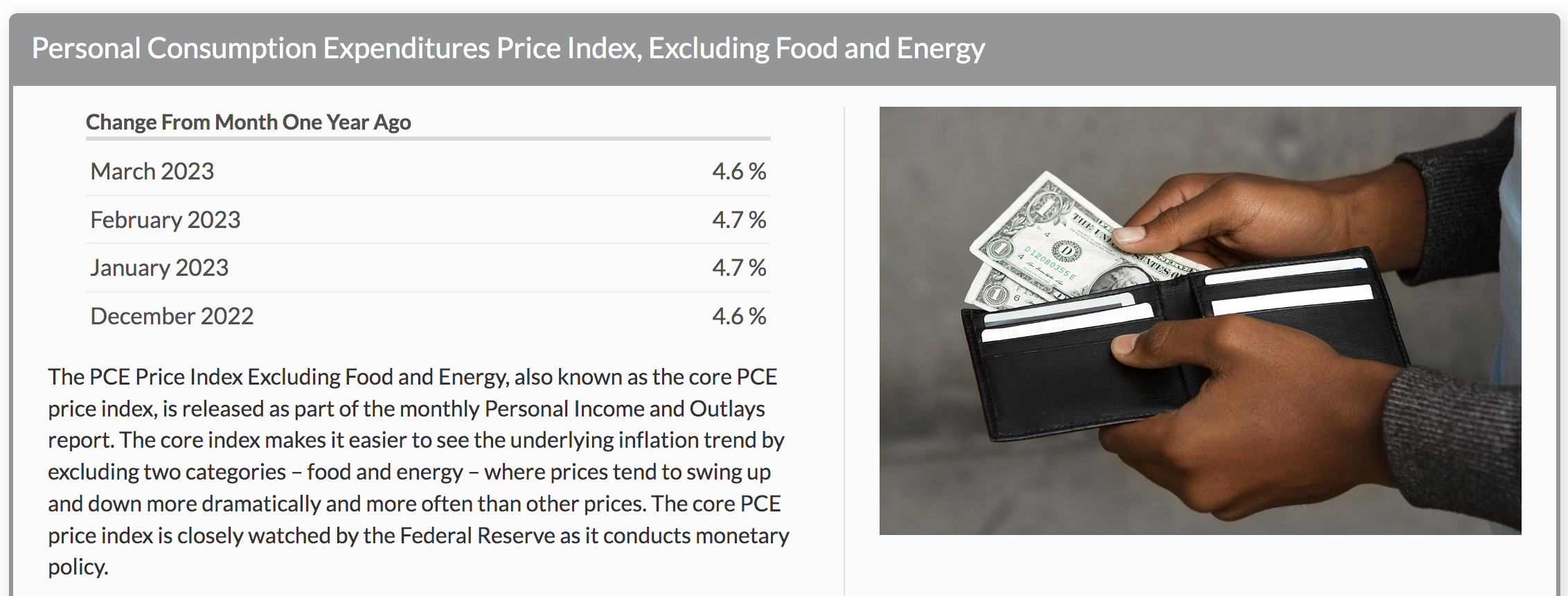

Now in the absence of Core PCE inflation being 4.6% – we could see the Fed consider rate cuts before the end of the year (given the obvious slow-down in the economy)

That said, my view is the Fed will “happily” take a (mild) recession if it means killing unwanted (systemic) inflation.

That won’t please some politicians (as they rarely get re-elected in the event of a recession) – however that’s the Fed mindset.

But let’s talk to credit conditions…

This is where I see more tightening as banks look to shore up their balance sheets in the wake of recent events.

Why Regional Bank Failures Could Hurt Stocks

Again, I would not be too bothered if the US had “1,000 less” regional banks.

It doesn’t need more (greedy) bankers and/or banks.

That said, conservatively run regional banks serve a very important purpose.

And we need them.

Many of them will lend to the productive part of the economy (i.e. small business)

But why do we need so many bankers?

As an aside, this morning I was listening to Berkshire’s annual investor conference.

Every year I take away more wisdom.

Now Charlie and Warren were asked about the problems with banking and their words resonated.

