- Fitch and Moody’s dampen investor sentiment

- Why it’s all about evaluating the ‘equity risk premium’

- This game is about balancing risk vs reward

Stocks cannot get out of neutral.

And if anything, they appear to be going into reverse.

Makes sense… they ripped~ 30% higher in 9 short months.

That’s a cracking pace…

Here’s a quick look at the weekly chart:

Aug 9 2023

The Index is fractionally (~3%) off its recent high…

But let’s talk to why stocks are taking an expected pause; and why I think there’s more to come.

Downgrades

The first thing to make investors hit the pause button was Fitch’s downgrade on US government debt.

I talked about the downgrade here – citing a couple of reasons behind Fitch’s “surprise” call.

I can understand why the likes of Jamie Dimon and Janet Yellen called it ridiculous… they are ‘talking their own books’!

What else would they say?

But the reality is the government has a spending problem… they just don’t want to admit it.

Higher interest rates are forcing them too.

This week, Moody’s added to the negative sentiment by downgrading the credit ratings for 10 small to mid-sized US banks.

Here’s Reuters:

Moody’s cut credit ratings of several small to mid-sized U.S. banks on Monday and said it may downgrade some of the nation’s biggest lenders, warning that the sector’s credit strength will likely be tested by funding risks and weaker profitability

Moody’s cut the ratings of 10 banks by one notch and placed six banking giants, including Bank of New York Mellon, US Bancorp, State Street and Truist Financial on review for potential downgrades.

The agency added that many banks’ second-quarter results showed growing profitability pressures that will reduce their ability to generate internal capital.

From mine, this news wasn’t all that surprising.

Small and mid-sized banks are still working through the challenges of higher rates (and likely losses)

Consider the commercial real-estate sector… there’s a massive amount of losses coming down the pike.

But this will take time to play out…

Put together, these two downgrades had investors asking a few questions – especially as bond yields rallied.

Which brings to the real reason I think investors are hitting pause…

It’s all about the risk investors are being asked to pay vs risk free returns.

It’s as poor as we have seen in well over a decade… and it’s not talked about enough.

It’s Getting ‘Riskier’ to own Stocks

For those less familiar, stocks are some of the riskiest assets you can own.

Why?

Because many of them go broke every day.

Now investing in an Index helps you remove a lot of that risk – however you can still pay far too much.

Remember:

It’s not just what we buy… it’s equally about how much we pay.

But I want to talk about a concept known as equity risk premium.

In other words, what are you really paying to own stocks (vs safer alternatives like treasuries).

That’s what this game is all about…

It’s a constant game of managing risk vs reward.

With that – let’s start with a definition:

Equity risk premium refers to an excess return that investing in the stock market provides over a risk-free rate.

This excess return you get from equities compensates investors for taking on the higher risk of owning these assets.

The size of the premium varies and depends on the level of risk in a portfolio and naturally changes over time.

And lately – given the ~30% rally – that risk premium is exceptionally low (especially as yields rise).

Whatever return you earn above a risk-free investment such as a U.S. Treasury bill (T-bill) or a Treasury bond is called an equity risk premium.

An equity risk premium is based on the idea of the risk-reward tradeoff.

It is a forward-looking figure and, as such, the premium is theoretical.

I say that because no-one can know what stocks will earn in the future.

I’m sure you have your own opinion (as does everyone) – but reality is none of us really know.

Therefore, an equity risk premium is an estimation as a backward-looking metric (which I will get to below with some assumptions).

What’s the Risk Free Rate?

The next part of the equation is understanding what you can return risk-free.

That’s the benchmark we should always be measuring against when making an investment (e.g., stocks, gold, property etc)

For years (over a decade) – this rate was basically zero – and why we heard the term There Is No Alternative (“TINA”)

Investors were essentially being forced into risk assets... as they were losing money on cash or bonds.

Not today.