Here’s 99-year old Charlie Munger:

I’m old fashioned. I liked it better when banks didn’t do investment banking. That makes me very outmoded in the modern world. However, the country decided it was in the public interest and banks got back at it. I don’t think having a bunch of bankers, who are all trying to get rich, leads to good things.

I think a banker should be more like an engineer. He’s more concerned with avoiding trouble than he is getting rich.

They could do fine simply avoiding trouble. But now we have banks (and bankers) where everybody who joins just wants to get rich. This is a contradiction in values.

A lot of time it was known that people that borrow a lot of money cause a danger to the bank system. You get too many in the picture and all of that sort of thing. And what’s happened? The banks figured out different ways to do it. So if you borrow on a hundred percent margin, you know, through derivatives and everything, it just totally distorted everything. The problem is there’s more money in it today (derivatives) and that’s why they’re in it.

But (this incentive) isn’t necessarily a great social outcome for the rest of us. Banking can have all kinds of new inventions (e.g., derivatives) but it needs to have old values.

You’ve got to have the penalties, and you’ve got to hit the people that cause the problems (e.g. CEOs, CFOs etc). And if they took risks that they should not have – the penalties need to fall on them

This is what you need to change if you’re going to change how people are going to behave in the future. You need to change the incentives.

I love the line bankers should be more like engineers (and the contradiction in values we find with the system today)

A good engineer will approach a problem of how this could fail.

He or she will ask the question of what could go wrong.

And from mine, that’s the mindset of a successful investor (ps: my Masters Degree was in Science Engineering)

I digress…

Regardless, should many of these poorly-managed (profit focused) banks collapse (i.e. those who failed to ask what could go wrong) – it will likely have an impact on the economy (and risk assets)

That impact will be less credit.

To be clear, the US banking system is exceptionally sound.

Powell reminded us last week (as did JP Morgan CEO Jamie Dimon and others)

And I’m very happy picking up banking stocks like BAC, JPM and WFC at valuations of around 1x book value.

That’s all you should pay for a bank.

Sure, they might drop another 20% or more but that doesn’t bother me.

I remain confident they will be worth a lot more in 3+ years (given their balance sheets and quality of deposits and assets)

But today I want to talk about the impact of less available money.

Put simply, if financial conditions tighten, this increases the odds of a recession.

And if we see a recession – earnings will (not might) contract further.

Now a banking “crisis” (if we want to choose that word) is a blunt instrument for slowing price rises.

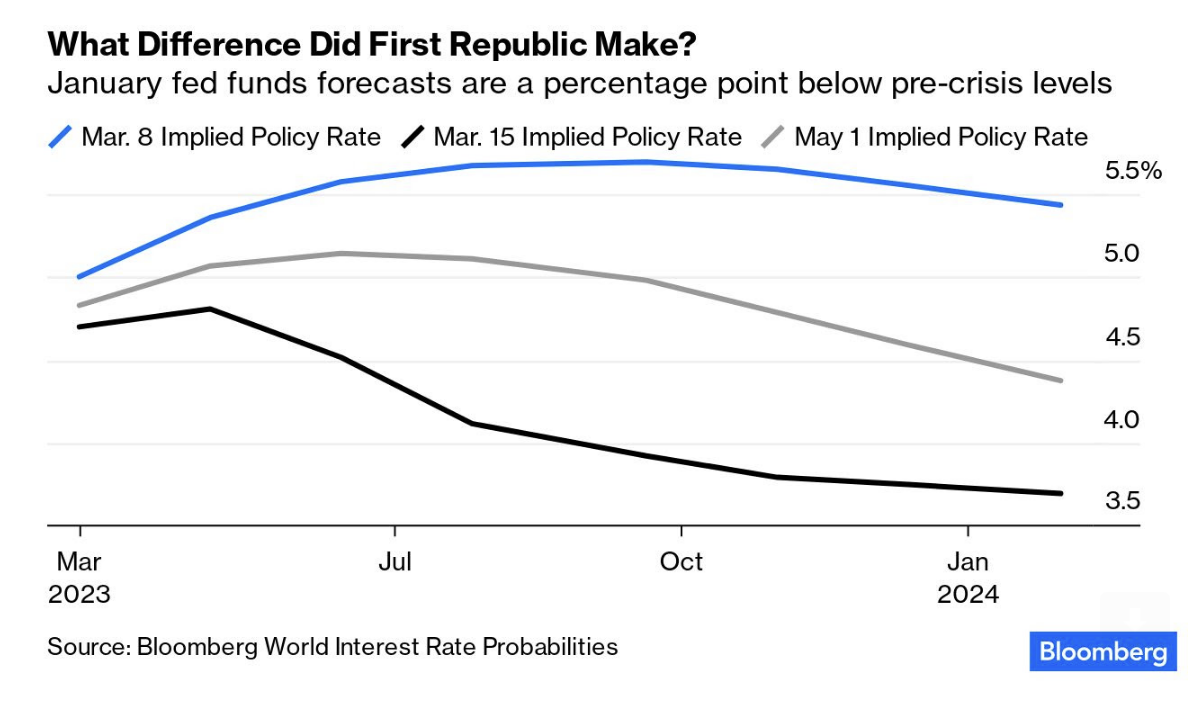

For example, when the poorly managed Silicon Valley Bank (SVB) crashed in March – expectations immediately changed in the market.

Take a look at this chart from Bloomberg:

From March 15 – expectations for rate rises plummeted (black line).

Since then, expectations for near-term rates have risen slightly.

However, the divergence with expectations is still present.

My thinking is the bank failures are now starting to do some of the Fed’s tightening work.

Now is that worth 25, 50 or 100 bps of rate rises – who knows?

Jay Powell has asked that specific question and said it’s very difficult to estimate (pointing to lots of literature on that subject).

But regardless, it’s reasonable to say it’s worth at least 25 bps.

Perhaps the best guide is what comes from the quarterly surveys that central banks conduct of banks’ senior lending officers.

Chair Powell has talked to its importance in previous addresses (from March):

“For purposes of our monetary policy tool, we’re looking at what’s happening among the banks and asking, ‘Is there going to be some tightening in credit conditions?’” Federal Reserve Chair Jerome Powell said at the March Federal Open Market Committee meeting.

“It’s highly uncertain how long the situation will be sustained or how significant any of those effects would be, so we’re just going to have to watch.”

The survey goes out to senior loan officers at up to 104 banks across the country.

It asks questions about how demand for different loans to businesses and households have changed, as well as if banks are tightening standards for those loans. The Federal Reserve is authorized to conduct the survey up to six times a year, but it’s typically done four times a year.