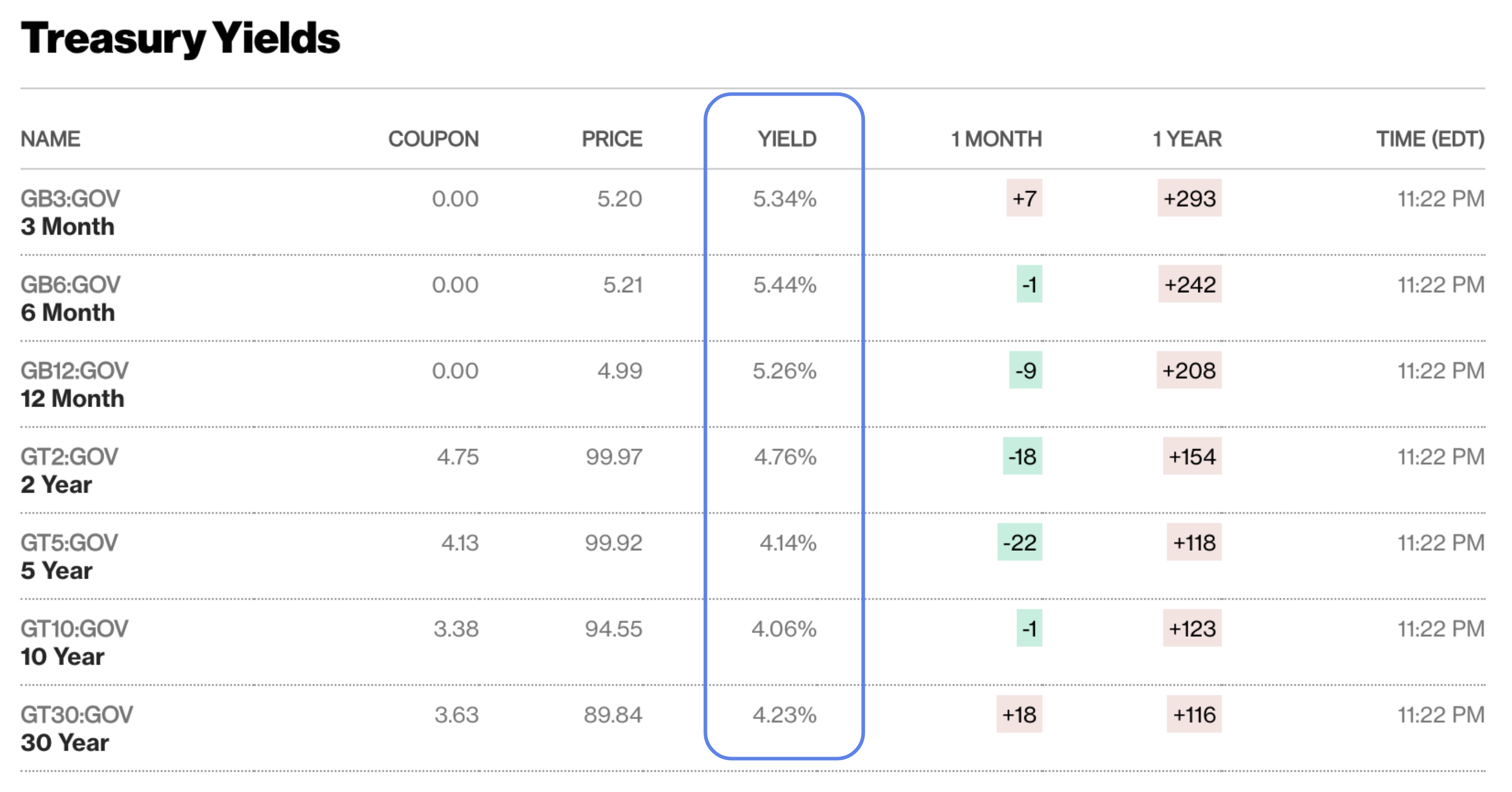

At the time of writing, the US government is paying you anything from 4.00% to 5.44% on your money (pending the duration)

Bloomberg: August 7 2023

Again, these risk-free returns are about as high as we have seen in decades.

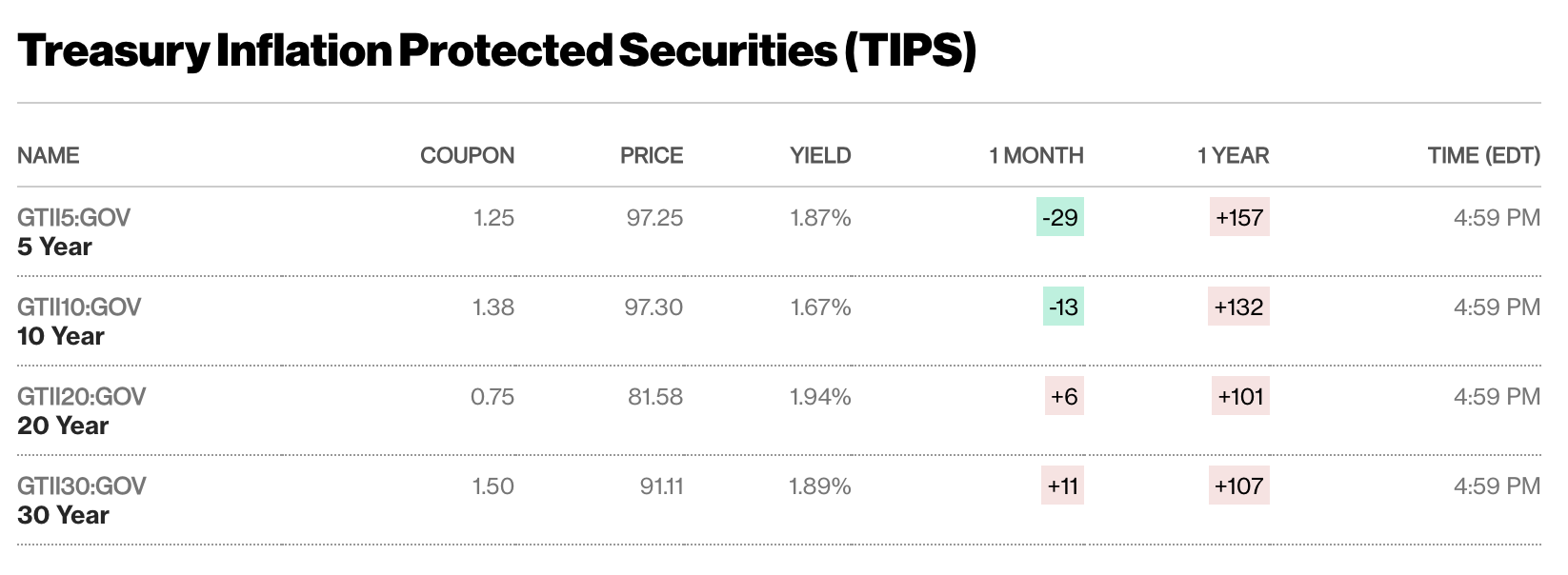

If we look at real-rates (those adjusted for inflation) – the US 20-year is paying close to 2.0%

Bloomberg: August 7 2023

How Does that Compare to Stocks?

Given we know you can ‘bank’ anything from 4.00% to over 5.00% for the next 12 months – can we get the same from stocks?

That’s hard to say…

The answer all depends on earnings…

And to that end, whether they can really take off in the second half of the year (and further into 2024).