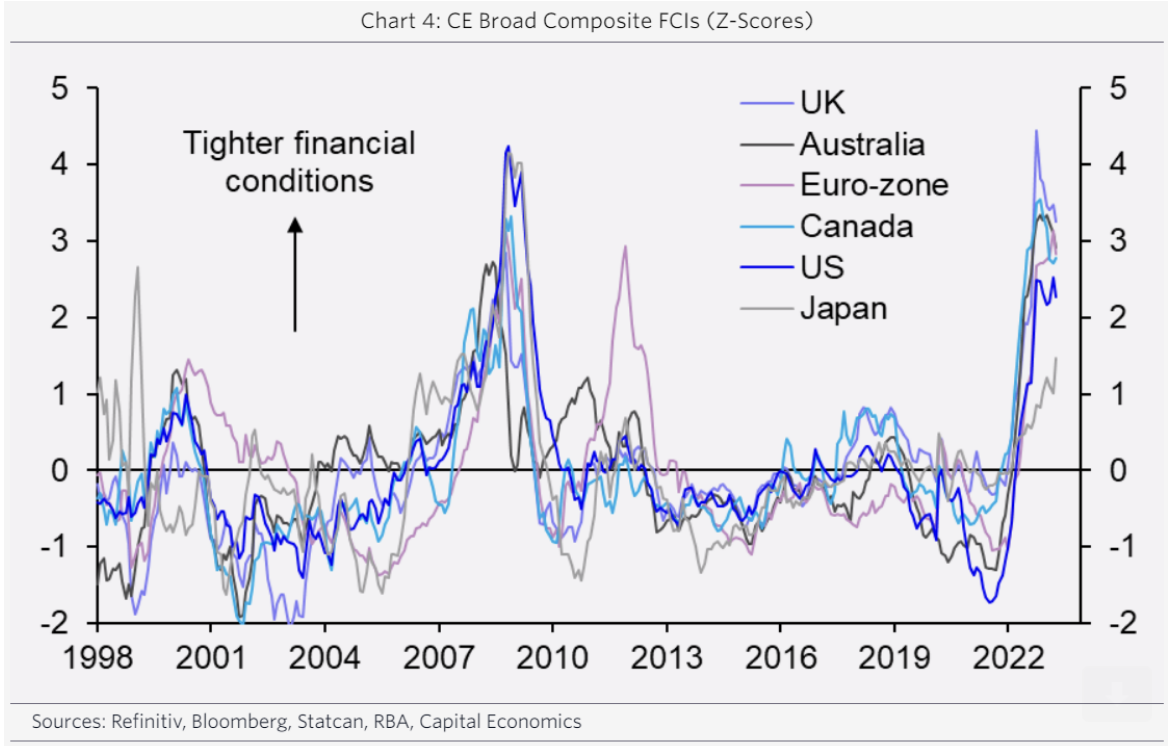

Now, the following chart comes from Capital Economics.

They include a range of bond yields and bank and mortgage rates, exchange rates, measures of house prices and equity prices to cover the strength of collateral, an array of volatility indexes and debt spreads, and surveys of bank lending standards. This is the blended result:

It’s safe to say financial conditions are tighter than anytime we have seen since 2008.

And yet – the market is completely unfazed – trading at 19x forward.

If I’m right – and I may not be – this could result in a painful adjustment (e.g. 15%+) for stocks.

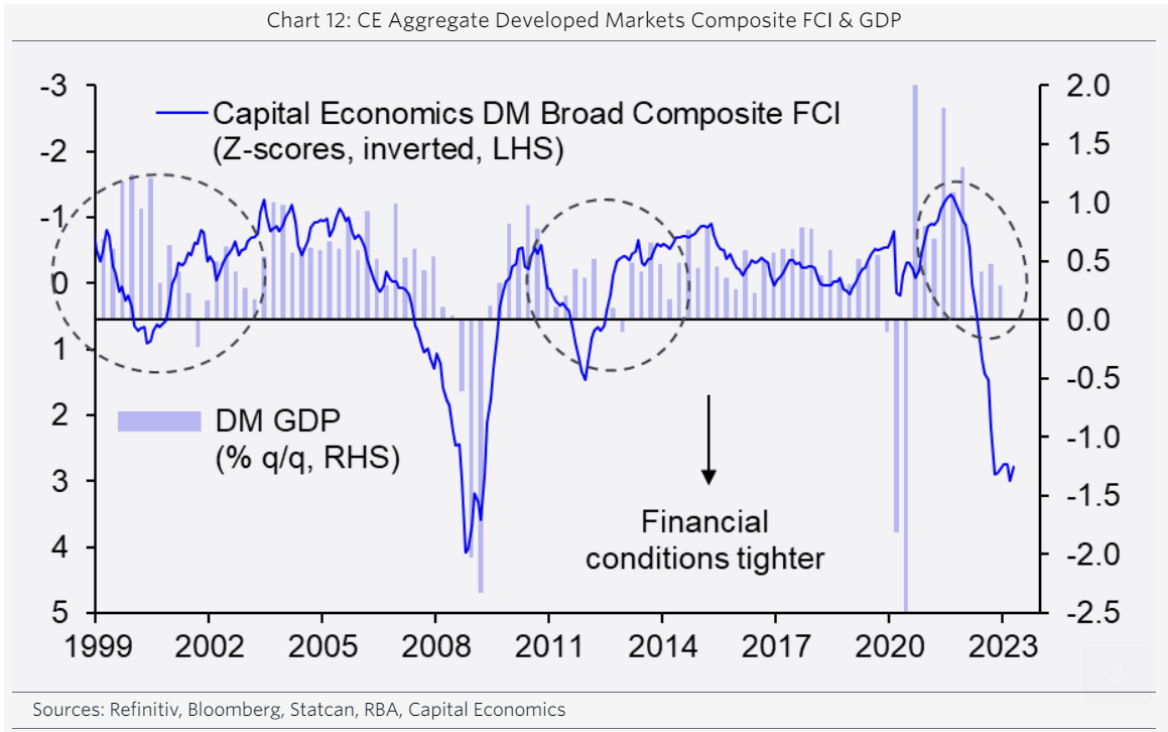

This chart – from Capital Economics – shows what is potentially ahead when credit conditions severely tighten:

This is why regional bank failures will matter.