Because that’s what the market thinks…

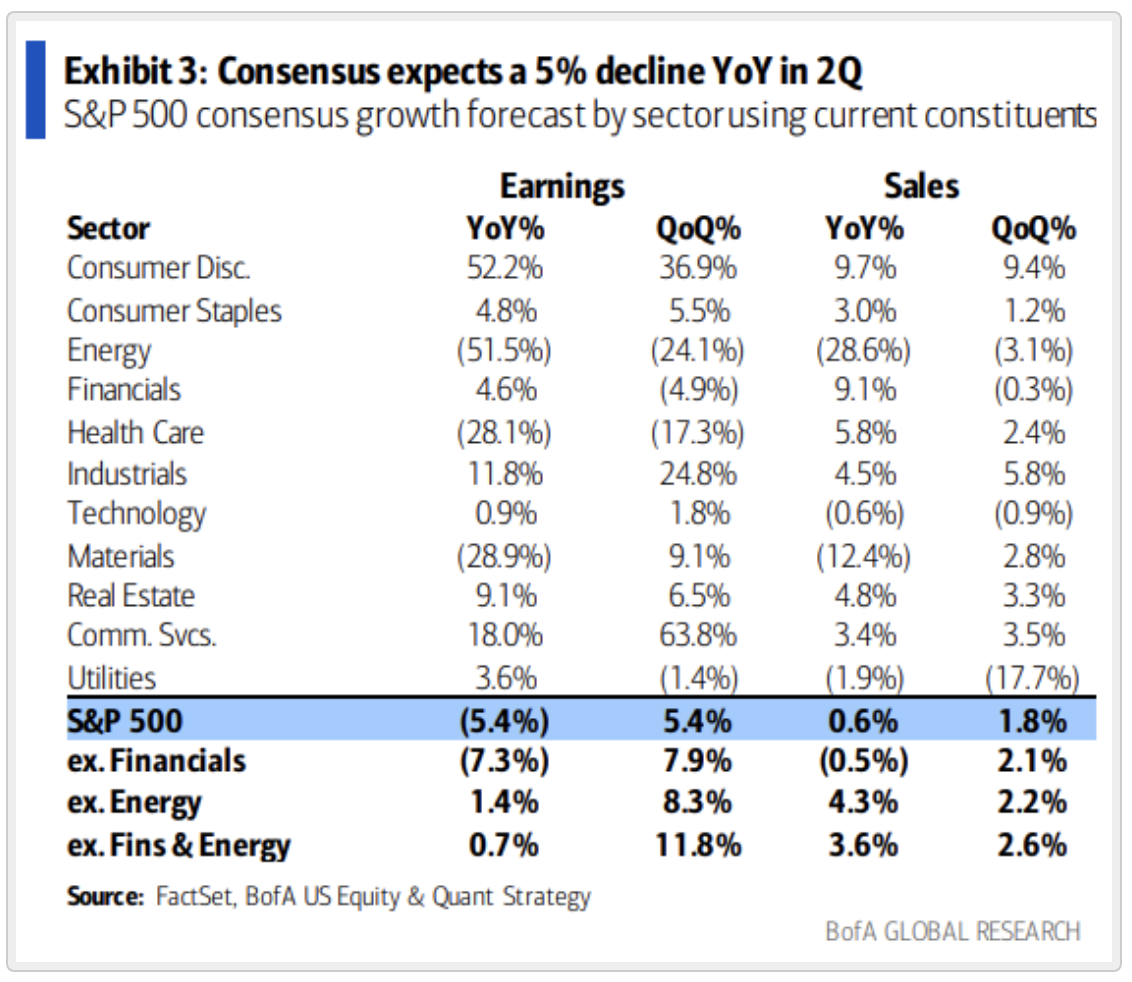

Above is what we’ve seen (so far) with earnings growth for Q2 YoY.

The broader market declined by 5.4% (third straight quarter of declines) – weighed down in part by energy (which has a 4% weighting on the Index)

However, the 5.4% decline is much better than the 7.0% decline the market was expecting.

But that’s behind us…

As you know, the market is always forward looking.

Analysts are now expecting earnings growth of 12.2% YoY next year – which would see S&P 500 EPS grow to $245

With the Index trading ~4500 — that’s a 2024 PE of 18.4x

Two questions to ask:

- Will earnings grow 12.2% YoY to $245 in 2024 (in what is a slowing economy); and

- Is paying 18.4x a good risk/reward with risk free returns well north of 5.0%?

Your view will differ to mine (which is what makes a market).

Remember:

If we’re to have a recession next year (which remains my base case) – earnings will contract.

But let’s take the analyst’s consensus and use the 18.4x forward 2024 multiple.

The inverse of 18.4 is what we call the earnings yield.

1 / 18.4 = 5.4%

Now as I demonstrated above – we can secure a risk-free 5.26% for 12-month with treasuries.

So are stocks a great risk/reward at ~4500 (or above)?

I don’t think so.

It’s also worth pointing out that it is most unusual for the equity risk premium to be this low (i.e., where the premium is said to be what is above the risk free return)

We saw it in 2007 (when no-one was talking about recession); and we saw it in 2001.

Now don’t take that to think we will repeat the events of 2008 or 2001 next year.

We probably won’t…

But it demonstrates the type of territory we’re in (in terms of a paltry equity risk premium)

As an aside, this is the math the likes of Buffett (and others) are doing when they are buying bonds.

They are weighing the equity risk premium.

Repeating what I said over the weekend – if the market was trading at “4000” (or less) and rates were back at say “3.0%” – I could make the case for taking the risk with stocks.

Under this scenario (assuming forward 2024 earnings of $245) – we get a forward PE of 16.3x or earnings yield of ~6.1%

That would represent a risk premium of maybe 1% (at best).

But things are far more attractive if bond yields were say “3.0%” (e.g., in turn elevating the equity risk premium to something like 3.0%)

You’re getting sufficiently compensated to take on the risk of owning (riskier) equities.

But that’s not the equation we have now.

So Why is Everyone So Bullish?

In a word, because the so-called ‘animal spirits’ are alive and well.

There’s no other way to say it.

A quote from John Maynard-Keynes:

Even apart from the instability due to speculation, there is the instability due to the characteristic of human nature that a large proportion of our positive activities depend on spontaneous optimism rather than on a mathematical expectation, whether moral or hedonistic or economic.

Most, probably, of our decisions to do something positive, the full consequences of which will be drawn out over many days to come, can only be taken as a result of animal spirits – of a spontaneous urge to action rather than inaction, and not as the outcome of a weighted average of quantitative benefits multiplied by quantitative probabilities.

I love the line saying a “spontoneous urge to do something”

When markets continue to leg higher – it almost ‘forces’ economists and the analysts to revise their targets higher.

And that feeds on itself.

They work furiously to change the numbers to fit the price action – even if it doesn’t make sense.

But the market will do what it will do…

Again, go back to 2007.

No-one was talking about a recession in mid 2007… not even the Fed.

And with unemployment only ~4.0% (i.e., close to full employment) – GDP at 2.5% – analysts were saying expect 8-10% earnings growth for 2008.

Below is the Fed’s own forecast for growth in August 2007:

A second challenge that we faced in putting the forecast together—more routine than the task of factoring in the implications of financial-market developments—was to take account of the annual revision to the national income and product accounts.

In line with our custom in years past, we carried the revision to the growth of potential through into the forecast period. As a result, we now have potential output increasing 2.25 percent in both 2007 and 2008.

Now, in addition, look at what we saw with the yield curve throughout 2006 and 2007:

It was inverted for a lengthy duration (not as deep as today) before it steepened.

Naturally, investors in 2007 were saying ‘ahhh but this time it’s different’.

Sure enough, between Jan 2006 and Sep 2007 – the market added ~30%

But the point is this can go on for some time…

However, my staunch view is:

- The “trillions” in fiscal stimulus we’ve seen the past 2 years will begin to fade;

- Consumers will start to “tap out” as they continue to leverage their credit card; and

- The impact of the Fed’s 550 basis points of rate hikes will start to work their way through.

Again, the average time rates hikes ‘hit the economy’ are anywhere from 12 to 24 months after the first hike (which was March 2022).

However, the Fed’s hikes were cushioned due to three primary things:

- $2+ Trillion in excess consumer savings (now below $1 Trillion);

- 70% of home borrowers securing a 30-year mortgage below 4.0%; and

- Several trillions in government spend.

With the government now curbing its spend (long overdue with record deficits); and consumers relying more on credit – growth gets harder from here.

Putting it All Together

In closing, I still maintain a 65% long exposure to the market.

That hasn’t changed all year.

That has allowed me to capture some (not all) of the rally – with my YTD gains ~13%

I will happily forgo the “extra 3-4%” I would have gained as I balance exposure against the risks.

That’s the game.

Remember – when markets turn down – it can happen very fast. When participants rush to the exits – it’s generally a stampede.

I’m not suggesting that will happen this year (it probably won’t) – but I don’t want to be in that situation.

What I want to be able to do is put money to work (~35% in high-yielding cash) to buy stocks at more attractive long-term valuations.

And if I have to wait a few more quarters to see 4,000 or below on the Index – that’s fine.

For now, the very poor (historically low) premium that I stand to recieve by buying stocks here is just not worth it.