Again, I don’t mind if many more regional bank failures result. There’s a good argument to be made there are far too many regardless.

Quick stat for you:

- Australia has 95 banks servicing 25M people (1 bank to 263K people)

- United States has 4,200 banks servicing 330M people (1 bank to 79K people)

Put another way, the US (on a per capita basis) was 3.3x the number of banks than Australia.

Why?

My guess – echoing Charlie Munger – because they are chasing the money.

That’s not what you want from a bank.

Apologies for the tangent – but stocks imply minimal damage to the economy with credit tightening.

That feels presumptious.

Put it this way, to some extent the tightening of financial conditions is a result of real losses.

That is money being lost by someone.

In the case of the regional banks – that money is coming from the FDIC (which the banks fund)

But do the math – banks will need to replenish the funds used by the FDIC – who do you think will pay for that?

You will.

As an aside, Joe Biden was telling us how the bailout of SVB didn’t cost the taxpayer one cent.

Oh Joe…

It will cost the taxpayer plenty in the form higher bank fees (and lending rates).

For example, CFRA Research estimates that the cost of replenishing the Deposit Insurance Fund could translate to a 14% hit to the banking industry’s earnings over one year, a 7% hit over two years, or just below 5% over three years.

Given my timeframe is 3+ years on these banking investments – I will happy buy them a 1x book (on panic valuations) opposite an estimated 5% hit due to replenishing the FDIC.

But don’t worry – major banks will pass those costs on.

Consumers will wear this cost (Joe can’t see that)

S&P 500’s Battle with 4200 Zone

So let’s look at the tape…

Is the market remiss of the risks ahead (e.g. further credit tightening and its impact)?

At 19x forward earnings – participants clearly don’t think the impacts of:

- Interest rates being higher for longer;

- Further bank credit tightening; and

- Quantitative tightening…

… will be detrimental to earnings and or economic growth.

Let’s look at the chart – as I have not needed to change its title for 4 weeks:

May 6th 2023

So what’s changed here?

Nothing.

The zone of 4200 (which could extend as far as 4300) continues to act as stiff resistance.

I think participants mostly understand they’re being asked to pay a large multiple to take risk.

For example, a forward multiple of 20x (or higher) might be justified if rates were at zero; there was no inflation; and no risk of recession.

But for me, the average market multiple of around 16x feels like a better risk reward.

Based on 2023 EPS of $220 per share (which I think is at the higher end given what we have seen after Q1) – that puts us around 3520.

Round this up and you can think about adding to risk in the zone of 3600.

I am not willing to rule out that zone being tested this year – as the market starts to understands we will not avoid a recession.

And whether an economic contraction happens later this year or early next – it doesn’t matter – I think it’s coming.

Further credit tightening from banks (as a result of more bank failures) in parallel with the Fed (via QT) — will only make the so-called landing a little ‘firmer’.

Putting it All Together

I continue to play defense in this climate.

I like asking the question of “what could go wrong?” And “what am I missing?”

Put another way, I’m not asking “how can I get rich?”

I think that comes from making fewer dumb decisions.

If you simply do that – you will do better than most.

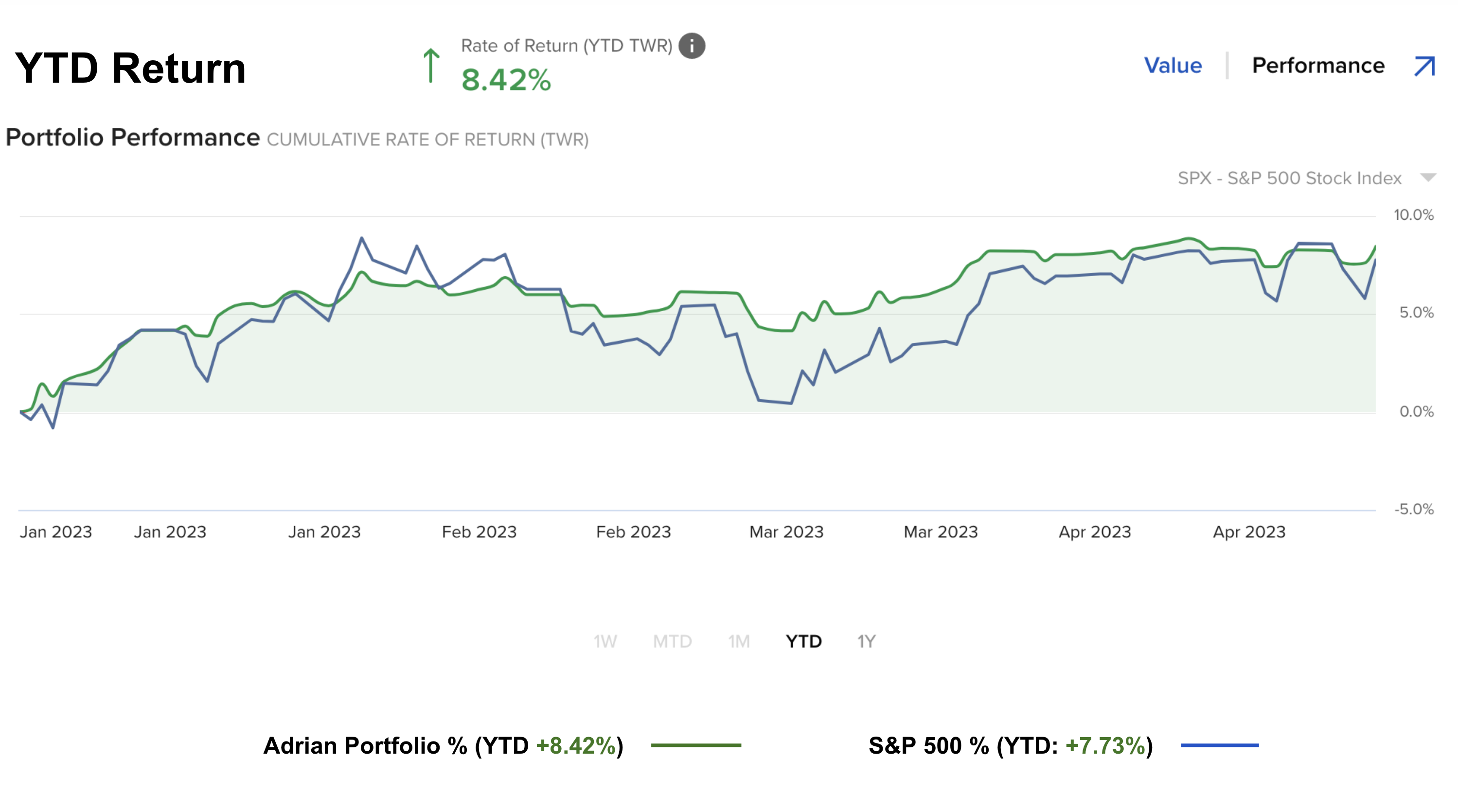

My performance YTD is slightly ahead of the market at 8.42%. The S&P 500 is up 7.73%

That puts me about 20% ahead of the market over the course of the past 16 months (mostly from avoiding taking large risks)

My portfolio was dragged lower by exposure to (quality) large banks and energy this week.

However, the downside was offset by gains in Apple.

Something to point out:

Notice what my portfolio does when the market legs down sharply. My performance remains relatively smooth. It rarely suffers the same sharp drawdowns.

This is due to risk management.

The downside to my approach is if the market should shoot sharply higher – I will underperform (given my 65% net long exposure)

And in this climate of higher interest rates, tighter credit and risks of recession – I am happy to sit aside.

That said, I will happily weigh into quality stocks (strong free cash flow, balance sheet, operating moats, profit margins) – if I see better long-term risk reward.

Let’s see what the next quarterly surveys of banks’ senior lending officers tell us.

I expect further tightening of credit.

If so, that will act as headwind for the market (as credit availability is its oxygen)

Stay patient.